- Home

- »

- Consumer F&B

- »

-

Europe Kombucha Market Size, Share, Industry Report, 2033GVR Report cover

![Europe Kombucha Market Size, Share & Trends Report]()

Europe Kombucha Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Conventional, Hard), By Distribution Channel (On-trade, Off-trade), By Region, And Segment Forecasts, Consumer Behavior And Competitive Analysis

- Report ID: GVR-4-68040-635-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Kombucha Market Summary

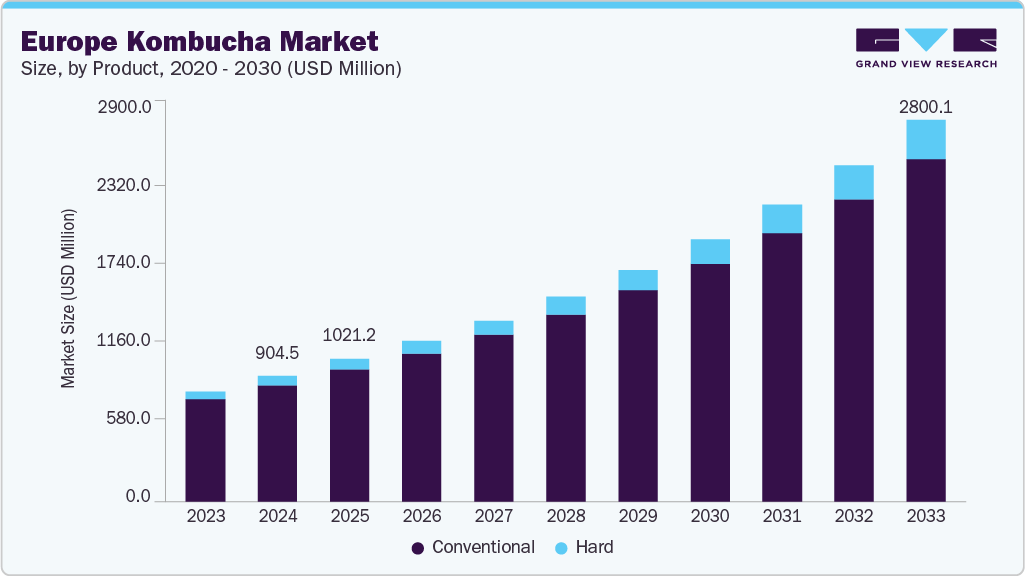

The Europe kombucha market size was estimated at USD 904.5 million in 2024 and is projected to reach USD 2.80 billion by 2033, growing at a CAGR of 13.4% from 2025 to 2033. The market is driven by the increasing consumer awareness of gut health and digestive wellness, demand for low-sugar and low-calorie drink options, and increased availability of diverse kombucha flavors.

Key Market Trends & Insights

- Germany made the largest contribution to the market in 2024, with 20.1% of the revenue share.

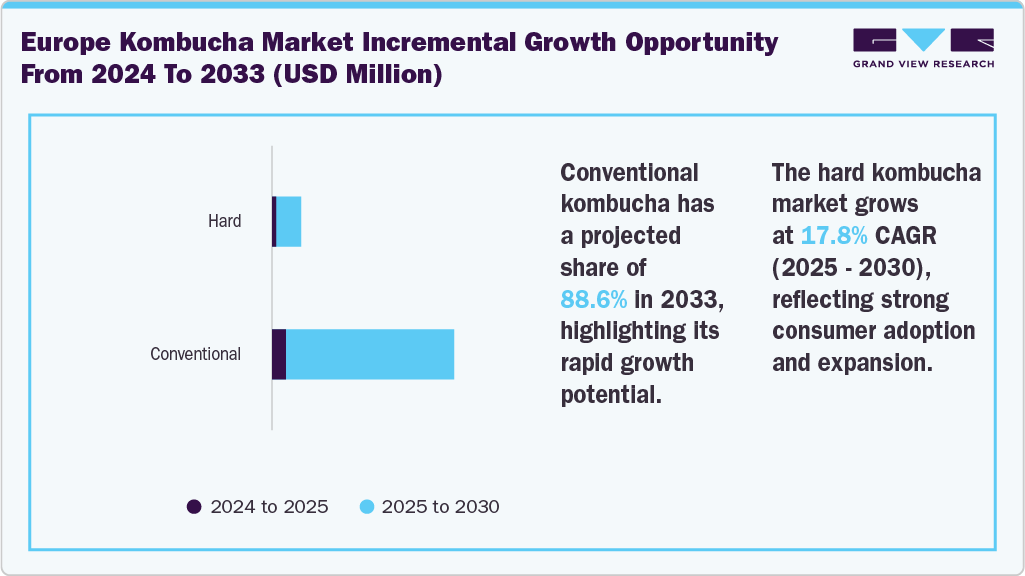

- By product, the conventional kombucha market in Europe led the market and accounted for a share of 91.9% in 2024.

- By product, hard kombucha is expected to grow at a CAGR of 17.8% during the forecast period.

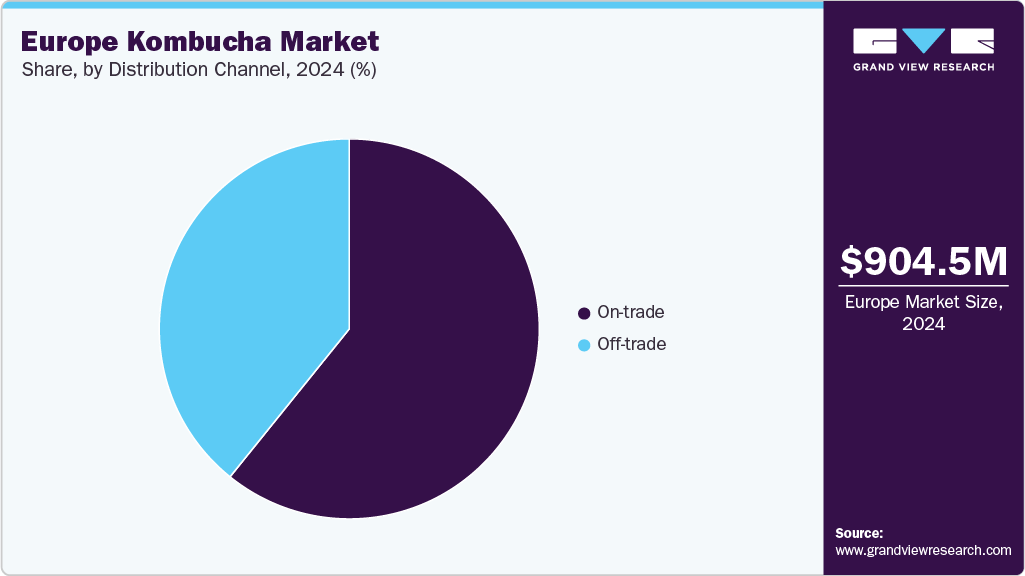

- By distribution channel, the on-trade channel led the market and accounted for a share of 60.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 904.5 Million

- 2033 Projected Market Size: USD 2.80 Billion

- CAGR (2025-2033): 13.4%

- Germany: Largest market in 2024

- France: Fastest growing market

The European market is driven by increasing consumer focus on health and wellness, strongly favoring natural, organic, and clean-label products. Growing interest in probiotic and gut-friendly beverages is expanding the consumer base. Innovation in unique flavors, functional blends, and localized product adaptations appeals to diverse European tastes.The market growth in Europe is supported by increasing consumer interest in sustainable and eco-friendly products, reflecting the region’s strong environmental consciousness. Rising demand for beverages with natural fermentation processes and authentic craftsmanship encourages market adoption. Furthermore, regulatory support for probiotic products and stringent food safety standards boost consumer confidence. According to the International Probiotics Association data published in January 2023, 59% of consumers are aware of live cultures, while 72% are familiar with live bacteria.

In addition, the expanding presence of specialty health stores and organic supermarkets, alongside collaborations with local breweries and wellness brands, is enhancing product visibility. Growing awareness of mental well-being drives interest in adaptogenic and functional kombucha variants enriched with botanicals and herbs, appealing particularly to urban professionals and health-focused consumers.

Consumer Insights for Europe Kombucha

Product Insights

The conventional kombucha accounted for a share of 91.9% of the European revenue in 2024. In the European market, conventional kombucha is driven by increasing demand for health-conscious, probiotic-rich beverages that promote gut health and wellness. Consumers increasingly opt for clean-label, organic, and plant-based products, making kombucha popular among those following vegan and organic diets. According to the data published in April 2024, about 99% of European manufacturers prefer clean label products as an essential strategy for their business.

The hard kombucha is projected to grow at a CAGR of 17.8% from 2025 to 2033. The rise of premium, small-batch artisanal kombucha and its expanding availability in health-focused retail channels further fuel its growth. The hard kombucha is gaining traction due to the growing preference for low-alcohol, alternative alcoholic beverages that align with wellness trends. Its craft appeal, innovative flavors, and health benefits, coupled with the shift away from traditional alcoholic drinks, drive consumer interest in this segment across Europe. Companies such as Ummi offer hard kombucha at 6% ABV in various flavors such as lemon ginger, hibiscus Berry, and elderflower pear.

Distribution Channel Insights

The sales through the on-trade distribution channel accounted for a share of around 60.8% of the European revenue in 2024. The on-trade distribution channel for kombucha in Europe is fueled by the increasing demand for functional and trendy beverages in social settings. With the rise of health-conscious dining and wellness-focused cafés, kombucha offers an appealing alternative to traditional alcoholic drinks. Its inclusion in cocktail menus and as a non-alcoholic option at bars and restaurants appeals to health-conscious consumers and those seeking low-alcohol options. In addition, the growing café culture and focus on experiential consumption are helping kombucha gain visibility in trendy urban areas. As consumers prioritize socializing and unique dining experiences, on-trade sales are seeing steady growth. Companies such as GUTsy Captain UK Shop offer kombucha in various formulations, such as Zero sugar and calories, and cans through their website.

The sales through the off-trade distribution channel market are projected to grow at a CAGR of 15.3% from 2025 to 2033. The off-trade channel for kombucha in Europe benefits from the increasing demand for convenient, health-oriented products easily purchased at supermarkets, health food stores, and e-commerce platforms. With rising health awareness, consumers are more inclined to purchase kombucha for regular grocery shopping. The growth of organic and wellness-focused retail outlets, alongside the convenience of online shopping, is expanding product accessibility. Moreover, off-trade distribution allows kombucha brands to reach a broader consumer base, from budget-conscious buyers to premium shoppers seeking high-quality, small-batch products. For instance, in February 2022 , Remedy, a UK kombucha brand, launched its new Wild Berry flavor exclusively at Tesco supermarkets to celebrate World Kombucha Day.

Regional Insights

The Europe kombucha market is experiencing significant growth, driven by increasing health consciousness, shifting dietary preferences, and the demand for functional beverages. Countries like Germany, the UK, and France are leading the way, with consumers increasingly seeking natural, probiotic-rich drinks for their digestive and wellness benefits. The growing trend of plant-based and organic diets further fuels kombucha’s popularity, as it aligns with these preferences. Both local producers and global brands are expanding their presence in Europe to capitalize on this thriving market. For instance, according to the data published in November 2023 , hard kombucha brand Ummi was looking forward to expanding its brand across the European region, catering to the rising demand.

Germany Kombucha Market

In 2024, Germany is projected to hold the largest share at 20.1% in Europe. The growing popularity of kombucha in Germany is driven by an increasing focus on health and wellness, with consumers becoming more aware of probiotic-rich beverages' digestive and immune benefits. As Germans increasingly embrace clean-label, organic, and plant-based diets, kombucha aligns perfectly with these preferences, making it a sought-after alternative to sugary drinks. The rising trend of functional beverages and a shift toward more natural, sustainable options further fuels demand. Moreover, the expanding availability of kombucha in health food stores, supermarkets, and cafes has made it more accessible to a broader consumer base. For instance, ROY Kombucha, a Berlin-based kombucha brand, offers kombucha in a variety of flavors, including Strawberry & Basil, Ginger, Raspberry, Cucumber & Mint, and many more.

France Kombucha Market

France is the fastest-growing region in Europe, projected to grow at a CAGR of 15.0% from 2025 to 2033. Kombucha has gained significant popularity in France, transitioning from a niche drink to a mainstream choice among health-conscious consumers. Recognized for its probiotic properties, this fermented tea has captured the interest of individuals seeking natural and organic food options. As French consumers emphasize wellness and healthy living, kombucha’s benefits, such as supporting digestion and boosting immune function, are increasingly appealing. The French market has seen a rise in local brewers and brands, each offering distinctive flavors and artisanal craftsmanship, further contributing to the beverage's widespread appeal. For instance, KOMBUCHA BY LAURENT offers kombucha in exotic flavors such as Vibrant Ginger , Blanc Floral, and Herbsbucha.

Key Europe Kombucha Company Insights

Many brands in the European industry have identified untapped opportunities within their product lines and are taking steps to address these market gaps. This often involves developing new product designs or marketing campaigns to meet consumer needs and preferences.

Key Europe Kombucha Companies:

- GUTsy Captain UK Shop.

- Equinox Kombucha

- Biomel

- Left Field Kombucha

- Purearth

- Booch & Brew

- Kombucheria

- Karma Kombucha

- Hippie Kombucha

- Happy Kombucha

Recent Developments

-

In April 2025, MOMO Kombucha collaborated with Natoora to launch new seasonal kombucha, a limited-edition variation of Blood Orange kombucha. The limited-edition kombucha is made from Carmelo’s seasonal harvest combined with MOMO Kombucha’s taw and unfiltered formulation.

-

In November 2023, Momo Kombucha and Orbit Beers collaborated to create an alcohol-free hopped kombucha. This innovative beverage combines the probiotic benefits of kombucha with the complex flavors of hops, typically found in craft beers. The collaboration was aimed at offering a unique and healthy alternative to traditional alcoholic drinks, catering to the growing demand for non-alcoholic options. This product is part of a broader trend toward health-conscious consumption, highlighting the evolving preferences in the beverage market.

Europe Kombucha Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 1.02 billion

Revenue Forecast in 2033

USD 2.80 billion

Growth rate (revenue)

CAGR of 13.4% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative (Revenue) units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Regional Scope

Europe

Country scope

Germany; UK; France; Netherlands; Switzerland

Key companies profiled

GUTsy Captain UK Shop.; Equinox Kombucha; Biomel; Left Field Kombucha; Purearth, Booch & Brew; Kombucheria; Karma Kombucha; Hippie Kombucha; Happy Kombucha

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Kombucha Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the Europe kombucha market report based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Conventional

-

Hard

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

On-trade

-

Off-trade

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

Europe

-

Germany

-

UK

-

France

-

Netherlands

-

Switzerland

-

Frequently Asked Questions About This Report

b. The Europe kombucha market size was estimated at USD 904.5 million in 2024 and is expected to reach USD 1.02 billion in 2025.

b. The Europe kombucha market is expected to grow at a compound annual growth rate (CAGR) of 13.4% from 2025 to 2033 to reach USD 2.80 billion by 2033.

b. Conventional kombucha accounted for a revenue share of 91.9% in 2024, driven by increasing health awareness, demand for natural beverages, and rising consumer preference for functional drinks.

b. Some key players operating in the Europe kombucha market include GUTsy Captain UK Shop.; Equinox Kombucha; Biomel; Left Field Kombucha; Purearth, Booch & Brew; Kombucheria; Karma Kombucha; Hippie Kombucha; Happy Kombucha

b. Key factors driving growth in the Europe kombucha market include rising consumer awareness of gut health and wellness, growing demand for natural and functional beverages, and increased preference for low-sugar, organic, and probiotic-rich drinks. Additionally, innovation in flavors, premium product offerings, and wider distribution through retail and online channels are accelerating market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.