- Home

- »

- Automotive & Transportation

- »

-

Europe Third-party Logistics Market Size, Share Report 2030GVR Report cover

![Europe Third-party Logistics Market Size, Share & Trends Report]()

Europe Third-party Logistics Market Size, Share & Trends Analysis Report By Services (DTM, VALS), By End Use (Retail, Manufacturing), By Transport (Roadways, Railways, Waterways, Airways), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-326-8

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Europe Third-party Logistics Market Trends

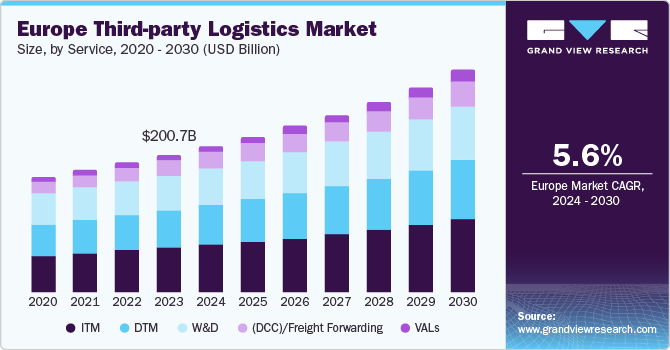

The Europe third-party logistics market size was estimated at USD 200.7 billion in 2023 and is projected to grow at a CAGR of 5.6% from 2024 to 2030. The expansion of international trade is the key factor driving market growth. Several companies find it infeasible to manage global supply chains. Thus, they often outsource logistics to third-party logistics (3PL) providers to navigate the complexities of supply chain management (SCM). Most importantly, 3PL providers offer expertise in value-added logistics (VALs) and international transportation management, allowing firms to concentrate on their core activities, such as manufacturing, R&D, and strategic planning.

The Europe third-party logistics market held a share of 18.3% of the global third-party logistics market revenue in 2023. The growth of the e-commerce sector, which entails quick and effective logistics solutions across the continent, is a major factor driving market growth. Outsourcing 3PL services for product fulfillment operations benefits an entire logistics set-up. This includes warehousing, order processing equipment, and computer and software systems. Firms with limited in-house resources can economically manage high order volumes by outsourcing their logistics.

In addition, firms are increasingly inclined towards tech-driven logistics. 3PL providers are integrating advanced technologies with their services. This includes inventory tracking, online documentation for international freight, real-time data, and warehouse management to enhance operational efficiency. 3PL vendors use the latest IT software and applications to strengthen distribution coverage and provide quality customer service, making these services economically viable options for firms.

Market growth in specific industries, such as automotive, retail, healthcare, and manufacturing, has stoked the expansion of the 3PL market in Europe. The automobile and auto components industry, in particular, relies heavily on 3PL services to distribute parts and finished products. Furthermore, the rise in mergers and acquisitions activities is creating larger, more capable 3PL entities that can meet the diverse needs of a growing customer base.

Service Insights

The domestic transportation management (DTM) segment dominated the market with a share of 31.8% in 2023. The surge in trade movement from unloading docks to warehouses, cross-docking services, fuel surcharge, and soaring carrier rates demanded efficient and rapid logistics solutions for the suppliers to meet consumer expectations and sustain a competitive edge in the market. Factors, such as the growth of the European e-commerce sector, increased consumer demand in healthcare and retail, and uniform GDP growth, have made DTM services a pivotal component. These sectors utilize DTM services to meet consumer demands in the evolving logistics landscape.

The VALs services segment is projected to register a CAGR of 7.6% during the forecast period. As businesses continue to seek 3PL suppliers for additional services beyond basic transportation and warehousing, this market is expected to grow. The VALs segment includes services, such as packing, labeling, and reverse logistics. By offering these services, 3PL providers enhance customer satisfaction and competitiveness, positioning themselves as strategic partners for businesses aiming to optimize their supply chain and streamline operations. With theability to deliver value-added services, 3PL services have become crucial for meeting the requirements of shippers. This helps them maintain a competitive edge in the logistics industry and continue business expansion.

End Use Insights

The retail segment dominated the market with a share of 25.9% in 2023. It is expected to grow rapidly during the forecast period due to the increasing complexity of in-house logistics operations. 3PL providers offer retailers big data analytics for decision-making to optimize inventory management and streamline supply chains. Outsourcing logistics operations to 3PL providers has allowed retailers to focus on their core competencies. Moreover, by utilizing such services, retailers benefit from economies of scale and reduce capital expenditure. In addition, the expansion of online retailing was a major factor driving the 3PL market growth. The rise of the e-commerce sector led to a greater need for efficient logistics solutions. This was complemented by the rise in mergers and acquisitions, which expanded service offerings and geographic reach.

The manufacturing segment is anticipated to grow significantly at a CAGR of 6.3% during the forecast period. With technological advancements at the forefront, 3PL providers have integrated digital technologies in SCM, leading to enhanced efficiency and transparency. 3PL companies also provide inbound and outbound logistics services including raw material purchasing, order processing, inventory management, warehousing & distribution, and transportation. Outsourcing these services helps manufacturers focus on their score specialization, reduce costs, and improve operational efficiency.

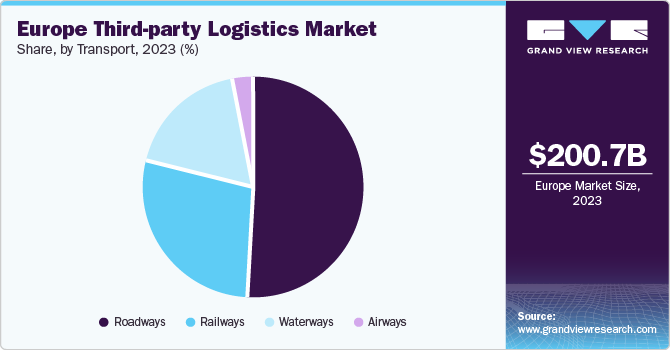

Transport Insights

The roadway segment dominated the market with a share of more than 50.0% in 2023 due to the growing public-private partnerships model. These partnerships enhanced the supply chain infrastructure, leading to more efficient and reliable road transport services. The extensive and well-maintained road infrastructure across the continent facilitated flexible and cost-effective route management. This made a strong foundation for the dominance of roadways in the 3PL market. The emphasis on supply chain infrastructure by government bodies and private entities to create efficient transportation systems also contributed to segment growth.

Government bodies adopted advanced features, including digital technologies, to meet the rising demand for high-quality 3PL services in the manufacturing and retail sectors. This has further augmented the usage of roadways by 3PL providers. The airways segment is anticipated to grow at a CAGR of 7.1% during the forecast period. The increased adoption of software solutions including RFID-enabled devices and transportation management solutions has primarily played a crucial role as a key market driver.

Country Insights

Germany Third-party Logistics Market Trends

The third-party logistics market in Germany accounted for a dominant share of 38.5% in 2023 owing to the rise in e-commerce and online retailing sector, supported by Germany’s robust digital infrastructure. This is primarily due to the need to manage increased goods and services moving through supply chains. Automation in logistics has emerged as another driving factor as the German 3PL providers are progressively integrating cutting-edge technologies to enhance operational accuracy and remain sustainable. In addition, the industry has witnessed a growing concern for the environment and the need for sustainable practices. This has led to the development of the cold chain sector, which expanded to meet the demand for temperature-controlled transportation and storage. Moreover, Germany has positioned itself as a center for global trade with strategic location and logistics infrastructure with companies including Deutsche Post (DHL).

UK Third-party Logistics Market Trends

The UK third-party logistics market is expected to register the fastest CAGR of 6.3% over the forecast period. The retail and e-commerce sectors have emerged as significant contributors to the demand for 3PL services, with a considerable rise in online sales since the pandemic. Online retailing necessitated efficient handling of freight and mail order operations, which increased the demand for 3PL providers as they are well-equipped to manage these operations. The geographical advantage has further played a pivotal role in distribution networks. For instance, Midland’s Golden Logistics Triangle has become a strategic logistics hub, with its central location enabling supply chain companies to reach over 90% of the UK population within four hours. Furthermore, high-end technologies, including mobile technology and RFID chips, have improved agility, provided real-time tracking of shipments, and enhanced customer service.

Key Europe Third-party Logistics Company Insights

The Europe third-party logistics market is fragmented with key players attempting to maintain their dominant footprint. They are expanding their businesses via strategic collaborations and advanced service offerings. In addition, they are considering new facility center expansion as a key strategy to cater to the significantly growing demand for transportation and warehousing services.

Key Europe Third-party Logistics Companies:

- Agility

- Americold Logistics, LLC.

- BDP International

- C.H. Robinson

- CEVA Logistics

- DB Schenker Logistics

- Deutsche Post AG

- DSV PANALPINA A/S

- Expeditors International of Washington, Inc.

- FedEx Corporation

- Flexport Inc.

- Kerry Logistics Network Limited

Europe Third-party Logistics Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 294.3 billion

Growth rate

CAGR of 5.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, end use, transport, and country

Country scope

Germany; UK; France

Key companies profiled

Agility; Americold Logistics, LLC; BDP International; C.H. Robinson; CEVA Logistics; DB Schenker Logistics; Deutsche Post AG; DSV PANALPINA A/S; Expeditors International of Washington, Inc.; FedEx Corp.; Flexport Inc.; Kerry Logistics Network Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Third-party Logistics Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Europe third-party logistics market report based on service, transport, end use, and country:

-

Service Outlook (Revenue, USD Billion, 2017 - 2030)

-

Dedicated Contract Carriage (DCC)/Freight forwarding

-

Domestic Transportation Management (DTM)

-

International Transportation Management (ITM)

-

Warehousing &Distribution (W&D)

-

Value Added Logistics Services (VALs)

-

-

Transport Outlook (Revenue, USD Billion, 2017 - 2030)

-

Roadways

-

Railways

-

Waterways

-

Airways

-

-

End Use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Manufacturing

-

Retail

-

Healthcare

-

Automotive

-

Others

-

-

Country Outlook (Revenue, USD Billion, 2017 - 2030)

-

Germany

-

UK

-

France

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."