- Home

- »

- Food Safety & Processing

- »

-

Filling Machines Market Size & Share Analysis Report, 2030GVR Report cover

![Filling Machines Market Size, Share & Trends Report]()

Filling Machines Market (2022 - 2030) Size, Share & Trends Analysis Report By Product (Volumetric, Aseptic), By Mode Of Operation (Automatic, Semi-automatic), By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-549-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global filling machines market size was valued at USD 8.88 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.1% from 2022 to 2030. The market for filling machines is one of the significant sectors in the packaging equipment market. The demand for filling machines is projected to be triggered by a combination of factors, including an increase in people’s preference for processed and packaged goods, an increase in income, population expansion, urbanization, and an increased awareness regarding the importance of maintaining a healthy lifestyle. The introduction of the Covid-19 pandemic has resulted in a global economic impact across all industry sectors in 2020. As a result of the crisis, manufacturers of filling machines are also witnessing difficulties, resulting in a halt in production and sales. The lockdown and temporary suspension have slowed down the manufacturing of filling machines.

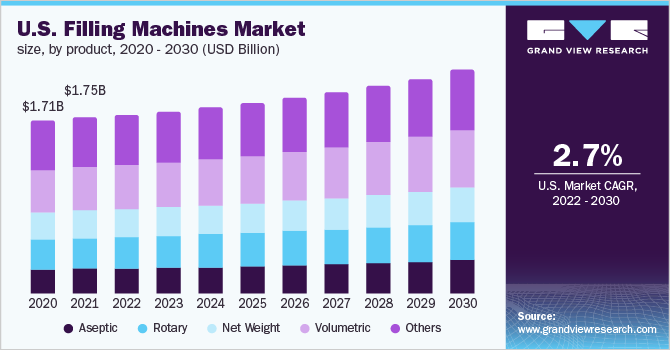

The U.S., which is one of the biggest markets in North America for filling machines, has a sizeable market share in the industry. The U.S. food and beverage sectors are advantageous due to the vast number of market participants, favorable opportunities made available by government laws, and industrial automation.

Robotics, desired production output, technical support, and little to no human involvement are a few of the variables that encourage firms to choose technological support for operational operations. To achieve the appropriate level of sanitation and product quality, machine manufacturers must choose standardization due to strict government rules governing the beverage, food, and related industries.

The uses of filling machines continue to expand as automation increases. Considering the adaptability of filling machines, the majority of organizations have implemented automation to cut labor costs, satisfy consumer demand, and increase revenue and profit margins in return.

Filling machines are utilized in numerous industries, including the pharmaceutical, food and beverage, and chemical sectors. The filling industry has had to make the shift from manual to semi-automatic, and in the last two decades, from semi-automatic to automatic processes with less manual supervision. This is owing to the growing demand for foods, beverages, and medications.

Product Insights

The others segment held the largest share of over 25.0% in 2021. The aseptic segment is expected to witness the fastest growth in 2021. The demand for aseptic filling machines is increasing as they are flexible and minimize waste and product loss when compared to a manual process. Aseptic filling machines provide good nutrient retention, uniform product quality, and other desirable performance benefits, which boost the market’s overall sales.

Rotary filling machines are frequently used in the application industries because they may be simply combined with existing equipment, such as sorting and capping machines. The manufacturers reconstruct the market for rotary filling machines by embracing technological advances in operational procedures.

Net weight filling machines alert system operators when the weight has to be adjusted or when to make necessary alterations. In addition, the net weight fillers are very accurate, data-tracking, quick, and simple to clean.

The volumetric segment accounted for the second-largest revenue share in 2021. Owing to its unique characteristics and widespread use in a variety of sectors, including the beverage and pharmaceutical industries, the volumetric filling machine industry is anticipated to observe significant expansion in the years to come.

Mode of Operation Insights

The semi-automatic filling machines segment accounted for the largest revenue share of over 50.0% in 2021. Semi-automatic filling equipment is a combination of fully automated and semi-automated machines in which a few tasks, such as bottle capping and filling, are either fully automated or require manual intervention at specific stages.

Small to medium-sized manufacturers can benefit from semi-automatic filling machines depending on their production requirements. Clean filling, quick changeover, prolonged life, exact filling, and high-quality valves are advantages of semi-automatic machines. Liquids, flavors, alcohols, syrups, and adhesives are filled using semi-automatic filling equipment.

The automatic segment is expected to witness lucrative growth over the forecast period. The variable fill time-setting option in automated filling machines enables the user to alter the length of time required to fill the bottle. Machines relieve the operator of the monotonous task of inserting and tightening caps on individual bottles.

The machine has a significant initial investment and installation costs despite its quick speed. Automatic devices are used to cap bottles or cans in the beverage industry. The benefits of automatic filling machines include higher production rates, dependability and consistency, adaptability, reduced operator involvement, and simple controls.

Application Insights

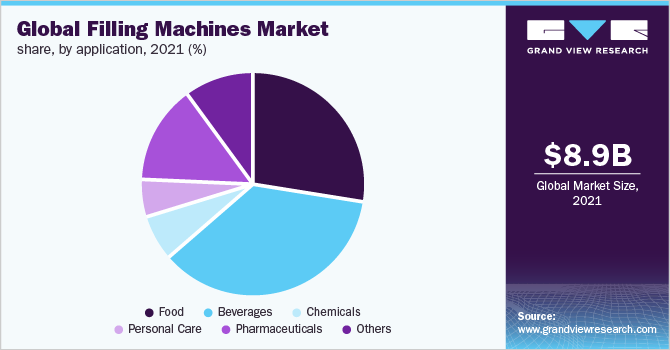

The beverage segment accounted for the largest share of over 35.0% in 2021. In terms of juices, fruit pulps, dairy products, soft drinks, alcoholic beverages, and non-alcoholic beverages, the beverage sector focuses especially on liquids. The beverage market presents excellent prospects for manufacturers to grow their businesses with an improved product portfolio thanks to technological innovation.

The food segment held the second-largest share in 2021. The industry has witnessed tremendous expansion as a result of good market conditions, population growth, the population’s high dependence on food to meet basic needs, technological advancements, the industry’s prognosis for food processing and packaging, and countless other important aspects.

The chemical industry is a substantial contributor to sales of these products. The safe handling and filling of such chemicals into containers such as jars, bottles, and cans call for specialized equipment, which filling machines provide.

The pharmaceutical application segment is expected to witness the fastest growth over the forecast period. Pharmaceutical packaging protects the pharmaceuticals or treatments from the external environment. It protects the medicine from external microbiological activity, guarantees its safety, and extends its shelf life.

Regional Insights

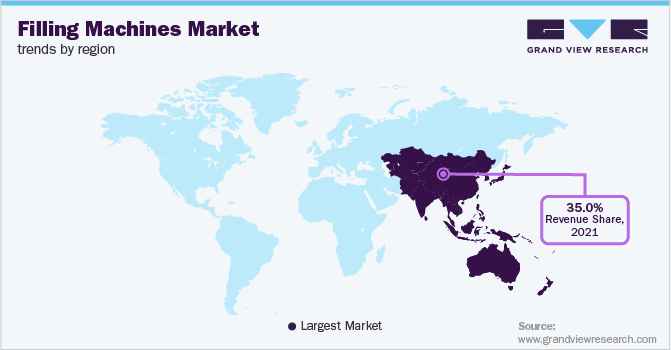

Asia Pacific accounted for the largest revenue share of over 35.0% in 2021. Innovations in technology, industry 4.0, green manufacturing, and other factors fuel the global expansion of the packaging industry, which benefits the market. The expanding middle-class population, their purchasing power, the large number of young people who enjoy processed and packaged foods, a growing health consciousness, and rising foreign investor interest in the Asia Pacific region all contribute to the expansion of the industry in this region.

The food and beverage sector in Japan is significant and thriving. Japan relies extensively on food imports, offering numerous market opportunities for operators in the food and beverage sector. The Japanese food and beverage industry is driven by a range of factors, including a growing focus on ready-to-eat and convenience meals, family structure, demography, dietary diversity in Japan, and an increase in demand for packaged goods. The aforementioned factors assist the growth of the packaging equipment industry, which, in turn, benefits the market over the forecast period.

In North America, demand for filling machines is driven by urbanization, high purchasing power, rising family income, rapid industrialization, and changes in consumer food preferences. In addition, favorable government regulations, technological advancements, and infrastructural growth in the region are fueling the expansion of the packing equipment industry, which has a positive impact on the market.

The U.S. is one of the leading markets for filling machines in North America due to the excellent opportunities created by government laws and industrial automation. In the U.S. market, attractive and innovative packaging for beverages, food, pharmaceuticals, and other products is in high demand. The expanding food and beverage industry in the U.S. is expected to increase demand for filling machines.

Key Companies & Market Share Insights

Filling machines are widely utilized in the food and beverage industries, among others, making them a key segment of the packaging equipment market. It is anticipated that a competitive environment compelling manufacturers to choose new filling machines and product line development to boost their global footprint would contribute to the success of the firm.

For instance, KHS developed a modular PET filler platform in April 2022. With this innovative PET filler platform, users can modify, alter, and expand their requirements at any time. The PET filler platform consumes and emits extremely little energy and carbon.Some prominent players in the global filling machine market include:

-

Barry- Wehmiller Companies, Inc.

-

Ronchi Mario S.P.A.

-

KHS Group

-

Accutek Packaging Equipment Companies, Inc.

-

Gea Group Ag

-

Tetra Laval International S.A.

-

Krones Ag

-

JBT Corporation

-

Coesia S.P.A.

-

Robert Bosch GmbH

-

COMPASS INTERNATIONAL CORP. LTD.

-

Canadian Armour Ltd.

Filling Machine Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 9.13 billion

Revenue forecast in 2030

USD 12.72 billion

Growth Rate

CAGR of 4.1% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, mode of operation, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; Russia; Spain; Italy; U.K.; China; Japan; India; Australia; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

Barry- Wehmiller Companies, Inc.; Ronchi Mario S.P.A.; KHS Group; Accutek Packaging Equipment Companies, Inc.; Gea Group Ag; Tetra Laval International S.A.; Krones Ag; JBT Corporation; Coesia S.P.A.; Robert Bosch GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Filling Machine Market Segmentation

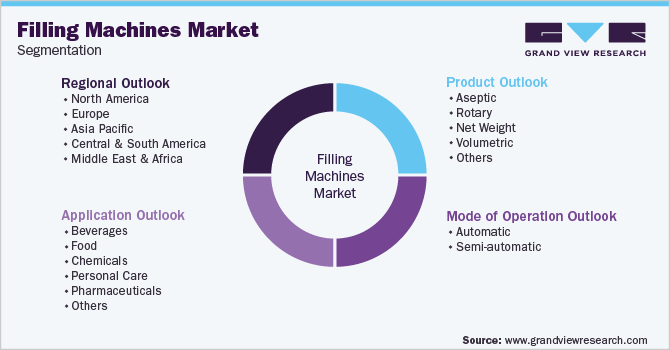

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global filling machine market report on the basis of product, mode of operation, application, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Aseptic

-

Rotary

-

Net Weight

-

Volumetric

-

Others

-

-

Mode of Operation Outlook (Revenue, USD Million, 2017 - 2030)

-

Automatic

-

Semi-automatic

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Beverages

-

Food

-

Chemicals

-

Personal Care

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

U.K.

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global filling machine market size was estimated at USD 8.88 billion in 2021 and is expected to reach USD 9.13 billion in 2022

b. The global filling machine market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.1% from 2022 to 2030 to reach USD 12.72 billion by 2030

b. Asia Pacific dominated the filling machine market with a share of 36.7% in 2020. This is attributable to the increasing demand for convenience food and the majority of the youth population preferring processed & packaged food.

b. Some key players operating in the filling machine market include Barry- Wehmiller Companies, Inc., Ronchi Mario S.P.A., KHS Group, Accutek Packaging Equipment Companies, Inc, Gea Group Ag, Tetra Laval International S.A., Krones Ag, Jbt Corporation and among others.

b. Key factors that are driving the market growth include increasing industrial development, purchasing power parity, and adoption of automated technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.