- Home

- »

- HVAC & Construction

- »

-

Fencing Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Fencing Market Size, Share & Trends Report]()

Fencing Market (2024 - 2030) Size, Share & Trends Analysis Report By Material, By Distribution Channel, By Installation, By Application (Residential, Agricultural, Industrial), By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-526-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fencing Market Summary

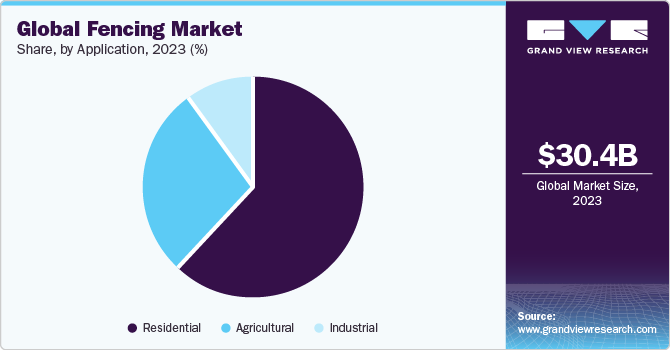

The global fencing market size was estimated at USD 30.42 billion in 2023 and is projected to reach USD 44.39 billion by 2030, growing at a CAGR of 5.6% from 2024 to 2030. An unabated rise in new housing construction, home improvement projects, remodeling activities, and commercial construction is expected to drive the growth of the market over the forecast period.

Key Market Trends & Insights

- North America dominated the fencing market in 2021 with a revenue share of over 34%.

- Canada is expected to register the highest CAGR from 2024 to 2030.

- By material, the metal segment accounted for the largest revenue share of over 52% in 2023.

- By distribution channel, the retail segment accounted for the largest market share in 2023.

- By installation, the contractor segment dominated the fencing market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 30.42 Billion

- 2030 Projected Market Size: USD 44.39 Billion

- CAGR (2024-2030): 5.6%

- North America: Largest market in 2023

The growing concerns over safety and security coupled with the lower maintenance costs and higher reliability attributes associated with the latest fencing solutions are expected to contribute to the growth of the market.

The demand for fencing products is anticipated to rise in line with the growing need for improving the appearance and increasing the value of the property and the growing availability of lightweight, affordable, and easy-to-install PVC and plastic fences. As such, cost, quality, design, and aesthetic value are emerging among the major customer criteria. Increased spending on institutional construction and the growing government spending for strengthening the physical security of parks, public places, and government premises also bodes well for the growth of the market.

A looming surge in real estate development, growing industrialization, and the aggressive investments public and private organizations are making in the construction industry, especially in emerging countries, such as China and India, are driving the need for physical safety and security solutions. Increasing instances of security breaches and the subsequent need for innovative safety and security solutions are prompting market players to offer enhanced fencing solutions in line with the continuously evolving end-user demands, thereby contributing to the growth of the market.

Eco-friendly fencing is getting popular, but the high level of maintenance eco-friendly fencing requires is driving the demand for low-maintenance fencing solutions, such as vinyl fencing. Plastic fencing is also emerging as a relatively economical, lightweight, and easy-to-install alternative. For farmers looking forward to protecting their property and livestock, market players are offering smart solutions that can provide accurate, data-driven insights. However, the rising number of unlicensed contractors offering inferior products and rising raw material prices are expected to restrain the growth of the market.

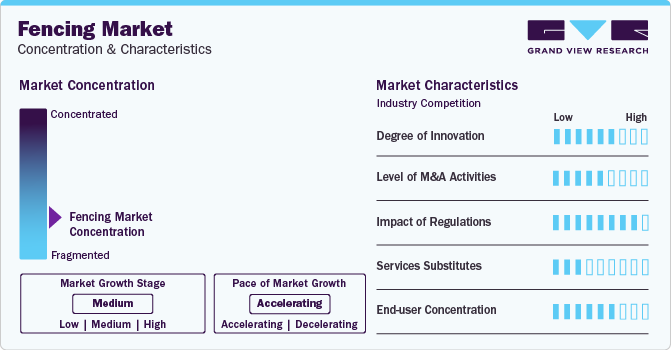

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The market can be described as a highly competitive market characterized by a high degree of fragmentation and dominated by a large number of local manufacturers catering to the needs of the customers in their respective regions. At this juncture, innovation and advances in technology and designs would be crucial for market players to cement their position in the market.

There is a medium threat of substitution for the fencing market owing to the presence of cement walls as a fencing substitute. However, the threat of internal substitution is low as no major technology is expected to be developed to replace fencing in the market in the near future.

Prominent players in the market are continuously looking to acquire small or medium-sized players in the market for mergers and acquisitions to maintain their leading positions. There is intense competition among players on a local level. Companies are competing intensely and adopting different marketing and advertising strategies to expand their market share.

Material Insights

The metal segment accounted for the largest revenue share of over 52% in 2023. Metal fencing is particularly used in public places and by government organizations. The growing preference for chain-link fences and ornamental fences is expected to drive the growth of the segment. The growing need to install a stronger fence to enhance security can also be considered one of the key factors driving the popularity of metal fencing. The growing preference for durable fences that can potentially withstand the changing weather conditions bodes well for the growth of the segment.

Wood fencing is a popular choice for residential applications, especially in semi-urban and rural areas, owing to its distinctive aesthetic appeal and the easy availability of wood at affordable prices. These factors have been driving the growth of the wood segment over the past few years. However, wooden fencing is anticipated to witness intense competition from plastic & composite fencing, owing to the lower cost and maintenance associated with the latter. Hence, the plastic & composite segment is also poised for significant growth over the forecast period.

Distribution Channel Insights

The retail segment accounted for the largest market share in 2023. The retail distribution channel provides customers with instant access to the products offered by key vendors. It also helps vendors in reducing their marketing budget, thereby contributing to the growth of the segment. Customers looking for customized fences prefer visiting retail stores. Given that customized solutions are rarely available on popular online marketplaces; customers can conveniently visit retail outlets to procure fences as per their requirements.

The online segment is expected to register the fastest growth over the forecast period. There are several benefits associated with online distribution channels. Setting up an online distribution channel calls for relatively lower startup costs as compared to a retail store. Besides, online channels also allow customers to check out all the products on offer and compare those with each other in real-time. The growing awareness about the benefits associated with online channels is also encouraging vendors to opt for online distribution channels, thereby driving the growth of the segment.

Installation Insights

The contractor segment dominated the fencing market in 2023. There are several contractors present in the market offering adequate expertise in installing fences according to customers’ suggestions related to aesthetics. Contractors possess the material handling capability usually hard to establish on the customers' part. Contractors can also deploy skilled professionals capable of installing fences with utmost efficiency. Hence, customers prefer getting fences installed through contractors. All these factors are allowing the contractor segment to dominate the market.

The Do-It-Yourself segment is poised for significant growth over the forecast period in line with the customers’ growing preference for customized fences. There are numerous Do-It-Yourself (DIY) fencing kits available in the market. In most cases, fences constructed using DIY kits tend to be vinyl fences as they are the easiest to install. However, although installing a fence as a DIY activity can be an option for customers, it is often highly time-consuming. In other words, customers opting for DIY kits may have to cope with a lengthy fence construction process.

Application Insights

The residential segment led the market in 2023. The increasing residential construction and remodeling activities allowed the segment to dominate the market. The strong emphasis households are putting on security and privacy and the increasing levels of disposable income are driving investments in fencing products for residential applications. The preference for installing customized fences and enhancing the aesthetic appeal of residential properties is also emerging as one of the key factors driving the growth of the segment.

The growing need to safeguard farm animals, crops, and farm areas from wild animals and thieves is anticipated to drive the demand for fences for agricultural applications. The rise in the instances of agricultural area intrusions is propelling the demand for fencing for agricultural applications. Fences used in agricultural applications are typically designed and manufactured according to customers’ requirements using good-quality raw materials. Meanwhile, the industrial segment is anticipated to grow in line with the growing demand for fencing solutions from industrial and manufacturing units.

End-use Insights

The military & defense segment accounted for the largest market share in 2023. The growing need for adequate border control and safety is expected to drive the growth of the segment. Meanwhile, the energy & power segment is expected to emerge as the fastest-growing end-use segment over the forecast period. The growing demand for high-security fencings, such as anti-cut and anti-climb perimeter fencing and partitioning to protect critical power grid infrastructure is estimated to drive the growth of the segment over the forecast period.

Petroleum companies and chemical companies are making significant investments in upgrading their existing refineries and processing plants as well as developing new industrial infrastructure. Activities carried out in these facilities often involve the release of hazardous chemicals and gases, which can be harmful to both trespassers and other individuals invading the premises knowingly or unknowingly. Hence, these companies are installing strong and durable fencing to counter any potential instances of trespassing, thereby driving the growth of the petroleum & chemicals segment.

Regional Insights

North America dominated the fencing market in 2021 with a revenue share of over 34%. The unabated growth in construction activities across North America is allowing the region to dominate the global market. The U.S. alone is home to more than 50,000 fence contractors. These contractors provide materials and services around the world. The regional market is also poised for significant growth over the forecast period. The growing demand for home decoration products from households across North America is estimated to drive the growth of the regional market.

The Asia Pacific regional market is anticipated to gain traction over the forecast period. The growing concerns over safety among consumers and the initiatives being pursued by various governments in the region to develop and improve public infrastructure are expected to contribute to the growth of the regional market. Continued urbanization and the strong emphasis farmers are putting on safeguarding their property and assets are anticipated to drive the growth of the regional market. The increased spending on institutional construction in India also bodes well for the growth of the regional market.

Key Companies & Market Share Insights

The market players are extensively adopting various inorganic growth strategies, including mergers and acquisitions, to consolidate their market position amid a competitive environment. Market players are primarily focusing on acquiring local players as the latter has a dedicated customer base. Vendors are also focusing on increasing their product penetration by leveraging their product offerings and broader geographical footprint to serve customers across the globe and by pursuing cross-selling opportunities.

-

In September 2023, Fencing Supply Group announced the acquisition of Atlantic Fence Supply, a U.S.-based fencing supplier. This acquisition will allow Fencing Supply Group to expand its capabilities and increase its customer base.

-

In January 2023, Fencing Supply Group acquired Florida-based vinyl and aluminum fencing wholesaler Hartford Fence Supply. With this acquisition, Fencing Supply Group can expand its footprint in the Tampa region.

Key Fencing Companies:

- Allied Tube & Conduit

- Ameristar Fence Products Incorporated

- The American Fence Company

- Associated Materials LLC

- Bekaert

- Betafence NV

- CertainTeed Corporation

- Gregory Industries, Inc.

- Jerith Manufacturing Company Inc.

- Long Fence Company Inc.

- Ply Gem Holdings Inc.

- Poly Vinyl Creations Inc.

Recent Developments

- In March 2023, Gregory Highway, a business unit of Gregory Industries Inc. expanded its partnership with Safence to manufacture, sell, and distribute the fencing cable barrier system product line in Canada

Fencing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 32.00 billion

Revenue forecast in 2030

USD 44.39 billion

Growth rate

CAGR of 5.6% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, installation, application, distribution channel, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Belgium; Poland; China; India; Japan; Brazil; Mexico; Saudi Arabia; UAE

Key companies profiled

Allied Tube & Conduit; Ameristar Fence Products Incorporated; Associated Materials LLC; Bekaert; Betafence NV; CertainTeed Corporation; Gregory Industries, Inc.; Jerith Manufacturing Company Inc.; Long Fence Company Inc.; Ply Gem Holdings Inc.; Poly Vinyl Creations Inc.,The American Fence Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fencing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global fencing market report based on material, distribution channel, installation, application, end use, and region:

-

Material Outlook (Revenue, USD Million, 2017 - 2030)

-

Metal

-

Wood

-

Plastic & Composite

-

Concrete

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Online

-

Retail

-

-

Installation Outlook (Revenue, USD Million, 2017 - 2030)

-

Do-It-Yourself

-

Contractor

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Residential

-

Agricultural

-

Industrial

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Government

-

Petroleum & Chemicals

-

Military & Defense

-

Mining

-

Energy & Power

-

Transport

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Belgium

-

Poland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global fencing market size was estimated at USD 27.88 billion in 2021 and is expected to reach USD 29.2 billion in 2022.

b. The global fencing market is expected to grow at a compound annual growth rate of 5.5% from 2022 to 2030 to reach USD 44.39 billion by 2030.

b. North America dominated the fencing market with a share of 34.9% in 2021. This is attributable to increasing construction activities and demand for decorative home products in the region.

b. Some key players operating in the fencing market include CertainTeed Corporation; Bekaert; Ameristar Fence Products Incorporated; Allied Tube & Conduit; and Ply Gem Holdings Inc.

b. Key factors that are driving the fencing market growth include rising interest in home enhancement, increasing disposable income, increasing residential and commercial projects, and rising preference for personal safety and security.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.