- Home

- »

- Medical Devices

- »

-

External Pacemakers Market Size & Share Report, 2030GVR Report cover

![External Pacemakers Market Size, Share & Trends Report]()

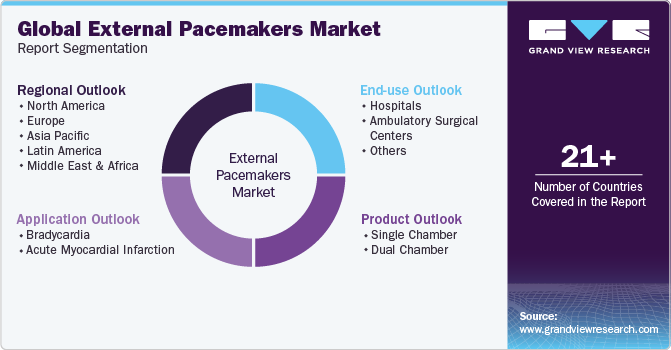

External Pacemakers Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Single Chamber, Dual Chamber), By Application (Bradycardia, Acute Myocardial Infarction), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-139-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

External Pacemakers Market Size & Trends

The global external pacemakers market size was estimated at USD 1.67 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 3.4% from 2023 to 2030. The growing prevalence of cardiovascular disease (CVDs), the increasing cost of cardiac disease management, favorable government initiatives and policies, and the introduction of new and enhanced technological products are the growth driving factors for this market. The rising burden of CVDs, such as arrhythmia and atrial fibrillation, is one of the key factors for the market's growth. According to the World Health Organization (WHO), CVDs are the primary cause of global mortality, claiming an estimated 17.9 million lives annually.

Cardiovascular diseases have become a prominent global public health issue, primarily propelled by a range of risk factors, including a sedentary lifestyle, elevated blood pressure, stress, and diabetes. For instance, according to the American Heart Association, there are around 3 million people globally with pacemakers, and each year, 600,000 pacemakers are implanted. The sharp increase in CVD-related deaths underscores the urgent need for effective preventive, diagnostic, and treatment measures.

The increasing geriatric population globally and technological advancements in pacemakers are key factors projected to impact the market's growth significantly. The older population, particularly those aged between 65 and above, is more vulnerable to chronic diseases such as CVDs, which often require the placement of external pacemakers to maintain an adequate heart rate. In November 2022, the article" Senior Population Statistics: A Portrait of Aging Americans" reported that around 54.1 million (16.3%) individuals in the U.S. are aged 65 or above. Thus, the growing geriatric population contributes to the increasing demand for external pacemakers.

In addition, the market's growth was also driven by R&D organizations and various companies developing new products. For instance, in June 2021, researchers at George Washington and Northwestern Universities (GW) developed the first-ever transient pacemaker that can disappear after it is no longer needed. The rising investment by government and private organizations to enhance the quality of products increases the demand for external pacemakers.

The COVID-19 pandemic has impacted all industries, including the market for external pacemaker devices. Market players have experienced huge losses in their pacemaker segments due to the cancellation or postponement of CVD procedures. For instance, in July 2020, according to the National Center for Biotechnology Information, around 73% reduction was observed in the implantation of pacemaker devices during COVID-19.

Partnerships and strategic collaborations enable market players to extend their reach to new geographical regions and enter untapped market segments. Through collaborative efforts and continuous innovation, these companies drive the widespread adoption of cutting-edge technologies and enhance the external pacemaker industry. For instance, in January 2021, Boston Scientific Corporation announced the acquisition of Preventice Solutions, Inc. This acquisition delivered Boston Scientific Corporation a foothold in the high-growth ambulatory electrocardiography space, such as the implantable cardiac monitor market.

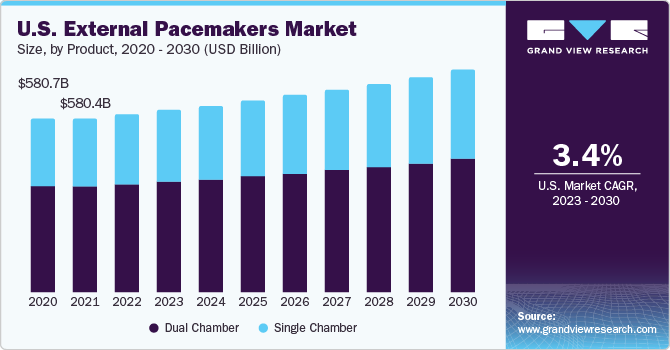

Product Insights

Based on product, the market is segmented into dual and single chambers. The dual chamber segment held the largest market share of 59.32% in 2022. The rising demand for such devices for treating atrial fibrillation and cardiac arrhythmias drives market growth. According to the CDC statistics, more than 454,000 individuals are hospitalized with atrial fibrillation in the U.S. annually. Similarly, it is anticipated that 12.1 million people in the U.S. are projected to have atrial fibrillation by 2030. Thus, the market's growth is driven by a rising prevalence of CVDs.

The single chamber segment is projected to grow at the fastest CAGR during the forecast period. Single chamber pacemakers are non-invasive, and postsurgical complications are less risky. In addition, these devices are beneficial for patients to record and track daily heart activities. Furthermore, these external pacemakers are the fastest available devices for synchronizing cardiac rhythm, which is expected to fuel segment growth. The presence of key market players such as Pacetronix, Oscor Inc., and Medtronic dealing in the single chamber external pacemakers' is also projected to influence segment growth positively.

Application Insights

Based on application, the bradycardia segment held the largest market share at 85.83% and is projected to grow at the fastest CAGR. Factors such as sedentary lifestyle, smoking, and excessive alcohol consumption contribute to the prevalence of cardiac arrhythmia (tachycardia, bradycardia). According to a report titled "Bradycardia and Heart Rate Fluctuation Are Associated with a Prolonged Intensive Care Unit Stay in Patients with Severe COVID-19," 72.1% of the patients admitted to the ICU between April and June 2021 at Chiang Mai University Hospital had bradycardia. Thus, the growing prevalence of cardiac arrhythmia has fueled the demand for technologically advanced external pacemakers during the forecast period.

The acute myocardial infarction segment is expected to show promising growth during the forecast period. The day-by-day prevalence of acute myocardial infarction is increasing due to lack of exercise, unhealthy diet, obesity, and lifestyle disorders. These benefits drive their increasing adoption and contribute to their market growth. According to the American Heart Association, approximately every 40 seconds, someone in the U.S. is expected to have a myocardial infarction. The rise in the incidence of heart attacks led to an increase in the market's growth.

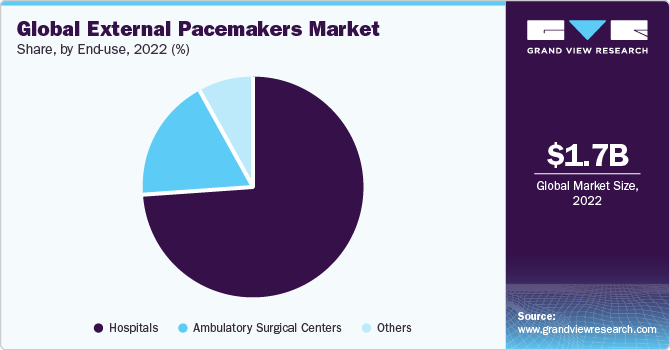

End-use Insights

The market is segmented into hospitals, ambulatory surgical centers, and others based on end-use, and the hospitals segment accounted for the largest market share of 73.93% in 2022. The growing elderly population and the increasing prevalence of CVD drive the market. This surge in demand is expected to be the primary driver fueling the expansion of the external pacemaker sector. According to the American Heart Association, global CVD-related deaths were estimated to be 19.1 million in 2022. The age-adjusted mortality rate was 239.8 per 100,000 people, and the age-adjusted prevalence was 7354.1 per 100,000.

Although hospitals are vital in specialized medical care for diagnosing and treating CVDs, the ambulatory surgical center segment is anticipated to show significant growth during the forecast period due to its ease of treatment and market reach, specifically in rural areas. Furthermore, the need to reduce surgical and post-surgical expenses and the rising incidences of CVDs are projected to impact the segment's growth positively.

Regional Insights

North America accounted for the largest market share of 41% in 2022 due to several factors, including an increasing prevalence of heart diseases, a growing elderly population, the strong presence of industry players in the region, and a well-developed healthcare infrastructure. It heightened awareness among the public and healthcare stakeholders regarding available technologies. According to the CDC, in 2021, approximately 695,000 individuals in the U.S. died from heart disease (1 in every 5 deaths). In addition, the rising number of heart-related disorders and technological advancements are driving the market in the region.

The Asia Pacific region is expected to experience substantial market growth in the market due to several contributing factors such as sedentary lifestyles, unhealthy dietary habits, and an aging population leading to an increased incidence of CVD, creating a higher demand for effective treatment options such as external pacemakers. According to the “2022 Report on Global Burden of Cardiovascular Diseases and Risk Published,” the high-income Asia Pacific region recorded 76.6 deaths per 100,000 individuals, with the lowest age-standardized total CVD mortality rate. In comparison, Central Asia registered 516.9 deaths per 100,000 people, with an age-standardized total CVD mortality rate. This high prevalence of CVD leads to an increasing number of cardiology intervention procedures in the region, consequently driving the market growth.

Key Companies & Market Share Insights

Key players are introducing advanced products at affordable prices to increase their market share and implementing strategic initiatives, such as acquisitions, mergers, product approval, and collaborations, to maximize their market dominance. For instance, in January 2022, Medtronic received regulatory approval and launched Japan's Micra AV Transcatheter Pacing System. It is the first version approved in Japan for patients requiring single-chamber pacing. Some prominent players in the global external pacemakers market include:

-

Boston Scientific Corporation

-

Medtronic

-

Pacetronix.com

-

OSYPKA MEDICAL

-

OSCOR Inc.

-

Fluke

-

Abbott

-

Avery Biomedical Devices, Inc.

-

BIOTRONIK

-

Lepu Medical Technology (Beijing) Co., Ltd.

External Pacemakers Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.72 billion

Revenue forecast in 2030

USD 2.17 billion

Growth rate

CAGR of 3.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Boston Scientific Corporation; Medtronic; Pacetronix.com; OSYPKA MEDICAL; OSCOR Inc.; Fluke; Abbott; Avery Biomedical Devices; Inc.; BIOTRONIK; Lepu Medical Technology(Beijing)Co.,Ltd

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global External Pacemakers Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global external pacemakers market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Chamber

-

Dual Chamber

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bradycardia

-

Acute Myocardial Infarction

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global external pacemaker market size was estimated at USD 1.67 billion in 2022 and is expected to reach USD 1.72 billion by 2023.

b. The global external pacemaker market is expected to grow at a compound annual growth rate of 3.4% from 2023 to 2030 to reach USD 2.17 billion by 2030.

b. North America emerged as the leading market region in 2022, holding the largest share of 41.27%. The region's advanced medical facilities, skilled healthcare professionals, and robust healthcare infrastructure contribute to the market growth in the region.

b. Key market players include Boston Scientific Corporation, Medtronic, Pacetronix.com, OSYPKA MEDICAL, OSCOR Inc., Fluke, Abbott, Avery Biomedical Devices, Inc., BIOTRONIK, and Lepu Medical Technology (Beijing) Co., Ltd.

b. The demand for external pacemakers is rising due to an increasing incidence of bradycardias associated with cardiovascular diseases (CVDs), such as sinus node infarction, complete heart block, and myocardial infarction.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.