- Home

- »

- Next Generation Technologies

- »

-

Fiber To The Home (FTTH) Market Size & Share Report 2030GVR Report cover

![Fiber To The Home Market Size, Share,& Trends Report]()

Fiber To The Home Market Size, Share,& Trends Analysis Report By Product (50 Mbps to 100 Mbps, 100 Mbps to 1 Gbps), By Application (VoIP, Internet TV), By Service Provider, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-123-9

- Number of Report Pages: 115

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

The global fiber to the home (FTTH) market size was estimated at USD 47.04 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 11.6% from 2023 to 2030. The market growth can be attributed to the rising need for better connection speeds, enhanced internet infrastructure, and the growing adoption of intelligent devices. At the same time, the rise in governmental initiatives to foster the evolution of smart urban projects and automated home initiatives presents alluring prospects for FTTH growth.

Furthermore, the rapid pace of urban development, shifts in lifestyles, a notable surge in investments, and an augmentation in consumer expenditures collectively exert a positive influence on the market for Gigabit Passive Optical Network (GPON) technology within the FTTH domain. Several FTTH service providers globally are increasingly focusing on launching symmetrical fiber internet services to offer customers efficient connectivity. For instance, in July 2023, Optimum, a subsidiary of Altice USA, launched its latest offering, the 8 Gig symmetrical fiber internet service. This advanced service is now accessible to over 1.7 million residents and businesses within the company's expansive fiber network coverage.

As the year draws to a close, Optimum's 8 Gig Fiber Internet will extend its reach to nearly 3 million locations, marking a significant milestone in its ongoing fiber network expansion. This notable launch signifies the most extensive rollout of 8 Gig internet speeds nationwide, firmly establishing Optimum as the foremost provider of 8 Gig internet nationally. This achievement solidifies their position as the premier choice for the swiftest fiber internet within their serviceable area.

A notable trend within the FTTH landscape involves the integration of 5G wireless technology, presenting the potential for delivering exceedingly fast, responsive, and high-capacity mobile connectivity. The effectiveness of 5G hinges upon the presence of fiber backhaul and fronthaul networks, which establish connections between base stations and the core network. In this context, FTTH assumes a crucial role in facilitating the deployment and optimal performance of 5G technology. However, the convergence of 5G also introduces both challenges and prospects concerning the troubleshooting and upkeep of FTTH networks. To illustrate, the 5G paradigm necessitates increased fiber density, heightened network segmentation, more precise synchronization, and enhanced coordination among diverse network components.

The rising adoption of Artificial Intelligence (AI) and machine learning in FTTH to automate tasks is further contributing to the growth of the market. Seamless integration of AI and machine learning techniques, imparting the capacity for data-driven learning, process optimization, and task automation. These AI-driven approaches bolster FTTH troubleshooting and maintenance through predictive failure anticipation, fault diagnosis, route optimization, and actionable recommendations. However, the effectiveness of these AI technologies hinges on copious data availability, substantial processing capabilities, and robust storage solutions. As AI's role continues to expand, the FTTH sector must adeptly gather, analyze, and manage voluminous data from diverse sources, spanning optical fibers, network hardware, user devices, and external systems.

The proliferation of internet-connected smart home devices, encompassing a range of technologies such as cameras, smart speakers, sensors, thermostats, and appliances, is significantly influencing the market's growth trajectory. The seamless integration of FTTH technology with smart home systems amplifies connectivity, accelerates data transfer rates, and enables real-time interactions. This harmonious fusion has facilitated the development of a resilient ecosystem wherein Internet of Things (IoT) devices can operate optimally, effectively supporting functions like home automation, security monitoring, and energy management. Furthermore, the escalating adoption of these intelligent devices has generated an increased demand for high-speed and unwavering internet connections, further solidifying FTTH as the favored solution to meet these imperatives. With the ongoing expansion of the smart home and IoT domains, FTTH is primed to assume a pivotal role in shaping the future landscape of interconnected living.

COVID-19 Impact Analysis

The COVID-19 pandemic has had a positive impact on the FTTH market. The widespread shift to remote work, online learning, and virtual interactions prompted an unprecedented upswing in the demand for dependable and high-speed internet access. FTTH swiftly emerged as a pivotal technology during this period, capable of providing the necessary bandwidth and stability to accommodate the escalated online activities. The pandemic acted as a catalyst, expediting the adoption of FTTH as households sought to sustain productivity, engagement, and entertainment from the confines of their homes. This heightened demand not only compelled network operators to accelerate their FTTH deployments but also spotlighted the vital importance of a resilient digital infrastructure capable of meeting the demands of contemporary connected living.

Product Insights

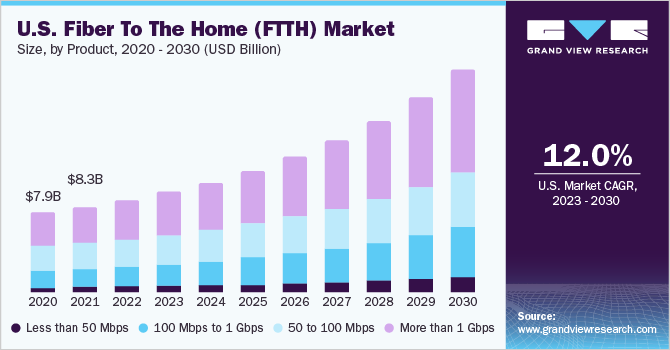

In terms of product, the more than 1 Gbps segment dominated the market in 2022 with a market share of more than 42.0%. The rapid proliferation of data-intensive applications like 4K and 8K video streaming, as well as the burgeoning realms of virtual and augmented reality, have ignited an ever-growing demand for ultra-high-speed internet connections. This escalating need has precipitated a surge in the requirement for FTTH solutions that can not only accommodate but also exceed, the gigabit threshold. The more than 1 Gbps segment is now not solely addressing the preferences of tech-savvy users and content creators, but also adeptly catering to the escalating digital requisites of businesses spanning diverse sectors. Such factors bode well for the growth of the segment over the forecast period.

The 50 to 100 Mbps segment is anticipated to grow at a moderate CAGR over the forecast period. As consumer expectations for faster and more reliable internet experiences continue to evolve, this particular speed bracket has gained significant prominence. With the proliferation of data-intensive applications such as high-definition streaming, online gaming, video conferencing, and cloud-based services, the demand for stable and efficient connectivity within the 50 to 100 Mbps range has grown substantially. This segment is positioned to cater to the requirements of residential users, striking a balance between cost-effectiveness and enhanced performance. As digital lifestyles increasingly rely on robust internet connections, the 50 to 100 Mbps segment stands as a pivotal driving force in shaping the future of FTTH offerings.

Service Provider Insights

In terms of service provider, the telecom operators segment dominated the market in 2022 with a revenue share of more than 32.0%. With the escalating demand for high-speed and reliable internet services, telecom operators are increasingly focusing on expanding their FTTH networks to cater to homes. This expansion is driven by the need to provide seamless connectivity for data-intensive applications, including streaming, gaming, remote work, and online learning. Moreover, the competitive landscape is pushing operators to offer higher bandwidth packages, further accentuating the importance of robust FTTH infrastructure. As 5G wireless technology gains momentum, telecom operators are also exploring strategic integration of FTTH and 5G networks to enhance coverage and capacity.

The internet service provider segment is expected to grow at the highest CAGR over the forecast period. In response to escalating demands for faster, more reliable, and higher-capacity internet services, ISPs are strategically directing their efforts toward expanding and enhancing their FTTH offerings. This strategic focus is driven by the essential need to furnish uninterrupted connectivity for data-intensive applications, encompassing streaming, online gaming, remote work, and digital learning. Internet service providers globally are aiming to expand their broadband reach in remote geographies. For instance, in June 2022, Bharti Airtel, a prominent solution provider of communication solutions in India, launched its FTTH broadband service, Airtel Xstream Fiber, in the Ladakh and Andaman and Nicobar Islands regions. This milestone establishes Airtel as the pioneering private ISP to extend FTTH broadband to these distant areas, thereby delivering top-tier digital connectivity to customers and connecting them to the digital highway.

Application Insights

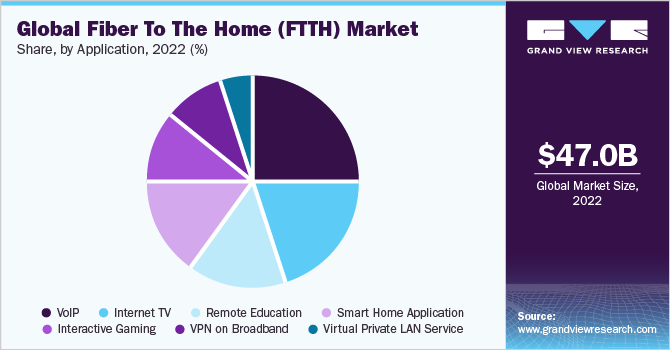

In terms of application, the VoIP segment dominated the market in 2022 with a revenue share of more than 24.0%. As communication patterns evolve, the integration of VoIP services has gained significant traction. VoIP, which enables voice communication over the internet, is becoming a favored choice for its cost-effectiveness, versatility, and improved call quality. With the expansion of FTTH networks, VoIP services are benefiting from the increased bandwidth and stability that FTTH technology provides, resulting in superior voice call experiences. Moreover, the global shift toward remote work and virtual communication has accelerated the demand for reliable and seamless voice communication, further elevating the significance of VoIP within the FTTH market.

The smart home application segment is expected to grow at a moderate CAGR over the forecast period. As the concept of smart living gains momentum, there is an increasing reliance on FTTH technology to support a diverse array of connected devices and applications. This surge in demand for seamless integration of smart devices, such as thermostats, security cameras, lighting controls, and voice assistants, is driving the adoption of FTTH infrastructure. With its high-speed, low-latency connectivity, FTTH is laying the foundation for robust and responsive smart home experiences. The trend toward energy efficiency and enhanced security further accentuates the importance of a reliable and speedy connection for these smart applications.

Regional Insights

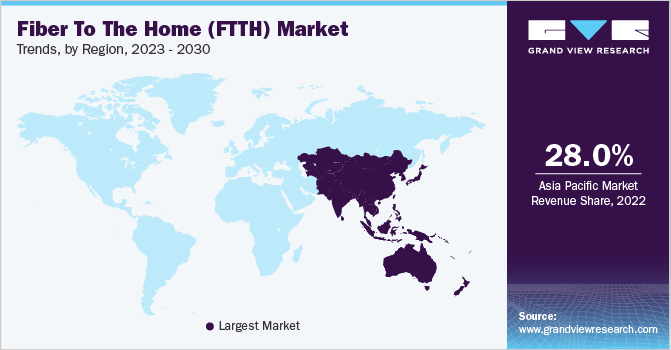

The Asia Pacific region dominated the market in 2022 with a revenue share of more than 28.0% and it is expected to retain its dominance over the forecast period.Given its swiftly growing economies, expanding population, and heightened urbanization, the Asia Pacific region is emerging as a central hub for the implementation and uptake of FTTH systems. Government authorities and telecommunication firms spanning various Asia Pacific nations increasingly acknowledge the importance of swift, high-capacity internet connectivity for bolstering economic advancement and societal development. This acknowledgment has kindled considerable investments in the enhancement of FTTH infrastructure, thereby propelling the amplification of networks and services. Furthermore, the wide proliferation of digital technologies, combined with the surging demand for online services and streaming content, is prompting consumers to actively pursue enhanced, more dependable internet connections. This trend reinforces the region's significance in the global FTTH landscape, poised to profoundly influence the trajectory of FTTH technologies and services in the times ahead.

The North America region is expected to grow at a moderate CAGR over the forecast period. With its well-established technological infrastructure and digitally mature consumer base, the region is at the forefront of FTTH adoption. Governments, businesses, and consumers in North America are increasingly recognizing the crucial role of high-speed internet connectivity in fostering innovation, economic growth, and enhanced quality of life. This recognition has propelled notable investments in FTTH infrastructure, driving the expansion of networks and services to cater to the mounting demand for reliable and high-speed internet access.

Key Players & Market Share Insights

The key players in the market include AT&T, Inc., Ziply Fiber, Etisalat, Verizon Communications Inc., Optimum, Singtel, Softbank Group Corp., Century Link, Frontier Communications Parent, Inc., and Windstream Intellectual Property Services, LLC. The landscape of the FTTH market displays fragmentation, with several significant contributors employing competitive strategies to ensure their sustained market presence. This environment presents hurdles for newcomers striving to establish their foothold. Established participants employ strategies including geographical expansion, continuous innovation, and customer-centric approaches, shaping a competitive environment characterized by its dynamic and progressive nature, benefiting all stakeholders engaged in the market.

Numerous entities in the FTTH market are forming partnerships, introducing products, and embarking on collaborative initiatives with other participants in the industry. Companies globally are launching internet services to support customers efficiently. For instance, in April 2023, Ziply Fiber, a residential internet provider in the Northwestern region, launched its 10-Gig home internet service, encompassing its expansive presence across Washington, Oregon, Idaho, and Montana. The wide accessibility of this novel ultra-high-speed service category, transmitted via Ziply Fiber's 100-gig fiber network, positions the company in an exceptional league. This launch unequivocally solidifies Ziply Fiber's standing as the speediest home internet service provider within the Northwestern region, as well as one of the most rapid nationwide. Some prominent players in the global fiber to the home (FTTH) market include:

-

AT&T, Inc.

-

Ziply Fiber

-

Etisalat

-

Verizon Communications Inc

-

Optimum

-

Singtel

-

Softbank Group Corp.

-

Century Link

-

Frontier Communications Parent, Inc.

-

Windstream Intellectual Property Services, LLC.

Fiber To The Home (FTTH) Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 51.20 billion

Revenue forecast in 2030

USD 110.44 billion

Growth rate

CAGR of 11.6 % from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Product, service provider, application, region

Regional scope

North America; Europe; Asia Pacific; South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa.

Key companies profiled

AT&T, Inc.; Ziply Fiber; Etisalat; Verizon Communications Inc.; Optimum; Singtel; Softbank Group Corp.; Century Link; Frontier Communications Parent, Inc.; Windstream Intellectual Property Services, LLC.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fiber To The Home (FTTH) Market Report Segmentation

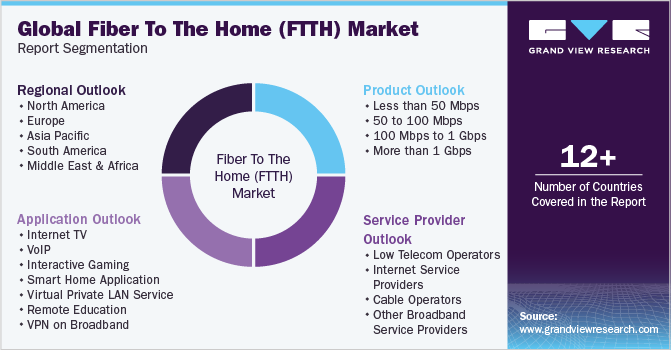

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global fiber to the home (FTTH) market report based on product, service provider, application, and region.

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Less than 50 Mbps

-

50 to 100 Mbps

-

100 Mbps to 1 Gbps

-

More than 1 Gbps

-

-

Service Provider Outlook (Revenue, USD Million, 2017 - 2030)

-

Low Telecom Operators

-

Internet Service Providers

-

Cable Operators

-

Other Broadband service providers

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Internet TV

-

VoIP

-

Interactive Gaming

-

Smart Home Application

-

Virtual Private LAN Service

-

Remote Education

-

VPN on Broadband

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fiber to the home market size was estimated at USD 47.04 billion in 2022 and is expected to reach USD 51.20 billion by 2023.

b. The global fiber to the home (FTTH) market is expected to grow at a compound annual growth rate of 11.6% from 2023 to 2030 to reach USD 110.44 billion by 2030.

b. The telecom operators segment dominated the market in 2022 and accounted for more than 32.0% share of the global revenue. With the escalating demand for high-speed and reliable internet services, telecom operators are increasingly focusing on expanding their FTTH networks to cater to homes, thereby contributing to the growth of the segment.

b. Some of the key players in the FTTH market include AT&T, Inc., Ziply Fiber, Etisalat, Verizon Communications Inc., Optimum, Singtel, Softbank Group Corp., Century Link, Frontier Communications Parent, Inc., and Windstream Intellectual Property Services, LLC.

b. The market growth can be attributed to the rising need for better connection speeds, enhanced internet infrastructure, and the growing embrace of intelligent devices. At the same time, the rise in governmental initiatives to foster the evolution of smart urban projects and automated home initiatives presents alluring prospects for FTTH growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."