- Home

- »

- Communication Services

- »

-

Field Service Management Market Size & Share Report 2030GVR Report cover

![Field Service Management Market Size, Share & Trends Report]()

Field Service Management Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment (On-premise, Cloud), By Enterprise, By End-use, By Region And Segment Forecasts

- Report ID: GVR-1-68038-963-0

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Field Service Management Market Summary

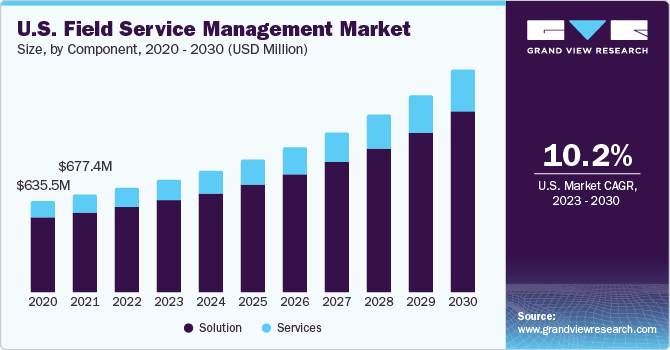

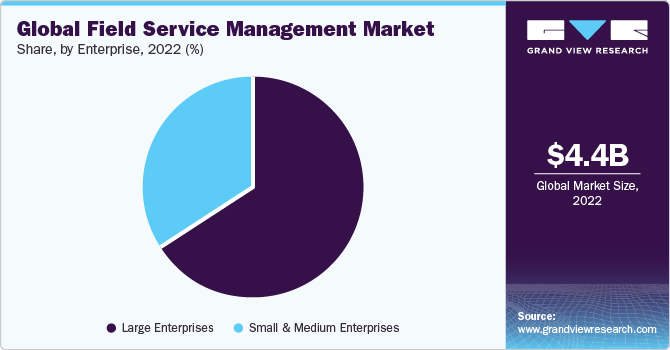

The global field service management market size was valued at USD 4.43 billion in 2022 and is projected to reach USD 11.78 billion by 2030, growing at a compound annual growth rate (CAGR) of 13.3% from 2023 to 2030, due to the growing number of field operations across different end-use industries such as telecom, oil & gas, construction, and energy & utilities.

Key Market Trends & Insights

- North America dominated the market and accounted for the largest revenue share of 26.5% in 2022.

- Asia Pacific is expected to grow at the fastest CAGR of 19.4% during the forecast period.

- Based on component, the solution segment accounted for the largest revenue share of 81.3% in 2022.

- Based on deployment, the cloud segment accounted for the largest revenue share of 67.7% in 2022.

- Based on enterprise, the large enterprises segment accounted for the largest revenue share of 66.1% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 4.43 Billion

- 2030 Projected Market Size: USD 11.78 Billion

- CAGR (2023-2030): 13.3%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Furthermore, the rapid adoption of FSM solutions by different small & medium enterprises is also expected to drive market growth over the forecast period.

Component Insights

The solution segment accounted for the largest revenue share of 81.3% in 2022. In an organization, enhanced productivity leads to an increase in profitability. With this software, there are better lines of communication between the front office, management, and technicians. Since technicians and field workers spend less time coordinating logistical tasks, they have more time for client work. The development of technologies, including cloud, big data, and advanced analytics, supports the integration of mobility and cloud with FSM software. Several cloud technology service providers offer an enhanced level of FSM solutions that cater to the needs of small, medium, and large enterprises and are expected to drive the field service management market growth in the coming years.

The FSM software provides various solutions for the execution of fieldwork. It also helps gain visibility into the individual performance of field workers and technicians. FSM solutions assist in the management and execution of service contracts made with customers, vendors, partners, and employees. The service contract management process broadly deals with travel, tooling, sub-contracting, document maintenance, help desk service, and contract renewals.

These solutions also aid in rapidly reducing warranty costs & reserves, increasing supplier recovery, forecasting accuracy, and better cash flow for maximum profitability. They also provide inventory management services and supervise non-capitalized assets and stock items. They provide companies with different practices, strategies, and technologies required to manage and analyze customer interactions and data throughout the customer lifecycle. This software helps lower the costs of these different field processes with better efficiency. Therefore, many enterprises would adopt the FSM software for better performance and increased organizational productivity.

The service segment is expected to grow at the fastest CAGR of 14.1% during the forecast period. The FSM solutions are implemented in organizations for assistance in workforce management. The software carries out the management of on-field workers. Thus, the adoption of the FSM among end-use industries is expected to increase.

When FSM is implemented in an organization, it supports its employees and the organization concerning different aspects such as employee performance, work status, and customer and inventory management. Instead of field surveys, the software does the required work and provides updated information. It also offers training to the workers.

The FSM solutions, when installed in the enterprise, provide consultation services to the organization. The software assembles all the data and delivers it as required. Based on the data gathered, the software advises the organization to improve its performance and efficiency.

Furthermore, it reduces human efforts and saves time since all the data gathered on a real-time basis is analyzed, and the necessary information is given to the organization. Therefore, it leads to better efficiency and reduced human efforts. Hence, its adoption across end-use industries is expected to increase.

Deployment Insights

The cloud segment accounted for the largest revenue share of 67.7% in 2022 and is expected to grow at the fastest CAGR of 14.9% during the forecast period. The cloud deployment of the FSM software is expected to gain traction with the increase in cloud usage. Industries are gradually moving their storage from on-premise to the cloud since the deployment of cloud services results in better efficiency of work processes and increased storage space.

Cloud deployment helps keep an organization's capital and operational expenses minimum. It helps to save substantial capital costs with zero in-house server storage and application requirements. Cloud-based FSM solutions offer flexibility, scalability, low cost, and real-time access to data, regardless of the location of the employees.

The on-premise segment is expected to witness significant growth over the forecast period. On-premise deployment of this software requires large storage space on the systems. However, the on-premise deployment of the software is more flexible to use. If multiple users are hosted on the same cloud server, a hacker might try to break into the data of other users hosted and stored on the same server.

Enterprise Insights

The FSM software offers various solutions to all user types, including small, medium, and large enterprises. The large enterprises segment accounted for the largest revenue share of 66.1% in 2022. The adoption of FSM software is higher in large enterprises than in small & medium enterprises. Large enterprises are extensively adopting the software owing to a large workforce. It assists in maintaining employee records, individual performance statistics, sub-contracting, contract renewals, and document maintenance, among others. The FSM software uses mobile computing to improve communication with field workers, streamline work processes, and enhance productivity.

The small and medium enterprises segment is expected to grow at the fastest CAGR of 16.4% during the forecast period. Small and medium enterprises consist of fewer employees as compared to large enterprises. However, these enterprises are increasingly adopting the FSM across their organization. The adoption is growing rapidly across small and medium enterprises in response to proven business results from projects and technology developments in Software as a Service (SaaS), mobility, and machine learning. The software assists in dispatching technicians to customer locations to provide services such as repair & maintenance and installing customer-owned equipment or systems.

End-use Insights

The growth of end-use industries such as energy & utilities, telecom, manufacturing, healthcare, BFSI, construction & real estate, transportation & logistics, retail & wholesale, and others are expected to increase the demand for FSM solutions. The telecom segment accounted for the largest revenue share of 30.8% in 2022 and is expected to grow at the fastest CAGR of 15.4% during the forecast period. The telecom segment growth is due to the increasing demand for 5G and other new technologies, the rising complexity of telecom networks, and the need to improve customer satisfaction. Cloud-based field service management solutions are becoming increasingly popular among telecom providers due to their scalability, flexibility, and cost-effectiveness.

The manufacturing segment is expected to witness a significant CAGR of 14.6% over the forecast period. It is attributed to the use of field service management solutions to track the installation and maintenance of their equipment, manage the repair of their equipment, and inventory spare parts. FSM helps minimize machine downtime and adopt Industry 4.0 technologies for real-time solutions.

The healthcare industry is expected to witness significant growth over the forecast period due to the enhanced competitive landscape of healthcare in developing countries which calls for efficient FSM solutions to reduce supply chain management costs. The energy & utilities sector had a significant market share in 2022 due to the need to automate business processes in power plants under continuous pressure to increase their productivity and enhance their business capability.

Furthermore, the construction & real estate industry is also expected to grow over the forecast period due to the rapid industrialization and increase in population, particularly in developing countries like India and China. The construction & real estate industry deploys FSM to track site construction activities. Thus, the growth of the construction industry would lead to a rise in the adoption of this software.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 26.5% in 2022. The region has witnessed significant growth rapidly due to several factors, including the growing need for cost-effective solutions, the rising demand for mobility solutions, and the need to simplify field service teams and processes.

Asia Pacific is expected to grow at the fastest CAGR of 19.4% during the forecast period. Asia Pacific is projected to be the fastest-growing market over the forecast period, followed by Europe. The rise in end-use industries, along with the increasing demand for optimized workflow and enhanced productivity in Asia Pacific, is expected to fuel the demand for the FSM solution in this region.

The rapid development of the global oil & gas and healthcare industries is projected to propel the demand for FSM solutions. The market is set to witness increased adoption of FSM solutions in Asia Pacific, Middle East & Africa, and Latin America due to increased IT investment and digital workplace transformation initiatives.

Key Companies & Market Share Insights

The market is characterized by moderate competition with the presence of a few major global players and other small vendors offering the FSM solutions. The FSM industry is witnessing mergers and acquisitions as a means of inorganic growth strategy amongst software development companies. For instance, IBM Corporation acquired Ravy Technologies Pvt. Ltd and Agile 3 Solutions LLC, both of which work in the information security domain. These acquisitions have enabled IBM to provide better security features to its FSM solutions. In addition, the software developers are inching toward better customer service to maintain their position in the market.

Key Field Service Management Companies:

- IBM Corporation

- Agile 3 Solutions LLC

- Accenture

- Comarch SA

- Salesforce, Inc.

- Infor

- Klugo Group, SAP SE

- Astea International, Inc.

- Trimble Navigation Limited

- Tech Mahindra Limited

Recent Developments

-

In September 2022, Tech Mahindra launched YANTR.AI, a new cognitive AI solution that enhances and simplifies field services. The solution is expected to provide actionable insights to enterprises for better planning and execution of field services. It further strengthens Tech Mahindra's Business Process as a Service (BPaaS) portfolio.

-

In July 2022, Accenture was selected by Hero MotoCorp Ltd. to help the company manage the increasing complexity of its products, markets, and supply chain networks. The program includes planning optimization, supply chain strategy, and logistics enhancement & cost optimization of overall digital supply chain suite.

-

In October 2021, Opsivity, a field support Software-as-a-Service (SaaS) provider, launched in the U.S. market. The company targets the fast-growing remote field operations sector, needing more skilled field technicians. Opsivity's SaaS solution uses AI and AR to help field technicians solve technical issues faster, increasing productivity in a labor-challenged industry.

-

In April 2020, IBM launched an equipment maintenance assistant, IBM Maximo, an AI-powered solution that helps organizations improve their asset maintenance program. The solution provides insights into equipment failure patterns and recommends the most effective repair methods. It helps to reduce knowledge gaps and silos within organizations, leading to faster repairs, lower costs, and extended asset life.

-

In August 2019, Salesforce announced the acquisition of ClickSoftware, a provider of field service management solutions. The acquisition will improve Salesforce Service Cloud by offering clients a more connected and intelligent customer service experience. Salesforce's acquisition of ClickSoftware enabled it to provide its customers with a full field service management solution. It enables firms to improve the efficiency and efficacy of their field service operations, resulting in better customer service.

Field Service Management Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.91 billion

Revenue forecast in 2030

USD 11.78 billion

Growth rate

CAGR of 13.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, UK, Germany, France, China, Japan, India, Australia, South Korea, Brazil, Mexico, Saudi Arabia, South Africa ,UAE

Key companies profiled

IBM Corporation; Agile 3 Solutions LLC; Accenture; Comarch SA; Salesforce, Inc.; Infor; Klugo Group, SAP SE; Astea International, Inc.; Trimble Navigation Limited; Tech Mahindra Limited

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Field Service Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global field service management market on the basis of component, deployment, enterprise, end-use and region:

-

Component Outlook (Revenue in USD Million, 2017 - 2030)

-

Solution

-

Mobile field execution

-

Service contract management

-

Warranty management

-

Workforce management

-

Customer management

-

Inventory management

-

Others

-

-

Services

-

Implementation

-

Training & support

-

Consulting & advisory

-

-

-

Deployment Outlook (Revenue in USD Million, 2017 - 2030)

-

On-Premise

-

Cloud

-

-

Enterprise Outlook (Revenue in USD Million, 2017 - 2030)

-

Large enterprises

-

SMEs

-

-

End-use Outlook (Revenue in USD Million, 2017 - 2030)

-

Energy & utilities

-

Telecom

-

Manufacturing

-

Healthcare

-

BFSI

-

Construction & real estate

-

Transportation & logistics

-

Retail & wholesale

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global field service management market size was estimated at USD 4.43 billion in 2022 and is expected to reach USD 4.49 billion in 2023.

b. The global field service management market is expected to grow at a compound annual growth rate of 13.3% from 2023 to 2030 to reach USD 11.78 billion by 2030.

b. Telecom dominated the field service management market with a share of 30.7% in 2022. The telecom segment growth is due to the increasing demand for 5G and other new technologies, the rising complexity of telecom networks, and the need to improve customer satisfaction.

b. Some key players operating in the field service management market include IBM Corporation ; Agile 3 Solutions LLC; Accenture; Comarch SA; Salesforce, Inc.; Infor; Klugo Group, SAP SE; Astea International, Inc.; Trimble Navigation Limited; and Tech Mahindra Limited.

b. Key factors that are driving the market growth include rising number of field operations across different end-use industries such as telecom, oil & gas, construction and energy & utilities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.