- Home

- »

- IT Services & Applications

- »

-

Farming As A Service Market Size, Industry Report, 2033GVR Report cover

![Farming As A Service Market Size, Share & Trends Report]()

Farming As A Service Market (2025 - 2033) Size, Share & Trends Analysis Report By Service Type (Farm Management Solutions, Production Assistance, Access To Market), By Delivery Model, By End-use (Farmers, Government, Corporate), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-964-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Farming-as-a-Service Market Summary

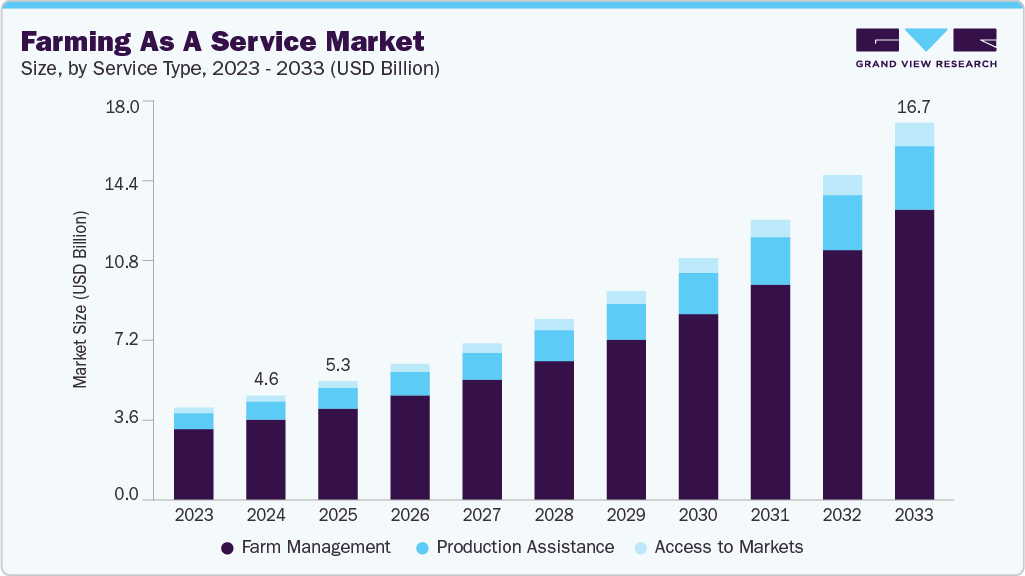

The global farming as a service market size was estimated at USD 4.63 billion in 2024 and is projected to reach USD 16.74 billion by 2033, growing at a CAGR of 15.5% from 2025 to 2033. The rising demand for access-based agriculture solutions is expected to be a primary factor driving growth.

Key Market Trends & Insights

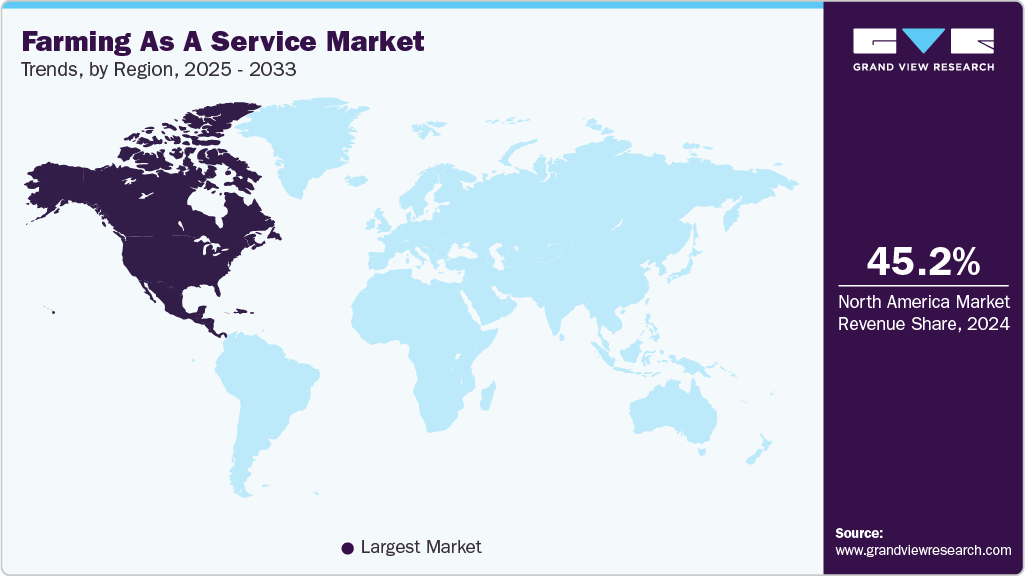

- North America held a 45.2% revenue share of the global farming-as-a-service market in 2024.

- In the U.S., the increasing penetration of digital technologies and mobile connectivity in rural areas are driving the growth of farming-as-a-service market.

- By service type, farm management solutions segment held the largest revenue share of 76.8% in 2024.

- By delivery model, the subscription segment held the largest revenue share in 2024.

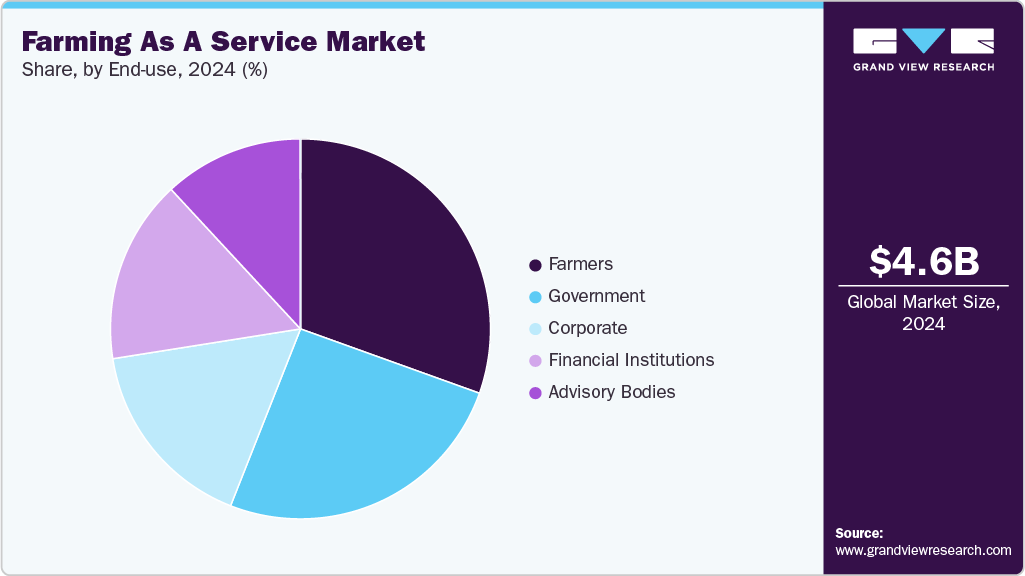

- By end user, farmers segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.63 Billion

- 2033 Projected Market Size: USD 16.74 Billion

- CAGR (2025-2033): 15.5%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

The rapid advancement and adoption of digital technologies in agriculture are drivng the farming-as-a-service market growth. Precision farming tools, satellite imaging, drones, and IoT-based sensors are transforming how farms are managed. FaaS providers integrate these technologies to deliver services such as real-time crop monitoring, variable rate application of inputs, and predictive analytics for better decision-making. These solutions increase operational efficiency and contribute to resource conservation by reducing the overuse of water, fertilizers, and pesticides. The digital ecosystem created by FaaS enhances transparency, traceability, and accountability across the value chain, making it attractive to both farmers and agribusiness stakeholders.The increasing adoption of digital technologies in agriculture drives the farming-as-a-service market growth. With the rise of precision farming tools, data analytics, GPS-enabled equipment, and remote sensing, farmers are now more equipped than ever to make data-driven decisions. However, many small and marginal farmers, especially in emerging economies, lack the capital or technical expertise to adopt these technologies independently. FaaS addresses this gap by offering access to advanced machinery, services, and digital tools on a subscription or pay-per-use model, making precision agriculture financially viable and operationally accessible to a wider base of farmers.

Government support and favorable policy frameworks are also propelling the FaaS market forward. Many countries are recognizing the role of technology in ensuring food security. They are introducing subsidies, grants, and public-private partnerships to promote precision farming and rural mechanization through FaaS platforms. In addition, climate change and the associated unpredictability of weather patterns have increased the demand for adaptive farming solutions. FaaS helps mitigate risks associated with erratic climatic conditions by offering tailored agronomic insights and insurance-related services, thus enhancing farmers’ resilience.

The rising popularity of outcome-based farming models is driving the adoption of the farming-as-a-service market. Unlike conventional models that rely heavily on ownership of assets and inputs, FaaS promotes a shift towards result-oriented services where productivity, efficiency, and sustainability are prioritized over input volume. This change aligns with broader global trends in smart agriculture and the circular economy, positioning FaaS as a crucial enabler of future-ready farming systems. As farmers increasingly look for innovative, scalable, and economically viable solutions, the relevance and adoption of farming-as-a-service will continue to grow across both developed and developing agricultural landscapes.

Service Type Insights

The farm management solutions segment dominated the farming-as-a-service market with a market share of 76.8% in 2024. Farm management solutions include solutions such as providing insights to government, farmers, corporates, and other final advisory firms. Farm management services also include precision farming services, which have shown tremendous growth in recent years owing to the growing acceptance of precision farming to meet the rising global demand for high-quality food products. Tools such as hyperspectral imaging technology, sensors (to gather data on weather conditions and soil health), auto-guidance equipment, precision irrigation systems, etc., to improve agricultural results. Further boosting demand for precision farming and quickening market expansion is the worsening water issue and the growing need to conserve natural resources.

The access to markets segment is projected to be the fastest-growing segment from 2025 to 2033. The increasing penetration of digital platforms and mobile technologies in rural areas drives the FaaS market growth. With smartphones becoming more accessible and mobile internet coverage expanding, it has become easier to deliver services such as remote sensing, satellite imagery-based advisory, and market intelligence to farmers. These platforms allow service providers to reach remote locations and deliver customized, real-time recommendations, thereby enhancing farm productivity. Moreover, data analytics integrated with these platforms helps farmers make informed decisions regarding crop planning, irrigation, pest control, and harvesting schedules.

Delivery Model Insights

The subscription segment dominated the farming-as-a-service market in 2024. The popularity of the recurring service model is growing due to its affordability and convenience for resource-constrained farmers. Rather than making high-capital purchases for machinery or analytics tools, farmers can subscribe to services on a monthly, seasonal, or per-hectare basis. This model democratizes access to advanced technologies such as drones, automated irrigation systems, and yield forecasting software. It also ensures regular updates, maintenance, and customer support, which are essential for farmers who may not have the technical expertise to operate or troubleshoot complex equipment. Furthermore, subscription models often allow for scalability and customization, letting farmers choose specific service bundles based on their crop type, land size, or regional challenges. This flexibility enhances service adoption and fosters long-term engagement, which, in turn, supports the sustainability of FaaS platforms.

The pay per use segment is projected to growing at a CAGR of 15.3% from 2025 to 2033. The growing need among smallholder farmers for better price realization and improved market connectivity is drivng the segment growth. Traditionally, many farmers have faced exploitation from middlemen and limited access to competitive marketplaces, resulting in inconsistent income and low profitability. FaaS platforms are now bridging this gap by directly connecting farmers to end-buyers, including agribusinesses, food processors, and retailers, often through digital marketplaces. This ensures transparency in pricing, reduces transaction layers, and opens up broader demand channels for their produce. Moreover, the availability of market intelligence and price forecasting through FaaS tools enables farmers to plan their harvest and sales strategies more efficiently. These services are particularly valuable in remote or underserved regions where access to market information has historically been minimal.

End-use Insights

The farmers segment dominated the farming-as-a-service market in 2024. The seasonal and cyclical nature of farming activities makes on-demand access to equipment and skilled labor particularly appealing. Many farmers, especially those with small landholdings, cannot afford to purchase expensive machinery such as harvesters, seeders, or sprayers for limited seasonal use. FaaS offerings, such as equipment rental marketplaces and mechanization-as-a-service models, address this gap by enabling shared access to machinery, which enhances operational efficiency without adding capital expenditure burdens. This democratization of technology through service-based models significantly strengthens the value proposition for farmers, thereby propelling market growth.

The government segment is projected to grow at a CAGR of 15.8% from 2025 to 2033. Subsidy programs and policy frameworks are propelling the growth of FaaS under the government segment. Governments are increasingly allocating funds and grants for precision agriculture, farm mechanization, and agri-tech startups offering service-based models. These initiatives often include incentives for drone-based surveillance, satellite mapping, and real-time weather and crop advisory systems, all delivered through FaaS platforms. Moreover, several public-private partnerships (PPPs) are being launched to create scalable and efficient models for technology-driven farming, further integrating government efforts into the ecosystem.

Regional Insights

North America dominated the farming as a service market with a market share of 45.2% in 2024. The rise in demand for organic and sustainably grown food is influencing farmers to modernize their practices, and FaaS is helping them transition smoothly. By outsourcing critical functions such as crop advisory, monitoring, and analytics, farmers can implement best practices without needing deep in-house expertise. This trend is particularly relevant in North America, where consumers are increasingly conscious of food origin and agricultural transparency. As a result, FaaS is not just a cost-saving measure but also a strategic tool for farms aiming to meet evolving market expectations.

U.S. Farming As A Service Market Trends

The U.S. farming-as-a-service industry is projected to grow during the forecast period. The growth of digital infrastructure across North America is accelerating the growth of the Farming-as-a-Service (FaaS) market. High-speed internet connectivity, increasing mobile device penetration, and the expansion of cloud-based platforms have enabled seamless deployment of smart farming solutions. These digital tools allow real-time data collection and remote management of farm activities, which is especially valuable in vast agricultural regions where on-ground supervision is difficult. FaaS providers are leveraging this digital transformation to offer services such as satellite-based crop monitoring, predictive weather alerts, and cloud-integrated farm management systems. This connectivity also allows farmers to access these services through user-friendly mobile apps, simplifying decision-making and operational planning.

Europe Farming As A Service Market Trends

The farming-as-a-service industry in Europe is expected to grow during the forecast period. The widespread adoption of digital farming technologies is also accelerating the FaaS market in Europe. With strong telecommunications infrastructure and rising awareness of agri-tech solutions, European farmers are increasingly turning to cloud-based farm management systems, remote sensing, and AI-driven decision support tools. These technologies are typically bundled into service models by FaaS providers, enabling real-time monitoring of crop conditions, predictive analysis for yield forecasting, and timely advisory services. Such data-driven approaches help farmers make more precise and sustainable decisions, improve operational transparency, and optimize the use of inputs like water, seeds, and fertilizers.

The farming-as-a-service industry in the UK is grow during the forecast period. The UK government’s growing emphasis on agri-environmental payments and results-based farming schemes is driving the farming-as-a-service market growth. These new schemes often require farmers to submit detailed records of their land management practices, environmental impacts, and biodiversity outcomes. Managing and reporting such complex data can be time-consuming and technically difficult without specialist tools. FaaS platforms increasingly offer these record-keeping and compliance-reporting capabilities as part of their packages, which not only simplifies administration but also helps farmers qualify for higher levels of government funding. This built-in alignment between FaaS services and policy frameworks provides an added incentive for farmers to adopt such models.

Asia Pacific Farming As A Service Market Trends

The Asia Pacific farming-as-a-service industry is expected to be the fastest-growing segment, with a CAGR of 16.8% over the forecast period. The need to modernize agriculture across a diverse and predominantly agrarian landscape is driving the farming-as-a-service market growth. Many countries in the region, such as India, China, Vietnam, Indonesia, and the Philippines, rely heavily on agriculture for employment and rural livelihoods yet face serious challenges related to productivity, land fragmentation, labor shortages, and climate vulnerability. In this context, FaaS has emerged as a viable solution to bridge the technological and operational gaps that hinder farm efficiency. By offering on-demand services ranging from equipment rental to precision farming and advisory support, FaaS helps small and marginal farmers access modern tools without needing to invest in expensive capital assets.

The farming-as-a-service industry in China is projected to grow during the forecast period. The rise of agritech startups and corporate participation is further propelling the FaaS market in China. Numerous technology companies, including giants like Alibaba and Tencent, are investing in agriculture platforms that integrate AI, IoT, big data, and cloud computing into farming operations. These companies are collaborating with cooperatives, local governments, and agricultural service firms to offer end-to-end farming solutions under the FaaS model.

Key Farming As A Service Company Insights

Some of the key companies operating in the market Mahindra & Mahindra Ltd, and Deere & Company, among others are some of the leading participants in the farming-as-a-service market.

-

Mahindra & Mahindra Ltd. manufactures farm equipment and automotive vehicles. The company also offers information technology, hospitality, and financial services. The company’s subsidiaries include Mahindra Engineering and Chemical Products Limited, Mahindra Overseas Investment Company (Mauritius) Ltd., Mahindra Vehicle Manufacturers Limited, Mahindra Two Wheelers Europe Holdings S.a.r.l., Mahindra USA, Inc., Mahindra Consulting Engineers Limited, Mahindra Holdings Limited, and Mahindra Airways Limited.

-

Deere & Company is engaged in the manufacturing & construction of agricultural and forestry machinery, drivetrains, and diesel engines for heavy equipment and lawn care machinery. Additionally, the company also manufactures and provides other heavy manufacturing equipment. The company serves diverse industries such as agriculture, forestry, construction, landscaping & grounds care, engines & drivetrain, government and military, and sports turf.

Agrostar, and Bighaat are some of the emerging market participants in the farming-as-a-service market.

-

Agrostar is an agriculture product and service provider. The company, through its platform, provides farmers with expert advice, agricultural information, agronomy information, and weather forecasts.

-

Bighaat is an agritech startup that provides farmers with a platform to exchange information and learn about all aspects of farming. The company also offers products and services, including healthcare and crop support services.

Key Farming As A Service Companies:

The following are the leading companies in the farming as a service market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- AGRIVI

- Apollo Agriculture

- BigHaat

- Conservis

- Deere & Company

- EM3 Agriservices

- GeoPard Agriculture

- IBM Corporation

- ITC Limited

- Mahindra&Mahindra Ltd.

- Syngenta

- Taranis

- Trimble Inc.

Recent Developments

-

In June 2025, Pivot Bio partnered with Taranis to help farmers adopt more sustainable nutrient management practices through the Taranis Conservation program. Through this partnership, Pivot Bio’s dealer network will be able to offer Taranis Conservation services, which assist growers in securing NRCS funding for regenerative practices such as soil testing, nitrogen stabilizers, and variable rate technology.

-

In October 2024, Syngenta signed a multi-year partnership with Taranis to drive AI-powered advancements in agronomic productivity and conservation-focused innovation for agricultural retailers across the U.S. As part of this collaboration, a significant investment will support ag retailers in adopting Taranis’ AI-based agronomic platforms. The initiative is designed to modernize ag retail workflows, improve on-farm decision-making, promote the adoption of conservation practices, and ultimately enhance farm profitability.

-

In September 2024, AGRIVI partnered with the Barbados Agricultural Development and Marketing Corporation (BADMC) to launch an innovative AI-powered advisory platform aimed at boosting the productivity and sustainability of agriculture across Barbados. This initiative features the AI Agronomic Advisor, a virtual agronomy expert accessible to all Barbadian farmers via WhatsApp, 24/7. Acting as a direct link between BADMC and the farming community, the platform provides continuous access to expert consultations, agricultural knowledge, and active support on critical farming issues.

Farming As A Service Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.28 billion

Revenue forecast in 2033

USD 16.74 billion

Growth rate

CAGR of 15.5% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Service type, delivery model, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; China; India; Japan; Australia; Southeast Asia; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Mahindra & Mahindra Ltd.; Deere & Company; ITC Limited; Trimble Inc.; EM3 Agriservices; Apollo Agriculture; Accenture; Taranis; IBM Corporation; BigHaat; Conservis; AGRIVI; Syngenta; GeoPard Agriculture

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Farming As A Service Market Report Segmentation

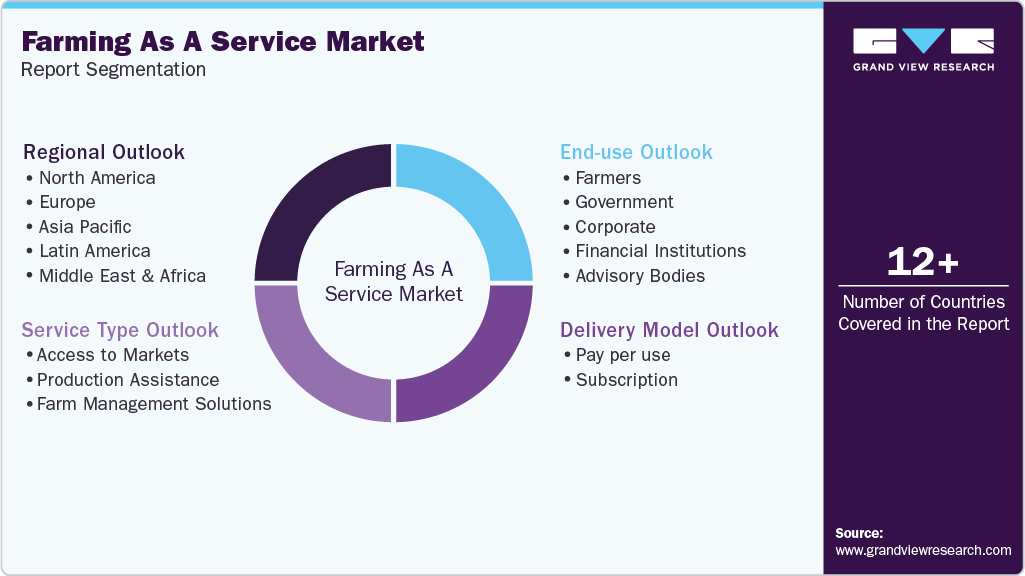

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global farming-as-a-service market report based on service type, delivery model, end-user, and region.

-

Service Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Farm Management Solutions

-

Precision Farming Tools

-

Analytics

-

Information Sharing

-

-

Production Assistance

-

Equipment Rentals

-

Labor Services

-

Utility Services

-

-

Access to Markets

-

Supplier to Farmers

-

Farmers to End Market

-

-

-

Delivery Model Outlook (Revenue, USD Billion, 2021 - 2033)

-

Pay per use

-

Subscription

-

-

End-use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Farmers

-

Government

-

Corporate

-

Financial Institutions

-

Advisory Bodies

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Southeast Asia

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global farming as a service market size was estimated at USD 4.63 billion in 2024 and is expected to reach USD 5.28 billion in 2025.

b. The global farming as a service market is expected to grow at a compound annual growth rate of 15.5% from 2025 to 2033 to reach USD 16.74 billion by 2033.

b. North America is one of the largest farming economies in the world and has one of the largest average farm sizes around the globe. North America currently has around 897,400,000 acres under cultivation.

b. Some key players operating in the farming as a service market include Mahindra & Mahindra, John Deere, ITC, Trimble, EM3, Apollo, Accenture, Taranis, BigHaat, Precision Hawk, IBM, and NinjaKart.

b. Key factors that are driving farming as a service market growth include increasing adoption of modern agricultural methods, reducing labor costs, and rising demand for food due to the growing population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.