- Home

- »

- IT Services & Applications

- »

-

Europe Enterprise Resource Planning (ERP) Software Market Report, 2030GVR Report cover

![Europe Enterprise Resource Planning (ERP) Software Market Size, Share & Trends Report]()

Europe Enterprise Resource Planning (ERP) Software Market (2023 - 2030) Size, Share & Trends Analysis Report By Function (Finance, Supply Chain), By Deployment (Cloud, On-premises), By Enterprise Size, By Vertical, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-146-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

ERP Software Market Size & Trends

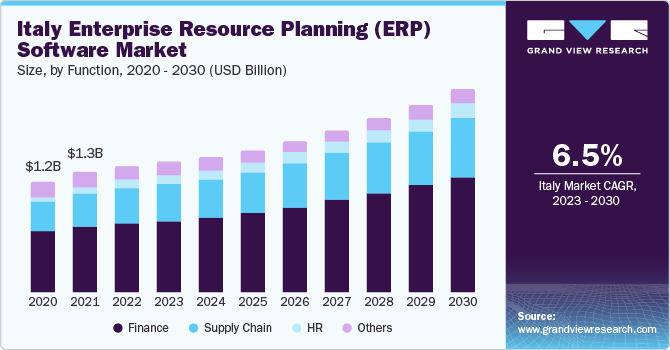

The Europe Enterprise Resource Planning (ERP) software market size was estimated at USD 17.88 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 9.1% from 2023 to 2030. The ever-growing need for automation to streamline business processes, as well as the integration of ERP software in small- & medium-sized enterprises (SMEs) for business scalability, are factors driving market growth. Additionally, the growing demand for cloud-based and mobile-based ERP software for real-time data access in remote locations is poised to boost market expansion. Moreover, the increasing adoption of cognitive technologies such as blockchain, Artificial Intelligence (AI), and Machine Learning (ML) has enhanced market demand in recent years.

Europe ERP software providers have continued to provide mobile functionality, and mobile applications are increasingly common in Europe. To enable employees to perform back-end and front-end tasks irrespective of the location, from the warehouse floor to a retail checkout terminal to an airport, ERP solutions are being developed to offer on-the-go access to vital business data. Mobile ERP can also encourage collaboration for geographically dispersed workers working in different time zones. Mobile ERP programs are designed with an easy user interface that enables users to execute tasks when not using a computer. Employees can perform tasks such as call logging, expense reporting, and time monitoring on their smartphones, as well as monitor the status of essential procedures or approvals. Mobile ERP delivers significant benefits, such as always-on remote access, higher agility, increased productivity, and real-time data and insights. These benefits have received widespread acclaim in recent years, which has increased the demand for the market.

ERP software users are increasingly accelerating ERP software to the cloud to enhance latency and transform their business with various technologies such as artificial intelligence (AI) and blockchain. Thus, ERP software providers are collaborating to offer cloud infrastructure database services to simplify cloud migration, multi-cloud deployment, and management. For instance, in September 2023, Oracle Corporation, an ERP software provider extended its partnership with Microsoft Corporation, an IT software company, to offer Oracle DatabaseAzure, to provide customers direct access to Oracle database services running on Oracle Cloud Infrastructure (OCI) and deployed in Microsoft Azure datacenters. Oracle DatabaseAzure delivers all the performance, scale, and workload availability advantages of Oracle Database on OCI with security and flexibility, as well as Microsoft Azure, including AI services like Azure OpenAI. This combination provides customers with more flexibility regarding where they run their workloads. It also provides a streamlined environment that simplifies cloud purchasing and management between Oracle Database and Azure services. Thus, such strategic initiatives are expected to enhance the Europe market.

However, enterprise resource planning software is expensive, and setting up ERP systems can be costly for SMEs and new businesses. Businesses strive to run smoothly and efficiently; thus, good planning, qualified personnel, and an experienced team are crucial. In addition, upgrading network infrastructure, security software, and computer hardware is required to deploy solutions, which increases costs. This factor acts as a critical restraining factor for the market growth.

Function Insights

Theothers function segment includes compliance and risk management, project management, sales, inventory, and marketing segment, and this segment held the largest revenue share of over 33% in 2022. ERP solutions enable real-time compliance monitoring capabilities to track changes in regulations and standards and automatically updates compliance processes and reporting accordingly. Moreover, ERP software helps automate the generation of compliance reports, reducing manual efforts and the risk of human errors in reporting. This streamlines compliance processes and ensures accuracy. Organizations often manage multiple complex projects simultaneously using ERP software. Thus, the aforementioned factors are driving the growth of the segment for the software market.

The finance segment is anticipated to register a CAGR of 9.6% from 2023 to 2030. The increasing demand from enterprises to gain visibility into their financial activities is one of the key factors driving the growth of the finance segment in the Europe market. Moreover, ERP solutions are integrated with AI and ML capabilities to automate repetitive tasks, improve predictive analytics, and enhance fraud detection. AI-driven insights can transform financial data analysis and risk assessment. Cloud ERP systems use AI algorithms to analyze historical data, market patterns, and outside influences, providing more precise and useful financial projections, thereby boosting the growth of the finance segment in the market.

Deployment Insights

The cloud segment held the largest revenue share of over 60% in 2022. This is due to factors such as the rising adoption of SaaS solutions because of the functional ability of cloud computing for improving business performance of enterprises and increasing migration of enterprises to cloud ecosystems to reduce operational costs and improve security. In addition, the increasing need to deploy advanced ERP solutions that contain advanced analytics features, identify probable issues such as delays and disruptions, and rapid inclusion of artificial intelligence & machine learning technologies in the development of cloud ERP solutions are observed as key trends contributing to the growth of the Europe market.

The on-premise segment is anticipated to register a CAGR of 8.4% over the forecast period. With the adoption of on-premise ERP solutions, organizations can maintain complete control over their data while adhering to industry rules. Organizations with legacy systems prefer on-premise ERP solutions to enable integration. This is critical for ensuring companies’ continuity and minimizing interruption during the transition. On-premise ERP systems provide enhanced customization and control over the software environment. Companies can customize ERP solutions to their business processes and combine them with other on-premise applications. Thus, the aforementioned factors are driving the on-premise segment growth.

Enterprise Size Insights

The small enterprises segment held a market share of 26.93 % in 2022. ERP solutions for small enterprises include advanced reporting and analytics tools. These technologies enhance data-driven decision-making by providing real-time data visualization, configurable dashboards, and predictive analytics. For instance, in June 2023, SAP Fioneer, a software company, announced the launch of SME Banking Edition. The solution is expected to allow banks and neobanks to provide banking services in a data-driven, digital-first approach specific to the financial requirements of small and medium-sized enterprises (SMEs). By linking banks to external data sources such as open banking, central business registries, e-commerce, and Enterprise Resource Planning (ERP) data, SME Banking Edition tackles various issues and creates actionable insights that significantly assist SMEs in staying competitive. Thus, driving the growth of the segment.

The medium enterprises segment is anticipated to grow at the fastest CAGR of 10.2% over the forecast period. Several factors such as the necessity of scalability, automation for efficiency, monitoring processes, and unified data administration are attributed to the growth of this segment. Medium enterprises are increasingly shifting to cloud-based ERP solutions to manage huge amounts of data from various sources. With the adoption of cloud-based ERP solutions, medium organizations can centralize customer data, increase data accuracy, and deliver insightful data, which is expected to drive the growth of the segment.

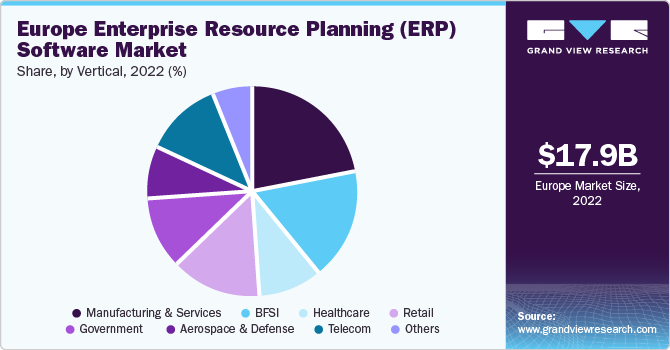

Vertical Insights

The manufacturing and services segment held the largest market share of over 22% in 2022. The growth of this segment can be attributed to the increasing utilization of advanced analytics within ERP solutions. Predictive analytics and AI-powered insights are used in smart manufacturing processes. ERP software streamlines these processes by centralizing data, automating workflows, and ensuring process consistency. Thus, driving the market demand for this segment.

The government segment is anticipated to grow at the fastest CAGR of 11.1% over the forecast period. ERP solutions facilitate public sector firms by enabling instant access to data analytics and empowering them to make better-informed decisions. In addition, real-time data facilitates the early detection of problems and allows government organizations to implement changes accordingly, Moreover, it improves efficiency and integrates different government department operations into a single platform. Thus, these factors collectively drive the demand for this segment.

Country Insights

In terms of country, Germany dominated the market in 2022 with a revenue share of over 28%. German manufacturers, especially those in automotive, machinery, and food processing, require ERP software to manage production, quality control, and supply chain operations efficiently. In Germany, ERP systems are incorporated with advanced analytics and Business Intelligence (BI) capabilities. This enables businesses to harness data-driven insights for decision-making, predictive analytics, and process optimization. Industries such as retail benefit from customer-centric data analysis, which is driving the software market growth in the country.

The UK is expected to grow significantly with a CAGR of 10.3% over the forecast period due to the advancement of technological implementation in enterprises. There are various factors that contribute to the country’s growth including the use of advanced expertise, surge in IT services, and the rise of SMEs. The development of custom ERP software is becoming more popular in this country due to an increasing number of highly skilled developers working in minimum time.

Key Companies & Market Share Insights

Europe ERP software providers are undertaking various strategic initiatives such as partnership, collaboration, and merger & acquisition to stay competitive in the market. For instance, in March 2023, TeamSystem S.p.A, an ERP software provider, acquired a 100% controlling stake in Multidata S.r.l., a company that develops and markets software for the textile industry. Furthermore, Europe ERP software providers are also expanding their presence across the region to capture new markets. For instance, in April 2023, SB Italia Srl, an ERP software provider, opened a new branch in Reggio Emilia, in the Emilia-Romagna administrative region of northern Italy. The new branch marked the company’s fourth branch in Italy after the district HQs in Milan and the existing branches in Varese and Genoa; which has allowed the company to provide enterprise solutions for digital transformation and sustainability, in line with the company’s development plan aimed at geographical expansion in Italy.

Key Europe Enterprise Resource Planning (ERP) Software Companies:

- Centro Software srl

- Epicor Software Corporation

- Eurosoft s.r.l.

- Fluentis SrL

- Hewlett-Packard Development Company, L.P.

- Infor

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- SB Italia Srl

- Sisthema SpA

- TeamSystem S.p.A

- Unit4

- Zucchetti spa

Europe Enterprise Resource Planning (ERP) Software Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 19.12 billion

Revenue forecast in 2030

USD 35.07 billion

Growth rate

CAGR of 9.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Function, deployment, enterprise size, vertical, country

Country scope

UK; Germany; France; Italy; Spain; Romania

Key companies profiled

Centro Software SrL; Epicor Software Corporation; Eurosoft SrL; Fluentis SrL; Hewlett-Packard Development Company, L.P.; Infor; International Business Machines Corporation; Microsoft Corporation; Oracle Corporation; SAP SE; SB Italia Srl; Sisthema SpA; TeamSystem SpA; Unit4; Zucchetti SpA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Enterprise Resource Planning (ERP) Software Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe enterprise resource planning (ERP) software market report based on function, deployment, enterprise size, vertical, and country:

-

Function Outlook (Revenue, USD Billion, 2018 - 2030)

-

Finance

-

Human Resource (HR)

-

Supply Chain

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Medium Enterprises

-

Small Enterprises

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

Manufacturing & Services

-

BFSI

-

Healthcare

-

Retail

-

Government

-

Aerospace & Defense

-

Telecom

-

Others

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Romania

-

Frequently Asked Questions About This Report

b. The Europe enterprise resource planning (ERP) software market size was estimated at USD 17.88 billion in 2022 and is expected to reach 19.12 billion in 2023.

b. The Europe enterprise resource planning software market is expected to grow at a compound annual growth rate of 9.1% from 2023 to 2030 to reach USD 35.07 billion by 2030.

b. The cloud segment accounted for the largest revenue share of over 60% in 2022. Owing to the factors such as the rising adoption of SaaS solutions due to the functional ability of cloud computing to improve the business performance of enterprises and the increasing migration of enterprises to the cloud ecosystem for reducing operational costs and improve security. . In addition, the increasing need to deploy advanced ERP solutions that contain advanced analytics features, identify probable issues such as delays and disruptions, and rapid inclusion of artificial intelligence & machine learning technologies in the development of cloud ERP solutions are observed as key trends contributing to the growth of the Europe ERP software market.

b. The key players in the market are Centro Software srl, Epicor Software Corporation, Eurosoft s.r.l., Fluentis SrL, Hewlett-Packard Development Company, L.P., Infor, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, SB Italia Srl, Sisthema SpA, TeamSystem S.p.A, Unit4, and Zucchetti spa.

b. The increased need for automation to streamline business processes and the integration of ERP software in Small & Medium Enterprises (SMEs) for business scalability are driving the demand for the Europe Enterprise Resource Planning (ERP) software market. Moreover, the rising demand for cloud-based and mobile-based ERP software for real-time data access in remote location is expected to drive the demand for the Europe ERP software market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.