- Home

- »

- Advanced Interior Materials

- »

-

Ferrous Scrap Recycling Market Size, Industry Report, 2030GVR Report cover

![Ferrous Scrap Recycling Market Size, Share & Trends Report]()

Ferrous Scrap Recycling Market (2025 - 2030) Size, Share & Trends Analysis Report By Sector (Construction, Automotive, Consumer Goods, Industrial Goods), By Region (North America, Europe, Asia Pacific, Central & South America, MEA), And Segment Forecasts

- Report ID: GVR-4-68038-830-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ferrous Scrap Recycling Market Trends

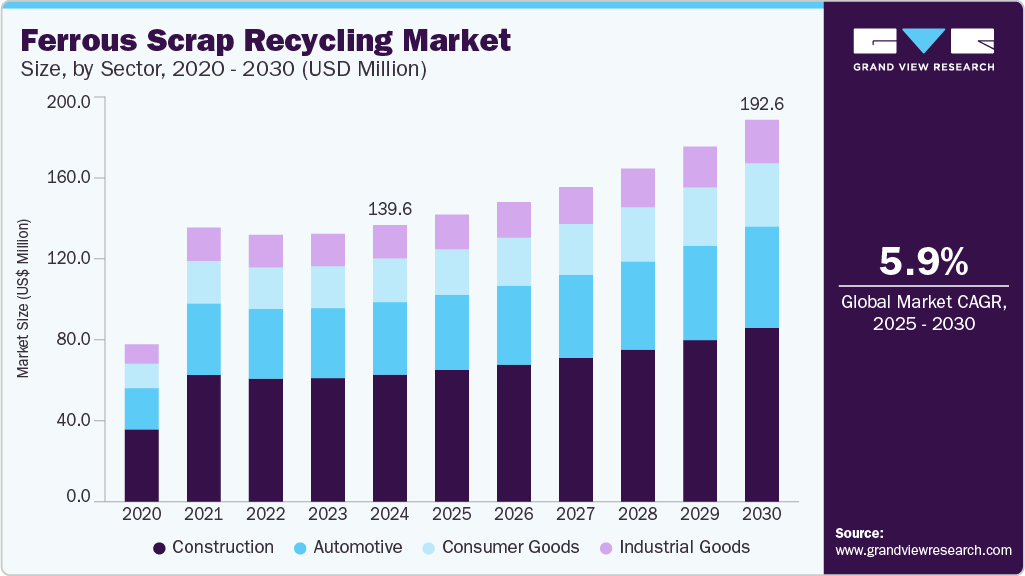

The global ferrous scrap recycling market size was estimated at USD 139.6 million in 2024 and is projected to grow at a CAGR of 5.9% from 2025 to 2030. Rising efforts from steel manufacturers to reduce carbon emissions are expected to propel market growth in the forecast period.

Key Highlights:

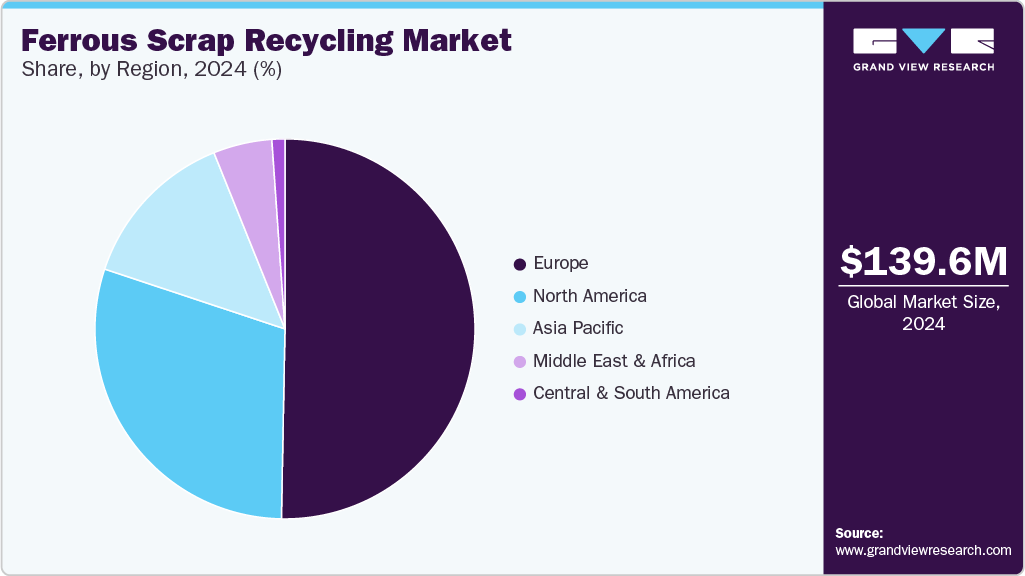

- Europe ferrous scrap recycling market holds the largest revenue share of over 50.3% in 2024.

- The U.S. ferrous scrap recycling market is at the forefront in North America, with a share of over 80% in 2024.

- Based on sector, the construction segment accounting for a revenue share of 45.0% in 2024.

- By sector, the consumer goods segment is anticipated to grow at a CAGR of 6.8% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 139.6 million

- 2030 Projected Market Size: USD 192.6 million

- CAGR (2025-2030): 5.9%

- Europe: Largest market in 2024

Manufacturers are increasing the consumption of recycled steel as it requires less processing for reuse. Moreover, the inclination towards electric arc furnaces (EAF) is rising compared to blast furnaces, as it reduces carbon emissions by around 70%. These efforts by steel makers toward sustainability are aiding market growth.

Recycling is vital in the U.S. owing to its economic benefits. The industry creates jobs and helps to reduce carbon emissions. Steel is a widely recycled material in the country. Furthermore, favorable government policies to reduce carbon emissions are expected to drive market growth.

As of 2024-25, significant global trade and policy developments positively impact the ferrous scrap recycling market, aligning with the U.S. and EU's emission-based sectoral arrangement on steel and aluminum. The U.S. has implemented a 25% tariff on all steel and aluminum imports, eliminating previous exemptions. This move mandates that qualifying steel must be "melted and poured" and aluminum "smelted and cast" within the U.S., aiming to curb the influx of carbon-intensive materials and bolster domestic production.

Carbon emissions from the global steel industry must decrease by at least 50% to achieve global energy and climate targets by 2050. As a result, key players are investing in EAF to reduce their carbon emissions and improve energy efficiency. This is expected to enhance the consumption of ferrous scraps in the coming years.

For instance, JSW Steel announced its commitment to achieving net-neutral carbon emissions by 2050 in January 2024. As part of this initiative, the company has earmarked an investment of $1 billion to reduce its CO₂ emission intensity from 2.36 tonnes per tonne of crude steel to 1.95 tonnes by 2030. This ambitious plan includes adopting green hydrogen technologies and carbon capture, utilization, and storage (CCUS) methods to decarbonize its operations.

Drivers, Opportunities & Restraints

The ferrous scrap recycling market is witnessing strong growth, primarily fueled by the global emphasis on sustainable manufacturing, tighter environmental regulations, and the expanding use of Electric Arc Furnace (EAF) technology in steel production. Government-led initiatives, such as extended producer responsibility (EPR) programs and comprehensive metal recycling policies, drive investments into formal recycling infrastructure and systems.

Technological innovations, particularly the application of artificial intelligence (AI) and machine learning in sorting technologies, have significantly boosted the precision and efficiency of metal separation processes. AI-enabled systems can now accurately distinguish and sort different metal types, resulting in higher-quality recycled outputs. Furthermore, the widespread adoption of EAF technology facilitates increased use of recycled scrap in steelmaking, contributing to substantial reductions in carbon emissions. These trends are reinforced by supportive public policies prioritizing circular economy models and long-term environmental sustainability.

Volatile scrap metal prices, shaped by macroeconomic trends and geopolitical developments, challenge recycling companies' profitability. Trade measures such as tariffs have disrupted global scrap metal trade flows, affecting availability and market pricing. In 2024, the United States emerged as the leading scrap supplier to Turkey; however, shifting trade dynamics with other key exporters like Russia and the United Kingdom continue to create uncertainty. These market fluctuations make it difficult for recycling businesses to maintain stable profit margins and formulate consistent pricing strategies.

India is experiencing notable expansion in its ferrous scrap recycling industry. In June 2024, Mitsui & Co. invested strategically in MTC Business Private Ltd., which manages over 30 recycling facilities nationwide. This investment is intended to scale up metal scrap processing and vehicle recycling operations, reinforcing the steel manufacturers' supply chain and supporting more environmentally friendly recycling practices. These efforts align with broader sustainability objectives and the rising demand for recycled materials in steel production, setting the stage for sustained market growth in the years ahead.

Sector Insights

Construction dominated the market, accounting for a revenue share of more than 45.0% of the global market in 2024. Building demolitions produce substantial scrap, particularly due to the extensive use of steel in beams, reinforcement bars, and other structural components. In September 2022, Re Sustainability was awarded a contract by the Noida Authority in India to recycle 30 kilotons of waste from demolishing the Supertech twin towers in Noida.

Automotive was the second-largest segment of the market in 2024. The growing inclination toward creating a sustainable economy has encouraged several companies to expand their recycling operations. For instance, in December 2022, the Qishun End-of-Life Vehicle (ELV) Comprehensive Utilization Project was launched in Taizhou, Zhejiang Province. This project, a collaboration between Scholz Group and Chiho Environmental Group, is focused on recycling end-of-life vehicles, lithium batteries, and waste metals. The first phase involves an investment of approximately USD 22.5 million (160 million RMB) and aims to process 50,000 ELVs and 10,000 tons of retired lithium batteries annually. During the entire operation, the project is expected to generate an annual output value of around USD 105.6 million (750 million RMB), create approximately 280 jobs, and reduce carbon emissions by 120,000 tons per year.

The consumer goods sector is anticipated to grow at a CAGR of 6.8% over the forecast period, ranging from 2025 to 2030. The industry holds significant potential owing to the large-scale collection and recycling of scrap worldwide. India is the world's third-largest producer of e-waste, generating approximately 3.8 million tonnes in FY24, up from 2 million tonnes in FY14. The consumer segment contributes nearly 70% of this total.

Regional Insights

North America ferrous scrap recycling market holds the second largest regional segment globally, with a revenue share of over 29.8% in 2024. The growth is attributed to increasing government efforts to create a circular economy and target to achieve net-zero greenhouse gas emissions by 2050. This target will positively aid the country's ferrous scrap recycling market growth.

U.S. Ferrous Scrap Recycling Market Trends

The ferrous scrap recycling market in the U.S. is at the forefront in North America, with a share of over 80% in 2024. The market is experiencing notable developments driven by technological advancements, shifting demand dynamics, and evolving trade policies.

Asia Pacific Ferrous Scrap Recycling Market Trends

Asia Pacific held a revenue share of over 13.0% in 2024; however, the region dominated the global market in terms of volume. Automotive giants are investing in setting up regional recycling centers, which is further anticipated to benefit market growth. As of May 2025, Mahindra MSTC Recycling Pvt. Ltd. (CERO) is actively advancing its vehicle scrapping initiatives in India. The company has expanded its operations to 11 locations in India. CERO plans to establish at least 100 vehicle scrapping centers across India by 2025, aiming to enhance its capacity to dismantle up to one million end-of-life vehicles annually by 2026-27. Each facility is designed to process approximately 15,000 vehicles per year, with potential for capacity expansion to meet growing demand.

Europe Ferrous Scrap Recycling Market Trends

The European ferrous scrap recycling market is experiencing significant growth, driven by regulatory support, technological advancements, and shifting industrial dynamics. The adoption of electric arc furnaces (EAFs) in steel production is increasing, allowing for scrap metal recycling and reducing CO₂ emissions. For instance, CELSA Group, a leading European steel manufacturer, produces 97% of its steel from recycled materials, significantly lowering its environmental impact.

Middle East & Africa Ferrous Scrap Recycling Market Trends

The Middle East & Africa region is an emerging market for ferrous scrap, where governments across the region support domestic steel production, thereby propelling demand for scrap.

Key Ferrous Scrap Recycling Company Insights

Some of the key players operating in the market include American Iron & Metal Company Inc., European Metal Recycling Ltd., and Innovative Metal Recycling.

-

American Iron & Metal Company Inc. (AIM Recycling) was founded in 1936 and is headquartered in Montreal, Canada. It has over 130 recycling sites globally and specializes in recovering and recycling ferrous and non-ferrous metals. In 2023, AIM acquired auto shredding plants in Erie, Pennsylvania, Phoenix, Arizona, from Chiho Environmental Group, enhancing its processing capabilities in the United States.

-

European Metal Recycling Ltd. (EMR) Established in 1994 and based in Warrington, England, EMR is a global leader in metal recycling with over 150 locations worldwide. The company processes various metals, including ferrous scrap, and serves multiple automotive, construction, and manufacturing industries. In 2022, EMR opened a new metal recycling facility in Glasgow, Scotland, to enhance its processing capacity and support the growing demand for recycled metals.

-

Established in 1999, Innovative Metal Recycling specializes in the processing and recycling of ferrous and non-ferrous metals. While specific information about the number of facilities is limited, the company is widely recognized for its commitment to sustainable recycling practices. It serves various industrial sectors, including automotive, construction, and manufacturing. Their focus on eco-friendly and efficient recycling processes positions them as a key player in the metal recycling industry.

Key Ferrous Scrap Recycling Companies:

The following are the leading companies in the ferrous scrap recycling market. These companies collectively hold the largest market share and dictate industry trends.

- American Iron & Metal Company Inc.

- European Metal Recycling Ltd.

- Innovative Metal Recycling

- OmniSource, LLC

- Sims Limited

- SA Recycling LLC

- Schnitzer Steel Industries, Inc.

- Rudolf Schuy GmbH & Co. KG

- TSR Recycling GmbH & Co. KG

- Ward Recycling Ltd, Inc.

Recent Developments

-

In November 2023, OmniSource, a Steel Dynamics, Inc. subsidiary, acquired a 55-acre rail-served tract in Gulf Inland Logistics Park, Dayton, Texas. The new facility, expected to begin operations in 2024, will enhance OmniSource's metals recycling capacity along the Gulf Coast, leveraging strategic proximity to Houston and key transportation networks.

-

In August 2023, Sims Metal acquired Baltimore Scrap Corp., a major Northeast U.S. recycler with 17 facilities across five states, processing approximately 600,000 tonnes of scrap annually. The acquisition, valued at $177 million, enhances Sims' presence in key domestic markets.

-

In May 2023, TSR Recycling inaugurated its TSR40 processing plant in Duisburg, Germany. The facility can process up to 450,000 tons of materials, including end-of-life vehicles and mixed scrap, utilizing advanced measurement and separation technologies to improve recycling efficiency.

Ferrous Scrap Recycling Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 144.9 million

Revenue forecast in 2030

USD 192.6 million

Growth rate

CAGR of 5.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million/billion, CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sector, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; Australia

Key companies profiled

American Iron & Metal Company Inc.; European Metal Recycling Ltd.; Innovative Metal Recycling; OmniSource, LLC; Sims Limited; SA Recycling LLC; Schnitzer Steel Industries, Inc.; Rudolf Schuy GmbH & Co. KG; TSR Recycling GmbH & Co. KG; Ward Recycling Ltd, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ferrous Scrap Recycling Market Report Segmentation

This report forecasts revenue growth at the global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ferrous scrap recycling market report based on sector, and region.

-

Sector Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Construction

-

Automotive

-

Consumer Goods

-

Industrial Goods

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

-

Asia Pacific

-

China

-

Japan

-

Australia

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global ferrous scrap recycling market size was estimated at USD 139.6 million in 2024 and is expected to reach USD 144.9 million in 2025.

b. The global ferrous scrap recycling market is expected to grow at a compound annual growth rate of 5.9% from 2025 to 2030 to reach USD 192.6 million by 2030.

b. Construction dominated the market, accounting for a revenue share of more than 45.0% of the global market in 2024.

b. Some of the key vendors in the global ferrous scrap recycling market are American Iron & Metal Company Inc.; European Metal Recycling Ltd.; Innovative Metal Recycling; OmniSource, LLC; Sims Limited; SA Recycling LLC; Schnitzer Steel Industries, Inc.; Rudolf Schuy GmbH & Co. KG; TSR Recycling GmbH & Co. KG; Ward Recycling Ltd, Inc.

b. The ferrous scrap recycling market is witnessing strong growth, primarily fueled by the global emphasis on sustainable manufacturing, tighter environmental regulations, and the expanding use of Electric Arc Furnace (EAF) technology in steel production.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.