- Home

- »

- Automotive & Transportation

- »

-

Europe Refrigerated Truck Rental Market Size Report, 2030GVR Report cover

![Europe Refrigerated Truck Rental Market Size, Share & Trends Report]()

Europe Refrigerated Truck Rental Market Size, Share & Trends Analysis Report By Truck Type (Light (Upto 7.5t), Medium (7.5t to 14t), Heavy (More than 14t)), By Rental Type, By Country, and Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-460-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

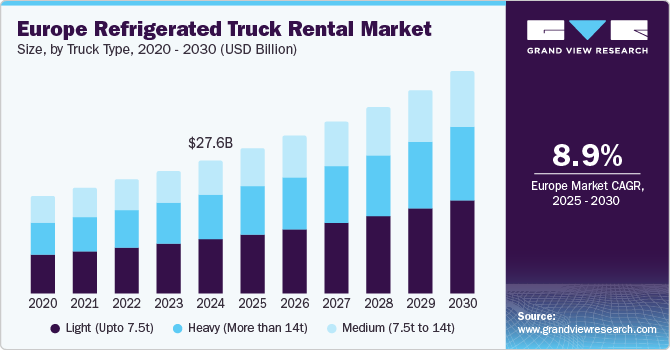

The Europe refrigerated truck rental market size was valued at USD 27.60 billion in 2024 and is projected to grow at a CAGR of 8.9% from 2025 to 2030. The rising demand for temperature-controlled transportation, particularly for perishable goods such as food and pharmaceuticals, is a major contributor to this market's growth. The expansion of the food and beverage sector and the growth of e-commerce have heightened the demand for reliable refrigerated logistics solutions. In addition, the rise in cross-border trade within Europe has further fueled demand for efficient and dependable refrigerated transport services as businesses seek to ensure the safe delivery of temperature-sensitive products.

There is a growing adoption of eco-friendly refrigerated trucks equipped with energy-efficient refrigeration systems and environmentally friendly refrigerants. Furthermore, advancements in telematics and GPS tracking technologies are enhancing operational efficiency and safety in refrigerated transport, making these rental services more feasible for businesses. For instance, the Thermo King ConnectedSuite provides essential information that enables fleets to control and monitor their truck or trailer refrigeration units in real time. This system ensures temperature traceability and compliance with the Food Safety Modernization Act (FSMA), allowing users to manage their operations from anywhere.

In addition, regulatory changes aimed at improving food safety standards are anticipated to further stimulate demand for refrigerated truck rentals. Governments across Europe are implementing stricter regulations regarding the transportation of perishable goods, ensuring that they are moved in compliant and safe conditions. For instance, the EU has adopted a farm-to-fork strategy for food safety, which means that every aspect of the food supply chain is regulated. This approach mandates that food businesses implement necessary measures to guarantee the safety, integrity, and quality of food products at every stage of the chain. This regulatory environment encourages businesses to utilize rented refrigerated trucks that meet these standards without the burden of maintaining a dedicated fleet. As consumer preferences shift toward fresh and frozen food products, the Europe refrigerated truck rental industry is set for substantial growth in the coming years.

Truck Type Insights

The light (up to 7.5t) segment dominated the market with a revenue share of 40.7% in 2024 due to its suitability for urban transportation of perishable goods. Light refrigerated trucks are ideal for navigating congested city streets, making them a preferred choice for businesses that distribute frozen foods and other temperature-sensitive products. The growth of e-commerce and the increasing demand for Quick-Service Restaurants (QSRs) have further fueled the need for these vehicles, as they provide efficient solutions for last-mile delivery. As more retailers seek to enhance their logistics capabilities, the light truck segment is expected to maintain its leading position in the market.

The heavy (more than 14t) segment is projected to grow at a significant CAGR during the forecast period, driven by the rising demand for long-distance transportation of perishable goods. Heavy refrigerated trucks are essential for transporting larger volumes of frozen foods and pharmaceuticals across regions, making them crucial for supply chain efficiency. As the cold chain logistics industry expands, companies are increasingly investing in heavy-duty refrigerated vehicles to meet the growing needs of retailers and distributors. This trend is expected to propel the heavy segment's growth within the Europe refrigerated truck rental industry.

Rental Type Insights

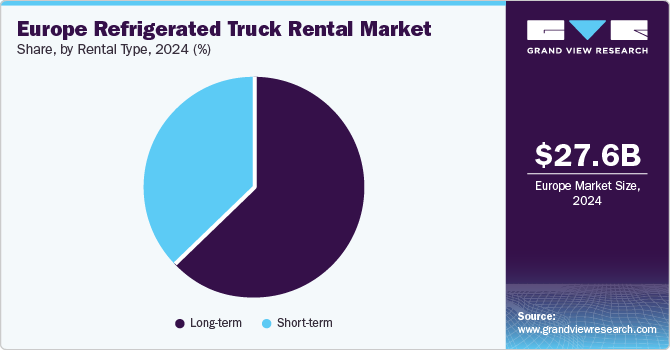

The long-term segment dominated the market with the largest share in 2024 due to its appeal for businesses requiring consistent access to refrigerated transport solutions. Companies often prefer long-term rentals as they provide a stable and reliable option for transporting perishable goods without the costs associated with owning a fleet. This arrangement allows businesses in sectors such as food distribution and pharmaceuticals to maintain operational efficiency while ensuring compliance with stringent temperature control regulations.

The short-term segment is anticipated to grow at the highest CAGR over the forecast period, driven by the need for flexibility among businesses facing seasonal demand fluctuations. Short-term rentals allow companies to quickly adapt to varying logistics needs without long-term commitments, making them a viable option for those requiring refrigerated trucks for limited periods. This flexibility is particularly beneficial during peak seasons or special projects where temporary increases in transportation capacity are necessary. As e-commerce and food delivery services expand, the short-term rental segment within the Europe refrigerated truck rental industry is well-positioned for significant growth, catering to businesses that prioritize agility and cost-effectiveness in their operations.

Country Insights

Germany Refrigerated Truck Rental Market Trends

Germany accounted for a 27.9% revenue share of the refrigerated truck rental market in 2024 due to its robust logistics infrastructure and a strong demand for cold chain solutions. Germany's well-developed food and beverage industry relies heavily on efficient refrigerated transport to maintain the quality and safety of perishable goods. The country's strategic location in Europe also facilitates cross-border trade, further enhancing the need for reliable refrigerated truck rentals. As businesses increasingly prioritize compliance with food safety regulations and consumer preferences for fresh products, Germany's dominance in the Europe refrigerated truck rental industry is expected to continue.

UK Refrigerated Truck Rental Market Trends

The UK refrigerated truck rental market is anticipated to grow at the highest CAGR over the forecast period, driven by a surge in demand for frozen foods and the expansion of retail food chains. The UK's frozen food sector is currently one of the fastest-growing categories in retail, prompting businesses to seek flexible logistics solutions that can accommodate fluctuating demand. For instance, in 2023, the value of frozen food sales grew by 15.6% compared to the previous year, while the volume of sales saw a modest increase of 0.4%. Furthermore, advancements in e-commerce are increasing the need for efficient cold-chain logistics to ensure the timely delivery of temperature-sensitive products. As retailers focus on developing long-term strategies to stay competitive, the UK market's growth within the Europe refrigerated truck rental industry is expected to experience significant growth.

Key Europe Refrigerated Truck Rental Company Insights

The Europe refrigerated truck rental market include several companies that provide vital services for transporting temperature-sensitive goods. Petit Forestier specializes in refrigerated vehicle rental, offering solutions that ensure compliance with cold chain regulations. Enterprise Holdings, Inc. provides flexible rental options for refrigerated trucks through its Enterprise Flex-E-Rent division, focusing on customer service and reliability. Penske Corporation, Inc. also offers various refrigerated transport solutions, emphasizing efficient logistics and fleet management.

-

Petit Forestier specializes in refrigerated vehicle rental, focusing on solutions for transporting chilled and frozen products across Europe. The company offers a range of vehicles designed to meet the specific needs of its customers in various industries, ensuring compliance with cold chain regulations. Petit Forestier is dedicated to providing high-quality service through its extensive network of branches and support facilities, making it a trusted partner for businesses requiring temperature-controlled logistics.

-

The Hertz Corporation operates in the vehicle rental industry, providing various transportation solutions, including trucks for refrigerated transport. The company offers flexible rental options tailored to personal and commercial needs, including specialized vehicles for businesses requiring temperature-controlled logistics. Hertz emphasizes convenience and customer service, ensuring that clients have access to reliable vehicles and support to meet its operational requirements.

Key Europe Refrigerated Truck Rental Companies:

- ALLROUND Car Rental

- Enterprise Holdings, Inc.

- Fraikin

- Penske Corporation, Inc.

- Petit Forestier

- The Hertz Corporation

- Ryder System, Inc.

- Auto Wichert GmbH

- FedEx

- Polar Leasing, Inc.

Recent Development

-

In June 2023, Volta Trucks announced a partnership with Petit Forestier to provide rental and leasing solutions for refrigerated variants of its all-electric Volta Zero trucks across Europe and the UK. This collaboration builds on a previous purchase and supply agreement, positioning Petit Forestier as the designated partner for these environmentally friendly vehicles. The partnership aims to simplify the transition to electric fleets for businesses by combining Volta Trucks' expertise in electric vehicles with Petit Forestier's proficiency in refrigerated transport solutions.

Europe Refrigerated Truck Rental Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 29.96 billion

Revenue forecast in 2030

USD 45.79 billion

Growth rate

CAGR of 8.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Truck type, rental type, country

Country scope

UK, Germany, Italy

Key companies profiled

ALLROUND Car Rental; Enterprise Holdings, Inc.; Fraikin ; Penske Corporation, Inc.; Petit Forestier; The Hertz Corporation; Ryder System, Inc.; Auto Wichert GmbH; Polar Leasing, Inc.; FedEx.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Refrigerated Truck Rental Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Europe refrigerated truck rental market report based on truck type, rental type, and country:

-

Truck Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Light (Upto 7.5t)

-

Medium (7.5t to 14t)

-

Heavy (More than 14t)

-

-

Rental Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Short-term

-

Long-term

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

UK

-

Italy

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."