- Home

- »

- Medical Devices

- »

-

Europe Surgical Equipment Market, Industry Report, 2030GVR Report cover

![Europe Surgical Equipment Market Size, Share & Trends Report]()

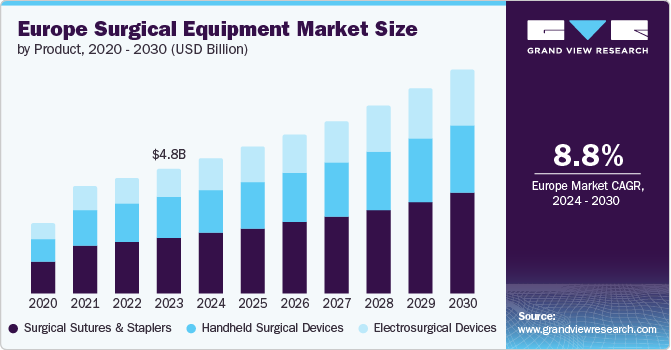

Europe Surgical Equipment Market Size, Share & Trends Analysis Report By Product (Surgical Sutures And Staplers, Handheld Surgical Devices), By Application, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-646-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Europe Surgical Equipment Market Trends

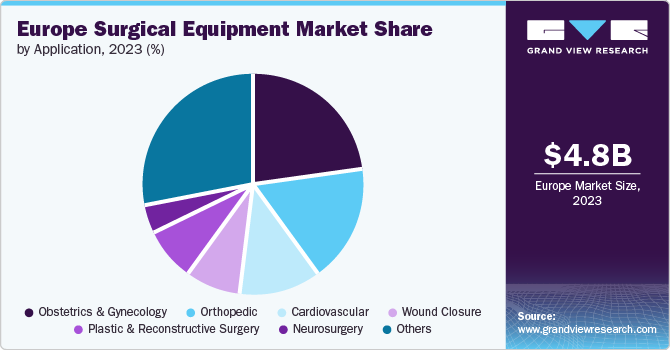

The Europe surgical equipment market size was valued at USD 4.80 billion in 2023 and is projected to grow at a CAGR of 8.8% from 2024 to 2030. Technological innovations, including minimally invasive surgery (MIS) devices, robotics and power-aided systems, are expected to propel the market growth. Surgical equipment has applications in plastic and reconstructive surgeries, obstetrics and gynecology, urology, neurosurgery, cardiovascular, wound closure, thoracic surgery, laparoscopy, micro-vascular, orthopedic surgery, and others. In the UK, approximately 31% of deliveries are performed through cesarean section, marking a notable increase of about 50% in the C-section rate over the last two decades, rising from 1 in 5 to 1 in 3 births. Moreover, a minimum of 1.14 million C-sections were carried out in the EU during 2021.

Furthermore, Europe has significantly invested in enhancing and updating its healthcare infrastructure, which has had a positive impact on the surgical equipment market. For instance, healthcare costs made up nearly 11% of GDP and nearly 16% of all public spending in the EU. Countries such as France, Germany, and the UK have made efforts to improve their healthcare systems by building new hospitals and surgical centers. Considerable funds have been allocated by the German government for building and upgrading hospitals, surgical centers, and outpatient clinics. This investment has made it possible to purchase advanced surgical equipment in response to the increasing need for surgical procedures.

Moreover, according to the European Federation of Pharmaceutical Industries and Associations (EFPIA), 25% of the working-age population suffers from a chronic disease related to the cardiovascular, urological, dermatological, or orthopedic systems. Every year, USD 125 billion in economic loss in the EU is due to premature deaths from chronic diseases among the working-age population. The rising occurrence of long-term illnesses is leading to more surgeries being carried out in total. Efforts made by different organizations to enhance healthcare services for disorders of the female reproductive system are also a significant motivator.

In addition, technological advancements in surgery are also aiding growth. Increasingly efficient human-operated surgical robots are being used to perform surgeries that require high precision. The introduction of robotics and other electrosurgical technologies are, thus, collectively driving the market. Integration of virtual reality in surgeries is yet another key driver.

Product Insights

Surgical sutures & stapler products dominated the market in 2023. These are utilized to close surgical incisions, reduced infection risk, providing quick placement, effective wound closure, and minimal tissue reaction, leading to a high demand for these instruments in surgical procedures. Moreover, the growing number of surgeries in Europe, due to a growing elderly population and increasing rates of chronic illnesses, improvements in suture and stapler technology, make them easier to use and could lower the risk of infection.

Electrosurgical devices are expected to grow at the fastest CAGR over the forecast period. The rise in chronic diseases has played a substantial role in the expansion of the electrosurgical devices and equipment market. Electrosurgical tools are utilized for treating various serious illnesses including non-cancerous moles, basal cell carcinomas, wound surgery, skin cancer, and more.

Application Insights

Obstetrics & gynecology dominated the market in 2023, as more women are getting procedures for gynecological conditions such as endometriosis, fibroids, and uterine prolapse. In addition, the increasing number of elderly individuals results in a higher demand for surgical procedures addressing age-related issues in the reproductive system among women. Furthermore, a growing trend in the use of specialized equipment for OB/GYN procedures due to the increasing popularity of minimally invasive surgical techniques is driving the demand.

Plastic & reconstructive surgery is projected to grow at the fastest CAGR over the forecast period. This increase in the number of aesthetic and plastic surgical procedures-such as breast augmentation, eyelid surgery, and liposuction-has increased the demand for surgical equipment. This surge is also driven by the presence of a large number of plastic surgeons and top plastic surgery equipment manufacturers in the region.

Country Insights

Germany Surgical Equipment Market Trends

Germany dominated the market with a revenue share of 23.6% in 2023 and is projected to grow over the forecast period. The growing focus on outpatient and day surgeries in the German healthcare system drives market growth. With the increasing emphasis on reducing healthcare costs and improving patient convenience, there is a shift toward performing more surgeries in outpatient settings. This trend increases demand for portable and easily operable surgical equipment in ambulatory surgery centers. The expansion of outpatient surgical services is driving the market for compact and versatile surgical devices that meet the specific needs of these facilities.

Spain Surgical Equipment Market Trends

Spain is expected to grow at the significant CAGR over the forecast period. The increasing prevalence of hospital-acquired infections (HAIs) has prompted healthcare facilities in Spain to invest in high-quality surgical equipment designed to minimize contamination risks. Due to concerns over HAIs, surgical instruments that offer better sterilization processes, disposable surgical tools, and improved operating room technologies are in higher demand. Increased investments in surgical equipment enhance cleanliness, precision, and safety during surgeries, further driving the market's expansion.

Key Europe Surgical Equipment Company Insights

Some of the key companies in the surgical equipment market include B. Braun SE, Stryker, and Medtronic. To obtain a competitive advantage in the market, businesses are concentrating on growing their customer base. As a result, important players are pursuing several calculated risks, including partnerships, mergers, and acquisitions with other major companies.

-

Medtronic offers a various range of surgical products in the European market to meet different surgical requirements. Its offering includes cutting-edge surgical tools, navigation and imaging systems, robotic-assisted surgery platforms for urologic and gynecologic procedures, and electrosurgical devices.

Key Europe Surgical Equipment Companies:

The following are the leading companies in the Europe Surgical Equipment market. These companies collectively hold the largest market share and dictate industry trends.

- B. Braun SE

- Smith & Nephew plc

- Zimmer Biomet

- Stryker

- Alcon Laboratories, Inc.

- Aspen Surgical Products, Inc.

- BD

- Medtronic

- Johnson & Johnson Services, Inc.

View a comprehensive list of companies in the Europe Surgical Equipment Market

Recent Developments

-

In April 2024, Karolinska University Hospital became the first hospital in the European region to perform surgery using single-port robot. The robot was previously used in the U.S. and recently received approval in Europe.

-

In March 2024, Stryker medical technology firm announced the acquisition of SERF SAS, a joint replacement company in France, from Menix. This acquisition is expected to boost the global portfolio and commitment to orthopedic excellence.

-

In May 2023, Olympus announced the launch of POWERSEAL Sealer/Divider in EMEA region. It offers surgeons improved ergonomics and performance.

Europe Surgical Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.19 billion

Revenue forecast in 2030

USD 8.61 billion

Growth Rate

CAGR of 8.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, country

Country scope

UK, France, Italy, Spain, Norway, Sweden, Denmark

Key companies profiled

B. Braun SE; Smith & Nephew plc; Zimmer Biomet; Stryker; Alcon Laboratories, Inc.; Aspen Surgical Products, Inc.; BD; Medtronic; and Johnson & Johnson Services, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Surgical Equipment Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe surgical equipment market report based on product, application and country :

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgical Sutures and Staplers

-

Handheld Surgical Devices

-

Forceps and Spatulas

-

Retractors

-

Dilators

-

Graspers

-

Auxiliary Equipment’s

-

Cutter Equipment’s

-

Others

-

-

Electrosurgical Devices

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Neurosurgery

-

Plastic and Reconstructive Surgery

-

Wound Closure

-

Obstetrics and Gynecology

-

Cardiovascular

-

Orthopedic

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."