- Home

- »

- Next Generation Technologies

- »

-

Fiber Optic Cable Accessories Market Size Report, 2030GVR Report cover

![Fiber Optic Cable Accessories Market Size, Share & Trends Report]()

Fiber Optic Cable Accessories Market (2023 - 2030) Size, Share & Trends Analysis Report By Product Type (Connectors, Adapters, Patch Cables & Panels, Splicers), By Application (Data Center, LAN Residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-151-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fiber Optic Cable Accessories Market Trends

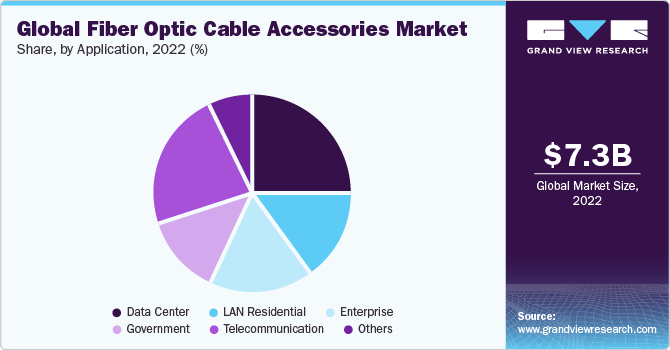

The global fiber optic cable accessories market size was estimated at USD 7.26 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.4% from 2023 to 2030. Fiber optic networks are becoming denser to meet the demands of higher data traffic. This trend is being driven by the increasing popularity of multi-fiber connectors, such as MTP, which can accommodate many fibers in a single connector. These connectors are essential for data centers and telecommunication providers where space and scalability are critical. As data demands continue to grow, the need for accessories that support high fiber density is expected to increase. Manufacturers are continuously innovating to provide compact and high-density solutions to address this trend.

The expansion of 5G networks is a key driver of the fiber optic accessory industry. 5G technology relies on an extensive network of small cells and high-capacity fiber connections to deliver the high-speed and low-latency connectivity it promises. Fiber optic accessories like small-cell fiber enclosures and high-capacity connectors are indispensable for establishing and sustaining these 5G networks. This trend is expected to persist as 5G deployment expands into more regions, encompassing both urban and rural areas.

The expansion of fiber-to-the-home (FTTH) networks is fundamentally changing the way individuals connect to the internet. Fiber optic cable accessories are instrumental in the implementation of FTTH systems. Drop cable assemblies and home networking solutions are growing in complexity to ensure the delivery of effective and dependable connectivity to homes. With a growing number of internet service providers making substantial investments in FTTH infrastructure to provide high-speed broadband to residential users, there is an increasing demand for these accessories. Moreover, the trend toward smart homes and the proliferation of IoT devices underscores the critical role of robust FTTH networks.

Product Type Insights

The connectors segment dominated the market with a revenue share of over 38.0% in 2022. The increasing demand for specialized connectors in the medical and biotechnology sectors is driven by their unique requirements. These connectors are meticulously engineered to withstand sterilization processes and resist the corrosive effects of chemicals. They find their ideal applications in medical imaging, diagnostic equipment, and laboratories. This growing trend underscores the critical necessity for connectors that adhere to strict performance, cleanliness, and safety standards, ensuring their optimal performance within sensitive and heavily regulated medical and research environments.

The splice closures & trays segment is expected to grow with the fastest CAGR from 2023 to 2030. The growing demand for splice closures & trays is driving a significant shift in their design, emphasizing their resilience in harsh environmental conditions. This trend is characterized by the development of robust and weather-resistant enclosures, engineered to shield spliced optical fibers from moisture, dust, UV radiation, and extreme temperature fluctuations. These durable designs have become a necessity for outdoor installations, notably in critical applications such as telecommunication infrastructures and the rollout of FTTH networks, where the ability to withstand environmental challenges is paramount.

Application Insights

The data center segment dominated the market with a revenue share of over 24.0% in 2022. The need for optical interconnects and transceivers within data centers is experiencing a substantial increase. These components are of utmost importance as they facilitate high-speed data transmission and ensure low-latency connections. The current trend leans toward the adoption of cutting-edge optical interconnect solutions that have the capability to accommodate data rates of 100G, 400G, and even higher. Such solutions are indispensable for meeting the substantial bandwidth demands of modern data center applications, including cloud computing, artificial intelligence, and high-performance computing.

The increasing demand for secure communication is fuelling a noticeable trend within the telecommunication sector, characterized by an escalating focus on enhancing network security measures. This heightened emphasis on security is driving the need for specialized fiber optic cable accessories explicitly designed to safeguard telecommunication data and protect against potential breaches. These accessories are equipped with security features such as tamper-evident connectors and intrusion detection systems, responding to the imperative necessity of maintaining the confidentiality and integrity of communications in an era marked by heightened cyber threats and escalating security concerns.

Regional Insights

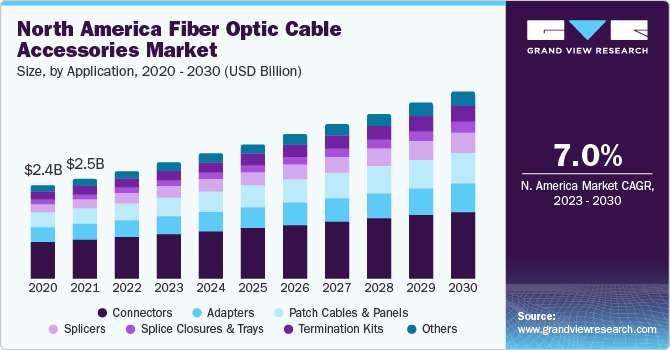

North America dominated the market with a revenue share of over 37.0% in 2022. The incorporation of smart city projects and the expansion of the IoT are generating a demand for advanced telecommunication infrastructure in the region. Fiber optic cable accessories that facilitate high-bandwidth connectivity for IoT devices are crucial for establishing interconnected urban environments. This trend resonates with North America's increasing enthusiasm for harnessing technology to enhance urban services, elevate the overall quality of life, and endorse a variety of IoT applications, ranging from intelligent transportation systems to environmental monitoring initiatives. It underscores the region's dedication to constructing a technologically advanced and interlinked future.

The Asia Pacific region comprises emerging markets experiencing swift technological development. A key focus of this trend is the extension of fiber optic networks in these markets, aimed at aiding digital transformation and enhancing connectivity in areas where internet accessibility has traditionally been constrained. There is a significant demand for fiber optic accessories customized to meet the distinct needs of these emerging markets. This trend serves not only to drive economic expansion and progress in these regions but also to create avenues for inventive solutions and worldwide connectivity.

Key Companies & Market Share Insights

The market is characterized by fierce competition, with only a few major global players dominating a significant portion of the market. Their focus is on developing new and creative products while promoting cooperation among key industry stakeholders. In July 2022, the U.S. Department of Agriculture made public its intention to allocate $401 million for granting high-speed internet access to 31,000 residents and businesses in rural areas across 11 states. This initiative is a representation of the U.S. government's pledge to invest in rural infrastructure and make affordable high-speed internet accessible to everyone.

In another instance, OFS Fitel, LLC announced the launch of Fiber Solutions for America's broadband expansion in August 2023. Leveraging their deep expertise and U.S. manufacturing power, they aim to support the growth of broadband and middle-mile infrastructure, aligning with the Build America, Buy America Act.

Key Fiber Optic Cable Accessories Companies:

- 3M

- Acacia Communications, Inc.

- Belden Inc.

- Broadcom Inc.

- CommScope Inc.

- Corning Incorporated

- Fujitsu Optical Components Limited

- Furukawa Electric Co., Ltd.

- OFS Fitel, LLC

- Optical Cable Corporation (OCC)

- TE Connectivity

Fiber Optic Cable Accessories Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.0 billion

Revenue forecast in 2030

USD 14.96 billion

Growth rate

CAGR of 9.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments Covered

Product type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

The U.S.; Canada; UK; Germany; China; India; Japan; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

3M; Acacia Communications, Inc.; Belden Inc.; Broadcom Inc.; CommScope Inc.; Corning Incorporated; Fujitsu Optical Components Limited; Furukawa Electric Co., Ltd.; OFS Fitel, LLC; Optical Cable Corporation (OCC); TE Connectivity

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Global Fiber Optic Cable Accessories Market Report Segmentation

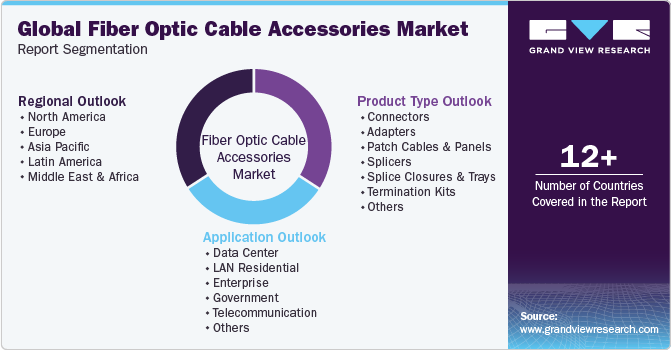

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global fiber optic cable accessories market report based on product type, application, and region:

-

Product Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Connectors

-

Adapters

-

Patch Cables & Panels

-

Splicers

-

Splice Closures & Trays

-

Termination Kits

-

Others (Testers, Cleavers, Enclosures, installation tools, etc.)

-

-

Application Outlook (Revenue, USD Million, 2017 Fiber - 2030)

-

Data Center

-

LAN Residential

-

Enterprise

-

Government

-

Telecommunication

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fiber optic cable accessories market size was estimated at USD 7.26 billion in 2022 and is expected to reach USD 8.04 billion in 2023.

b. The global fiber optic cable accessories market is expected to grow at a compound annual growth rate of 9.4% from 2023 to 2030 to reach USD 14.96 billion by 2030.

b. North America dominated the fiber optic cable accessories market with a share of 37.75% in 2019. This is attributable to the increasing demand for advanced telecommunications infrastructure for the incorporation of smart city projects and the expansion of the Internet of Things (IoT) in the region.

b. Some key players operating in the fiber optic cable accessories market include 3M, Acacia Communications, Inc., Belden Inc., Broadcom Inc., CommScope Inc., Corning Incorporated, Fujitsu Optical Components Limited, Furukawa Electric Co., Ltd., OFS Fitel, LLC, Optical Cable Corporation (OCC), and TE Connectivity

b. Key factors that are driving the market growth include increasing demand for high-speed internet, data center growth, and various government initiatives and funding

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.