- Home

- »

- Advanced Interior Materials

- »

-

Europe MRO Distribution Market Size & Share, Report, 2030GVR Report cover

![Europe MRO Distribution Market Size, Share & Trends Report]()

Europe MRO Distribution Market Size, Share & Trends Analysis Report By Distribution Channel (Direct, Indirect), By Maintenance Type, By Sourcing/Service Type, By Product, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-886-2

- Number of Report Pages: 183

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Europe MRO Distribution Market Size & Trends

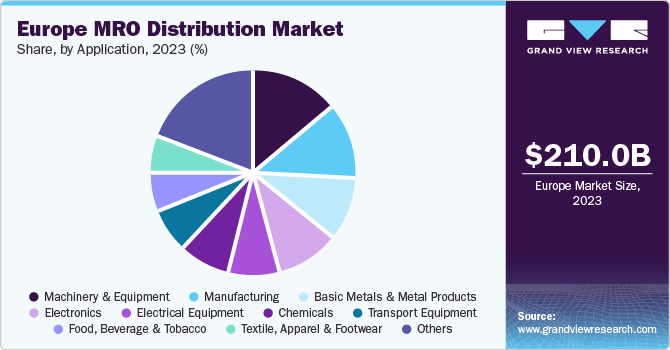

The Europe MRO distribution market size was estimated at USD 210.02 billion in 2023 and is projected to grow at a compounded annual growth rate (CAGR) of 3.2% from 2024 to 2030. The increasing need for the development, maintenance, and repair of industrial equipment and services for industries in the region is expected to drive the demand for MRO distribution over the forecast period.

The increasing cost of logistics is a challenging factor for suppliers as it directly affects the cost of MRO operations. The components used in MRO operations vary in terms of size, shape, and dimensions; hence, they require dedicated transportation. Moreover, some of the MRO components need specialized logistic services owing to their fragile property, thereby, increasing the cost of logistics. However, logistic companies are acquiring contracts in the supply channel to transport the components from manufacturer to distributor or directly to the OEMs, thus reducing the overall cost of operations.

Prominent players across the globe are focusing on achieving quality standards in order to provide quality services at affordable prices. On the other hand, the pressure to adhere to demand by equipment manufacturers, along with the growing importance of cost reduction, has amplified the attractiveness of distributors and dropped the barriers to advanced and new concepts in integrated services.

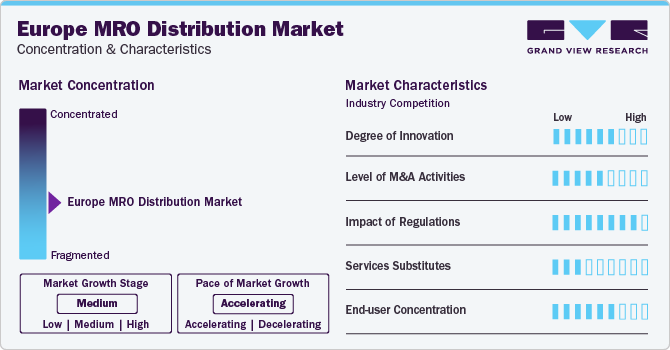

Market Concentration & Characteristics

The market growth stage is medium and the pace of the growth is accelerating. The MRO distributors in the market to enhance the process and make it more efficient have adopted several technologies. MRO distribution has been a labor-intensive industry, which requires skilled professional service providers. However, with increasing labor costs, distributors are investing and focusing on embedding robotics in the MRO market.

Committee such as the European Committee for Standardization (CEN) and the European Committee for Electrotechnical Standardization (CENELEC) are part of the specialized system. These committees deal with particular fields of technical activity, such as MRO distribution. Additionally, machinery directive regulates a uniform level of safety for machines in order to enable free merchandise traffic and distribution within the European Economic Area. It applies to manufacturers and distributors of machinery and devices, but not to operating companies.

MRO distribution channels have a limited number of direct substitutes. However, the equipment distribution media have seen a paradigm shift in the past few years with the emergence of several e-commerce platforms. Distribution through e-commerce platforms has increased dramatically in most economies as compared to conventional counterparts. Hence, the threat of substitutes is low.

Product Insights

The machine consumables segment dominated the market with a revenue share of 30.3% in 2023. MRO service providers are increasingly focusing on the installation of higher-quality consumables in machinery in order to enhance its performance and lifecycle. However, certain critical parts used in some machinery require replacement as they tend to wear out and their performance is reduced over time. The expanding manufacturing industry in Europe is likely to surge demand for advanced technology machines. Maintenance of these machines is anticipated to propel the demand for MRO operations pertaining to machine consumables.

Bearings are widely utilized in movable mechanical instruments such as wheels, steering, and other rotating parts. Various types of bearings include roller, ball, spherical roller, cylindrical roller, needle roller, and tapered roller bearings. The demand for bearings in automotive and machinery manufacturing industries is attributed to their efficiency in carrying high loads and requirement for low maintenance. Rising demand for durable and sophisticated bearings is anticipated to drive this product segment over the forecast period.

Sourcing/Service Type Insights

The external MRO segment accounted for the largest revenue share in 2023. External MRO distribution operations are expected to witness significant growth on account of increasing contracts with third-party MRO service providers. A majority of companies are focusing on reducing efforts of their internal departments pertaining to MRO operations. Instead, the task of these operations is assigned to external service providers with a skilled workforce. Growing manufacturing industries, increasing need for precise manufacturing activities, and technological developments are factors that have led to the introduction of advanced machinery in production facilities. External MRO service companies in Europe are focusing on providing precise solutions for advanced technology machinery.

Internal MRO services are majorly used to avoid interruptions caused by unexpected issues that occur during production. The management carries out these operations for immediate repair and maintenance when a machine breaks down due to some fault. However, over the past few years, demand for internal MRO distribution has witnessed a decline as manufacturers are increasingly focusing on contracting with external third-party MRO service providers.

Maintenance Type Insights

The preventive/scheduled maintenance segment dominated the market in 2023. Protecting the machinery or equipment from unexpected breakdowns and ensuring a smooth flow of operations are the factors anticipated to increase the need for scheduled maintenance among companies. Moreover, this type of maintenance is preferred by production facilities to avoid unplanned maintenance activities, improve equipment life, and reduce operational costs.

Corrective maintenance activities are majorly carried out when an issue is sensed in conditional monitoring when there is a potential fault in routine inspection and equipment breakdown. Companies keep corrective maintenance activity to a minimum by servicing the equipment beforehand. Corrective maintenance costs more than preventive maintenance depending on the nature of the breakdown and the MRO equipment used in tasks. The aforementioned factors are expected to hamper the growth of the corrective maintenance type segment over the forecast period.

Distribution Channel Insights

The direct distribution channel segment dominated the market in 2023 owing to the rising trend of procuring materials directly from MRO manufacturers. The players engaged in MRO supplies are focusing on the procurement of components in large quantities to reduce procurement efforts and operational time for services. The bulk delivery of components used in MRO operations is anticipated to further drive the direct supply segment’s growth over the forecast period.

Indirect distribution of MRO components involves multiple entities such as manufacturers, wholesalers, distributors, retailers, and end users or OEMs. Multiple levels of distributors and wholesalers are present in the supply chain, thus impacting the pricing structure of the MRO components used in various operations. Instead of directly supplying the products to OEMs, component manufacturers do so through a dedicated distribution channel. The aforementioned factors are expected to propel the indirect distribution segment’s growth.

Application Insights

The machinery & equipment application segment dominated the market in 2023. Manufacturing of machinery and equipment is one of the most competitive and largest manufacturing segments in Europe. The presence of a large machinery manufacturing segment generates a huge demand for maintenance & repair equipment and periodic services. The segment has been growing significantly, which, in turn, is likely to further drive the demand for MRO products in the coming years.

Manufacturing industries in European countries are anticipated to witness an upward trend in the coming years owing to government reforms to develop manufacturing industries in major countries. Automotive, aerospace, and machinery manufacturing were estimated to be major contributors to the industrial growth in the region in recent past. These aforementioned factors are projected to support the market for MRO services.

Regional Insights

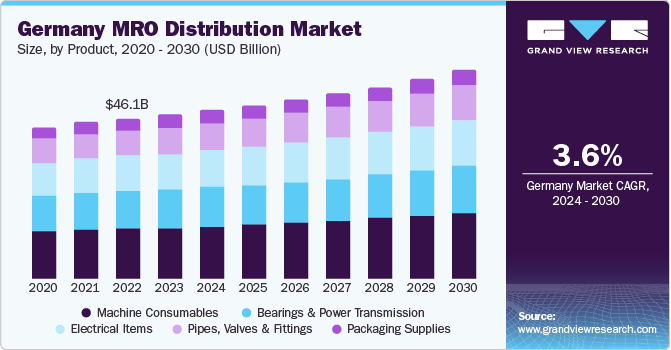

Germany dominated the market and accounted for a 21.9% share in 2023. Industries contributing to the country’s economic growth include automotive, metal, coal, machine tools, optics, textile, plastic goods, chemical, electrical equipment, ship, high precision equipment, and pharmaceutical. Germany majorly exports products such as aircraft & spacecraft, motor vehicles & their related parts, and packaged medicaments. The growth of these industries is likely to escalate the need for maintenance and repair of the machines, which in turn is likely to fuel demand for MRO.

Czech Republic MRO Distribution Market

Mining, automotive, and chemical industries in the Czech Republic are the major contributors to industrial developments. Availability of natural resources, limestone, and black coal mines in the country is creating growth opportunities for the mining industry. Moreover, the country is a major hub for automotive manufacturing with the presence of multinational players including Toyota, Hyundai Motor Manufacturing Czech, and Skoda Auto. Over 50% of exports from the country are automotive products. Reforms for the development of manufacturing facilities and expansion in production quantity are expected to drive demand for MRO services.

France MRO Distribution Market

The manufacturing industry in France is inclusive of sectors such as textiles, food, electronics, mechanical engineering, metallurgy, chemicals, and automotive. The MRO industry contributed a significant share of the country’s GDP in 2018, wherein automotive manufacturing held the largest share. Renault and Peugeot SA are the major automotive manufacturers in France who also operate multiple manufacturing units across the globe. The MRO services are frequently required in these facilities, as the production lines are continuous and capable of producing nearly four million cars annually.

Italy MRO Distribution Market

Demand for MRO distribution in Italy is expected to grow at a significant pace over the coming years. Italy has significantly contributed to the regional manufacturing output in the past few years owing to its well-established manufacturing industries including automotive, machine tools, food products, pharmaceuticals, and fashion items. These factors have been contributing to the market growth.

Netherlands MRO Distribution Market

The Netherlands’ GDP is mainly driven by the strong development of agriculture, manufacturing, resource & power, and finance services. Major manufacturing industries in the Netherlands include electrical & electronics, food & beverages, chemical, metal, and petroleum. Furthermore, the increasing development in microelectronics digital economy and biotechnology is anticipated to increase the number of facilities in the Netherlands, which, in turn, is likely to have a positive impact on MRO services.

Key Europe MRO Distribution Company Insights

Some of the key players operating in the market include WABCO, Graco, and Wurth Group.

-

Graco operates as a global supplier of several varieties of fluid handling systems and associated components. The major functions of these systems include moving, measuring, controlling, and dispensing in tandem with applying a complete portfolio of fluids along with viscous materials used in commercial & industrial settings and vehicle lubrication. Industries served by the company include manufacturing, construction, maintenance, and processing.

-

WABCO operates as a global supplier of commercial vehicle technologies and services for enhancing safety, efficiency, and connectivity of commercial vehicles. The key products that the company designs and markets include stability, braking, & transmission control, air compressing systems, and suspension for commercial trucks, buses, trailers, passenger cars, and SUVs. It sells its products directly to auto and auto component manufacturers including BMW, Volvo, Ashok Leyland, and Daimler.

-

Elmbridge Supplies Company Ltd., Ferguson plc, Kron CIS GmbH are some of emerging market participants.

-

Elmbridge Supplies Company Ltd. operates as a distributor of industrial products specializing in wood coatings, industrial coatings, industrial spray equipment, abrasives, compressors, and welding and engineering supplies. The company’s services include maintenance & repair, installations, repair, support & training, and consulting.

-

Ferguson plc provides plumbing, heating, and industrial services to industries involved in water and heating solutions. The company changed its name from Wolseley plc to Ferguson plc in July 2017. The company distributes products of brands such as Plumb Center, Parts Center, Drain Center, Pipe Center, Climate Center, Burdens Civil, MPS Civil, Fusion Utilities, Utility Power Systems, Utility Fiber Systems, MCA-fusion Hire & Repair, William Wilson, Discounted Heating, and Clearance Center.

Key Europe MRO Distribution Companies:

The following are the leading companies in the Europe MRO distribution market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these Europe MRO distribution companies are analyzed to map the supply network.

- Cromwell Group (Holdings) Ltd.

- Graco

- WABCO

- Mento AS

- Valeo Service

- Ascendum

- Bodo Möller Chemie GmbH

- Lindberg & Lund AS

- MCtechnics

- Neumo-Egmo Spain SL

- Gazechim Composites Norden AB

- Plastorgomma Srl

- Norwegian Oilfield Supply AS

- Kron CIS GmbH

- Elmbridge Supplies Company Ltd.

- Mates Italiana SRL

- ABIC Kemi AB

- Ferguson plc

- RS Components

- Transfer Multisort Elektronik Sp. z.o.o.

- Premier Farnell Limited

- Sonepar

- Wurth Group

- Lapp Group

- Weidmüller Interface GmbH & Co. KG

- Pepperl+Fuchs

- ebm-papst Group

- WAGO Kontakttechnik GmbH & Co. KG

- Rittal GmbH & Co. KG

- Phoenix Contact

- Schneider Electric

- Panasonic Industry Europe GmbH

- Festo AG & Co. KG

- ABB Group

- Rohde & Schwarz

- Fluke Corporation

- Testo SE & Co. KGaA

- BENNING Elektrotechnik und Elektronik GmbH & Co. KG

- Wera Werkzeuge GmbH

Recent Developments

-

In February 2023, Bodo Möller Chemie GmbH expanded its business in West Africa. The company started its warehouse Nigerian metropolitan area, which supplies adhesives, fillers, resins, and additives. The new facility will help the company shorten the supply chain of products.

-

In October 2022, Premier Farnell Limited strengthened its investments in industrial products in order to support predictive maintenance services for manufacturers. This includes accumulation of industrial internet of things (IIoT) to help manufacturers save time, cost and effort required to implement scheduled maintenance.

Europe MRO Distribution Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 214.60 billion

Revenue forecast in 2030

USD 259.15 billion

Growth rate

CAGR of 3.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, sourcing/service, maintenance type, distribution channel, application, region

Regional scope

Europe

Country scope

Germany; France; Czech Republic; Hungary; Solvakia; Austria; Finland; Italy; Belgium; The Netherlands; Poland; Sweden; Denmark; Switzerland

Key companies profiled

Cromwell Group (Holdings) Ltd.; Graco; WABCO; Mento AS; Valeo Service; Ascendum; Bodo Möller Chemie GmbH; Lindberg & Lund AS; MCtechnics; Neumo-Egmo Spain SL; Gazechim Composites Norden AB; Plastorgomma Srl; Norwegian Oilfield Supply AS; Kron CIS GmbH; Elmbridge Supplies Company Ltd.; Mates Italiana SRL; ABIC Kemi AB; Ferguson plc; RS Components; Transfer Multisort Elektronik Sp. z.o.o.; Premier Farnell Limited; Sonepar; Wurth Group; Lapp Group; Weidmüller Interface GmbH & Co. KG; Pepperl+Fuchs; ebm-papst Group; WAGO Kontakttechnik GmbH & Co. KG; Rittal GmbH & Co. KG; Phoenix Contact; Schneider Electric; Panasonic Industry Europe GmbH; Festo AG & Co. KG; ABB Group; Rohde & Schwarz; Fluke Corporation; Testo SE & Co. KGaA; BENNING Elektrotechnik und Elektronik GmbH & Co. KG; Wera Werkzeuge GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe MRO Distribution Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe MRO distribution market report based on product, sourcing/service, maintenance type, distribution channel, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bearings & Power Transmission

-

Pipes, Valves & Fittings

-

Electrical Items

-

Packaging Supplies

-

Machine Consumables

-

-

Sourcing/Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Internal MRO

-

External MRO

-

-

Maintenance Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Preventive/Scheduled maintenance

-

Corrective maintenance

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct

-

Indirect

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food, Beverage & Tobacco

-

Textile, Apparel & Footwear

-

Wood & Paper

-

Mining, Oil & Gas

-

Basic Metals & Metal Products

-

Rubber, Plastic and Non-metallic Products

-

Chemicals

-

Pharmaceuticals

-

Electronics

-

Machinery and Equipment

-

Electrical Equipment

-

Transport Equipment

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

Germany

-

France

-

Italy

-

Netherlands

-

Belgium

-

Switzerland

-

Sweden

-

Denmark

-

Poland

-

Austria

-

Finland

-

Czech Republic

-

Hungary

-

Slovakia

-

-

Frequently Asked Questions About This Report

b. The Europe MRO distribution market size was estimated at USD 210.02 billion in 2023 and is expected to reach USD 214.60 billion in 2024.

b. The Europe MRO distribution market is expected to grow at a compound annual growth rate of 3.2% from 2024 to 2030 to reach USD 259.15 billion by 2030.

b. The external MRO service segment end-use segment of Europe MRO distribution market accounted for the largest revenue share of 71.5% in 2023 and is further expected to grow at a CAGR of 3.4% over the forecast period on account of increasing contracts to third-party MRO service providers.

b. Some of the key players operating in the Europe MRO distribution market include Cromwell Group (Holdings) Ltd., Graco Inc., WABCO, Mento AS, Valeo Service U.K. Ltd., Ascendum, Bodo Möller Chemie GmbH, Lindberg & Lund AS, MCtechnics, Neumo-Egmo Spain SL, Gazechim Composites Norden AB, and Plastorgomma Srl

b. The key factors that are driving the demand for MRO distributors in Europe is increasing substantial product and service requirements from various end-use industries in the region.

Table of Contents

Chapter 1. Europe MRO Distribution Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Europe MRO Distribution Market: Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Europe MRO Distribution Market: Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.2. Industry Value Chain Analysis

3.2.1. Impact of e-commerce on Europe MRO Distribution Industry

3.2.2. Technological Overview

3.2.3. Manufacturing Trends

3.2.4. Sales Channel Analysis

3.3. Regulatory Framework

3.4. Market Dynamics

3.4.1. Market Driver Analysis

3.4.2. Market Restraint Analysis

3.4.3. Industry Challenges

3.5. Industry Analysis Tools

3.5.1. Porter’s Five Forces Analysis

3.5.2. PESTEL Analysis

3.6. Qualitative Analysis for the Following Products

3.6.1. Bearings & Power transmission

3.6.1.1. Transmission components

3.6.1.2. Pneumatics

3.6.1.3. Electronic components

3.6.2. Electrical items (excluding raceways and struts)

3.6.2.1. Cables

3.6.2.2. Lighting systems

3.6.2.3. Electrical & motor controls

3.6.2.4. Electrical boxes

3.6.2.5. Conduits

3.6.2.6. Branch circuits & wiring devices

3.6.2.7. Medium voltage switchgears and feeders

Chapter 4. Europe MRO Distribution Market: Product Estimates & Trend Analysis

4.1. Product Movement Analysis & Market Share, 2023 & 2030

4.2. Europe MRO Distribution Market Estimates & Forecast, By Product, 2018 to 2030 (USD Million)

4.3. Bearings & Power Transmission

4.3.1. Europe MRO Distribution Market Revenue Estimates and Forecasts, by Bearings & Power Transmission, 2018 - 2030 (USD Million)

4.4. Pipes, Valves, & Fittings

4.4.1. Europe MRO Distribution Market Revenue Estimates and Forecasts, by Pipes, Valves, & Fittings, 2018 - 2030 (USD Million)

4.5. Electrical Items

4.5.1. Europe MRO Distribution Market Revenue Estimates and Forecasts, by Electrical Items, 2018 - 2030 (USD Million)

4.6. Packaging Supplies

4.6.1. Europe MRO Distribution Market Revenue Estimates and Forecasts, by Packaging Supplies, 2018 - 2030 (USD Million)

4.7. Machine Consumables

4.7.1. Europe MRO Distribution Market Revenue Estimates and Forecasts, by Machine Consumables, 2018 - 2030 (USD Million)

Chapter 5. Europe MRO Distribution Market: Sourcing/Service Estimates & Trend Analysis

5.1. Sourcing/Service Movement Analysis & Market Share, 2023 & 2030

5.2. Europe MRO Distribution Market Estimates & Forecast, By Sourcing/Service, 2018 to 2030 (USD Million)

5.3. Internal MRO

5.3.1. Europe MRO Distribution Market Revenue Estimates and Forecasts, by Internal MRO, 2018 - 2030 (USD Million)

5.4. External MRO

5.4.1. Europe MRO Distribution Market Revenue Estimates and Forecasts, by External MRO, 2018 - 2030 (USD Million)

Chapter 6. Europe MRO Distribution Market: Maintenance Type Estimates & Trend Analysis

6.1. Maintenance Type Movement Analysis & Market Share, 2023 & 2030

6.2. Europe MRO Distribution Market Estimates & Forecast, By Maintenance Type, 2018 to 2030 (USD Million)

6.3. Preventive/Scheduled Maintenance

6.3.1. Europe MRO Distribution Market Revenue Estimates and Forecasts, by Preventive/Scheduled Maintenance, 2018 - 2030 (USD Million)

6.4. Corrective Maintenance

6.4.1. Europe MRO Distribution Market Revenue Estimates and Forecasts, by Corrective Maintenance, 2018 - 2030 (USD Million)

Chapter 7. Europe MRO Distribution Market: Distribution Channel Estimates & Trend Analysis

7.1. Distribution Channel Movement Analysis & Market Share, 2023 & 2030

7.2. Europe MRO Distribution Market Estimates & Forecast, By Distribution Channel, 2018 to 2030 (USD Million)

7.3. Direct

7.3.1. Europe MRO Distribution Market Revenue Estimates and Forecasts, by Direct, 2018 - 2030 (USD Million)

7.4. Indirect

7.4.1. Europe MRO Distribution Market Revenue Estimates and Forecasts, by Indirect, 2018 - 2030 (USD Million)

Chapter 8. Europe MRO Distribution Market: Application Estimates & Trend Analysis

8.1. Application Movement Analysis & Market Share, 2023 & 2030

8.2. Europe MRO Distribution Market Estimates & Forecast, By Application, 2018 to 2030 (USD Million)

8.3. Food, beverage & tobacco

8.3.1. Europe MRO Distribution Market Revenue Estimates and Forecasts, by Food, beverage & tobacco, 2018 - 2030 (USD Million)

8.4. Textile, apparel & footwear

8.4.1. Europe MRO Distribution Market Revenue Estimates and Forecasts, by Textile, apparel & footwear, 2018 - 2030 (USD Million)

8.5. Wood & paper

8.5.1. Europe MRO Distribution Market Revenue Estimates and Forecasts, by Wood & paper, 2018 - 2030 (USD Million)

8.6. Mining and oil & gas

8.6.1. Europe MRO Distribution Market Revenue Estimates and Forecasts, by Mining and oil & gas, 2018 - 2030 (USD Million)

8.7. Basic metals & metal products

8.7.1. Europe MRO Distribution Market Revenue Estimates and Forecasts, by Basic metals & metal products, 2018 - 2030 (USD Million)

8.8. Rubber, plastic, and non-metallic products

8.8.1. Europe MRO Distribution Market Revenue Estimates and Forecasts, by Rubber, plastic, and non-metallic products, 2018 - 2030 (USD Million)

8.9. Chemical

8.9.1. Europe MRO Distribution Market Revenue Estimates and Forecasts, by Chemical, 2018 - 2030 (USD Million)

8.10. Pharmaceuticals

8.10.1. Europe MRO Distribution Market Revenue Estimates and Forecasts, by Pharmaceuticals, 2018 - 2030 (USD Million)

8.11. Electronics

8.11.1. Europe MRO Distribution Market Revenue Estimates and Forecasts, by Electronics, 2018 - 2030 (USD Million)

8.12. Machinery and equipment

8.12.1. Europe MRO Distribution Market Revenue Estimates and Forecasts, by Machinery and equipment, 2018 - 2030 (USD Million)

8.13. Electrical equipment

8.13.1. Europe MRO Distribution Market Revenue Estimates and Forecasts, by Electrical equipment, 2018 - 2030 (USD Million)

8.14. Transport equipment

8.14.1. Europe MRO Distribution Market Revenue Estimates and Forecasts, by Transport equipment, 2018 - 2030 (USD Million)

8.15. Manufacturing

8.15.1. Europe MRO Distribution Market Revenue Estimates and Forecasts, by Manufacturing, 2018 - 2030 (USD Million)

8.16. Others

8.16.1. Europe MRO Distribution Market Revenue Estimates and Forecasts, by other applications, 2018 - 2030 (USD Million)

Chapter 9. Europe MRO Distribution Market: Regional Estimates & Trend Analysis

9.1. Regional Movement Analysis & Market Share, 2023 & 2030

9.2. Czech Republic

9.2.1. Czech Republic MRO Distribution Market Estimates & Forecast, 2018 - 2030 (USD Million)

9.3. Hungary

9.3.1. Hungary MRO Distribution Market Estimates & Forecast, 2018 - 2030 (USD Million)

9.4. Slovakia

9.4.1. Slovakia MRO Distribution Market Estimates & Forecast, 2018 - 2030 (USD Million)

9.5. Austria

9.5.1. Austria MRO Distribution Market Estimates & Forecast, 2018 - 2030 (USD Million)

9.6. Finland

9.6.1. Finland MRO Distribution Market Estimates & Forecast, 2018 - 2030 (USD Million)

9.7. France

9.7.1. France MRO Distribution Market Estimates & Forecast, 2018 - 2030 (USD Million)

9.8. Germany

9.8.1. Germany MRO Distribution Market Estimates & Forecast, 2018 - 2030 (USD Million)

9.9. Italy

9.9.1. Italy MRO Distribution Market Estimates & Forecast, 2018 - 2030 (USD Million)

9.10. Belgium

9.10.1. Belgium MRO Distribution Market Estimates & Forecast, 2018 - 2030 (USD Million)

9.11. The Netherlands

9.11.1. The Netherlands MRO Distribution Market Estimates & Forecast, 2018 - 2030 (USD Million)

9.12. Poland

9.12.1. Poland MRO Distribution Market Estimates & Forecast, 2018 - 2030 (USD Million)

9.13. Sweden

9.13.1. Sweden MRO Distribution Market Estimates & Forecast, 2018 - 2030 (USD Million)

9.14. Denmark

9.14.1. Denmark MRO Distribution Market Estimates & Forecast, 2018 - 2030 (USD Million)

9.15. Switzerland

9.15.1. Switzerland MRO Distribution Market Estimates & Forecast, 2018 - 2030 (USD Million)

Chapter 10. Europe MRO Distribution Market - Supplier Intelligence

10.1. Kraljic Matrix

10.2. Negotation Strategies

10.3. Engagement Model

10.4. Vendor Selection Criteria

10.5. Sourcing Best Practices

10.6. List of Suppliers

Chapter 11. Europe MRO Distribution Market - Competitive Landscape

11.1. Recent Developments & Impact Analysis, By Key Market Participants

11.2. Company Categorization

11.3. Company Market Share/Position Analysis, 2023

11.4. Company Heat Map Analysis

11.5. Strategy Mapping

11.6. Company Profiles

11.6.1. Cromwell Group (Holdings) Limited.

11.6.1.1. Participant’s overview

11.6.1.2. Financial performance

11.6.1.3. Product benchmarking

11.6.1.4. Recent developments

11.6.2. Graco Inc.

11.6.2.1. Participant’s overview

11.6.2.2. Financial performance

11.6.2.3. Product benchmarking

11.6.2.4. Recent developments

11.6.3. WABCO

11.6.3.1. Participant’s overview

11.6.3.2. Financial performance

11.6.3.3. Product benchmarking

11.6.3.4. Recent developments

11.6.4. Mento AS

11.6.4.1. Participant’s overview

11.6.4.2. Financial performance

11.6.4.3. Product benchmarking

11.6.4.4. Recent developments

11.6.5. VALEO SERVICE U.K. LIMITED

11.6.5.1. Participant’s overview

11.6.5.2. Financial performance

11.6.5.3. Product benchmarking

11.6.5.4. Recent developments

11.6.6. Ascendum

11.6.6.1. Participant’s overview

11.6.6.2. Financial performance

11.6.6.3. Product benchmarking

11.6.6.4. Recent developments

11.6.7. Bodo Möller Chemie GmbH

11.6.7.1. Participant’s overview

11.6.7.2. Financial performance

11.6.7.3. Product benchmarking

11.6.7.4. Recent developments

11.6.8. Lindberg & Lund AS

11.6.8.1. Participant’s overview

11.6.8.2. Financial performance

11.6.8.3. Product benchmarking

11.6.8.4. Recent developments

11.6.9. MCTechnics

11.6.9.1. Participant’s overview

11.6.9.2. Financial performance

11.6.9.3. Product benchmarking

11.6.9.4. Recent developments

11.6.10. Neumo-Egmo Spain SL

11.6.10.1. Participant’s overview

11.6.10.2. Financial performance

11.6.10.3. Product benchmarking

11.6.10.4. Recent developments

11.6.11. Gazechim Composites Norden AB

11.6.11.1. Participant’s overview

11.6.11.2. Financial performance

11.6.11.3. Product benchmarking

11.6.11.4. Recent developments

11.6.12. Plastorgomma Srl

11.6.12.1. Participant’s overview

11.6.12.2. Financial performance

11.6.12.3. Product benchmarking

11.6.12.4. Recent developments

11.6.13. Norwegian Oilfield Supply AS

11.6.13.1. Participant’s overview

11.6.13.2. Financial performance

11.6.13.3. Product benchmarking

11.6.13.4. Recent developments

11.6.14. Kron-CIS GmbH

11.6.14.1. Participant’s overview

11.6.14.2. Financial performance

11.6.14.3. Product benchmarking

11.6.14.4. Recent developments

11.6.15. Elmbridge Supplies Company Ltd.

11.6.15.1. Participant’s overview

11.6.15.2. Financial performance

11.6.15.3. Product benchmarking

11.6.15.4. Recent developments

11.6.16. Mates Italiana SRL

11.6.16.1. Participant’s overview

11.6.16.2. Financial performance

11.6.16.3. Product benchmarking

11.6.16.4. Recent developments

11.6.17. ABIC Kemi AB

11.6.17.1. Participant’s overview

11.6.17.2. Financial performance

11.6.17.3. Product benchmarking

11.6.17.4. Recent developments

11.6.18. Ferguson plc

11.6.18.1. Participant’s overview

11.6.18.2. Financial performance

11.6.18.3. Product benchmarking

11.6.18.4. Recent developments

11.6.19. RS Components

11.6.19.1. Participant’s overview

11.6.19.2. Financial performance

11.6.19.3. Product benchmarking

11.6.19.4. Recent developments

11.6.20. Transfer Multisort Elektronik Sp. z.o.o.

11.6.20.1. Participant’s overview

11.6.20.2. Financial performance

11.6.20.3. Product benchmarking

11.6.20.4. Recent developments

11.6.21. Premier Farnell

11.6.21.1. Participant’s overview

11.6.21.2. Financial performance

11.6.21.3. Product benchmarking

11.6.21.4. Recent developments

11.6.22. Sonepar

11.6.22.1. Participant’s overview

11.6.22.2. Financial performance

11.6.22.3. Product benchmarking

11.6.22.4. Recent developments

11.6.23. Wurth Group

11.6.23.1. Participant’s overview

11.6.23.2. Financial performance

11.6.23.3. Product benchmarking

11.6.23.4. Recent developments

11.6.24. Lapp Group

11.6.24.1. Participant’s overview

11.6.24.2. Financial performance

11.6.24.3. Product benchmarking

11.6.24.4. Recent developments

11.6.25. Weidmüller Interface GmbH & Co. KG

11.6.25.1. Participant’s overview

11.6.25.2. Financial performance

11.6.25.3. Product benchmarking

11.6.25.4. Recent developments

11.6.26. Pepperl+Fuchs AG

11.6.26.1. Participant’s overview

11.6.26.2. Financial performance

11.6.26.3. Product benchmarking

11.6.26.4. Recent developments

11.6.27. ebm-papst Group

11.6.27.1. Participant’s overview

11.6.27.2. Financial performance

11.6.27.3. Product benchmarking

11.6.27.4. Recent developments

11.6.28. WAGO Kontakttechnik GmbH & Co. KG

11.6.28.1. Participant’s overview

11.6.28.2. Financial performance

11.6.28.3. Product benchmarking

11.6.28.4. Recent developments

11.6.29. Rittal GmbH & Co. KG

11.6.29.1. Participant’s overview

11.6.29.2. Financial performance

11.6.29.3. Product benchmarking

11.6.29.4. Recent developments

11.6.30. Phoenix Contact

11.6.30.1. Participant’s overview

11.6.30.2. Financial performance

11.6.30.3. Product benchmarking

11.6.30.4. Recent developments

11.6.31. Schneider Electric

11.6.31.1. Participant’s overview

11.6.31.2. Financial performance

11.6.31.3. Product benchmarking

11.6.31.4. Recent developments

11.6.32. Panasonic Industry Europe GmbH

11.6.32.1. Participant’s overview

11.6.32.2. Financial performance

11.6.32.3. Product benchmarking

11.6.32.4. Recent developments

11.6.33. Festo AG & Co. KG

11.6.33.1. Participant’s overview

11.6.33.2. Financial performance

11.6.33.3. Product benchmarking

11.6.33.4. Recent developments

11.6.34. ABB Group

11.6.34.1. Participant’s overview

11.6.34.2. Financial performance

11.6.34.3. Product benchmarking

11.6.34.4. Recent developments

11.6.35. Rohde & Schwarz

11.6.35.1. Participant’s overview

11.6.35.2. Financial performance

11.6.35.3. Product benchmarking

11.6.35.4. Recent developments

11.6.36. Fluke Corporation

11.6.36.1. Participant’s overview

11.6.36.2. Financial performance

11.6.36.3. Product benchmarking

11.6.36.4. Recent developments

11.6.37. Testo SE & Co. KGaA

11.6.37.1. Participant’s overview

11.6.37.2. Financial performance

11.6.37.3. Product benchmarking

11.6.37.4. Recent developments

11.6.38. BENNING Elektrotechnik und Elektronik GmbH & Co. KG

11.6.38.1. Participant’s overview

11.6.38.2. Financial performance

11.6.38.3. Product benchmarking

11.6.38.4. Recent developments

11.6.39. Wera Werkzeuge GmbH

11.6.39.1. Participant’s overview

11.6.39.2. Financial performance

11.6.39.3. Product benchmarking

11.6.39.4. Recent developments

List of Tables

Table 1 Europe MRO Distribution Market Estimates & Forecast, By Product 2018 - 2030 (USD Billion)

Table 2 Europe MRO Distribution Market Estimates & Forecast, By Sourcing/Service 2018 - 2030 (USD Billion)

Table 3 Europe MRO Distribution Market Estimates & Forecast, By Maintenance Type 2018 - 2030 (USD Billion)

Table 4 Europe MRO Distribution Market Estimates & Forecast, By Distribution Channel 2018 - 2030 (USD Billion)

Table 5 Europe MRO Distribution Market Estimates & Forecast, By Application 2018 - 2030 (USD Billion)

List of Figures

Fig. 1 Europe MRO distribution market segmentation

Fig. 2 Information Procurement

Fig. 3 Data Analysis Models

Fig. 4 Market Formulation And Validation

Fig. 5 Data Validating & Publishing

Fig. 6 Regional Outlook

Fig. 7 Segmental Outlook

Fig. 8 Segmental Outlook

Fig. 9 Segmental Outlook

Fig. 10 Competitive Outlook

Fig. 11 Market lineage Outlook, 2022 (USD Billion)

Fig. 12 Europe MRO distribution market - Value chain analysis

Fig. 13 Europe MRO distribution market driver impact analysis

Fig. 14 Germany aerospace & defense production (USD Million)

Fig. 15 Europe MRO distribution market restraint impact

Fig. 16 Industry Analysis: Porter’s

Fig. 17 PESTEL analysis, by SWOT

Fig. 18 Product Key Takeaways

Fig. 19 Product: Market Share, 2023 & 2030

Fig. 20 Europe MRO distribution market estimates & forecasts, by bearings & power transmission, 2018 - 2030 (USD Billion)

Fig. 21 Europe MRO distribution market estimates & forecasts, by pipes, valves & fittings, 2018 - 2030 (USD Billion)

Fig. 22 Europe MRO distribution market estimates & forecasts, by electrical items, 2018 - 2030 (USD Billion)

Fig. 23 Europe MRO distribution market estimates & forecasts, by packaging supplies, 2018 - 2030 (USD Billion)

Fig. 24 Europe MRO distribution market estimates & forecasts, by machine consumables, 2018 - 2030 (USD Billion)

Fig. 25 Sourcing/Service: Key Takeaways

Fig. 26 Sourcing/Service: Market Share, 2022 & 2030

Fig. 27 Europe internal MRO distribution market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 28 Europe external MRO distribution market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 29 Maintenance Type: Key Takeaways

Fig. 30 Maintenance Type: Market Share, 2023 & 2030

Fig. 31 Europe MRO distribution market estimates & forecasts, by preventive/scheduled maintenance 2018 - 2030 (USD Billion)

Fig. 32 Europe MRO distribution market estimates & forecasts, by corrective maintenance 2018 - 2030 (USD Billion)

Fig. 33 Distribution Channel: Key Takeaways

Fig. 34 Distribution Channel: Market Share, 2023 & 2030

Fig. 35 Europe direct MRO distribution market estimates & forecasts,2018 - 2030 (USD Billion)

Fig. 36 Europe indirect MRO distribution market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 37 Application: Key Takeaways

Fig. 38 Application: Market Share, 2023 & 2030

Fig. 39 Europe MRO distribution market estimates & forecasts, in food, beverage & tobacco, 2018 - 2030 (USD Billion)

Fig. 40 Europe MRO distribution market estimates & forecasts, in textile, apparel & footwear, 2018 - 2030 (USD Billion)

Fig. 41 Europe MRO distribution market estimates & forecasts, in wood & paper, 2018 - 2030 (USD Billion)

Fig. 42 Europe MRO distribution market estimates & forecasts, in mining and oil & gas, 2018 - 2030 (USD Billion)

Fig. 43 Europe MRO distribution market estimates & forecasts, in basic metals & metal products, 2018 - 2030 (USD Billion)

Fig. 44 Europe MRO distribution market estimates & forecasts, in rubber, plastic, and non-metallic products, 2018 - 2030 (USD Billion)

Fig. 45 Europe MRO distribution market estimates & forecasts, in chemical, 2018 - 2030 (USD Billion)

Fig. 46 Europe MRO distribution market estimates & forecasts, in pharmaceuticals, 2018 - 2030 (USD Billion)

Fig. 47 Europe MRO distribution market estimates & forecasts, in electronics, 2018 - 2030 (USD Billion)

Fig. 48 Europe MRO distribution market estimates & forecasts, in machinery and equipment, 2018 - 2030 (USD Billion)

Fig. 49 Europe MRO distribution market estimates & forecasts, in electrical equipment, 2018 - 2030 (USD Billion)

Fig. 50 Europe MRO distribution market estimates & forecasts, in transport equipment, 2018 - 2030 (USD Billion)

Fig. 51 Europe MRO distribution market estimates & forecasts, in manufacturing, 2018 - 2030 (USD Billion)

Fig. 52 Europe MRO distribution market estimates & forecasts, in others, 2018 - 2030 (USD Billion)

Fig. 53 Europe MRO distribution market revenue, by country, 2023 & 2030 (USD Billion)

Fig. 54 Regional marketplace: Key takeaways

Fig. 55 Regional marketplace: Key takeaways

Fig. 56 Czech Republic MRO distribution market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 57 Hungary MRO distribution market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 58 Slovakia MRO distribution market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 59 Austria MRO distribution market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 60 Finland MRO distribution market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 61 France MRO distribution market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 62 Germany MRO distribution market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 63 Italy MRO distribution market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 64 Belgium MRO distribution market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 65 Netherlands MRO distribution market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 66 Poland MRO distribution market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 67 Sweden MRO distribution market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 68 Denmark MRO distribution market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 69 Switzerland MRO distribution market estimates & forecasts, 2018 - 2030 (USD Billion)

Fig. 70 Europe MRO Distribution market - Company CategorizationWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Europe MRO Distribution Product Outlook (Revenue, USD Million, 2018 - 2030)

- Bearings & Power Transmission

- Pipes, Valves & Fittings

- Electrical Items

- Packaging Supplies

- Machine Consumables

- Europe MRO Distribution Europe MRO Sourcing/Service Outlook (Revenue, USD Million, 2018 - 2030)

- Internal MRO

- External MRO

- Europe MRO Distribution Maintenance Type Outlook (Revenue, USD Million, 2018 - 2030)

- Preventive/Scheduled Maintenance

- Corrective Maintenance

- Europe MRO Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

- Direct

- Indirect

- Europe MRO Distribution Application Outlook (Revenue, USD Million, 2018 - 2030)

- Food, Beverage & Tobacco

- Textile, Apparel & Footwear

- Wood & Paper

- Mining, Oil & Gas

- Basic Metals & Metal Products

- Rubber, Plastic and Non-metallic Products

- Chemicals

- Pharmaceuticals

- Electronics

- Machinery and Equipment

- Electrical equipment

- Transport equipment

- Manufacturing

- Others

- Europe MRO Distribution Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- Europe

- Europe MRO Distribution Market, By Product

- Bearings & Power Transmission

- Pipes, Valves & Fittings

- Electrical Items

- Packaging Supplies

- Machine Consumables

- Europe MRO Distribution Market, By Sourcing/Service

- Internal MRO

- External MRO

- Europe MRO Distribution Market, By Maintenance Type

- Preventive/Scheduled Maintenance

- Corrective Maintenance

- Europe MRO Distribution Market, By Distribution Channel

- Direct

- Indirect

- Europe MRO Distribution Market, By Application

- Food, Beverage & Tobacco

- Textile, Apparel & Footwear

- Wood & Paper

- Mining, Oil & Gas

- Basic Metals & Metal Products

- Rubber, Plastic and Non-metallic Products

- Chemicals

- Pharmaceuticals

- Electronics

- Machinery and Equipment

- Electrical equipment

- Transport equipment

- Manufacturing

- Others

- Germany

- Germany MRO Distribution Market, By Product

- Bearings & Power Transmission

- Pipes, Valves & Fittings

- Electrical Items

- Packaging Supplies

- Germany MRO Distribution Market, By Sourcing/Service

- Internal MRO

- External MRO

- Germany MRO Distribution Market, By Maintenance Type

- Preventive/Scheduled Maintenance

- Corrective Maintenance

- Germany MRO Distribution Market, By Distribution Channel

- Direct

- Indirect

- Germany MRO Distribution Market, By Application

- Food, Beverage & Tobacco

- Textile, Apparel & Footwear

- Wood & Paper

- Mining, Oil & Gas

- Basic Metals & Metal Products

- Rubber, Plastic and Non-metallic Products

- Chemicals

- Pharmaceuticals

- Electronics

- Machinery and Equipment

- Electrical equipment

- Transport equipment

- Manufacturing

- Others

- Germany MRO Distribution Market, By Product

- France

- France MRO Distribution Market, By Product

- Bearings & Power Transmission

- Pipes, Valves & Fittings

- Electrical Items

- Packaging Supplies

- France MRO Distribution Market, By Sourcing/Service

- Internal MRO

- External MRO

- France MRO Distribution Market, By Maintenance Type

- Preventive/Scheduled Maintenance

- Corrective Maintenance

- France MRO Distribution Market, By Distribution Channel

- Direct

- Indirect

- France MRO Distribution Market, By Application

- Food, Beverage & Tobacco

- Textile, Apparel & Footwear

- Wood & Paper

- Mining, Oil & Gas

- Basic Metals & Metal Products

- Rubber, Plastic and Non-metallic Products

- Chemicals

- Pharmaceuticals

- Electronics

- Machinery and Equipment

- Electrical equipment

- Transport equipment

- Manufacturing

- Others

- France MRO Distribution Market, By Product

- Italy

- Italy MRO Distribution Market, By Product

- Bearings & Power Transmission

- Pipes, Valves & Fittings

- Electrical Items

- Packaging Supplies

- Italy MRO Distribution Market, By Sourcing/Service

- Internal MRO

- External MRO

- Italy MRO Distribution Market, By Maintenance Type

- Preventive/Scheduled Maintenance

- Corrective Maintenance

- Italy MRO Distribution Market, By Distribution Channel

- Direct

- Indirect

- Italy MRO Distribution Market, By Application

- Food, Beverage & Tobacco

- Textile, Apparel & Footwear

- Wood & Paper

- Mining, Oil & Gas

- Basic Metals & Metal Products

- Rubber, Plastic and Non-metallic Products

- Chemicals

- Pharmaceuticals

- Electronics

- Machinery and Equipment

- Electrical equipment

- Transport equipment

- Manufacturing

- Others

- Italy MRO Distribution Market, By Product

- Netherlands

- Netherlands MRO Distribution Market, By Product

- Bearings & Power Transmission

- Pipes, Valves & Fittings

- Electrical Items

- Packaging Supplies

- Netherlands MRO Distribution Market, By Sourcing/Service

- Internal MRO

- External MRO

- Netherlands MRO Distribution Market, By Maintenance Type

- Preventive/Scheduled Maintenance

- Corrective Maintenance

- Netherlands MRO Distribution Market, By Distribution Channel

- Direct

- Indirect

- Netherlands MRO Distribution Market, By Application

- Food, Beverage & Tobacco

- Textile, Apparel & Footwear

- Wood & Paper

- Mining, Oil & Gas

- Basic Metals & Metal Products

- Rubber, Plastic and Non-metallic Products

- Chemicals

- Pharmaceuticals

- Electronics

- Machinery and Equipment

- Electrical equipment

- Transport equipment

- Manufacturing

- Others

- Netherlands MRO Distribution Market, By Product

- Belgium

- Belgium MRO Distribution Market, By Product

- Bearings & Power Transmission

- Pipes, Valves & Fittings

- Electrical Items

- Packaging Supplies

- Belgium MRO Distribution Market, By Sourcing/Service

- Internal MRO

- External MRO

- Belgium MRO Distribution Market, By Maintenance Type

- Preventive/Scheduled Maintenance

- Corrective Maintenance

- Belgium MRO Distribution Market, By Distribution Channel

- Direct

- Indirect

- Belgium MRO Distribution Market, By Application

- Food, Beverage & Tobacco

- Textile, Apparel & Footwear

- Wood & Paper

- Mining, Oil & Gas

- Basic Metals & Metal Products

- Rubber, Plastic and Non-metallic Products

- Chemicals

- Pharmaceuticals

- Electronics

- Machinery and Equipment

- Electrical equipment

- Transport equipment

- Manufacturing

- Others

- Belgium MRO Distribution Market, By Product

- Switzerland

- Switzerland MRO Distribution Market, By Product

- Bearings & Power Transmission

- Pipes, Valves & Fittings

- Electrical Items

- Packaging Supplies

- Switzerland MRO Distribution Market, By Sourcing/Service

- Internal MRO

- External MRO

- Switzerland MRO Distribution Market, By Maintenance Type

- Preventive/Scheduled Maintenance

- Corrective Maintenance

- Switzerland MRO Distribution Market, By Distribution Channel

- Direct

- Indirect

- Switzerland MRO Distribution Market, By Application

- Food, Beverage & Tobacco

- Textile, Apparel & Footwear

- Wood & Paper

- Mining, Oil & Gas

- Basic Metals & Metal Products

- Rubber, Plastic and Non-metallic Products

- Chemicals

- Pharmaceuticals

- Electronics

- Machinery and Equipment

- Electrical equipment

- Transport equipment

- Manufacturing

- Others

- Switzerland MRO Distribution Market, By Product

- Sweden

- Sweden MRO Distribution Market, By Product

- Bearings & Power Transmission

- Pipes, Valves & Fittings

- Electrical Items

- Packaging Supplies

- Sweden MRO Distribution Market, By Sourcing/Service

- Internal MRO

- External MRO

- Sweden MRO Distribution Market, By Maintenance Type

- Preventive/Scheduled Maintenance

- Corrective Maintenance

- Sweden MRO Distribution Market, By Distribution Channel

- Direct

- Indirect

- Sweden MRO Distribution Market, By Application

- Food, Beverage & Tobacco

- Textile, Apparel & Footwear

- Wood & Paper

- Mining, Oil & Gas

- Basic Metals & Metal Products

- Rubber, Plastic and Non-metallic Products

- Chemicals

- Pharmaceuticals

- Electronics

- Machinery and Equipment

- Electrical equipment

- Transport equipment

- Manufacturing

- Others

- Sweden MRO Distribution Market, By Product

- Denmark

- Denmark MRO Distribution Market, By Product

- Bearings & Power Transmission

- Pipes, Valves & Fittings

- Electrical Items

- Packaging Supplies

- Denmark MRO Distribution Market, By Sourcing/Service

- Internal MRO

- External MRO

- Denmark MRO Distribution Market, By Maintenance Type

- Preventive/Scheduled Maintenance

- Corrective Maintenance

- Denmark MRO Distribution Market, By Distribution Channel

- Direct

- Indirect

- Denmark MRO Distribution Market, By Application

- Food, Beverage & Tobacco

- Textile, Apparel & Footwear

- Wood & Paper

- Mining, Oil & Gas

- Basic Metals & Metal Products

- Rubber, Plastic and Non-metallic Products

- Chemicals

- Pharmaceuticals

- Electronics

- Machinery and Equipment

- Electrical equipment

- Transport equipment

- Manufacturing

- Others

- Denmark MRO Distribution Market, By Product

- Poland

- Poland MRO Distribution Market, By Product

- Bearings & Power Transmission

- Pipes, Valves & Fittings

- Electrical Items

- Packaging Supplies

- Poland MRO Distribution Market, By Sourcing/Service

- Internal MRO

- External MRO

- Poland MRO Distribution Market, By Maintenance Type

- Preventive/Scheduled Maintenance

- Corrective Maintenance

- Poland MRO Distribution Market, By Distribution Channel

- Direct

- Indirect

- Poland MRO Distribution Market, By Application

- Food, Beverage & Tobacco

- Textile, Apparel & Footwear

- Wood & Paper

- Mining, Oil & Gas

- Basic Metals & Metal Products

- Rubber, Plastic and Non-metallic Products

- Chemicals

- Pharmaceuticals

- Electronics

- Machinery and Equipment

- Electrical equipment

- Transport equipment

- Manufacturing

- Others

- Poland MRO Distribution Market, By Product

- Austria

- Austria MRO Distribution Market, By Product

- Bearings & Power Transmission

- Pipes, Valves & Fittings

- Electrical Items

- Packaging Supplies

- Austria MRO Distribution Market, By Sourcing/Service

- Internal MRO

- External MRO

- Austria MRO Distribution Market, By Maintenance Type

- Preventive/Scheduled Maintenance

- Corrective Maintenance

- Austria MRO Distribution Market, By Distribution Channel

- Direct

- Indirect

- Austria MRO Distribution Market, By Application

- Food, Beverage & Tobacco

- Textile, Apparel & Footwear

- Wood & Paper

- Mining, Oil & Gas

- Basic Metals & Metal Products

- Rubber, Plastic and Non-metallic Products

- Chemicals

- Pharmaceuticals

- Electronics

- Machinery and Equipment

- Electrical equipment

- Transport equipment

- Manufacturing

- Others

- Austria MRO Distribution Market, By Product

- Finland

- Finland MRO Distribution Market, By Product

- Bearings & Power Transmission

- Pipes, Valves & Fittings

- Electrical Items

- Packaging Supplies

- Finland MRO Distribution Market, By Sourcing/Service

- Internal MRO

- External MRO

- Finland MRO Distribution Market, By Maintenance Type

- Preventive/Scheduled Maintenance

- Corrective Maintenance

- Finland MRO Distribution Market, By Distribution Channel

- Direct

- Indirect

- Finland MRO Distribution Market, By Application

- Food, Beverage & Tobacco

- Textile, Apparel & Footwear

- Wood & Paper

- Mining, Oil & Gas

- Basic Metals & Metal Products

- Rubber, Plastic and Non-metallic Products

- Chemicals

- Pharmaceuticals

- Electronics

- Machinery and Equipment

- Electrical equipment

- Transport equipment

- Manufacturing

- Others

- Finland MRO Distribution Market, By Product

- Czech Republic

- Czech Republic MRO Distribution Market, By Product

- Bearings & Power Transmission

- Pipes, Valves & Fittings

- Electrical Items

- Packaging Supplies

- Czech Republic MRO Distribution Market, By Sourcing/Service

- Internal MRO

- External MRO

- Czech Republic MRO Distribution Market, By Maintenance Type

- Preventive/Scheduled Maintenance

- Corrective Maintenance

- Czech Republic MRO Distribution Market, By Distribution Channel

- Direct

- Indirect

- Czech Republic MRO Distribution Market, By Application

- Food, Beverage & Tobacco

- Textile, Apparel & Footwear

- Wood & Paper

- Mining, Oil & Gas

- Basic Metals & Metal Products

- Rubber, Plastic and Non-metallic Products

- Chemicals

- Pharmaceuticals

- Electronics

- Machinery and Equipment

- Electrical equipment

- Transport equipment

- Manufacturing

- Others

- Czech Republic MRO Distribution Market, By Product

- Hungary

- Hungary MRO Distribution Market, By Product

- Bearings & Power Transmission

- Pipes, Valves & Fittings

- Electrical Items

- Packaging Supplies

- Hungary MRO Distribution Market, By Sourcing/Service

- Internal MRO

- External MRO

- Hungary MRO Distribution Market, By Maintenance Type

- Preventive/Scheduled Maintenance

- Corrective Maintenance

- Hungary MRO Distribution Market, By Distribution Channel

- Direct

- Indirect

- Hungary MRO Distribution Market, By Application

- Food, Beverage & Tobacco

- Textile, Apparel & Footwear

- Wood & Paper

- Mining, Oil & Gas

- Basic Metals & Metal Products

- Rubber, Plastic and Non-metallic Products

- Chemicals

- Pharmaceuticals

- Electronics

- Machinery and Equipment

- Electrical equipment

- Transport equipment

- Manufacturing

- Others

- Hungary MRO Distribution Market, By Product

- Hungary

- Hungary MRO Distribution Market, By Product

- Bearings & Power Transmission

- Pipes, Valves & Fittings

- Electrical Items

- Packaging Supplies

- Hungary MRO Distribution Market, By Sourcing/Service

- Internal MRO

- External MRO

- Hungary MRO Distribution Market, By Maintenance Type

- Preventive/Scheduled Maintenance

- Corrective Maintenance

- Hungary MRO Distribution Market, By Distribution Channel

- Direct

- Indirect

- Hungary MRO Distribution Market, By Application

- Food, Beverage & Tobacco

- Textile, Apparel & Footwear

- Wood & Paper

- Mining, Oil & Gas

- Basic Metals & Metal Products

- Rubber, Plastic and Non-metallic Products

- Chemicals

- Pharmaceuticals

- Electronics

- Machinery and Equipment

- Electrical equipment

- Transport equipment

- Manufacturing

- Others

- Hungary MRO Distribution Market, By Product

- Slovakia

- Slovakia MRO Distribution Market, By Product

- Bearings & Power Transmission

- Pipes, Valves & Fittings

- Electrical Items

- Packaging Supplies

- Slovakia MRO Distribution Market, By Sourcing/Service

- Internal MRO

- External MRO

- Slovakia MRO Distribution Market, By Maintenance Type

- Preventive/Scheduled Maintenance

- Corrective Maintenance

- Slovakia MRO Distribution Market, By Distribution Channel

- Direct

- Indirect

- Slovakia MRO Distribution Market, By Application

- Food, Beverage & Tobacco

- Textile, Apparel & Footwear

- Wood & Paper

- Mining, Oil & Gas

- Basic Metals & Metal Products

- Rubber, Plastic and Non-metallic Products

- Chemicals

- Pharmaceuticals

- Electronics

- Machinery and Equipment

- Electrical equipment

- Transport equipment

- Manufacturing

- Others

- Slovakia MRO Distribution Market, By Product

- Europe MRO Distribution Market, By Product

- Europe

Europe MRO Distribution Market Dynamics

Drivers: Technology Advancements And Optimization Of The Supply Chain

The MRO supply chain is the primary challenge for manufacturers and distributors as the industry has progressed enormously owing to noteworthy technological advancements over the past few years. The latest technology advancements in supply chain management and optimization are expected to drive market growth and must be addressed by integrated MRO providers. During the supply chain of products, MRO-related problems tend to grow in complexity and scale with many data sources and significant requirement benefits of stakeholder groups. Owing to these factors, companies focus on MRO-integrated providers for process optimization.

Major players are adopting various initiatives, such as management strategies, effective data standardization, beneficial sourcing & supplier relationship-building tactics, efficient & centralized person-to-person (P2P) transaction services, best-in-class storeroom operation resources, inventory optimization techniques, state-of-the-art technology, and focus on continuous improvement, which are anticipated to drive market growth.

Supply chain management and business pressure are the triggering factors for firms to evaluate indirect materials and MRO. Typically, the total expenses incurred by a company on MRO is approximately 15% or higher of the whole operating expenditure. The communication gap in a supply chain is expected to result in complexity, lack of coordination, and higher costs, widening servicing gaps. The integration of strategic sourcing/procurement, physical supply chain, and technology tools and fabrication services includes an approach to managing the supply chain and organizational challenges.

Growth Of Various End-Use Industries

The growth of various end-use sectors such as manufacturing, construction, chemicals, and electronics is a major factor driving the European MRO market. MRO is an essential process in every sector, including the manufacturing industry, which is engaged in various production techniques and several non- critical activities.

It also finds applications in small-scale enterprises, such as those involved in manufacturing musical instruments, along with companies engaged in large businesses, including the manufacturing of complex products such as vehicles and aircraft. As per the NACE section C survey, in 2019, Europe had over 2 million manufacturing enterprises, which is expected to boost the MRO distribution market. An analysis of an industrial sector helps the end user understand its MRO requirements and defines the magnitude/structure (preventive and corrective) and effectiveness of MRO across industrial activities. This can also be applied to other large and diverse sectors such as construction, electrical and electronics, mining, and transportation services. Thus, the growth of the manufacturing sector is expected to drive the MRO market.

Restraints: Mounting Price Pressure On The Distributors

Across most business sectors, manufacturers are constantly looking for larger profit margins and concentrating on maximizing the returns on net assets. In order to increase profit margins, MRO players are repairing and rebuilding existing equipment rather than replacing it. Producers prefer using old and used instruments for setting up a facility even for new programs and in conditions of capacity expansion. This leads to increased maintenance costs due to the increasing age of machines.

Thus, it is expected that the overall spending of manufacturers on MRO will continuously rise during the next few years in various industries, including life sciences, aerospace, automotive, and food manufacturing. However, despite the increasing spending on MRO, distributors cannot rely on the assumption that stock-keeping-unit (SKU) and scale count alone will safeguard the companies’ bottom lines. Increased stock does not necessarily convert into higher profitability or revenues.

For instance, pricing transparency about cash flow acts as a limitation for manufacturers and distributors due to the requirement of providing benchmarking inputs and cost breakdowns to the customer companies. The extended design life of any equipment may reduce the overall ownership costs for customers, but this can lead to a reduction in long-term MRO costs for new equipment and machines, which can further affect the cash flow of service providers.

What Does This Report Include?

This section will provide insights into the contents included in this Europe MRO distribution market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Europe MRO distribution market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Europe MRO distribution market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the Europe MRO distribution market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for Europe MRO distribution market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of Europe MRO distribution market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Europe MRO Distribution Market Categorization:

The Europe MRO distribution market was categorized into six segments, namely product (Bearings & Power Transmission, Pipes, Valves & Fittings, Electrical Items, Packaging Supplies, Machine Consumables), sourcing/service (Internal MRO, External MRO), maintenance type (Preventive/Scheduled Maintenance, Corrective Maintenance), distribution channel (Direct, Indirect), application (Food, Beverage & Tobacco, Textile, Apparel & Footwear, Wood & Paper, Mining, Oil & Gas, Basic Metals & Metal Products, Rubber, Plastic & Non-metallic Products, Chemicals, Pharmaceuticals, Electronics, Machinery & Equipment, Electrical Equipment, Transport Equipment, Manufacturing), and country (Germany, France, Czech Republic, Hungary, Slovakia, Austria, Finland, Italy, Belgium, Netherlands, Poland, Sweden, Denmark, and Switzerland).

Segment Market Methodology:

The Europe MRO distribution market was segmented into product, sourcing/service, maintenance type, distribution channel, application, and country. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The Europe MRO distribution market was analyzed at a country level. The globe is divided into Europe, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. This region was further divided into fourteen countries, namely, Germany, France, Czech Republic, Hungary, Slovakia, Austria, Finland, Italy, Belgium, Netherlands, Poland, Sweden, Denmark, and Switzerland.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Europe MRO distribution market companies & financials:

The Europe MRO distribution market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Cromwell Group (Holdings) Limited - Cromwell Group (Holdings) Ltd. was established in 1970 and is headquartered in Leicester, England. It operates as a holding company and an independent supplier of maintenance, repair, and operations related products with a comprehensive broad product portfolio for numerous industries, professions, and trades. The company supplies several products, including cutting tools, power tools, precision equipment, bearings and transmissions, fasteners, welding site maintenance products, personal protection equipment, and many others under the name of over 100 brands. Some of the brands that company supplies include Bosch, DeWalt, Dremel, Dronco, Edison, Hitachi, Osaki, and 3M. The company operates as a subsidiary of W.W. Grainger, Inc. and owns 54 branches in the UK, offering collection service/trade counter and a daily delivery to local industry. Its global spread includes 67 distribution centers worldwide, 4 specialist companies, and export division operating in over 50 countries in 5 continents.

-

Graco - Graco was established in 1926 and is headquartered in Limburg, Belgium. The company operates as a global supplier of several varieties of fluid handling systems and associated components. The major functions of these systems include moving, measuring, controlling, and dispensing in tandem with applying a complete portfolio of fluids along with viscous materials used in commercial & industrial settings and vehicle lubrication. Industries the company serves include manufacturing, construction, maintenance, and processing. The company works with many distributors and service partners for activities such as customer service, technical support, sales, marketing, training, assembly, and distribution. It supplies products across the countries of Australia, Belgium, China, India, Japan, Korea, U.S., and Uruguay. Some of its key brands include Graco, Airlessco, Magnum, and Glascraft.

-

WABCO - WABCO was established in 1869 and is headquartered in Bern, Switzerland. The company operates as a global supplier of commercial vehicle technologies and services for enhancing commercial vehicle safety, efficiency, and connectivity. The key products that the company designs, and markets include stability, braking, & transmission control, air compressing systems, and suspension for commercial trucks, buses, trailers, passenger cars, and SUVs. It sells its products directly to auto and auto component manufacturers, including BMW, Volvo, Ashok Leyland, and Daimler. The company has 28 manufacturing locations and caters to automotive manufacturing applications in 40 countries across the globe. It has a maximum market share in Europe (approximately 55%), followed by the U.S. (nearly 15%), and other regions (30%). The company generates approximately 60% of its revenue from OEMs of trucks and buses. Wabco Austria GesmbH is one of the company's major subsidiaries. WABCO provides solutions for vehicle systems, including trucks, trailers, buses, cars, fleet, and off-highway solutions. Moreover, it has three dedicated testing tracks for testing of components manufactured by them. As of May 2020, ZF Group has completed the acquisition of WABCO. The formerly independent company now operates as a part of ZF Commercial Vehicle Control Systems Division.

-

Mento AS - Mento AS was established in 1971 and is headquartered in Tananger, Norway. The company manufactures maintenance, repair, and operations (MRO) related products for the oil & gas industry. The company's significant offerings include products, rental, and hose management. It also offers rental services for products including hoses, flowline equipment, and filters. The company’s major product offerings include filtrations, hoses, valves, and drilling-related equipment. Under its rental category, the company includes a wide range of hoses, flowline, and filtration equipment for rent. The company offers major mechanical solutions ranging from development to testing and delivery. The wide range of the company's portfolio includes some of the mostly serviced products such as API valves, process valves, flowlines, choke & kill manifolds, standpipe manifolds, pipe spools, and high-pressure hoses.

-