- Home

- »

- Network Security

- »

-

Extended Detection And Response Market Size Report, 2033GVR Report cover

![Extended Detection And Response Market Size, Share & Trends Report]()

Extended Detection And Response Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Solutions, Services), By Deployment (Cloud-based, On-Premises), By Application (Large Enterprises, SMEs), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-304-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Extended Detection And Response Market Summary

The global extended detection and response market size was estimated at USD 1,336.3 million in 2025 and is projected to reach USD 5,967.0 million by 2033, growing at a CAGR of 20.5% from 2026 to 2033. Extended detection and response (XDR) is an emerging security technology, developed to respond to the need for sophisticated and comprehensive detection and response.

Key Market Trends & Insights

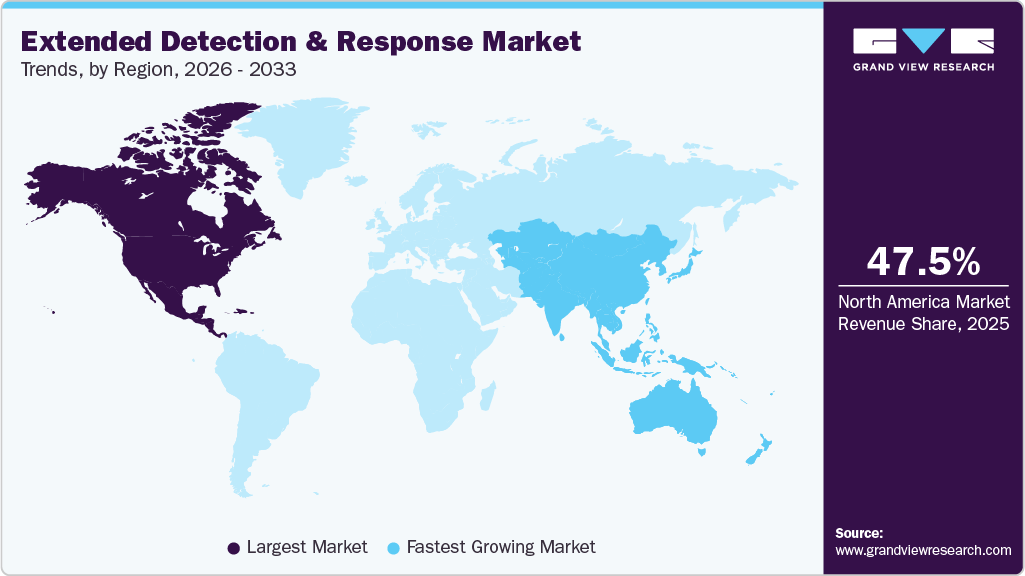

- North America held a 47.5% revenue share of the global extended detection and response industry in 2025.

- In the U.S., the market is driven by growing cyber threats, rising cloud adoption, and increasing demand for integrated AI-powered security solutions.

- By component, the solutions segment held the largest revenue share of 55.6% in 2025.

- By deployment, the on-premises segment held the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 1,336.3 Million

- 2033 Projected Market Size: USD 5,967.0 Million

- CAGR (2026-2033): 20.5%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Ongoing developments in technologies such as the cloud and the Internet of Things (IoT) have raised the risk of cyber threats, creating challenges in securing critical data. As a result, businesses are spending on several security solutions to strengthen their security and reduce redundant attacks. The increased integration of several software solutions with existing systems and heightened complexities in managing multiple alerts with limited context about the increasing number of security threats cause security teams to lose visibility, hampering business operations. The scenario has led to the development of XDR technology, which uses machine learning techniques and dynamic analytics to deliver extended visibility, response, and analysis across clouds, networks, and endpoints.Over the years, the enhanced visibility and awareness of security threats offered by XDR solutions have led to their increased popularity in the U.S. By integrating XDR solutions, enterprise security analysts can eliminate and target cyber threats based on the severity at which they can impact the organization’s IT infrastructure.

The rising need for real-time monitoring and investigation of advanced threats is compelling organizations to adopt security solutions that extend the capabilities of threat detection from endpoints to multiple security control points such as emails, servers, the cloud, and networks. This is driving the adoption of XDR tools that allow behavioral and telemetry analysis across several security layers. It allows security analysts to visualize several threats. Leading cybersecurity vendors are now introducing comprehensive XDR platforms to address these growing enterprise security demands. For instance, in November 2025, Kaspersky in Europe launched its Extended Detection and Response (XDR) solution, integrating log correlation, asset management, and investigation tools, which enable early adopters to evaluate advanced threat protection in test environments before full deployment. In addition, the use of XDR tools reduces downtime on critical servers by offering tailored incident responses. These benefits are expected to drive extended detection and response industry growth over the forecast period.

Component Insights

The solutions segment accounted for the largest revenue share of 55.6% in 2025. The need for a unified solution that can provide a holistic view of cyber threats across several control points, ranging from end-points to networks and servers, has helped increase the adoption of XDR solutions. Moreover, the need to reduce the complexities associated with managing several security solutions and the alerts provided by such solutions have also contributed to the growth of the segment.

The services segment is expected to register the fastest CAGR over the forecast period from 2026 to 2033. The evolving risks of cyber threats across security perimeters of organizations are driving the need for managed services. Demand for managed XDR vendors also continues to rise, to assess the IT infrastructures of organizations in real-time and also to detect and mitigate advanced threats. Furthermore, the rising demand for implementation and training services is driving the services segment.

Deployment Insights

The on-premises segment dominated the market and accounted for the largest revenue share in 2025. Enterprises with mandatory IT infrastructure prefer the installation of extended detection and response solutions on their own premises as they possess entire ownership of the upgrades and solutions. Many large enterprises and organizations which deal with critical business information select on-premises XDR solutions as they provide an optimum level of data security and physical access controls.

The cloud-based segment is expected to grow at the fastest CAGR during the forecast period from 2026 to 2033. The cloud-based segment has gained popularity owing to its cost benefits and flexibility. This trend is further supported by ongoing innovations in cloud-native security solutions. For instance, in October 2025, Seceon, a leading AI-powered cybersecurity provider, announced the release of aiSIEM CGuard 2.0 in the United States. This advanced solution introduced true multi-rule correlation, dynamic cloud-aware response actions, and seamless multi-cloud protection across major platforms, enhancing automated incident response and threat resilience. The launch strengthens competition in the extended detection and response (XDR) market while accelerating adoption of cloud-native deployments among enterprises seeking unified, scalable security. In addition, the major market players are concentrating on launching cloud-based advanced threat management solutions to capitalize on the rising cloud solutions market.

Application Insights

The large enterprises segment dominated the market and accounted for the largest revenue share in 2025. Large organizations face a bigger risk from cyber threats, owing to the large number of employees processing sensitive business information and data on their workstations. This growing need for advanced, integrated XDR solutions is prompting strategic collaborations to strengthen security for complex enterprise environments. For instance, in February 2024, Vectra AI and Gigamon announced a new OEM partnership in the U.S. This collaboration integrated Gigamon's deep observability with Vectra AI's attack signal intelligence to deliver enhanced hybrid XDR, reducing cybersecurity risks for large enterprises across on-premises and multi-cloud environments. Furthermore, the increasing trend of Bring Your Own Device (BYOD) among technology companies is intensifying the threat of cyber-attacks, driving the demand for XDR solutions.

The small and medium enterprises (SMEs) segment is expected to register the fastest growth during the forecast period. With the increased adoption of mobile and web-based applications for business operations, SMEs are deploying XDR solutions to identify security gaps and mitigate cyber risks. SMEs are increasingly becoming aware of the benefits of threat detection and response systems. Moreover, the increasing number of large-scale start-ups is expected to drive the demand for extended detection and response solutions and services over the forecast period.

Regional Insights

North America accounted for the largest market share of 47.5% in 2025, driven by the region's high concentration of cybersecurity vendors, stringent regulatory requirements such as SEC disclosure rules, and widespread adoption of cloud and hybrid environments. Organizations in key sectors, including banking, healthcare, and government, are increasingly adopting XDR platforms to achieve unified visibility across endpoints, networks, cloud workloads, and identity systems. This enables faster detection and automated response to sophisticated cyber threats. According to a study by the World Economic Forum, only 48% of respondents in North America believe their organizations are adequately prepared to respond to major cyber incidents targeting critical infrastructure. This relatively strong readiness level, combined with ongoing cyber risks, highlights the continued demand for advanced threat detection and response solutions in the region.

U.S. Extended Detection And Response Market Trends

The U.S. extended detection and response industry is experiencing robust expansion amid a surge in sophisticated cyber threats and the push toward hybrid cloud infrastructures that demand seamless security across endpoints, networks, and applications. Key drivers include rising ransomware attacks on critical industries such as BFSI and healthcare, alongside regulatory pressures for stronger data protection, fostering a landscape where AI-powered analytics play a central role in proactive defense. For instance, in September 2025, Sophos, a security software and hardware company announced its recognition as a leader in the IDC MarketScape for XDR, having achieved key milestones including Secureworks integration while its endpoint protections and adaptive attack capabilities were highlighted as strong defenses. Such advancements are expected to accelerate U.S. extended detection and response adoption by raising performance benchmarks and strengthen competitive innovation across the market.

Europe Extended Detection And Response Market Trends

The extended detection and response industry in Europe is anticipated to register significant growth from 2026 to 2033, businesses are increasingly turning to unified security platforms that blend network, endpoint, and cloud defenses to tackle sophisticated cyber threats head-on, spurred by stringent regulations such as GDPR and a surge in ransomware attacks targeting critical sectors such as manufacturing and finance. Leading nations including the UK, Germany, and Rest of Europe are at the forefront, where organizations prioritize seamless threat intelligence sharing and AI-driven analytics to streamline incident response and minimize downtime, all while navigating the push for digital sovereignty to lessen reliance on non-European vendors. This evolving landscape reflects a broader commitment to proactive cybersecurity, for instance, in July 2025, Palo Alto Networks, Inc. acquired Protect AI, which strengthen XDR capabilities with specialized safeguards for machine learning systems and underscores the continent's accelerating integration of advanced technologies in defense strategies.

The extended detection and response industry in Germany accounted for the largest share in 2025, as businesses grapple with increasingly complex cyber threats, shifting toward unified platforms that streamline visibility and automate responses across endpoints, networks, and cloud environments. Key drivers include the country's stringent data protection regulations under the EU's GDPR framework, alongside the manufacturing and automotive sectors' urgent need to shield intricate supply chains from disruptions such as ransomware and supply-chain compromises. Organizations are prioritizing XDR solutions that incorporate artificial intelligence for proactive threat hunting, moving away from fragmented tools to foster quicker incident resolution and compliance.

The extended detection and response industry in the UK is poised for accelerated growth from 2026 to 2033, driven by the rising sophistication of cyber threats and the need for integrated security solutions that span endpoints, networks, cloud environments, and beyond. Organizations across sectors such as finance, healthcare, and government are increasingly adopting XDR platforms to achieve unified visibility, faster threat detection, and automated response capabilities, particularly as regulatory pressures such as GDPR continue to emphasize robust data protection. This shift is further supported by major vendors expanding their XDR offerings through strategic partnerships and managed services in the region. For instance, in November 2024, UK based Logicalis launched Cisco XDR as a Managed Service, expanding its Intelligent Security portfolio and enhancing global threat-hunting with AI automation, advanced attack-chain visibility, and verified Global MXDR partner capabilities with Cisco and Microsoft.

Asia Pacific Extended Detection And Response Market Trends

Asia Pacific extended detection and response industry is expected to register the fastest CAGR from 2026 to 2033, driven by rapid digital transformation, widespread cloud adoption, and escalating cyber threats across sectors such as banking, healthcare, and government. Organizations in the region increasingly turn to unified XDR platforms for enhanced visibility and automated threat response across endpoints, networks, and cloud environments, addressing skill shortages and the need for proactive security measures. This momentum is reinforced by key partnerships and localized deployments by leading vendors to expand XDR adoption. For instance, in June 2025, Seceon announced a strategic partnership with Aquion to introduce its aiXDR360 and Open Threat Management platforms across Australia, New Zealand and Japan, which enable enhanced cybersecurity distribution, proactive detection, and compliance capabilities for regional enterprises and government organizations.

The extended detection and response industry in China held a dominant share in 2025. Organizations are increasingly turning to integrated XDR platforms to unify threat intelligence from endpoints, networks, and cloud environments, enabling quicker identification and neutralization of advanced attacks while streamlining security operations under stringent data sovereignty regulations. This shift reflects a broader strategic priority on proactive defense, with local providers enhancing offerings through AI-driven analytics to address hybrid IT challenges and reduce response times.

The extended detection and response industry in India is expected to register the fastest CAGR from 2026 to 2033. Businesses are turning to integrated XDR platforms that unify threat intelligence from endpoints, networks, and cloud environments, enabling faster incident response and reducing the strain on overstretched security teams. This shift is fueled by stricter regulatory mandates, such as data protection laws, and a growing recognition of the need for proactive defenses against ransomware and supply chain attacks, particularly as hybrid work models expand attack surfaces.

Key Extended Detection And Response Company Insights

Key players operating in the extended detection and response industry are McAfee, LLC, Broadcom, Fortinet, Inc., and others. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In April 2025, Accenture Federal Services launched Managed Extended Detection and Response (MxDR) for government in partnership with Google Public Sector, integrating AI-powered SecOps with federal cybersecurity expertise to enhance threat detection, automated response, and overall security resilience for federal agencies. This launch is expected to drive adoption of managed XDR solutions in the U.S. federal market, setting new standards for AI-driven cybersecurity.

-

In October 2023, Cisco unveiled its XDR solution as part of the Cisco Security Cloud, delivering AI-driven, telemetry-centric threat detection and response across endpoints, networks, and cloud, enabling faster incident remediation and enhanced security for hybrid enterprise environments. This launch is expected to strengthen the extended detection and response market in U.S. by promoting integrated, AI-powered solutions and accelerating enterprise adoption.

Key Extended Detection And Response Companies:

The following are the leading companies in the extended detection and response market. These companies collectively hold the largest market share and dictate industry trends.

- Bitdefender

- Broadcom

- Check Point Software Technologies Ltd.

- CrowdStrike, Inc.

- Cybereason

- Cynet

- Elasticsearch B.V.

- Fidelis Cybersecurity

- Fortinet, Inc.

- McAfee, LLC

- Microsoft

- Palo Alto Networks

- Red Piranha Limited

- SentinelOne

- Sophos Ltd

Extended Detection And Response Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 1618.1 million

Revenue forecast in 2033

USD 5,967.0 million

Growth Rate

CAGR of 20.5% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report Coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

Bitdefender; Broadcom; Cybereason; Cynet; Fidelis Cybersecurity; McAfee, LLC; Microsoft; Palo Alto Networks; Red Piranha Limited; SentinelOne; Sophos Ltd; CrowdStrike, Inc.; Fortinet, Inc.; Check Point Software Technologies Ltd.; Elasticsearch B.V.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Deployment and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Extended Detection And Response Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the extended detection and response market report based on component, deployment, application, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Solutions

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud-based

-

On-premise

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Large Enterprises

-

SMEs

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global extended detection and response size was estimated at USD 1,336.3 million in 2025 and is expected to reach USD 1,618.1 million in 2026.

b. The global extended detection and response market is expected to grow at a compound annual growth rate of 20.5% from 2026 to 2033 to reach USD 5,967.0 million by 2033.

b. The solutions segment dominated the extended detection and response market in 2025 due to the increasing adoption of integrated security platforms that provide centralized threat detection, real-time monitoring, and automated response capabilities, helping organizations efficiently manage complex cyber threats.

b. Some key players operating in the market include Bitdefender, Broadcom, Cybereason, Cynet, Fidelis Cybersecurity, McAfee, LLC, Microsoft, Palo Alto Networks, Red Piranha Limited, SentinelOne, Sophos Ltd, CrowdStrike, Inc., Fortinet, Inc., Check Point Software Technologies Ltd., Elasticsearch B.V. and others.

b. Factors such as the rising sophistication of cyber threats, the need for unified threat detection across endpoints, networks, and cloud environments, and the demand for automated, real-time incident response play a key role in accelerating the extended detection and response market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.