- Home

- »

- Plastics, Polymers & Resins

- »

-

Europe Polyolefin Foam Market Size, Industry Report, 2030GVR Report cover

![Europe Polyolefin Foam Market Size, Share & Trends Report]()

Europe Polyolefin Foam Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Building & Construction, Automotive, Packaging, Consumer Goods), By Country (Germany, France), And Segment Forecasts

- Report ID: GVR-4-68038-453-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Polyolefin Foam Market Trends

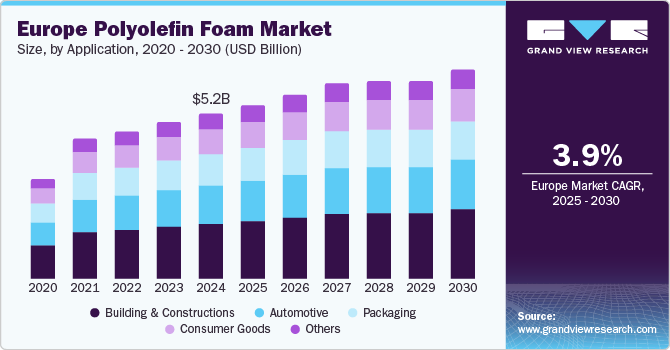

The Europe polyolefin foam market size was estimated at USD 5.18 billion in 2024 and is expected to grow at a CAGR of 3.9% from 2025 to 2030. This growth is attributed to the increasing demand from the building and construction sector, which focuses on energy efficiency and insulation. In addition, favorable government policies and substantial investments in residential construction further enhance this demand. Furthermore, the automotive industry's expansion, particularly with electric vehicle production, contributes significantly to market growth. Moreover, the versatility of polyolefin foams across various applications, including packaging and cushioning, also plays a crucial role in driving their adoption in Europe.

Polyolefin foam, a type of polymer created through the polymerization of simple olefins, is gaining traction in Europe due to its lightweight, versatile, and environmentally friendly characteristics. The construction industry significantly drives the market, where there is an increasing demand for energy-efficient building materials and insulation solutions to meet strict regulatory standards. Rising investments in residential construction projects further amplify this demand.

Furthermore, the automotive sector is expanding rapidly, particularly with the growth of electric vehicles that require lightweight materials for improved fuel efficiency. Owing to their excellent thermal properties and durability, Polyolefin foams are widely used in automotive components, including interior parts and insulation. Their versatility allows for extensive applications across various industries, such as packaging and furniture, enhancing their market presence.

Moreover, the growing emphasis on sustainability has led to innovations in biodegradable foam alternatives, aligning with environmental regulations and consumer preferences for eco-friendly products. This shift opens new opportunities for manufacturers and supports the overall growth of the polyolefin foam market in Europe.

Application Insights

The building and construction segment dominated the European polyolefin foam industry and accounted for the largest revenue share of 33.2% in 2024. This growth is attributed to the increasing demand for energy-efficient insulation materials. Stricter energy codes and regulations aimed at reducing energy loss have led to a rise in the use of polyolefin foams for insulation in both residential and commercial properties. In addition, these foams are favored for their excellent thermal properties, which help maintain temperature control and enhance energy efficiency. Furthermore, ongoing investments in construction projects and a focus on sustainable building practices further contribute to the growing adoption of polyolefin foams in this sector.

The packaging segment is expected to grow at a CAGR of 5.0% from 2025 to 2030, owing to the increasing need for lightweight, protective packaging solutions. Polyolefin foams are valued for their cushioning properties, making them ideal for protecting goods during transportation and storage. In addition, the rise in e-commerce and online shopping has further amplified the demand for efficient packaging materials that ensure product safety while minimizing weight. Moreover, the versatility of polyolefin foams allows them to be used across various packaging types, including food packaging and consumer goods, enhancing their appeal to manufacturers seeking sustainable and cost-effective solutions.

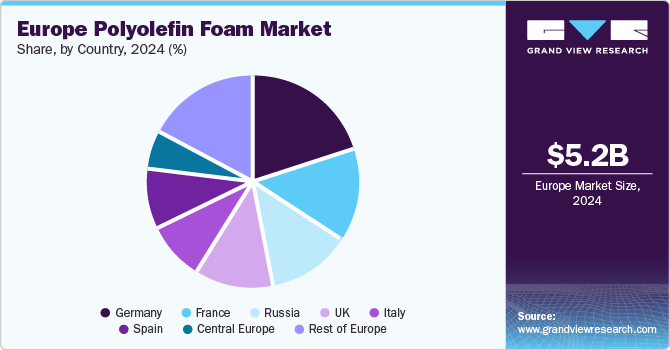

Country Insights

The Germany polyolefin foam market dominated the European market and accounted for the largest revenue share of 20.0% in 2024. This growth is attributed to the growing construction sector focused on energy efficiency and sustainability. In addition, the German government has implemented stringent building regulations promoting high-performance insulation materials, including polyolefin foams. These foams are favored for their excellent thermal insulation properties, contributing to reduced energy consumption in buildings. Furthermore, the country’s commitment to reducing carbon emissions further fuels demand for eco-friendly construction materials, positioning polyolefin foams as a preferred choice in the market.

France Polyolefin Foam Market Trends

The polyolefin foam market in France is expected to grow at a CAGR of 5.2% over the forecast period, owing to the increasing demand from the automotive industry. As manufacturers shift towards lightweight materials to enhance fuel efficiency and reduce emissions, polyolefin foams are being increasingly utilized in various automotive components such as interior cushioning and insulation. In addition, the French government's initiatives to promote electric vehicles also contribute to this trend, as these vehicles often require lightweight materials for better performance. Furthermore, the versatility of polyolefin foams allows their application in packaging and construction, broadening their market appeal.

UK Polyolefin Foam Market Trends

The UK polyolefin foam market is expected to grow significantly over the forecast period, driven by a resurgence in the building and construction industry following the pandemic. With a focus on sustainable development and energy-efficient solutions, there is a growing preference for polyolefin foams as insulation materials in residential and commercial projects. Furthermore, the rising demand for protective packaging solutions in e-commerce further boosts the consumption of polyolefin foams across various sectors, enhancing overall market growth.

Key Europe Polyolefin Foam Company Insights

Key companies in the Europe polyolefin foam industry include BASF SE, Armacell International S.A., Borealis AG, and others. These companies adopt various strategies to enhance their competitive position. These include investing in research and development to innovate new foam products with improved properties and applications. In addition, firms focus on strategic partnerships and collaborations to expand their market reach and leverage complementary strengths. Furthermore, companies also emphasize sustainability by developing eco-friendly foam solutions, aligning with regulatory requirements and consumer preferences for environmentally responsible products.

-

Arkema Group manufactures a range of polyolefin foams known for their lightweight, flexible, and durable properties. The company operates primarily in the construction, automotive, and packaging segments, providing energy efficiency and sustainability solutions. Their products are utilized in insulation applications, automotive components, and protective packaging.

-

BASF SE manufactures polyolefin foams characterized by their excellent thermal insulation and cushioning properties. The company operates across several segments, including automotive, construction, and packaging. Their foams are extensively used for insulation materials in buildings, automotive interiors, and protective packaging solutions.

Key Europe Polyolefin Foam Companies:

- Sekisui Alveo

- Arkema Group

- BASF SE

- Armacell International S.A.

- Borealis AG

- TotalEnergies

- DOW INC

- Intecfoams

- KANEKA CORPORATION

- SABIC

- DuPont de Nemours, Inc.

Europe Polyolefin Foam Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.48 billion

Revenue forecast in 2030

USD 6.63 billion

Growth rate

CAGR of 3.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Volume in Kilotons, Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application and country

Regional scope

Europe

Country scope

Germany, UK, France, Italy, Spain, Russia, and Central Europe

Key companies profiled

Sekisui Alveo; Arkema Group; BASF SE; Armacell International S.A.; Borealis AG; TotalEnergies; DOW INC; Intecfoams; KANEKA CORPORATION; SABIC; DuPont de Nemours, Inc.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Polyolefin Foam Market Report Segmentation

This report forecasts revenue growth at regional and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the Europe polyolefin foam market report based on application, and country.

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Building & Constructions

-

Automotive

-

Packaging

-

Consumer Goods

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Central Europe

-

Rest of Europe

-

-

Frequently Asked Questions About This Report

b. Europe polyolefin foam market size was estimated at USD 3,907. 1 million in 2019 and is expected to reach USD 4,132.0 million in 2020.

b. Europe polyolefin foam market is expected to witness a compound annual growth rate of 5.8% from 2020 to 2027 to reach USD 6,146.5 million by 2027.

b. Building & construction dominated the Europe polyolefin foam market with a share of 33.95% in 2019. This is attributable to the growing spending on infrastructure development across European countries.

b. Some key players operating in the Europe polyolefin foam market include Sekisui Alveo; Arkema Group; BASF SE; Armacell International S.A.; Zotefoams plc; Trelleborg AB; and Borealis AG.

b. The Europe polyolefin foam market report scope covers segmentation by application, and country.

b. Key factors that are driving the market growth include increasing use in sealing, insulation, ground cushioning, thermal pipe insulation, ground cushioning, and curing sheets among other applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.