- Home

- »

- Medical Devices

- »

-

External Catheters Market Size, Share, Industry Report, 2033GVR Report cover

![External Catheters Market Size, Share & Trends Report]()

External Catheters Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Self-Adhesive, Non-adhesive), By Material (Silicone, Latex), By Gender (Male, Female), By End Use (Hospitals, Home Healthcare), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-685-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

External Catheters Market Summary

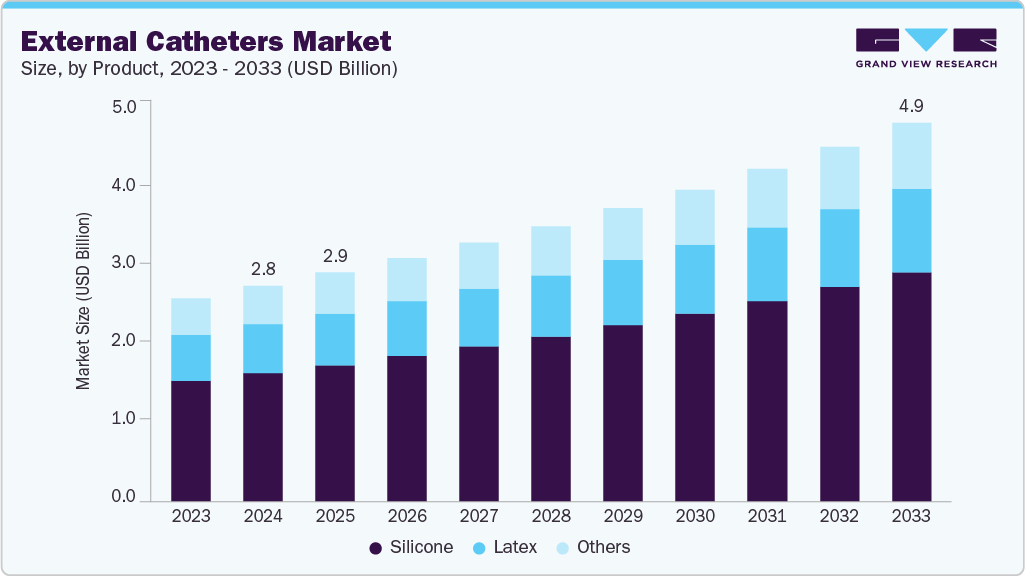

The global external catheters market size was estimated at USD 2.82 billion in 2024 and is projected to reach USD 4.95 billion by 2033, growing at a CAGR of 6.49% from 2025 to 2033. This growth is driven by the rising geriatric population and increasing prevalence of urological disorders such as urinary incontinence and prostate-related conditions.

Key Market Trends & Insights

- North America dominated the external catheters market with the largest revenue share of 48.73% in 2024.

- The external catheters market in the U.S. accounted for the largest revenue share of 82.66% in North America in 2024.

- By product, the self-adhesive segment is anticipated to grow fastest with a CAGR of 6.9% in the market over the forecast period.

- Based on gender, the female segment is anticipated to grow fastest in the market over the forecast period.

- By material, the silicone segment led the market with the largest revenue share of 59.60% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.82 Billion

- 2033 Projected Market Size: USD 4.95 Billion

- CAGR (2025-2033): 6.49%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Moreover, the growing adoption of home healthcare and technological advancements in catheter design and materials are further boosting market demand. The increasing prevalence of urological disorders is a key factor driving growth in the external catheters market. In 2025, OU Health reported that nearly 80 million women in the U.S. experience urinary incontinence (UI), affecting 1 in 2 women. Additionally, data from City of Hope in November 2024 revealed that 11% to 34% of older men experience UI, with 2% to 11% reporting daily occurrences. This substantial burden highlights a growing need for non-invasive urinary management solutions, supporting the continued expansion of the external catheters segment in the coming years.

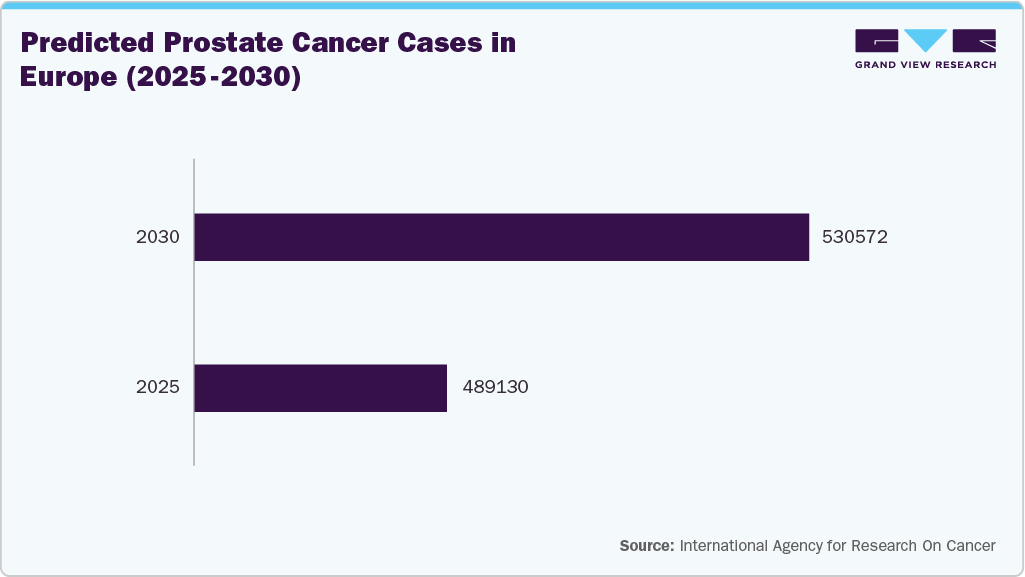

In addition to the rising burden of urinary incontinence, the increasing prevalence of cancers-such as bladder cancer, prostate cancer, and ovarian cancer-is further contributing to the growing demand for external catheters. Patients undergoing treatment for these cancers often experience urinary complications or require temporary catheterization due to surgery. External catheters, also known as condom catheters, offer a less invasive and more comfortable solution for managing urinary output in such cases, particularly for patients with limited mobility or sensitivity post-treatment. As these cancers continue to rise globally, the need for reliable, non-invasive urinary management options like external catheters is expected to increase, driving sustained market growth.

The increasing preference for external catheters or condom catheters, particularly among female patients, is anticipated to create significant growth opportunities in the market. Several companies in the industry have already reported encouraging feedback, reinforcing the market potential.

Furthermore, the availability of reimbursement for external catheters for both male and female patients is expected to support market adoption significantly. Reimbursement policies reduce the financial burden on patients and healthcare providers, encouraging wider usage and accessibility. This support is particularly crucial in long-term care and chronic condition management settings.

Product Name

Reimbursement HCPCS Code

Meatal cup female external urinary collection device

A4327

A pouch type female external collection device

A4328

Male external catheter with an integrated collection chamber that does not require the use of an additional leg bag

A4326

MALE EXTERNAL CATHETER, WITH OR WITHOUT ADHESIVE, DISPOSABLE, EACH

A4349

An external catheter that contains a barrier for attachment

A4335

Source: Centers for Medicare & Medicaid Services

In addition, companies are receiving reimbursement approvals for external catheters. For instance, in April 2023, Ur24 Technology, Inc., a privately held medical device company, achieved a significant milestone by securing Medicare reimbursement approval for its TrueClr external catheter system. Such reimbursement approvals are anticipated to support the market expansion in the coming years

Key Opinion Leaders

Company Name

KOLs

Growth Opportunities

Dan Moyer, Vice President of Sales & Marketing at RA Fischer Co.

"This is a breakthrough we've all been waiting for. We know that for many patients, the cost of the external wicks was a major hurdle. Now more will have the confidence to get started. With PureWick, we've found that patients can reduce their reliance on traditional incontinence aids and minimize other costs associated with things like unexpected ER visits. These benefits represent a proactive approach to healthcare, and we're excited to get the word out. This announcement from CMS is a big step forward in urology patient care.”

- Increased Accessibility through CMS Coverage

- Encourages early adoption by new users previously deterred by out-of-pocket costs.

David Jin, M.D., Ph.D., President and Chief Executive Officer of Avalon GloboCare.

"The GeeWhiz External Condom Catheter represents a significant advancement in managing male incontinence. Not only is this device FDA-registered and approved for reimbursement by Medicare, but it is also supported by several private insurance providers. The GeeWhiz External Condom Catheter is meticulously engineered to address the needs of men with urinary incontinence and bladder control issues. Its innovative design aims to provide enhanced comfort, security, and ease of use, ultimately improving the quality of life for users.

- Design-Driven Differentiation

- Private Insurance Support = Competitive Edge

Victoria Suarez, chief operating officer of Ur24Technology

“This is a major financial step for hospitals, nursing homes, assisted-living facilities and at-home patients who will now be reimbursed for a large portion of the cost of this system - the only catheter of its kind in the world - which delivers the highest level of safety, efficiency, comfort and dignity to patients.”

- Medicare Reimbursement Unlocks Market Expansion

Source: Grand View Research Analysis

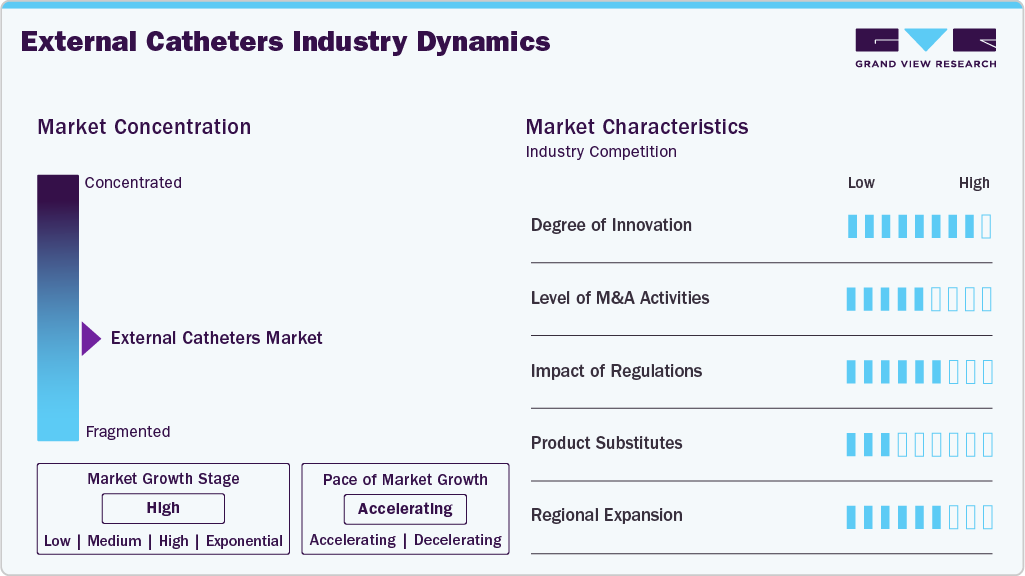

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The external catheters market is characterized by high growth owing to the rising burden of urological disorders, increasing reimbursement, regulatory approvals from authorities, and the development of novel products.

-

Industry participants and researchers are increasingly focusing on developing advanced external catheters. Several companies have launched new or improved versions of male and female external catheters, focusing on enhanced comfort, wear time, and ease of use. For instance, in January 2022, Stryker launched an improved version of its PrimaFit External Urine Management System, designed to deliver greater comfort and adaptability. Key improvements include longer, more flexible tubing to support a broader range of suction angles particularly advantageous for larger patients-a 14% increase in ultra-soft core fabric, and a newly tapered end to optimize skin protection and overall patient comfort.

-

Regulatory approvals play a vital role in driving innovation and market expansion within the external catheter industry. By overseeing the classification and authorization of these devices, regulatory bodies help ensure safety, effectiveness, and quality, ultimately improving patient access to advanced, reliable catheterization solutions.

Table 1 Regulatory Classification of External Catheters by the U.S. FDA

FDA Classification

Product Name

Brands Approved

Class I Devices

Female external urinary catheters (FEUCs)

PureWick Catheter

Class I Devices

Male external catheters

CONVEENOPTIMA

Source: U.S. FDA, Grand View Research Analysis

- External catheter companies are actively pursuing regional and global expansion to meet growing demand for innovative urinary care solutions. For example, Ur24 Technology has partnered with Miami-based DemeTECH Corp. to manufacture and distribute its TrueClr external catheter system across the U.S. and international markets. Additionally, Ur24 has secured distribution agreements with BKG Medical Supplies, Vitality Medical, Inc., and Biolabs International LLC-further enhancing its domestic presence and global market reach.

Product Insights

The self-adhesive segment dominated the external catheters market in 2024. It is also anticipated to grow fastest in the coming years. These catheters feature a skin-safe adhesive coating that allows for secure placement without needing tape or additional securing adhesives, offering patients greater comfort and ease of use. Their simple application and removal make them especially well-suited for home care and long-term care settings, where ease and efficiency are critical. The secure fit provided by the adhesive reduces the risk of leakage and accidental dislodgement. Thus, such benefits associated with self-adhesive external catheters are anticipated to propel the segment growth over the forecast period.

The non-adhesive segment is projected to experience moderate growth in the external catheters market. Designed for use with tape or specialized securement glues, these catheters are well-suited for patients with sensitive skin or adhesive sensitivities. Their adoption in clinical settings-where frequent catheter changes are required-continues to support the segment’s steady growth.

Material Insights

The silicone segment held the largest revenue share of 59.60% within the material segment in 2024. It is also anticipated to grow fastest over the forecast period. Silicone catheters are particularly beneficial for individuals with latex allergies or sensitive skin. Known for being non-allergenic, silicone’s smooth texture and flexibility enhance ease of insertion while minimizing urethral irritation. Compared to latex, silicone catheters exhibit lower encrustation and are more tissue-friendly, making them a preferred choice for long-term use. These advantages are expected to drive increased adoption of silicone catheters in the coming years.

The other segment is projected to witness significant growth over the forecast period. This growth is driven by increasing demand for alternative catheter materials that cater to specific patient needs. Innovations in biocompatible materials, improved ease of use, and enhanced patient comfort are key drivers, alongside the growing burden of urological disorders.

Gender Insights

The male segment dominated the external catheters market in 2024. This dominance is driven by the widespread availability of male external catheters or condom catheters from players like BD, B. Braun SE, Coloplast, and Hollister Incorporated. Additionally, strategic partnerships aimed at expanding distribution networks further fuel segment growth. For example, in April 2024, Medline and Consure Medical entered an exclusive agreement for Medline to distribute the QiVi MEC male external urine management device, designed to reduce the risk of incontinence-associated dermatitis (IAD) and catheter-associated urinary tract infections (CAUTI). These distribution agreements are expected to continue driving growth in the segment.

The female external catheter segment is expected to be the fastest-growing segment in the external catheters market from 2025 to 2033. This growth is driven by the increasing prevalence of urinary incontinence (UI) among women and the development of innovative products like UriCap Female for managing UI. A December 2023 study published by Springer Nature reported that 11.2% of women experience UI, significantly higher than the 5.5% prevalence in men. This rising burden of UI among females is anticipated to fuel the segment's growth in the coming years.

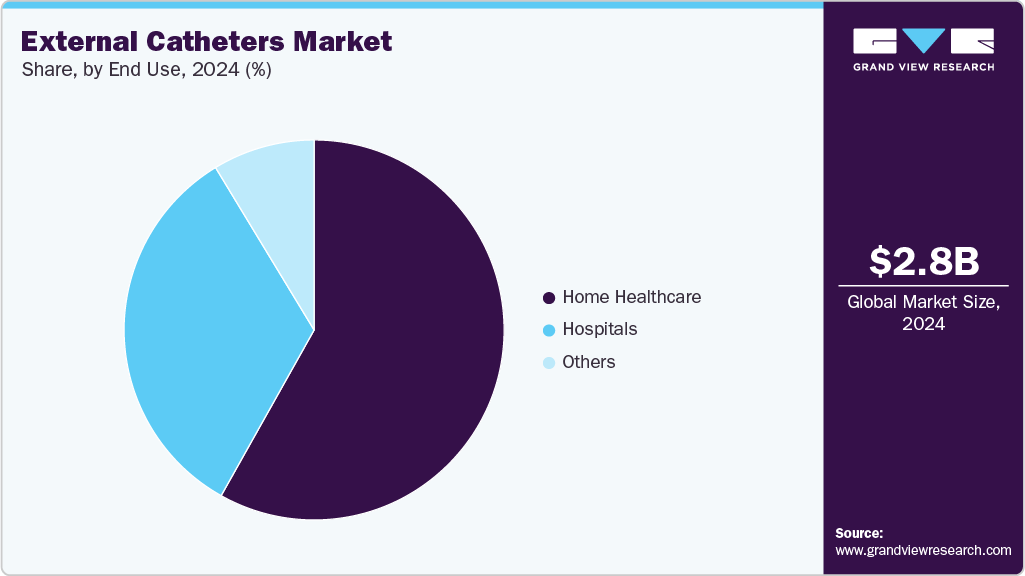

End Use Insights

The home healthcare segment led the external catheters market with the largest revenue share at 33.18% in 2024. It is also anticipated to grow fastest over the forecast period. This growth is attributed to the growing preference for at-home care among aging populations and individuals with chronic conditions. External catheters offer a non-invasive, easy-to-use solution that supports greater independence and comfort for patients managing urinary incontinence outside clinical settings. The increasing availability of reimbursable products and caregiver-friendly designs further contributes to the segment’s strong growth. As healthcare systems continue to shift toward cost-effective, home-based care models, demand for external catheters in the home healthcare setting is expected to remain robust.

The hospital segment is projected to experience significant growth in the external catheters market from 2025 to 2033. This growth is driven by the increasing adoption of external urinary management devices in hospital settings. Hospitals are shifting toward non-invasive solutions as part of infection prevention strategies and enhanced patient care protocols. Additionally, rising surgical procedures, longer hospital stays among elderly patients, and greater clinical awareness of external catheter benefits are expected to further support the segment’s expansion during the forecast period.

Regional Insights

The North America external catheters market accounted for the largest revenue share of 48.7% of total revenue in 2024. This dominance is primarily driven by the strong presence of players such as BD, Hollister Incorporated, and others, along with ongoing product innovations in the urinary care space. Additionally, rising awareness of urinary incontinence (UI) and the growing availability of treatment options continue to support market growth. Public education efforts are playing a crucial role, such as the “We Count” initiative launched by the National Association for Continence (NAFC) in May 2025, which focused on raising awareness of Stress Urinary Incontinence (SUI) nationwide.

U.S. External Catheters Market Trends

The external catheter market in the U.S. is set for strong growth, driven by key industry players and novel product launches. For instance, in November 2022, Ur24Technology Inc. launched its TrueClr catheter product line, the first external catheter system designed to actively empty the bladder.

Europe External Catheters Market Trends

The Europe external catheters market is expected to witness significant growth in the coming years, driven by a rapidly aging population and the increasing prevalence of urological disorders. According to data published by ScienceDirect in June 2025, the economic burden of urinary incontinence (UI) in the EU reached USD 80.46 billion in 2023 excluding caregiver costs with women accounting for four times the burden compared to men. This growing healthcare demand and the need for effective, non-invasive urinary management solutions are anticipated to accelerate market expansion across the region.

The external catheters market in the UK is expected to witness substantial growth in the coming years, driven by a rising aging population, increasing cases of urinary incontinence, and growing adoption of home-based care. Enhanced NHS support for non-invasive urinary solutions and awareness campaigns further boosts the market’s steady growth.

Germany external catheter market is expected to grow significantly, driven by the increasing burden of an aging population. According to Statistisches Bundesamt (Destatis), as of December 2022, the number of individuals aged 67 and over is projected to rise by approximately 4 million, reaching at least 20 million by the mid-2030s. This demographic shift, coupled with a rise in surgical procedures and hospital admissions, is fueling demand for non-invasive urinary management solutions, such as external catheters, to support patient comfort and reduce infection risks in acute and long-term care settings.

Asia Pacific External Catheters Market Trends

The external catheters market in the Asia Pacific is emerging as the fastest-growing market for external catheters, fueled by multiple key drivers. The rising incidence of urinary incontinence and other urological disorders particularly among aging populations in India, China, and Japan is increasing demand for external urinary management devices. Government-backed awareness campaigns and growing healthcare investments are accelerating adoption.

India external catheters market is projected to witness significant growth over the forecast period, driven by the country’s expanding elderly population and rising incidence of urinary disorders. According to a November 2024 publication in the Istanbul Medical Journal, the International Continence Society estimates that 10-20% of Indians experience some form of urinary incontinence (UI), with notably higher prevalence among women, particularly postmenopausal women. This growing clinical need, combined with increasing awareness and healthcare access, is expected to fuel demand for non-invasive urinary management solutions such as external catheters across hospital and home care settings.

Latin America External Catheters Market Trends

The external catheters market in Latin America is witnessing steady growth, driven by the rising prevalence of urinary disorders, increasing surgical procedures, and expanding healthcare access especially in Brazil, which is driving adoption. External catheter solutions are gaining traction as a preferred non-invasive management option, supported by demographic trends, improved healthcare infrastructure, and heightened regional awareness.

Middle East and Africa External Catheters Market Trends

The Middle East and Africa (MEA) external catheter market is witnessing significant growth, fueled by a high prevalence of urological disorders, an increasing aging population, and investment in healthcare infrastructure. Furthermore, heightened awareness of urological health further fuels demand for non-invasive urinary incontinence management devices.

The external catheter market in UAE is expected to grow substantially in the coming years, primarily driven by the increasing prevalence of urinary incontinence (UI). According to a 2023 publication in the Medicine Journal, one in five nulliparous women in the UAE is affected by UI, highlighting a significant unmet clinical need. Growing awareness, rising healthcare expenditure, and the shift toward non-invasive urinary management solutions are further expected to accelerate nationwide market expansion.

Key External Catheters Company Insights

Stryker, BD, Consure Medical, Bravida Medical, TillaCare Ltd, Coloplast Corp, Hollister Incorporated, Ur24Technology, Inc., Cardinal Health, Boehringer Laboratories, LLC, Medline Industries, LP, B. Braun SE, Ribbel International Limited, Sterimed Group., Apothecaries Sundries Mfg. Pvt. Ltd., Medilivescare Manufacturing Pvt. Ltd., Hangzhou Rollmed Co., Ltd, and Ningbo GreatCare Trading Co., Ltd. are some major players in the external catheters market. Companies are launching condom catheters and female external catheters. Furthermore, the ongoing partnerships and collaborations for distributing condom catheters and female external catheters are expected to drive the market growth.

Key External Catheters Companies:

The following are the leading companies in the external catheters market. These companies collectively hold the largest market share and dictate industry trends.

- Stryker

- BD

- Consure Medical

- Bravida Medical

- TillaCare Ltd

- Coloplast Corp

- Hollister Incorporated

- Ur24Technology, Inc.

- Cardinal Health

- Boehringer Laboratories, LLC

- Medline Industries, LP.

- B. Braun SE

- Ribbel International Limited

- Sterimed Group.

- Apothecaries Sundries Mfg. Pvt. Ltd.

- Medilivescare Manufacturing Pvt. Ltd.

- Hangzhou Rollmed Co., Ltd.

- Ningbo GreatCare Trading Co., Ltd

Recent Developments

-

In August 2024, Avalon GloboCare Corp. reported that Laboratory Services MSO, LLC (LSM) has officially commenced manufacturing of the GeeWhiz External Condom Catheter. This development marks a key milestone in scaling production and meeting the growing demand for advanced, reimbursable solutions in the male urinary external catheter segment.

-

In April 2024, Medline and Consure Medical entered an exclusive agreement for Medline to distribute the QiVi MEC male external urine management device, designed to reduce the risk of incontinence-associated dermatitis (IAD) and catheter-associated urinary tract infections (CAUTI).

-

In January 2023, Ur24Technology Inc. launched a latex-free external product line, the TrueClr catheter, designed to actively drain bladders in children and adults.

External Catheters Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.99 billion

Revenue forecast in 2033

USD 4.95 billion

Growth rate

CAGR of 6.49% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, gender, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE and Kuwait

Key companies profiled

Stryker; BD; Consure Medical; Bravida Medical; TillaCare Ltd; Coloplast Corp; Hollister Incorporated; Ur24Technology, Inc.; Cardinal Health; Boehringer Laboratories, LLC; Medline Industries, LP.; B. Braun SE; Ribbel International Limited; Sterimed Group.; Apothecaries Sundries Mfg. Pvt. Ltd.; Medilivescare Manufacturing Pvt. Ltd.; Hangzhou Rollmed Co., Ltd.; Ningbo GreatCare Trading Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global External Catheters Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global external catheters market report based on product, material, gender, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Self-Adhesive

-

Non-adhesive

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Silicone

-

Latex

-

Others

-

-

Gender Outlook (Revenue, USD Million, 2021 - 2033)

-

Male

-

Female

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Home Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global external catheter market size was estimated at USD 2.82 billion in 2024 and is expected to reach USD 2.99 billion in 2025.

b. The global external catheter market is expected to grow at a compound annual growth rate of 6.49% from 2025 to 2033 to reach USD 4.95 billion by 2033.

b. North America dominated the external catheter market with a share of 48.7% in 2024. This dominance is primarily driven by the strong presence of players such as BD, Hollister Incorporated, and others, along with ongoing product innovations in the urinary care space.

b. Some of the players operating in the external catheter market are Stryker, BD, Consure Medical, Bravida Medical, TillaCare Ltd, Coloplast Corp, Hollister Incorporated, Ur24Technology, Inc., Cardinal Health, Boehringer Laboratories, LLC, Medline Industries, LP, B. Braun SE, Ribbel International Limited, Sterimed Group., Apothecaries Sundries Mfg. Pvt. Ltd., Medilivescare Manufacturing Pvt. Ltd., Hangzhou Rollmed Co., Ltd, and Ningbo GreatCare Trading Co., Ltd.

b. Key factors that are driving the external catheter market growth include the rising geriatric population and increasing prevalence of urological disorders such as urinary incontinence and prostate-related conditions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.