- Home

- »

- Medical Devices

- »

-

External Fixators Market Size, Share, Industry Report, 2030GVR Report cover

![External Fixators Market Size, Share & Trends Report]()

External Fixators Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Manual Fixators, Computer-Aided Fixators), By Fixation Type (Circular, Hybrid), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-380-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

External Fixators Market Size & Trends

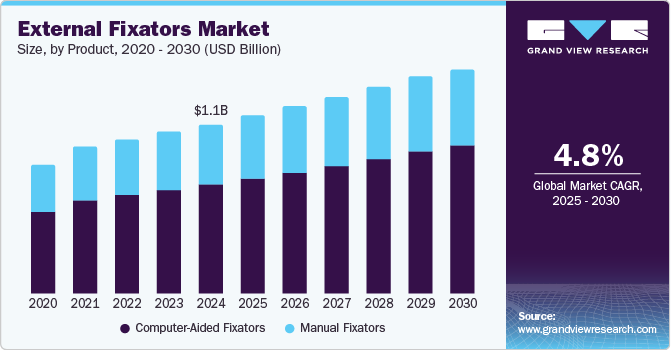

The global external fixators market size was estimated at USD 1.05 billion in 2024 and is projected to grow at a CAGR of 4.8% from 2025 to 2030. The increasing frequency of road accidents, sports-related injuries, and age-related fractures among the aging population has significantly fueled demand for external fixators as an essential treatment option. With chronic diseases affecting a substantial portion of the population, approximately 50% of adults in Europe report having at least one chronic condition, including cardiovascular diseases and diabetes. As reported by the European Chronic Disease Alliance, the need for effective orthopedic solutions continues to escalate.

Technological advancements also play a pivotal role in propelling the external fixators market forward. For instance, in May 2024, Metric Medical Devices, Inc. announced FDA clearance and U.S. market availability of its LINK Percutaneous Dynamic Compression Bone Fixator, designed for minimally invasive bone fracture fixation. Innovations in advanced materials, biomechanical designs, and smart fixation technologies enhance patient outcomes, accelerate recovery, and increase the appeal of external fixation procedures to healthcare providers and patients.

The Centers for Medicare & Medicaid Services (CMS) in the U.S. updated its reimbursement policies in late 2023, providing comprehensive coverage for external fixation devices used in trauma care. This change is expected to increase patient access and encourage healthcare providers to incorporate these devices into treatment protocols. Similarly, France’s social security system revised its reimbursement framework in January 2024, ensuring better coverage for innovative orthopedic devices, including external fixators.

Moreover, healthcare infrastructure development plays a critical role in increasing market accessibility, especially in emerging economies. The Australian government announced a funding boost in 2024 to enhance orthopedic services in rural areas, improving access to external fixation treatments for patients with traumatic injuries. As healthcare facilities expand and modernize globally, the external fixators market will likely continue its robust growth trajectory, driven by increasing demand for advanced orthopedic solutions that improve patient care.

Product Insights

Computer-aided fixators dominated the market and accounted for a share of 64.6% in 2024, driven by advanced technological features that improve precision and efficiency in orthopedic surgeries. These devices minimize fluoroscopy use, reduce surgical complications, enable real-time fracture healing monitoring, and align with the trend toward patient-centric treatments, enhancing their appeal to healthcare providers in clinical settings.

Manual fixators are expected to register significant growth over the forecast period, fueled by their simplicity, accessibility, and cost-effectiveness. Their broad availability in healthcare settings allows for immediate trauma response, while their straightforward design ensures ease of use for surgeons. They enhance control through tactile feedback and contribute to persistent demand in orthopedic practices worldwide.

Fixation Type Insights

Circular fixation led the market with a revenue share of 38.9% in 2024, attributed to its minimally invasive nature, modularity, and biomechanical properties. It offers superior stability for complex fractures, enables precise adjustments, and promotes healing while reducing soft tissue damage, resulting in increased popularity among orthopedic surgeons and healthcare facilities for various applications.

Hybrid and other fixation types are expected to register the fastest CAGR of 5.5% over the forecast period. Hybrid fixators merge the advantages of both circular and traditional external fixators, offering enhanced stability and versatility for applications like limb lengthening and deformity correction. Their adaptability to various surgical needs and improvements in design and materials contribute to better patient outcomes and increased adoption among orthopedic surgeons.

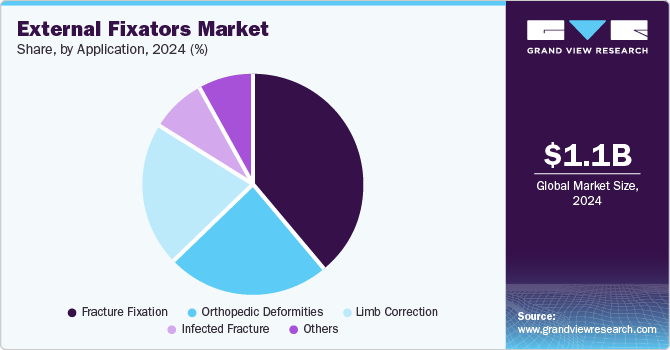

Application Insights

Fracture fixation led the market and accounted for a share of 39.0% in 2024, aided by the rising incidence of traumatic injuries from road accidents and sports. External fixators are vital for stabilizing fractures in emergencies, particularly for complex cases with soft tissue compromise. Furthermore, the aging population’s increased fracture susceptibility amplifies the demand for effective fracture management solutions.

Limb correction is anticipated to witness the fastest growth, with a CAGR of 5.6% over the forecast period. External fixators offer effective solutions for correcting congenital and acquired deformities, utilizing distraction osteogenesis for gradual adjustments. The increasing prevalence of conditions such as osteogenesis imperfecta, especially in pediatric populations, reinforces the demand for these devices, which facilitate limb lengthening with minimal surgical intervention.

End Use Insights

Hospitals & clinics held the largest revenue share of 48.5% in 2024. Hospitals with advanced medical infrastructure and skilled professionals are primary venues for external fixation treatments. The rising incidence of road accidents and fractures demands immediate stabilization, while the emphasis on enhancing patient outcomes and adopting innovative fixation technologies drives the growing demand for external fixators in these facilities.

Orthopedic and trauma centers are expected to grow at the fastest rate of 5.2% over the forecast period. These centers are equipped with advanced technologies and skilled personnel, ensuring comprehensive trauma care essential for effective external fixation treatments. The rising incidence of road accidents and sports injuries requires prompt, specialized interventions, while a commitment to patient-centric care enhances the adoption of external fixators in these facilities.

Regional Insights

North America external fixators market dominated the global market with a revenue share of 45.9% in 2024. The regional market features advanced healthcare infrastructure, a high prevalence of trauma cases, and rising road accidents. Significant investments in medical technology and innovation have fostered the development of advanced external fixation devices. Moreover, favorable reimbursement policies and an aging population increase demand for these products.

U.S. External Fixators Market Trends

The external fixators market in the U.S. dominated North America with the largest revenue share in 2024. In the U.S., approximately 60% of adults are affected by chronic diseases, including diabetes, depression, and cardiovascular diseases. This growing prevalence and the country’s well-established network of trauma centers and orthopedic specialists leveraging advanced external fixation technologies drive demand. Significant investments in research and development by leading medical device companies and favorable reimbursement policies support healthcare providers in adopting these innovations.

Europe External Fixators Market Trends

The Europe external fixators market held a substantial market share in 2024. The rising incidence of orthopedic injuries and an aging population prone to fractures are driving demand for effective external fixation solutions. Advanced healthcare systems, regulatory support for new technologies, improved reimbursement frameworks, and significant investments in research and development by key players collectively enhance market access for European healthcare providers.

The external fixators market in Germany is expected to grow lucratively over the forecast period. Germany boasts numerous specialized orthopedic centers employing advanced external fixation devices for trauma management and limb correction. The rising incidence of road traffic accidents and sports injuries fuels the demand for effective fracture stabilization solutions. Additionally, a strong emphasis on research and innovation enhances treatment outcomes, attracting domestic and international patients.

Asia Pacific External Fixators Market Trends

Asia Pacific external fixators market is expected to register the fastest CAGR of 6.3% over the forecast period. Developing countries in the region are enhancing healthcare infrastructure and improving access to advanced medical technologies such as external fixators. Increased road traffic accidents and sports injuries drive demand for effective fracture management solutions while growing awareness among patients and healthcare professionals supports market expansion.

The external fixators market in Australia is expected to grow at the fastest rate of 7.5% in the Asia Pacific market over the forecast period, driven by its robust healthcare system and high standards in orthopedic care. With a growing aging population needing effective fracture stabilization and limb correction solutions, the country’s emphasis on innovative medical technologies broadens treatment options. Increased awareness of advanced orthopedic procedures among healthcare providers and favorable reimbursement policies enhance access to external fixation devices in hospitals and clinics.

Key External Fixators Company Insights

Some key companies operating in the market include Johnson & Johnson Services, Inc.; Stryker; Zimmer Biomet; Smith+Nephew; and Orthofix Medical Inc., among others. Strategic initiatives encompass mergers, acquisitions, and partnerships to strengthen market presence, investments in advanced technologies, and product portfolio expansion to meet rising demand in trauma care and orthopedic surgeries.

-

Stryker specializes in developing and manufacturing a comprehensive range of external fixation devices, delivering innovative solutions for trauma and orthopedic surgeries to enhance stability, surgical outcomes, and patient recovery during fracture healing.

-

Smith+Nephew provides diverse external fixation systems tailored for effective fracture stabilization and limb reconstruction. Their advanced devices utilize modern materials and engineering to support minimally invasive procedures and optimize healing for orthopedic trauma care.

Key External Fixators Companies:

The following are the leading companies in the external fixators market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson & Johnson Services, Inc.

- Stryker

- Zimmer Biomet

- Smith+Nephew

- Orthofix Medical Inc.

- Ortho-SUV Ltd.

- Response Ortho

- Tasarimmed Tıbbi Mamuller San. Tic A.Ş.

- Auxein

- Acumed LLC, a Colson Medical | Marmon | Berkshire Hathaway Company

Recent Developments

-

In September 2024, Paragon 28 launched the R3FLEX Stabilization System, which enables precise tension adjustment for ankle syndesmotic injury repair, enhances surgical outcomes, and addresses complications associated with such fractures.

-

In July 2024, Stryker finalized its acquisition of Artelon, enhancing its soft tissue fixation offerings and bolstering its competitive position in foot and ankle and sports medicine equipment and solutions.

-

In February 2024, Auxein Medical showcased its latest advanced orthopedic implants and innovations at Arab Health, enhancing its global presence and strengthening connections with surgeons and businesses in the UAE market.

External Fixators Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.10 billion

Revenue forecast in 2030

USD 1.39 billion

Growth rate

CAGR of 4.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, fixation type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Johnson & Johnson Services, Inc.; Stryker; Zimmer Biomet; Smith+Nephew; Orthofix Medical Inc.; Ortho-SUV Ltd.; Response Ortho; Tasarimmed Tıbbi Mamuller San. Tic A.Ş.; Auxein; Acumed LLC, a Colson Medical | Marmon | Berkshire Hathaway Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global External Fixators Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global external fixators market report based on product, fixation type, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual Fixators

-

Computer-Aided Fixators

-

-

Fixation Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Unilateral and Bilateral

-

Circular

-

Hybrid and Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedic Deformities

-

Fracture Fixation

-

Infected Fracture

-

Limb CorrectionOthers

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Ambulatory Surgery Centers

-

Orthopedic and Trauma Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global external fixators market size was estimated at USD 1.05 billion in 2024 and is expected to reach USD 1.10 billion in 2025.

b. The global external fixators market is expected to grow at a compound annual growth rate of 4.8% from 2025 to 2030 to reach USD 1.39 billion by 2030.

b. The computer-aided product segment held the largest revenue share of over 64.6% in 2024 in the external fixators market.

b. Some key players operating in the external fixators market include Johnson & Johnson Services, Inc. (DePuy Synthes), Stryker, Zimmer Biomet, Smith+Nephew, Orthofix Medical, Inc., Ortho-SUV Ltd., Response Ortho, Tasarimmed Tıbbi Mamuller San. Tic A.Ş., Auxein Medical, Acumed.

b. Key factors that are driving the external fixators market growth include the growing burden of chronic diseases, demand for surgical innovations, increasing number of road accidents, and availability of well-established healthcare infrastructure & skilled professionals in the developed nations.

b. The circular fixation type segment held the largest revenue share of over 38.9% in 2024.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.