- Home

- »

- Plastics, Polymers & Resins

- »

-

Fertilizer Bag Market Size And Share, Industry Report, 2033GVR Report cover

![Fertilizer Bag Market Size, Share & Trends Report]()

Fertilizer Bag Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Polypropylene, Polyethylene, Jute, Paper, Non-Woven Fabric), By Size, By Closure Type, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-704-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fertilizer Bag Market Summary

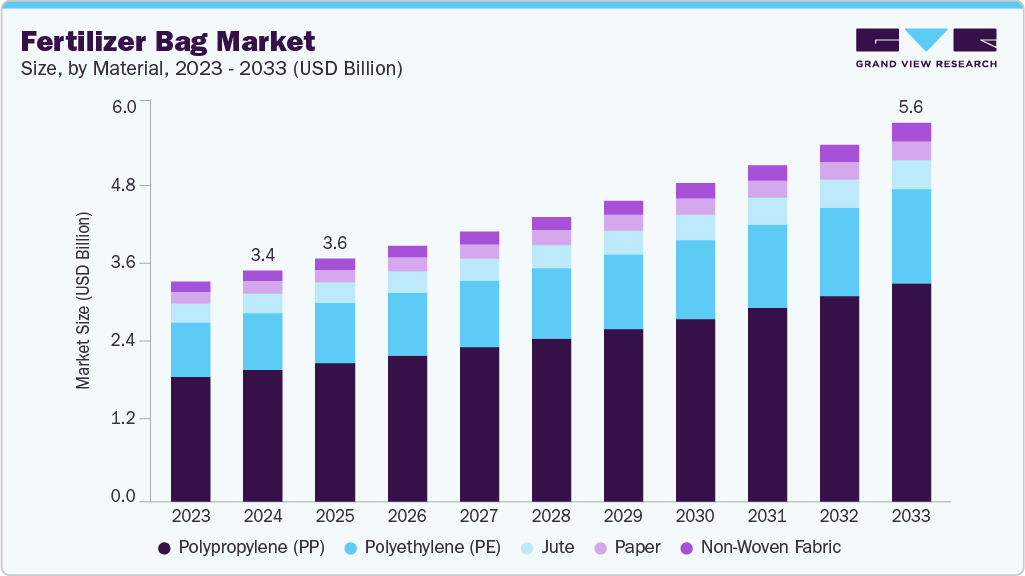

The global fertilizer bag market size was estimated at USD 3.39 billion in 2024 and is projected to reach USD 5.56 billion by 2033, growing at a CAGR of 5.7% from 2025 to 2033. The rising demand for fertilizers drives the market due to increasing global food production needs and the expansion of modern agricultural practices.

Key Market Trends & Insights

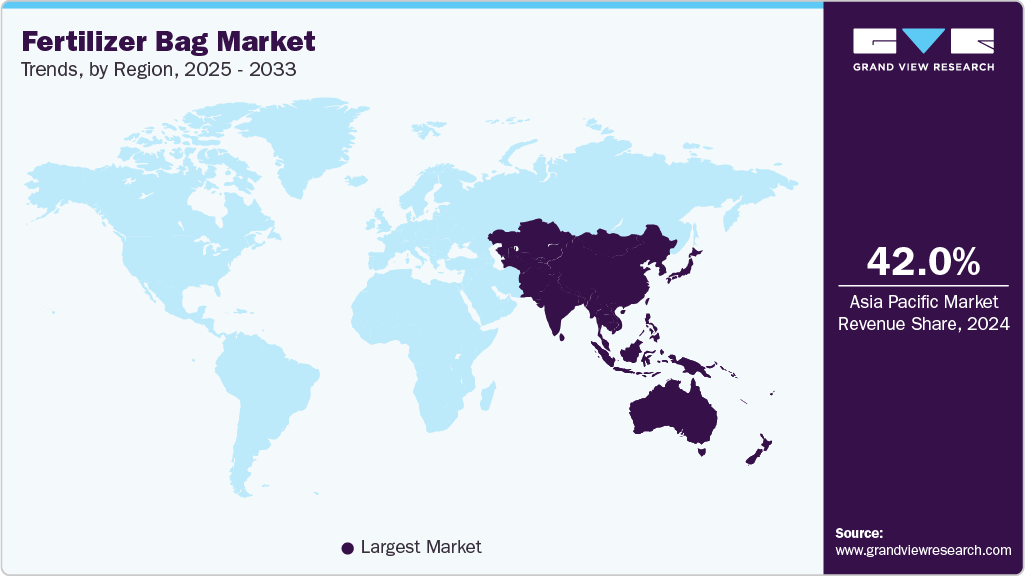

- Asia Pacific dominated the fertilizer bag market with the largest revenue share of over 42.0% in 2024.

- The U.S. fertilizer bag market is driven by large-scale farming, technological advancements, and sustainability trends.

- By material, the non-woven fabric segment is expected to grow at a considerable CAGR of 6.3% from 2025 to 2033 in terms of revenue.

- By size, the less than 10 kg segment is expected to grow at a considerable CAGR of 6.6% from 2025 to 2033 in terms of revenue.

- By closure type, the drawstring segment is expected to grow at a considerable CAGR of 6.1% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 3.39 Billion

- 2033 Projected Market Size: USD 5.56 Billion

- CAGR (2025-2033): 5.7%

- Asia Pacific: Largest Market in 2024

In addition, growing focus on efficient storage, transportation, and preservation of fertilizer quality is boosting the adoption of durable and cost-effective packaging solutions. The Food and Agriculture Organization (FAO) estimates that global food demand is anticipated to increase by over 50% by 2050. This projection is driven by a combination of factors, including population growth, rising incomes, and changing dietary preferences. This outlook is expected to boost the consumption of fertilizers for crop yield improvement. Fertilizer bags, ranging from woven polypropylene (PP) to multi-layer paper and polyethylene bags, play a crucial role in protecting fertilizer quality during transportation and storage by preventing moisture ingress and product degradation. For example, in countries like India and China, where agriculture remains a major economic driver, government subsidies on fertilizers directly contribute to the growing production and distribution of fertilizer bags to meet market needs.

The shift toward durable and sustainable packaging solutions in the fertilizer sector also contributes to market growth. Manufacturers are increasingly developing fertilizer bags with UV-resistant properties, anti-slip coatings, and eco-friendly materials to cater to performance and environmental regulations. In regions like Europe, stringent sustainability directives have pushed producers toward recyclable woven PP bags or biodegradable paper bags, reducing plastic waste. Moreover, innovations such as hermetically sealed, laminated bags extend fertilizer shelf life and reduce wastage during storage, making them popular among large agricultural cooperatives and export markets in Latin America and Africa.

The market is also being propelled by logistics efficiency and branding opportunities that fertilizer bags offer. High-quality printed bags serve as a cost-effective marketing tool for fertilizer companies, especially in competitive markets where brand differentiation influences farmer purchasing decisions. For instance, in African and Southeast Asian markets, bright, multi-color branding on bags enhances visibility and trust among smallholder farmers. At the same time, bags with improved stacking strength and resistance to tearing help reduce losses during long-distance shipping, which is critical for export-oriented fertilizer producers in countries such as Russia, Canada, and Morocco. Together, these functional and marketing benefits make fertilizer bags a strategic asset in the agricultural supply chain, further fueling market growth.

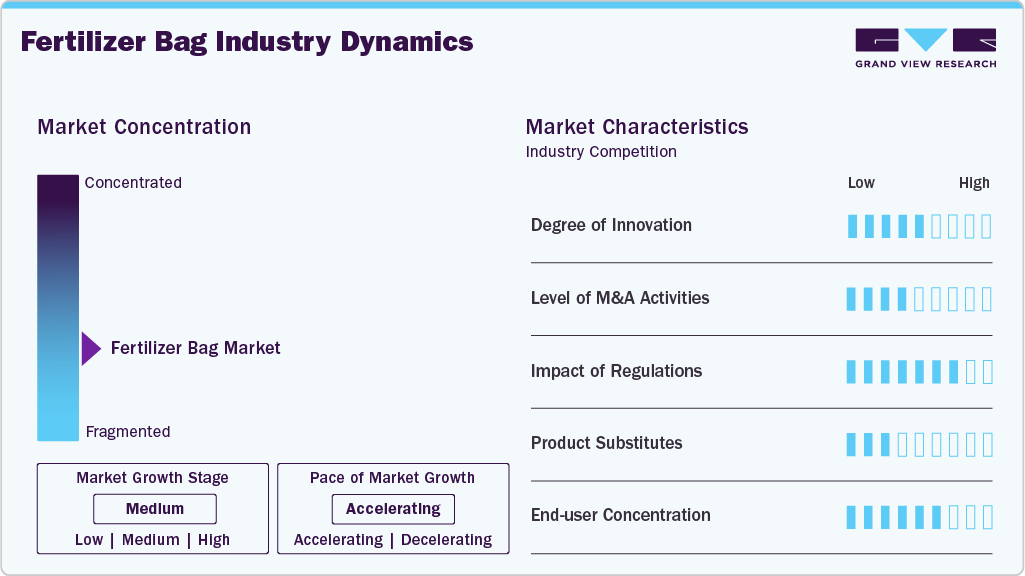

Market Concentration & Characteristics

The global fertilizer bag industry is characterized by high-volume production and strong linkage to the agricultural sector’s seasonality and regional demand patterns. Demand tends to spike during planting seasons and in regions with intensive agricultural practices, leading to cyclical but predictable production schedules. The market is heavily influenced by fertilizer production trends, which in turn are tied to food demand, government agricultural subsidies, and commodity price fluctuations. Manufacturers operate in a cost-sensitive environment where bulk order contracts from fertilizer producers and cooperatives dictate margins, making operational efficiency and material cost control crucial.

Innovation plays a functional and compliance-driven role in this market. While the basic design of fertilizer bags remains consistent, enhancements such as UV protection, anti-slip coatings, easy-open features, and high-quality printing are increasingly important differentiators. The market also adapts to regulatory changes, particularly in the European Union and certain parts of Asia, where packaging waste management laws push for recyclable and sustainable solutions. Furthermore, the fertilizer bag industry serves both domestic consumption and export markets, meaning manufacturers must meet varied performance standards to handle different climate conditions and shipping requirements.

Material Insights

The polypropylene (PP) segment recorded the largest market revenue share of over 56.0% in 2024. PP bags are the most widely used in the fertilizer industry due to their high tensile strength, moisture resistance, and durability. They are lightweight, easy to transport, and available in woven and laminated forms, making them suitable for bulk and retail fertilizer packaging. Increasing demand from large-scale agricultural distributors and advancements in woven PP manufacturing technology further support their dominance. Rising fertilizer exports also boost demand for PP bags due to their high load-bearing capacity and suitability for long-distance shipping.

Non-woven fabric is expected to grow at the fastest CAGR of 6.3% during the forecast period. Non-woven fabric bags are made using synthetic fibers bonded together mechanically, thermally, or chemically, rather than weaving or knitting. They are lightweight, reusable, and customizable in terms of size, color, and branding. In the fertilizer industry, they are gaining retail and promotional packaging traction. Rising demand for reusable and durable packaging solutions is fueling the growth of non-woven fabric bags.

Size Insights

The 50-100 kg segment recorded the largest market revenue share of over 30.0% in 2024. Bags in the 50-100 kg range are primarily used in large-scale commercial farming, agro-industrial operations, and fertilizer distribution hubs. They are suited for bulk transactions where minimizing packaging costs per fertilizer unit is crucial. This segment is common in regions with extensive cereal, sugarcane, and plantation crop farming. The main driver is reducing per-unit transportation and packaging costs for large farms and agribusinesses. Regions with industrial-scale agriculture, such as plantations in Southeast Asia or large grain farms in North America, particularly favor these sizes.

The less than 10 kg segment is expected to grow at the fastest CAGR of 6.6% during the forecast period. These bags are typically used for retail and small-scale agricultural needs, such as home gardening, landscaping, or specialty crops. These bags are popular in urban and peri-urban areas where small landholdings dominate, and they often feature consumer-friendly packaging with branding, instructions, and resealable options. They are common for premium or specialty fertilizers like micronutrient blends, water-soluble fertilizers, and organic variants. The growth of the home gardening sector, urban farming, and landscaping services is driving demand for less-than-10 kg fertilizer bags.

Closure Type Insights

The sewn closure segment recorded the largest market share of over 47.0% in 2024. Sewn closures involve stitching the bag’s open end with industrial thread, creating a permanent and robust seal. They are common in woven polypropylene bags used for large fertilizer quantities, ensuring high tensile strength and preventing leakage. Sewing can be done manually or via automated bag-closing machines. The demand for maximum strength and protection in bulk fertilizer packaging drives this closure type. Agricultural wholesalers and industrial users prefer sewn closures to withstand rough handling and stacking during storage and transport.

The drawstring segment is projected to grow at the fastest CAGR of 6.1% during the forecast period. Drawstring closures use a cord, rope, or string integrated into the bag’s opening, which can be pulled to tighten and secure the contents. This closure type is typically used in woven or fabric-based fertilizer bags, offering reusability and ease of opening and closing without additional tools. Drawstring bags are often lightweight and are suitable for smaller fertilizer quantities or retail packaging. The demand for drawstring closures is driven by the increasing preference for reusable and user-friendly packaging, particularly among small-scale farmers and home gardeners.

Application Insights

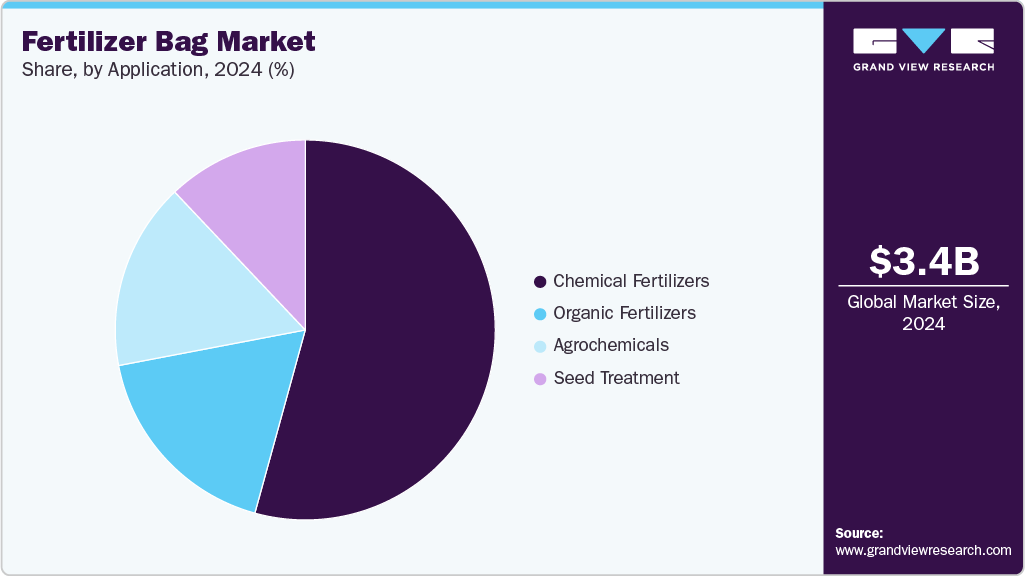

The chemical fertilizers segment recorded the largest market revenue share of over 54.0% in 2024. Chemical fertilizers are synthetic or inorganic compounds designed to supply essential nutrients such as nitrogen (N), phosphorus (P), and potassium (K) to crops for rapid and targeted growth. These bags also often have UV protection to prevent degradation during outdoor storage and transport. Large-scale commercial farming, high global agricultural productivity needs, and the growing use of high-yield crop varieties drive the demand for fertilizer bags in chemical fertilizer applications.

The organic fertilizers segment is expected to grow at the fastest CAGR of 6.6% during the forecast period. Organic fertilizers are derived from natural sources such as compost, manure, bone meal, and plant-based materials, supplying nutrients slowly and improving soil health over time. Packaging for organic fertilizers often emphasizes eco-friendly materials, biodegradable liners, and appealing branding for retail markets, as these products target environmentally conscious consumers and niche agricultural sectors. Rising consumer preference for organic food, expanding organic farming acreage, and stricter government regulations on chemical fertilizer usage are key growth drivers for fertilizer bags in this segment.

Region Insights

Asia Pacific dominated the market and accounted for the largest revenue share of over 42.0% in 2024 and is expected to grow at the fastest CAGR of 6.0% over the forecast period. This dominance is due to its vast agricultural sector, high population density, and increasing food demand. Countries such as India and China are major contributors, with large-scale farming operations requiring efficient packaging solutions for fertilizers. Government initiatives promoting sustainable agriculture and using high-quality fertilizers further boost demand. For example, India’s Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) supports farmers with subsidies, indirectly driving the need for durable and cost-effective fertilizer bags. In addition, the rise of organized retail and e-commerce in agricultural supplies has increased the demand for branded and customized fertilizer packaging.

China Fertilizer Bag Market Trends

The fertilizer bag market in China is the largest consumer and producer of fertilizers globally, driving significant demand for fertilizer bags. The country’s vast agricultural sector and government support for food security (e.g., China’s 2025 Agricultural Modernization Plan) fuel the need for efficient packaging. Chinese manufacturers focus on cost-effective woven polypropylene bags, with innovations like anti-counterfeiting labels to ensure product authenticity. The shift toward premium fertilizers (e.g., slow-release and organic variants) has also increased demand for high-quality, branded packaging.

North America Fertilizer Bag Market Trends

The fertilizer bag market in North America is driven by advanced farming techniques, high mechanization, and the presence of large agribusinesses. The U.S. and Canada are key players, with a strong focus on precision agriculture and sustainable practices, leading to demand for specialized fertilizer bags. The region’s strict environmental regulations also push manufacturers to innovate in eco-friendly packaging. Moreover, the growing adoption of controlled-release fertilizers in North America requires high-barrier packaging, further propelling market growth.

The U.S. fertilizer bag market is driven by large-scale farming, technological advancements, and sustainability trends. Major fertilizer producers such as Nutrien and CF Industries require durable, weather-resistant bags for bulk distribution. The rise of precision farming has led to demand for smaller, pre-measured fertilizer bags for controlled application. Moreover, the growing organic farming sector (supported by USDA programs) boosts the need for eco-friendly packaging, such as paper-based and compostable bags.

Europe Fertilizer Bag Market Trends

The fertilizer bag market in Europe is influenced by stringent environmental policies, a shift toward organic farming, and high agricultural productivity in countries such as France and Spain. The EU’s Farm to Fork Strategy encourages sustainable fertilizer use, increasing demand for biodegradable and compostable bags. Germany and Netherlands lead in innovation, with companies developing smart packaging solutions. Furthermore, Eastern Europe’s expanding agricultural sector contributes to rising demand for fertilizer bags, particularly in Poland and Ukraine. The trend toward bulk packaging for large-scale farms also shapes the market, with manufacturers offering heavy-duty woven polypropylene bags for durability and cost efficiency.

Key Fertilizer Bag Company Insights

The market's competitive environment is moderately fragmented, with a mix of global packaging giants, regional manufacturers, and specialized suppliers competing to serve agricultural input producers. Companies differentiate themselves through product durability, moisture resistance, cost efficiency, and the use of sustainable materials such as biodegradable plastics or woven polypropylene.

Strategic partnerships with fertilizer manufacturers, investments in lightweight yet high-strength materials, and innovations in eco-friendly packaging are becoming key to gaining market share. Moreover, price sensitivity among end users, coupled with volatile raw material costs, fuels rivalry, while emerging markets in Asia Pacific, Africa, and Latin America present growth opportunities for established and new players.

-

In May 2024, Brazil’s Packem Textil replaced traditional non-recyclable polypropylene bulk bags with fully recyclable PET Big Bags, developed with Starlinger Machinery.

-

In March 2023, Mosaic Fertilizers, in partnership with Zaraplast and Braskem, launched new fertilizer bags made from polypropylene with 30% post-consumer recycled resin, marking the first such use in Brazil's fertilizer industry. This sustainable packaging initiative aims to reduce environmental impact and is expected to help avoid the emission of more than 100 tons of CO2 in 2023, showcasing a significant step towards circular economy practices in agribusiness packaging.

Key Fertilizer Bag Companies:

The following are the leading companies in the fertilizer bag market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- ProAmpac

- CDF Corporation

- Türkkraft

- CarePac

- MST Packaging Co., Ltd.

- Tex-Trude

- Miller Weldmaster

- Turf Care Supply, LLC

- Balcan Innovations Inc.

- SHU Packaging Co., Ltd

- Rathi Packaging Pvt. Ltd.

Fertilizer Bag Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.57 billion

Revenue forecast in 2033

USD 5.56 billion

Growth rate

CAGR of 5.7% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, size, closure, type, application, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Amcor plc; ProAmpac; CDF Corporation; Türkkraft; CarePac; MST Packaging Co., Ltd.; Tex-Trude; Miller Weldmaster; Turf Care Supply, LLC; Balcan Innovations, Inc.; SHU Packaging Co., Ltd.; Rathi Packaging Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fertilizer Bag Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global fertilizer bag market report based on material, size, closure type, application, and region:

-

Material Outlook (Revenue, USD Million 2021 - 2033)

-

Polypropylene (PP)

-

Polyethylene (PE)

-

Jute

-

Paper

-

Non-Woven Fabric

-

-

Size Outlook (Revenue, USD Million 2021 - 2033)

-

Less than 10 kg

-

10-25 kg

-

25-50 kg

-

50-100 kg

-

More than 100 kg

-

-

Closure Type Outlook (Revenue, USD Million 2021 - 2033)

-

Drawstring

-

Plastic Tie

-

Wire Tie

-

Sewn Closure

-

Glued Closure

-

-

Application Outlook (Revenue, USD Million 2021 - 2033)

-

Chemical Fertilizers

-

Organic Fertilizers

-

Seed Treatment

-

Agrochemicals

-

-

Region Outlook (Revenue, USD Million 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global fertilizer bag market was estimated at around USD 3.39 billion in the year 2024 and is expected to reach around USD 3.57 billion in 2025.

b. The global fertilizer bag market is expected to grow at a compound annual growth rate of 5.7% from 2025 to 2033 to reach around USD 5.56 billion by 2033.

b. The chemical fertilizers segment emerged as the dominating application segment in the fertilizer bag market due to its high global usage in large-scale agriculture and the need for moisture-resistant, durable packaging to maintain product efficacy during transport and storage.

b. The key players in the global fertilizer bag market include Amcor plc, ProAmpac, CDF Corporation, Türkkraft, CarePac, MST Packaging Co., Ltd., Tex-Trude, Miller Weldmaster, Turf Care Supply, LLC, Balcan Innovations Inc., SHU Packaging Co., Ltd., and Rathi Packaging Pvt. Ltd.

b. The market is driven by the rising demand for fertilizers due to increasing global food production needs and the expansion of modern agricultural practices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.