- Home

- »

- Renewable Chemicals

- »

-

Fatty Alcohol Market Size, Share And Trends Report, 2030GVR Report cover

![Fatty Alcohol Market Size, Share & Trends Report]()

Fatty Alcohol Market (2024 - 2030) Size, Share & Trends Analysis Report By Type, By Application (Soaps & Detergents, Personal Care, Lubricants, Plasticizers Amines), By Region, And Segment Forecasts

- Report ID: 978-1-68038-436-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fatty Alcohol Market Summary

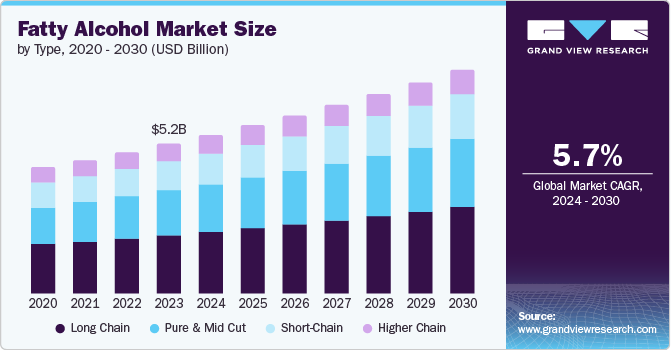

The global fatty alcohol market size was valued at USD 5.17 billion in 2023 and is projected to reach USD 8.07 billion by 2030, growing at a CAGR of 5.7% from 2024 to 2030. Factors driving market growth include the growing demand for surfactants, increasing demand for bio-based products, and growing demand from personal care and industrial and domestic application. Fatty alcohols are biodegradable in nature and cater to the same application as petrochemicals.

Key Market Trends & Insights

- Asia Pacific fatty alcohol market dominated the global fatty alcohols market with a revenue share of 40.1% in 2023.

- The fatty alcohol market in China dominated the Asia Pacific fatty alcohol market with a share of 37.0%.

- By type, Long chain accounted for the largest market revenue share of 38.9% in 2023.

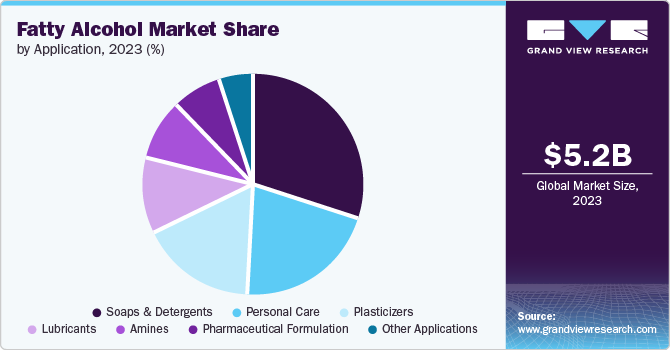

- By application, the soaps & detergents accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 5.17 Billion

- 2030 Projected Market Size: USD 8.07 Billion

- CAGR (2024-2030): 5.7%

- Asia Pacific: Largest market in 2023

The fatty alcohol market is driven by several key factors, including the increasing demand for surfactants in personal care products, rising demand for eco-friendly products, availability of raw materials, and expanding usage across diverse end-user industries. The demand for surfactants in shower gels, conditioners, lipsticks, and antiperspirants is a significant driver of the fatty alcohol market. Moreover, the growing awareness of environmental issues is encouraging consumers and manufacturers to opt for natural and sustainable products, leading to an increased demand for fatty alcohols derived from oleochemical feedstocks.

The availability of raw materials such as palm oil and the growing consumption of fatty alcohols in emerging markets, particularly in the Asia-Pacific region, are also contributing to the market growth. Furthermore, the increasing usage of fatty alcohols across industries like personal care, pharmaceuticals, lubricants, and industrial & domestic cleaning is fueling the overall market growth. These industries require fatty alcohols for their emulsifying, thickening, and moisturizing properties.

The trend towards sustainability is a significant driver of the fatty alcohol market. Manufacturers are shifting towards eco-friendly options due to customer demand for bio-based products. Fatty alcohols produced from bio-based oleochemicals are environmentally friendly and can be reused, unlike conventional options. As a result, these types of alcohols are in high demand in the personal care and pharmaceutical sectors due to their minimal side effects. Overall, the drivers of the fatty alcohol market are driven by a combination of factors, including increasing demand for surfactants, eco-friendly products, availability of raw materials, and expanding usage across diverse end-user industries.

Type Insights & Trends

Long chain accounted for the largest market revenue share of 38.9% in 2023. Long-chain fatty alcohols, with 14-22 carbon atoms, are in high demand due to their versatile applications as surfactants, emulsifiers, and emollients in personal care products and industrial cleaners. The growing preference for natural and sustainable ingredients is driving the adoption of long-chain fatty alcohols derived from renewable sources like vegetable oils and animal fats, which are more environment-friendly.

The pure & mid-cut segment is expected to register the fastest CAGR of 6.4% during the forecast period. The rapid segment growth is attributable to the widespread usage in producing Sodium Laureth Sulfate (SLS) and Sodium Lauryl Ether Sulfate (SLES) for personal care items like soaps, shampoos, toothpaste, and more. Anticipated factors are likely to drive up demand in the upcoming forecast period.

Application Insights & Trends

Soaps & detergents accounted for the largest market revenue share in 2023. Segment growth is driven by enhancements in living standards in developing economies and a growing focus on personal hygiene. Moreover, the increasing need for household and industrial cleaners in order to uphold cleanliness is projected to enhance the sector.

Personal care is projected to grow at the fastest CAGR over the forecast period. Rising consumer purchasing power is driving the demand for personal care products such as lotions, essential oils, and shampoos, which rely heavily on fatty alcohols as a key component. Fatty alcohols are essential in the production of surfactants, which possess properties that enable cleaning, emulsifying, and foaming, making them ideal for use in soaps, detergents, hand sanitizers, and other personal care products.

Regional Insights & Trends

Asia Pacific fatty alcohol market dominated the global fatty alcohols market with a revenue share of 40.1% in 2023. During the forecast period, the market is expected to grow due to the strong demand from different industries like surfactants, personal care, cosmetics, and pharmaceuticals in major economies such as China, India, and Japan. Market growth in these regions is expected to be driven by the increasing demand for application industries like cleaners and detergents leading to exponential growth. Because of the growing population, there is a rapid increase in the demand for cleaning products in the developing countries of Asia Pacific.

China Fatty Alcohol Market Trends

The fatty alcohol market in China dominated the Asia Pacific fatty alcohol market with a share of 37.0% due to Chinese economy maintains high-speed growth that has been stimulated by the consecutive increases of industrial output, import & export, consumer consumption and capital investment for over two decades.

North America Fatty Alcohol Market Trends

The fatty alcohol market in North America is expected to experience significant growth due to rising demand for personal care and cleaning products, as well as increasing consumer preference for eco-friendly and sustainable ingredients. Major companies are adopting bio-based fatty alcohols to meet consumer demand for natural and biodegradable alternatives. The presence of regulations on petrochemical-derived ingredients is also driving the shift towards plant-based and renewable fatty alcohols.

U.S. Fatty Alcohol Market Trends

The U.S. fatty alcohol market is driven by the presence of major personal care and consumer goods companies, which are incorporating bio-based and sustainable fatty alcohols into their products to meet consumer demand for natural and eco-friendly ingredients. The country’s established oleochemicals industry, favorable government initiatives, and robust manufacturing capabilities contribute to its growing importance in the global fatty alcohol market.

Europe Fatty Alcohol Market Trends

The Europe fatty alcohol market is poised to grow rapidly over the forecast period, fueled by growing demand for eco-friendly products, stringent regulations on petrochemical-derived ingredients, and established oleochemicals industry. Major companies are adopting bio-based fatty alcohols, while increasing consumer awareness of environmental impact incentivizes manufacturers to shift towards plant-based and renewable options, fueling market growth.

Germany Fatty Alcohol Market Trends

The fatty alcohol market in Germany is a key market for fatty alcohols, driven by its strong personal care and consumer goods industries. The demand for eco-friendly products and regulations on petrochemical-derived ingredients fuel adoption of bio-based fatty alcohols. Germany’s established oleochemicals industry and leading brands’ use of natural fatty alcohols contribute to the market’s growth.

Key Fatty Alcohol Company Insights

Some key companies in the market include Univar Solutions Inc.; BASF SE; KLK OLEO; and Wilmar International Ltd. Key players in the market are acquiring companies, launching new products, and forming partnerships to gain a competitive edge. The shift towards bio-based and sustainable fatty alcohols is driven by consumer demand and regulations, with companies focusing on innovation, supply chain integration, and strategic partnerships to cater to growing demand.

-

KLK OLEO is a global oleochemical manufacturer that produces premium beauty and personal care ingredients from non-GMO palm fruits. The company adheres to NDPE, RSPO, and sustainability standards to ensure environmental responsibility, prevent deforestation, and promote responsible palm oil production.

-

Ecogreen Oleochemicals is a leading producer of natural fatty alcohols, with production facilities in Indonesia, offering a range of products including saturated and unsaturated fatty alcohols, oleic acid, refined glycerin, and specialty esters like MCT for various industries.

Key Fatty Alcohol Companies:

The following are the leading companies in the fatty alcohol market. These companies collectively hold the largest market share and dictate industry trends.

- Univar Solutions LLC

- BASF SE

- KLK OLEO

- Wilmar International Ltd

- VVF L.L.C.

- Ecogreen Oleochemicals

- Emery Oleochemicals

- Arkema Group

- Royal Dutch Shell Plc .com

- Oleon NV

- SABIC

- Evyap Sabun Yağ Gliserin San. ve Tic. A.Ş.

- Kao Corporation

- Musim Mas Group

- The Procter & Gamble Company

Recent Developments

-

In June 2024, KLK OLEO introduced PALMESTER Fatty Acid Esters, a plant-derived emollient collection that enabled the creation of the perfect sensory experience for skincare products.

-

In February 2024, Univar Solutions LLC revealed an exclusive distribution deal with Extractos Naturales Gelymar S.A. in the U.S. and Canada, expanding their partnership from food and pharmaceutical ingredients to personal care, with a shared goal of accelerating the transition to sustainable solutions in the beauty sector.

Fatty Alcohol Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.46 billion

Revenue forecast in 2030

USD 8.07 billion

Growth rate

CAGR of 5.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

Univar Solutions LLC; BASF SE; KLK OLEO; Wilmar International Ltd; VVF L.L.C.; Ecogreen Oleochemicals; Emery Oleochemicals; Arkema Group; Royal Dutch Shell Plc .com; Oleon NV; SABIC; Evyap Sabun Yağ Gliserin San. ve Tic. A.Ş.; Kao Corporation; Musim Mas Group; The Procter & Gamble Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

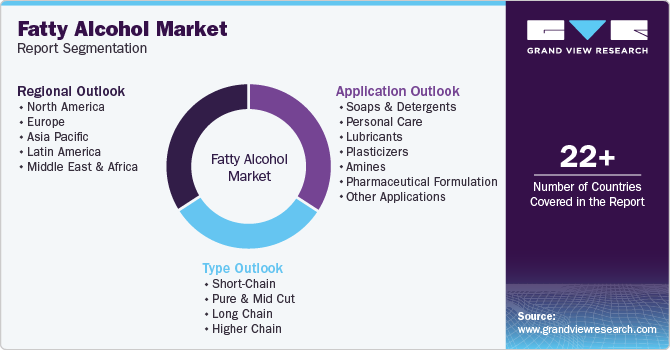

Global Fatty Alcohol Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fatty alcohol market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Short-Chain

-

Pure & Mid cut

-

Long Chain

-

Higher Chain

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Soaps & Detergents

-

Personal Care

-

Lubricants

-

Plasticizers

-

Amines

-

Pharmaceutical Formulation

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.