- Home

- »

- Advanced Interior Materials

- »

-

Explosives & Pyrotechnics Market, Industry Report, 2030GVR Report cover

![Explosives & Pyrotechnics Market Size, Share & Trends Report]()

Explosives & Pyrotechnics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Blasting Agents, Propellants, Pyrotechnics), By Application (Mining, Construction, Military), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-186-3

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Explosives & Pyrotechnics Market Summary

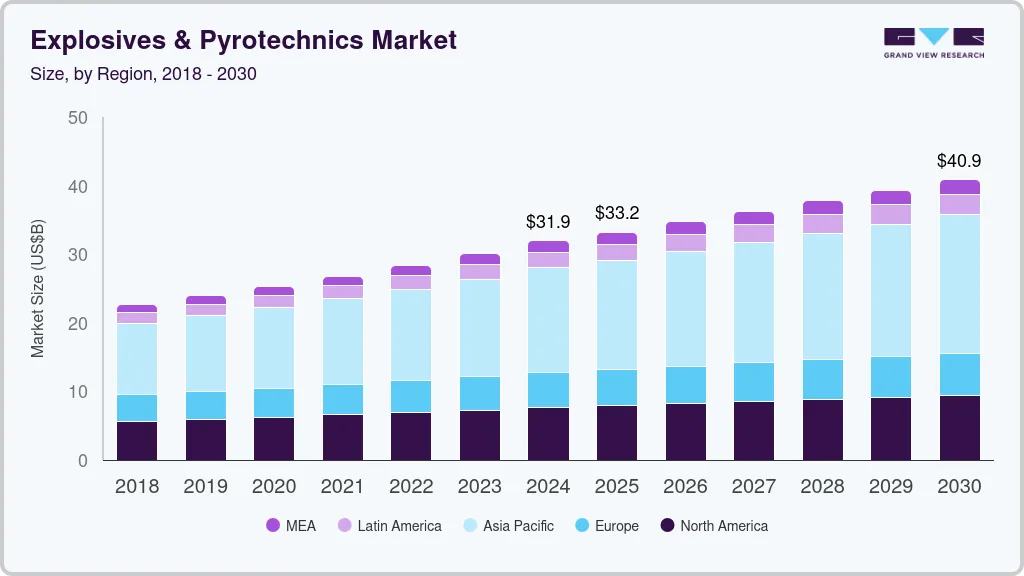

The global explosives & pyrotechnics market size was estimated at USD 31.95 billion in 2024 and is projected to reach USD 40.87 billion by 2030, growing at a CAGR of 4.3% from 2025 to 2030. The growth is driven by the increasing demand for explosives in the mining, construction, and demolition industries.

Key Market Trends & Insights

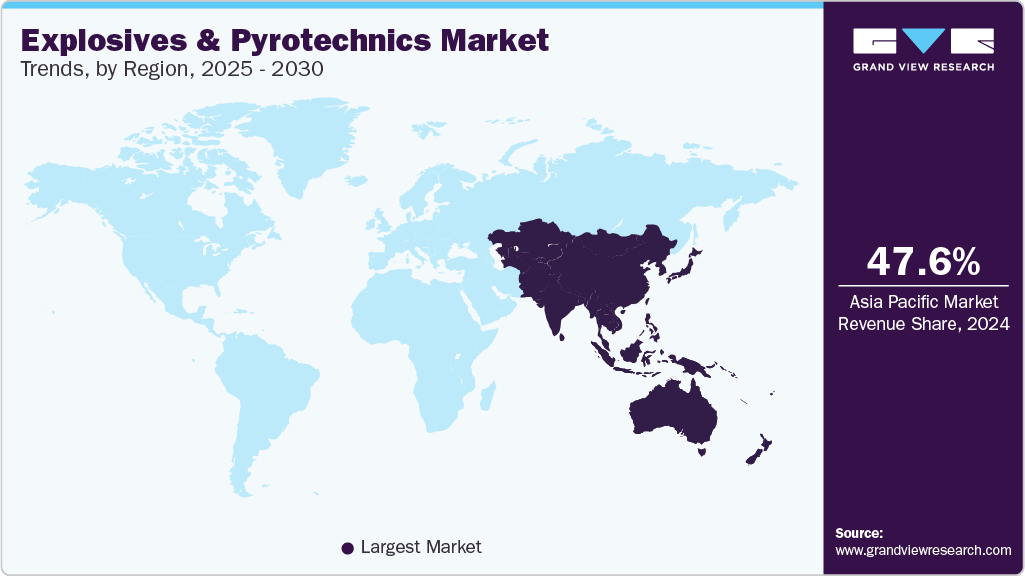

- Asia Pacific dominated the market and accounted for the largest revenue share of 47.6% in 2024 and is expected to grow at the fastest CAGR of 4.9% over the forecast period

- The U.S. market is a major contributor to North America’s explosive and pyrotechnics industry.

- Based on product, the pyrotechnics segment accounted for the largest revenue share of 43.7% in 2024. It is expected to grow at the fastest CAGR of 4.5% over the forecast period.

- Based on application, the mining segment accounted for the largest revenue share of 72.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 31.95 Billion

- 2030 Projected Market Size: USD 40.87 Billion

- CAGR (2025-2030): 4.3%

- Asia Pacific: Largest market in 2024

Additionally, the growing demand for pyrotechnics in the entertainment industry is also contributing to the market. The environmental impact of explosives is a major concern for many people. In recent years, there has been a growing demand for eco-friendly explosives that do not have a negative impact on the environment. The development of eco-friendly explosives is expected to drive the growth of the global explosives & pyrotechnics industry.

Growing mining operations in Australia, the U.S., Russia & South Africa, as well as rising consumer demand for outdoor crackers, shows at sporting events, and personal events, including weddings, are expected to drive the explosives & pyrotechnics industry growth over the forecast period. Developments are expected to continue, driving explosive demand due to their use in drilling and blasting at mining and construction sites. Blasting & explosives technology are essential components of any mining operation. It is employed in both open pit & underground mining operations.

The creation of improvised explosive devices (IEDs) for use in mining and other industries has boosted the global market growth. Furthermore, increased coal output and mining activities help expand the market. The market has grown rapidly as safety awareness has increased and the need to secure national borders & boundaries has increased. In addition, government spending on the military, defense, and ammunition industries has also witnessed an increase in recent years. The U.S., China, India, Saudi Arabia, and Russia are the leading five defense & military application spenders.

Market Concentration & Characteristics

The degree of innovation in the explosives and pyrotechnics market is high, driven by the industry's need to balance performance with safety and environmental sustainability. Companies are actively developing "green" pyrotechnics that generate less smoke and harmful residues, along with advanced digital ignition systems that enhance precision and operational safety. Cutting-edge research into nano-explosives and smart materials is enabling more controlled and effective applications in sectors such as mining, defense, and entertainment. These continuous innovations not only improve functional outcomes but also help firms meet stringent environmental and regulatory standards, thus strengthening their competitive position in a dynamic global market.

The threat of substitutes in the explosives and pyrotechnics industry is moderate but growing, especially with the increasing focus on safety and environmental sustainability. Alternatives such as mechanical rock-cutting equipment in mining, laser-based demolition systems, and digital light shows replacing traditional fireworks in events pose potential challenges. Moreover, stricter environmental regulations and public opposition to noise and air pollution from pyrotechnics are accelerating the adoption of these substitutes. While explosives still offer unmatched power in specific industries, ongoing innovation in substitute technologies could gradually erode their dominance in certain use-cases.

Product Insights

The pyrotechnics segment accounted for the largest revenue share of 43.7% in 2024. It is expected to grow at the fastest CAGR of 4.5% over the forecast period due to the increasing demand for pyrotechnics in the entertainment industry. Pyrotechnics are used to create special effects, such as fireworks, flares, and smoke bombs.

The blasting agents segment held a considerable revenue share in 2024 and is expected to grow significantly over the forecast period, due to the increasing demand for blasting agents in the mining industry. Blasting agents are used to break up rocks and ore, and to create tunnels and shafts. The global mining industry is growing rapidly, and this growth is expected to drive the demand for blasting agents in the coming years.

Application Insights

Based on application, the explosives market is segmented into mining, construction, military, and others. The mining segment accounted for the largest revenue share of 72.5% in 2024. The global demand for minerals and metals is growing rapidly, driven by the increasing demand for these commodities in a variety of industries, such as construction, manufacturing, and electronics. This growth in demand is expected to drive the demand for explosives in the mining industry in the coming years.

The mining industry is hazardous, and there is a growing focus on safety and efficiency in mining operations. This focus on safety and efficiency is expected to drive the demand for explosives that are safer and more efficient. In addition, there is a continuous development of new technologies for the mining industry, such as automation and robotics.

The construction segment is expected to grow at the fastest CAGR of 4.4% over the forecast period. Explosives are used extensively in the construction industry to break up rocks and ore and to create tunnels and shafts. In addition, the global demand for infrastructure development is growing rapidly, driven by the increasing population and the need to improve the quality of life.

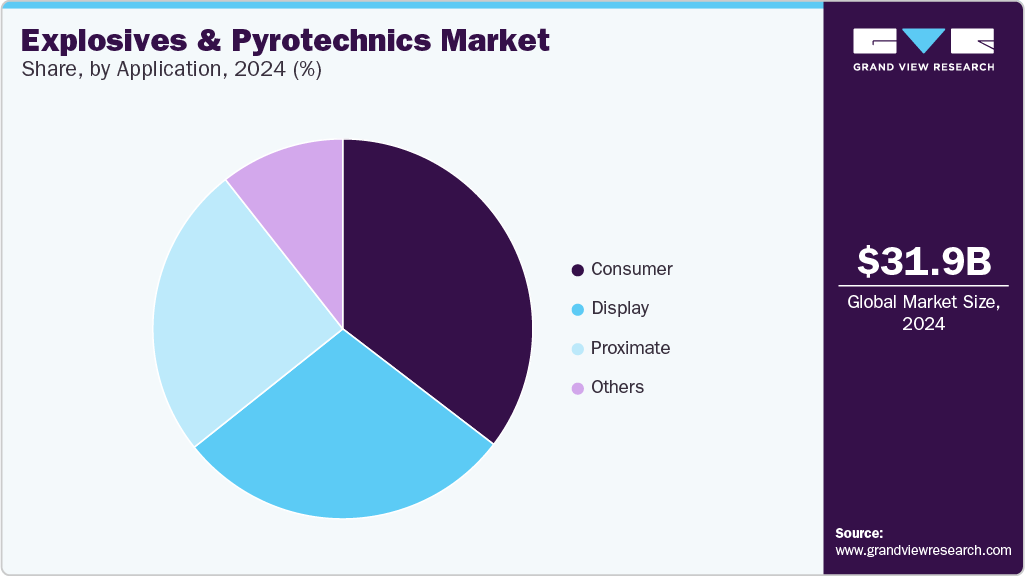

Based on application, the pyrotechnics market is segmented into consumer, proximate, display, and others. The consumer segment held the largest revenue share of 35.4% in 2024 due to its usage in personal applications, such as fireworks, flares, and smoke bombs. Fireworks are used extensively in the consumer market for entertainment purposes, such as celebrating holidays, weddings, and other special occasions. Flares are used extensively in the consumer market for safety and signaling purposes, such as signaling for help in an emergency or marking a location. Smoke bombs are used extensively in the consumer market for entertainment purposes, such as creating a smoke screen or adding a dramatic effect to performance.

The proximate segment is expected to grow at the fastest CAGR of 4.7% over the forecast period due to the increasing use of proximate pyrotechnics in military applications, such as signaling, illumination, and crowd control. Global military spending is growing rapidly, driven by the increasing tensions between countries and the need to maintain a strong military presence. An increasing number of events, including sports events such as IPL, BPL, T20, NBA, and other entertainment events, is expected to propel demand over the forecast period. In addition, there is a continuous development of new proximate pyrotechnic products with improved properties, such as increased safety, brightness, and duration.Regional Insights

Asia Pacific dominated the explosives and pyrotechnics market and accounted for the largest revenue share of 47.6% in 2024 and is expected to grow at the fastest CAGR of 4.9% over the forecast period, as the region is home to some of the world's largest mining and construction industries. The military spending in the region is growing rapidly, which is further driving the demand for explosives and pyrotechnics for defense applications. The presence of numerous prominent mining companies in Australia and China, owing to the presence of coal and gold reserves, is expected to play a crucial role in increasing demand for explosives. Also, the prevalence of numerous religious festivals in the region, particularly in China and India, is likely to propel demand for consumer pyrotechnics.

China explosives and pyrotechnics market leads the global marketspace, both in production and consumption. Its deep-rooted cultural traditions involving fireworks, especially during events like Chinese New Year and National Day, fuel consistent domestic demand for pyrotechnics. On the industrial side, rapid urbanization, infrastructure expansion, and large-scale mining operations contribute significantly to the consumption of explosives. The Chinese government's ongoing Belt and Road Initiative and aggressive infrastructure projects across Asia and Africa also drive the export of industrial explosives and fireworks. Moreover, China supplies over 80% of the world’s fireworks, solidifying its role as the global manufacturing hub for pyrotechnics.

Europe Explosives & Pyrotechnics Market Trends

The growth of the Europe explosives and pyrotechnics industry is driven by demand from the mining, tunneling, and defense sectors. Countries such as Sweden and Poland are seeing increased mining exploration, while infrastructure renovation projects across the continent require controlled blasting. The entertainment and sports sectors continue to use pyrotechnics for stadium shows and festivals. However, the region is highly regulated, especially in terms of environmental impact and safety, pushing manufacturers to develop low-emission, biodegradable, and digitally controlled explosive systems. The EU's focus on sustainability has led to increasing adoption of green pyrotechnics and non-toxic explosive compounds, fostering innovation and R&D in this space.

Germany explosives & pyrotechnics market is expected to witness significant growth over the forecast period. Germany represents one of the most technologically advanced markets in Europe for explosives and pyrotechnics. The country’s demand is primarily driven by infrastructure development, mining, tunneling for transportation projects, and military modernization. The government’s defense budget expansion and investment in advanced weapons systems also fuel demand for high-performance explosives. Additionally, Germany hosts many international fairs, sports events, and cultural festivals where pyrotechnics play a key role. The German market is particularly sensitive to environmental and safety regulations, prompting the adoption of smart ignition systems and reduced-smoke compositions in both military and civilian applications.

North America Explosives & Pyrotechnics Market Trends

In North America, the explosives and pyrotechnics industry is experiencing robust growth due to extensive mining, quarrying, and construction activities, particularly in Canada and the U.S. The resurgence of oil and gas exploration, including shale gas extraction, also contributes to increased industrial explosive use. In parallel, pyrotechnics are widely used in the entertainment industry, including concerts, sporting events, and theme parks like Disney and Universal Studios. Regulatory bodies such as the ATF and OSHA enforce strict compliance standards, leading to innovation in safer and more efficient blast technologies, including electronic detonation and remote-controlled systems.

U.S. Explosives & Pyrotechnics Market Trends

The U.S. market is a major contributor to North America’s explosive and pyrotechnics industry. Industrial explosives see heavy use in mining, tunneling, and oilfield operations, particularly in states like Texas, Wyoming, and Nevada. The defense sector remains a significant end user, with the Department of Defense investing in advanced munitions and explosive systems. Pyrotechnics are in high demand across Fourth of July celebrations, New Year events, theme parks, and large-scale entertainment productions. However, there is a growing trend toward low-emission alternatives, including drone light shows and biodegradable firework compositions, due to increasing environmental awareness and pressure from local authorities.

Latin America Explosives & Pyrotechnics Market Trends

Latin America shows rising demand for explosives, largely due to the expanding mining sector in mineral-rich countries like Chile, Peru, and Brazil. The construction of roads, dams, and urban infrastructure also necessitates controlled blasting techniques. Furthermore, pyrotechnics are deeply embedded in local culture and are widely used during festivals, carnivals, and religious events. However, safety regulations and environmental standards in the region are evolving, which is opening up opportunities for international players offering more advanced, compliant technologies. The combination of industrial development and vibrant cultural traditions ensures a strong, multifaceted demand.

Middle East & Africa Explosives & Pyrotechnics Market Trends

The Middle East & Africa region is seeing increased use of explosives in mining, oil exploration, and mega-infrastructure projects like the NEOM city in Saudi Arabia and various rail and road developments in sub-Saharan Africa. In countries like South Africa and Ghana, mineral exploration drives consistent demand for industrial explosives. Pyrotechnics also see seasonal spikes, especially during national holidays, religious festivals, and sports celebrations in nations such as the UAE and Egypt. Additionally, rising security needs and defense procurement in the Gulf countries are boosting demand for military-grade explosives and controlled detonation systems, prompting global companies to enter joint ventures and local partnerships.

Key Explosives & Pyrotechnics Company Insights

Some of the key players operating in the market include Atlas Copco and Hitachi Koki Co., Ltd.

-

Atlas Copco AB is a manufacturer of explosives & pyrotechnics equipment, compressors, and industrial machines.

-

Koki Holdings Co., Ltd. is involved in manufacturing and selling explosives & pyrotechnics tools. Major brands under the company include HIKOKI, Metabo HPT, and Metabo.

Stanley Black & Decker & Hilti Corporation are some of the emerging participants in the explosives & pyrotechnics market.

-

Stanley Black & Decker offers hand and explosives & pyrotechnics tools with related accessories, fastening systems and products, services, and equipment for various industries such as oil & gas and infrastructure, security systems, and healthcare solutions

-

Hilti Corporation is a technology company focused on product development and manufacturing, logistics, sales, and servicing of technological equipment.

Key Explosives & Pyrotechnics Companies:

The following are the leading companies in the explosives & pyrotechnics market. These companies collectively hold the largest market share and dictate industry trends.

- Orica Limited

- Dyno Nobel (Incitec Pivot)

- MAXAM Corp.

- EPC Groupe

- AEL Mining Services

- Sasol Limited

- ENAEX

- Hanwha Corporation

- Solar Industries India

- Austin Powder Company

Recent Developments

-

In June 2024, Orica and Fertiberia achieved a significant milestone by executing the first blast using low-carbon Technical Ammonium Nitrate (TAN) at the Canteras de Santullán quarry in Spain. This innovative product is produced using renewable hydrogen, marking a step forward in sustainable blasting solutions.

-

In April 2023, Solar Industries India signed into a Business Acquisition Agreement to purchase a 98.39% share in Rajasthan Explosives & Chemicals. The consideration would be paid by issuing redeemable preference shares to Rajasthan Explosives & Chemicals' existing shareholders.

Explosives & Pyrotechnics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 33.18 billion

Revenue forecast in 2030

USD 40.87 billion

Growth rate

CAGR of 4.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Taiwan; South Korea; Argentina; Brazil; Saudi Arabia

Key companies profiled

Orica Limited; Dyno Nobel (Incitec Pivot); MAXAM Corp.; EPC Groupe; AEL Mining Services; Sasol Limited; ENAEX; Hanwha Corporation; Solar Industries India; Austin Powder Company

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Explosives & Pyrotechnics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global explosives & pyrotechnics market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Blasting agents

-

Propellants

-

Pyrotechnics

-

Others

-

-

Explosives Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Mining

-

Construction

-

Military

-

Others

-

-

Pyrotechnics Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Proximate pyrotechnics

-

Consumer pyrotechnics

-

Display pyrotechnics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Taiwan

-

South Korea

-

-

Latin America

-

Argentina

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global explosives & pyrotechnics market size was estimated at USD 31.95 billion in 2024 and is expected to reach USD 40.87 billion in 2025.

b. The Explosives & Pyrotechnics market is expected to grow at a compound annual growth rate of 4.3% from 2025 to 2030 to reach USD 40.87 billion by 2030.

b. The pyrotechnics segment dominated the explosives & pyrotechnics market with a share of 43.7% in 2024. This is due to their widespread use in entertainment, festive events, and military training applications, which ensures consistent year-round demand.

b. Some of the key players operating in the explosives and pyrotechnics market include Orica Mining Services, Sasol Limited, Austin Powder Company, Chemring Group, ENAEX, Maxam Corp., Incitec Pivot, AECI Group, Pyro Company Fireworks, ePC Group, Alliant Techsystems, AEL Mining Services and Titanobel SAS.

b. Key factors driving the explosives and pyrotechnics market include rising mining and construction activities, defense spending, and the growing demand for advanced blasting technologies and safer, environmentally friendly materials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.