- Home

- »

- Medical Devices

- »

-

Eyelid Surgery Market Size & Trends, Industry Report, 2030GVR Report cover

![Eyelid Surgery Market Size, Share & Trends Report]()

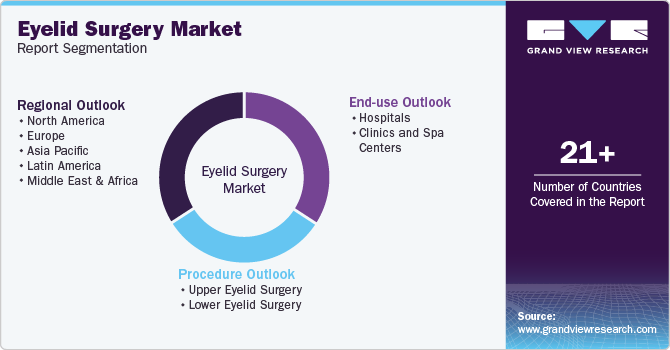

Eyelid Surgery Market (2025 - 2030) Size, Share & Trends Analysis Report By Procedure Type (Upper Eyelid, Lower Eyelid), By End-use (Hospitals, Clinics & Spa Centers), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-3-68038-516-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Eyelid Surgery Market Summary

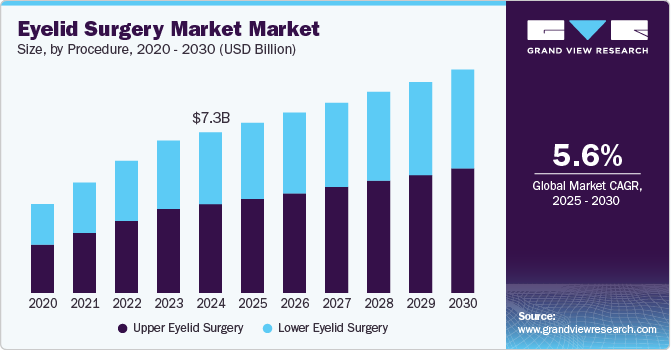

The global eyelid surgery market size was valued at USD 7.31 billion in 2024 and is projected to reach USD 10.15 billion by 2030, growing at a CAGR of 5.6% from 2025 to 2030. Market growth worldwide is significantly propelled by the increasing prevalence of ocular infections and disorders, particularly within the expanding geriatric population.

Key Market Trends & Insights

- The North American eyelid surgery market held the largest share of 37.1% in the global market in 2024.

- The U.S. eyelid surgery market dominated the North America market with a revenue share of 82.4% in 2024.

- By procedure, upper eyelid surgeries segment accounted for the largest share of 55.2% in 2024.

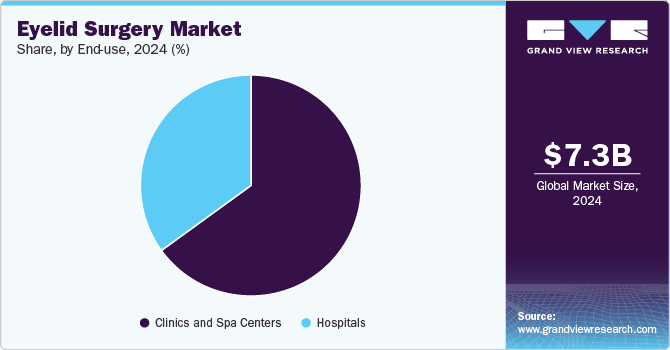

- By end-use, clinics and spa centers segment held the largest market share of 65.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.31 Billion

- 2030 Projected Market Size: USD 10.15 Billion

- CAGR (2025-2030): 5.6%

- North America: Largest market in 2024

Conditions such as ptosis (droopy eyes), blurred vision, and periorbital wrinkles, which are common among the aging population, are becoming increasingly common, thereby escalating the demand for targeted surgical interventions such as blepharoplasty. This procedure effectively addresses excess fatty deposits, mitigating eye puffiness and improving visual clarity.

Heightened awareness regarding aesthetic appearance across specific age demographics serves as a substantial driver for the adoption of blepharoplasty. The procedure enhances the aesthetic appeal of the eyes by rectifying the abnormalities mentioned above. The pervasive influence of social media platforms, including YouTube, Instagram, and TikTok, in beauty discussions has also contributed to this trend. Generation Z, in particular, is continuously exposed to novel skincare products and treatments, fostering a perception of cosmetic procedures as tools for beauty enhancement.

The confluence of an aging global population and the associated decline in peripheral vision constitutes prominent market drivers. According to the American Society of Plastic Surgery report 2023, a majority of individuals undergoing eyelid surgery were over the age of 40. Moreover, the Cleveland Clinic has highlighted the suitability of blepharoplasty for healthy adults above the age of 30. The readily available access to qualified surgeons further bolsters market growth, simplifying patient access to these treatments and consequently amplifying demand. Notably, the BBC reported that in the UK alone, the number of blepharoplasty procedures performed in 2024 reached 27,462, marking a 5% increase compared to 2023.

In recent years, there has been a growing preference among surgeons for innovative non-surgical and minimally invasive technologies in eyelid surgery. These modern techniques offer several advantages over traditional surgical approaches, which typically involve surgical incisions, anesthetization, and extended recovery periods. Contemporary technological procedures effectively address these limitations. According to a report by the International Society of Aesthetic Plastic Surgery (ISAPS), approximately 1.7 million individuals worldwide underwent eyelid surgery in 2023, underscoring the global adoption of this procedure. For instance, advanced technologies utilizing laser and plasma exeresis methods provide cost-effective, non-invasive solutions with immediate results. These continuous technological advancements are anticipated to be a significant driving force for market expansion throughout the forecast period.

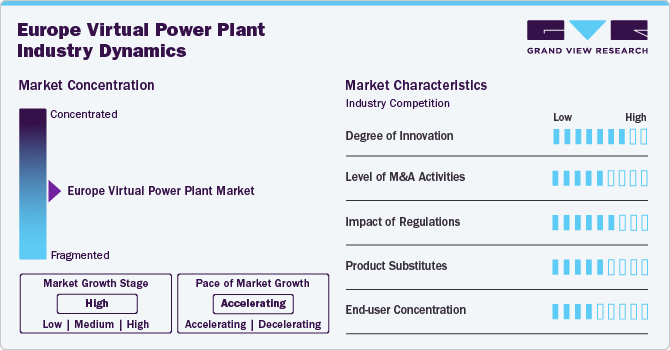

Market Concentration & Characteristics

Market growth stage is high and the pace of the market growth is accelerating. The industry is characterized by a significant degree of innovation owing to rapid technological advancements such as laser-assisted blepharoplasty, growing usage of PlasmaBlade devices, and other minimally invasive approaches.

The blepharoplasty industry is also characterized by a significant level of merger and acquisition (M&A) activity and product expansions by leading players. For instance, in September 2023, FCI Ophthalmics, a global leader in the development of ophthalmic surgical devices, announced the launch of EzyPor in the U.S. EzyPor is a polyethylene orbital implant with a proprietary suturing platform.

Government regulatory bodies around the world such as the FDA and GMC have published a regulatory framework to make sure of the safety, quality, and effectiveness of the products and equipment used in surgeries performed. For instance, as per the U.S. Code of Federal Regulation (eCFR), the devices used in the surgeries shall not be commercially distributed after the date shown, unless the manufacturer has an approval under section 515 of the act, in the regulation classifying the device.

For blepharoplasty, the number of direct service substitutes are remarkable. There are plenty of nonsurgical alternatives available such as Botox, Dermal fillers, radiofrequency microneedling, PRP Injections, laser skin resurfacing, to name a few. There are some benefits attributed to non-surgical alternatives such as low cost, no usage of general anesthesia, little or zero recovery time. The end user concentration for blepharoplasty is considerably high due to the procedure’s niche patient base.

Procedure Insights

Upper eyelid surgeries accounted for the largest share of 55.2% in 2024, owing to an aging population seeking vision correction for droopy lids and enhanced cosmetic appeal for a youthful look. Functional benefits of improved peripheral vision, increasing social acceptance of cosmetic procedures, particularly in South Korea and China, and safer, quicker non-invasive technological advancements such as PlexR further drive this demand.

Lower eyelid surgery market is also expected to show significant growth over the forecast period. Demand for lower eyelid surgery is driven by the aesthetic desire to reduce under-eye bags, wrinkles, and dark circles for a youthful appearance, particularly within an aging population experiencing skin laxity. Technological advancements offering non-invasive options and heightened awareness via social media further contribute, alongside functional benefits of improved eye contour and addressing structural issues.

End-use Insights

Clinics and spa centers held the largest market share of 65.2% in 2024, owing to the growing number of clinics, highly qualified plastic and cosmetic surgeons, and growing demand for medical tourism. Moreover, the convenience and cost-effectiveness of these procedures are driving individuals towards clinics and spa centers. Individuals are increasingly preferring clinics and spa centers with good safety and quality standards, contributing to increasing demand.

The hospitals segment is expected to grow significantly over the forecast period, driven by infrastructure advancements, a high concentration of surgeons and technology, and insurance coverage. The rising aging population, particularly in Asia-Pacific, seeking solutions for age-related eye conditions, coupled with the growing popularity of cosmetic procedures and the adoption of advanced, minimally invasive techniques is increasing hospital visits. Greater accessibility, shifting social norms influenced by media, and the availability of synergistic procedures further contribute to this expansion.

Regional Insights

The North American eyelid surgery market held the largest share of 37.1% in the global market in 2024. The region's advanced healthcare infrastructure and cutting-edge medical technology position it as a cosmetic surgery hub for eyelid procedures. A growing acceptance of these surgeries, particularly among millennials and the rising geriatric population seeking to address age-related concerns such as droopy eyelids, fuels demand. Increased disposable income and a greater emphasis on personal aesthetics further contribute to this market expansion.

U.S. Eyelid Surgery Market Trends

The U.S. eyelid surgery market dominated the North America market with a revenue share of 82.4% in 2024 due to its advanced healthcare infrastructure and cutting-edge technologies, coupled with a strong cultural emphasis on aesthetics and a high demand for cosmetic procedures. The presence of numerous skilled surgeons and the adoption of technological advancements further solidify its dominance. Insurance coverage for medically necessary blepharoplasty and the rise of minimally invasive techniques contribute to market growth.

Europe Eyelid Surgery Market Trends

The Europe eyelid surgery market was identified as a lucrative region in 2024. According to the European Commission, in January 2024, the EU population was estimated at 449.3 million, with over one-fifth (21.6%) aged 65 years and over across the European Union. Europe's aging population is a key driver for blepharoplasty due to age-related concerns. Technological advancements, including minimally invasive and laser-assisted procedures, ensure safer, faster recoveries and further propel demand. Rising disposable incomes across European nations enhance accessibility while increasing cultural acceptance, and the influence of social media showcasing results also contributes to the growing popularity of eyelid surgeries.

The Germany eyelid surgery market is expected to grow lucratively in the coming years. The country’s substantial elderly population drives demand for blepharoplasty to address age-related vision and aesthetic concerns. Growing beauty consciousness, fueled by social media, and the acceptance of cosmetic procedures further increase interest. Technological advancements, economic stability enabling access to skilled professionals, and the dual functional and cosmetic benefits of eyelid surgery also contribute to market growth in Germany.

Asia Pacific Eyelid Surgery Market Trends

The Asia Pacific eyelid surgery market is anticipated to grow at the fastest CAGR of 6.4% during the forecast period, supported by cultural beauty standards favoring large eyes, exemplified by the popularity of double eyelid surgery and celebrity influence. Economic growth and rising disposable incomes enable greater affordability, while social acceptance, media influence (including K-pop), and medical advancements in minimally invasive techniques further boost demand across demographics, including a growing geriatric population seeking to address age-related concerns. South Korea and China lead this trend, with India and Japan also experiencing growth.

The South Korea eyelid surgery market held a substantial market share in 2024. In South Korea, the high demand for double eyelid surgery (also known as Asian blepharoplasty) is driven by cultural beauty standards that favor larger eyes, often perceived as more attractive than monoids. Societal pressure in a competitive environment, where appearance influences personal and professional success, further fuels this demand. The relatively low cost (USD 1,000– USD 3,000), minimally invasive nature, and quick recovery make it economically accessible. It has become a common rite of passage for young adults, often supported by parents, and is reinforced by the influence of K-pop and media within a society emphasizing homogeneous beauty ideals.

Key Eyelid Surgery Company Insights

Some of the key companies in the eyelid surgeries market include Integra LifeSciences Corporation; Stanford Health Care; Surgical Holdings; Stryker; and others. The eyelid surgery market features numerous independent practitioners and clinics. Strategic initiatives in the industry focus on expanding geographically (especially in Asia-Pacific) and leveraging technological advancements to attract a broader patient base.

-

Integra LifeSciences, a medical device and surgical instrument manufacturer, offers tools applicable to various surgeries, including ophthalmic and plastic procedures that may encompass eyelid surgery, though they do not specialize in eyelid-specific products.

-

Stanford Health Care offers comprehensive ophthalmology and plastic surgery services, including functional and cosmetic eyelid surgery. Their expertise makes them a significant player, especially for complex and specialized cases.

Key Eyelid Surgery Companies:

The following are the leading companies in the eyelid surgery market. These companies collectively hold the largest market share and dictate industry trends.

- Integra LifeSciences Corporation

- Stanford Health Care

- Surgical Holdings

- Stryker

- American Society of Plastic Surgeons

- London Bridge Plastic Surgery

- Montenegro Clinic of Plastic Surgery

- Shoyukai Medical Association

Recent Developments

-

In April 2025, Avulux migraine glasses, developed with optical technology to manage photophobia, joined the FDA-funded CTIP pediatric medical device accelerator program in the USA.

-

In November 2024, Novoxel Inc. launched Tixel i in the U.S. after FDA clearance. This two-minute Thermo-Mechanical Action treatment significantly reduced dry eye symptoms for patients with Meibomian Gland Dysfunction.

Eyelid Surgery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.73 billion

Revenue forecast in 2030

USD 10.15 billion

Growth rate

CAGR of 5.6% from 2024 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Procedure, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, KSA, UAE, South Africa

Key companies profiled

Integra LifeSciences Corporation; Stanford Health Care; Surgical Holdings; Stryker; American Society of Plastic Surgeons; London Bridge Plastic Surgery; Montenegro Clinic of Plastic Surgery; Shoyukai Medical Association

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Eyelid Surgery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global eyelid surgery market report based on procedure, end-use, and region.

-

Procedure Outlook (Revenue, USD Million, 2018 - 2030)

-

Upper Eyelid Surgery

-

Lower Eyelid Surgery

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics and Spa Centers

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global eyelid surgery market size was estimated at USD 7.31 billion in 2024 and is expected to reach USD 7.73 billion in 2025.

b. The global eyelid surgery market is expected to grow at a compound annual growth rate of 5.6% from 2025 to 2030 to reach USD 10.15 billion by 2030.

b. North America dominated the eyelid surgery market with a share of 37.1% in 2024. This is attributable to availability of improved facilities and growing demand for cosmetic surgery from the millennials as well as geriatric population.

b. Some key players operating in the eyelid surgery market include Stanford Health Care, USA Plastic Surgery, London Bridge Plastic Surgery, Montenegro Clinic of Plastic Surgery, and Shoyukai.

b. Key factors that are driving the market growth include rising geriatric population and growing demand for non-invasive surgical procedures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.