- Home

- »

- Beauty & Personal Care

- »

-

Feminine Intimate Care Market Size & Share Report, 2030GVR Report cover

![Feminine Intimate Care Market Size, Share & Trends Report]()

Feminine Intimate Care Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (OTC Products, Wash, Wipes, Moisturizers), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-979-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Feminine Intimate Care Market Summary

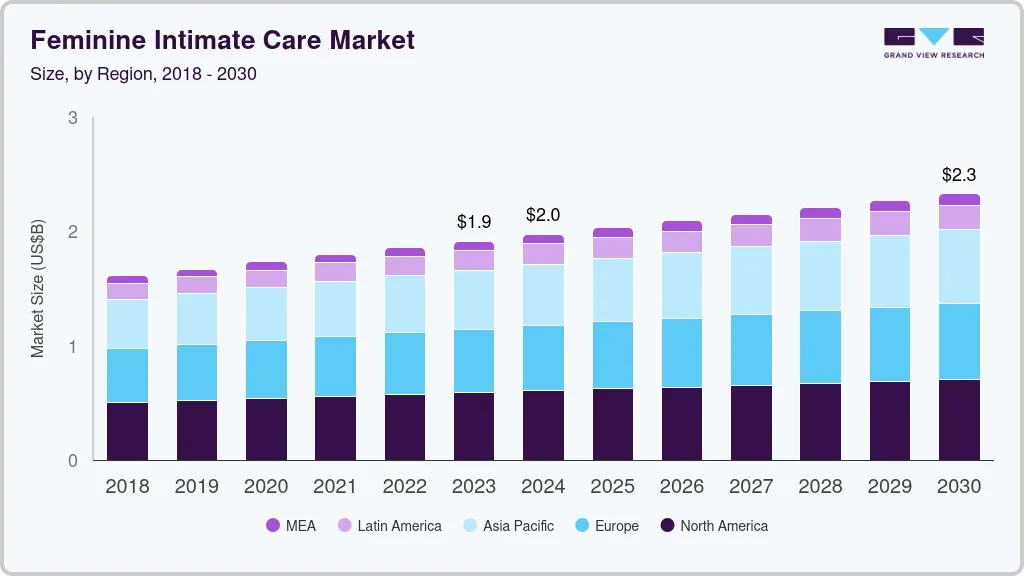

The global feminine intimate care market size was estimated at USD 1,913.7 million in 2023 and is projected to reach USD 2,329.2 million by 2030, growing at a CAGR of 2.8% from 2024 to 2030. Increasing awareness about intimate hygiene among women globally, developing technologically advanced products by manufacturers, and increasing economic independence among middle-class women in emerging economies have fueled market growth.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- In terms of segment, otc products accounted for a revenue of USD 1,913.7 million in 2023.

- OTC Products is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 1,913.7 Million

- 2030 Projected Market Size: USD 2,329.2 Million

- CAGR (2024-2030): 2.8%

- North America: Largest market in 2023

Additionally, various NGOs' increased educational initiatives and media campaigns have fostered a greater understanding of intimate health and hygiene. This has led to heightened demand for specialized care products such as pH-balanced intimate washes, wet wipes, lotions, and OTC products manufacturers' extensive marketing efforts have led to a rise in awareness among rural women about the importance of intimate hygiene. A substantial demand is expected from these newly tapped markets in the coming years.

The steadily increasing participation of women workforce in the developing economies of Asia Pacific, the Middle East, and Africa has led to a higher disposable income, enabling greater expenditure on personal care, beauty, and intimate care products. A noticeable shift towards a more busy and active lifestyle practice has created an urgent need for reliable and convenient intimate care products among this demographic. Furthermore, a pronounced inclination toward natural and organic ingredients and a preference for premium, chemical-free, and specialized products is driving market expansion. Manufacturers offer distinctive products, addressing consumers' budgetary and other personal requirements, leading to improved sales.

Adopting Western lifestyle practices, particularly in emerging economies such as India, China, and Brazil, influences consumer behavior toward a more frequent usage of intimate care products. For instance, talking about periods and female intimate hygiene is no longer considered distasteful in urban culture. The new generation has understood the importance of discussing feminine hygiene. Additionally, the proliferation of online marketplaces and e-commerce platforms has opened doors for small manufacturers to showcase their products without spending heavily on marketing. These factors are expected to drive demand for customized intimate hygiene products during the forecast period.

Product Insights

OTC products accounted for the highest revenue share of 40.6% in 2023 in the global market. OTC intimate care products are formulated to address common concerns such as odor, irritation, itching, and dryness. Their mild nature and safe profile build consumer trust and drive repeated purchases. For instance, a large consumer base regularly purchases medicated creams and ointments. Moreover, compared to prescription-based alternatives, OTC products have a lower price point, making them a more affordable option for a wider consumer base. These significant factors of widespread availability and economic accessibility contribute to this segment’s market dominance.

Wipes are expected to register the fastest CAGR during the forecast period in the feminine intimate care market. Manufacturers offer wipes with specialized formulations, such as natural, chemical-free, and skin-friendly ingredients. Additionally, manufacturers have expanded their product range, catering to diverse consumer preferences. The increasing number of women participating in the workforce and the growing popularity of active lifestyles have fueled the demand for portable intimate care products such as wipes. Furthermore, governments, especially in emerging economies, frequently launch campaigns to generate awareness about these products and dispel myths associated with them among the female demographic, aiding industry expansion.

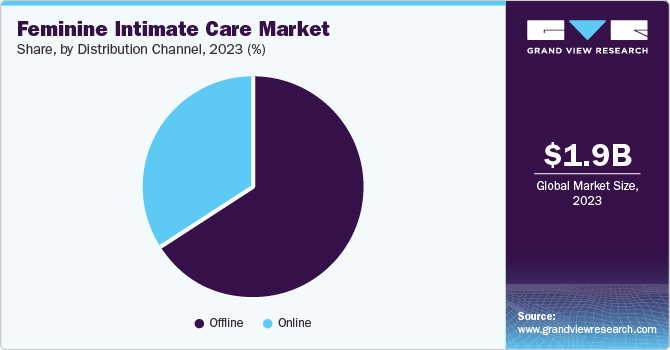

Distribution Channel Insights

Offline channels accounted for the highest revenue share of the market in 2023. It is owing to a well-established network of retail outlets, pharmacies, supermarkets, and convenience stores offering consumers a wide range of intimate care products. The ability to physically examine these products, compare multiple products, and make easy returns in case of dissatisfaction leads to a stronger preference for offline purchases by a large customer base. The robust supply chain infrastructure in these channels ensures timely delivery and constant availability of hygiene products. Additionally, supermarkets offer heavy discounts on bulk purchases, attracting consumers to buy these items in large quantities.

Meanwhile, online channels are anticipated to witness the fastest growth rate from 2024 to 2030. It is owing to the widespread proliferation and use of e-commerce marketplaces across developed and emerging economies. Due to their busy schedules, the urban population needs help to allocate time for shopping for necessities, thus resorting to online platforms. Growing disposable income levels, increased smartphone usage, and rising internet penetration in remote places have fueled the demand from an untapped consumer base. Moreover, as distribution and logistics become efficient and faster, the segment growth can be expected to become more pronounced over the forecast period.

Regional Insights

North America held the largest revenue share of 30.8% in 2023. A relatively higher standard of living and disposable income levels in this region have enabled female consumers to allocate a more significant expenditure on personal care products in the intimate care category. Furthermore, a more open and accepting societal attitude towards women's health and body positivity has driven demand for a wider range of intimate care solutions in the region, leading to its market dominance. Major providers of intimate care solutions have established their presence in regional economies such as Canada and the U.S., thus developing a robust distribution channel over the years.

U.S. Feminine Intimate Care Market Trends

The U.S. held a substantial share of the regional market in 2023. This is attributed to the country's well-established retail infrastructure, which includes an extensive presence of supermarkets, convenience stores, and pharmacies that ensure widespread availability of intimate care products, facilitating consumer access and purchase. Moreover, a robust healthcare system and increased awareness regarding women's health issues in the country have fostered a conducive environment for adopting intimate care products.

Europe Feminine Intimate Care Market Trends

Europe accounted for a notable revenue share of the global market in 2023. This is owing to the presence of a large number of developed economies in the region, such as Germany, France, the UK, and Italy, where a substantial proportion of the working class comprises women. The ability to make individual decisions and high spending capacity empower them to purchase personal care items such as intimate hygiene products. Additionally, the growing focus of women on incorporating organic and natural ingredients has propelled the expansion of the premium category of intimate care products.

The UK feminine intimate care market held a significant revenue share of the European market in 2023. According to the UK Labor Force Survey of 2023 by the Office for National Statistics, over 16 million women aged 16 years and above were part of the workforce in the UK. It has resulted in greater economic independence among female consumers, who can spend on personal care products. Additionally, extensive awareness about the importance and necessity of intimate hygiene, along with specialized product offerings by manufacturers in this segment, has led to substantial market growth in the economy.

Asia Pacific Feminine Intimate Care Market Trends

Asia Pacific is expected to advance at a substantial growth rate during the forecast period. The region has experienced strong economic growth over the past three decades, leading to increased employment opportunities for women, resulting in higher income levels. It has fueled demand for a wider range of beauty and personal care products, such as intimate care items. Moreover, rapid urbanization and increased social media usage have led to a rapid shift in consumer behavior, with a growing preference for advanced hygienic products. Hence, this drives the demand for female intimate care items in the region.

The rising number of women enrolling in higher education and entering the workforce across India has led to a growing awareness of personal hygiene and feminine care among this demographic. Online websites dedicated to women's personal care products, such as Nykaa, have increased intimate care product sales. Furthermore, various government initiatives that aim to spread awareness about the importance of female hygiene and a heightened focus by the country's middle-class population on their overall health and wellness have translated into the increased consumption of intimate care products.

Key Feminine Intimate Care Company Insights

Some key companies involved in the feminine intimate care market include Namyaa Care R G BIOCOSMETIC PRIVATE LIMITED, COMBE, and SweetSpot Labs USA, among others.

-

Namyaa Care R G BIOCOSMETIC PRIVATE LIMITED is an Indian manufacturer of intimate care products. The company offers a wide variety of products for skincare, personal care, hygiene, stretch marks, and wellness supplements. In the hygiene segment, intimate washes, perfumes, menstrual cups, and period care kits are some notable products offered by the company. In addition, the company publishes an online magazine on its website to address intimate hygiene-related concerns of women.

-

COMBE is a U.S.-based personal care product manufacturer. It operates in the women's intimate care section under its brand Vagisil. Vagisil products include itch relief crème and medicines, yeast infection treatment, dryness relief gels, cleansing powders and washes, and supplements.

Key Feminine Intimate Care Companies:

The following are the leading companies in the feminine intimate care market. These companies collectively hold the largest market share and dictate industry trends.

- Sanofi

- Bayer AG

- Namyaacare Industries ltd.

- C.B. Fleet Company, Inc.

- CTS

- Wet and Dry Personal Care Private Limited

- COMBE

- SweetSpot Labs USA

- Sliquid LLC

- The Honey Pot Co.

Recent Developments

-

In February 2024, Compass Diversified (CODI) announced the acquisition of The Honey Pot Co., an Atlanta-based feminine care brand. With this strategic move, the company expects to support The Honey Pot Co.'s innovation efforts while also helping to ensure significant product portfolio growth in the coming years. The Honey Pot Co. leverages plant-derived ingredients in its feminine care products, catering to the menstrual, feminine hygiene, and sexual wellness segments.

-

In August 2023, the private equity company AOI Capital announced the acquisition of SweetSpot Labs (SSL). Through this deal, AOI Capital aims to enable SweetSpot Labs to develop new products by utilizing the former’s comprehensive resources in manufacturing, pharmaceuticals, online sales, technology, remote healthcare, and logistics. The agreement also accelerates AOI Capital’s intention to expand the SSL international and domestic retailer network.

Feminine Intimate Care Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.97 billion

Revenue Forecast in 2030

USD 2.33 billion

Growth rate

CAGR of 2.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, Australia & New Zealand, South Korea, India, Brazil, South Africa

Key companies profiled

Sanofi; Bayer AG; Namyaa Care R G BIOCOSMETIC PRIVATE LIMITED; C.B. Fleet Company, Inc.; CTS; Wet and Dry Personal Care Private Limited; COMBE; SweetSpot Labs USA; Sliquid LLC; The Honey Pot Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Feminine Intimate Care Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global feminine intimate care market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

OTC Products

-

Creams

-

Tablets/Suppositories

-

-

Wash

-

Wipes

-

Moisturizers

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.