- Home

- »

- Electronic & Electrical

- »

-

Lamps Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Lamps Market Size, Share & Trends Report]()

Lamps Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Desk Lamp, Floor Lamp), By Type (Reading Lamp, Decorative Lamp), By Application (Residential/Retail, Commercial/Hospitality), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-097-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Lamps Market Summary

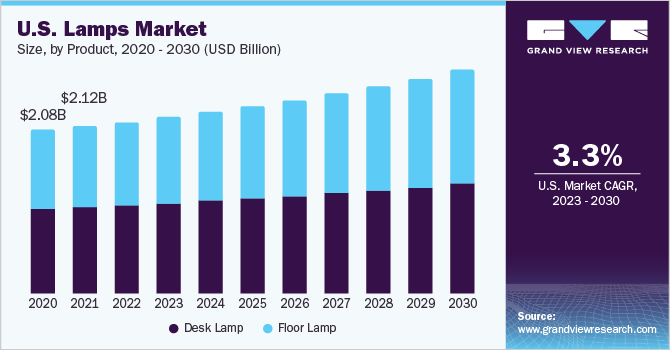

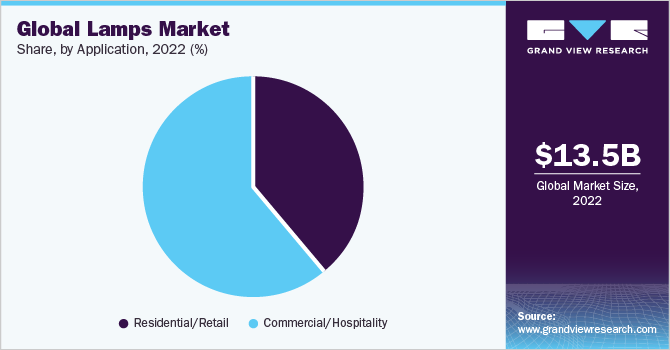

The global lamps market size was estimated at USD 13,530.2 million in 2022 and is projected to reach USD 19,691.1 million by 2030, growing at a CAGR of 4.8% from 2023 to 2030. The growing focus on interior aesthetics and the desire to create visually appealing spaces have led to a significant surge in demand for floor lamps and desk lamps.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2022.

- Country-wise, U.S. is expected to register the highest CAGR from 2023 to 2030.

- In terms of segment, desk lamp accounted for a revenue of USD 7,050.6 million in 2022.

- Floor Lamp is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 13,530.2 Million

- 2030 Projected Market Size: USD 19,691.1 Million

- CAGR (2023-2030): 4.8%

- Asia Pacific: Largest market in 2022

These lighting fixtures serve a dual purpose by providing both functional lighting and enhancing the overall ambiance of residential and commercial spaces. Consumers are increasingly seeking lighting solutions that provide adequate illumination and add a touch of style and elegance to their interiors. Floor and desk lamps come in a versatile range of designs, materials, and lighting options, making them highly appealing to consumers looking for customizable lighting solutions to complement various interior styles.

The availability of floor and desk lamps in different sizes, shapes, and finishes allows consumers to choose options that best suit their needs and preferences. Additionally, the flexibility of these lamps in terms of adjustable heights, swivel heads, and directional lighting further enhances their appeal, making them suitable for a wide range of applications and spaces, from living rooms and bedrooms to offices and study areas.

With the increase in disposable income of customers and the declining cost of lighting products, individuals can now afford an expanded range of lighting services, particularly in emerging economies. The expanding population and the increasing number of households further fuel this rise in demand for lighting services. In the commercial sector, the need to illuminate larger spaces is the driving force behind the demand for lighting services.

According to the 2020 Residential Energy Consumption Survey (RECS), U.S. citizens with annual income less than USD 100,000 accounted for almost 27% of the total lighting consumption in the country. Since a significant portion of lighting consumption comes from individuals with lower incomes, there may be a higher demand for affordable lighting solutions in the market. This could lead to an increased demand for budget-friendly lamps that cater to the needs and budget constraints of this demographic.

In addition, Energy efficiency has become a critical consideration for consumers and businesses alike, leading to a growing preference for lighting solutions that minimize energy consumption. Floor lamps and desk lamps equipped with Light Emitting Diode (LED) technology offer significant energy savings compared to traditional lighting options. LEDs are highly efficient, converting a higher percentage of electrical energy into visible light and wasting less energy as heat.

Moreover, LEDs also have a longer lifespan, reducing the need for frequent replacements. LED lamps are eco-friendly, as they do not contain hazardous substances like mercury, and their production processes have a lower carbon footprint than other lighting technologies.

The energy-efficient and sustainable nature of LED-based floor lamps and desk lamps aligns with the values of environmentally conscious consumers who prioritize reducing their energy consumption and carbon emissions. Furthermore, the cost savings associated with energy-efficient lighting solutions, such as lower electricity bills and reduced maintenance expenses, make LED floor lamps and desk lamps an attractive long-term investment for residential and commercial users.

As per the International Energy Agency (IEA), in recent years, there has been a significant global surge in the sales of LED lighting products. The market share of LED lighting has experienced a remarkable increase, jumping from approximately 5% in 2013 to over 50% of the total global lighting sales in 2021. Integrated LED luminaires have also witnessed a growing presence within this market.

This is fueling the demand for LED lamps in the global market. In February 2023, Delmege Forsyth & Co Ltd expanded its product line by adding new LED bulbs specifically designed for use in lamps. These LED bulbs stand out due to their remarkable efficiency, boasting an energy utilization that surpasses 90%, far exceeding that of traditional incandescent light bulbs.

The lighting industry has witnessed rapid technological advancements, which have significantly impacted floor and desk lamps. The integration of smart features is enhancing user convenience and expanding the functionality of these lighting solutions. Smart lamps now offer a range of advanced features, including remote control capabilities, voice command activation, adjustable brightness settings, color-changing options, and even compatibility with smart home ecosystems.

These features provide users with seamless control over their lighting environment, allowing them to adjust the brightness easily, and color temperature, or even create lighting scenes according to their preferences. The ability to control the lamps remotely via smartphone apps or voice assistants adds convenience and flexibility to the user experience. Smart lamps also enable users to integrate their lighting with other smart devices, such as smart speakers or home automation systems, creating a connected and synchronized lighting ecosystem.

Product Insights

The desk lamps segment accounted for a share of over 50% in 2022. In recent years, desk lamps have undergone notable trends and advancements, reflecting the evolving needs and preferences of consumers. One prominent trend is the increasing popularity of LED desk lamps. LED technology offers energy efficiency, a longer lifespan, and versatile lighting options, making it an appealing choice for both residential and commercial settings.

These lamps often feature adjustable brightness levels, color temperatures, and flexible designs to provide optimal lighting conditions for various tasks. Another trend in desk lamps is the integration of smart features. Many modern desk lamps now come equipped with built-in wireless charging pads for smartphones or other devices. They can also be controlled remotely through mobile apps or voice assistants, allowing users to adjust brightness and color and set schedules or timers.

The floor lamps segment is anticipated to grow at a CAGR of 5.4% over the forecast period. Floor lamps have witnessed several notable trends in recent times, reflecting consumers' evolving needs and design preferences. One key trend is the rise in popularity of minimalist and modern floor lamp designs. These lamps feature sleek, clean lines and simple silhouettes that blend seamlessly with contemporary interiors.

They often incorporate materials such as metal, glass, or wood to create a sophisticated and elegant aesthetic. Versatility is another key trend in floor lamps. Many models now offer adjustable arms, allowing users to direct the light precisely where it is needed, whether for reading, working, or ambient lighting. Some floor lamps also include built-in shelves or USB charging ports, adding functionality and convenience to the lighting fixture.

Type Insights

The reading lamp segment accounted for a share of over 35% in 2022. Reading lamps have become an ideal tool to accessorize and illuminate any room or space, be it the desk in a home office or a reading corner in the living room. These are available in various options-floor standing, desk, clamps, wall/shelf-mounted, or compact, portable lamps.

As workspaces across residential and commercial settings become more compact, there is a demand for reading lamps with space-saving designs. Manufacturers are introducing slim-profile reading lamps that take up minimal desk space. Clamp-on lamps are other space-saving reading lights that can be attached to the edge of the desk or bed or mounted on walls or shelves. These options provide effective lighting while optimizing the available workspace.

The decorative lamp segment is expected to grow with a CAGR of 5.6% over the forecast period. Decorative lamps have witnessed various trends in recent times, reflecting the evolving tastes and design preferences of consumers. Lamps made from natural materials like wood, bamboo, rattan, or stone are sought after for their rustic and earthy appeal.

The use of advanced and innovative materials also gives companies an edge over their competitors. While organic shapes such as curved or asymmetrical forms add a touch of uniqueness and natural elegance to interior spaces, decorative lamps in geometric designs such as hexagons, triangles, or abstract shapes embrace a more modern and contemporary aesthetic.

Application Insights

The residential segment accounted for a share of approximately 40% in 2022. Changing interior design and home decor trends heavily influence the demand for residential lamps. As homeowners and individuals seek to enhance the aesthetics of their living spaces, they look for lighting fixtures that complement their overall decor theme and create ambiance.

Emerging trends in styles, materials, colors, and finishes drive the demand for a wide range of residential lamps. Residential lamp demand is influenced by the overall housing construction and renovation activities. As new homes are built, and existing ones undergo remodeling, the need for lighting fixtures, including lamps, increases. Market growth is driven by these construction and renovation projects necessitating various types of residential lamps.

The commercial segment is expected to grow with a CAGR of 5.0% over the forecast period. The visual appeal and integration of lamps into the overall architectural design of commercial spaces are important drivers in the commercial lamp market category. Businesses and organizations seek lamps that provide functional illumination and contribute to their premises' aesthetic appeal. Architectural lighting designs, such as recessed or track lamp lighting, are preferred to create visually appealing and impactful lighting installations.

The integration of commercial lamps into smart building systems is driving market growth. Smart buildings utilize connected technologies to enhance energy efficiency, optimize lighting control, and enable centralized management of lighting systems. Commercial lamps with compatibility for smart building integration, such as connectivity protocols and interoperability with building management systems, experience increased demand in this evolving market segment.

Regional Insights

North America held a share of over 19% of the global market in 2022. Technological advancements and the increasing focus on environmental protection have driven the demand for energy-efficient lighting products in North America. Moreover, government agencies at various levels in North America have recognized the importance of energy-efficient lighting and have implemented initiatives and rebate programs to encourage its adoption.

These factors have led to the development of various lighting technologies and solutions that help reduce energy consumption and minimize environmental impact. Light-emitting diode (LED) lighting has gained significant popularity recently due to its energy efficiency, long lifespan, and versatility. According to the Residential Energy Consumption (REC) Survey, U.S. households are increasingly purchasing LED bulbs for their indoors. The report revealed that 47% of U.S. households used LED lighting products for illuminating their indoor spaces in 2020.

The market in Europe is anticipated to grow at a CAGR of 3.7% over the forecast period. There is a growing preference for sustainable lighting solutions in the UK, driven by environmental concerns and increased awareness of energy consumption. LED lamps are considered more sustainable due to their energy efficiency, long lifespan, and recyclability. Consumers and businesses are actively seeking out lamps that align with their sustainability goals, thus contributing to market growth.

Major players in the lamps market are investing in research and development to create innovative lighting solutions. This includes the development of LED lamps with advanced features such as dimmability, color temperature control, and smart connectivity. These features cater to the evolving needs of residential and commercial customers, offering enhanced functionality and customization options.

Key Companies & Market Share Insights

Key market players are adopting various steps to increase their presence in the market. These steps include strategies such as partnerships, mergers & acquisitions, global expansion, and others. Some of the initiatives include:

-

In April 2023, Signify introduced the newer version of the Philips Ultra Efficient LED bulbs that consume 40% less energy and deliver 3x the lifetime usage compared to standard bulbs.

-

In April 2023, Xiaomi launched the MIJIA multifunctional and rechargeable desk lamp equipped with a 2000mAh lithium battery and a 360-degree adjustability feature. The vertical desk lamp can also be used as a clamp lamp or flashlight with its magnetic suction design. The lamp provides at least 4 hours of maximum brightness and has four different lighting modes.

-

In March 2023, IKEA announced a partnership with nonprofit organization Little Sun to release the SAMMANLÄNKAD collection comprising 2 solar-powered LED lamps: a table lamp and a smaller portable lamp. The former can be used as a table or pendant lamp and the light source comes apart from the stand to be used as a flashlight. The latter comes with a yellow strap that can be handheld or hung from a backpack or window for use or for charging.

Some prominent players in the global lamps market include:

-

Signify (Philips Lighting)

-

OSRAM GmbH

-

Herman Miller Inc.

-

Inter IKEA B.V.

-

Artemide S.p.A.

-

Pablo Design

-

Lutron Electronics

-

Koncept Inc.

-

OttLite Technologies

-

Flos S.p.A.

Lamps Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 14.10 billion

Revenue forecast in 2030

USD 19.69 billion

Growth rate

CAGR of 4.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Signify (Philips Lighting); OSRAM GmbH; Herman Miller Inc.; Inter IKEA B.V.; Artemide S.p.A.; Pablo Design; Lutron Electronics; Koncept Inc.; OttLite Technologies; Flos S.p.A.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lamps Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global lamps market based on product, type, application, and region:

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Desk Lamp

-

Floor Lamp

-

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Reading Lamp

-

Decorative Lamp

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Residential/Retail

-

Commercial/Hospitality

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global lamps market size was estimated at USD 13.53 billion in 2022 and is expected to reach USD 14.10 billion in 2023.

b. The global lamps market is expected to grow at a compounded growth rate of 4.8% from 2023 to 2030 to reach USD 19.69 billion by 2030.

b. Desk Lamps dominated the market with a share of 55.1% in 2022. This is attributed to notable trends and advancements, reflecting the evolving needs and preferences of consumers. One prominent trend is the increasing popularity of LED desk lamps. LED technology offers energy efficiency, a longer lifespan, and versatile lighting options, making it an appealing choice for both residential and commercial settings.

b. Some key players operating in market include Signify (Philips Lighting), OSRAM GmbH, Herman Miller Inc., Inter IKEA B.V., Artemide S.p.A., Pablo Design, Lutron Electronics, Koncept Inc., OttLite Technologies, Flos S.p.A.

b. Key factors that are driving the market growth include, a growing focus on interior aesthetics and the desire to create visually appealing spaces have led to a significant surge in demand for floor lamps and desk lamps. These lighting fixtures serve a dual purpose by providing both functional lighting and enhancing the overall ambiance of residential and commercial spaces.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.