- Home

- »

- Next Generation Technologies

- »

-

Field Activity Management Market Size & Share Report, 2033GVR Report cover

![Field Activity Management Market Size, Share & Trends Report]()

Field Activity Management Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Solutions, Services), By Deployment Mode (On-Premises, Cloud-Based), By Organization Size, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-661-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Field Activity Management Market Summary

The global field activity management market size was estimated at USD 1.46 billion in 2024 and is projected to reach USD 5.45 billion by 2033, growing at a CAGR of 16.0% from 2025 to 2033. The growing need for real-time visibility, workforce coordination, and operational efficiency across various sectors propels the market.

Key Market Trends & Insights

- North America held a 38.3% revenue share of the global field activity management market in 2024.

- In the U.S., the market is driven by the growing need to modernize the geographically dispersed field operations across sectors such as utilities, telecom, healthcare, and logistics.

- By component, the solution segment held the largest revenue share of 75.2% in 2024.

- By organization size, large enterprises segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.46 Billion

- 2033 Projected Market Size: USD 5.45 Billion

- CAGR (2025-2033): 16.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Industries such as telecom, utilities, construction, logistics, and healthcare are dependent on FAM solutions to manage dispersed teams, schedule and dispatch jobs, and ensure service delivery compliance. A key trend driving the market is the convergence of FAM platforms with AI, IoT, and geospatial analytics. By leveraging real-time location data, predictive maintenance algorithms, and mobile device integrations, businesses automate routing, track assets, forecast job durations, and ensure SLA adherence. This evolution transforms field operations from reactive to proactive, minimizing costs and enhancing customer satisfaction. For instance, energy utilities are increasingly deploying AI-integrated FAM systems to monitor field crew performance, anticipate outages, and streamline restoration workflows.

The growing demand for AI-powered assistance and automation in field operations is also driving the market share. Organizations are seeking tools that not only digitize workflows but also improve technician decision-making in real-time, improving first-time fix rates and reducing training overhead. For instance, in April 2024, PTC introduced enhancements to its ServiceMax platform, including expanded capabilities for ServiceMax Copilot, a conversational AI tool that helps field technicians troubleshoot issues, access asset knowledge, and streamline job workflows directly on mobile devices. These updates also included improvements in multi-day routing, asset visibility, and case management.

Component Insights

The solution segment dominated the market and accounted for the revenue share of 75.2% in 2024 fueled by rising enterprise demand for integrated platforms that unify scheduling, dispatch, mobile execution, analytics, and automation within a single system. Organizations are adopting comprehensive FAM suites over standalone tools to simplify deployment, improve SLA compliance, and enhance technician productivity through intelligent workflows and real-time data insights. For instance, in October 2024, Oracle launched AI-powered workflows within its Fusion Cloud Service and Fusion Cloud Field Service suite. These enhancements introduced generative AI agents for task prioritization, automatic summarization of service calls, and intelligent knowledge search to assist field teams. Therefore, the increasing adoption of solutions is contributing significantly in driving the growth of the global field activity management market.

The service segment is expected to register the fastest growth during the forecast period, driven by the increasing need for implementation, customization, and ongoing optimization of complex field activity management systems. As organizations transition to cloud-based FAM platforms, they require professional services for seamless implementation including system integration, data migration, and workflow customization to ensure rapid deployment and optimal platform utilization. This growing demand for value-added services is further driven by the need for platform scalability and managed service models that help businesses maintain high performance standards, respond to dynamic field conditions, and continuously optimize field operations over time. For instance, in June 2024, Bucher Emhart Glass selected IFS Cloud Field Service Management to digitize its global operations across 13 sites, leveraging IFS’s implementation and service expertise to support predictive maintenance and automation. Therefore, the growing dependence on expert services to ensure seamless deployment and long-term success is significantly contributing to the robust growth of the services segment in the global field activity management market.

Deployment Mode Insights

Cloud-based segment accounted for the largest revenue share in 2024, due to its ease of deployment and ability to support real-time data access and coordination across distributed field teams. Organizations are adopting cloud-based FAM solutions as they reduce IT maintenance costs and enable seamless updates and feature enhancements. These platforms also facilitate remote workforce management, mobile accessibility, and AI-driven analytics, suitable for industries with geographically dispersed operations. For instance, in June 2025, Gigaphoton adopted IFS Cloud to enhance its global field service capabilities and support its expansion strategy, highlighting the preference for cloud-based solutions to achieve scalability and operational agility. Therefore, as businesses continue to prioritize flexibility, real-time visibility, and faster time-to-value, the demand for cloud deployment models is expected to dominate during the forecast period.

The on-premises segment is expected to register the second fastest growth over the forecast period as organizations in highly regulated or security-sensitive industries such as defense, utilities, and manufacturing require full control over their data and infrastructure. These businesses often deal with mission-critical operations, proprietary workflows, or compliance obligations that restrict cloud adoption, making on-premises deployments preferable for enhanced data sovereignty. Additionally, enterprises with legacy IT ecosystems or limited internet connectivity continue to invest in on-premises field activity management solutions to ensure stable performance and seamless compatibility with existing infrastructure. Hence, the steady growth of this segment reflects a sustained demand for deployment models that offer control, reliability, and compliance assurance.

Organization Size Insights

Large enterprises segment accounted for the largest revenue share in 2024, driven by their need to support field workforces, complex service-level agreements, and multi-site operations with sophisticated technology. These organizations are at the forefront of digital transformation, integrating AI-driven, cloud-based FAM platforms that offer centralized orchestration and deep workflow customization. For instance, in May 2025, IgniteTech launched StreetSmart AI, an AI-powered field force management platform designed specifically for large-scale organizations, introducing intelligent dispatch, voice-activated task support, and AR-guided workflows to elevate enterprise-level field service operations. Consequently, the growing adoption of field activity management solutions in large enterprises owing to the above-mentioned benefits is contributing notably to spurring the market size.

Small and Medium Enterprises segment is expected to register the fastest growth over the forecast period, driven by the adoption of digital field activity management tools to enhance operational agility, reduce manual errors, and compete with larger counterparts. Additionally, cloud-based platforms provide modular, subscription-driven models specifically designed for SMEs, enhancing affordability, simplifying deployment, and reducing the need for extensive IT infrastructure. Moreover, SMEs are leveraging mobile-first applications, automated scheduling, and lightweight analytics to optimize technician productivity, monitor task progress in real time, and improve customer satisfaction. Furthermore, the rise of AI and low-code/no-code configurations enable SMEs to customize workflows and scale operations without deep technical expertise. Subsequently, as these businesses prioritize efficiency, customer responsiveness, and faster service delivery, their demand for flexible, cost-effective FAM solutions continues to grow, fueling the expansion of small and medium enterprises segment.

Application Insights

The service & maintenance management segment accounted for the largest share in 2024 due to its crucial role across asset-intensive industries such as utilities, manufacturing, telecom, and healthcare. These sectors rely heavily on routine and emergency field service operations to ensure equipment uptime, regulatory compliance, and uninterrupted customer service. As a result, organizations are increasingly adopting FAM platforms that offer intelligent scheduling, preventive maintenance tracking, technician mobility, and real-time reporting to streamline service workflows and reduce downtime. The shift toward predictive maintenance, driven by IoT sensor data and AI, has further accelerated this adoption by enabling proactive issue resolution and extending asset life cycles. Additionally, compliance-heavy industries prioritize digital service records and automated checklists to meet audit requirements and maintain safety standards. Therefore, the above-mentioned applications have positioned service & maintenance management as the largest application segment within the global field activity management market.

The customer relationship management segment is expected to register the fastest growth during the forecast period, driven by the increasing demand for field teams to deliver personalized, data-driven customer interactions. Technicians require immediate access to full customer profiles, service history, and preferences while onsite which is enabled by CRM-integrated FAM platforms to resolve issues faster and strengthen client trust. Additionally, AI-powered tools automate follow-ups, anticipate service needs, and uncover upsell opportunities, further heightening customer retention and revenue generation. For instance, in April 2025, Salesforce introduced Agentforce for Field Service, that leverages AI agents to enhance field interactions through intelligent appointment scheduling, real-time issue resolution, and context-aware customer engagement. Therefore, such developments are accelerating the adoption of CRM-integrated FAM solutions, which in turn is driving the growth of the market.

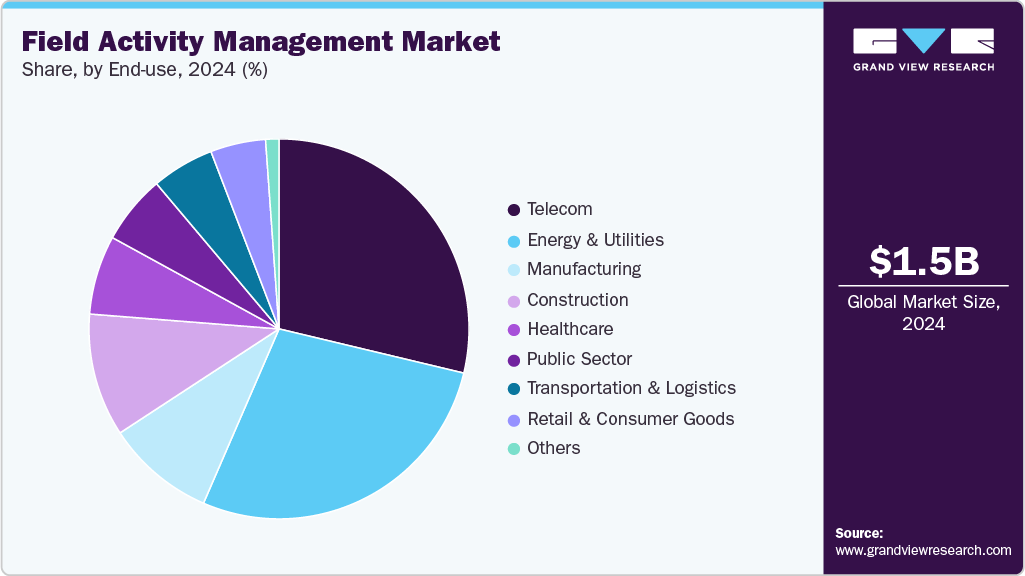

End Use Insights

Telecom segment accounted for the largest revenue share of over 28.0% in 2024, due to the industry’s heavy reliance on large, distributed field service operations to install, maintain, and upgrade complex network infrastructure. Additionally, telecom providers manage high volumes of service requests, tight service-level agreements (SLAs), and geographically dispersed customer bases requiring advanced FAM solutions to ensure timely dispatch, remote troubleshooting, and inventory visibility. Moreover, the ongoing rollout of 5G networks is further increasing field service demands, compelling operators to invest in AI-powered scheduling, mobile execution tools, and predictive maintenance capabilities to reduce downtime and enhance customer experience. For instance, according to the Indian government, India is at the forefront of 5G adoption, with over 90% coverage and affordable services fueling rapid growth in subscriptions. This widespread rollout is a key driver of the nation’s digital transformation and is projected to contribute approximately USD 455 billion to the economy between 2023 and 2040, accounting for over 0.6% of GDP by 2040.

The retail & consumer goods segment is expected to grow at the fastest CAGR during the forecast period, propelled by rising demand for last-mile delivery orchestration, in-store maintenance, and on-demand merchandising services as omnichannel retail accelerates. Retailers demand real-time visibility into field operations such as shelf audits, inventory restocking, promotional execution, and delivery coordination making FAM platforms equipped with intelligent task assignment and mobile-enabled execution essential for operational agility and service excellence. For instance, in January 2025, Cognizant launched Stores 360 in partnership with ServiceNow, a storefront operations suite powered by AI and IoT designed to streamline new store openings, asset management, and daily field tasks. It has 10-20% faster launch timelines, 30-40% lower operating costs, and up to 98% system uptime, thereby driving the adoption of field activity management solutions in retail and consumer goods segment.

Regional Insights

North America field activity management market share of 38.3% in 2024, driven by sector-specific demands, particularly from industries such as telecom and utilities undergoing major infrastructure upgrades and 5G rollouts. Additionally, companies are prioritizing technician enablement through mobile-first platforms and AI-powered scheduling to address widespread labor shortages and improve first-time fix rates. Moreover, U.S.-based enterprises are also rapidly integrating FAM with ERP and CRM systems to drive unified customer service across decentralized operations. Furthermore, strict regulatory frameworks such as OSHA and FCC service mandates are prompting organizations to adopt FAM solutions that ensure compliance through automated reporting and audit-ready documentation.

U.S. Field Activity Management Market Trends

The field activity management industry in the U.S. is expected to grow significantly driven by the growing need to modernize the geographically dispersed field operations across sectors such as utilities, telecom, healthcare, and logistics. U.S. organizations are rapidly adopting cloud-native FAM platforms that integrate mobile workforce tools, AI-powered scheduling, and predictive maintenance to improve SLA performance and reduce response times. Additionally, these platforms also enable real-time data capture, compliance management, and system integration with CRM and ERP solutions, supporting seamless operational workflows. Moreover, with a strong regulatory focus on service quality, safety, and environmental standards, U.S. firms are relying on FAM solutions to automate reporting, maintain audit-ready documentation, and meet compliance objectives.

Europe Field Activity Management Market Trends

Field activity management industry in Europe is anticipated to register considerable growth from 2025 to 2033, driven by increasing adoption of mobile-first solutions, IoT-connected asset monitoring, and AI-powered workflow automation across various sectors. Companies are integrating field tools with mobile apps and cloud services to empower technicians with real-time job data, route optimization, and remote diagnostics, improving productivity and service quality. Additionally, there is a notable shift toward predictive maintenance enabled by IoT sensor feeds, which, combined with AI models, helps detect potential equipment failures before they occur and transitions field operations from reactive to proactive. Moreover, customer-centric service delivery is also on the rise, as firms seek to leverage FAM platforms for enhanced SLA compliance and dynamic scheduling based on changing field conditions. These trends, supported by Europe’s investment in digital infrastructure and regulatory frameworks, which are developing an innovation-focused FAM landscape that highlights operational resilience, compliance, and service excellence.

The UK field activity management market is evolving due to infrastructure modernization efforts, particularly in utilities and telecom sectors undergoing digitized asset maintenance and 5G rollout. Additionally, utilities firms are deploying predictive field service platforms to address aging grid assets and decarbonization goals, while telecom providers use FAM tools for optimizing engineer dispatch and minimizing downtime during network upgrades. Moreover, facilities management companies in the UK are integrating IoT and AI-enabled FAM solutions to deliver SLA-bound services across commercial real estate portfolios. Furthermore, the UK government’s push toward digital procurement through frameworks like G-Cloud has also catalyzed public sector adoption, which is contributing to the market’s growth.

The field activity management market in Germany is gaining significant traction in industrial and construction sectors, driven by the demand for digitalized field operations, particularly in machinery and infrastructure-heavy industries. For instance, Putzmeister implemented SAP Field Service Management to digitalize its global service processes. This deployment enables technicians to access inspections, asset data, and inventory in real time resulting in streamlined dispatches, faster invoicing, and enhanced field productivity. This case reflects a broader trend in Germany’s "Mittelstand" industrial base, where companies are increasingly integrating mobile-first FAM tools with ERP systems to support predictive maintenance, ensure compliance, and improve operational outcomes.

Asia Pacific Field Activity Management Market Trends

Asia Pacific is expected to register the fastest CAGR of 17.4% from 2025 to 2033, driven by rapid digitalization, increasing adoption of automation, and the rising use of mobile technologies such as tablets and smartphones for business operations. Economic expansion and a growing young workforce in the region are accelerating the demand for enterprise mobility solutions that enhance real-time data collection, workforce productivity, and operational efficiency. Government initiatives promoting technology adoption and sustainability goals further support this trend. Key developments include the integration of cloud-based and mobile field activity management platforms, using IoT sensors for predictive maintenance, and incorporating wearables to enable hands-free operations, all aimed at improving collaboration between field teams and centralized operations. Consequently, field activity management is emerging as a key driver of operational agility and competitive differentiation across APAC’s rapidly evolving industrial landscape.

Japan field activity management market is experiencing substantial growth, owing to the modernization of its industrial backbone, particularly in logistics, construction, and utilities. The country’s emphasis on automation and digital transformation under government-backed initiatives like “i-Construction” has led to increased adoption of mobile-first FAM platforms equipped with AI-driven voice recognition. Additionally, Japanese firms are also integrating these tools with ERP and IoT systems to standardize workflows, reduce manual errors, and ensure regulatory compliance. Moreover, large enterprises are leveraging FAM platforms to improve coordination between centralized control centers and decentralized field teams, boosting response efficiency and customer satisfaction.

The field activity management market in Chinaheld a substantial market share in 2024, driven by the rapid digitalization of industrial operations and large-scale field deployments across telecom, utilities, and manufacturing sectors. Enterprises are actively integrating AI-enabled scheduling, IoT-based asset tracking, and mobile execution platforms to enhance workforce productivity and reduce operational downtime. For instance, China Telecom migrated its field operations infrastructure to a cloud-native architecture, incorporating intelligent dispatch and real-time service orchestration to manage its vast nationwide network more efficiently. Also, this reflects the growing trend under national initiatives like "Made in China 2025," where organizations prioritize predictive maintenance, data-driven workflows, and cloud adoption to modernize field services. As a result, FAM solutions are becoming central to operational strategy, enabling Chinese enterprises to scale with agility while meeting rising service expectations and regulatory demands.

Key Field Activity Management Company Insights

Key players operating in the field activity management industry are Forcepoint, Salesforce, Microsoft Corporation, Oracle Corporation and others. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Field Activity Management Companies:

The following are the leading companies in the field activity management market. These companies collectively hold the largest market share and dictate industry trends.

- Accruent

- FieldAware

- Forcepoint

- Housecall Pro

- IFS

- Jobber

- Kickserv

- Microsoft Corporation

- Oracle Corporation

- Praxedo

- Salesforce

- SAP SE

- ServiceMax

- Trimble

- Verizon Connect

- Zuper

Recent Developments

-

In May 2025, ServicePower acquired Inveniam enhancing its Field Activity Management offering with advanced computer vision. The integration enables real-time visual assessments such as fiber-optic installation checks and asset condition monitoring via AI-powered image recognition.

-

In April 2025, Oracle NetSuite launched NetSuite Field Service Management solution, which combines intelligent scheduling and dispatch, inventory and asset management, and financial billing enabling organizations to reduce operational costs, boost productivity, and enhance customer satisfaction through unified, real-time field‑to‑office workflows.

-

In April 2025, ECI Software Solutions acquired Davisware, a specialist in ERP and field service management tools, to deepen its offerings across sectors like HVAC, food equipment, and refrigeration. This strategic move expands ECI’s cloud-based field service capabilities, enhances its industry-specific functionality, and scales its reach across North America and India.

-

In October 2024, Weir Minerals implemented SAP Field Service Management, integrated with SAP ERP to replace paper-based processes and fragmented data silos, enabling field technicians to access real-time asset information and record service actions digitally.

Field Activity Management Market Report Scope

Report Attribute

Details

Market size in 2025

USD 1.66 billion

Revenue forecast in 2033

USD 5.45 billion

Growth rate

CAGR of 16.0% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report Application

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment mode, organization size, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Forcepoint; Salesforce; Microsoft Corporation; Oracle Corporation; SAP SE; ServiceMax; Trimble; FieldAware; Verizon Connect; IFS; Accruent; Praxedo; Housecall Pro; Jobber; Kickserv; Zuper

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Field Activity Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the field activity management market report based on component, deployment mode, organization size, application, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Solutions

-

Scheduling & Dispatching

-

Work Order Management

-

Mobile Field Execution

-

Inventory Management

-

Reporting & Analytics

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-Premises

-

Cloud-Based

-

-

Organization Size Mode Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

Small and Medium Enterprises

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Service & Maintenance Management

-

Sales Force Automation

-

Delivery Operations Management

-

Workforce Management

-

Customer Relationship Management

-

Inventory & Asset Tracking

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Telecom

-

Healthcare

-

Energy & Utilities

-

Manufacturing

-

Construction

-

Retail & Consumer Goods

-

Transportation & Logistics

-

Public Sector

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global field activity management market size was valued at USD 1.46 billion in 2024 and is expected to reach USD 1.66 billion in 2025.

b. The global field activity management market is expected to witness a compound annual growth rate of 16.0% from 2025 to 2033 to reach USD 5.45 billion by 2033.

b. The solution segment dominated the market and accounted for the revenue share of 75.2% in 2024 fueled by rising enterprise demand for integrated platforms that unify scheduling, dispatch, mobile execution, analytics, and automation within a single system.

b. Some of the companies operating in the field activity management market include Forcepoint, Salesforce, Microsoft Corporation, Oracle Corporation, SAP SE, ServiceMax, Trimble, FieldAware, Verizon Connect, IFS, Accruent, Praxedo, Housecall Pro, Jobber, Kickserv, Zuper, and Others

b. The market is propelled by the growing need for real-time visibility, workforce coordination, and operational efficiency across various sectors. Industries such as telecom, utilities, construction, logistics, and healthcare are dependent on FAM solutions to manage dispersed teams, schedule and dispatch jobs, and ensure service delivery compliance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.