- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Europe Dietary Supplements Market Size Report, 2033GVR Report cover

![Europe Dietary Supplements Market Size, Share & Trends Report]()

Europe Dietary Supplements Market (2025 - 2033) Size, Share & Trends Analysis Report By Ingredients (Vitamin, Botanicals), By Form, By Type, By Application, By End Use, By Distribution Channel, By Region, Segment Forecasts

- Report ID: GVR-4-68040-065-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Dietary Supplements Market Summary

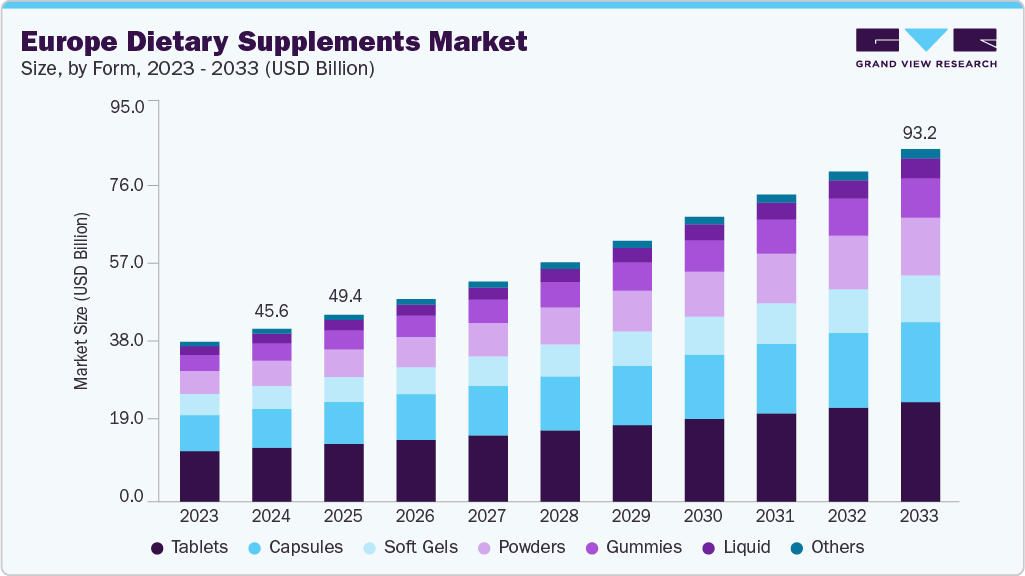

The Europe dietary supplements market size was estimated at USD 45.64 billion in 2024 and is projected to reach USD 93.20 billion by 2033, growing at a CAGR of 8.3% from 2025 to 2033. The key drivers of market growth include rising awareness of healthcare, the availability of affordable or government-funded healthcare, an expanding elderly population, and a growing emphasis on preventive care and personalized nutrition.

Key Market Trends & Insights

- Italy dominated the Europe dietary supplements market with the largest revenue share of 18.1% in 2024.

- The Germany dietary supplements market is anticipated to grow at a significant CAGR of 8.6% during the forecast period.

- The vitamin supplements segment led the market with the largest revenue share of 27.6% in 2024.

- The powdered supplements segment is expected to witness at the fastest CAGR of 9.6% from 2025 to 2033.

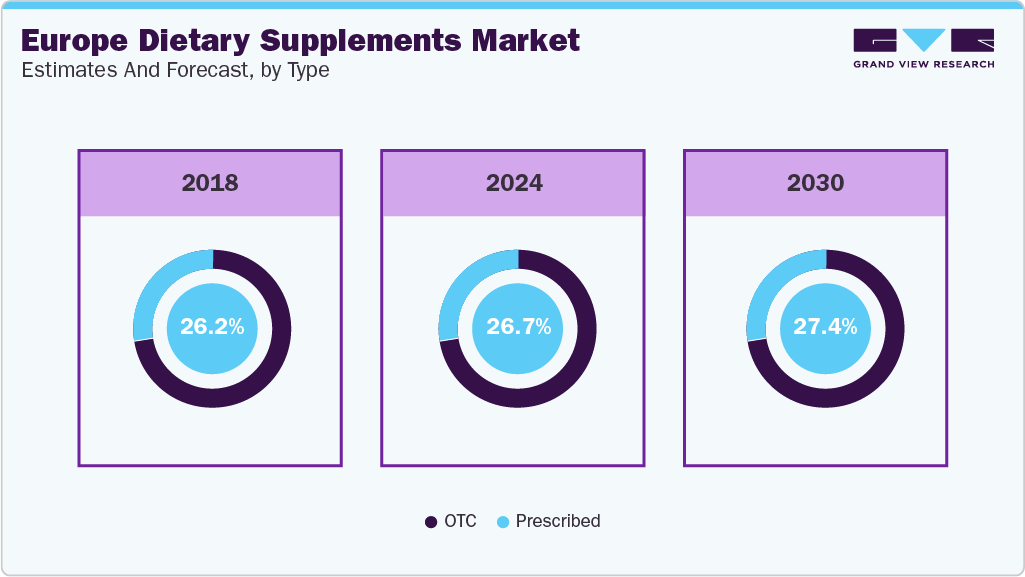

- The OTC supplements segment led the market with the largest revenue share of 73.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 45.64 Billion

- 2033 Projected Market Size: USD 93.20 Billion

- CAGR (2025-2033): 8.3%

- Italy: Largest market in 2024

- Spain: Fastest growing market

In addition, consumers are increasingly embracing self-managed care, influenced by the rising trend of personal health and wellness. Compared to other regions, European Union residents tend to be more informed and discerning when it comes to nutrition and physical well-being.The growing focus on fitness among young people is expected to drive increased demand for energy and weight management supplements. In addition, the rising popularity of sports as a professional career is contributing to the expansion of the sports nutrition market, thereby supporting overall market growth. Social media influencers and wellness bloggers have also played a key role, significantly shaping consumer preferences by recommending health and wellness products.

Moreover, the COVID-19 pandemic had a considerable impact on several European countries, including Italy, Spain, the UK, France, and Germany, regions where the dietary supplement market is heavily concentrated. For instance, the European Society for Clinical Nutrition and Metabolism (ESPEN) recommended the consumption of dietary supplements such as omega-3, vitamin D & vitamin B and minerals including zinc, iron for patients infected with COVID-19.

The market witnessed a significant boost due to the rising demand for immunity-boosting supplements. In Europe, an increasing number of consumers are focusing on their health and opting for natural and organic alternatives instead of conventional medicines. This trend is fueling the growth of dietary supplements made from natural and organic ingredients. For manufacturers, research and development (R&D) is a vital component for success, though it requires substantial investment. For instance, in September 2024, Airborne, a ReckittBenckiser Group PLC brand, launched mineral-based dietary supplements with greater amounts of zinc, newly added vitamin D, and high concentrations of vitamin C. The product is available in effervescent and chewable supplement form and features key nutrients such as vitamins A, E, C, and D, zinc, and manganese.

Consumer Insights for Europe Dietary Supplements:

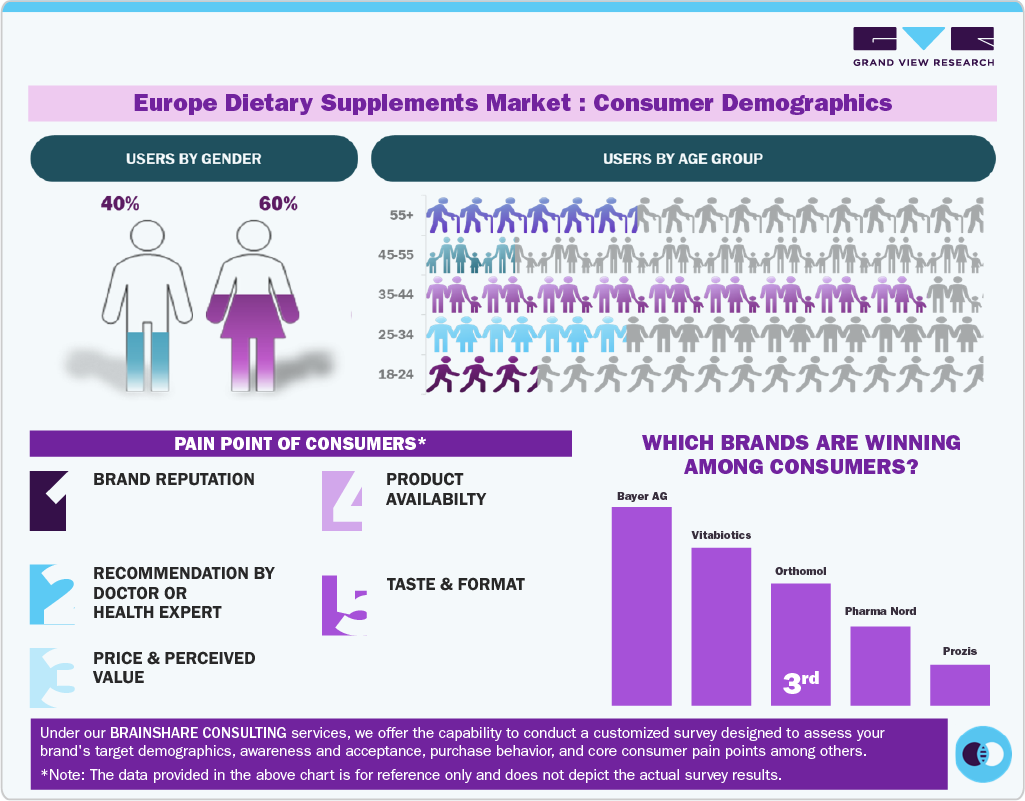

The Europe dietary supplements industry serves a wide range of consumers, including health-focused individuals, fitness enthusiasts, and those pursuing preventive healthcare. As awareness of holistic well-being continues to grow, the market appeals to diverse groups, from older adults looking for nutritional support to younger generations adopting proactive approaches to health.

The increasing integration of dietary supplements into daily routines is being driven by busy lifestyles and poor dietary habits. Urban populations often struggle to meet nutritional needs through food alone, leading to higher reliance on supplements. Workplace wellness programs and corporate health initiatives are also encouraging supplement use. Moreover, rising stress levels and sleep disorders are fueling demand for mood-enhancing and relaxation-support products. Technological advancements in supplement delivery formats, such as gummies and powders, are enhancing consumer appeal.

Ingredients Insights

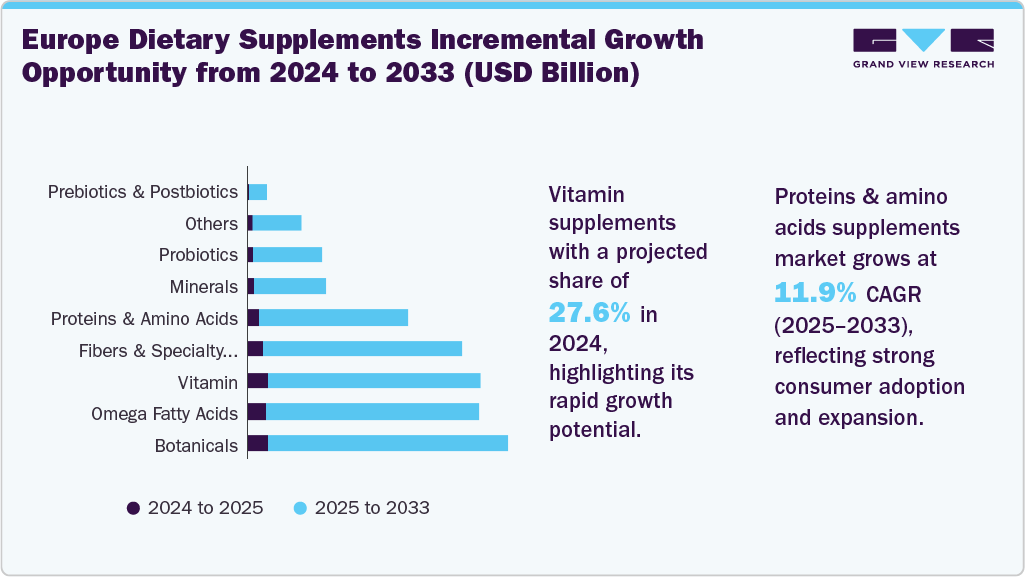

The vitamin supplements segment led the market with the largest revenue share of 27.6% in 2024. In Europe, the demand for vitamins in the dietary supplements market is driven by increasing health awareness and efforts to prevent chronic diseases. Consumers are focusing on boosting immunity, improving energy levels, and addressing nutrient deficiencies due to imbalanced diets. The aging population is also fueling demand for vitamins that support bone, heart, and cognitive health. In addition, growing interest in self-care and personalized nutrition is encouraging the regular use of vitamin supplements across all age groups. For instance, in June 2024, Bayer AG introduced One A Day Age Factor Cell Defense, a dietary supplement designed to support cellular aging. Enriched with omega-3 fatty acids, vitamins A and D, and niacin, this supplement aims to enhance cell resilience.

The protein & amino acids segment is expected to grow at the fastest CAGR of 11.9% from 2025 to 2033. The demand for protein and amino acid supplements in Europe is rising due to growing interest in fitness, muscle building, and active lifestyles. Consumers are increasingly incorporating these supplements into their routines to support workout recovery, muscle maintenance, and overall physical performance. The popularity of high-protein diets and plant-based nutrition is also contributing to this trend. In addition, expanding gym culture and sports participation across all age groups are driving consistent growth in this segment.

Type Insights

The over the counter (OTC) dietary supplements segment led the market with the largest revenue share of 73.3% in 2024. OTC sales are expected to witness steady growth over the coming years, owing to the rising consumer inclination towards self-medication and preventive healthcare. Increased health awareness, coupled with the convenience of accessing supplements without prescriptions, is driving this trend. Expanding retail channels, including pharmacies, supermarkets, and e-commerce, further support easy availability. In addition, strong trust in established brands and growing demand for immunity, energy, and general wellness products are reinforcing the rise in OTC dietary supplement sales across Europe.

The prescribed dietary supplements segment is projected to grow at the fastest CAGR of 8.5% from 2025 to 2033. The demand for prescribed Europe dietary supplements is growing due to heightened awareness of preventive healthcare and the increasing diagnosis of nutrient deficiencies through routine medical checkups. As lifestyle-related conditions and chronic illnesses become more prevalent, particularly among aging populations, patients are turning to doctor-recommended supplements for targeted health support. Greater trust in medical professionals and the healthcare system plays a key role in this shift. The appeal of regulated, high-quality supplements with personalized dosages further reinforces the demand for prescription-based products across the region.

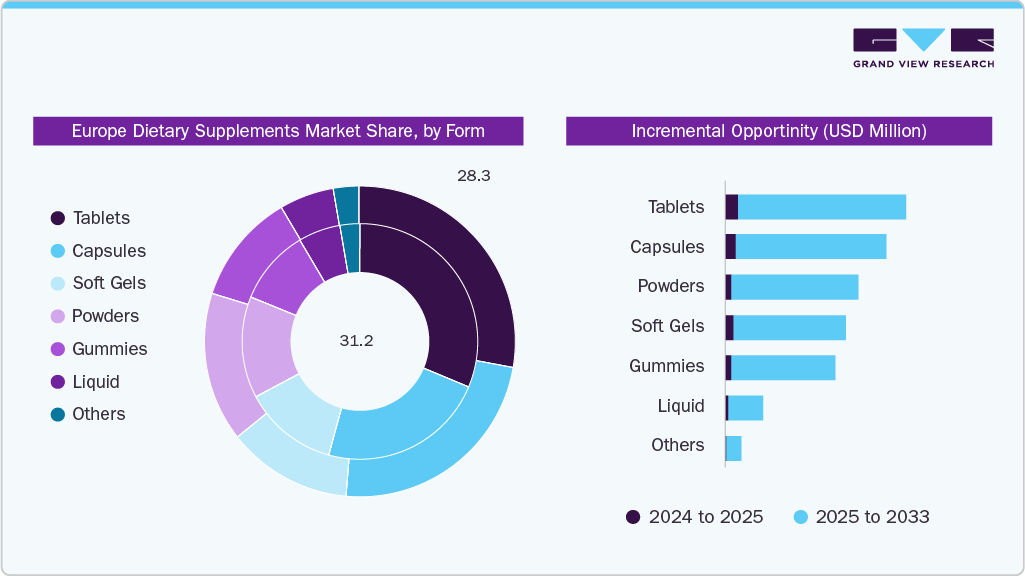

Form Insights

The tablet supplements segment led the market with the largest revenue share of 31.2% in 2024. The demand for dietary supplements in tablet form is rising in the Europe region due to increasing health consciousness and the need for convenient, reliable supplementation options. Tablets are preferred for their ease of use, accurate dosing, and portability, fitting well with busy and on-the-go lifestyles. In addition, a growing aging population seeking targeted nutritional support, combined with widespread availability through pharmacies, health stores, and online platforms, is boosting tablet supplement consumption. Increasing investments in preventive healthcare and a focus on chronic disease management further support the popularity of tablet-based supplements across European countries.

The powdered supplements segment is projected to grow at the fastest CAGR of 9.6% from 2025 to 2033. Consumers in Europe favor powdered supplements for their versatility and convenience, as they can be easily mixed with water, milk, or smoothies to fit into daily routines. The expanding fitness culture and increasing interest in functional and personalized nutrition are driving demand for protein powders, herbal blends, and vitamin-enriched drink mixes. In addition, the cost-effectiveness, extended shelf life, and flexibility in dosage make powdered supplements popular among a wide range of age groups across the region. Growing awareness of clean-label and natural ingredients also supports the rising preference for powdered formats.

Application Insights

The immunity segment led the market with the largest revenue share of 11.3% in 2024. Consumers in Europe are increasingly focused on enhancing their immune health through natural and preventive approaches. Factors such as urban living, environmental stressors, and changing lifestyles have heightened vulnerability to illnesses, encouraging the use of supplements with key ingredients such as vitamin C, vitamin D, zinc, eGermanycea, and traditional botanicals such as elderflower and ginseng.

The rising emphasis on long-term wellness and disease prevention is fueling robust demand for immunity-boosting supplements throughout the region. Growing public health awareness and recommendations from healthcare professionals further support this trend. For instance, in November 2022, NutriLeads launched BeniCaros, an organic immune health ingredient to be used in dietary supplements, food & beverages. The ingredient is known to enhance healthy cellular and gut-initiated immune responses and reduce severity of common cold symptoms.

The prenatal health segment is projected to grow at the fastest CAGR of 12.2% from 2025 to 2033. The demand for dietary supplements supporting prenatal health is increasing steadily in Europe, driven by greater awareness of maternal nutrition and enhanced access to quality healthcare. Emphasis on essential nutrients such as folic acid, iron, calcium, and DHA during pregnancy is encouraging more expectant mothers to include supplements in their daily regimen. In addition, factors such as rising disposable incomes, urban lifestyles, and delayed motherhood among working women are contributing to the growing adoption of prenatal supplements across European countries. Government health programs and recommendations from healthcare professionals further support this trend.

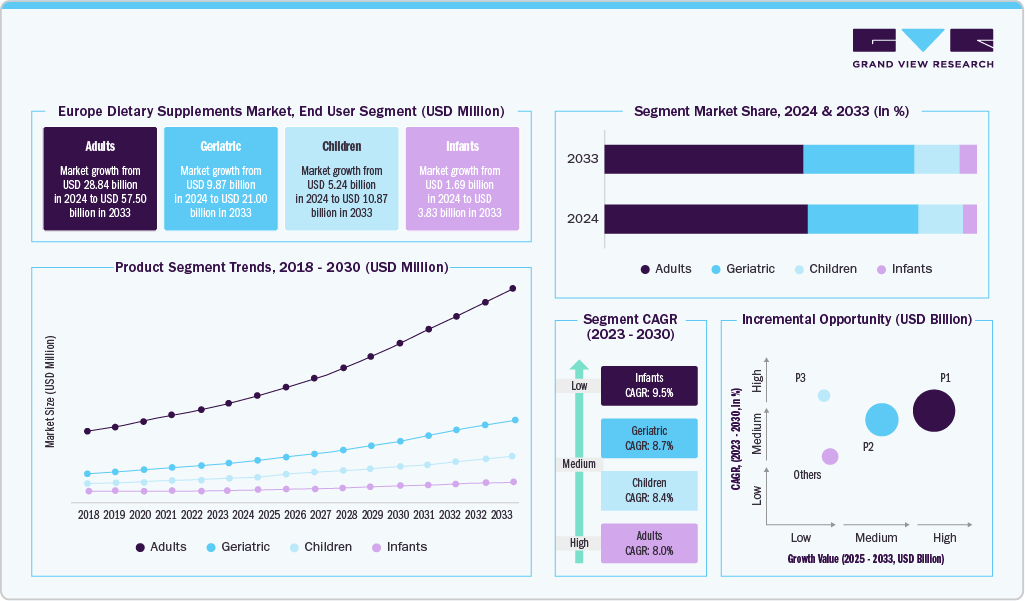

End Use Insights

The adults segment led the market with the largest revenue share of 63.2% in 2024. The demand for dietary supplements among adults in Europe is rising due to growing health awareness, hectic lifestyles, and the need to address nutritional deficiencies from unbalanced diets. Adults are increasingly turning to supplements to boost immunity, enhance energy levels, support digestion, improve mental well-being, and maintain fitness. Concerns related to aging, stress, and chronic health conditions are also motivating consumers to seek convenient, preventive health solutions. This trend reflects a broader focus on long-term wellness and quality of life across the region.

The infants segment is projected to grow at the fastest CAGR of 9.5% from 2025 to 2033. The demand for dietary supplements among infants in Europe is growing due to increased awareness of the importance of early childhood nutrition and pediatric recommendations for essential nutrients such as vitamin D, iron, and omega-3 fatty acids. Rising concerns over nutrient deficiencies, especially in breastfed or picky-eating infants, are prompting parents to seek supplemental support. In addition, factors such as premature births and the need to support immunity, bone health, and cognitive development during early growth stages are further driving this trend. Enhanced healthcare guidance and growing parental focus on preventive care are also contributing to increased supplement adoption.

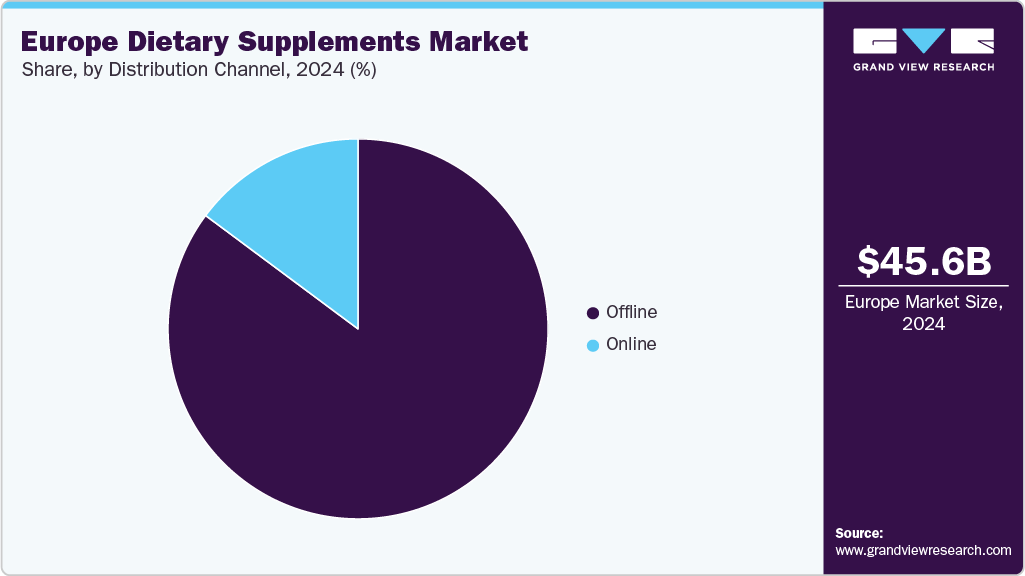

Distribution Channel Insights

The offline channels segment led the market with the largest revenue share of 85.18% in 2024. The sales of dietary supplements in Europe through offline channels are driven by strong consumer trust in pharmacies, health stores, and supermarkets for product authenticity and expert advice. In-store consultations with pharmacists and nutritionists provide reassurance, especially for first-time buyers or those seeking personalized recommendations. The ability to physically inspect products before purchase adds to consumer confidence. In addition, widespread retail presence and established distribution networks make offline shopping convenient and accessible across urban and rural areas. According to the consumer survey on food supplements in Europe data published in 2022, about 63% of the consumers purchased dietary supplements through offline channels such as pharmacies.

The online channels segment is projected to grow at the fastest CAGR of 9.8% from 2025 to 2033. The sales of dietary supplements in Europe through online channels are growing rapidly due to the convenience of home delivery, wider product variety, and competitive pricing. Consumers appreciate the ability to compare brands, read reviews, and access detailed product information before purchasing. The rise of e-pharmacies, health-focused e-commerce platforms, and mobile apps has further streamlined the buying process. In addition, increased digital literacy and internet penetration across the region are making online shopping a preferred choice for many.

Regional Insights

The dietary supplements market in Italy led the market with the largest revenue share of 18.1% in 2024. A strong cultural emphasis on health, wellness, and preventive care drives the dietary supplements industry in Italy. Growing awareness of natural and herbal remedies, along with an aging population seeking support for chronic conditions, boosts demand. High consumer trust in pharmacies and healthcare professionals also supports supplement use. In addition, the popularity of the Mediterranean diet complements interest in nutritional supplementation for overall well-being. For instance, according to the consumer survey on food supplements in Europe data published in 2022, about 35% of consumers in Italy consume dietary supplements such as multivitamins or mineral supplements.

The France dietary supplements market is projected to grow at a significant CAGR of 9.0% from 2025 to 2033. The dietary supplements industry in Spain is driven by increasing health consciousness and a growing focus on preventive healthcare. Rising demand for natural and plant-based products aligns with traditional wellness practices in the country. An aging population and lifestyle-related health concerns are also fueling supplement use, particularly for immunity, digestion, and heart health. In addition, strong pharmacy networks and expanding online retail channels support wider product accessibility.

The dietary supplements market in Germany is projected to grow at the fastest CAGR of 8.6% from 2025 to 2033, owing to rising health awareness, an aging population, and increasing interest in preventive healthcare. As lifestyles become more sedentary and dietary habits shift, consumers are turning to supplements to address nutritional gaps and support overall well-being. The growing prevalence of chronic conditions such as cardiovascular diseases, diabetes, and obesity is further encouraging the use of targeted nutritional products. In addition, the high standard of healthcare and strong regulatory oversight in Germany boost consumer confidence in the safety and efficacy of dietary supplements. For instance, according to the consumer survey on food supplements in Europe data published in 2022, about 43% of consumers in Germany consume dietary supplements such as magnesium supplements.

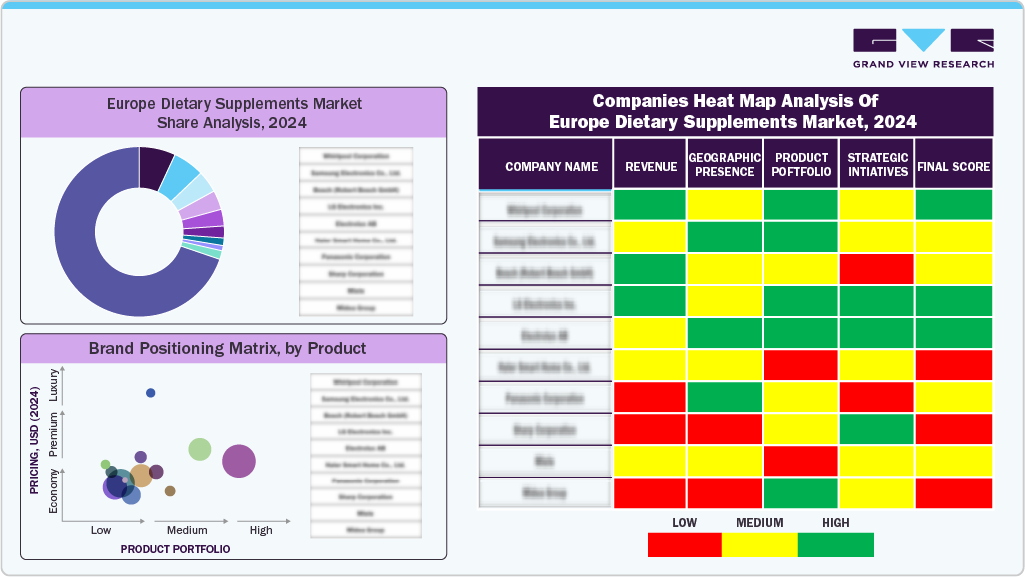

Key Europe Dietary Supplements Company Insights

Established brands and emerging players in the Europe dietary supplements industry are fostering a competitive landscape by focusing on innovation, product differentiation, and adherence to strict quality standards. Companies are investing in research and development, advanced manufacturing technologies, and clean-label formulations to meet evolving consumer preferences and regulatory requirements. Strategic pricing and strong branding are also key to capturing market share in a highly health-conscious region. In addition, the growing demand for personalized nutrition and sustainable packaging is influencing product strategies and partnerships across the industry.

Key Europe Dietary Supplements Companies:

- Bayer AG

- Nestlé Health Science

- Reckitt Benckiser Group plc

- Sanofi

- GSK plc

- Holland & Barrett

- Glanbia plc

- Orkla Health

- Pharmavite LLC

- Bioglan

- Queisser Pharma

- Kerry Group plc

Recent Developments

-

In September 2024, Airborne, a Reckitt Benckiser Group PLC brand, launched mineral-based dietary supplements with greater amounts of zinc, newly added vitamin D, and high concentrations of vitamin C. The product is available in effervescent and chewable supplement form and features key nutrients such as vitamins A, E, C, and D, zinc, and manganese.

-

In October 2023, Glanbia-owned brand Optimum Nutrition launched Clear Protein, a plant-based protein isolate with high-quality protein and available in 2 delicious flavors: lime sorbet and juicy peach in a sugar variant.

-

In February 2022, GSK plc announced a new company called Haleon as an independent entity in the consumer health portfolio with five major categories, including Digestive, health, and Vitamins, Minerals & supplements (VMS), with brands such as Centrum.

Europe Dietary Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 49.39 billion

Revenue forecast in 2033

USD 93.20 billion

Growth rate

CAGR of 8.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ingredients, type, form, application, end use, distribution channel, product-form, product-end use, product-application, region

Regional scope

Europe

Country scope

Germany; UK; France; Italy; Spain

Key companies profiled

Bayer AG; Nestlé Health Science.; Reckitt Benckiser Group plc.; Sanofi.; GSK plc; Holland & Barrett.; Glanbia plc.; Orkla Health; Pharmavite LLC.; Bioglan.; Queisser Pharma.; Kerry Group plc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Dietary Supplements Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the Europe dietary supplements market report based on ingredients, type, form, application, end use, distribution channel, product-form, form-end use, form-application, and region.

-

Ingredients Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (Selenium, Chromium, Copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

OTC

-

Prescribed

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Energy & Weight Management

-

General Health

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

-

-

Geriatric

-

Children

-

Infants

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Others (Direct to Consumer, MLM)

-

-

Online

-

-

Product-Form Outlook (Revenue, USD Billion, 2018 - 2033)

-

Vitamin

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

Multivitamin

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Vitamin A

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Vitamin B

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Vitamin C

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Vitamin D

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Vitamin K

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Vitamin E

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

-

Mineral

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

Calcium

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Potassium

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Magnesium

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Iron

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Zinc

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Others (selenium, chromium, copper)

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

-

-

Botanicals

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Protein & amino acids

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

Collagen

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Others

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

-

-

Fibers & Specialty Carbohydrates

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Omega Fatty Acids

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Probiotics

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Prebiotics & Postbiotics

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Others

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

-

-

Form-End User Outlook (Revenue, USD Billion, 2018 - 2033)

-

Tablets

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

-

Geriatric

-

Children

-

Infants

-

-

Capsules

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Geriatric

-

Children

-

Infants

-

-

-

Softgels

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

-

Geriatric

-

Children

-

Infants

-

-

Powders

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

-

Geriatric

-

Children

-

Infants

-

-

Gummies

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

-

Geriatric

-

Children

-

Infants

-

-

Liquid

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

-

Geriatric

-

Children

-

Infants

-

-

Others

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

-

Geriatric

-

Children

-

Infants

-

-

-

Form-Application Outlook (Revenue, USD Billion, 2018 - 2033)

-

Tablets

-

Energy & Weight Management

-

General Health

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Capsules

-

Energy & Weight Management

-

General Health

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Softgels

-

Energy & Weight Management

-

General Health

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Powders

-

Energy & Weight Management

-

General Health

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Gummies

-

Energy & Weight Management

-

General Health

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Liquid

-

Energy & Weight Management

-

General Health

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Others

-

Energy & Weight Management

-

General Health

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Frequently Asked Questions About This Report

b. The Europe dietary supplements market was valued at USD 38.19 billion in 2022 and is projected to reach USD 40.73 billion in 2023.

b. The Europe dietary supplements market is expected to grow at a compound annual growth rate (CAGR) of 7.0% from 2023 to 2030, to reach USD 65.44 billion by 2030.

b. Italy accounted for the largest share of 18.34% of the Europe dietary supplements market revenue in 2022, owing to the growing consumer base and growing trend towards preventive healthcare.

b. Some of the key market players in the Europe dietary supplements market include Amway, Abbott, Bayer AG, Glanbia plc, Pfizer Inc., Archer Daniels Midland, GlaxoSmithKline plc., NU SKIN, Herbalife Nutrition, and Nature's Sunshine Products Inc.

b. Key factors driving the Europe dietary supplements market growth include increasing geriatric population, changing consumer habits, rising health consciousness, and shift from pharmaceutical to nutraceutical products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.