- Home

- »

- Next Generation Technologies

- »

-

Fiber Laser Market Size And Share, Industry Report, 2033GVR Report cover

![Fiber Laser Market Size, Share & Trends Report]()

Fiber Laser Market (2025 - 2033) Size, Share & Trends Analysis Report By Laser Type (Infrared Fiber Lasers, Ultrafast Fiber Lasers), By Power Output, By Operation Mode, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-643-5

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Fiber Laser Market Summary

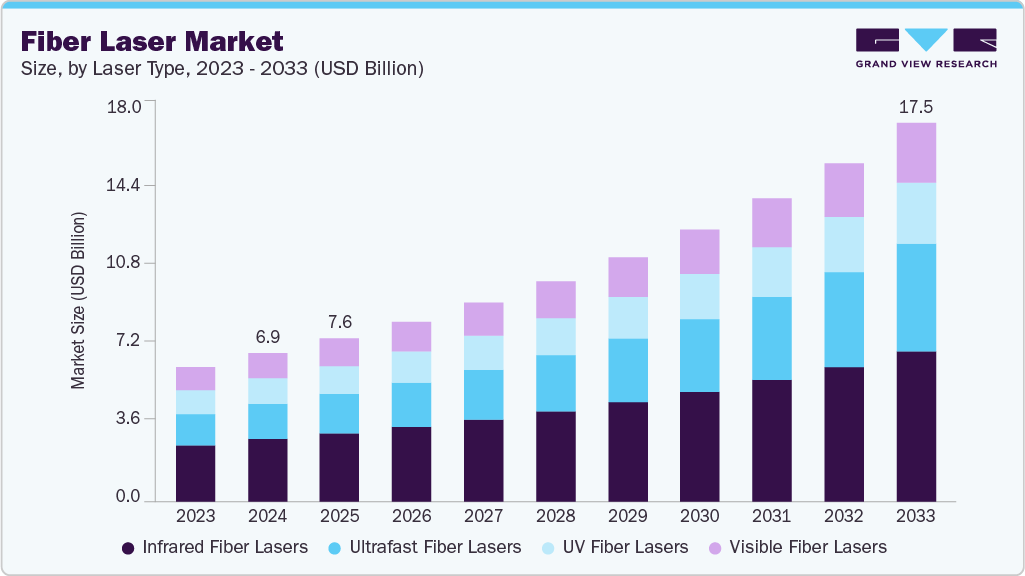

The global fiber laser market size was estimated at USD 6,874.7 million in 2024 and is projected to reach USD 17,549.1 million by 2033, growing at a CAGR of 11.1% from 2025 to 2033. The global fiber laser market is growing steadily due to increasing automation across manufacturing industries.

Key Market Trends & Insights

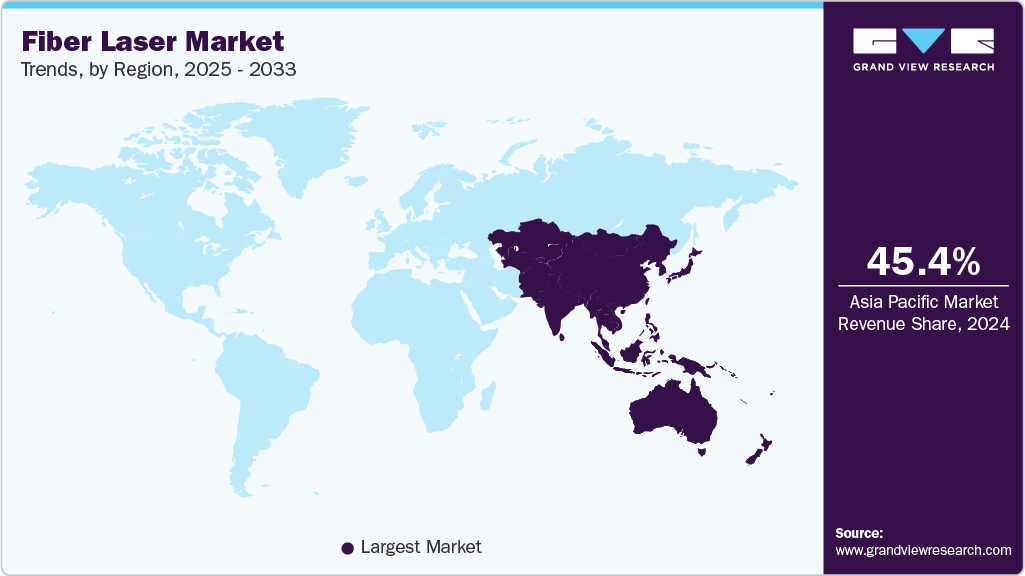

- Asia Pacific Fiber Laser dominated the global market with the largest revenue share of 45.4% in 2024.

- The Fiber Laser market in U.S. led the North America market and held the largest revenue share in 2024.

- By laser type, infrared fiber lasers led the market and held the largest revenue share of 42.1% in 2024.

- By power output, the high power segment held the dominant position in the market and accounted for the largest revenue share of 47.9% in 2024.

- By operation mode, the Continuous Wave (CW) segment held the dominant position in the market and accounted for the largest revenue share of 51.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6,874.7 Million

- 2033 Projected Market Size: USD 17,549.1 Million

- CAGR (2025-2033): 11.1%

- Asia Pacific: Largest market in 2024

Integration with Industry 4.0 systems allows fiber lasers to perform precise, high-speed tasks such as welding and marking in real time. This compatibility with smart factory operations is accelerating their adoption and expanding market. There is growing interest in high-power fiber lasers across industrial sectors. These systems enable faster processing of thicker and harder materials. Manufacturers benefit from improved productivity and reduced cycle times. Higher power levels also support more complex applications with greater precision. This trend is especially strong in the automotive, heavy machinery, and aerospace industries. As efficiency demands rise, high-power fiber lasers are becoming a preferred solution. For instance, in October 2024, Coherent Corp., a semiconductor manufacturing company, launched the ARM FL20D fiber laser, featuring a 20 kW power level and a unique dual-ring beam configuration for precise, high-speed welding, particularly in demanding materials such as cast aluminum. The system is designed to improve efficiency and weld quality while reducing costs.

There is a growing trend of expanding access to advanced laser cutting systems in industrializing regions. Manufacturers are partnering with local automation and distribution firms to reach new markets more effectively. This allows for better after-sales service, training, and customization suited to regional needs. It also lowers adoption barriers for small and mid-sized enterprises. The approach is helping drive fiber laser deployment in areas previously reliant on conventional cutting methods. As a result, the market is expanding beyond traditional strongholds into new geographies. Companies are pursuing regional collaborations and distributor agreements to strengthen market presence, enhance service capabilities, and boost fiber laser adoption in growing industrial regions. For instance, in December 2024, Eagle Lasers, a manufacturer of fiber laser cutting systems partnered with Cuttech, Indian automation specialist as their official distributor. This strategic alliance aims to enhance Eagle’s market presence in India, enabling local manufacturers to access high-power laser cutting solutions such as the iNspire series and FlowIN systems.

The growth of electric vehicle and battery manufacturing is significantly boosting demand for fiber lasers. These industries require highly precise, clean, and repeatable processes for welding and cutting battery components. Fiber lasers provide the necessary control and thermal stability for delicate materials such as aluminum and copper. Their ability to deliver high power with minimal distortion ensures strong, reliable welds. Battery pack assembly, tab welding, and hairpin processing are key areas using fiber laser systems. The push for lighter, more efficient vehicles also drives interest in compact and energy-efficient laser tools. Automation in EV production lines further supports fiber laser integration. Manufacturers prefer fiber lasers for their speed, accuracy, and low maintenance. As global EV production expands, so does the need for scalable laser solutions. This trend is helping accelerate fiber laser market growth across automotive and energy sectors.

Laser Type Insights

In terms of laser type, the infrared fiber lasers segment dominates the fiber laser market is anticipated to hold 42.1% in 2024. Their wavelength is highly effective for processing metals and other industrial materials. These lasers are commonly used in cutting, welding, and surface treatment applications. They offer high beam quality, energy efficiency, and consistent output. Their ability to operate at high speeds supports productivity in manufacturing. Infrared lasers are compatible with both thin and thick materials. Industries favor them for their stability and lower operational costs. Continued demand for precision and speed is reinforcing their market position. Their widespread availability and proven reliability further support strong adoption across regions.

The ultrafast fiber lasers segment is projected to grow significantly over the forecast period. Ultrafast fiber lasers are experiencing increased adoption across advanced applications in the fiber laser market. Their ability to deliver ultra-short pulses enables high-precision material processing. These lasers minimize thermal damage, making them ideal for delicate or micro-scale tasks. They are widely used in medical device manufacturing and semiconductor fabrication. Industries value their accuracy in drilling, cutting, and marking at microscopic levels. As miniaturization and precision requirements rise, ultrafast lasers are gaining more importance. Their non-contact process reduces mechanical stress on sensitive components. Growing interest in high-end electronics and photonics is further supporting their expansion within the fiber laser market.

Power Output Insights

The High-power fiber lasers segment accounted for the largest market revenue share in 2024, due to their ability to handle demanding industrial tasks. They are widely used for cutting thick metals, welding structural components, and other heavy-duty applications. These systems offer superior processing speed and depth compared to lower-power alternatives. Their reliability and efficiency make them ideal for continuous operation in manufacturing settings. High-power lasers are critical in industries such as automotive, aerospace, and heavy machinery. As production volumes increase, demand for high-power systems remains consistently strong. Their ability to deliver precise results at scale gives them a strategic advantage in large-scale production environments.

Medium power fiber lasers are gaining traction as industries seek more balanced solutions for performance and cost. They are well-suited for general-purpose tasks such as precision welding, marking, and light-duty cutting. These lasers offer a good combination of speed, accuracy, and affordability. Small and mid-sized manufacturers find them practical for a wide range of applications. Technological improvements are expanding their capabilities across new use cases. As adoption spreads, the medium-power segment is showing steady growth in the fiber laser market. Growing awareness of their versatility is further boosting their appeal across different production settings.

Operation Mode Insights

The Continuous Wave (CW) lasers segment accounted for the largest market revenue share in 2024, due to their ability to deliver a constant, stable beam. They are widely used in applications requiring uninterrupted energy flow, such as cutting, welding, and cladding. CW lasers offer high precision and consistent performance in industrial operations. Their efficiency and control make them suitable for long-duration processing tasks. Industries prefer CW lasers for handling thick materials and complex joints. The demand remains strong due to their reliability and adaptability. Their compatibility with automation systems further supports their dominance in production environments. Continued investment in high-power CW systems is reinforcing their position across global manufacturing sectors.

Pulsed fiber lasers are growing in adoption as industries seek precise and controlled energy delivery. They are ideal for applications such as marking, engraving, micromachining, and surface texturing. Pulsed systems reduce heat-affected zones, making them suitable for delicate materials. Their short bursts of energy enable detailed and clean processing. As demand rises for fine-feature processing, pulsed lasers are gaining wider acceptance. Their role in electronics, medical, and consumer goods manufacturing is expanding. Technological advancements are improving pulse control, further driving interest in this category. Manufacturers are increasingly recognizing their value in high-precision, low-damage processing tasks.

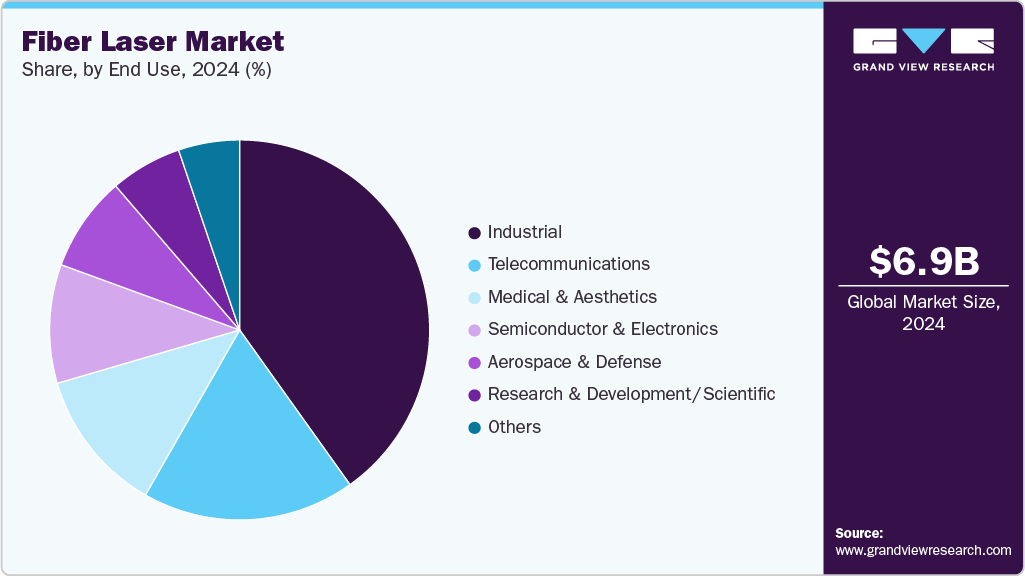

End Use Insights

The Industrial segment accounted for the largest market revenue share in 2024, due to their broad use in cutting, welding, drilling, and marking. These systems are essential for high-volume production across sectors such as automotive, heavy machinery, and metal fabrication. Fiber lasers offer speed, precision, and low operating costs, making them well-suited for continuous industrial use. Their ability to handle a variety of materials supports their widespread deployment in factories. Manufacturers rely on fiber lasers to improve efficiency and maintain product consistency. Industrial demand remains strong as companies prioritize automation and scalable technologies. Ongoing innovation in laser systems continues to enhance industrial productivity. This dominance is expected to persist

Telecommunications is a growing area of the fiber laser market, supported by expanding data infrastructure and high-speed networks. Fiber lasers are used in the production and maintenance of optical components and systems. As demand for bandwidth increases, so does the need for precision in optical device fabrication. Fiber lasers enable clean and accurate micromachining of sensitive components. The rollout of 5G and data center expansion is boosting demand for advanced laser tools. Manufacturers are investing in fiber lasers to meet quality and performance standards in telecom equipment. Compact laser designs also suit the space constraints of telecom production. As connectivity needs rise, this sector is becoming a more prominent consumer of fiber laser technologies.

Regional Insights

Asia Pacific held the largest share of the fiber laser market in 2024, accounting for 45.4%. Rapid industrialization and strong manufacturing output in countries such as China, Japan, and South Korea drove this growth. The region benefits from high demand in automotive, electronics, and metal fabrication sectors. Government support for smart factories and advanced production technologies has further accelerated adoption. Competitive pricing and a large supplier base also contribute to the region’s dominance.

U.S. Fiber Laser Market Trends

The fiber laser market in the U.S. is driven by strong demand across automotive, aerospace, and defense industries. High levels of automation and investment in advanced manufacturing are supporting fiber laser adoption. Key players in the U.S. are introducing high-power, efficient laser systems tailored to domestic needs. Growth is also supported by innovation in clean energy and semiconductor fabrication. The country remains a hub for technological development and high-spec industrial applications.

Europe Fiber Laser Market Trends

In Europe, fiber laser demand is supported by automotive production, precision engineering, and green manufacturing initiatives. Countries such as Germany, the UK, and France are investing in high-efficiency, low-emission fabrication technologies. EU directives favoring energy-efficient systems further promote laser-based processing. European firms are focusing on quality, consistency, and integration into Industry 4.0 workflows. Cross-border collaborations and research programs continue to enhance fiber laser innovation.

North America Fiber Laser Trends

In North America, fiber laser adoption is driven by automation, advanced manufacturing, and demand for high-precision processing. Industrial sectors are integrating fiber lasers into welding, cutting, and marking applications to improve output and efficiency. The region is seeing increased focus on energy-efficient systems and low-maintenance technologies. Growth in electric vehicles and aerospace applications is boosting interest in high-power laser systems. Manufacturers are also prioritizing system integration and real-time process monitoring, supporting smarter production lines.

Key Fiber Laser Company Insights

Some of the key companies in the Fiber Laser industry include Coherent Corp., Fujikura Ltd., Han's Laser Technology Industry Group Co., Ltd., IPG Photonics Corporation, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Coherent Corp. continues to enhance its fiber laser portfolio with innovations in high-power and precision systems. The company focuses on industrial applications, particularly welding and cutting. Recent product developments include dual-beam configurations for improved control. Its systems are designed for high-speed, energy-efficient performance. Strategic partnerships and global reach support its fiber laser advancements. Continuous investment in R&D ensures alignment with evolving industry demands.

-

Fujikura Ltd. is strengthening its position in the fiber laser market through compact and reliable laser solutions. The company emphasizes research in beam quality and power stability. Its lasers are widely used in electronics and microfabrication. Product development targets energy efficiency and long operational life. Ongoing innovation reflects its focus on industrial-grade laser systems. The firm leverages its optical expertise to expand application potential.

Key Fiber Laser Companies:

The following are the leading companies in the fiber laser market. These companies collectively hold the largest market share and dictate industry trends.

- Coherent Corp.

- Fujikura Ltd.

- Han's Laser Technology Industry Group Co., Ltd.

- IPG Photonics Corporation

- Jenoptik AG

- Lumentum Operations LLC

- Maxphotonics Co., Ltd.

- nLIGHT, Inc.

- TRUMPF

- Wuhan Raycus Fiber Laser Technologies Co., Ltd.

Recent Developments

-

In November 2024, IPG Photonics Corporation introduced its YLR‑AMB dual-beam fiber laser series (1-4 kW), designed for additive-manufacturing environments. The lasers feature independently controlled core and ring beams for improved build quality, efficiency, and compact integration.

-

In October 2024, Coherent Corp. introduced the EDGE FL series of high-power fiber lasers, offering 1.5 to 20 kW power levels to cut applications in the machine tool industry. Designed for high performance at competitive pricing, the series emphasizes beam quality, energy efficiency, and seamless integration with Coherent’s optics and EDGE CUT packages to provide a complete, value-driven laser-cutting solution.

Fiber Laser Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7,561.9 million

Revenue forecast in 2033

USD 17,549.1 million

Growth rate

CAGR of 11.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive sector, growth factors, and trends

Segment scope

Laser type, power output, operation mode, end use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

Coherent Corp.; Fujikura Ltd.; Han's Laser Technology Industry Group Co., Ltd.; IPG Photonics Corporation; Jenoptik AG; Lumentum Operations LLC; Maxphotonics Co., Ltd.; nLIGHT, Inc.; TRUMPF; Wuhan Raycus Fiber Laser Technologies Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fiber Laser Market Rport Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global fiber laser market in terms of laser type, power output, operation mode, end use, and region.

- Laser Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Infrared Fiber Lasers

-

Ultrafast Fiber Lasers

-

UV Fiber Lasers

-

Visible Fiber Lasers

-

- Power Output Outlook (Revenue, USD Million, 2021 - 2033)

-

Low Power

-

Medium Power

-

High Power

-

- Operation Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Continuous Wave (CW)

-

Pulsed

-

Quasi-CW

-

- End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Industrial

-

Medical & Aesthetics

-

Telecommunications

-

Aerospace & Defense

-

Semiconductor & Electronics

-

Research & Development / Scientific

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fiber laser market size was estimated at USD 6,874.7 million in 2024 and is expected to reach USD 7,561.9 million in 2025.

b. The global fiber laser market is expected to grow at a compound annual growth rate of 11.1% from 2025 to 2033 to reach USD 17,549.1 million by 2033.

b. Asia Pacific dominated the fiber laser market with a share of 45.4% in 2024. This is attributed to strong manufacturing activity and rising demand across the automotive, electronics, and metal processing industries.

b. Some key players operating in the fiber laser market include Coherent Corp., Fujikura Ltd., Han's Laser Technology Industry Group Co., Ltd., IPG Photonics Corporation, Jenoptik AG, Lumentum Operations LLC, Maxphotonics Co., Ltd., nLIGHT, Inc., TRUMPF, Wuhan Raycus Fiber Laser Technologies Co., Ltd.

b. Key factors driving the market growth include global expansion of industrial automation, increasing demand for high-precision machining, and rising adoption of fiber lasers in medical and aerospace applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.