- Home

- »

- Advanced Interior Materials

- »

-

Fall Protection Equipment Market Size, Industry Report, 2033GVR Report cover

![Fall Protection Equipment Market Size, Share & Trends Report]()

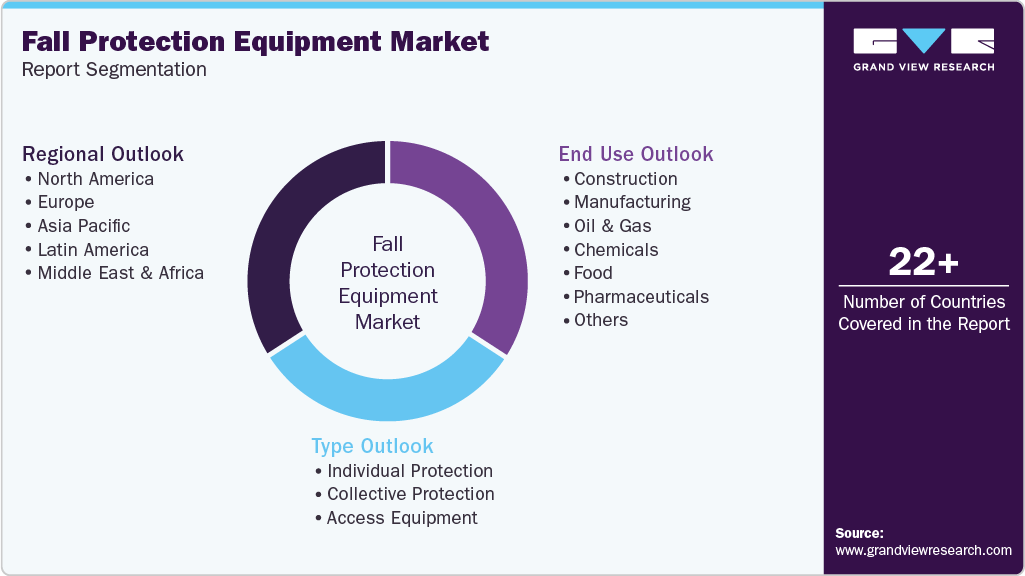

Fall Protection Equipment Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Individual Protection, Collective Protection, Access Equipment), By End Use (Construction, Manufacturing, Oil & Gas, Chemicals, Food, Pharmaceuticals, Healthcare), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-977-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Fall Protection Equipment Market Summary

The global fall protection equipment market size was estimated at USD 3,192.1 million in 2025 and is projected to reach USD 5,606.6 million by 2033, growing at a CAGR of 7.4% from 2026 to 2033. The market growth is driven by rising awareness of workplace safety, the enforcement of stringent occupational safety regulations, and increasing employer focus on employee wellbeing and risk mitigation.

Key Market Trends & Insights

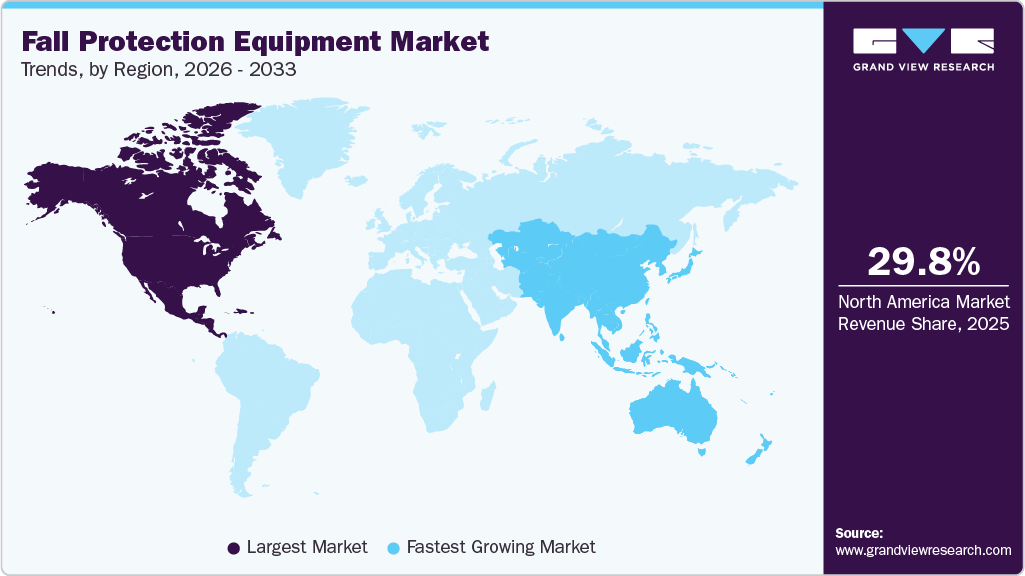

- North America dominated the fall protection equipment market with the largest revenue share of 29.8% in 2025.

- The fall protection equipment market in India is expected to grow at a substantial CAGR of 10.2% from 2026 to 2033.

- By type, the collective protection segment is expected to grow at the fastest CAGR of 8.2% from 2026 to 2033 in terms of revenue.

- By end use, the manufacturing segment is expected to grow at the fastest CAGR of 8.2% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 3,192.1 Million

- 2033 Projected Market Size: USD 5,606.6 Million

- CAGR (2026-2033): 7.4%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

High-risk industries such as construction, manufacturing, and oil & gas continue to be key demand generators, as the need to comply with safety standards and reduce fall-related accidents accelerates the adoption of comprehensive fall protection systems worldwide. Technological advancements in fall protection equipment, such as smart harnesses and self-retracting lifelines, are also contributing to the market growth.

These innovations provide real-time monitoring and enhanced user comfort, making them more appealing to end users. The growth of e-commerce and digital platforms enables easier access to safety gear, especially for small businesses. Moreover, employer liability concerns and efforts to reduce insurance costs are encouraging firms to adopt high-quality fall protection equipment solutions.

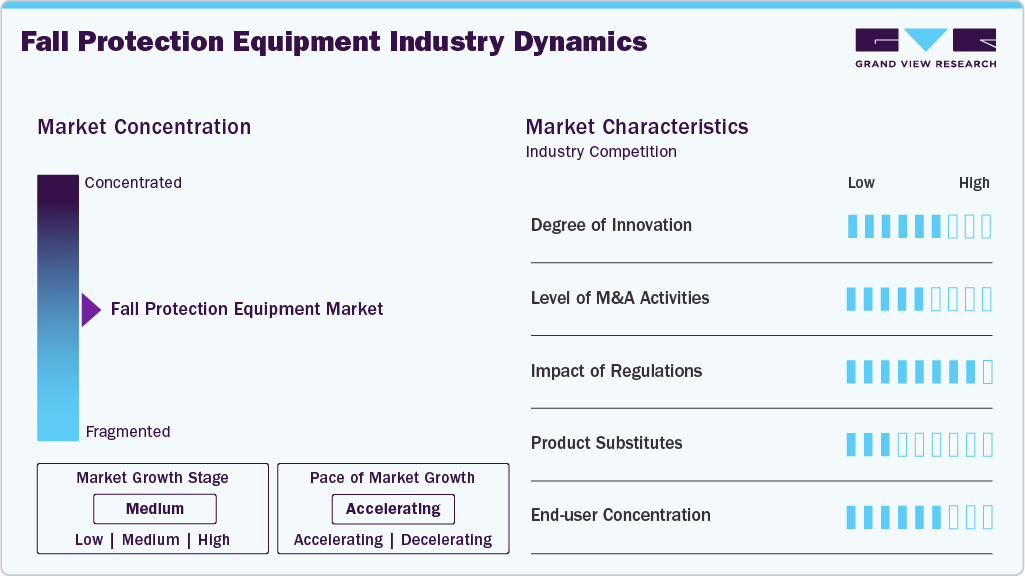

Market Concentration & Characteristics

The fall protection equipment market is moderately concentrated, with a few key players holding significant market share due to their strong brand presence and extensive product portfolios. These leading companies often set industry standards through innovation and regulatory compliance. However, the presence of numerous regional and niche manufacturers adds a degree of fragmentation. This competitive landscape drives continuous product development and pricing competition across the market.

The degree of innovation in the fall protection equipment market is moderate and largely application focused. Manufacturers prioritize improvements in worker comfort, durability, and ease of installation to increase on-site compliance. Material advancements such as lightweight alloys and corrosion-resistant components extend product life in demanding environments. While smart features such as inspection tracking and load monitoring are emerging, adoption remains gradual due to cost sensitivity.

The fall protection market is driven by regulatory mandates, growing awareness around occupational safety, and an increasing emphasis on worker well-being across high-risk industries such as construction, oil & gas, mining, manufacturing, and utilities. The market is highly compliance-oriented, shaped by international safety standards such as OSHA (U.S.), ANSI, CSA (Canada), and EN (Europe). Demand patterns vary by region, with North America and Europe leading in adoption due to stringent safety regulations, while Asia Pacific is emerging as a fast-growing market driven by infrastructure expansion and industrialization.

End user concentration in the market is moderate, with demand distributed across various sectors, including construction, manufacturing, energy, and infrastructure. Large industrial operators and infrastructure owners generate significant recurring revenue through long-term safety programs. Smaller contractors contribute to volume demand but often favor rental models and standardized products. This balance results in a mix of large project-based orders and fragmented, repeat purchases.

Drivers, Opportunities & Restraints

Stringent workplace safety regulations across various sectors, including construction, mining, and manufacturing, are major drivers of the fall protection equipment market. Increasing awareness about occupational hazards and the rising number of workplace accidents further boost demand. The growth of infrastructure projects and high-rise construction also contributes to market expansion. Moreover, advancements in personal protective equipment enhance usability and compliance.

Emerging economies present significant growth opportunities due to rapid industrialization and evolving safety standards. Technological innovations such as smart fall detection systems open new avenues for product differentiation. Partnerships between safety equipment providers and construction firms can further drive market penetration. Moreover, increasing focus on worker safety training supports long-term market potential.

High initial costs of advanced fall protection equipment systems can deter adoption, especially among small and medium enterprises. Lack of awareness and enforcement of safety standards in certain developing regions hampers market growth. Resistance to change and limited training for using sophisticated safety gear can also pose challenges. Furthermore, fluctuating raw material prices may impact the profitability of manufacturers.

Type Insights

The individual protection type segment led the market and accounted for 58.9% in 2025. The segment growth can be attributed to the industries prioritized approach toward worker safety. Moreover, regulatory standards such as OSHA, CSA, and (EU) 2016/425 related to worker safety have become increasingly stringent. With an increasing awareness among organizations about the economic and human costs associated with workplace accidents, companies are investing in advanced individual fall protection equipment systems, thereby driving the global adoption of such systems over the forecast period.

Collective fall protection equipment systems ensure the reliable safety of individuals positioned on flat roofs (with a maximum inclination of 20 degrees) or at the top of the upper surface of flat machines. Guardrails, handrails, and safety nets are included in the category of collective fall protection equipment systems. By forming a barrier between the falling edges and individuals in the fall-risk areas, collective fall protection equipment systems effectively neutralize the potential danger by providing comprehensive protection to workers operating in elevated locations.

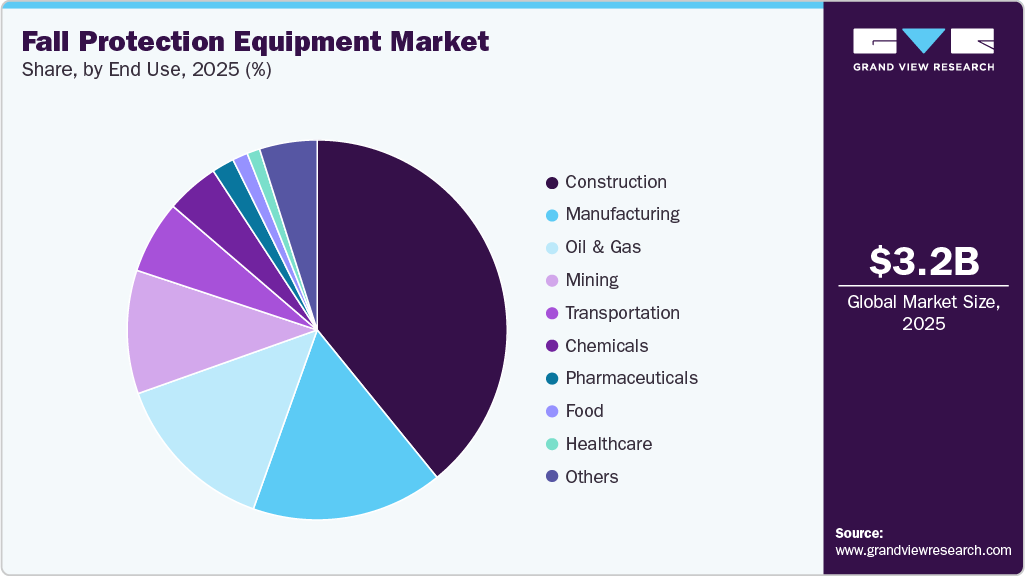

End Use Insights

The construction segment showed lucrative growth and accounted for 39.1% share in 2025, driven by urbanization, infrastructure development, and population expansion. This is particularly crucial in the context of high-rise buildings, bridges, and other elevated structures where workers are exposed to fall hazards. Moreover, there is a growing awareness in the construction industry about the occupational hazards associated with working at heights. Employers and workers are recognizing the need for comprehensive fall protection equipment measures to mitigate the risks posed by elevated work environments.

The manufacturing sector is the fastest-growing end use segment in the fall protection equipment market, driven by increasing safety concerns and stricter regulatory enforcement in industrial environments. The increasing automation and use of elevated work platforms demand reliable fall protection equipment systems. Employers are investing more in safety gear to reduce workplace injuries and downtime. In addition, the global emphasis on worker welfare and productivity is accelerating the adoption of these practices in factories and production facilities.

Regional Insights

North America fall protection equipment market led the global industry, accounting for a revenue share of 29.8% in 2025. The major revenue contributors to this market in the region are the U.S. and Canada. The market in this region is experiencing revenue growth as a result of rising worker safety concerns, early adoption of cutting-edge technology, and the existence of tight rules that require the use of fall protection equipment in many industries such as construction, oil & gas, manufacturing, and others.

U.S. Fall Protection Equipment Market Trends

Fall protection equipment market in the U.S. is projected to grow at a CAGR of 7.8% from 2026 to 2033. Increasing investments in the construction industry and surging expenditure on construction activities across the U.S. are expected to drive demand for affordable and effective fall protection equipment systems and equipment.

Canada fall protection equipment market is expanding with increased investments in construction, mining, and energy sectors. Regulatory frameworks, such as those from the Canadian Centre for Occupational Health and Safety (CCOHS), ensure compliance and protect workers. Harsh weather conditions also necessitate specialized fall protection equipment gear for outdoor worksites. In addition, government-led infrastructure initiatives boost demand for safety systems.

Europe Fall Protection Equipment Market Trends

The fall protection equipment market in Europe has seen significant growth in recent years due to stringent safety regulations, increasing awareness about workplace safety, and the growing adoption of advanced safety solutions. Countries such as Germany, UK, and France are key contributors to this market, driven by their robust industrial sectors

Germany fall protection equipment market is dominating due to its strong industrial base and strict enforcement of occupational safety regulations. The construction and automotive sectors are key drivers, requiring advanced safety systems for elevated work environments. The country’s focus on worker health and automation integration encourages the adoption of smart fall protection equipment devices.

Fall protection equipment market in the UK is expanding with rising infrastructure development and urban renewal projects. Regulatory bodies such as the HSE (Health and Safety Executive) enforce strict safety guidelines, pushing companies to comply with high standards. Increased employer accountability and awareness of fall-related accidents also drive adoption. Moreover, the growing renewable energy sector, especially wind power, creates new demand for height safety solutions.

Asia Pacific Fall Protection Equipment Market trends

Fall protection market in Asia Pacific region is expected to witness fastest growth at 8.6% over the forecast period due to ongoing industrialization, increasing construction activities, and growing awareness about workplace safety in the region. Countries in the Asia Pacific region, particularly China and India, are implementing stricter legal and policy measures to enhance worker safety, particularly regarding accidental falls in industries like construction, oil &gas, manufacturing, and mining.

China fall protection equipment market is growing rapidly due to large-scale infrastructure projects and expanding industrial activity. Government focus on improving workplace safety standards is driving stricter enforcement and compliance. The construction boom and rise in high-rise developments increase demand for height safety equipment. Additionally, increasing investment in smart cities and industrial automation supports the adoption of advanced fall protection equipment systems.

Fall protection equipment market in India is fueled by urbanization, industrial expansion, and rising awareness of occupational safety. The government’s emphasis on infrastructure development through initiatives like Smart Cities Mission and Make in India boosts demand. While regulatory enforcement is still evolving, multinational firms are adopting global safety practices. Growing construction activity and foreign direct investments in sectors like manufacturing and energy further accelerate market demand.

Latin America Fall Protection Equipment Market Trends

The fall protection equipment market in Latin America is expected to witness robust growth over the forecast period, driven by increasing awareness about workplace safety and regulatory initiatives aimed at reducing occupational hazards.The construction, oil & gas, mining, and manufacturing industries are among the primary sectors fueling the demand for fall protection equipment in the region.

Brazil fall protection equipment market is expanding due to the country's ongoing infrastructure development and industrial growth. Government regulations and rising awareness about worker safety are driving the demand for protective equipment. The construction and energy sectors, especially in oil & gas, are key contributors to this growth. Additionally, increased investments in safety training and compliance are encouraging wider adoption of fall protection equipment systems.

Middle East & Africa Fall Protection Equipment Market Trends

The fall protection equipment market in the Middle East and Africa region has experienced steady growth in recent years, driven by increasing industrialization, infrastructure development, and a growing emphasis on worker safety. Rapid urbanization and investments in infrastructure projects, such as commercial buildings, airports, and energy facilities, have heightened the demand for fall protection equipment in the region.

Fall protection equipment market in Saudi Arabia is witnessing strong growth due to large-scale infrastructure and industrial projects under Vision 2030. The expansion of the construction and oil & gas sectors has led to higher demand for safety systems in elevated work environments. Authorities are emphasizing stricter workplace safety regulations to minimize fall-related accidents. Additionally, the adoption of smart technologies like IoT-enabled gear is improving on-site worker safety.

Key Fall Protection Equipment Company Insights

Some of the key players operating in the market include FallTech, Petzl, SKYLOTEC.

-

FallTech is a U.S.-based manufacturer that specializes in developing and producing advanced fall protection equipment tailored for high-risk industries like construction, utilities, and tower climbing. The company designs and assembles most of its products in its California facility, allowing for strict quality control and compliance with ANSI and OSHA standards. Its product line includes innovative solutions such as the DuraTech SRLs, TowerClimber harnesses, and rugged anchorage connectors engineered for extreme job site conditions. FallTech is also known for integrating user feedback into product design to enhance safety, comfort, and durability in field-specific applications.

-

Petzl, a France-based company, is renowned for its technically advanced equipment designed for verticality and rescue applications, especially in sectors like industrial rope access, confined space entry, and tactical operations. Unlike general PPE providers, Petzl focuses on precision-engineered gear such as the ASAP mobile fall arrester, Vertex helmets, and AVAO harnesses, which are widely adopted by professionals working at height. The company conducts rigorous in-house testing and operates the Petzl Technical Institute to offer hands-on training and safety certification programs. Petzl's product development is heavily driven by field research and collaboration with professional users to meet specific operational challenges.

Key Fall Protection Equipment Companies:

The following are the leading companies in the fall protection equipment market. These companies collectively hold the largest Market share and dictate industry trends.

- FallTech

- Petzl

- SKYLOTEC

- WernerCo

- Guardian Fall

- MSA

- PIP

- 3M

- Gravitec Systems, Inc

- Kee Safety Inc

- French Creek Production

- Safewaze

- Tritech Fall Protection Equipment

- GISS

- Webb-Rite Safety

Recent Developments

-

In March 2025, SureWerx has announced the acquisition of Reliance Fall Protection Equipment to enhance its portfolio of engineered fall safety solutions. This move adds products like Skyloc II, MicroLoc, and Enviroshield systems to SureWerx’s offerings. The acquisition aligns with SureWerx’s strategy to expand its leadership in safety and productivity solutions. Both companies share a commitment to high industry standards and plan to accelerate growth through expanded distribution networks.

-

In July 2024, Gamgee BV has introduced a new fall detection system for seniors that operates through Wi-Fi, without relying on wearable devices or cameras. It instantly alerts caregivers and family members in the event of a fall. The system also tracks daily movement to provide insights into overall well-being. Gamgee plans to expand its reach through a crowdfunding campaign and future smart-home integrations.

-

In January 2024, WenerCo introduced a groundbreaking fall protection equipment utility lifeline tailored for utility workers and linemen that provides them with an elevated level of climbing security. This innovative offering includes an anchor strap fall arrest system, which is specifically designed to meet the unique safety requirements of professionals working on utility poles or similar structures. With this product launch, WenerCo demonstrates its commitment to advancing safety solutions for workers in specialized industries, thereby offering a comprehensive and effective tool to enhance fall protection equipment in utility-related environments.

Fall Protection Equipment Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 3,395.8 million

Revenue forecast in 2033

USD 5,606.6 million

Growth rate

CAGR of 7.4% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Spain; UK; Sweden; Denmark; Norway; Poland; Netherlands; Belgium; Switzerland; Austria; Portugal; Ireland; China; Japan; India; South Korea; Australia; Argentina; Brazil; Saudi Arabia; South Africa; UAE

Key companies profiled

FallTech; Petzl; SKYLOTEC; WernerCo; Guardian Fall;

MSA; PIP; 3M; Gravitec Systems Inc; Kee Safety Inc; French Creek Production; Safewaze; Tritech Fall Protection Equipment; GISS; Webb-Rite Safety.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fall Protection Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global fall protection equipment market report based on type, end use, and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Individual Protection

-

Collective Protection

-

Access Equipment

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Construction

-

Manufacturing

-

Oil & Gas

-

Chemicals

-

Food

-

Pharmaceuticals

-

Healthcare

-

Transportation

-

Mining

-

Others

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Italy

-

Spain

-

UK

-

Sweden

-

Denmark

-

Norway

-

Poland

-

Netherlands

-

Belgium

-

Switzerland

-

Austria

-

Portugal

-

Ireland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The growth of the market can be attributed to the surge in awareness regarding workplace safety, the presence of stringent workplace safety regulations, and the increase in emphasis on employee wellbeing.

b. The global fall protection equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.4% from 2026 to 2033 to reach USD 5,606.6 million by 2033.

b. The global fall protection market size was estimated at USD 3,192.1 million in 2025 and is expected to be USD 3,395.8 million in 2026.

b. North America led the market and accounted for 29.8% of the global revenue share in 2025. The major revenue contributors to this market in the region are the U.S. and Canada. The market in this region is experiencing revenue growth as a result of rising worker safety concerns, early adoption of cutting-edge technology, and the existence of tight rules that require the use of fall protection equipment in many industries such as construction, oil & gas, manufacturing, and others.

b. Some of the key players operating in the fall protection equipment market include FallTech, Petzl, SKYLOTEC, WernerCo, Guardian Fall, MSA, PIP, 3M, Gravitec Systems, Inc, Kee Safety Inc, French Creek Production, Safewaze, Tritech Fall Protection, GISS, and Webb-Rite Safety.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.