- Home

- »

- Plastics, Polymers & Resins

- »

-

Feed Packaging Market Size, Share, Industry Report, 2033GVR Report cover

![Feed Packaging Market Size, Share & Trends Report]()

Feed Packaging Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Plastic, Paper & Paperboard), By Packaging Type, By End Use, By Packaging Format, By Feed Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-693-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Feed Packaging Market Summary

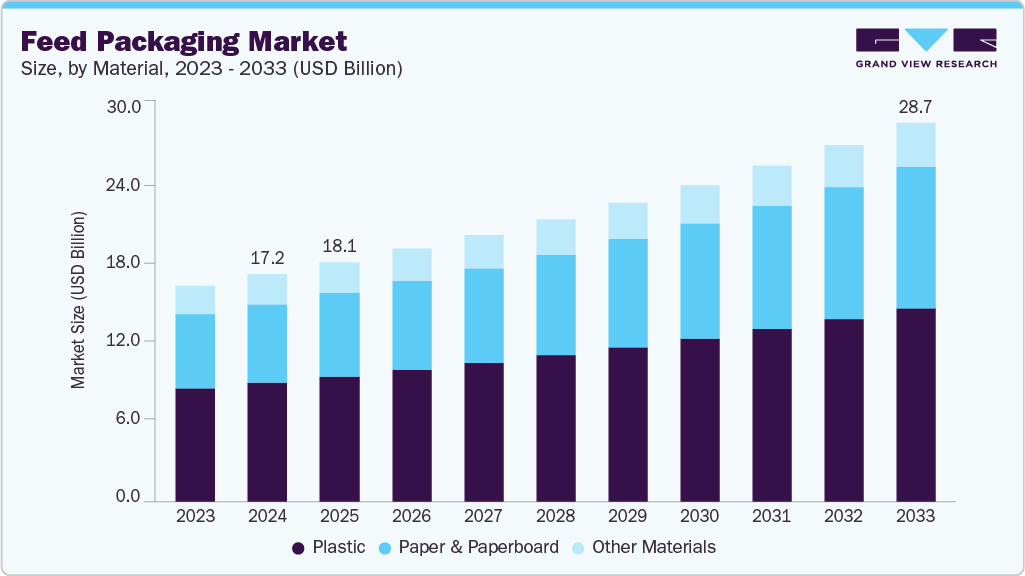

The global feed packaging market size was estimated at 17.20 billion in 2024 and is projected to reach 28.68 billion in 2033, growing at a CAGR of 5.9% from 2025 to 2033. Rising employee health and safety awareness, combined with high industrial deaths in emerging economies due to shortage of protective equipment, is likely to fuel market expansion over the forecast period.

Key Market Trends & Insights

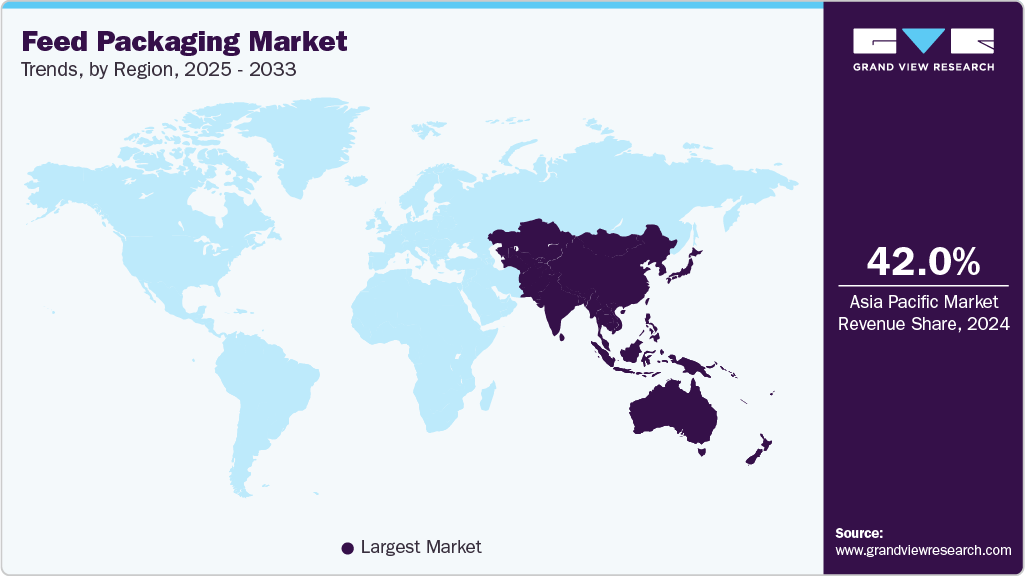

- Asia Pacific dominated the feed packaging market with the largest revenue share of over 42.0% in 2024.

- The feed packaging industry in China is expected to grow at a substantial CAGR of 6.6% from 2025 to 2033.

- By material, the paper & paperboard segment is expected to grow at a considerable CAGR of 6.9% from 2025 to 2033 in terms of revenue.

- By packaging type, the flexible segment is expected to grow at a considerable CAGR of 6.2% from 2025 to 2033 in terms of revenue.

- By end use, the aquatic feed packaging segment is expected to grow at a considerable CAGR of 6.5% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 17.20 Billion

- 2033 Projected Market Size: USD 28.68 Billion

- CAGR (2025-2033): 5.9%

- Asia Pacific: Largest market in 2024

Additionally, expanding livestock farming and pet food sectors are boosting market growth. As livestock farming intensifies to meet the demand for meat, dairy, and eggs, the need for safe, efficient, and long-lasting packaging solutions becomes critical. For example, in Asia-Pacific countries such as China and India, rising meat consumption is prompting large-scale feed production and thus increasing demand for high-barrier packaging to preserve the quality of feed. Efficient packaging ensures longer shelf life and protection from contamination, reducing feed wastage and improving overall supply chain efficiency.Governments and international organizations are enforcing stricter regulations related to feed quality and safety, driving demand for advanced packaging. Packaging must now comply with standards that prevent microbial contamination, moisture ingress, and degradation of nutritional content. This is particularly important in the poultry and aquaculture sectors, where improper feed handling can directly affect animal health and human food safety. For instance, the European Union’s Feed Hygiene Regulation (EC No 183/2005) mandates that feed packaging materials must not adversely affect feed safety, pushing manufacturers toward high-barrier laminates and multi-layer plastic bags with resealable closures.

Innovations in feed packaging technologies, including vacuum packaging, UV-resistant films, and biodegradable materials, are reshaping the market landscape. These technologies enhance product integrity during transportation and storage. The adoption of multi-layer laminated bags and woven polypropylene sacks with barrier films is growing, as this helps preserve nutritional content while being tear-resistant and lightweight. Leading companies such as Mondi and LC Packaging are introducing sustainable and cost-effective solutions like recyclable paper-based feed bags and compostable film layers, which are especially popular in markets with strong environmental regulation and consumer awareness.

The rapid expansion of the pet food industry and increasing consumer willingness to invest in premium pet nutrition are driving innovations in smaller, branded, and consumer-oriented feed packaging. Flexible pouches with zip-locks, printed designs, and portion-controlled packaging are gaining traction in developed markets like North America and Europe. Simultaneously, specialty feeds, such as those for horses, rabbits, and aquaculture, require differentiated packaging formats that support brand identity and functional use. This trend is pushing packaging companies to invest in customized and niche solutions, spurring market growth across a variety of feed types.

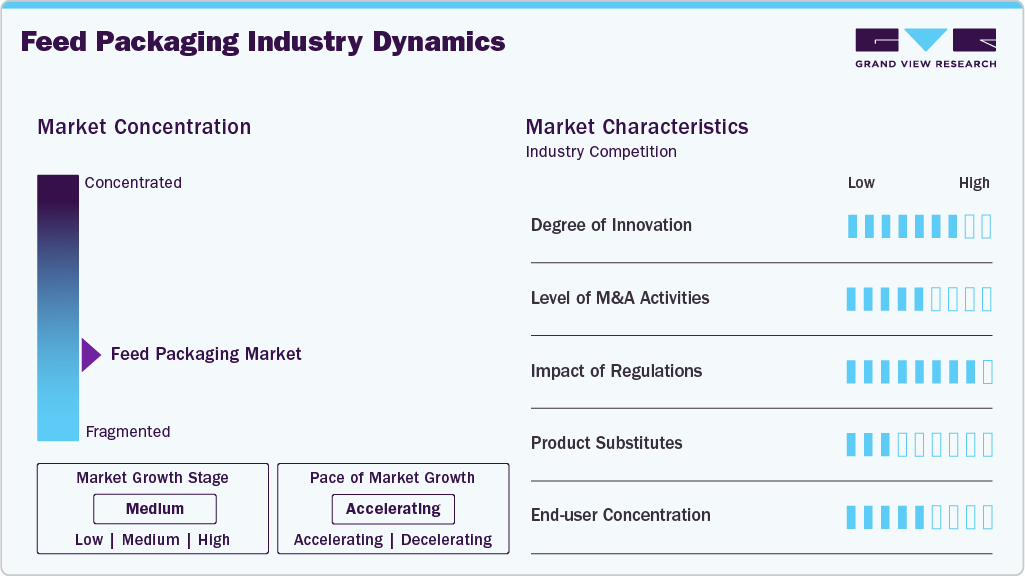

Market Concentration & Characteristics

The feed packaging market is moderately consolidated, featuring a mix of global packaging giants and specialized regional players. Large firms dominate the high-volume animal feed and bulk packaging segments, while smaller players often serve niche markets like pet food or aquaculture feed packaging. This structure allows for a balance between innovation-driven premium solutions and cost-effective mass production.

The feed packaging industry is highly dependent on the health and growth of the livestock, poultry, aquaculture, and pet food industries. Any fluctuations in these sectors, caused by disease outbreaks, feed ingredient shortages, or shifts in consumer dietary preferences, can directly impact feed packaging demand. Additionally, the market is tied to agricultural cycles and commodity prices, making it somewhat seasonal and sensitive to raw material costs.

Material Insights

The plastic segment recorded the largest revenue share of over 52.0% in 2024. Plastic is the most widely used material in feed packaging due to its durability, flexibility, lightweight nature, and excellent barrier properties. It is predominantly used in the form of polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET) in flexible and rigid formats, including bags, pouches, and containers. Plastic packaging ensures longer shelf life by providing protection against moisture, contaminants, and UV rays, making it highly suitable for animal feed stored over long periods or transported across long distances.

The paper & paperboard segment is expected to grow at the fastest CAGR of 6.9% during the forecast period. Paper and paperboard are gaining popularity in feed packaging due to their renewable and biodegradable nature. They are commonly used for small pet feed packs and bulk sacks for livestock feed, often with inner linings to improve moisture resistance. The growing consumer and regulatory push toward sustainable packaging is the primary driver for paper & paperboard feed packaging.

Packaging Type Insights

The flexible segment recorded the largest revenue share of over 72.0% in 2024 and is expected to grow at the fastest CAGR of 6.2% during the forecast period. Flexible feed packaging includes materials such as plastic films, paper, and multi-layer laminates that can be easily shaped. Common formats include bags, pouches, and wraps. This type of packaging is widely used for dry feed, pet food, and specialty animal nutrition products due to its lightweight nature, ease of handling, and lower material usage. It offers excellent printability for branding and labeling, resealability, and is cost-effective for transportation and storage.

Rigid feed packaging includes containers such as plastic tubs, metal cans, and paperboard boxes. This packaging type offers enhanced protection and structural integrity, making it ideal for bulk feed storage, premium pet food, or liquid feed applications. It provides better barrier properties against moisture, pests, and contamination. Rigid packaging is often used in industrial-scale livestock operations and specialized animal nutrition products. Rigid packaging demand is driven by the need for product integrity and protection during transport and storage, particularly in longer supply chains and industrial-scale livestock operations.

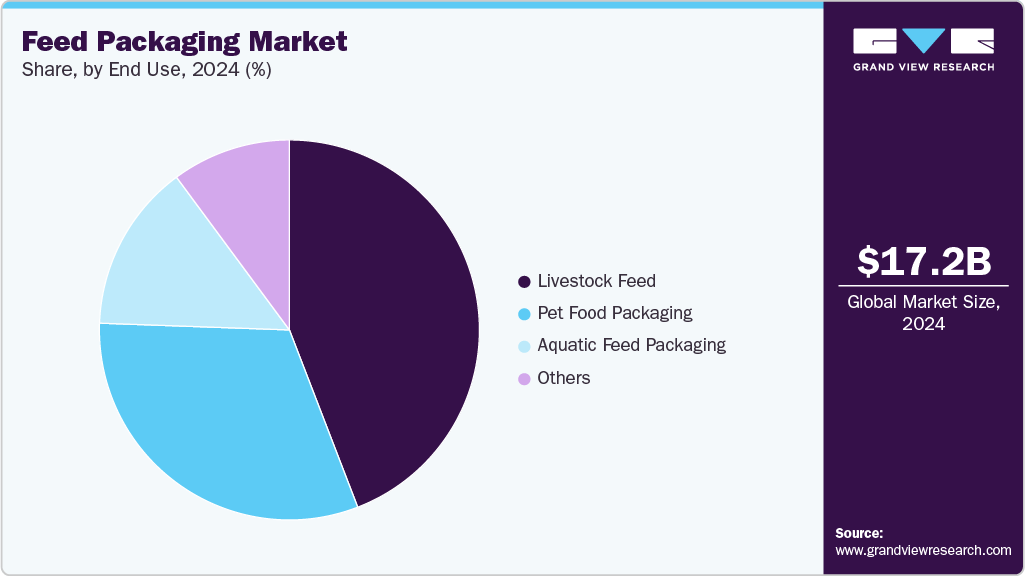

End Use Insights

The livestock feed segment recorded the largest market share of over 44.0% in 2024. Livestock feed packaging caters to the nutritional feed requirements of farm animals such as cattle, poultry, swine, and goats. Packaging in this segment is designed for bulk transport and storage, focusing on moisture resistance, durability, and cost-efficiency. Common packaging formats include multi-wall paper bags, woven polypropylene sacks, and large flexible intermediate bulk containers (FIBCs), often tailored for large-scale farms and commercial feed producers. The growth of the livestock feed packaging segment is primarily driven by the increasing demand for animal-based products such as meat, milk, and eggs due to the rising global population and changing dietary preferences.

The aquatic feed packaging segment is projected to grow at the fastest CAGR of 6.5% during the forecast period. Aquatic feed packaging serves the aquaculture industry, which includes feeding fish, shrimp, and other marine life. The packaging for this segment is specialized to preserve the nutritional integrity of high-protein feeds, protect against humidity, and offer strength for marine environments. Common formats include moisture-barrier bags and HDPE woven sacks with liners. The growth of aquaculture as a sustainable source of protein is the major driver for aquatic feed packaging.

Packaging Format Insights

The bags segment led the feed packaging market with the largest revenue share of over 45.0% in 2024. Bags are the most widely used packaging format for animal feed, especially bulk and dry feed products such as grains, pellets, and mash. They are typically made from materials such as polypropylene (PP), paper, or multi-layer laminates to ensure durability and moisture resistance. Bags are popular in both commercial livestock and pet feed sectors due to their cost-effectiveness and scalability. The demand for bags is driven by their affordability, high-volume capacity, and ease of transportation and storage.

The pouches/pockets segment is expected to grow at the fastest CAGR of 6.3% during the forecast period. Pouches or pockets are flexible, resealable packaging formats commonly used for premium pet food and specialty animal nutrition products. These are often designed with zippers or spouts and made from multi-layer films offering high barrier protection against oxygen, moisture, and contaminants. The growth of pouches is primarily driven by increased urban pet ownership and the demand for premium, portion-controlled packaging.

Feed Type Insights

The dry feed segment dominated the feed packaging industry with the largest revenue share of over 53.0% in 2024. Dry feed is the most common type of animal and pet feed and includes kibbles, pellets, flakes, and crumbles. It is widely used due to its longer shelf life, lower production costs, and ease of storage and transportation. Packaging for dry feed typically involves multilayer paper bags, plastic pouches, or woven polypropylene sacks to ensure protection from moisture and contamination.

The chilled & frozen segment is expected to grow at the fastest CAGR of 6.8% during the forecast period. Chilled and frozen feed includes perishable formulations such as raw meat-based diets or frozen meal packs, commonly used for high-end pet food or special livestock feeding regimens. Packaging solutions here focus on insulation, vacuum sealing, and temperature control, often using laminated films or plastic trays. The growing popularity of raw and fresh pet diets, especially among affluent urban consumers, is a key driver.

Regional Insights

Asia Pacific dominated the feed packaging market with the largest revenue share of over 42.0% in 2024 and is expected to grow at the fastest CAGR of 6.4% over the forecast period. This positive outlook is due to rapid industrialization in agriculture, increasing meat consumption, and expanding livestock production. Countries such as China, India, andVietnam are witnessing a surge in demand for high-quality feed packaging to support their growing poultry, aquaculture, and dairy industries. The rise of organized livestock farming and government initiatives promoting animal nutrition further boosts the need for durable and sustainable packaging solutions.

The China feed packaging market dominates due to its massive livestock and aquaculture industries, which demand high volumes of packaged feed. The country’s shift toward intensive farming has increased the need for moisture-proof and UV-resistant packaging, particularly for poultry and swine feed. Companies such as New Hope Group and COFCO use multi-layer plastic bags and woven polypropylene sacks to ensure durability during storage and transport. Government policies promoting feed safety and quality further accelerate packaging innovations, such as anti-counterfeit seals and vacuum packaging.

Europe Feed Packaging Market Trends

Europe’s feed packaging industry is shaped by strict EU regulations on food safety, sustainability, and animal welfare, driving demand for high-barrier and eco-friendly materials. Countries like Germany, France, and the Netherlands are at the forefront of adopting bio-based plastics and recyclable packaging to comply with the European Green Deal. The region’s strong dairy and poultry industries rely on airtight and pest-resistant packaging to maintain feed quality. For example, German feed manufacturers use silo bags and FIBCs (Flexible Intermediate Bulk Containers) for large-scale storage and transportation.

North America Feed Packaging Market Trends

Advanced farming practices, stringent food safety regulations, and high meat consumption in the U.S. and Canada drive the growth of the North America’s feed packaging industry. The region emphasizes sustainable and efficient packaging solutions, such as recyclable plastics and paper-based materials, to align with environmental policies. For instance, major feed producers such as Cargill and ADM use bulk packaging and intermediate bulk containers (IBCs) to optimize storage and transportation. The growing demand for organic and non-GMO animal feed has also led to innovations in barrier films and vacuum-sealed packaging to preserve nutritional integrity.

U.S. Feed Packaging Market Trends

The U.S. feed packaging industry’s growth is driven by large-scale livestock farming, pet food demand, and technological advancements in packaging. The country’s beef, poultry, and dairy industries rely on bulk packaging solutions like FIBCs and paper bags for cost-effective distribution. Major players like Land O’Lakes and Tyson Foods use automated packaging lines to enhance efficiency and reduce contamination risks. The increasing popularity of premium pet food has also spurred demand for resealable and branded pouches, with companies like Blue Buffalo using high-barrier films to extend shelf life.

Key Feed Packaging Company Insights

The competitive environment of the feed packaging market is moderately fragmented, with a mix of global packaging giants and regional players competing based on innovation, sustainability, cost-efficiency, and customization. Companies such as Amcor plc, Mondi, Sonoco Products Company, Sealed Air, and ProAmpac dominate the market through strong R&D capabilities, diversified product portfolios, and strategic partnerships with feed manufacturers. Additionally, market players are increasingly investing in digital printing and smart packaging technologies to enhance brand differentiation and traceability, further intensifying competition.

-

In June 2025, Mondi partnered with French pet food manufacturer Saga Nutrition to launch a recyclable, mono-material packaging, replacing traditional non-recyclable multi-material plastics, for Saga’s dry pet food range. Dubbed the re/cycle FlexiBag, this innovative solution ensures product freshness with high-barrier protection against moisture, fat, and odour, while supporting a circular economy and complying with CEFLEX recycling guidelines.

-

In April 2025, UFlex Limited opened a USD 50 million manufacturing plant in Mexico to produce woven polypropylene bags for dry pet food packaging, targeting North and South American markets. The facility, set to operate by 2025-26, will boost regional supply with durable, moisture-resistant, and recyclable packaging, supporting the growing USD 135 billion pet food market in the Americas.

-

In December 2024, Berry Global Inc. and VOID Technologies teamed up to launch a high-performance, sustainable polyethylene film for pet food packaging. The new film offers enhanced strength and recyclability, using VOID’s VO+ technology to reduce plastic use and improve opacity. This collaboration supports eco-friendly packaging solutions that meet food safety standards and help reduce environmental impact.

Key Feed Packaging Companies:

The following are the leading companies in the feed packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Mondi

- WINPAK LTD.

- Huhtamaki

- Berry Global Inc.

- UFlex Limited

- ProAmpac

- Sealed Air

- Tetra Pak

- Graphic Packaging International, LLC

- SHU Packaging Co., Ltd

- Duropack Limited

- Sonoco Products Company

- LC Packaging

Feed Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.13 billion

Revenue forecast in 2033

USD 28.68 billion

Growth rate

CAGR of 5.9% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, packaging type, end use, packaging format, feed type, region

States scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Key companies profiled

Amcor plc; Mondi; WINPAK LTD.; Huhtamaki; Berry Global Inc.; UFlex Limited; ProAmpac; Sealed Air; Tetra Pak; Graphic Packaging International, LLC; SHU Packaging Co., Ltd; Duropack Limited; Sonoco Products Company; LC Packaging

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Feed Packaging Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global feed packaging market report based on material, packaging type, end use, packaging format, feed type, and region:

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Plastic

-

Paper & Paperboard

-

Others

-

-

Packaging Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Flexible

-

Rigid

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Livestock Feed

-

Pet Food Packaging

-

Aquatic Feed Packaging

-

Others

-

-

Packaging Format Outlook (Revenue, USD Million, 2021 - 2033)

-

Bags

-

Pouches/Pockets

-

Boxes/Cartons

-

Jars/Containers

-

Others

-

-

Feed Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Dry Feed

-

Pet Treats

-

Chilled & Frozen

-

Wet Feed

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global feed packaging market was estimated at around USD 17.20 billion in the year 2024 and is expected to reach around USD 18.13 billion in 2025.

b. The global feed packaging market is expected to grow at a compound annual growth rate of 5.9% from 2025 to 2030 to reach around USD 28.68 billion by 2033.

b. The livestock feed segment emerged as the dominating end use segment in the feed packaging market due to the high global demand for meat, dairy, and poultry products, driving large-scale livestock farming.

b. The key players in the feed packaging market include Amcor plc; Mondi; WINPAK LTD.; Huhtamaki; Berry Global Inc.; UFlex Limited; ProAmpac; Sealed Air; Tetra Pak; Graphic Packaging International, LLC; SHU Packaging Co., Ltd; Duropack Limited; Sonoco Products Company; and LC Packaging.

b. The expanding livestock farming and pet food sectors are boosting market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.