- Home

- »

- Electronic Devices

- »

-

Europe LED Lighting Market Size, Industry Report, 2030GVR Report cover

![Europe LED Lighting Market Size, Share, & Trends Report]()

Europe LED Lighting Market (2025 - 2030) Size, Share, & Trends Analysis Report By Product (Lamps, Luminaires), By Installation Type (New, Retrofit), By Application, By Sales Channel, By End Use, By Country, And Segment Forecasts

- Report ID: GVR-3-68038-481-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe LED Lighting Market Trends

The Europe LED lighting market size was estimated at USD 22.85 billion in 2024 and is anticipated to grow at a CAGR of 7.6% from 2025 to 2030. The rise in stringent government regulations, such as the ban on less-efficient lighting sources and incentives & rebates on LED lighting, is expected to drive the market significantly over the forecast period. The region also has several standards that govern the safety and performance of indoor commercial lighting, garage illumination, roadway lighting, and parking lighting. Moreover, increasing awareness about energy conservation is further driving market growth.

The European commercial & industrial sector is flourishing owing to the growth of the regional automotive and IT industries. The region has also fully recovered from the 2008 financial crisis, and most industries affected by it have been recording steady growth over the years. The region witnessed the lowest office vacancy rates in 2018 since the financial crisis. Favorable business conditions and growing individual economies are expected to improve the demand for LED lighting in the region over the forecast period.

Similarly, the construction industry has observed notable growth from the commercial & industrial sectors in the past few years, as the need for commercial spaces is rising. To benefit from this trend, electricity supply companies have collaborated with the government to distribute subsidized LED lights to the commercial sector. As LED lighting considerably brings down electricity and maintenance costs compared to traditional technologies such as gas-discharge, incandescent, and compact fluorescent lights, such collaborations are expected to further encourage the adoption of LED lighting solutions in the enterprise sector.

LED lights offer a greener, sustainable, and viable alternative to their traditional counterparts owing to their high energy efficiency and longer lifespan. LED lights also score very low in terms of any hazardous chemicals associated with them, which significantly reduces the probability of a ban or phase-out. While LED lighting solutions can be integrated or embedded with lighting controllers, they are also recyclable.

European LED manufacturers benefit from the stringent regulations levied on the import of lighting products. The American market has emerged as one of the prominent consumers of European lighting, with growing trade tensions between the U.S. and Italy benefiting European companies. The trend is likely to continue to benefit the market.

Product Insights

The luminaires segment dominated with a revenue market share of over 61.0% in 2024. The adoption of advanced LED luminaires, such as downlights and troffers, is rising in the commercial sector. Moreover, many European countries are replacing conventional halogen lamp street lights with LED lights as a part of the European Union’s green initiative, which will likely drive the segment growth further. The rising popularity of designer luminaires for architectural applications in Western European countries, as the construction of modern and sustainable homes grows in the region, is also likely to drive segment growth.

Lamps is anticipated to be the fastest-growing segment during the forecast period. The rising demand for A-type and T-type lamps in residential and commercial sectors is expected to help the lamps segment acquire a significant market share. The rising demand for advanced lamps such as MR-16 and reflector lamps, especially in retail applications such as small stores, retail shops, and malls, is also expected to help the segment retain dominance.

Installation Type Insights

The new installation type segment dominated with a revenue market share of over 63.0% in 2024, driven by the surge in construction activities and infrastructural modernization across residential and commercial sectors. As new buildings are being designed with energy efficiency and sustainability at their core, developers are increasingly incorporating LED lighting systems from the outset. These installations offer long-term cost savings through lower energy consumption and reduced maintenance requirements, making them highly attractive to builders and property owners. In addition, European Union regulations and national energy performance standards are pushing new construction projects to adopt low-energy technologies, of which LED lighting is a crucial component. As a result, new building projects, from homes and offices to retail outlets and public spaces, are propelling the demand for integrated LED lighting solutions.

Retrofit installation type is anticipated to be the fastest-growing segment during the forecast period. The rise of the circular economy movement in Europe drives the retrofit segment growth. Rather than demolishing and rebuilding infrastructure, property owners are encouraged to refurbish and extend the life of existing assets. Retrofitting lighting systems with LEDs aligns perfectly with this philosophy. It minimizes waste, reduces the need for new raw materials, and allows incremental upgrades without significant disruption. This is particularly relevant in heritage buildings, historical landmarks, and government-owned properties, where preserving the structure is essential and a full overhaul of the lighting infrastructure is not always feasible.

Application Insights

The indoor segment dominated the Europe LED lighting industry in 2024. This growth can be attributed primarily to the growing use of LED light products in household lighting. Decreased prices, customer-centric product designs, and availability of various options have encouraged users to opt for LED light products for indoor applications. Furthermore, visually comforting and soothing experiences through LED lighting within commercial office spaces have broadened the use of indoor LED applications.

Outdoor is anticipated to be the fastest-growing segment during the forecast period. Encouraging government policies for adopting energy-efficient lighting products has led to the surging adoption of streetlight applications. Street, roadway, and walkway lighting are integral to cities and are among the highest energy consumption points. Traditionally, HID light sources dominated these applications due to their high lumen output, and hence, they could be mounted at different distances. However, this can be compensated by LED lighting products, particularly for outdoor applications, as they exhibit features such as high durability, excellent directional light sources, and greater efficiency.

Sales Channel Insights

The offline segment dominated the Europe LED lighting industry in 2024. Seasonal and promotional retail events contribute to offline market growth. In Europe, sales peaks often align with home renovation seasons, the lead-up to winter, or public infrastructure upgrades. During such periods, physical stores offer curated deals, bundled installations, or demonstration booths that attract footfall and generate impulse purchases. Retailers also host brand-sponsored exhibitions and lighting demos that give consumers a hands-on experience with emerging technologies such as tunable white lighting, human-centric lighting, or smart LED systems integrated with motion sensors. These immersive offline experiences are difficult to replicate in digital formats and are a powerful driver for brand conversion and product awareness.

The online segment is anticipated to be the fastest-growing segment during the forecast period. Integrating digital tools such as augmented reality (AR), 3D product visualization, and interactive product demos makes online shopping for lighting solutions more immersive and reliable. These features enable customers to visualize how a particular light fixture might look or function in their specific environment, reducing uncertainty and enhancing the overall purchase experience. Some platforms include virtual consultations with lighting experts or compatibility checkers to match LED products with existing fittings. These advancements contribute to higher buyer confidence and a reduced return rate, crucial for maintaining customer satisfaction in the online segment.

End Use Insights

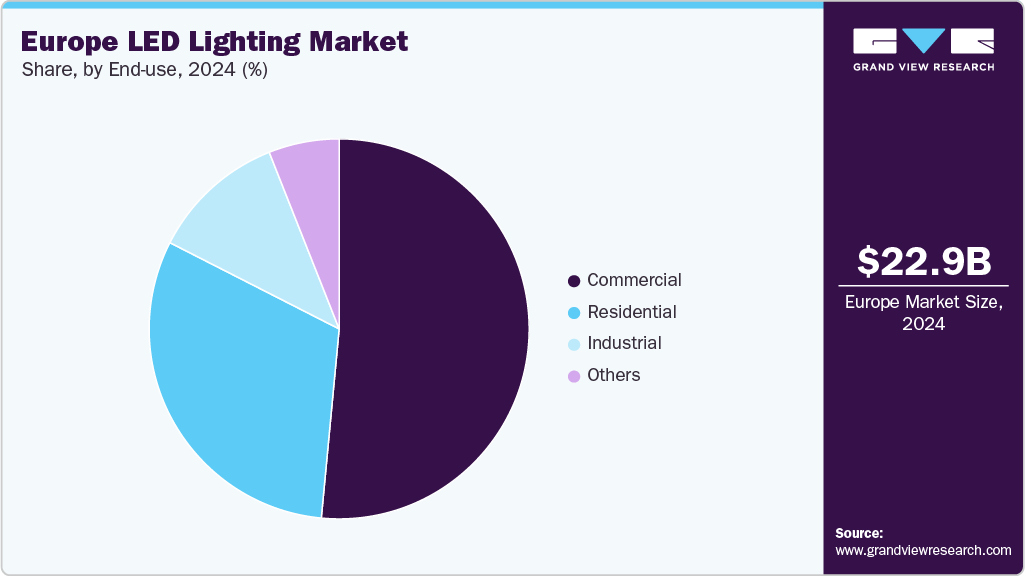

The commercial segment dominated the Europe LED lighting industry in 2024. The need for sophisticated lighting among exhibition, museum, and gallery owners for improved lighting applications is one of the driving forces behind the rapid growth of the commercial building industry around the world and is anticipated to promote market expansion. The demand for high-luminance LED lights is expanding predominantly owing to the requirements for office lighting to conform to government regulations and norms, boosting market expansion.

The residential segment is anticipated to be the fastest-growing segment during the forecast period. The growth is attributed to various factors, such as increased awareness and adoption of energy-efficient lighting solutions among homeowners, government regulations and initiatives promoting energy efficiency, advancements in LED technology providing improved performance and a wider range of options, declining prices making LED lighting more affordable, and the longer lifespan of LED bulbs reducing maintenance costs. These factors have contributed to the residential segment's swift market growth.

Country Insights

The UK LED lighting market is growing significantly during the forecast period. Commercial building renovations and retrofitting activities across the UK also accelerate demand for LED lighting. Many corporate offices, healthcare facilities, retail spaces, and educational institutions prioritize LED adoption as part of their ESG strategies and building decarbonization plans. Adopting Building Management Systems (BMS) and smart lighting controls has become more common in modern infrastructure projects. LED technology is central to these upgrades due to its compatibility with digital control platforms. Moreover, the push for compliance with building energy performance standards such as BREEAM and the Energy Performance Certificate (EPC) system further incentivizes property owners to invest in high-efficiency lighting solutions. This trend is especially strong in London and other urban centers where environmental certifications add to real estate value and rental competitiveness.

The LED lighting industry in Germany is growing significantly during the forecast period. The retail infrastructure in Germany has also played a key role in the market’s growth, with major players such as Bauhaus and OBI and online platforms like Amazon and Conrad offering a vast range of LED lighting solutions. These distribution networks ensure that consumers and businesses have access to reliable and energy-efficient lighting products. Furthermore, the professional lighting design market in Germany is highly developed, with architects and engineers increasingly incorporating LED systems into urban projects, museums, retail showrooms, and public spaces for both aesthetic and sustainability reasons.

France LED lighting market is growing significantly during the forecast period. France’s manufacturing and industrial segments are also significant adopters of LED lighting, particularly in logistics, automotive, and aerospace facilities. These sectors prioritize operational efficiency, and LED technology fits well due to its robust performance in high-demand environments. Facilities that operate 24/7 benefit from the reduced energy load and minimal maintenance requirements of LEDs. Furthermore, companies in France are increasingly incorporating sustainability goals into their corporate strategies, driving investment in energy-efficient technologies, including advanced LED systems with intelligent controls and real-time monitoring features.

The LED lighting market in Italy is growing significantly during the forecast period. The residential segment in Italy is also experiencing strong growth in LED adoption, driven by rising energy prices and heightened environmental awareness among consumers. Homeowners increasingly opt for LED lighting during renovations or new home construction, particularly in combination with smart home systems. The growing popularity of voice assistants, mobile lighting control apps, and home automation platforms is influencing purchasing decisions, with many consumers choosing smart LED bulbs for convenience, energy efficiency, and customization features. Retailers and e-commerce platforms such as Unieuro, MediaWorld, and Amazon have played a key role in making a wide range of LED products accessible to the general public.

Spain LED lighting market is growing significantly during the forecast period. Spain’s strong solar energy sector complements LED lighting in off-grid and energy-independent setups, driving market growth. In rural and island communities, LED systems powered by solar panels are increasingly used for street lighting and household illumination, especially where extending the grid is costly. This synergy between solar and LED technologies supports Spain’s renewable energy ambitions while promoting sustainable development in less connected regions.

Key Europe LED Lighting Company Insights

Some key companies operating in the market include Acuity Brands, Inc., and ams-OSRAM AG, which are some of the leading participants in the European market.

-

Acuity Brands Lighting, Inc., provides building and lighting technology solutions and services. Its product portfolio includes lighting controls, lighting components, prismatic skylights, power supplies, fluorescent and LED lighting products, high-intensity discharge, and embedded and standalone light control solutions. The company offers residential, industrial, commercial, infrastructure, life safety, and lighting control solutions. Its LED lighting products are available under the Lithonia Lighting and Luminaire LED brands.

-

ams-OSRAM AG is a global company specializing in innovative light and sensor solutions. The company focuses on illumination, visualization, and sensing technologies that enable transformative advancements across automotive, industrial, medical, and consumer markets. OSRAM leverages a broad portfolio of emitter and sensor technologies, supported by over 13,000 patents, and aligns its business with societal megatrends such as digitalization, smart living, and sustainability.

Dialight and Leviton Manufacturing Co. are some of the emerging market participants.

-

Dialight manufactures LED lighting for industrial applications. The company’s industrial solutions include high bays, floodlights, area lights, linear, low bays, and wall packs/bulkheads. Dialight operates through two segments: Lighting and Signals and Components. The Lighting division offers LED lighting solutions from DuroSite Industrial Solutions, StreetSense Infrastructure Solutions, SafeSite Hazardous Area Solutions, and architectural solutions.

-

Leviton Manufacturing Co., Inc. manufactures electrical wiring devices, lighting energy management solutions, networking, security, and home automation products. The company offers over 25,000 products, including switches, dimmers, outlets, circuit breakers, EV charging stations, and commercial data infrastructure solutions. Leviton serves residential, commercial, and industrial markets worldwide. The company emphasizes innovation and quality, continuously expanding through acquisitions and new technologies such as smart home controls and high-speed networking.

Key Europe LED Lighting Companies:

- Acuity Brands Lighting, Inc.

- Digital Lumens, Incorporated

- WOLFSPEED, INC.

- Dialight

- Eaton

- General Electric

- Zumtobel Group

- Signify Holding

- ams-OSRAM AG

- Seoul Semiconductor Co., Ltd.

- Leviton Manufacturing Co.

- LEDVANCE GmbH

Recent Developments

-

In February 2025, LEDVANCE GmbH partnered with German Bundesliga team SV Werder Bremen to revamp the floodlights and stadium lighting system of the Weser Stadium, enhancing the lighting technology to UEFA standards.

-

In January 2025, LEDVANCE GmbH acquired loblicht, a German specialist known for its high-quality, design-focused lighting products. This strategic move represents a key milestone in LEDVANCE’s efforts to enhance its expertise in lighting projects and expand its brand portfolio.

-

In November 2024, ams-OSRAM AG launched its NIGHT BREAKER LED SMART front fog lamps, completing its range of LED retrofit lighting options. These new lamps are available in H8, H10, H16, and HB4 formats, allowing cars, campers, specialist vehicles, and motorcycle owners to upgrade their entire headlight systems to advanced LED technology. Designed for quick and easy installation due to their compact design, the NIGHT BREAKER LED SMART fog lamps offer a seamless and efficient lighting solution, bringing innovative LED performance to a wide range of vehicles.

-

In April 2024, ams-OSRAM AG partnered with DOMINANT Opto Technologies to integrate its Open System Protocol (OSP) into DOMINANT's intelligent RGB LEDs for automotive ambient lighting, promoting interoperability in the automotive sector.

-

In January 2024, Dialight launched a new battery backup model for its LED High Bay fixtures. Designed to provide enhanced safety and reliability, these advanced fixtures offer improved peace of mind in demanding industrial environments, including oil and gas refineries, metal and steel plants, petrochemical facilities, pulp and paper mills, wastewater treatment plants, and general manufacturing settings.

-

In June 2023, ams-OSRAM AG launched the latest generation of its OSLON Square Hyper Red horticulture LED. This latest iteration was specifically designed to enhance plant growth rate and optimize system costs. The new OSLON Square Hyper Red LED suits various horticultural lighting applications, including inter-lighting, greenhouse top lighting, vertical farming, and sole-source lighting.

-

In February 2023, LEDVANCE GmbH introduced the LED TUBE EXTERNAL SYSTEM, a highly efficient lighting solution with an external DALI-2 driver and an LED tube. This system enables the upgrade of existing T8 and T5 fluorescent lamps to dimmable LED lighting while also providing emergency lighting capabilities. With its replaceable components, the LED TUBE EXTERNAL SYSTEM is cost-effective and contributes to sustainability and the principles of the circular economy.

Europe LED Lighting Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 23.89 billion

Revenue forecast in 2030

USD 34.44 billion

Growth rate

CAGR of 7.6% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Report updated

June 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, installation type, application, sales channel, end use, country

Country scope

UK; Germany; France; Spain; Italy

Key companies profiled

Acuity Brands Lighting, Inc.; Digital Lumens, Incorporated; WOLFSPEED, INC.; Dialight; Eaton; General Electric; Zumtobel Group; Signify Holding; ams-OSRAM AG; Seoul Semiconductor Co., Ltd.; Leviton Manufacturing Co.; LEDVANCE GmbH

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe LED Lighting Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe LED lighting market report based on product, installation type, application, sales channel, end use, and country:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Lamps

-

A-Lamps

-

T-Lamps

-

Other

-

-

Luminaires

-

Streetlights

-

Downlights

-

Troffers

-

Others

-

-

-

Installation Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

New

-

Retrofit

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Indoor

-

Outdoor

-

-

Sales Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial

-

Residential

-

Industrial

-

Others

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Frequently Asked Questions About This Report

b. Europe LED lighting market size was estimated at USD 22.85 billion in 2024 and is expected to reach USD 23.89 billion in 2025.

b. Europe LED lighting market is expected to grow at a compound annual growth rate of 7.6% from 2025 to 2030 to reach USD 34.44 billion by 2030.

b. The luminaires segment dominated the Europe LED lighting industry with a revenue share of over 61.0% in 2024. The adoption of advanced LED luminaires, such as downlights and troffers, is rising in the commercial sector.

b. Some key players operating in the Europe LED lighting market include Acuity Brands Lighting, Inc., Digital Lumens, Incorporated, OSRAM GmbH., WOLFSPEED, INC., Dialight, Eaton, General Electric, Zumtobel Group, Signify Holding, and Seoul Semiconductor Co., Ltd.

b. Key factors that are driving the market growth include the rise in the number of stringent government regulations and increasing awareness about energy conservation, improved lifespan, lower costs, versatility, smart lighting, and increased consumer awareness.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.