- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Fiberglass Fabric Market Size, Share, Industry Report, 2033GVR Report cover

![Fiberglass Fabric Market Size, Share & Trends Report]()

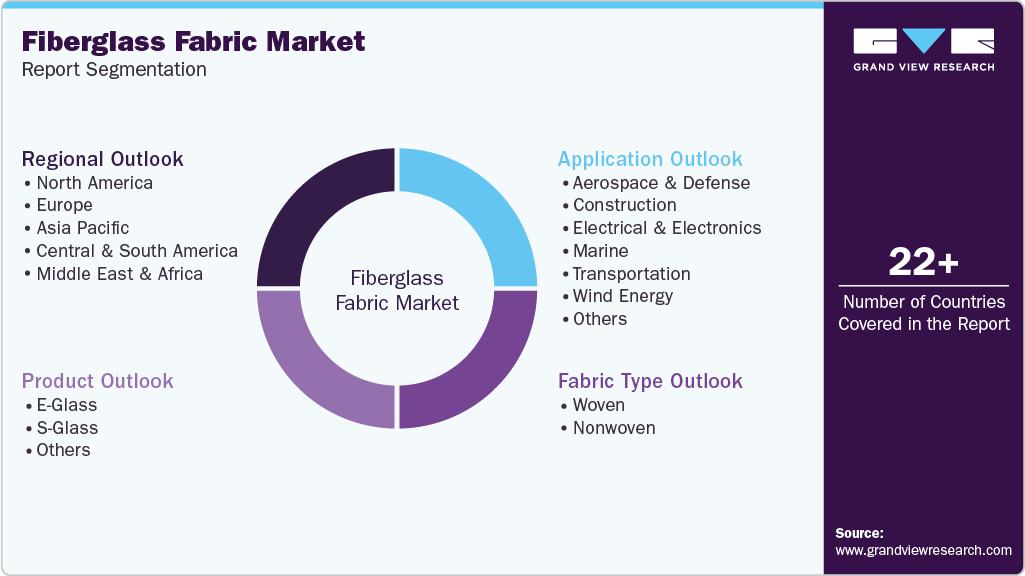

Fiberglass Fabric Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Construction, Wind Energy, Electrical & Electronics, Marine), By Product (E-Glass, S-Glass), By Fabric Type (Woven, Nonwoven), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-730-8

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Fiberglass Fabric Market Summary

The global fiberglass fabric market size was estimated at USD 14.01 billion in 2024 and is expected to reach USD 25.65 billion by 2033, growing at a CAGR of 7.0% from 2025 to 2033. The growing demand for lightweight, high-strength materials across various end-use industries is a primary driver of the fiberglass fabric market.

Key Market Trends & Insights

- Asia Pacific dominated the fiberglass fabric market with the largest revenue share of 41.61% in 2024.

- Based on product, the S-glass segment is expected to grow at a considerable CAGR of 7.2% from 2025 to 2033.

- By fabric type, the non-woven segment is expected to grow at a considerable CAGR of 7.1% from 2025 to 2033.

- By application, the wind energy segment is expected to grow at a considerable CAGR of 8.5% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 14.01 Billion

- 2033 Projected Market Size: USD 25.65 Billion

- CAGR (2025-2033): 7.0%

- Asia Pacific: Largest market in 2024

Industries such as aerospace, automotive, and construction are increasingly incorporating fiberglass fabrics due to their superior mechanical properties, corrosion resistance, and thermal insulation capabilities. In the automotive sector, for instance, manufacturers are leveraging fiberglass fabrics to reduce vehicle weight and improve fuel efficiency, aligning with stringent environmental regulations and carbon emission targets. Similarly, in the aerospace industry, the material offers significant advantages in terms of weight reduction and structural performance, which are critical for improving fuel economy and payload efficiency.

The construction industry's emphasis on high-performance materials for insulation, roofing, and reinforcement is contributing to the market's expansion. Fiberglass fabrics are widely used in architectural applications, including wall coverings, ceiling tiles, and fireproofing systems, due to their flame resistance and sound insulation properties. As infrastructure development accelerates in emerging economies, the need for reliable, long-lasting, and energy-efficient materials is expected to rise, creating lucrative opportunities for fiberglass fabric manufacturers. Additionally, advancements in weaving technology and product customization are enabling broader use in specialized applications, further supporting market growth.

Another key factor fueling market growth is the expanding application of fiberglass fabric in the wind energy sector. As the global focus on renewable energy intensifies, wind turbine manufacturers are increasingly utilizing fiberglass fabric for manufacturing turbine blades due to its strength-to-weight ratio and resistance to environmental degradation. Additionally, government incentives and investments in wind power infrastructure, particularly in regions like Europe, North America, and Asia-Pacific, are further propelling the adoption of fiberglass composites in this sector. The durability and cost-effectiveness of fiberglass fabrics make them an attractive alternative to traditional materials used in energy infrastructure.

Market Concentration & Characteristics

The fiberglass fabric market is moderately concentrated, with a mix of global and regional players actively competing through innovation, product customization, and strategic expansions. The degree of innovation in the market is relatively high, driven by the growing demand for high-performance composites in sectors such as aerospace, wind energy, and automotive. Companies are investing in R&D to develop advanced fabrics with enhanced tensile strength, heat resistance, and lightweight properties, catering to industry-specific needs. Strategic partnerships and collaborations with end users and raw material suppliers further strengthen the competitive landscape, while large players leverage technological advancements to gain a competitive edge.

Mergers and acquisitions are moderately active in the market, often aimed at expanding geographical presence or integrating vertically to ensure a consistent supply of raw materials. Regulatory frameworks also play a crucial role, especially in applications involving fire resistance, environmental impact, and worker safety, influencing both product standards and production processes. Although substitutes such as carbon fiber or aramid fabric exist, their higher cost and limited applicability in certain sectors restrict widespread replacement of fiberglass fabric. End-user concentration varies across applications; while the automotive and wind energy sectors are characterized by a few major manufacturers driving bulk demand, the construction and industrial sectors present a more fragmented end-user base, offering opportunities for niche suppliers.

Application Insights

The construction segment dominated the global fiberglass fabric market, accounting for a revenue share of 25.48% in 2024, driven by the increasing demand for lightweight, durable, and corrosion-resistant materials in infrastructure development. Fiberglass fabrics are widely used in concrete reinforcement, insulation, and roofing systems, offering superior strength and longevity. The surge in urbanization and large-scale public infrastructure projects, especially in emerging economies, further fuels this demand. Strict regulations promoting energy efficiency and sustainable construction practices also encourage the use of fiberglass fabrics. Moreover, their resistance to moisture and fire makes them ideal for modern building materials. These attributes significantly contribute to their growing adoption in both residential and commercial construction.

Wind energy segment is expected to grow at the fastest CAGR of 8.5% over the forecast period, driven by its extensive application in wind energy and oil & gas industries. Wind turbine blades require lightweight yet high-strength composite materials, and fiberglass fabric meets these criteria effectively. Increasing global investments in renewable energy, particularly wind power, are accelerating the need for such materials. Additionally, fiberglass is used in pipelines, insulation, and protective equipment in the oil & gas industry due to its thermal and chemical resistance. The push for sustainable energy sources and infrastructure resilience further supports the growth of this segment. This aligns with global energy transition goals and infrastructure modernization efforts.

Product Insights

E-Glass segment dominated the global fiberglass fabric market, accounting for a revenue share of 79.13% in 2024, driven by its excellent electrical insulation, high strength-to-weight ratio, and cost-efficiency. E-glass fibers are extensively used in automotive, aerospace, electronics, and construction sectors where these properties are crucial. The affordability and availability of E-glass, along with its compatibility with various resins, make it a versatile material choice. Continuous product innovations and the development of advanced composites further drive its consumption. Its thermal stability and dimensional accuracy under diverse conditions are highly valued in end-use applications. These factors collectively underpin the strong demand for E-glass fabrics globally.

S-Glass segment is anticipated to experience the fastest CAGR of 7.2% during the forecast period, driven by demand from high-performance applications that require superior mechanical strength and thermal stability. S-glass fabrics are widely utilized in aerospace, defense, and high-end sports equipment industries due to their enhanced tensile strength and modulus. Although more expensive than E-glass, S-glass offers exceptional performance in extreme environments, making it ideal for mission-critical components. The growth in military spending and advanced aerospace manufacturing contributes significantly to the rising adoption of S-glass. In addition, its usage in ballistic protection and structural reinforcement in automotive and marine sectors is expanding. These niche but essential uses maintain steady demand for this premium fiberglass type.

Fabric Type Insights

The woven segment held the largest revenue share of 59.21% in 2024, driven by its balanced structural integrity, high dimensional stability, and design flexibility. These fabrics are commonly used in applications requiring uniform strength in multiple directions, such as boat hulls, industrial panels, and sports gear. The consistent performance and predictable behavior of woven fiberglass in stress conditions make it a preferred material in precision engineering. Growth in composite manufacturing and increasing demand for customized structural components are enhancing the uptake of woven variants. Moreover, their ease of handling and compatibility with various manufacturing processes support their use across industries. These characteristics keep woven fiberglass in high demand across both traditional and advanced applications.

The nonwoven segment is anticipated to experience the fastest CAGR of 7.1% during the forecast period, driven by its lightweight properties, cost-effectiveness, and suitability for insulation and filtration applications. These fabrics are often used in roofing materials, acoustic panels, and thermal insulation solutions, where uniform distribution and low density are beneficial. Rising environmental regulations and emphasis on energy efficiency in buildings further support the use of nonwoven fiberglass. Advancements in nonwoven processing technologies have improved their mechanical properties, expanding their applicability. Additionally, their recyclability and ease of installation are attractive for green construction and industrial settings. These market dynamics are steadily boosting the nonwoven segment's growth trajectory.

Regional Insights

Asia Pacific fiberglass fabric market held the highest revenue share of 41.60% in 2024, fueled by rapid industrialization, urban development, and infrastructure expansion. Countries like China, India, South Korea, and Japan are witnessing increased use of fiberglass in construction, automotive, and electronics industries. The push for energy-efficient and sustainable building materials is accelerating demand in residential and commercial projects. Additionally, expanding wind energy capacity and automotive production in the region are key growth contributors. Competitive manufacturing costs and the availability of raw materials also encourage large-scale production and export activities.

China fiberglass fabric market dominates the Asia Pacific market owing to its massive industrial base and government-driven infrastructure projects. The country is a leading producer and exporter of fiberglass products, benefiting from cost-effective labor and raw material access. Rapid expansion in the construction, transportation, and electronics sectors is fueling domestic consumption. The government's emphasis on renewable energy sources, especially wind power, has significantly driven the use of fiberglass composites. Additionally, the growing demand for electric vehicles and lightweight automotive components continues to spur innovation in fiberglass fabric applications.

North America Fiberglass Fabric Market Trends

The fiberglass fabric market in North America is driven by robust demand from the aerospace, defense, and wind energy sectors. The U.S. government’s increasing investments in renewable energy projects and military modernization have significantly boosted the need for lightweight and durable materials like fiberglass fabrics. Moreover, stringent regulations regarding emissions and fuel efficiency are pushing automotive manufacturers to adopt composite materials to reduce vehicle weight. Growth in infrastructure and industrial applications, especially in thermal insulation and corrosion resistance, further contributes to market expansion. Strong R&D capabilities and the presence of key manufacturers support ongoing innovation in the region.

U.S. Fiberglass Fabric Market Trends

The U.S. fiberglass fabric market benefits from advancements in composite manufacturing and a well-established base of end-use industries. Demand from high-performance sectors such as aerospace, electronics, and marine drives the adoption of engineered fiberglass solutions. The rapid growth in wind energy installations and electric vehicles also fuels the consumption of lightweight and high-strength materials. Favorable policies supporting domestic manufacturing and sustainability initiatives further support the market. The presence of leading players and a strong distribution network enhances product accessibility and application-specific innovation.

Europe Fiberglass Fabric Market Trends

Europe’s fiberglass fabric market is driven by sustainability goals and stringent regulatory standards across multiple sectors, particularly automotive, aerospace, and construction. The European Union’s Green Deal and carbon neutrality targets are encouraging the use of lightweight composite materials to improve energy efficiency. The automotive sector is undergoing a major shift toward electric mobility, which enhances demand for fiberglass for weight reduction. Furthermore, refurbishment of aging infrastructure and growing renewable energy initiatives, especially offshore wind energy, provide long-term opportunities for the fiberglass fabric industry.

Germany fiberglass fabric market holds a prominent share of European market, supported by its strong automotive and industrial base. German manufacturers are heavily investing in advanced composites to enhance vehicle performance, reduce emissions, and meet environmental standards. The country is also a hub for wind energy projects, particularly in offshore installations, which require durable and corrosion-resistant materials like fiberglass. Innovation in high-temperature and electrically insulating fabrics for electronics and machinery applications further supports market growth. Supportive regulations and government funding for green technologies play a pivotal role in fostering demand.

Central & South America Fiberglass Fabric Market Trends

The fiberglass fabric market in Central & South America is propelled by increasing demand for regional and low-cost air travel. Brazil, home to Embraer, is a significant contributor, particularly in the regional jet segment. The need to modernize older aircraft fleets in the region encourages retrofitting, boosting demand for insulation upgrades. Although budget constraints remain, international partnerships and investments in airport infrastructure help stimulate market activity. Growing environmental awareness is also encouraging interest in sustainable insulation fabric types.

Middle East & Africa Fiberglass Fabric Market Trends

The fiberglass fabric market in the Middle East & Africa is driven by large-scale construction projects and the growing oil & gas sector. High-temperature resistant and corrosion-proof fiberglass fabrics are widely used in pipelines, insulation, and protective applications. Countries like the UAE and Saudi Arabia are investing heavily in renewable energy projects, including solar and wind power, which require composite materials for components and infrastructure. Additionally, the region’s push toward economic diversification and sustainable building practices enhances opportunities for fiberglass fabric manufacturers. However, the market still faces challenges related to limited local manufacturing and supply chain constraints.

Key Fiberglass Fabric Company Insights

Some key players operating in the market include Owens Corning, and Jushi Group Co. Ltd.

-

Owens Corning is a global player in building and industrial materials, headquartered in the United States. The company is widely recognized for its innovations in composite materials, particularly in fiberglass technology. Owens Corning's product portfolio includes fiberglass fabrics, reinforcements, insulation materials, and roofing components, serving industries such as construction, automotive, wind energy, and industrial applications. Its fiberglass fabric offerings are known for their durability, lightweight nature, and resistance to heat and corrosion.

-

Jushi Group Co., Ltd, based in China, is one of the world’s largest manufacturers of fiberglass and fiberglass reinforced products. The company offers a broad range of fiberglass products including direct roving, chopped strands, woven roving, fiberglass mats, and fabrics. Its fiberglass fabric solutions are engineered to meet high-performance standards, catering to diverse industrial and structural reinforcement needs worldwide.

Gurit, Hexcel Corporation are some emerging participants in the market.

-

Gurit is a Swiss-based company that specializes in advanced composite materials, engineering, and tooling solutions. The company serves a range of sectors, including aerospace, marine, automotive, and wind energy. Gurit’s product portfolio comprises prepregs, structural core materials, adhesives, and engineered fiberglass fabrics. The company is particularly noted for its tailored composite solutions that enable lightweight, high-strength applications.

-

Hexcel Corporation, headquartered in the United States, is a leading producer of advanced composites and engineered materials. The company manufactures high-performance reinforcement fabrics, including fiberglass, carbon fiber, and hybrid textiles. Hexcel’s fiberglass fabrics are primarily used in aerospace, defense, automotive, and industrial sectors, offering strength, stiffness, and durability while reducing overall weight.

Key Fiberglass Fabric Companies:

The following are the leading companies in the fiberglass fabric market. These companies collectively hold the largest market share and dictate industry trends.

- Owens Corning

- Jushi Group Co. Ltd

- Gurit

- Hexcel Corporation

- BGF Industries, Inc.

Recent Developments

-

In October 2023, Owens Corning launched an advanced E-glass fabric engineered for superior strength and improved fire resistance, specifically tailored for use in wind turbine blade applications.

Fiberglass Fabric Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.93 billion

Revenue forecast in 2033

USD 25.65 billion

Growth rate

CAGR of 7.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Report updated

August 2025

Quantitative units

Revenue in USD million/billion, volume in million square meters and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, product, fiber type end use, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Russia; India; China; Japan; Australia, South Korea; Brazil; Argentina; South Africa

Key companies profiled

Owens Corning; Jushi Group Co. Ltd; Gurit; Hexcel Corporation; BGF Industries, Inc.

Customization scope

Free report customization (equivalent to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fiberglass Fabric Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global fiberglass fabric market report based on application, product, fabric type and region.

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Million, 2021 - 2033)

-

Aerospace & Defense

-

Construction

-

Electrical & Electronics

-

Marine

-

Transportation

-

Wind Energy

-

Others

-

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2021 - 2033)

-

E-Glass

-

S-Glass

-

Others

-

-

Fabric Type Outlook (Volume, Million Square Meters; Revenue, USD Million, 2021 - 2033)

-

Woven

-

Nonwoven

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fiberglass fabric market size was estimated at USD 14.01 billion in 2024 and is expected to reach USD 14.93 billion in 2025.

b. The global fiberglass fabric market is expected to grow at a compound annual growth rate of 7.0% from 2025 to 2033 to reach USD 25.64 billion by 2033.

b. Based on application, construction segment dominated the global fiberglass fabric market, accounting for a revenue share of 25.48% in 2024, driven by the increasing demand for lightweight, durable, and corrosion-resistant materials in infrastructure development.

b. Key players in the fiberglass fabric market include Owens Corning Jushi Group Co. Ltd Gurit Hexcel Corporation BGF Industries, Inc.

b. Key factors driving the fiberglass fabric market include rising demand for lightweight, durable, and heat-resistant materials across construction, energy, aerospace, and automotive industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.