- Home

- »

- Next Generation Technologies

- »

-

Factoring Services Market Size, Share & Trends Report 2030GVR Report cover

![Factoring Services Market Size, Share & Trends Report]()

Factoring Services Market Size, Share & Trends Analysis Report By Category (Domestic, International), By Type (Recourse, Non-Recourse), By Financial Institution, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-178-0

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Report Overview

The global factoring services market size was valued at USD 3,566.99 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.2% from 2023 to 2030. The increasing need for alternative sources of financing for micro and small & medium enterprises is driving market growth. Several organizations are taking advantage of Machine Learning (ML), Natural Language Processing (NLP), and Artificial Intelligence (AI), which are expected to generate profitable growth prospects for factoring services during forecast period. COVID-19 pandemic is expected to introduce a more collaborative approach, wherein banks and Supply Chain Finance (SCFs) would work together to provide benefits to the client ecosystems.

Market Dynamics

The increasing automation in financial services helps financial institutions to simplify their operations and optimize their credit collection process by automating repetitive and time-taking backend tasks. Furthermore, automation helps implement resources for value-added projects and improve the credibility of financial institutions. With the help of automation solutions, financial institutions have improved their operation processes, specifically accounts receivable processes. Account receivable solutions can integrate with various technologies, such as automation, Artificial Intelligence (AI), and machine learning throughout the credit cycle, which helps the institutions deal with the crisis effectively.

Several Business-to-Consumer (B2C) transactions and other payment methods such as cheques are being replaced with electronic alternatives. This is driving the demand for automation of accounts receivable. Furthermore, digitizing accounts receivable processes helps reduce printing costs and ensures more profits for employees. Several enterprises prefer on-premise deployment of accounts receivable solutions as it provides complete control over the infrastructure and assets. Moreover, it provides complete control over business and transaction records. Organizations in the healthcare and BFSI sectors prefer this type of deployment, as these verticals deal with critical data related to income and healthcare. These factors are likely to spur the demand for automation in the factoring services market.

The factoring services industry is expected to shift towards digital documentation, with cloud-based and AI-based models improving the efficiency of services post-pandemic, creating robust factoring services market opportunities. Growing public awareness regarding developments in financial technology, such as government and factoring group lobbying and activities, cryptocurrency, increasing international trade and widespread usage of digital platforms are some key factors driving market growth. Businesses often must wait for customers to pay which affects cash flow, thus, to remediate this delay, factoring companies offer upfront cash in exchange for account receivables, which makes factoring services more preferable. Businesses can reduce credit risk and acquire working capital loans with factoring services.

Finance, Competitiveness and Innovation Global Practice (FCI) are taking a series of steps to boost awareness, including hosting workshops to explain relevance of factoring to government officials and other key stakeholders. It continues to support the establishment of effective assignment legislation, third-party rights safeguards, and promotion of good governance to create a robust legal and regulatory environment to develop a strong legal infrastructure. As a result, in April 2022, FCI launched the Edifactoring 2.0 platform, an online platform to support two-factor business model for members of FCI through a set of Electronic Document Interchange (EDI) messages. The platform runs on FCI’s legal structure and helps to overcome challenges in cross-bordering factoring.

Since factoring businesses serve a variety of industries, their pricing and levels of customer service may differ and ability to complete the process and provide advance payment within 24-72 hours makes service faster than bank loans. However, new technologies are assisting factoring companies in providing better customer service by offering consumers access to web portals and applications to review and respond to frequently asked inquiries about their accounts.

Low-profit margin and rising digital threats such as viruses, ransomware, spyware & Distributed denial of service (DDoS) attacks are expected to affect market growth over forecast period. Several organizations have incurred significant losses in terms of unplanned workforce reduction, brand reputation, revenue, and business disruptions due to data breaches. Several cybersecurity companies, such as Cyber X, Inc. and Palo Alto Networks, are developing security solutions with Artificial Intelligence (AI) to help financial organizations facilitate safe & secure factoring services. These solutions enable automated threat detection, unauthorized access identification, and remediation, reducing efforts and time of IT professionals to track malicious activities, techniques, and tactics.

Category Insights

Domestic segment accounted for largest market share of over 70% in 2022. The segment growth can be attributed to rapid adoption of factoring receivable methods technique in major industries due to its effectiveness. Furthermore, increasing significance of electronic invoices has contributed to the consolidation of domestic factoring market. Domestic factoring provides businesses with a weekly or monthly analysis of sales and payable invoices. Additionally, easy risk coverage and low cost provided by domestic segment in comparison with international factoring allow this segment to attain a larger market share.

International factoring services segment is anticipated to register considerable growth with a CAGR of 9.8% during forecast period. International factoring services are a must-needed service for firms engaging in international trade, irrespective of size and industry they deal with. A rise in open account trading has pushed this segment to grow further, also the importers in developed countries consider factoring, a favorable alternative to conventional methods of trade finance. Besides, growth in international trade awareness and a shift of production facilities especially after the outbreak of COVID-19 from China to other economies such as Vietnam, Mexico, and the Philippines are boosting growth of this segment.

Type Insights

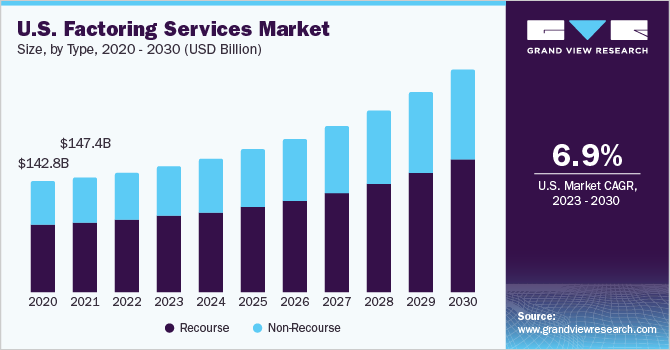

Recourse factoring segment is expected to hold largest market share of over 52% through 2030. The recourse factoring requires a personal guarantee from owner to maintain liquidity in case of bad debt and to purchase back nonperforming accounts receivable taken as collateral by factor. The recourse factoring segment offers various benefits, such as lower fees, flexibility on advanced rates, and flexibility on credit requirements, among others, driving segment growth. The recourse factoring services are used by firms with creditworthy invoice clients who want to sell their invoices at lowest discounts. The fact that firms pay smaller factor fees and receive the maximum money possible for invoices is what makes this segment used widely among businesses.

Non-recourse factoring segment is expected to show substantial growth with a CAGR of 9.6% during forecast period, as developing nations are increasingly adopting non-recourse factoring services. The non-recourse factoring offers complete credit security to businesses which is the key factor responsible for driving growth. Non-recourse factoring can be a good option for businesses with a large customer base, as businesses may want to clean up their balance sheet by offloading their accounts receivable. In case of non-recourse factoring, factoring firm bears if any bad debt occurs thus, they have more stringent credit requirements. Additionally, non-recourse factoring is widely used among truckers, as they belong at bottom of food chain and want financial security when it comes to getting paid on loads.

Financial Institution Insights

Bank segment held largest market share of over 80% in 2022. Banks, the major financing organizations worldwide, are also anticipated to show considerable growth during forecast period. Bank factoring firms use the same steps as traditional factoring firms. However, they are regulated by banks, which means no intermediary is involved, leading to lower factoring costs which is one of the key factors for development of this segment. In addition, banks are investing resources in advanced technologies such as Distributed Ledger Technology (DLT) and Blockchain to meet their client's financial needs, which will further support growth of this segment. Factors such as direct access to cash, a sense of security from a regulated bank, and more competitive rates will drive growth of this segment.

Non-banking financial institution segment is anticipated to show considerable growth of 10.5% during forecast period. The growth can be attributed to flexibility and transparency that non-banking financial institutions are offering to their clients. Non-banking financial institutions are increasingly adopting latest technologies to compete with banks. For instance, RTS Finance, one of the top invoice factoring companies for trucking, offers web browser apps and mobile apps for better integration with their platform. Truckers can track status of the transaction and avail various benefits such as fuel card discounts, no hidden costs such as automated clearing fees, and invoice upload fees.

End-use Insights

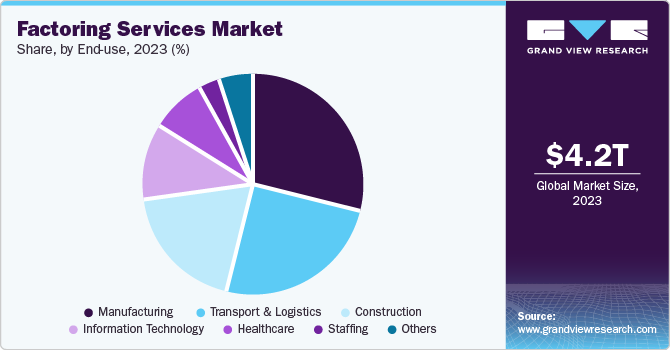

Manufacturing segment accounted for largest market share of over 30% in 2022. The manufacturing segment uses factoring services as it enables manufacturers to negotiate early-pay discounts and take advantage of bulk order incentives. Most companies in manufacturing sector are seasonal, which means they are slow for many months of the year and rely heavily only on a few months, which leads to poor cash flow and vast fluctuations in business. To avoid this, manufacturing firms rely on factoring services. A few other advantages of factoring services include high advance rates, volume-based factoring fees, and elimination of payment gaps, which are likely to drive this segment's growth.

Healthcare segment is expected to register a CAGR of 10.9% during forecast period. The healthcare industry relies on factoring services due to multiple benefits it can offer such as medical insurance claims can be paid within 72 hours instead of the usual 30 to 120 days. Factoring services are used in several medical businesses such as laboratory services, ambulatory services, health centers & hospitals, home health agencies, nurse staffing agencies, rehabilitation centers, medical equipment providers, and medical billing & transcription service providers. Companies such as US MED Capital, eCapital, Inc., Alleon Healthcare Capital, Xynergy Healthcare Capital LLC, and PRN Funding, Inc. offer specialized healthcare factoring services to hospitals and pharmaceutical companies.

Regional Insights

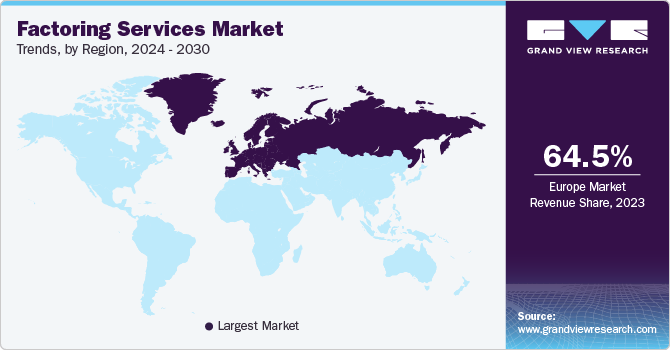

Europe region accounted for major market share of over 55% in 2022 owing to growing focus of transport companies on export business factoring and emerging start-ups in factoring services from countries such as the U.K., Germany, Italy, Romania, and Sweden. Considerable investments by EU in factoring services for small & medium enterprises and companies operating in manufacturing and engineering sectors are significantly contributing to improving market growth. Many service providers of this region are focusing on automating the process by utilizing advanced technologies such as Blockchain, which provides advanced data security and smart contract functionality. It is one of the crucial factors supporting market growth of this region.

The Asia Pacific region is expected to witness considerable growth with a CAGR of 11.5% in forecast period owing to expansion of the manufacturing sector in economies such as India and other South & Southeast Asian countries. Their economies are rapidly shifting from agrarian to manufacturing and export-oriented economies, supporting growth of factoring services in the region. Moreover, Asia Pacific region is home to a large number of developing economies, such as China, Thailand, India, and the Philippines, which are getting investments from developed markets that are saturated and exploring new opportunities in the region. In Asia Pacific, SMEs comprise more than half of all enterprises, and small & medium enterprises often look for monetary support to run their businesses smoothly.

Key Companies & Market Share Insights

The key players operating in factoring services industry include China Construction Bank Corporation; Eurobank; ICBC China; Mizuho Financial Group, Inc.; Barclays Bank PLC;Deutsche Factoring Bank; BNP Paribas; Hitachi Capital (UK) PLC; Kuke Finance; among others. Market players are focusing on strategic partnerships and mergers & acquisitions to actively engage with existing and new clients, in order to increase their respective market shares. They are also aggressively investing in advanced technologies such as distributed ledger and blockchain activities to gain a competitive edge in the market.

For instance, in September 2022, Wells Fargo launched a new Integrated Receivable AI Software, a new Accounts Receivable (AR) solution. Integrated receivables can fix errors and enhance matching logic over time owing to artificial intelligence and machine learning technology, which helps businesses spend less time and money on carrying out manual invoices. Some of the prominent players in the global factoring services market include:

-

altLINE (The Southern Bank Company)

-

Barclays Bank PLC

-

BNP Paribas

-

China Construction Bank Corporation

-

Deutsche Factoring Bank

-

Eurobank

-

Factor Funding Co.

-

Hitachi Capital (UK) PLC

-

HSBC Group

-

ICBC China

-

Kuke Finance

-

Mizuho Financial Group, Inc.

-

RTS Financial Service, Inc.

-

Société Générale S.A.

-

TCI Business Capital

Recent Development

-

In March 2023, BNP Paribas partnered with Hokodo to launch a BNPL (Buy now, Pay later) solution platform. Large international corporations will be able to provide their business clients with payment choices through this solution, which makes use of the B2B BNPL platform from Hokodo and the in-depth knowledge and financial stability of BNP Paribas. Hokodo and BNP Paribas offers this cutting-edge buy now, pay later option by utilizing the best of its cash management and factoring skills.

-

In March 2023, FINAMCO and Tradewidn Finance (Germany), one of the leading trade finance service providers, entered into a partnership to enhance the factoring services of enterprises in Colombia and the neighboring areas. The two businesses, which both specialize in international factoring, planned to combine their knowledge of trade finance and their regional and worldwide networks to provide Latin American businesses with affordable and efficient financing. With the help of the partnership, Tradewind, aimed to establish itself as a viable alternative lender in Latin America, a continent that has traditionally had limited access to trade finance.

-

In February 2022, Hitachi Capital (UK) PLC launched the Novuna brand as a mode of dealing for the recently established business: Mitsubishi HC Capital UK PLC. Novuna Consumer Finance, Novuna Business Finance, Novuna Vehicle Solutions, and Novuna Business Cash Flow (previously known as Invoice Finance) were the brands included under the Novuna brand. Additionally, Hitachi Personal Finance was replaced by Novuna Personal Finance, the loans division of Novuna Consumer Finance.

Factoring Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3,733.88 billion

Revenue forecast in 2030

USD 7,005.90 billion

Growth rate

CAGR of 9.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Volume in USD billion and CAGR from 2023 to 2030

Report coverage

Factoring volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Category, type, financial institution, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; China; India; Japan; Australia; South Korea; Singapore; Argentina; Chile; Mexico; Brazil; U.A.E.; Saudi Arabia; South Africa

Key companies profiled

altLINE; China Construction Bank Corporation; Deutsche Factoring Bank; Barclays Bank PLC; BNP Paribas; Factor Funding Co.; Hitachi Capital (UK) PLC; Eurobank; HSBC Group; ICBC China; Kuke Finance; Mizuho Financial Group, Inc.; RTS Financial Service, Inc.; Société Générale S.A.; TCI Business Capital

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Factoring Services Market Report Segmentation

This report forecasts factoring volume growth at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global factoring services market report based on category, type, financial institution, end-use, and region:

-

Category Outlook (Factoring Volume, USD Billion; 2018 - 2030)

-

Domestic

-

International

-

-

Type Outlook (Factoring Volume, USD Billion; 2018 - 2030)

-

Recourse

-

Non-Recourse

-

-

Financial Institution Outlook (Factoring Volume, USD Billion; 2018 - 2030)

-

Banks

-

Non-Banking Financial Institutions

-

-

End-use Outlook (Factoring Volume, USD Billion; 2018 - 2030)

-

Manufacturing

-

Transport & Logistics

-

Information Technology

-

Healthcare

-

Construction

-

Others (Staffing Agencies, Advertising, Oilfield Services, And Commercial Food & Beverages)

-

-

Regional Outlook (Factoring Volume, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Singapore

-

-

Latin America

-

Argentina

-

Brazil

-

Chile

-

Mexico

-

-

MEA

-

U.A.E.

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global factoring services market size was estimated at USD 3,566.99 billion in 2022 and is expected to reach USD 3,773.88 billion in 2023.

b. The global factoring services market is expected to witness a compound annual growth rate of 9.2% from 2023 to 2030 to reach USD 7,005.90 billion by 2030.

b. Europe held the largest share of over 55% in 2022 and is expected to dominate the global factoring services market, this can be due to the rapid adoption of factoring services in Central and Eastern Europe (CEE).

b. Deutsche Factoring Bank, Eurobank, BNP Paribas, Barclays Bank PLC, China Construction Bank Corporation, Hitachi Capital (UK) PLC, HSBC Group, ICBC China, Kuke Finance, Mizuho Financial Group, Inc. are some of the other players driving the factoring services market growth.

b. The rise in open account trading and cross-border business, plus the expansion of the manufacturing industry in Asian countries such as China, and India are expected to boost the growth of this market. Besides, the need for startups and Small & Medium Enterprises (SMEs) for an alternative source of finance propels the demand in this market

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."