- Home

- »

- Homecare & Decor

- »

-

Home Decor Market Size And Share, Industry Report, 2030GVR Report cover

![Home Decor Market Size, Share & Trends Report]()

Home Decor Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Furniture, Textile, Flooring, Others), By Application (Indoor, Outdoor), By Region (North America, Europe, APAC, CSA, MEA), And Segment Forecasts

- Report ID: GVR-2-68038-988-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Home Decor Market Summary

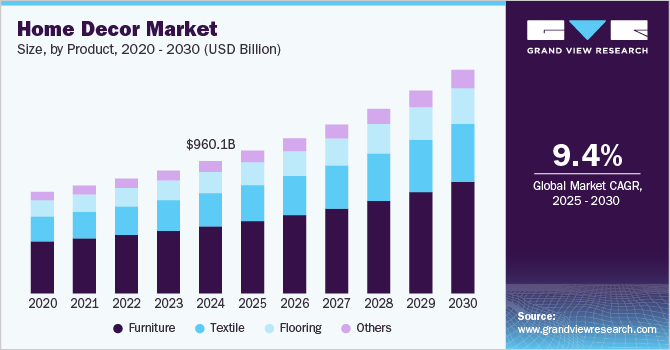

The global home decor market was valued at USD 960.14 billion in 2024 and is projected to reach USD 1,622.90 billion by 2030, growing at a CAGR of 9.4% from 2025 to 2030. The increasing adoption of sustainable materials in home décor, evolving interior design trends, and rapid urbanization are the primary factors driving the growth of the home décor industry.

Key Market Trends & Insights

- In 2024, the North America home decor industry dominated the global market, with a revenue share of 36.7%.

- The Asia Pacific home decor market is anticipated to experience the fastest CAGR during the forecast period.

- Based on product, the furniture segment dominated the global market with a revenue share of 50.7% in 2024.

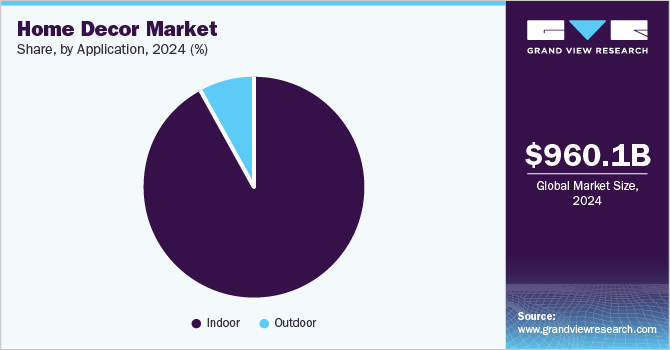

- By application, the indoor segment held the largest revenue share of the home decor market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 960.14 Billion

- 2030 Projected Market Size: USD 1,622.90 Billion

- CAGR (2025-2030): 9.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Consumers are increasingly inclined towards using sustainable materials like bamboo for furniture and flooring and organic fabrics for furnishings. Multipurpose and folding furniture also aligns with sustainable and space-efficient living. These trends reduce the environmental impact and enhance the aesthetic appeal of homes. Additionally, the accessibility of home décor content on social media platforms is encouraging consumers to frequently redecorate their interiors, further stimulating market growth.

With rapid global urbanization, more people are coming to cities to earn a living. With the continuous expansion of urban living, consumers urge to decorate their homes according to their liking. This has boosted the demand for different home décor articles, including furniture, linen and fabrics, and artificial flooring and roofing. The demand for home décor is high among first-time homeowners. These consumers are enthusiastic and willing to pay more for their home interiors and exteriors. Besides, a lot of content for home decor ideas on social media further lured consumers to undertake home makeovers on a regular basis. According to a report published by Opendoor in 2024, U.S. consumers spend an average of USD 5,635 on home renovation projects. Similarly, the consumer also spends an average of USD 1,598 on home décor activities.

Consumer demand for eco-friendly and responsibly sourced materials is becoming more prevalent. Growing awareness of the environment and the availability of sustainable materials are encouraging consumers to choose home décor responsibly. For instance, using bamboo furniture and other furnishings, such as flooring, is becoming more prevalent among responsible consumers. Bamboo is a sustainable alternative to wood without compromising on the strength, longevity, and aesthetic of home décor. Similarly, the use of eco-friendly textiles made from organic, natural, and recycled material is preferred by consumers to reduce environmental impact. Such trends are promoting the sustainable home décor industry. Besides, consumers also follow the lifestyle and practices of celebrities, as more celebrities are adopting sustainable living.

The easy availability of home décor products on e-commerce platforms and flexible payment options enables consumers to invest beyond their budgetary constraints. This has been a significant driver of the global home décor industry. Online home décor and e-commerce platforms offer a wide range of services, including consultations, delivery, installation, replacement, and after-sales support. These services facilitate convenient home furnishing with flexible payment options. According to a survey, over 82% of respondents are willing to shop for home décor online. Additionally, online platforms enable consumers to access global trends and replicate them in their homes. Data suggests that more than 42% of consumers are overwhelmed by the vast array of options available on online portals. Furthermore, the integration of AI-powered recommendations and augmented reality technology is further propelling the growth of the home décor market.

Product Insights

The furniture segment dominated the global home decor market based on product, with a revenue share of 50.7% in 2024. The growth of urban living and the increasing demand for stylish furniture have boosted the demand for this segment within the home décor market. Smaller urban apartments and limited living spaces have highlighted the importance of functional and folding furniture. Additionally, furniture made from sustainable materials such as bamboo and reclaimed wood is further driving the growth of the segment. Beyond indoor furniture, demand for outdoor furniture is also contributing to the growth of the furniture industry. Durable metal and composite furniture, capable of withstanding harsh outdoor conditions, is particularly popular among homeowners in lower-tier cities and rural areas.

The textile segment is also expected to experience the fastest CAGR from 2025 to 2030. Products such as bed linen, curtains, upholsteries, kitchen and bathroom linens are essential components of every household. The growing emphasis on hygiene and creating a welcoming home environment has boosted sales in the textile segment of the home décor industry. Additionally, the increasing adoption of oversized beds and mattresses, influenced by Western culture, is expected to further fuel segment growth.

Application Insights

The indoor segment held the largest revenue share of the home decor market in 2024. Growing demand for furniture and upholsteries for indoor spaces, including bedrooms, living rooms, bathrooms, and kitchens, has encouraged its growth. Consumers experimenting with indoor furnishing influenced by social media and online home décor content are influencing the spending on indoor home décor. Besides, the growing popularity of innovative functional and folding furniture is further luring consumers to buy indoor décor.

The outdoor segment is expected to experience the fastest market growth during the forecast period. The growing preference for open-space seating among urban consumers and the availability of durable furniture options are driving the growth of this segment. The trend of creating outdoor spaces with lounge and bar furniture, decorative lighting, and wooden or grass flooring is gaining popularity. Additionally, the increasing demand from consumers in tier 2 and tier 3 cities and rural areas with ample outdoor space is further contributing to the segment's growth.

Regional Insights

The North America home decor industry dominated the global market, with a revenue share of 36.7% in 2024. Consumers in the region spend considerably upgrading their living spaces. Higher spending capacity, availability of vast home décor options, and consumers following dynamic home décor trends are helping the region to dominate the home décor industry. The use of technological innovations in online platforms, including AI recommendations and AR, to check the appearance of furniture in homes is further helping the region remain dominant.

U.S. Home Decor Market Trends

The U.S. dominated the North American home decor market in 2024. U.S. consumers frequently opt to undertake renovation and home décor projects in every 3-5 years. Such projects necessitate purchasing furniture and upgrading flooring, ceilings, and lighting, thereby driving consistent growth in demand for home decor within the country. Responsible home décor with sustainable materials is another key trend in the country, boosting market growth.

Asia Pacific Home Decor Market Trends

The Asia Pacific home decor market is anticipated to experience the fastest CAGR during the forecast period. Countries such as China, India, and other ASEAN countries are undergoing rapid urbanization, which has resulted in growing demand for home decor and furniture. The average spending capacity of homeowners is rising steadily, allowing the consumer to invest in their home, thus encouraging market growth. Additionally, home décor material is easily available at a relatively low cost in the region.

China held the largest revenue share of the regional industry in 2024. China is experiencing rapid urbanization, with a significant population shift from rural to urban areas. In 2023, 66.2% of the population resided in cities. Experts predict that this figure will reach 75-80% by 2035. This rapid urbanization is expected to generate substantial demand for home décor products, including furniture, lighting, and textiles. This trend has been a major driver of the country's market growth. The vast domestic market also provides significant opportunities for the home décor industry.

Europe Home Decor Market Trends

The European home decor market is expected to experience significant growth during the forecast period. The European population is actively aware of their home décor and spends extensively on frequently renovating and upgrading their interiors and exteriors. Consumers in the region are rapidly shifting towards sustainable home decor, and the demand for ethically sourced material is on the rise. The presence of designer home décor brands, including Ikea, H&M Home, ZARA Home, and Roche Bobois, among others, launches fresh home décor products regularly. This further helps the regional market to maintain its relevance in the global home décor industry.

Key Home Decor Company Insights

Some of the key companies operating in the global home decor market are Inter IKEA Systems B.V., Kimball International Inc., Hanssem Corporation, Herman Miller, Inc., home24, Conair Corporation, Suofeiya Home Collection Co., Ltd., Koninklijke Philips N.V., Springs Window Fashions LLC, and Siemens AG. Major players in the home decor industry are rapidly adopting policies such as personalization and sustainable product offerings. These companies often collaborate with celebrities and other players in the market to expand their customer reach.

-

Ikea is a Sweden-based global furniture giant known for its affordable, stylish, and functional home furnishings. The company offers a wide range of furniture, including sofa sets and lounges, dining room furniture, shelves, cupboards and wardrobes, dressers, and bedroom furniture. It also offers textiles, lighting, flooring, and outdoor furniture. Its signature flat-pack furniture is designed for easy assembly, making it a popular choice for urban living.

-

MillerKnoll, Inc. is a U.S.-based office furniture and home furnishing company that operates under the name Herman Miller. The company is a renowned brand offering lounge seating, tables, storage, lighting, and home décor. The company is a responsible organization that has undertaken various sustainable practices in the last decade.

Key Home Decor Companies:

The following are the leading companies in the home decor market. These companies collectively hold the largest market share and dictate industry trends.

- IKEA Systems B.V.

- Kimball International Inc.

- Herman Miller, Inc.

- home24

- Hanssem Corporation

- Koninklijke Philips N.V.

- Conair Corporation

- Suofeiya Home Collection Co., Ltd.

- Springs Window Fashions LLC

- Siemens AG

Recent Developments

-

In December 2024, Ikea launched a new Nytillverkad furniture collection inspired by the chair designed in the 60s, 70s, and 80s. The collection also includes storage shelves, home décor textiles, and other accessories, including lights and vases.

-

In July 2024, Herman Miller, Inc., a leading player in the home decor industry, reintroduced its Eames Lounge Chair and Ottoman with bamboo-based upholstery. The chairs and ottoman were made from 100% recycled ocean-bound plastic, and the fabric is soft, durable, scratch-resistant, and colorfast. The product was designed to promote sustainable fishing.

Home Decor Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,037.14 billion

Revenue forecast in 2030

USD 1,622.90 billion

Growth rate

CAGR of 9.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, Australia, South Korea, Brazil, South Africa

Key companies profiled

Inter IKEA Systems B.V., Kimball International Inc., Herman Miller, Inc., home24, Hanssem Corporation, Koninklijke Philips N.V., Conair Corporation, Suofeiya Home Collection Co., Ltd., Springs Window Fashions LLC, Siemens AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Home Decor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand view research has segmented the global home decor market report based on product, application, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Furniture

-

Textile

-

Flooring

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Indoor

-

Outdoor

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

MEA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.