- Home

- »

- Homecare & Decor

- »

-

Europe Reusable Water Bottle Market, Industry Report, 2030GVR Report cover

![Europe Reusable Water Bottle Market Size, Share & Trends Report]()

Europe Reusable Water Bottle Market Size, Share & Trends Analysis Report By Raw Material (Glass, Aluminum), By Type (Insulated, Non-insulated), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-259-4

- Number of Report Pages: 88

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

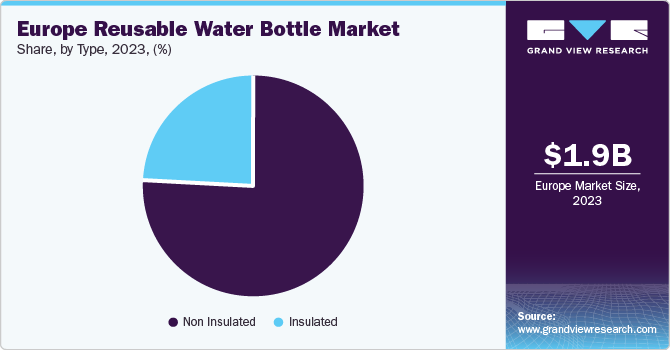

The Europe reusable water bottle market size was estimated USD 1.90 billion in 2023 and is expected to grow at a CAGR of 4.5% from 2024 to 2030. This growth is driven by legislative actions and bans aimed at reducing single-use plastic consumption. For instance, the Single-use Plastics Directive in the EU mandates ambitious recycling targets and promotes eco-friendly alternatives like reusable water bottles. Consumer attitude toward sustainability is also contributing to market growth, with rising awareness of the environmental impact of single-use plastics and increasing adoption of reusable alternatives.

The survey findings from Leatherhead indicate that 58% of respondents keep and reuse their plastic bottles, which reflects a growing consumer awareness and willingness to adopt sustainable practices. With the UK's commitment to eliminating all plastic waste by 2042, consumers have a clear incentive to prioritize recycling and seek reusable alternatives, resulting in a growing demand for reusable water bottles.

Moreover, consumers increasingly recognizing the value of sustainable products and strive to reduce their plastic consumption, this shift in consumer behavior bodes well for the market demand. In addition, due to the changing consumer preferences towards sustainability, major manufacturers in Europe are capitalizing on this trend by offering innovative and eco-friendly reusable water bottles, driving market growth and contributing to the overall goal of reducing plastic waste and promoting a circular economy.

The increasing trend of bio-plastic reusable water bottles among European consumers is driven by heightened environmental awareness and a strong commitment to sustainability. Consumers are increasingly rejecting single-use plastics in favor of eco-friendly alternatives, spurred by grassroots environmental movements and stringent government regulations to reduce plastic waste. Bio-plastics, derived from renewable sources like corn starch or sugarcane, offer a biodegradable and lower carbon footprint alternative, aligning with the continent's push towards a circular economy. This shift is supported by innovations in material science that enhance the durability and usability of bio-plastic products, making them a viable and attractive choice for conscientious consumers.

For instance, Bottle Up, an Amsterdam-based company, introduced the first fully reusable, pre-filled, plant-based water bottle in the UK in January 2024, aiming to address the significant issue of single-use plastic water bottle consumption. These bottles are made from sugar cane, a crop that requires minimal fertilizer and irrigation, and are BPA-free. The bottles are pre-filled with spring water from Elmhurst to reduce their carbon impact and can be cleaned at home in a dishwasher for continued reuse. Available in three colors, they are designed to be durable throughout their lifecycle and are sold through various retail and online outlets, with plans to expand into hospitality venues.

Companies are leveraging multiple retail channels and partnerships with end-users, such as hotel chains in the hospitality sector, to enhance their sales. For instance, Bottle Up has strategically positioned itself in the European reusable water bottle market by leveraging a multi-channel retail approach to maximize accessibility and reach. By partnering with well-known hospitality chains such as Accor, Bottle Up aims to penetrate the hospitality sector and promote the adoption of reusable bottles in various venues. The brand is also available through major retailers like Morrisons, Ocado, WH Smith, The Co-op, BP, Whole Foods, and Amazon, ensuring widespread distribution across both physical and online platforms, catering to diverse consumer preferences, and shopping habits

Market Concentration & Characteristics

The degree of innovation in the market is notably high, driven by consumer demand for sustainable, functional, and aesthetically pleasing products. Manufacturers are incorporating advanced materials such as bio-plastics and stainless steel, which offer durability and eco-friendliness. Innovations include features like built-in water filtration systems, smart technology integration for tracking hydration levels, and collapsible designs for convenience and portability. In addition, there is a strong emphasis on ergonomic design, customizable aesthetics, and insulation technology to keep beverages at desired temperatures. This dynamic market continues to evolve, focusing on reducing environmental impact and enhancing user experience through continuous technological and design advancements.

Regulation significantly impacts the market, primarily by driving demand and fostering innovation. European Union (EU) directives and national policies aimed at reducing single-use plastics have incentivized both consumers and manufacturers to shift towards reusable options. Regulations such as the EU Single-use Plastics Directive, which restricts the use of certain single-use plastic items, directly encourage the adoption of reusable alternatives. These policies promote environmental sustainability and stimulate market growth by creating a competitive landscape where companies are motivated to innovate and offer high-quality, eco-friendly products. As a result, regulations have accelerated the transition towards a circular economy, increased consumer awareness and adoption of reusable water bottles, and spurred advancements in sustainable materials and product designs.

The end-user concentration in the market is primarily composed of environmentally conscious consumers, health enthusiasts, and outdoor activity participants. Environmentally aware individuals, driven by sustainability concerns and a desire to reduce single-use plastic waste, form a significant segment. Health-conscious users who prioritize hydration and wellness seek reusable water bottles for their daily routines, including gym-goers, athletes, and fitness enthusiasts. In addition, the market includes many outdoor enthusiasts, such as hikers, campers, and cyclists, who require durable and reliable hydration solutions. The market is also expanding to include office workers and students who prefer reusable bottles for convenience and cost-effectiveness, reflecting a broadening appeal across various demographics committed to sustainability and personal health.

Raw Material Insights

Plastic dominated the market and accounted for the largest revenue market share of 31.04% in 2023. The demand for plastic reusable bottles is increasing among consumers owing to their large availability and low manufacturing cost. As per blogs published by Mathematics for Sustainability, investing in a reusable water bottle priced at USD 20 can lead to savings of up to USD 6,180 over five years compared to purchasing disposable plastic bottles. This period is considered the minimum expected lifespan of plastic-based reusable water bottles.

Steel is projected to grow at the fastest rate of CAGR of 5.5% from 2024 to 2030. Steel-based reusable water bottles are estimated to showcase strong growth in the coming years. Water stored in plastic bottles for long durations under various conditions may contain several contaminants, such as harmful chemicals from the inner surface of the bottle. This makes the water unsafe, unfit, and unhealthy for human consumption. In contrast, RO and UV-filtered water filled in stainless-steel bottles is a healthier and safer alternative, which is driving the demand for such products.

Type Insights

Non-insulated dominated the market and accounted for a revenue share of 76.16% in 2023. Non-insulated reusable water bottles are often more affordable and accessible than their insulated counterparts, making them an attractive option for budget-conscious consumers. With a wide range of price points and designs available in the market, non-insulated bottles cater to diverse consumer preferences and purchasing power. This affordability factor enhances the accessibility of reusable bottles, enabling more individuals to make sustainable choices in their everyday lives.

The insulated segment is projected to grow at a CAGR of 6.0% from 2024 to 2030. The growing importance of health and wellness is another driving force behind the popularity of insulated reusable water bottles in Europe. With increasing awareness of the importance of staying hydrated and maintaining optimal hydration levels, consumers seek convenient and reliable ways to access clean drinking water throughout the day. Insulated bottles help keep beverages at the desired temperature, whether hot or cold, encouraging regular hydration and supporting overall health and well-being.

Distribution Channel Insights

The offline segment accounted for a revenue share of around 82% in 2023. A large number of consumers in Europe prefer to purchase products from physical stores in order to check the product before buying. This is a crucial factor driving the offline sales channel. The easy availability of these products in stores is also responsible for the large share of offline retailers in the market. A growing number of home décor, furnishing, and lifestyle stores offer reusable water bottles made from different materials. This also drives product sales through offline channels.

The online segment is estimated is projected to grow at a CAGR of 5.9% over the forecast period of 2024-2030. The growing popularity of reusable water bottles among millennials and the commercial sector is boosting their sales via online channels. The availability of a wide range of products, ongoing efforts to minimize the risk of breakage, and easy doorstep delivery are among the major factors driving this segment. Fewer product options in stores concerning innovative designs, colors, and materials also compel consumers to switch from offline to online retailers and marketplaces.

Country Insights

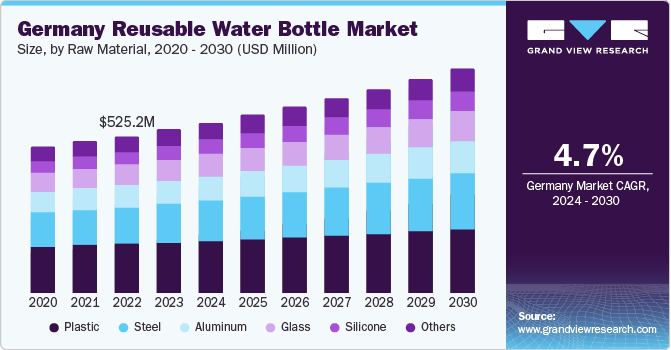

The reusable water bottle market in Germany held 28.77% of the Europe market revenue in 2023. The German government's push for people to switch to tap water over bottled water is expected to positively impact the country's reusable water bottle sector. With the promotion of tap water as a clean, safe, and environmentally friendly alternative, there is likely to be an increased awareness and adoption of reusable water bottles.

The reusable water bottle market in the UK is expected to grow at a CAGR of 5.5% from 2024 to 2030. In the UK, reusable water bottles became a popular eco-accessory, particularly in the summer of 2022, as scorching temperatures highlighted the urgency of the climate crisis. Factors such as a return to work and heightened concerns over plastic pollution and its potential health impacts contributed to the trend. Research by the Office for National Statistics’ (ONS’) Opinions and Lifestyle Survey (OPN) conducted in October 2021 indicated that 75% of UK adults were concerned about the climate crisis caused by plastic waste.

Key Europe Reusable Water Bottle Company Insights

The market features both established regional firms and emerging players. Key industry leaders prioritize product innovation, differentiation, and distinctive designs in line with evolving consumer preferences. These major players leverage extensive regional distribution networks to reach diverse customer bases and tap into emerging markets.

Key Europe Reusable Water Bottle Companies:

- Tupperware Brands Corporation

- SIGG Switzerland AG

- STANLEY

- YETI EUROPE (YETI Holdings, Inc.)

- 24Bottles

- HydroFlask

- Klean Kanteen

- Contigo Brands

- Camelbak

- Laken

- Ball Corporation

- Thermos LLC

- S'well

- Hydaway

- Chilly's Bottles

Recent Developments

-

In March 2024, Camelbak introduced the Podium Steel and Podium Titanium vacuum-insulated bike water bottle series. The new vacuum-insulated design addresses a common issue cyclists face during summer rides-the warming of water throughout the journey-by delivering superior thermal efficiency to maintain a consistent water temperature for extended periods. The Podium vacuum-insulated bottle series includes stainless steel options in two widely preferred sizes: 530 ml priced at USD 35 and 650 ml priced at USD 40, along with a titanium version in 530 ml offered at USD 100.

-

In January 2024, S'well introduced the S'well Explorer, its newest hydration innovation. Designed to focus on performance and functionality, the S'well Explorer incorporates the technology found in S'well's Original Bottles and Tumblers. Its fresh shape and enhanced usability makes it ideal for on-the-go hydration.

Europe Reusable Water Bottle Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.98 billion

Revenue forecast in 2030

USD 2.59 billion

Growth rate

CAGR of 4.5% from 2024 to 2030

Actual period

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in million units, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, type, distribution channel, region

Regional scope

Europe

Country scope

Germany; Austria; Switzerland; France; Great Britain; Spainl Italy

Key companies profiled

Tupperware Brands Corporation; SIGG Switzerland AG; STANLEY; YETI EUROPE (YETI Holdings, Inc.); 24Bottles; HydroFlask; Klean Kanteen; Contigo Brands; Camelbak; Laken; Ball Corporation; Thermos LLC; S'well; Hydaway; Chilly's Bottles

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Reusable Water Bottle Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe reusable water bottle market based on raw material, type, distribution channel, and region:

-

Raw Material Outlook (Volume, Million Units, Revenue, USD Million, 2018 - 2030)

-

Glass

-

Aluminum

-

Plastic

-

Silicone

-

Steel

-

Others

-

-

Type Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Insulated

-

Non-insulated

-

-

Distribution Channel Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Wholesale

-

Supermarkets/Hypermarkets

-

Specialty Stores

-

Sport Stores

-

Local Stores

-

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Europe

-

Germany

-

Austria

-

Switzerland

-

France

-

Great Britain

-

Spain

-

Italy

-

-

Frequently Asked Questions About This Report

b. Germany dominated the Europe reusable water bottle market with a share of around 28% in 2023. This shift in consumer behavior aligns with the government's goal of reducing plastic waste and CO2 emissions, creating a favorable environment for the reusable water bottle sector in Germany.

b. Some of the key players operating in the Europe reusable water bottle market include Tupperware Brands Corporation; SIGG Switzerland AG; STANLEY; YETI EUROPE (YETI Holdings, Inc.); 24Bottles; HydroFlask; Klean Kanteen; Contigo Brands; Camelbak; Laken; Ball Corporation; Thermos LLC; S'well; Hydaway; Chilly's Bottles

b. Key factors that are driving the Europe reusable water bottle market growth include legislative actions and bans to reduce single-use plastic consumption, and consumer attitude towards sustainable measures.

b. The Europe reusable water bottle market was estimated at USD 1.90 billion in 2023 and is expected to reach USD 1.98 billion in 2024.

b. The Europe reusable water bottle market is expected to grow at a compound annual growth rate of 4.5% from 2024 to 2030 to reach USD 2.59 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."