- Home

- »

- IT Services & Applications

- »

-

Federated Learning Market Size, Industry Report, 2030GVR Report cover

![Federated Learning Market Size, Share & Trends Report]()

Federated Learning Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Industrial Internet of Things, Drug Discovery, Risk Managemen), By Organization Size, By Industry Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-162-2

- Number of Report Pages: 99

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Federated Learning Market Summary

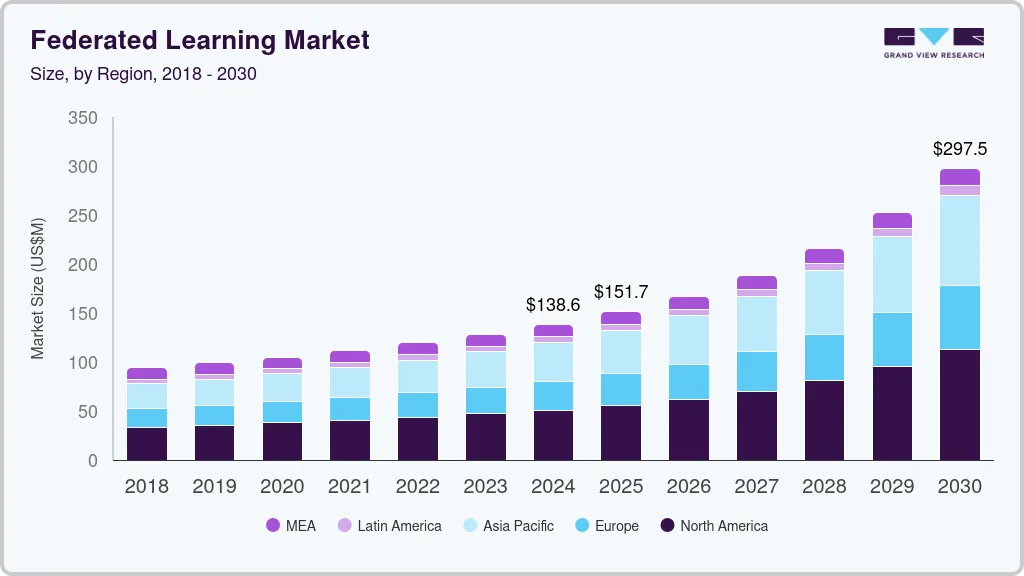

The global federated learning market size was estimated at USD 138.6 million in 2024 and is projected to reach USD 297.5 million by 2030, growing at a CAGR of 14.4% from 2025 to 2030. Several critical requirements drive the growing demand for production-ready federated learning platforms across industries.

Key Market Trends & Insights

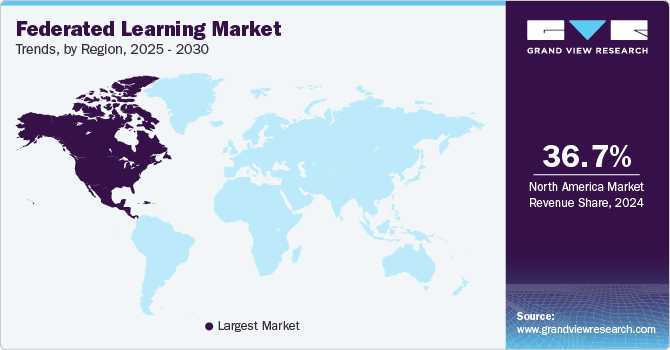

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, industrial internet of things accounted for a revenue of USD 38.2 million in 2024.

- Drug Discovery is the most lucrative application segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 138.6 Million

- 2030 Projected Market Size: USD 297.5 Million

- CAGR (2025-2030): 14.4%

- North America: Largest market in 2024

A key imperative is scalability to manage increasingly large datasets effectively. Furthermore, adherence to stringent data protection regulations necessitates privacy-preserving techniques like federated learning. Organizations expect these platforms to seamlessly integrate with their existing AI infrastructure and tools, allowing for a smooth transition and enhanced workflows. These needs are driving demand for federated learning across industries.

Organizations also want flexibility in operating across hybrid and multi-cloud setups. Developer-friendly frameworks are helping lower adoption barriers. For instance, in February 2025, Rhino Federated Computing partnered with Flower Labs to integrate Flower’s open-source federated learning framework into Rhino’s enterprise-grade Federated Computing Platform (FCP), enabling organizations across industries to deploy privacy-preserving AI at scale. The partnership blends Flower’s developer tools and privacy tech with Rhino FCP’s enterprise features to boost federated AI adoption across key industries.

Federated learning's scalability across a wide range of devices serves as a critical enabler for its adoption across organizations of varying sizes. It allows businesses to leverage AI capabilities without the need for heavy infrastructure investments, making advanced analytics more accessible. This democratization of AI aligns with the growing demand for cost-effective, high-performance technologies. Cost-efficiency remains a major incentive, especially for small and mid-sized enterprises that seek to adopt AI with limited resources. As organizations increasingly look to extract value from distributed data sources, federated learning offers a practical and efficient path forward. The combined strengths of scalability and affordability continue to attract stakeholders from sectors such as healthcare, finance, manufacturing, and IoT. These factors collectively push federated learning from a niche solution to a mainstream tool in enterprise AI strategy.

Healthcare institutions are rapidly adopting AI-driven technologies to enhance patient care. Federated learning offers a secure method for training AI models across multiple institutions without sharing sensitive data. This decentralized approach ensures that patient privacy is maintained while enabling collaboration. Allowing data to remain local, federated learning fosters innovation while maintaining security. It also enables AI models to be trained on diverse datasets, improving their accuracy and applicability across various healthcare settings. For instance, in December 2024, Siemens Healthineers, a healthcare technology company in Germany, collaborated with NVIDIA Corporation to integrate MONAI Deploy into their medical imaging platforms. This collaboration aims to accelerate the deployment of AI-driven solutions in clinical settings, making it easier for healthcare institutions to implement advanced AI technologies in medical imaging workflows.

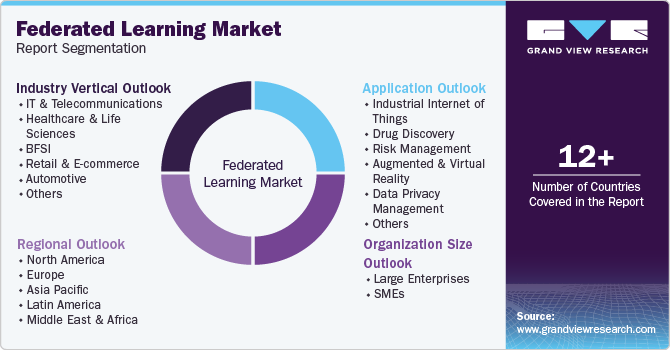

Application Insights

In terms of application, the Industrial Internet of Things segment dominates the market is anticipated to hold 24.8% in 2024. The growing demand for federated learning is driven by its alignment with the decentralized structure of IIoT environments. In IIoT, data is generated across various devices, making it challenging to centralize for AI training. Federated learning addresses this by enabling on-device model training, keeping data decentralized while preserving privacy and reducing latency. This ability to enhance AI across distributed devices optimizes IIoT operations in manufacturing, energy, and logistics sectors. As industries prioritize real-time analytics and secure data handling, federated learning is becoming crucial, accelerating adoption and market growth in IIoT applications.

Federated learning is becoming a key tool in drug discovery, enabling secure collaboration without sharing sensitive data. Organizations can collaborate on model training while decentralized proprietary and patient data, speeding up drug development. This approach improves clinical trials and preclinical research efficiency while adhering to strict data protection regulations. Major pharmaceutical companies, research labs, and healthcare organizations increasingly adopt federated learning to speed up innovation. As the technology proves its effectiveness in the pharmaceutical sector, its use is expanding, contributing significantly to the growth of the market.

Organization Size Insights

The large enterprises segment accounted for the largest market revenue share in 2024. Large enterprises are increasingly adopting federated learning due to its ability to align with their distributed structures and scale. This technology allows various organizational branches or units to collaborate on AI model training without centralizing sensitive data, ensuring compliance with strict privacy regulations. Federated learning efficiently handles the vast, diverse datasets typical of large enterprises, improving resource allocation and speeding up model development across departments. Its decentralized data management reduces the risk of breaches, aligning with the enterprises' risk management strategies. This secure, scalable solution fosters a culture of compliance and drives federated learning adoption across major industries.

Federated learning is helping drive market growth by enabling SMEs to participate in collaborative AI model training without heavy computational resources. This inclusive approach allows smaller businesses to leverage diverse datasets, refining models collectively without significant infrastructure investments. By providing access to advanced AI model training, federated learning democratizes technology and empowers SMEs to adopt advanced solutions. This approach eliminates the need for large-scale investments, making AI accessible to a broader range of businesses. The resource-efficient nature of federated learning supports expanding AI capabilities among SMEs, propelling market growth.

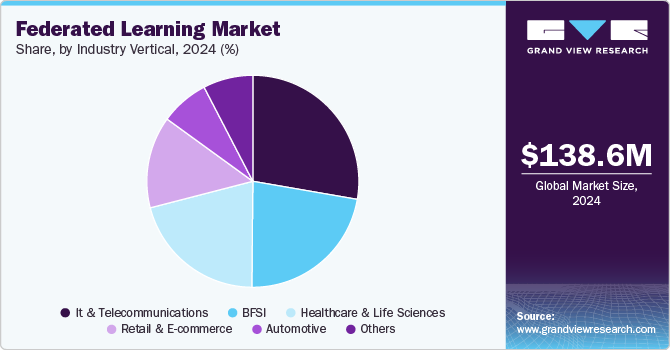

Industry Vertical Insights

The IT & telecommunications segment generated the highest market revenue in 2024. The IT and Telecommunications industries manage vast and diverse datasets spread across numerous systems and networks. Federated learning aligns well with their distributed structure, enabling collaborative model training while keeping sensitive data intact. The sector's strong focus on data privacy and security complements federated learning's decentralized approach. With constant innovation and optimization demands, these industries require efficient data utilization without centralizing it, a need fulfilled by federated learning. The sector's need for real-time data analysis and processing is supported by federated learning’s capability to perform on-device training, reduce latency, and improve network performance.

Healthcare and life sciences are significantly fueling market growth over the forecast period. The personalized nature of healthcare requires customized treatments based on individual patient data, with federated learning enabling the development of more accurate AI models for precision medicine while preserving patient confidentiality. It allows healthcare institutions to efficiently utilize diverse and extensive datasets, enhancing data-driven insights. The technology facilitates the collective analysis of data, leading to improvements in disease prediction, treatment optimization, and overall healthcare innovation. This capability is accelerating advancements in medical research and improving patient outcomes.

Regional Insights

North America dominated the market and accounted for 36.7% share in 2024. Key industries such as healthcare, finance, and technology in North America are early adopters of advanced AI technologies. Federated learning's ability to address data privacy concerns while enabling collaborative model training resonates well with these sectors, leading to widespread adoption and market dominance in the region. The region fosters strong collaborative networks among academia, research institutions, and industries. This collaboration encourages the sharing of expertise, resources, and data, ideal for federated learning's collaborative model training without compromising data privacy.

U.S. Federated Learning Market Trends

The U.S. federated learning market is expanding rapidly due to the country’s strong emphasis on data privacy and AI innovation. With industries such as healthcare, finance, and IT leading the way, federated learning offers solutions to secure data collaboration without compromising sensitive information. Regulatory frameworks such as HIPAA and GDPR drive the demand for privacy-preserving AI technologies. The U.S. continues to be a key player in advancing federated learning applications across multiple sectors.

Europe Federated Learning Market Trends

The Europe federated learning market is growing due to stringent data protection regulations, such as GDPR, which align well with federated learning’s privacy features. Industries such as healthcare, manufacturing, and finance are adopting federated learning to enable secure data analysis without centralizing sensitive information. The European market is focusing on ethical AI and data sovereignty, driving demand for privacy-preserving solutions. As businesses seek compliance and operational efficiency, federated learning is becoming a key component of AI strategies.

Asia Pacific Federated Learning Market Trends

The market for federated learning in Asia Pacific is experiencing significant growth, driven by expanding industries such as healthcare, finance, and telecommunications. The region’s diverse data privacy regulations and growing AI adoption are fostering interest in federated learning as a solution for secure and decentralized data processing. Countries such as China, India, and Japan are leading the charge in implementing AI-driven technologies while addressing privacy concerns.

Key Federated Learning Company Insights

Some of the key companies in the federated learning industry include Enveil, FedML, Google LLC, and IBM Corporation. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

FedML is significantly contributing to the federated learning industry with its open-source platform that streamlines the deployment of federated learning systems. It supports various machine learning frameworks such as TensorFlow and PyTorch, providing scalable, privacy-preserving solutions. FedML enables secure data sharing and collaborative model training without the need to centralize sensitive data. Its flexibility allows deployment across edge devices and cloud environments, making it suitable for various industries.

-

Google LLC has made substantial advancements in the market with its development of TensorFlow Federated (TFF). TFF helps organizations build and deploy federated learning models while ensuring data privacy and security. Google’s federated learning tools are being adopted across industries such as healthcare and finance, allowing AI models to be trained without centralizing sensitive data. Their focus on improving model efficiency, reducing latency, and boosting accuracy has set new standards.

Key Federated Learning Companies:

The following are the leading companies in the federated learning market. These companies collectively hold the largest market share and dictate industry trends.

- Acuratio, Inc.

- Cloudera, Inc.

- Edge Delta

- Enveil

- FedML

- Google LLC

- IBM Corporation

- Intel Corporation

- Lifebit

- NVIDIA Corporation

- Owkin, Inc.

Recent Developments

- In January 2025, Owkin, Inc., abiotech company in France, launched K1.0 Turbigo, an advanced operating system designed to accelerate drug discovery and diagnostics using AI and multimodal patient data from its federated network. This system powers biological insights and supports major pharmaceutical collaborations, with plans for K2.0 to integrate autonomous AI agents for future lab research and development.

- In December 2024, Google Cloud and Swift, a Belgium-based financial cooperative, are partnering to develop a secure, privacy-preserving AI model training solution for financial institutions using federated learning. The initiative, involving 12 global banks, aims to enhance fraud detection through shared fraud labels while ensuring that sensitive data remains encrypted throughout the process.

- In October 2024, Owkin, Inc, announced a partnership with AstraZeneca to develop an AI-powered tool for pre-screening germline BRCA mutations (gBRCAm) in breast cancer patients. This partnership focuses on creating a solution that can analyze digitized pathology slides to identify patients who may benefit from further genetic testing, thereby facilitating earlier and more accurate diagnosis.

Federated Learning Market Report Scope

Report Attribute

Details

Market Size value in 2025

USD 151.7 million

Revenue forecast in 2030

USD 297.5 million

Growth rate

CAGR of 14.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Application, organization size, industry vertical, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

Acuratio Inc.; Cloudera Inc.; Edge Delta; Enveil; FedML; Google LLC; IBM Corporation; Intel Corporation; Lifebit; NVIDIA Corporation; Owkin, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Federated Learning Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global federated learning market report based on of application, organization size, industry vertical, and region:

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Industrial Internet of Things

-

Drug Discovery

-

Risk Management

-

Augmented & Virtual Reality

-

Data Privacy Management

-

Others

-

-

Organization Size Outlook (Revenue, USD Million; 2018 - 2030)

-

Large Enterprises

-

SMEs

-

-

Industry Vertical Outlook (Revenue, USD Million; 2018 - 2030)

-

IT & Telecommunications

-

Healthcare & Life Sciences

-

BFSI

-

Retail & E-commerce

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global federated learning market size was estimated at USD 138.6 million in 2024 and is expected to reach USD 151.7 million in 2025.

b. The global federated learning market is expected to grow at a compound annual growth rate of 14.4% from 2025 to 2030 to reach USD 297.5 million by 2030.

b. North America dominated the federated learning market with a share of 36.7% in 2024. This is attributable to the region’s robust technological infrastructure, widespread access to high-performance computing resources, and early adoption of advanced AI solutions across sectors such as healthcare, finance, and automotive.

b. Some key players operating in the federated learning market include Acuratio Inc.; Cloudera Inc.; Edge Delta; Enveil; FedML; Google LLC; IBM Corporation; Intel Corporation; Lifebit; and NVIDIA Corporation.

b. Key factors driving market growth include rising concerns over data privacy, increased adoption of decentralized AI, and advancements in edge computing technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.