- Home

- »

- Advanced Interior Materials

- »

-

Europium Market Size, Share, Global Industry Trend Report, 2018-2025GVR Report cover

![Europium Market Report]()

Europium Market (2018 - 2025) Analysis By Application (Permanent Magnets, Catalysts, Glass Polishing, Phosphors, Ceramics, Metal Alloys, Glass Additives), By End-use, And Segment Forecasts

- Report ID: GVR-2-68038-031-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2014 - 2015

- Forecast Period: 2017 - 2025

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Industry Insights

The global europium market size was estimated at USD 209.0 million in 2016. The growing use of europium metal, oxides, and compounds for the manufacture of phosphors used in consumer electronics is projected to act as a key driver for market growth over the forecast period.

The rapidly-growing consumer electronics industry across the globe, owing to factors such as improved internet connectivity, technological advancements, and increasing consumer expenditure on premium electronics, is expected to have significant impacts on the overall industry growth. Further, the increasing penetration in numerous applications, including metal alloys, permanent magnets, glass additives, catalysts, and ceramics, is likely to have positive influences on the product demand over the next eight years.

The rapidly increasing demand for smartphones, wearables, gears, and smart televisions in emerging economies across the globe is expected to drive the consumer electronics industry, which, in turn, is expected to benefit the demand for the product during the forecast years.

Europium is one of the rarest elements on Earth, largely found in oxide form. It is extracted along with other rare earth elements from monazite and bastnasite ores. It is then separated and refined. Europium metal and oxides, along with other rare earth elements, are used for the production of numerous alloys, compounds, additives, and phosphors. The companies in the industry engage in exploration, mining, development, refining, manufacturing, and distribution of the element and related products.

The product price has been extremely volatile owing to numerous factors such as scarce availability, limited production, and the current slowdown in the rare earth industry. The production of europium is largely dependent on the production of other rare earth elements, as it occurs along with these metals. This phenomenon directly impacts product prices.

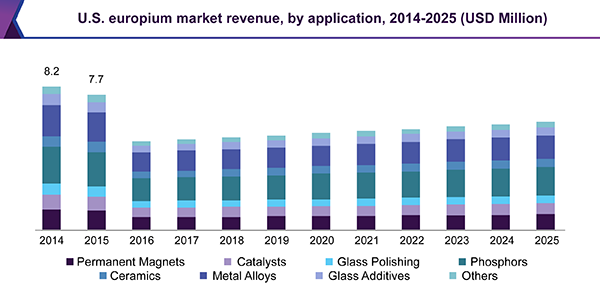

Application Insights

Phosphors account for the largest share of the industry revenues as of 2016, accounting for nearly 29% among all applications, and is expected to witness significant growth over the forecast period. The increasing use of the product for the manufacture of red and blue phosphors, widely used in all smartphones, flat displays, and televisions, is expected to drive product demand over the forecast period.

Permanent magnets and catalysts application segments are also expected to witness rapid growth owing to increasing applications in semiconductors, metallurgy, and automotive industry. The robust growth in the aforementioned end-use verticals is likely to propel growth in the above application segments. The permanent magnet segment is slated to grow at a CAGR of 4.8%, in terms of revenues, during the forecast period.

The industry players continuously engage in research & development to identify and expand the application scope of the product. The product is used along with terbium, yttrium, and other rare metals, for widespread applications in the energy, automotive, life sciences, and material science industries. The ongoing extensive research is expected to open new avenues for the product in several applications during the forecast period.

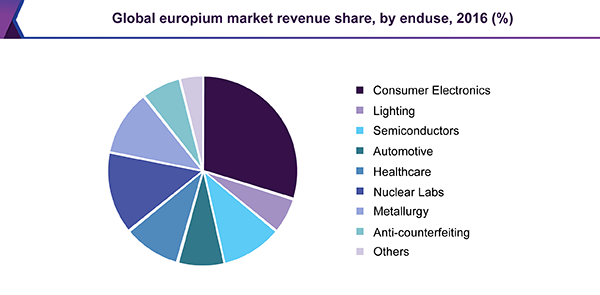

End-use Insights

The consumer electronics segment accounted for the largest share of industry revenues in 2016, valued at USD 62.4 million in 2016. The segment is expected to grow at a CAGR of 5.0% over the forecast years. The rapid growth of the electronics industry worldwide is slated to drive the product demand over the forecast period.

The rapid growth of the consumer electronics industry can be primarily attributed to the increasing volume sales of smartphones, wearables, and 4K televisions, especially in emerging economies in the Asia Pacific region, including India, Thailand, South Korea, and China.

Europium is widely used for anti-counterfeiting measures in electronic devices, currency, software, and consumer goods owing to the luminesce property it possesses. Governments across the globe are beginning to invest large amounts of capital for the development of anti-counterfeit products & services, to protect the consumers from fraudulent goods and currency domestically and internationally. This phenomenon is expected to benefit the product demand over the forecast period.

Regional Insights

The Asia Pacific dominated the global europium industry in terms of revenue and volume, as China solely produces over 86% of the total global output. Also, increasing applications of the product in major end-use industries is expected to propel product demand over the coming years. The rapidly-growing consumer electronics sector in emerging economies such as China, India, Indonesia, Vietnam, and Thailand, is expected to drive the product demand in the region over the forecast period.

China dominated the global industry, valued at USD 148.4 million in 2016, and is expected to witness significant growth during the next eight years. China acts as a key exporter of the concerned product and other rare earth across the globe. As of 2016, China operates as a monopolist, with the highest proven reserves and highest production. The growing domestic demand for the product in consumer electronics, energy, automotive, and semiconductor markets is expected to drive market growth.

The North America segment is expected to witness slow growth on account of the current slow-down in the rare earth industry. Also, the U.S. is a net importer of the element and related products owing to the high market prices and lack of production in the region. Over the forecast period, the region is likely to witness steady growth on account of growing production in Canada.

Competitive Insights

The market is highly competitive, on account of the presence of highly integrated players such as Lynas Corporation, China Minmetals, Avalon Advanced Materials Inc., Baotou Group, and Canada Rare Earth Corporation which are involved in the exploration, mining, and development of the metal along with other rare metals.

The market participants possess high volume resources and assets and operate with high production capacities. The mining companies integrate with companies that offer refining, separation, and distribution services. Moreover, the key players continuously invest in research & development to expand the application scope in major end-use verticals.

Report Scope

Attribute

Details

The base year for estimation

2016

Actual estimates/Historical data

2014 - 2015

Forecast period

2017 - 2025

Market representation

Market Volume in Tons; Revenue in USD Million; and CAGR from 2017 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Russia, Germany, UK, China, India, Australia, Brazil

Report coverage

Volume and revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the reportThis report forecasts volume and revenue growth at regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the europium market based on application, end-use, and region:

-

Application Outlook (Volume, Tons; Revenue, USD Million; 2014 - 2025)

-

Permanent Magnets

-

Catalysts

-

Glass Polishing

-

Phosphors

-

Ceramics

-

Metal Alloys

-

Glass Additives

-

Others

-

-

End-use Outlook (Volume, Tons; Revenue, USD Million; 2014 - 2025)

-

Consumer Electronics

-

Lighting

-

Semiconductors

-

Automotive

-

Healthcare

-

Nuclear Labs

-

Metallurgy

-

Anti-counterfeiting

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million; 2014 - 2025)

-

North America

-

U.S

-

Canada

-

-

Europe

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global telemedicine market size was estimated at USD 231.9 million in 2019 and is expected to reach USD 241.4 million in 2020.

b. The global Europium market is expected to grow at a compound annual growth rate of 4.6% from 2019 to 2025 to reach USD 308.9 million by 2025.

b. Phosphors dominated the Europium market with a share of 29.1% in 2019. This is attributable to the increasing use of the product for the manufacture of red and blue phosphors, widely used in all smart phones, flat displays, and televisions.

b. Some key players operating in the Europium market include Lynas Corporation, China Minmetals, Avalon Advanced Materials Inc., Baotou Group, and Canada Rare Earth Corporation.

b. Key factors that are driving the market growth include the growing use of the europium metal, oxides, and compounds for the manufacture of phosphors used in consumer electronics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.