- Home

- »

- Advanced Interior Materials

- »

-

Heating Equipment Market Size, Industry Report, 2030GVR Report cover

![Heating Equipment Market Size, Share & Trends Report]()

Heating Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Heat Pump, Unitary Heaters, Warm Air Furnaces), By Application (Residential, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-206-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Heating Equipment Market Summary

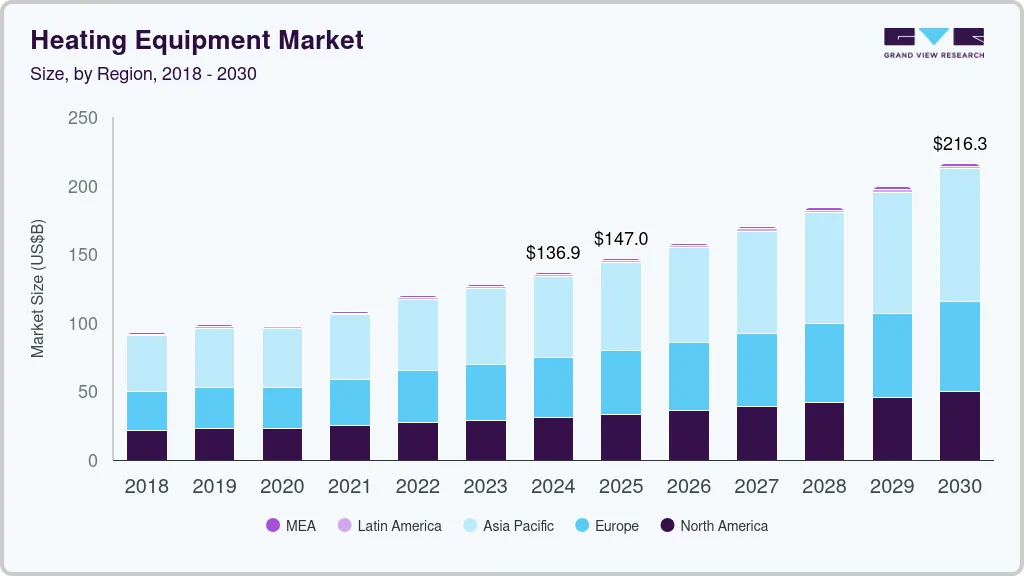

The global heating equipment market size was estimated at USD 136,891.4 million in 2024 and is projected to reach USD 216,296.4 million by 2030, growing at a CAGR of 8.0% from 2025 to 2030, owing to rising demand for energy-efficient solutions.

Key Market Trends & Insights

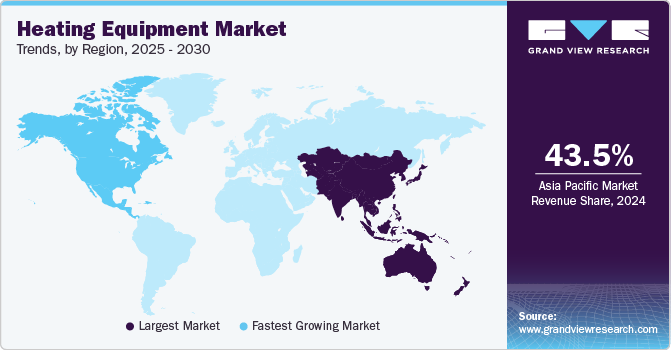

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, Norway is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, heat pump accounted for a revenue of USD 105,422.6 million in 2024.

- Heat Pump is the most lucrative product segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 136,891.4 Million

- 2030 Projected Market Size: USD 216,296.4 Million

- CAGR (2025-2030): 8.0%

- Asia Pacific: Largest market in 2024

Consumers and businesses increasingly prioritize cost-effective and sustainable heating options, leading to a shift towards advanced technologies such as heat pumps, smart thermostats, and infrared heating systems. Innovations in heating technologies enhance energy efficiency, reducing operational costs and environmental impact. As governments enforce stricter energy standards and offer incentives for eco-friendly systems, the market sees greater adoption of these efficient, cutting-edge solutions, further boosting its expansion.

Moreover, the retrofitting and replacement of aging heating systems, coupled with a focus on sustainability and green building practices, are anticipated to bolster the market size. As energy efficiency and environmental impact become top priorities, consumers and businesses increasingly opt for advanced, eco-friendly heating solutions. Retrofitting older buildings with energy-efficient systems and replacing outdated units with modern, low-emission alternatives align with global sustainability goals. In addition, regulations promoting green building standards and the rise of smart heating technologies are further fueling demand for sustainable heating equipment across residential, commercial, and industrial sectors.

Product Insights

Based on product, the heat pump segment dominated with the largest revenue share of 70.6% in 2024, fueled by its energy efficiency and versatility. Heat pumps can heat and cool, making them ideal for year-round use and increasing their appeal. They use renewable energy from the environment, reducing electricity consumption and operating costs and aligning with growing sustainability trends. Besides, government incentives and stricter energy regulations have further propelled their adoption. As consumers and businesses prioritize energy savings and eco-friendly solutions, heat pumps have become preferred in residential and commercial heating systems.

The unitary heater segment is expected to emerge as the fastest-growing segment and is projected to grow at a CAGR of 4.2% over the forecast period, attributed to their energy efficiency, ease of installation, and surge in demand for cost-effective heating solutions. These systems, which combine heating and ventilation in a single unit, are ideal for residential and commercial spaces seeking efficient temperature control. With a shift toward sustainable building practices and energy-efficient systems, unitary heaters align with these trends by offering reduced energy consumption and lower operational costs. Their versatility, compact design, and ability to maintain a consistent indoor climate make them a popular choice across various markets.

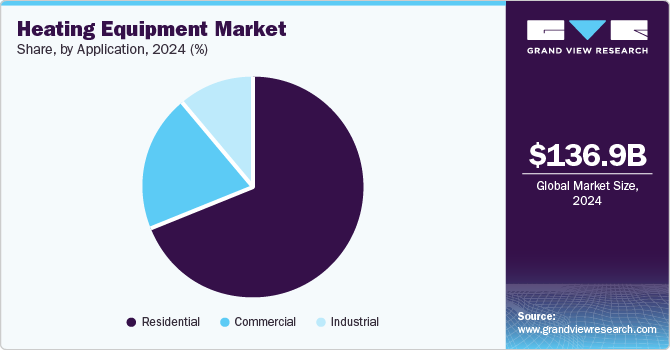

Application Insights

Based on application, the residential application segment held the largest revenue share of 69.4% in 2024, owing to the escalating demand for efficient and comfortable home heating solutions. As homeowners seek to lower energy bills and reduce environmental impact, energy-efficient heating systems, such as smart thermostats, heat pumps, and unitary heaters, have become highly popular. In addition, stricter building regulations and a growing focus on sustainability have driven the adoption of advanced heating technologies. The need for reliable, cost-effective solutions for heating homes in diverse climates continues to fuel the growth of this segment.

The industrial application segment is poised to stand out as the fastest growing segment and capture a CAGR of 7.1% over the forecast period due to surging demand across manufacturing, chemical, and energy industries. The need for advanced heating equipment grows as industries seek efficient and sustainable heating solutions for processes such as metal processing, chemical reactions, and power generation. Technological advancements, such as automation and energy-efficient systems, further drive this growth. Moreover, stricter environmental regulations and the push for reduced energy consumption encourage industries to invest in innovative, eco-friendly heating solutions, fueling the market’s expansion.

Regional Insights

North America heating equipment market is set to emerge as a fastest growing region and expand at a CAGR of an 8.4% from 2025 to 2030, driven by smart home integration and the development of advanced heating technologies, such as geothermal heating. As consumers increasingly seek convenience, energy efficiency, and control, smart thermostats and connected systems allow for remote monitoring and optimization of heating. Furthermore, geothermal heating, which uses the earth’s natural heat, is gaining popularity for its sustainability and cost-effectiveness. Together, these innovations cater to the growing demand for eco-friendly, high-performance solutions, contributing to regional market growth in residential and commercial sectors.

U.S. Heating Equipment Market Trends

The U.S. heating equipment market held a considerable position in North America in 2024, spurred by integration with renewable energy sources and increasing consumer demand for improved indoor air quality. As more homeowners and businesses prioritize sustainability, heating systems integrating solar power, wind energy, or geothermal sources are becoming more popular. Moreover, consumers seek systems that enhance indoor air quality by reducing pollutants and controlling humidity. These factors encourage the adoption of advanced heating technologies, improving energy efficiency and promoting healthier living environments, thereby boosting market growth.

Canada is projected to achieve a remarkable CAGR over the forecast period, owing to the focus on decarbonization and the rising demand for hydronic heating systems. As Canada works toward reducing greenhouse gas emissions, there's a shift away from fossil fuel-based heating solutions in favor of cleaner, more efficient systems. Hydronic heating, known for its energy efficiency and ability to provide consistent warmth, is gaining popularity in both residential and commercial sectors. This demand for sustainable and eco-friendly heating systems will fuel market expansion in the years ahead.

Europe Heating Equipment Market Trends

Europe garnered a prominent share in the heating equipment market, attributed to the region’s aging infrastructure and the growing need for upgrades. Many older heating systems are inefficient and require replacement, prompting demand for modern, energy-efficient solutions. In addition, consumer-centric solutions, including customizable heating systems that cater to specific needs such as energy savings, comfort, and smart home integration, are increasingly sought after. These trends, alongside a focus on sustainability and reduced carbon footprints, are expected to drive significant market growth as European consumers invest in upgrading and personalizing their heating systems.

Germany is anticipated to accumulate sizable gains by 2030, propelled by sustainability and changing consumer preferences. As German consumers increasingly prioritize eco-friendly solutions, there is a rising demand for energy-efficient, low-carbon heating systems. The popularity of hybrid heating systems, which combine traditional methods with renewable energy sources such as solar or heat pumps, aligns with this trend. These systems offer enhanced efficiency and reduced environmental impact, making them an attractive choice for residential and commercial sectors. This growing demand for sustainable, versatile heating solutions is expected to fuel market expansion further.

The UK is poised to establish a considerable foothold by 2030, fueled by increasing demand for energy-efficient solutions and government policies to reduce carbon emissions. With the UK’s commitment to achieving net-zero emissions by 2050, there is a growing shift towards renewable heating technologies, such as heat pumps and hydrogen boilers. Moreover, the aging infrastructure and the need for home and commercial building upgrades further drive the demand for modern heating systems. Government incentives and regulations also encourage investments in sustainable heating solutions, fueling market growth.

Asia Pacific Heating Equipment Market Trends

Asia Pacific heating equipment market secured the largest share of 43.5% in 2024, fueled by fast-paced urbanization, industrial growth, and burgeoning demand for residential and commercial heating solutions. The region’s expanding middle class, coupled with harsh winter climates in certain areas, drives the need for efficient heating systems. Besides, rising energy consumption and government initiatives to improve energy efficiency have boosted the adoption of advanced heating technologies. With countries such as China, Japan, and India leading the charge, Asia Pacific’s strong manufacturing base and growing infrastructure continue to fuel its dominance in the global market.

Asia Pacific is projected to grow at a noteworthy CAGR during the forecast period, spurred by rapid urbanization, increasing industrial activity, and rising energy demand. Countries such as China, India, and Japan are investing heavily in infrastructure development and energy-efficient technologies, driving the need for modern heating solutions. The region's diverse climate, including extremely cold and hot areas, increases the demand for heating and cooling systems. Besides, government incentives for sustainable energy practices and the shift towards green building standards further fuel the growth of the heating equipment market in Asia Pacific.

China is expected to emerge as a booming region over the forecast period, driven by rising demand for clean energy and the shift towards electrification.As China aims to reduce carbon emissions and transition away from coal, there is a growing focus on clean, renewable energy solutions such as heat pumps, electric boilers, and solar thermal systems. Electrification is a key strategy for achieving sustainability goals, leading to increased adoption of electric-based heating systems. This shift meets environmental targets and enhances energy efficiency, thereby propelling market expansion in the country.

India is set to emerge as the fastest growing region due to the shift toward energy-efficient heating systems and the growing demand in both residential and commercial sectors. As energy costs rise and environmental concerns increase, consumers and businesses seek more sustainable and cost-effective heating solutions. The adoption of energy-efficient technologies, such as heat pumps and smart heating systems, is gaining traction. With rapid urbanization and infrastructure development, there is a rising need for modern heating equipment, further driving market growth across residential, commercial, and industrial segments.

Key Heating Equipment Company Insights

Some of the key companies in the heating equipment market include Carrier, Mitsubishi Electric Corporation, Emerson Electric Co., Daikin Industries, Ltd, Trane, Robert Bosch GmbH, Lennox International, Johnson Controls, Inc., Midea Group, Hitachi, Ltd., Rheem Manufacturing Company, Haier (General Electric), Panasonic Holdings Corporation, Danfoss, Fujitsu, LG Electronics, Inc., Samsung, and others.

-

Midea Group offers a wide range of home appliances, including energy-efficient heating and cooling systems, air conditioners, and smart home solutions, focusing on innovation and sustainability.

-

Daikin Industries, Ltd specializes in advanced HVAC systems, including air conditioners, heat pumps, and air purifiers. These systems are renowned for their energy efficiency and eco-friendly technologies and cater to both residential and commercial markets globally.

Key Heating Equipment Companies:

The following are the leading companies in the heating equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Carrier

- Mitsubishi Electric Corporation

- Emerson Electric Co.

- Daikin Industries, Ltd

- Trane

- Robert Bosch GmbH

- Lennox International

- Johnson Controls, Inc.

- Midea Group

- Hitachi, Ltd.

- Rheem Manufacturing Company

- Haier (General Electric)

- Panasonic Holdings Corporation

- Danfoss

- Fujitsu

- LG Electronics, Inc.

- Samsung

Recent Developments

-

In January 2025, Midea introduced its Energy-Efficient Heat Pump Water Heater (HPWH) in North America. This innovative product highlights transitioning from conventional water heating methods to more sustainable, energy-efficient air-source technology.

-

In December 2024, Daikin launched a new line of residential air-to-water heat pumps for single-family homes, utilizing propane (R290) as the refrigerant. This environmentally friendly solution offers efficient heating and hot water, supporting the growing demand for sustainable and energy-efficient heating technologies in residential markets.

Heating Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 147.0 billion

Revenue forecast in 2030

USD 216.3 billion

Growth rate

CAGR of 8.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country

U.S., Canada, Mexico, Germany, France, Italy, Sweden, Norway, Spain, Finland, China, Japan, Australia, India, South Korea, Brazil, Argentina, Saudi Arabia, UAE

Key companies profiled

Carrier, Mitsubishi Electric Corporation, Emerson Electric Co., Daikin Industries, Ltd, Trane, Robert Bosch GmbH, Lennox International, Johnson Controls, Inc., Midea Group, Hitachi, Ltd., Rheem Manufacturing Company, Haier (General Electric), Panasonic Holdings Corporation, Danfoss, Fujitsu, LG Electronics, Inc., Samsung

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

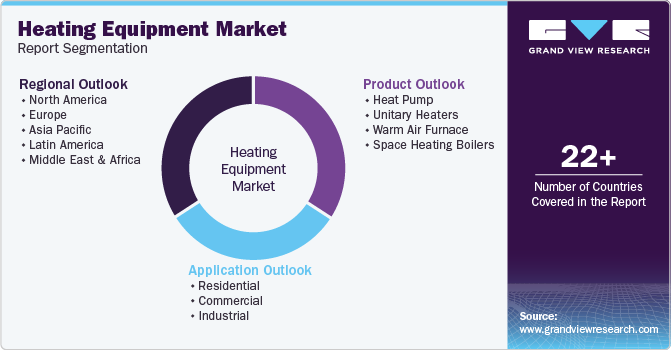

Global Heating Equipment Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global heating equipment market report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Heat Pump

-

Unitary Heaters

-

Warm Air Furnace

-

Space Heating Boilers

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Sweden

-

Norway

-

Spain

-

Finland

-

-

Asia Pacific

-

China

-

Japan

-

Australia

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.