- Home

- »

- Advanced Interior Materials

- »

-

Farm Tire Market Share And Share, Industry Report 2030GVR Report cover

![Farm Tire Market Size, Share & Trends Report]()

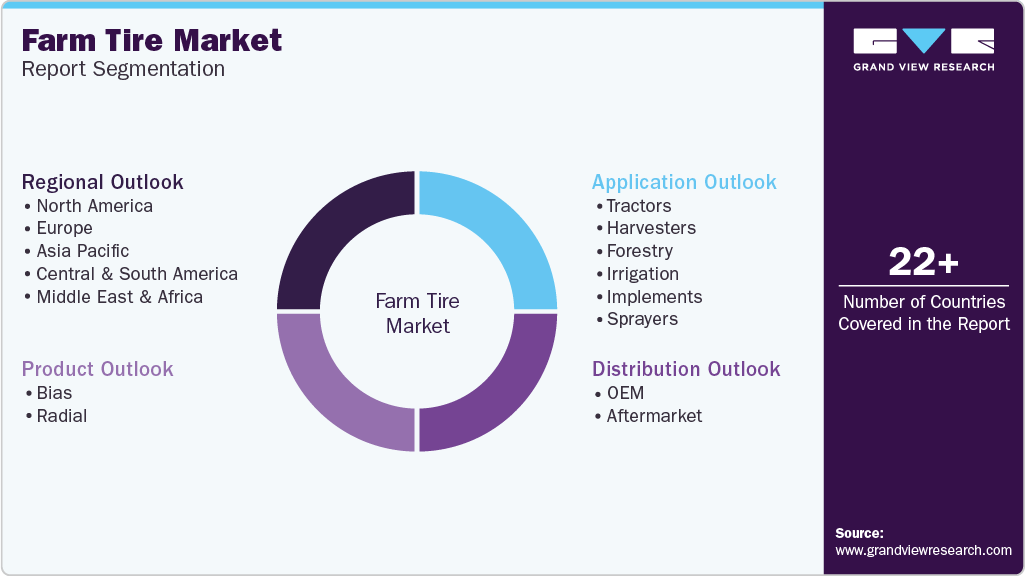

Farm Tire Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Bias, Radial), By Application (Tractors, Harvesters, Forestry, Irrigation, Implements, Sprayers), By Distribution (OEM, Aftermarket), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-707-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Farm Tire Market Size & Trends

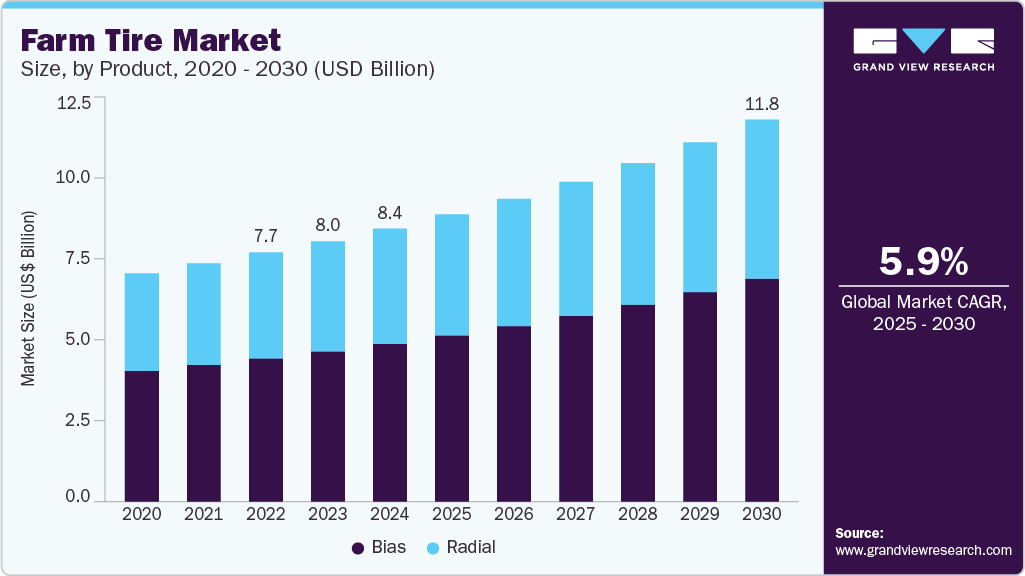

The global farm tire market size was estimated at USD 8.44 billion in 2024 and is expected to grow at a CAGR of 5.9% from 2025 to 2030. The growing demand for farm tires in agricultural vehicles, coupled with the expansion of the agriculture sector, is projected to boost the market growth over the forecast period.

Key Highlights:

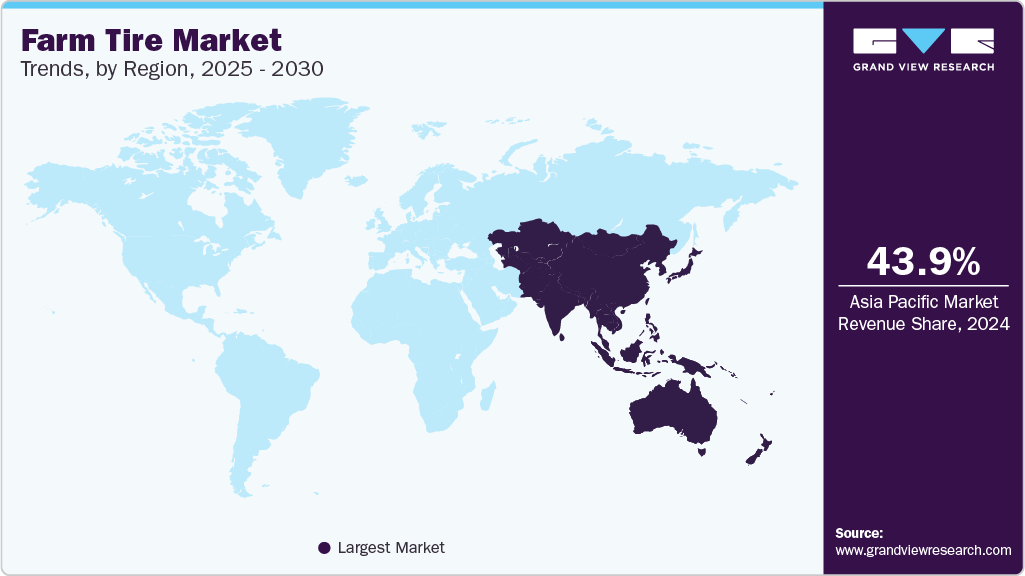

- The farm tire market in Asia Pacific dominated the global market and accounted for a 43.9% share of the revenue in 2024

- China farm tires market demand is rising due to increased agricultural mechanization and government support for modernizing farming practices

- In terms of segment, the bias tire segment led the market and accounted for a 72.6% revenue share of the global revenue in 2024

- In terms of segment, the aftermarket segment led the market and accounted for a 61.8% share of the global revenue in 2024

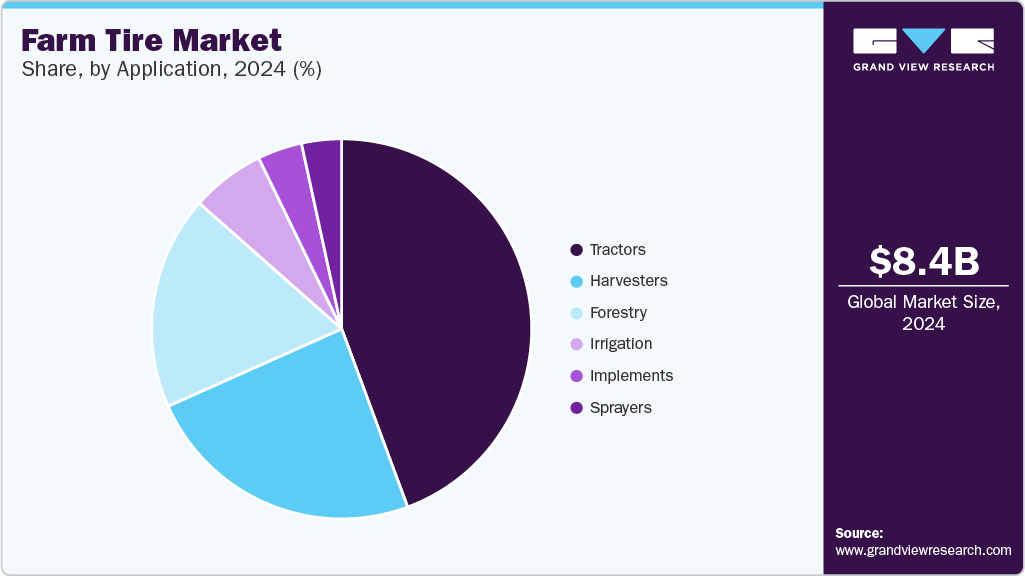

- In terms of segment, the tractors segment led the market and accounted for 44.4% share of the global revenue in 2024

Adoption of advanced technologies by farmers to increase the agricultural yield and meet the rising food demand is projected to be the key factor benefiting the farm tire market growth. In addition, the sales of tractors have witnessed substantial growth in the historic years on account of the rising demand for technological up-gradation, thereby having a positive impact on the farm tire market growth

The market in the U.S. is expected to witness high growth in the years to come on account of the presence of a number of manufacturing facilities. In addition, improvements in farming technologies and favorable policies are expected to aid the growth of the agriculture industry, thereby driving the demand for related products, including tires.

Rapid urbanization, coupled with the increasing standards of living, has imposed high pressure on food production and productivity across the globe. The expansion of the agricultural sector in order to meet the rising demand for food products is anticipated to benefit the demand for agricultural vehicles, thereby fueling the demand for farm tire over the forecast period.

Increasing demand for products with superior properties, such as high puncture and wear and tear resistance, is likely to propel the production of quality products. In addition, the high production of farm tires, coupled with the rising consumption across the globe, is likely to propel the growth of the farm tire market.

Local players mostly focus on their specific strengths and retain their customers by providing custom services to tractor and harvester manufacturers. Companies in the industry also focus on increasing their production capacity as the demand for farm tires is growing in the agricultural industry on account of the increasing demand for agricultural produce.

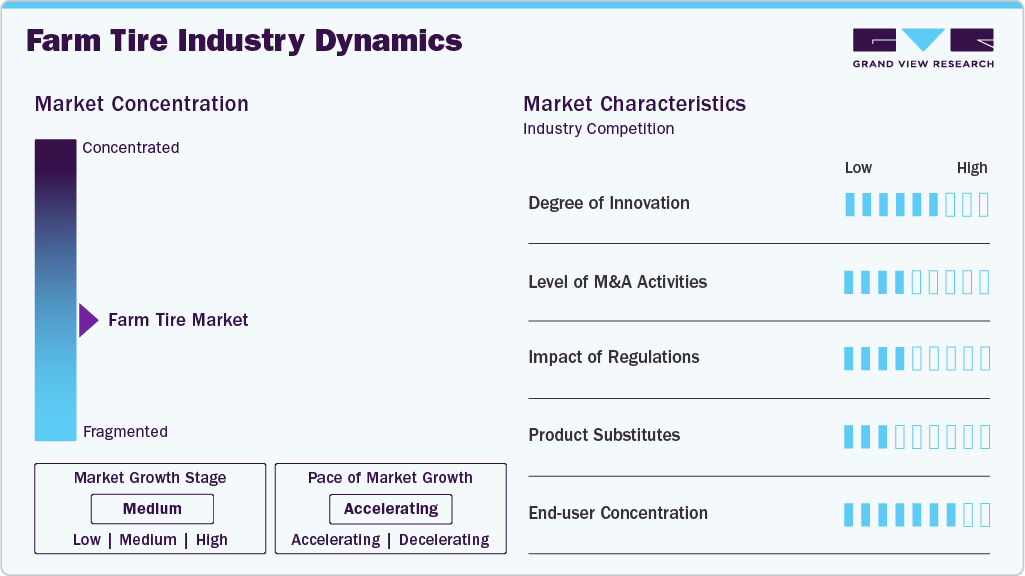

Market Concentration & Characteristics

The farm tire market is experiencing a moderate to high degree of innovation, driven by the evolving needs of modern agriculture and environmental sustainability. Manufacturers are investing in advanced materials like low-rolling resistance rubber compounds, self-cleaning treads, and airless tire technologies to enhance performance, durability, and fuel efficiency. Precision farming and autonomous machinery demand tires that are compatible with GPS and sensor-based systems, encouraging continuous R&D. Furthermore, the shift toward sustainable and regenerative agriculture has led to innovation in tire designs that minimize soil compaction and improve traction on diverse terrains. Collaborations between tire manufacturers and agri-tech firms also play a key role in pushing innovation boundaries.

The threat of substitutes in the farm tire market is relatively low, as there are limited alternatives that can fully replace the functionality, durability, and terrain-specific performance of specialized agricultural tires. While technologies like rubber tracks are gaining traction for specific applications such as minimizing soil compaction in large-scale farms, they are generally more expensive and less versatile compared to pneumatic tires. Moreover, traditional methods like animal-powered plowing or manual farming tools are no longer viable substitutes in commercial farming due to low efficiency. Therefore, despite emerging innovations, farm tires remain the most cost-effective and adaptable solution for modern agricultural machinery.

Product Insights

The bias tire segment led the market and accounted for a 72.6% revenue share of the global revenue in 2024. The use of bias tires is high in India and China as these tires are manufactured using natural rubber, which is produced mainly in the two countries. In addition, the crosshatch construction of the bias tire, coupled with its availability at low cost, is likely to fuel its demand.

The cost of raw materials is low, which, in turn, decreases the manufacturing cost of the product. However, the decreasing supply of natural rubber is likely to restrain the segment’s growth. In addition, natural rubber increases the rigidity of the tire, which loses uniformity after use, compromising the round shape of the farm tire and decreasing its shelf life.

Radial tires are manufactured with steel ply, which increases durability, along with bead-to-bead construction at an angle of 90 degrees to the circumferential centerline, which increases the flexibility of tires and reduces the rolling resistance, resulting in improved performance. This is likely to drive the demand for radial farm tires in agricultural vehicles over the forecast period.

The cost of radial tires is high on account of the use of synthetic rubber and modern manufacturing technology requiring high-cost machinery. As a result, the penetration of the product in the major agricultural markets and the developing economies, such as India and China, is low. The aforementioned factors are likely to limit the farm tire market expansion.

Distribution Insights

The aftermarket segment led the market and accounted for a 61.8% share of the global revenue in 2024. The rising demand for the replacement of tires by farmers on account of the expansion of agricultural activities across the globe is anticipated to benefit the segment growth over the forecast period.

The use of bias tires is reducing as they are being replaced with radial tires having high-performance characteristics. In addition, the growth of new vehicle sales is lower, indicating that the demand for tires is lower through OEM distribution compared to replacement. These factors are projected to drive the demand for farm tires through aftermarket sales.

The demand for new farm tires through aftermarket channels is increasing owing to the presence of different types of platforms, such as online, authorized dealers, and third-party dealers. However, the popularity of tire retreading in developing economies, such as India and China, is likely to restrain the demand for farm tires through the aftermarket.

The demand for farm tires through the OEM channel is expected to witness growth owing to the increasing demand for new agricultural vehicles, such as tractors and harvesters. The demand for these vehicles is high in developed economies as farmers are able to afford the newly introduced, expensive farm equipment that aids in executing farming activities on large patches of land.

Application Insights

The tractors segment led the market and accounted for 44.4% share of the global revenue in 2024, owing to its multipurpose nature. Tractors with high horsepower are widely preferred as they can be used for different farming activities. As a result, the demand for tires is also witnessing growth with the increasing popularity and use of tractors in the industry.

The demand for farm tires in the harvesters segment is expected to witness growth owing to the introduction of several types of harvesters to suit the farming needs. For instance, John Deere has introduced crop-specific harvesters to meet the requirements of farmers, resulting in the ease of harvesting crops, such as sugarcane and corn. This has led to an increased demand for harvesters for long patches of farm.

The growing demand for technologically advanced machinery for forestry operations is expected to drive the demand for tires. In addition, high penetration of forestry equipment in mature markets, including North America and Europe, results in rising aftermarket sales for the tires, which is likely to propel the market growth of farm tires over the forecast period.

The growth in the mechanization of irrigation processes on account of increased efficiency and superior crop yield, supported by mechanized irrigation, is expected to drive the market for irrigation equipment. This is further likely to drive the demand for irrigation equipment, including farm tires, thereby propelling the farm tire market growth.

Regional Insights

The farm tire market in Asia Pacific dominated the global market and accounted for a 43.9% share of the revenue in 2024. This is attributed to factors such as increasing population, rising disposable income of the middle-class population, and rapid industrialization and urbanization. In addition, the presence of small and large-scale manufacturers in the region is likely to benefit the farm tire market growth.

China farm tires market demand is rising due to increased agricultural mechanization and government support for modernizing farming practices. As the country shifts from labor-intensive to machinery-driven farming to address rural labor shortages and boost productivity, there’s a surge in demand for high-performance and durable farm tires. Additionally, China’s expanding agri-tech sector and its focus on food security are further fueling investments in advanced farming equipment, including tractors and harvesters, which directly drives tire demand.

Europe Farm Tire Market Trends

Europe farm tires market is witnessing steady growth in farm tire demand owing to precision agriculture practices, strong regulatory frameworks supporting sustainable farming, and the presence of well-established OEMs. Farmers are increasingly adopting high-tech machinery to improve yield efficiency, requiring tires that support better traction, reduced soil compaction, and fuel efficiency. Moreover, the push for eco-friendly agricultural methods has led to a preference for radial tires that offer better performance and environmental benefits.

As a key agricultural hub within Europe, farm tire market in Germany is growing due to advancements in agri-tech and a strong focus on automation. The German government’s support for smart farming initiatives, combined with the country's robust machinery manufacturing base, contributes to rising demand for specialized and high-load capacity farm tires. The growth of organic and sustainable farming practices also necessitates tires that minimize ground pressure and enhance field performance.

North America Farm Tire Market Trends

North America's farm tire demand is increasing as a result of the region's vast agricultural landscape, widespread use of mechanized farming, and adoption of cutting-edge farming technologies. Climate variability and the need for higher productivity have encouraged farmers to upgrade to more durable and efficient tires. The presence of major agricultural equipment manufacturers and a well-established aftermarket service ecosystem also bolsters tire sales across the U.S. and Canada.

U.S. Farm Tire Market Trends

The demand in the U.S. farm tires market is primarily driven by large-scale commercial farming, high equipment penetration, and continued investment in precision agriculture. Farmers are replacing old machinery with advanced tractors and harvesters that require high-quality tires capable of handling heavier loads and varied terrains. Additionally, rising grain prices and government subsidies for agricultural upgrades are further motivating farmers to invest in better equipment, including premium tires.

Latin America Farm Tire Market Trends

The Latin America farm tire market, especially countries like Brazil and Argentina, is experiencing growth in demand due to the expansion of commercial farming and export-oriented agriculture. The region's increasing soybean, maize, and sugarcane cultivation necessitates large-scale farming equipment, which in turn drives the need for robust and reliable tires. Improved rural infrastructure, foreign investments in agriculture, and growing awareness about the benefits of radial tires are also supporting market growth.

Middle East & Africa Farm Tire Market Trends

In the Middle East & Africa, farm tire demand is growing due to ongoing agricultural development projects, government-led food security initiatives, and the modernization of traditional farming methods. As more arid and semi-arid regions adopt irrigation-based farming, the need for equipment capable of operating in challenging conditions rises, increasing demand for durable, high-traction tires. Additionally, increasing imports of farm machinery and supportive policies are helping drive the farm tire market forward.

Key Farm Tire Company Insights

Some key players operating in the market include Bridgestone Corporation and Continental AG

-

Bridgestone is a global leader in tire manufacturing, offering a wide range of premium agricultural tires known for durability and performance. Its Firestone brand is especially dominant in the North American farm tire market, catering to tractors, harvesters, and sprayers.

-

Continental AG is a top-tier player recognized for its innovative agricultural tire solutions that enhance fuel efficiency and reduce soil compaction. The company focuses heavily on precision farming compatibility and sustainable tire technology.

Hankook Tire & MRF Limited are some emerging market participants in the farm tire market.

-

Hankook is steadily entering the agricultural segment with its growing portfolio of farm tires designed for high load-bearing and improved traction. The company is leveraging its R&D capabilities to compete with established players in emerging markets.

-

MRF is an Indian tire manufacturer expanding its presence in the farm tire sector with cost-effective, robust solutions tailored for local and regional farming needs. It is gaining traction in developing markets by focusing on affordability and reliability.

Key Farm Tire Companies:

The following are the leading companies in the farm tire market. These companies collectively hold the largest market share and dictate industry trends.

- Balkrishna Industries Limited (BKT)

- Bridgestone Corporation

- Continental AG

- Compagnie Générale des Établissements Michelin (CGEM)

- Sumitomo Rubber Industries, Ltd.

- Titan International, Inc.

- Mitas

- TBC Corporation

- Apollo Tyres Ltd.

- Hankook Tire

- MRF Limited

- JK Tyre & Industries Ltd.

- CEAT

- The Carlstar Group, LLC

- Specialty Tires of America, Inc.

- Alliance Tire Group (ATG)

- Trelleborg AB

Recent Developments

-

In October 2023, Continental AG expanded its agricultural range by launching new sizes in TractorMaster and CompactMaster AG/EM series to support larger and more powerful machinery.

-

In May 2023, Bridgestone expanded its VX-R TRACTOR tire range, introducing 23 new sizes in the 65, 70, and 85 series, ranging from 24 to 38-inch rims. These tires, developed with enliten technology, aim to enhance sustainability without compromising performance.

Farm Tire Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.88 billion

Revenue forecast in 2030

USD 11.80 billion

Growth rate

CAGR of 5.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in thousand units and revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Russia; Turkey; China; India; Japan; Australia; Brazil; Argentina; South Africa

Key companies profiled

Balkrishna Industries Limited (BKT); Bridgestone Corporation; Continental AG; Compagnie Générale des Établissements Michelin (CGEM); Sumitomo Rubber Industries, Ltd.; Titan International, Inc.; Mitas; TBC Corporation; Apollo Tyres Ltd.; Hankook Tire; MRF Limited; JK Tyre & Industries Ltd.; CEAT; The Carlstar Group, LLC; Specialty Tires of America, Inc.; Alliance Tire Group (ATG); Trelleborg AB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Farm Tire Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global farm tire market report based on the product, application, distribution, and region:

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Bias

-

Radial

-

-

Application Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Tractors

-

Harvesters

-

Forestry

-

Irrigation

-

Implements

-

Sprayers

-

-

Distribution Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

OEM

-

Aftermarket

-

-

Regional Outlook (Volume, Thousand Units; Revenue; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global farm tire market size was estimated at USD 8.44 billion in 2024 and is expected to reach USD 8.88 billion in 2025.

b. The farm tire market is expected to grow at a compound annual growth rate of 5.9% from 2025 to 2030 to reach USD 11.80 billion by 2030.

b. Bias tire dominated the farm tire market with a share of 72.6% in 2024, on account of crosshatch construction of the tires and low cost as compared to its counterpart.

b. Some of the key players operating in the farm tire market include Balkrishna Industries Limited (BKT), Bridgestone Corporation, Continental AG, Compagnie Générale des Etablissements Michelin, Sumitomo Rubber Industries, Ltd., Titan International, Inc., Mitas, TBC Corporation, Apollo Tyres Ltd., Hankook Tire, MRF Limited, JK Tyre & Industries Ltd., CEAT, The Carlstar Group, LLC, Specialty Tires of America, Inc., Alliance Tire Group (ATG), Trelleborg AB

b. The key factors that are driving the farm tire market include the expansion of the agricultural sector across the globe coupled with the use of advanced agricultural equipment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.