- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Europe Digestive Health Supplements Market Report, 2030GVR Report cover

![Europe Digestive Health Supplements Market Size, Share & Trends Report]()

Europe Digestive Health Supplements Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Prebiotics, Probiotics, Symbiotics, Enzymes, Fulvic Acids), By Form, By Type, By Distribution Channel, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-182-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

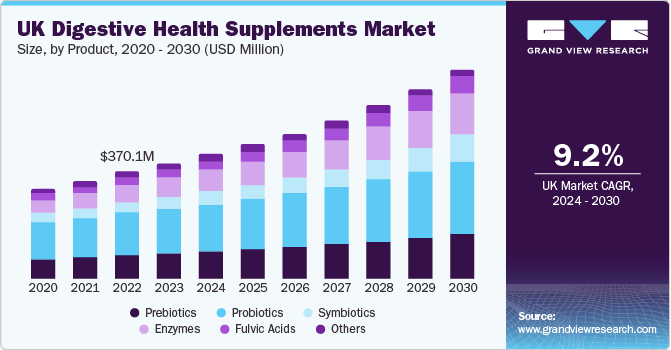

The Europe digestive health supplements market size was estimated at USD 4.03 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.5% from 2024 to 2030. The rising prevalence of digestive issues can be attributed to sedentary lifestyles, adopting Western diets rich in processed foods, and the increasing stressors of modern life. It includes conditions such as Irritable Bowel Syndrome (IBS), Inflammatory Bowel Diseases (IBD), acid reflux, and functional dyspepsia, which have become increasingly common and are affecting a significant portion of the European population and rising number of weight management programs.

The rising trend of fitness and sports nutrition is influencing the market for dietary supplements. There is an increasing demand for supplements that enhance performance, aid in muscle recovery, and promote overall physical well-being, driven by a growing population of fitness enthusiasts and athletes.

The dietary supplements market is also seeing a rise in demand for products that promote mental well-being. Consumers are becoming more aware of the connection between nutrition and mental health. As a result, there is an increased interest in supplements that can help with cognitive function, stress management, and mood enhancement.

Global awareness of and response to the COVID-19 pandemic has given rise to health-conscious behavior among consumers seeking supplements that support immune health, creating a heightened demand for vitamins, minerals, and other immune-boosting formulations. The pandemic has underscored the importance of proactive health measures, positioning dietary supplements as integral components of individuals' immune support strategies.

The influence of social media and digital marketing strategies also plays a pivotal role in shaping consumer perceptions and driving supplement sales. Platforms like Instagram, Facebook, and health-focused blogs are powerful for brand promotion and consumer education. Influencers and health experts leverage these channels to endorse and provide insights into the benefits of specific supplements, impacting consumer choices and fostering brand loyalty. Moreover, the rising global trend of plant-based diets influences the development and adoption of such dietary supplements. This trend aligns with the broader shift toward sustainable and ethical consumption, resonating with environmentally conscious consumers.

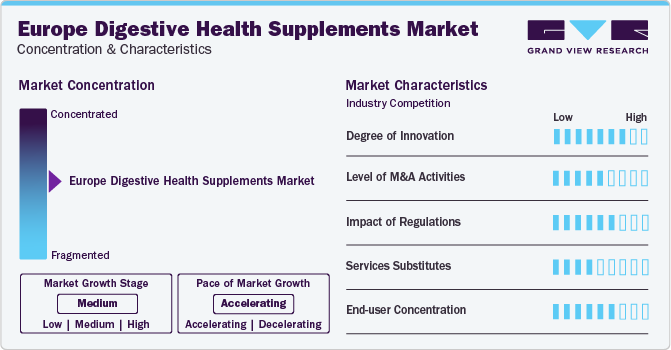

Market Concentration & Characteristics

The digestive health supplements market has seen various innovations in product formulations, delivery methods, and ingredients to meet consumer demands for effective and convenient solutions. The trend toward plant-based and clean-label products has influenced digestive health supplements. Consumers are seeking products with natural ingredients and fewer additives.

Merger and acquisition (M&A) activities have been notable in the European digestive health supplements market, with companies seeking strategic partnerships and acquisitions to strengthen their market positions. Companies are also looking for opportunities to diversify and expand their product portfolios. Acquiring businesses with established digestive health supplement lines allows companies to offer a broader range of products.

The regulatory landscape influences various aspects of the industry, including product formulation, labeling, marketing claims, and overall market dynamics. Regulations dictate the permissible health claims that manufacturers can make about their products. Health claims must be supported by scientific evidence, and adherence to labeling requirements is essential to provide consumers with accurate information about the product's intended use and benefits.

In the European digestive health supplements market, several product substitutes offer consumers alternative options to address their digestive health concerns. These substitutes may include natural foods, traditional remedies, and other dietary supplements.

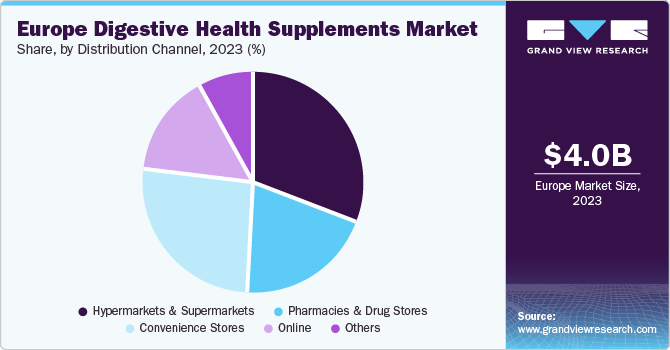

Distribution Channel Insights

The sales of digestive health supplements through hypermarkets & supermarkets held a market share of 30.4% of the total market in 2023. Demand for digestive health supplements is growing as consumers increasingly prioritize preventive healthcare and wellness. Factors such as hectic lifestyles, imbalanced diets, and increased stress levels have fueled interest in products that promote gut health, contributing to segment growth. The widespread availability of digestive health supplements in these retail outlets makes it easier for consumers to incorporate them into their daily routines. Moreover, the diverse range of options and competitive pricing in hypermarkets and supermarkets contribute to the segment's growth, appealing to a broad spectrum of consumers with varying preferences and budgets.

The sales of digestive health supplements through online retail stores are expected to grow at the fastest CAGR during the forecast period.The increasing digitization of healthcare and wellness trends is driving Europe's online digestive health supplement market. The convenience and accessibility offered by digital platforms play a critical role in meeting the demand for digestive health supplements in the European market. E-commerce is reshaping consumer behavior in the context of digestive health supplements.

Product Insights

In terms of product, probiotic supplements dominated with the largest market share of the total revenue, holding 38.5% of the total market in 2023. The prevalence of gastrointestinal disorders, including irritable bowel syndrome (IBS) and inflammatory bowel diseases, has propelled the demand for probiotics. The efficacy of probiotics in alleviating symptoms and promoting gut health aligns with the growing consumer inclination towards functional and preventive healthcare solutions. It is particularly evident among the geriatric population with a heightened awareness of digestive health issues.

The enzyme segment is anticipated to register a significant CAGR during the forecast period of 2024 to 2030. The prevalence of processed and refined foods in contemporary diets has contributed to suboptimal digestion issues. Enzymes play a crucial role in breaking down complex nutrients from such foods, and their supplementation is viewed as a strategic response to the challenges posed by nutrient-absent, highly processed diets.

Furthermore, lifestyle factors such as hectic schedules, processed food consumption, and stress have led to suboptimal dietary habits, impacting digestive health. Enzyme supplements, positioned as aids in optimizing digestion and nutrient utilization, resonate with individuals seeking convenient solutions to counteract the effects of modern lifestyles on their digestive systems. The digestive health supplements market is actively addressing the demand for a wide range of enzyme formulations, including broad-spectrum and specialized blends to cater to different needs.

Form Insights

In terms of form, tablets dominated with the largest market share of the total revenue, holding 32.0% of the total market in 2023. The impact of social media influencers and wellness advocates significantly contributes to the popularity of digestive health supplement tablets. Endorsements and testimonials from influencers with a significant following foster consumer awareness and trust. The accessibility of information through social media platforms develops a sense of community, encouraging individuals to explore and adopt tablets that align with their health goals, including digestive wellness. In addition, the trend of holistic health management focusing on the combination of digestive health and other health benefits is driving the adoption of tablets. Multifunctional tablets incorporating ingredients for joint health, skin vitality, and energy enhancement alongside digestive and immune support are gaining traction.

Type Insights

In terms of type, OTC (over-the-counter) sales of digestive health supplements dominated with the largest market share of the total revenue, holding 72.4% of the total market in 2023. OTC products are safe and effective for the public without the direct supervision of a healthcare professional. These products can include different medications, from pain relievers and cough medicine to dietary supplements and digestive health aids. OTC medications are easily accessible to consumers in pharmacies, drug stores, supermarkets, and other retail outlets. They provide the ability to self-diagnose and manage common health conditions without requiring a doctor's prescription. The availability of OTC products plays a crucial role in promoting self-care and empowering individuals to address minor health concerns independently.

Country Insights

Italy dominated the market with a share of 18.2% in 2023. Italy has a proactive approach to health, preferring natural solutions and evidence-based products. The regional demand for digestive health supplements is high, making Italy a leading player in the European market. The different regions in Italy have unique culinary traditions and dietary habits, resulting in distinct preferences for certain supplements. Online platforms and e-commerce channels significantly promote market growth in areas with a solid digital presence. Access to information and the convenience of online purchasing contribute to overall market expansion. For instance, in October 2020, Centro Sperimentale del Latte launched Flogranic Probiotics, a certified organic product range in Italy that offers Lactobacillus strains to improve respiratory and oral health.

Key Companies & Market Share Insights

The competitive landscape in the Europe digestive health supplements market is characterized by intense rivalry among key players, innovative product offerings, strategic partnerships, and a constant focus on meeting the evolving demands of the diverse and growing consumer demands. Several factors contribute to the dynamic nature of the competitive environment within this market. Major players in the market include well-established brands with a global presence.

Key Europe Digestive Health Supplements Companies:

- Amway

- Bayer AG

- Pfizer, Inc.

- Herbalife International of America, Inc.

- Royal DSM

- NOW Foods

- Procter & Gamble

- Vitabiotics

- Nestle Health Science

Recent Developments

-

In October 2023, Nestle launched a probiotic and HMO blend to mirror breast milk changes. This new proprietary blend for infant nutrition combines a probiotic strain with six human milk oligosaccharides (HMOs) at varying levels to support infant development through different life stages

-

In May 2023, Bayer launched a unit to develop new precision health consumer products. It is expected to help close the gap between monitoring, awareness, and diagnosis on one end and education, treatment, and prevention on the other by identifying digital and digitally supported consumer healthcare opportunities.

-

In April 2023, Royal DSM launched the Health from Gut platform, which was designed to meet the growing consumer demand for better gut health. Based on a holistic approach to the human microbiome, it will deliver clinically proven, multi-ingredient products featuring its industry-leading brands, including next-generation Humiome pre-, pro-, and postbiotics, GlyCare Human Milk Oligosaccharides (HMOs), Tolerase digestive enzymes, and Quali vitamins.

Europe Digestive Health Supplements Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.32 billion

Revenue forecast in 2030

USD 7.07 billion

Growth rate

CAGR of 8.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, form, type, distribution channel, country

Country scope

U.K.; Germany; France; Italy; Spain; Sweden; Netherlands; Denmark

Key companies profiled

Bayer AG; Pfizer, Inc.; Herbalife International of America, Inc.; Royal DSM; Procter & Gamble; Nestle Health Science; NOW Foods; Vitabiotics; Amway

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Digestive Health Supplements Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe digestive health supplements market based on product, form, type, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Prebiotics

-

Probiotics

-

Symbiotics

-

Enzymes

-

Fulvic Acids

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Capsules

-

Tablets

-

Powder

-

Liquid

-

Soft Gels

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

OTC

-

Prescribed

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Pharmacies & Drug Stores

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Netherlands

-

Denmark

-

-

Frequently Asked Questions About This Report

b. The Europe digestive health supplements market size was estimated at USD 4.03 billion in 2023 and is expected to reach USD 4.32 billion in 2030

b. The Europe digestive health supplements market is expected to grow at a compounded growth rate of 8.5% from 2024 to 2030 to reach USD 7.07 billion by 2030.

b. Italy dominated the Europe digestive health supplements market with a share of 18.2% in 2023 due to the increased demand for digestive health supplements from millennials and adult population, making Italy an important player in the European market

b. Some key players operating in the Europe digestive health supplements market include Bayer AG, Pfizer Inc, Herbalife International of America, Inc., Royal DSM, Procter & Gamble, Nestle Health Science, and Amway

b. The growth of digestive health supplements in Europe is influenced by various factors that reflect changing consumer preferences, increased awareness of digestive health, and the pursuit of overall well-being.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.