- Home

- »

- Biotechnology

- »

-

Extractable And Leachable Testing Services Market, 2033GVR Report cover

![Extractable And Leachable Testing Services Market Size, Share & Trends Report]()

Extractable And Leachable Testing Services Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (Container Closure Systems, Drug Delivery Systems), By Application (Parenteral Drug Products, Ophthalmic), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-112-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Extractable And Leachable Testing Services Market Summary

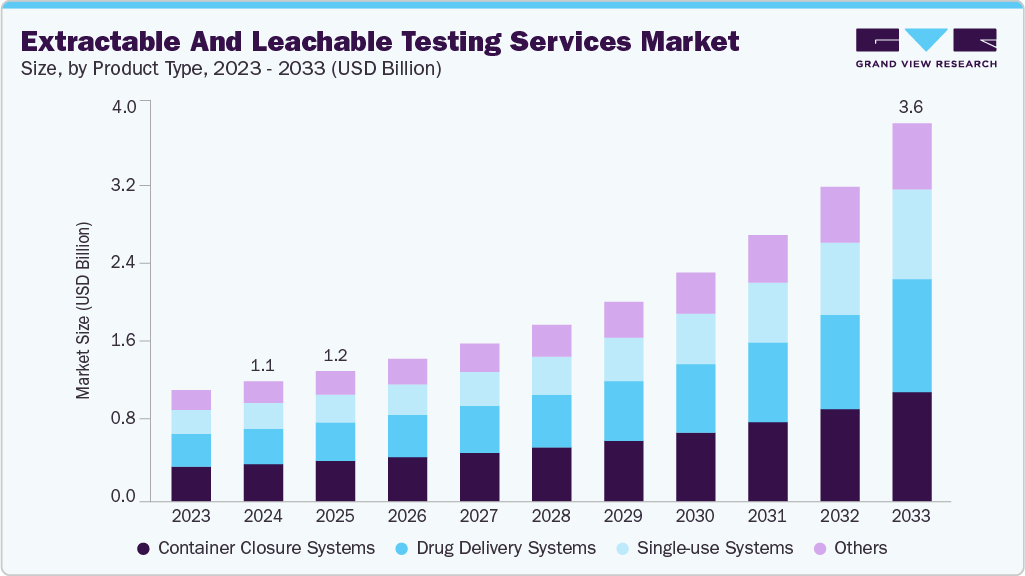

The global extractable and leachable testing services market size was estimated at USD 1.13 billion in 2024 and is expected to reach USD 3.57 billion by 2033, growing at a CAGR of 14.3% from 2025 to 2033. The expanding pharmaceutical and biotechnology sectors across the world are fueling the demand for E&L testing services.

Key Market Trends & Insights

- The North America extractable and leachable testing servicesmarket held the largest share of 37.73% of the global market in 2024.

- The extractable and leachable testing services industry in the U.S. is expected to grow significantly over the forecast period.

- By product type, the container closure systems segment held the largest market share of 31.17% in 2024.

- By application, the orally inhaled and nasal drug products (OINDP) segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.13 Billion

- 2033 Projected Market Size: USD 3.57 Billion

- CAGR (2025-2033): 14.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Moreover, increasing regulatory scrutiny on the quality of healthcare products, the rise of complex drug formulations, such as biologics and combination products, and rising emphasis on product safety are further anticipated to propel the market growth. The COVID-19 pandemic had positively impacted extractable and leachable testing services. With the heightened focus on healthcare and pharmaceuticals during the pandemic, there has been an increased awareness of the importance of rigorous testing to ensure the safety and efficacy of medical products. As a result, extractable and leachable testing services have gained more recognition and investment, leading to advancements in testing methodologies, equipment, and expertise. The pharmaceutical and medical device industries have been able to accelerate their research and development efforts to deliver innovative products while maintaining a strong commitment to safety and compliance. According to a WHO article, nearly 16 billion vaccine doses worth USD 141 billion were supplied in 2021, nearly thrice the market volume of 2019 (5.8 billion) and nearly three-and-a-half times the market value of 2019 (USD 38 billion). Thus, the increased demand for vaccines during the pandemic boosted the demand for extractable and leachable testing services.

The pharmaceutical and biotechnology industry has been rapidly growing in recent years due to advancements in technology, increased demand for novel drugs, and a growing incidence & prevalence of chronic diseases. This has also led to increased R&D activities for the creation of novel therapeutics. For instance, in 2022, the U.S. FDA’s Center for Drug Evaluation and Research (CDER) approved 37 new drugs, either as new molecular entities or as new therapeutic biological products. Thus, high product development and commercialization by pharmaceutical industries created a higher demand for extractable and leachable testing services.

Furthermore, patient safety is the top priority for medical devices and pharmaceutical industries and they are making significant efforts to safeguard the final product. Pharmaceutical companies are investing largely to develop robust methods for leachable and extractable testing. According to Merck KGaA, leachable and extractable are compounds that can migrate from the container to the formulation and can produce serious adverse effects such as toxicity and adverse drug reactions. To mitigate this, the company developed its pre-qualified secondary Certified Reference Materials (CRMs) and ready-to-use CRM mixtures. This reference material is certified ISO 17025 and 17034. This guidance material from the company can act as SOP for analytical laboratories providing extractable & leachable testing services. Thereby increasing the demand for extractable and leachable testing services over the forecast period.

Moreover, the presence of regulatory authorities, such as the FDA and the U.S. Pharmacopeia (USP), is pushing manufacturers to test their products for E&L substances. In addition, the rising use of single-use technologies for scaling up the process and various strategic initiatives undertaken by market players will likely create lucrative growth opportunities for the market. For instance, in May 2022, Pacific BioLabs launched In Vitro Services to support the biopharma, pharmaceuticals, and medical device industries. This service aided in the expansion of the company’s testing capabilities in analytical/bioanalytical and in vivo departments. Hence, the above-mentioned factors support the country’s market.

Market Concentration & Characteristics

E&L testing is being driven hard by analytical innovation: high-resolution LC-MS/HRMS workflows, advanced GC-MS, ICP-MS for elemental impurities, and better sample-prep automations are pushing detection limits down and turning previously “unknowns” into identifiable, reportable signals, which in turn expands the types of studies sponsors need and the value labs can charge for. These technical gains are also being paired with informatics (automated data pipelines, spectral libraries, AET-based decision tools) so labs can deliver faster, more defensible risk assessments to clients.

Consolidation and partnering across testing, CRO and analytical-instrument spaces are reshaping capacity and capability: large analytical service providers and CROs are buying specialized labs or forming alliances to rapidly add E&L expertise (and client pipelines), while strategic buyers in life sciences continue to acquire upstream/downstream capabilities to offer end-to-end services, a dynamic that raises scale, compresses lead times, and concentrates pricing power in the mid-to-large lab players.

FDA guidance and the recent momentum toward an ICH Q3E harmonized guideline are increasing sponsor expectations for formal, documented E&L risk assessments across drugs, biologics and devices, which drives more studies, more repeat testing, and higher technical bar for labs.

Service portfolios are broadening as labs add complementary offerings, from volatile/non-volatile screening and elemental impurity panels to PFAS screening, extractables profile libraries, and tox-interpretation packages, enabling single-vendor solutions for upstream material selection through final product release.

North America and Europe remain largest markets thanks to mature pharma and tight regulation, but APAC is the fastest-growing region as local manufacturing ramps up and sponsors increasingly outsource to regional specialists; that drives investments in local lab capacity, regional compliance knowledge and supply-chain E&L programs, meaning global labs must either partner locally or scale footprints to capture growth.

Product Type Insights

The container closure systems segment held the largest revenue share of 31.17% in 2024 of the market. The container closure systems (CCS) is dominating due to their capability to offer long-term stability in formulations. CCS includes various package and delivery systems, which can leach substances over time, making extractable and leachable (E & L) testing crucial. Ensuring adequate container closure systems is vital to uphold the safety, sterility, and overall quality of drugs. Several instances have been noted where the safety of pharmaceutical products was compromised or harmful contaminants formed as a result of impurities transferring from container closure systems to the drugs. Regulatory agencies have released guidelines to govern container closure systems and packaging materials in the pharmaceutical industry. For instance, the Food and Drug Administration (FDA) provided guidance in the Code of Federal Regulations Title 21, which emphasizes that container closure systems must safeguard drug products from potential external factors that could lead to contamination or degradation during storage and use.

The single-use systems segment is expected to grow at the fastest growth rate during the forecast period. The use of single-use components and systems in commercial and clinical biopharmaceutical manufacturing has witnessed a substantial rise. These components are typically composed of polymers or plastics. Single-use systems offer numerous advantages, such as enhanced speed, flexibility, and operational efficiency compared to reusable components. However, a significant concern associated with these single-use systems is the potential leaching of compounds from the polymeric materials, which can negatively affect the quality of pharmaceutical products or the efficiency of the manufacturing process. Consequently, the importance of extractable and leachable testing has grown significantly to address this issue for single-use systems.

Application Insights

The orally inhaled and nasal drug products (OINDP) segment led the market with the largest revenue share of 42.07% in 2024. This dominance can be attributed to the growing service launches for this high-risk category of drugs and the presence of guidelines and best practices for the E&L testing of OINDP. Orally inhaled and nasal drug products include nasal sprays, metered dose inhalers, dry powder inhalers, nebulizers, and inhalers. These products are widely used for systemic delivery of various therapeutics. Thus, increasing the demand for extractable and leachable testing services for this segment over the forecast period.

The parenteral drug products segment is projected to witness the fastest growth over the forecast period. Parenteral drugs are administered into the muscles, veins, or specialized tissues, such as the spinal cord or under the skin. The extractable & leachable testing of parenteral drug products of injectable ensure efficacy and safety of parenteral drug products. Thus companies, authorities, and regulatory bodies emphasize extractable and leachable testing for parenteral drugs. They are undertaking initiatives to enhance awareness about E&L testing and its applications for parenteral drug products. For instance, in August 2021, the Parenteral Drug Association presented a webinar series for extractable and leachable parenteral applications. This webinar covered various topics, including analytical E/L methodologies and large-volume parenteral. Moreover, in October 2021, the Parenteral and Ophthalmic Drug Products (PODP) L&E Working Group of the Product Quality Research Institute (PQRI) presented recommendations for E&Ls in parenteral drug products (PDP) to the US Food and Drug Administration (FDA). Thus, extractable and leachable testing is essential for parenteral drug products to improve the quality of drugs.

Regional Insights

North America extractable and leachable testing services marketheld the largest market share of 37.73% in 2024. The significant share of this region in the market is primarily due to the increasing adoption of novel technologies and biopharmaceuticals for the analysis and treatment of clinical conditions. Moreover, a large number of market players in the region are actively involved in continuously improving advanced tools for biopharmaceutical research. In addition, government funding for research has played a crucial role in boosting the extractable and leachable testing services market. For instance, in June 2021, the U.S. Department of Agriculture’s (USDA) National Institute of Food and Agriculture (NIFA) invested USD 5.4 million in research related to bioengineering, bioprocessing, biofuels, and other biobased products, further supporting the growth of the industry.

U.S Extractable And Leachable Testing Services Market Trends

The U.S. is leading largely due to the combination of very tight regulatory enforcement (FDA, USP, etc.), growth in biologics, complex drug delivery systems (especially single-use systems, inhalables, pre-filled devices), and high demand for speed & risk mitigation in product pipelines. Sponsors here don’t want surprises late in development, so earlier and more comprehensive E&L studies are becoming standard, especially for advanced formulations. The presence of many CROs/labs with high analytical capabilities also means capability is increasing, which in turn raises expectations.

Europe Extractable And Leachable Testing Services Market Trends

In Europe, regulators such as EMA & national authorities are sharpening guidance and oversight, especially for devices, combination products, and materials in contact with drugs; harmonization is creeping in via ICH, but diverse national requirements means companies want to ensure compliance across multiple markets.

UK extractable and leachable testing services market is witnessing growth due toregulatory expectations post-Brexit have remained largely aligned with EMA standards but with increasing emphasis on local compliance, patient safety, and risk-based material assessments. Also, the UK has a strong biotech / pharma innovation sector, so newer delivery systems, device-drug combinations, and more demanding packaging options are pushing up E&L testing demand.

Extractable and leachable testing services market in Germany is growing, supported by the presence of a substantial number of local providers of biotechnology and pharmaceutical tools, along with strong government research funding, advanced laboratory infrastructure, and rising demand for sustainability in packaging materials choices now require more testing up front. In the UK, despite Brexit, regulatory expectations remain high, and there’s increasing focus on patient safety, risk management, and newer delivery technologies.

Asia Pacific Extractable and Leachable Testing Services Market Trends

The Asia Pacific region is anticipated to have a significant CAGR of 16.4% during the forecast period. The notable advancements in the pharmaceutical and biotechnology sectors in the region are key drivers propelling the growth of single-use technology. Specifically, countries such as China, India, and Japan are expected to experience substantial expansion due to increased government investments in research and development centers. This, in turn, is driving the widespread adoption of single-use systems in vaccine production and various other research & therapy areas. For instance, in March 2023, Hetero Drugs made a USD 122 million investment in Andhra Pradesh to grow the state's pharmaceutical sector. Furthermore, according to statistics from the state industrial division, Andhra Pradesh's pharma sector garnered around USD 2 billion in investment in 2022.

China extractable and leachable testing services market is witnessing rapid growth in both pharma manufacturing and medical devices, and increasing regulatory tightening by the NMPA (formerly CFDA) especially in packaging, excipients, and material safety. Local companies are under pressure to match international standards, so they increasingly outsource or build up E&L capability.

Extractable and leachable testing services market in Japanis experiencing growth due toJapan’s oversight (via PMDA / MHLW) requires strong compliance to safety, non-clinical data, and GLP for submissions, plus tightening in how data integrity, safety, and performance are documented. This raises demand for high quality E&L testing, especially for medical devices and combined products. Japanese companies, and overseas companies seeking access to Japan, must align with Japanese standards (and translate data, sometimes conduct local studies), which increases the need for robust E&L services.

MEA Extractable And Leachable Testing Services Market Trends

In the Middle East (including Kuwait), the driver is regulatory modernization, import reliance, increasing healthcare spending, and the need to assure safety of imported medical devices and pharmaceuticals. Authorities are progressively demanding that imported products meet international safety standards, and local test or certification labs are under pressure/extensions to have appropriate analytical testing capacity.

Kuwait extractable and leachable testing services market is witnessing demand due to in Kuwait specifically, medical device testing and certification markets are growing because of strong hospital networks, significant imports of medical technologies, and mandates from the Ministry of Health that imported devices must undergo safety/performance verification to international norms.

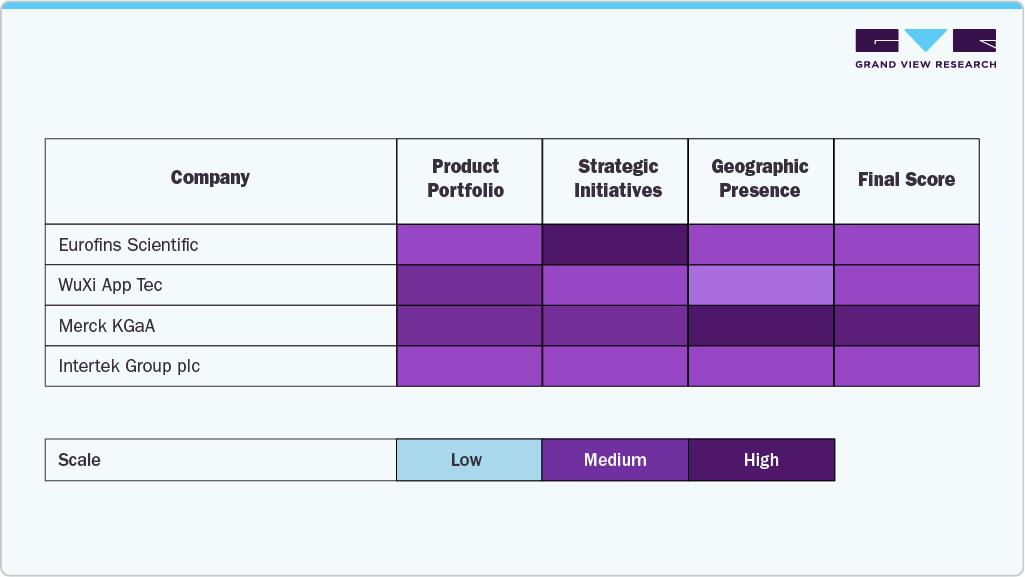

Key Extractable And Leachable Testing Services Company Insights

The Extractables & Leachables (E&L) Testing Services market is characterized by a mix of specialized analytical service providers and large multi-service CROs, each leveraging deep technical expertise and regulatory experience to capture share. Leading companies such as Eurofins Scientific, Intertek Group, Merck KGaA, WuXi AppTec and others dominate through global lab networks, extensive E&L method libraries, and toxicological risk assessment capabilities that support both pharma and medtech clients. These players are investing in advanced analytical technologies (such as high-resolution LC-MS and GC-MS platforms), automation, and data management tools to deliver faster turnaround and regulatory-compliant results.

Mid-tier and regional firms are differentiating via niche expertise and customer-centric services for early-stage biotech and device manufacturers. Overall, the competitive landscape is moderately consolidated but becoming more integrated, with increasing M&A activity aimed at expanding global reach, adding GLP/GMP-certified capacity, and combining extractables testing with complementary offerings such as container closure integrity, elemental impurity testing, and biocompatibility assessments.

Key Extractable And Leachable Testing Services Companies:

The following are the leading companies in the extractable and leachable testing services market. These companies collectively hold the largest market share and dictate industry trends.

- Eurofins Scientific

- Intertek Group plc

- SGS Société Générale de Surveillance SA

- WuXi AppTec

- Merck KGaA

- West Pharmaceutical Services, Inc

- Wickham Micro Limited (Medical Engineering Technologies Ltd.)

- Pacific Biolabs

- Boston Analytical

- Sotera Health (Nelson Laboratories, LLC)

Recent Developments

-

In October 2025, Intertek Pharmaceutical Services launched expert extractables and leachable testing services to support compliance with the new Korean Pharmacopeia requirements.

-

In March 2023, Nelson Laboratories, LLC – A Sotera Health Europe collaborated with Nemera, a drug delivery device solutions provider, to offer integrated services including E & L services to their customers.

Extractable And Leachable Testing Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.23 billion

Revenue forecast in 2033

USD 3.57 billion

Growth rate

CAGR of 14.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Mexico; Canada; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Eurofins Scientific; Intertek Group plc; SGS Société Générale de Surveillance SA; WuXi AppTec; Merck KGaA; West Pharmaceutical Services; Pacific Biolabs; Medical Engineering Technologies Ltd.; Boston Analytical; Sotera Health (Nelson Laboratories, LLC)

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Global Extractable And Leachable Testing Services Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global extractable and leachable testing services market based on product type, application, and region:

-

Product Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Container Closure Systems

-

Single-use Systems

-

Drug Delivery Systems

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Parenteral Drug Products

-

Orally Inhaled and Nasal Drug Products (OINDP)

-

Ophthalmic

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.