- Home

- »

- Advanced Interior Materials

- »

-

Europe Heating Radiator Market Size, Industry Report, 2030GVR Report cover

![Europe Heating Radiator Market Size, Share & Trends Report]()

Europe Heating Radiator Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Hydronic Heating Radiators, Electric Heating Radiators), By Application (Residential, Industrial, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-375-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Heating Radiator Market Trends

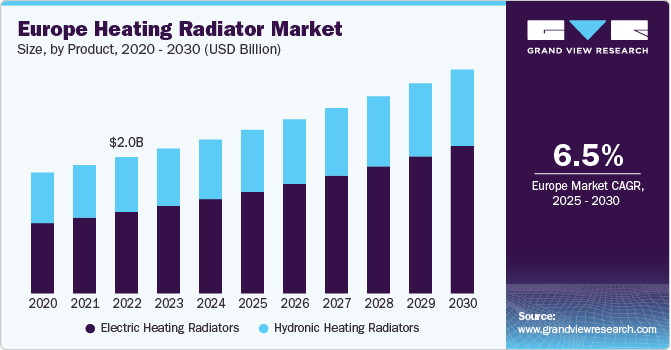

The Europe heating radiator market size was estimated at USD 2.28 billion in 2024 and is expected to grow at a CAGR of 6.5% from 2025 to 2030. The demand for heating radiators in Europe is expected to witness a significant rise with the growing demand for upgraded equipment, which, in turn, is expected to significantly contribute to the growth of the market. Moreover, increasing demand for energy-efficient solutions in the residential sector is anticipated to drive the demand for heating radiators and, in turn, trigger market growth over the forecast period.

Europe’s heating radiators industry is witnessing an increase in the demand for price-efficient, smaller, and wall-hung heating radiators. Factors such as ease in terms of installation, low cost, space-saving, and energy-saving features of radiators are expected to reshape the market with various growth prospects. Moreover, customers are demanding stylish, colored, and high-quality products that can be easily maintained. These types of products have proven to be the latest trends in the industry.

Drivers, Opportunities & Restraints

One of the primary drivers of the heating radiators industry in Europe is the increasing focus on energy efficiency and eco-friendly heating solutions. With a shift towards sustainable living and stringent government regulations aimed at reducing carbon emissions, consumers and businesses are investing in advanced heating systems. This trend is further supported by technological advancements that enhance the performance and energy efficiency of modern radiators, making them more appealing to environmentally conscious buyers looking to lower their energy bills.

A significant restraint on the heating radiators industry in Europe is the high initial installation costs associated with modern heating systems. Many consumers are deterred by the upfront investment required for purchasing and installing new radiators, especially in older buildings where retrofitting can be complex and expensive. In addition, there’s a prevalent perception that traditional heating methods are sufficient, leading to reluctance in upgrading to newer technologies.

The growing shift towards smart home technology presents a substantial opportunity for the heating radiators industry in Europe. As consumers look for integrated and automated solutions that offer convenience and energy savings, the development of smart heating systems that can be controlled via mobile devices or home automation platforms is on the rise. This trend not only boosts the demand for innovative radiator designs but also opens avenues for manufacturers to differentiate their products, improving overall industry appeal.

Product Insights

The electric heating radiators product segment led the market and accounted for 61.3% of the overall revenue share in 2024. Electric heating radiators are a popular and energy-efficient option for home and commercial heating. These radiators use electricity to heat an internal element, which then radiates heat into the room. They are easy to install, as they do not require a central heating system or plumbing, making them ideal for spaces that lack existing heating infrastructure. Electric radiators offer precise temperature control through thermostats and timers, allowing users to set desired room temperatures efficiently. They are available in various designs and sizes, often incorporating advanced features like energy-saving modes, digital controls, and even Wi-Fi connectivity for remote management. As they are self-contained units, electric radiators are low-maintenance and a flexible heating solution for modern living spaces.

Hydronic heating radiators are part of a central heating system that uses water heated by a boiler to circulate warmth throughout the home. The hot water passes through pipes connected to radiators, which then release heat into the room. Hydronic radiators are known for providing consistent, even heat distribution and are particularly energy-efficient when paired with renewable energy sources like solar panels or heat pumps. This type of system can be zoned for different areas of the home, allowing for individualized temperature control. While installation is more involved due to the need for plumbing and a boiler, hydronic systems offer long-term comfort and efficiency, making them a popular choice for whole-house heating in both residential and commercial settings.

Application Insights

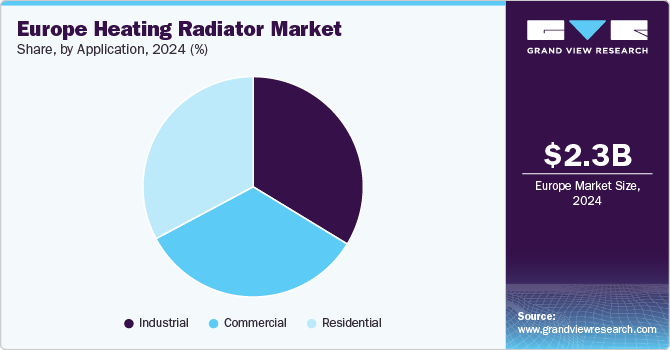

The industrial application segment led the market and accounted for 33.7% of the overall revenue share in 2024 and is expected to grow rapidly in the coming years. Heating radiators play a vital role in manufacturing, smelting, and others industrial applications. Heating equipment including radiators is widely used in aviation, food, beverage, mining, and other industries as well as in hazardous and non-hazardous areas.

The residential applications is experiencing steady growth, driven by increasing demand for energy-efficient, cost-effective, and comfortable heating solutions. As homeowners seek more sustainable alternatives to traditional heating systems, electric and hydronic radiators have become popular choices due to their ability to provide consistent and controllable warmth. The growing emphasis on energy conservation, coupled with advancements in smart home technologies, has led to the integration of features such as programmable thermostats, Wi-Fi connectivity, and energy-saving modes in modern radiators.

Country Insights

The Benelux heating radiators market is driven by the growing demand for energy-efficient and sustainable heating solutions, as the region seeks to meet ambitious climate goals and reduce reliance on fossil fuels. Countries like the Netherlands are leading the transition with a focus on eco-friendly alternatives, such as electric and low-carbon radiators, while Belgium and Luxembourg are also investing in modern heating systems for both new construction and retrofitting existing buildings. The increasing trend of smart home technologies and the growing popularity of stylish designer radiators further support market growth. As urbanization continues and energy efficiency regulations tighten, the demand for advanced, aesthetically pleasing, and energy-saving radiators is expected to continue to rise across the region.

The heating radiators market in Russia is heavily influenced by the country’s cold climate, driving consistent demand for reliable and efficient heating solutions in both residential and commercial buildings. Despite a strong reliance on natural gas for heating, there is a growing shift toward more energy-efficient radiator technologies as consumers become increasingly conscious of energy costs and environmental impact. The market sees strong demand for traditional radiators, such as cast iron and steel models, but also an emerging interest in modern solutions like electric and low-energy systems. As Russia modernizes its infrastructure and renovates older buildings, the need for high-performance, energy-efficient radiators is expected to grow, particularly in urban areas and new housing developments.

Key Europe Heating Radiator Company Insights

Some key players operating in the market include Stelrad Limited, Zehnder Group AG, and KORADO.

-

Stelrad Limited is a leading manufacturer of steel panel radiators, providing efficient heating solutions for residential and commercial applications. Headquartered in the UK, the company is known for its high-quality radiators and extensive product range. Stelrad focuses on innovation, offering advanced features such as energy efficiency and design flexibility. It serves customers across Europe, delivering reliable heating solutions that cater to modern home and building heating needs.

-

Zehnder Group AG, based in Switzerland, is a global leader in the production of heating, ventilation, and air-conditioning solutions. The company specializes in high-performance radiators, towel warmers, and indoor climate control systems for both residential and commercial markets. Known for its emphasis on energy efficiency, comfort, and sustainability, Zehnder’s products are used worldwide. The company’s innovative designs and focus on environmental impact make it a prominent player in the HVAC industry.

-

KORADO is a Czech manufacturer recognized for its high-quality steel radiators and innovative heating solutions. Specializing in both residential and commercial sectors, KORADO offers a wide range of products, including panel radiators, towel warmers, and designer radiators. The company is known for its energy-efficient and sustainable products, combining functional design with modern technology. With a strong presence in Europe, KORADO continues to expand its influence in the global heating industry.

Eskimo Products Ltd and Pitacs Limited are some of the emerging market participants in the industry.

-

Eskimo Products Ltd is a UK-based company specializing in the design and manufacture of high-quality refrigeration and heating solutions. Primarily known for its innovative range of electric heating radiators, Eskimo offers energy-efficient products that cater to both residential and commercial sectors. The company emphasizes sustainability, reliability, and advanced technology in its product offerings, providing customers with cost-effective and eco-friendly heating solutions. Eskimo Products Ltd is committed to meeting the evolving needs of the heating industry, ensuring optimal performance and comfort in a variety of environments.

-

Pitacs Limited is a leading UK manufacturer of heating products, specializing in electric and hydronic heating solutions. With a focus on quality and energy efficiency, the company offers a diverse range of products including panel radiators, towel warmers, and bespoke heating solutions. Pitacs is known for its commitment to innovation, customer satisfaction, and sustainable heating technologies, catering to residential, commercial, and industrial markets.

Key Europe Heating Radiator Companies:

- Stelrad Limited

- Foshan Sunfar Radiator Co., Ltd

- Zehnder Group AG

- KORADO

- Vasco Group

- IRSAP S.p.A.

- Nuociss

- Purmo Group

- Eskimo Products Ltd

- Pitacs Limited

Recent Developments

-

In July 2022, Stelrad Radiator Group Ltd. announced a definitive agreement to acquire DL Radiators. DL Radiators is a heat emitter manufacturer that specializes in the production and sale of hydronic and electric radiators. The company operates its primary manufacturing facility in Moimacco, near Udine, Italy, and employs approximately 350 individuals. This strategic acquisition by Stelrad aims to broaden the range of radiators available through its existing sales and distribution network, expand its market reach, incorporate a well-established complementary brand, and enhance its overall manufacturing capacity.

Europe Heating Radiator Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.43 billion

Revenue forecast in 2030

USD 3.32 billion

Growth rate

CAGR of 6.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, application, country

Country Scope

UK; Germany; France; Italy; Spain; Austria; Russia

Key companies profiled

Stelrad Limited; Foshan Sunfar Radiator Co.; Ltd; Zehnder Group AG; KORADO; Vasco Group; IRSAP S.p.A.; Nuociss; Purmo Group; Eskimo Products Ltd; and Pitacs Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Heating Radiator Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe heating radiators market report based on product, application, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hydronic Heating Radiators

-

Electric Heating Radiators

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

UK

-

Germany

-

Spain

-

France

-

Italy

-

Austria

-

Russia

-

Switzerland

-

Benelux

-

Frequently Asked Questions About This Report

b. The Europe heating radiator market size was estimated at USD 2.28 billion in 2024 and is expected to reach USD 2.43 billion in 2025.

b. The Europe heating radiator market is expected to grow at a compound annual growth rate of 6.5% from 2025 to 2030 to reach USD 3.32 billion by 2030.

b. The electric heating radiators product segment led the market and accounted for 61.3% of the overall revenue share in 2024. Electric heating radiators are a popular and energy-efficient option for home and commercial heating. These radiators use electricity to heat an internal element, which then radiates heat into the room. They are easy to install, as they do not require a central heating system or plumbing, making them ideal for spaces that lack existing heating infrastructure.

b. Some of the key players operating in the Europe heating radiator market include Stelrad Limited; Foshan Sunfar Radiator Co.; Ltd; Zehnder Group AG; KORADO; Vasco Grou; IRSAP S.p.A.; Nuociss; Purmo Group; Eskimo Products Ltd; and Pitacs Limited.

b. The demand for heating radiators in Europe is expected to witness a significant rise every year with the growing demand for upgraded equipment, which, in turn, is expected to significantly contribute to the growth of the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.