- Home

- »

- Next Generation Technologies

- »

-

Europe Supply Chain Analytics Market Size Report, 2030GVR Report cover

![Europe Supply Chain Analytics Market Size, Share & Trends Report]()

Europe Supply Chain Analytics Market (2023 - 2030) Size, Share & Trends Analysis Report By End Use (Healthcare, Manufacturing), By Enterprise Size (Large, SMEs), By Service, By Solution, By Deployment, And Segment Forecasts

- Report ID: GVR-4-68040-011-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

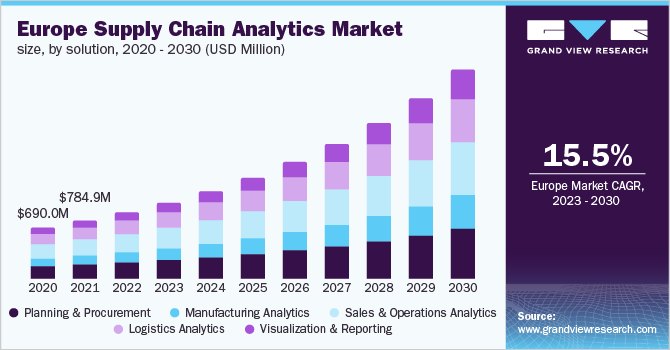

The Europe supply chain analytics market size was valued at USD 1.26 billion in 2022 and is expected to register a compound annual growth rate (CAGR) of 15.8% from 2023 to 2030. Low supply chain visibility, inefficient supplier networks, higher warehousing costs, inaccurate projections, and other reasons also drive industry growth. The use of technology allows for the estimation of optimum locations and identifying the appropriate number of distribution facilities. In addition, advantages of technological adoption include connecting distributed transport networks to predict product supply points and market demand. Other benefits include optimizing inventories, lowering inventory holding costs and hazards, and lowering order fulfillment, warehousing, port & shipping, inland transportation, and corporate tax management costs.

The industry is expected to grow due to the increased capacity of data, the need to improve supply chain efficiencies, and the introduction of machine learning and Artificial Intelligence (AI) into supply chain management. Opportunities would be created by increased cloud-based SCA use and increased understanding of SCA solutions across enterprises. During COVID-19, there were disruptions in the availability of commodities sourced from China, including finished goods for sale and factory raw materials. The market demand is due to widespread digitalization and internet penetration, enabling regional businesses to deliver robust SCA solutions and services.

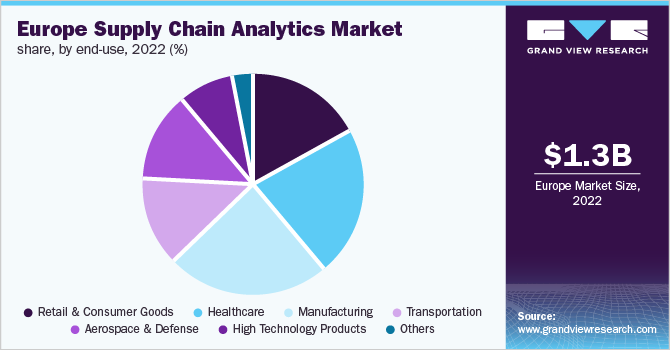

The retail industry in the region is also experiencing tremendous growth. The segment’s growth is fueled by the industry’s focus on lowering operational costs and removing the hazards connected with reverse logistics. The logistics analytics solution is commonly used to evaluate and control logistics data and operations. This technology aids firms in cost-benefit analysis, allowing them to improve their logistics and freight operations profitability. The SCA software allows users real-time visibility throughout the supply chain. Large corporations use these methods to lessen the impact and avoid interruption before it happens.

Several multinational corporations are implementing advanced analytics solutions to improve operational efficiency. European retailers use big data and analytics technology to reduce retail shrinkage, improve customer experience, increase ROI, and improve supply chain management. The need for SCA solutions is being driven by the desire of businesses to enhance operational efficiency through data-based decisions. Leading corporations in countries, such as the U.K., and Germany, are developing innovative technological solutions to help companies make better business decisions.

Solution Insights

The sales & operations analytics segment accounted for the maximum share of more than 28.10% in 2022. Many businesses in Europe use operational analytics systems on their premises or as a cloud-based service. Because of the cost savings and other time-saving capabilities, the demand for cloud-based operational analytics solutions has been unparalleled. Small and Medium-sized Enterprises (SMEs) have been quick to adopt the technology since they require low-cost solutions, which has been increasing their demand.

The planning & procurement segment is anticipated to register a considerable growth rate over the forecast period. The segment is expected to develop due to businesses’ rising attention to improving their procurement channels’ operational efficiencies and their impending requirement to manage compliance regulations and contracts. With the rise of digitization, procurement analytics has a huge potential, as it helps firms shift from detecting and repairing to predicting and preventing problems. Procurement analytics assists businesses in developing better customer-centric products and services as well as retaining customers, thus, increasing demand.

Service Insights

The professional service segment held the highest share of more than 64.00% in 2022. Professional services for data analysis and preservation and professional help in developing technologies are in higher demand. On the other hand, data scientist teams require specific skills to detect and reveal trends that aid marketers in making better judgments; as a result, the supply chain industry lacks experienced or professional services and persons. Furthermore, professional services are necessary to verify that new systems are compatible with old techniques to avoid data loss or theft, resulting in increased category growth.

The support & maintenance segment is anticipated to register the fastest CAGR over the forecast period. While deploying SCA solutions, understanding the software’s technicalities, maintaining and repairing the system during outages, and regularly updating the software are all things to think about. As a result, third-party support saves money while simultaneously providing the expertise of highly qualified and experienced professionals. Due to a lack of attention to these factors, production may suffer. As a result, demand for support and maintenance services is expected to rise over the forecast period.

Deployment Insights

The on-premise deployment segment held the highest revenue share of more than 51.55% in 2022. Large organizations with significant assets and sensitive data prefer to adopt an on-premise setup to meet compliance standards and relevant legislation. Data security concerns are a significant reason driving the adoption of on-premise supply chain solutions. When companies have limited access to the internet, especially in rural locations, they want an on-premise SCA solution. Over the forecast period, the cloud segment is expected to grow at the fastest growth rate.

Organizations in Europe are reorganizing their supply chains using cloud-based solutions as a digital supply network that connects actual product and service flows while also providing economical, safer, efficient, endlessly scalable solutions that are simple to integrate with existing systems. Cloud-based analytics that provides clear, complete visualizations, and decision-driving insights will become increasingly important in ensuring trustworthy, profitable supply agreements that run smoothly. The digitalization of the supply chain sector has been pushed by the adoption of cloud-based business operations, which can handle the amplitude of volatility and consistent speed and promote enhanced responsiveness to supply chain disruptions.

Enterprise Size Insights

The large enterprise segment held the highest share of more than 59.80% of the overall revenue in 2022. The SCA software allows users real-time visibility throughout the supply chain. Large corporations use these methods to lessen the impact and avoid interruption before it happens. Several multinational corporations are implementing advanced analytics solutions to improve operational efficiency. The lack of internal network architecture for data storage is expected to drive the demand for SCA solutions.

The increasing acceptance of digital transformation initiatives for SMEs in Europe and rising 4G and 5G investments to expedite the adoption of internet services are anticipated to boost segment growth. To achieve their supply chain goals, end-users leverage demand planning, procurement, production analytics, and managed or professional services. SMEs in the retail, manufacturing, healthcare, transportation & logistics, and automotive industries are employing these technologies to improve their supply chain capabilities in the region.

End-use Insights

The manufacturing segment held the highest share of more than 24.15% of the overall revenue in 2022. Ensuring product availability and timely delivery is increasing the demand for supply chain efficiency improvements, which is projected to fuel manufacturing segment growth over the forecast period. Manufacturing supply networks are rapidly incorporating AI into their digitization strategies. In supply chains, AI helps with data organization and analysis, which helps with decision-making in logistics and warehousing. AI-enabled apps and SCA solutions are projected to improve productivity and save time in the industrial sector.

The healthcare segment is anticipated to register a promising CAGR over the forecast period. In healthcare institutions, SCA solutions are in high demand to improve supply chain efficiency, fortify supply networks to withstand disruptions, streamline tracking procedures, automate time-consuming jobs, optimize inventory management, and improve demand forecasting accuracy. Hospital systems are using healthcare SCA to reduce waste, boost total profits, and ensure the safety of their patients and employees.

Country Insights

The U.K. dominated the market in 2022 and accounted for the largest share of over 30% of the total revenue. The country’s retailers are implementing big data and analytics technologies to lower retail shrinkage, improve customer experience, and enhance supply chain management, which is anticipated to drive market growth. SCA solutions are gaining popularity in the country due to the enterprise-wide requirement to increase operational efficiency through data-driven decisions. In addition, enterprises around the nation are developing advanced technology solutions to help companies make business decisions.

For instance, in October 2021, International Business Machines Corp. signed an agreement with Honda Motor Europe Ltd. to provide an integrated end-to-end solution that will assist Honda in increasing efficiency, lowering costs, standardizing processes throughout its European operations, ultimately putting the company on track to achieve its “Zero Touch” objective. Germany is anticipated to witness a considerable CAGR from 2023 to 2030. Many companies are creating advanced technological solutions to assist businesses in decision-making. For instance, in July 2022, SAP SE acquired Askdata to enhance its capacity to assist businesses in making informed decisions by utilizing AI-driven natural language searches.

Key Companies & Market Share Insights

Companies are encouraged to build sophisticated SCA solutions by enhancing supply chain solutions with big data and predictive analytics, utilizing interactive software solutions and functional dashboards. Some of the main companies offering unified software solutions that cater to the diverse needs of a supply chain are SAP SE, Oracle Corp., Accenture PLC, and International Business Machines Corp. The trend of optimizing delivery mechanisms from point of production to point of consumption has led to the use of unified advanced analytics software by businesses.

Furthermore, companies are pursuing various growth strategies, such as new product development, mergers & acquisitions, joint ventures, and collaborations, to stay competitive and expand their reach in the market. For instance, in October 2022, Capgemini acquired Braincourt, a German-based consulting company. The acquisition helps a former company to strengthen in-demand data and analytics capabilities in Germany and Northern Europe. Some of the prominent players in the Europe supply chain analytics market include:

-

Accenture PLC

-

Capgemini SA

-

Genpact

-

International Business Machines Corp.

-

Infor, Inc.

-

Kinaxis, Inc.

-

Oracle Corp.

-

Sage Clarity Systems

-

SAS Institute, Inc.

-

SAP SE

Europe Supply Chain Analytics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.45 billion

Revenue forecast in 2030

USD 4.07 billion

Growth rate

CAGR of 15.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, service, deployment, enterprise size, end-use, country

Country scope

U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway

Key companies profiled

Accenture PLC; Capgemini SA; Genpact; International Business Machines Corp.; Infor, Inc.; Kinaxis, Inc.; Oracle Corp.; Sage Clarity Systems; SAS Institute, Inc.; SAP SE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Supply Chain Analytics Market Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Europe supply chain analytics market report based on solution, service, deployment, enterprise size, end-use, and country:

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Logistics Analytics

-

Manufacturing Analytics

-

Planning & Procurement

-

Sales & Operations Analytics

-

Visualization & Reporting

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Professional

-

Support & Maintenance

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprise

-

Small & Medium Enterprises

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail & Consumer Goods

-

Healthcare

-

Manufacturing

-

Transportation

-

Aerospace & Defense

-

High Technology Products

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Frequently Asked Questions About This Report

b. The Europe supply chain analytics market size was estimated at USD 1.26 billion in 2022 and is expected to reach USD 1.45 billion in 2023.

b. The Europe supply chain analytics market is expected to witness a compound annual growth rate of 15.8% from 2023 to 2030 to reach USD 4.07 billion by 2030.

b. The U.K. held the largest share of over 30% in 2022. The country's retailers are implementing big data and analytics technologies to lower retail shrinkage, improve customer experience, and enhance supply chain management is anticipated to drive market growth.

b. Key industry players operating in the Europe supply chain analytics market include Accenture PLC, Capgemini SA, Genpact, International Business Machines Corporation, Infor, Inc., Kinaxis, Inc., Oracle Corporation, Sage Clarity Systems, SAS Institute, Inc., SAP SE

b. The market is expected to grow due to the increased capacity of data, the need to improve supply chain efficiencies and the introduction of machine learning and Artificial Intelligence (AI) into supply chain management.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.