- Home

- »

- Advanced Interior Materials

- »

-

Fire Suppression System Market Size, Industry Report, 2033GVR Report cover

![Fire Suppression System Market Size, Share & Trends Report]()

Fire Suppression System Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Fire Extinguishers, Sprinklers), By Application (Commercial, Industrial, Residential), By Region (North America, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68039-483-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Fire Suppression System Market Summary

The global fire suppression system market size was valued at USD 22,038.9 million in 2024 and is projected to reach USD 34,973.6 million by 2033, growing at a CAGR of 5.4% from 2025 to 2033. The market continues to expand steadily, fueled by rising demand from industries such as commercial construction, manufacturing, oil & gas, transportation, and data centers.

Key Market Trends & Insights

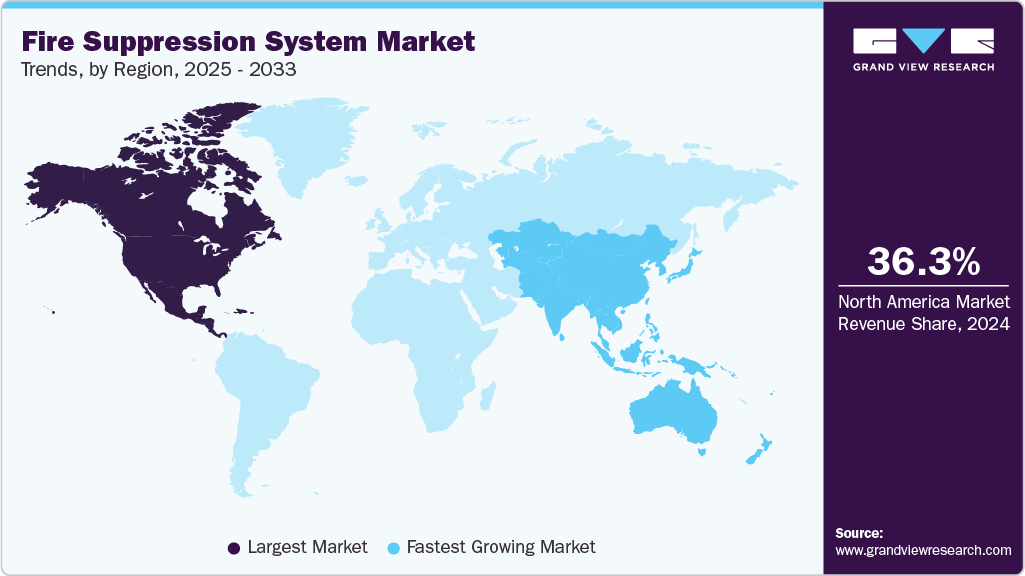

- North America dominated the fire suppression system market with the largest revenue share of 36.3% in 2024.

- The fire suppression system market in India is expected to grow at a rapid CAGR of 8.7% from 2025 to 2033.

- By product, the sprinklers segment is expected to grow at a considerable CAGR of 6.5% from 2025 to 2033.

- By application, the residential segment is projected to expand at a significant CAGR of 6.6% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 22,038.9 Million

- 2033 Projected Market Size: USD 34,973.6 Million

- CAGR (2025-2033): 5.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The increasing focus on occupant safety, asset protection, and compliance with strict fire safety codes is driving adoption. Businesses and property owners are opting for reliable, advanced suppression systems to minimize downtime and fulfill regulatory requirements. The integration of connected sensors, predictive analytics, and cloud-based monitoring with fire suppression systems enables real-time performance tracking, remote diagnostics, and automated maintenance scheduling-opening new revenue streams for system manufacturers and service providers. Moreover, heightened environmental consciousness and stricter global regulations on greenhouse gases are driving demand for clean-agent suppression systems, such as inert gas and water mist, which ensure effective fire protection while minimizing environmental impact.

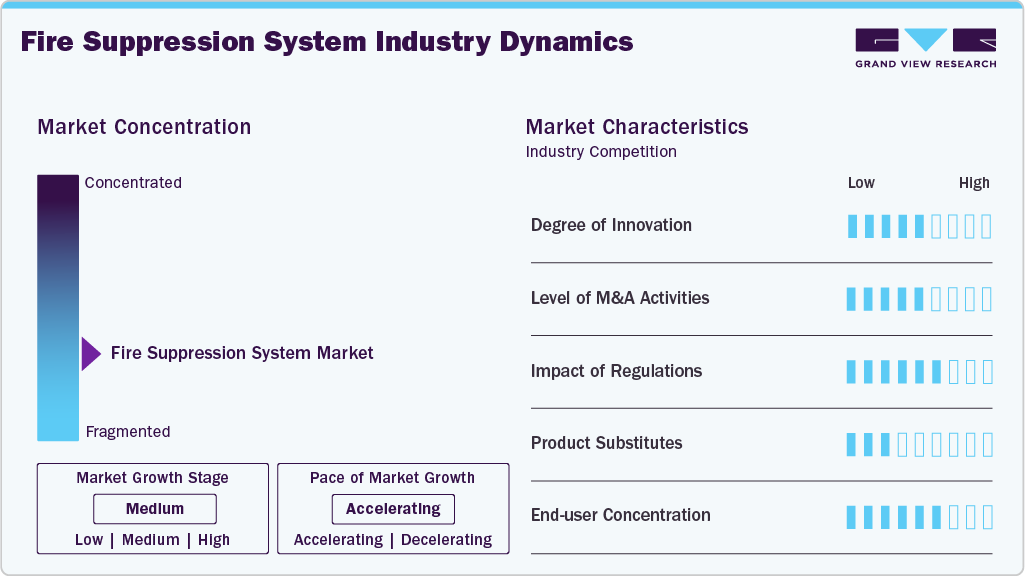

Market Concentration & Characteristics

The industry is moderately fragmented, featuring a mix of well-established multinational players and numerous regional or specialized providers. Leading companies such as Johnson Controls, Honeywell International, and Siemens hold significant influence with extensive portfolios spanning commercial, industrial, and residential fire safety solutions. These firms benefit from advanced R&D, a broad geographic footprint, and robust maintenance networks. At the same time, a large presence of local and niche firms-particularly in emerging economies-ensures competitive pricing, customization, and responsiveness to local codes. This diversity prevents complete market consolidation and supports innovation, service specialization, and tailored offerings across regions. Ongoing public and private investments in modern infrastructure and occupational safety continue to shape the sector's competitiveness and value proposition.

Mergers and acquisitions activity is on the rise as leading players seek to broaden regional coverage, expand technology portfolios, and add specialized service capabilities. Large firms actively acquire niche technology providers and local installers to bolster competitive positions and capture growth in emerging and technically demanding markets. These transactions support accelerated product rollouts and access to new customer segments.

Regulation remains a defining force in the market. National and international building codes, insurance requirements, and safety standards such as NFPA, EN, and ISO are key drivers of system upgrades, product innovation, and market entry strategies. Compliance pressures push companies to adopt advanced detection technologies, cleaner suppression agents, and improved reporting and performance auditing tools. Supportive public policies and incentives for life safety investments, coupled with stricter enforcement and inspection practices, are accelerating the shift toward more reliable, automated, and sustainable fire suppression solutions worldwide.

Drivers, Opportunities & Restraints

Stringent fire safety norms and building codes across commercial, industrial, and residential sectors are a primary market driver. The rise in mega-projects, urban infrastructure upgrades, and ever-tightening insurance and regulatory requirements is accelerating the installation of modern fire suppression solutions. Demand is further underpinned by heightened awareness of the social and financial risks associated with fire incidents, as well as the trend toward comprehensive risk management and business continuity planning.

The ongoing modernization of existing infrastructure, especially in Asia and the Middle East, is providing significant opportunities for fire suppression system upgrades and retrofits. Advances in clean-agent and environmentally friendly systems are aligning with global sustainability goals and opening new market segments. The integration of IoT, smart detection, and remote monitoring technologies is enabling predictive maintenance, real-time performance management, and value-added service models for both new installations and existing systems.

High initial installation and periodic maintenance costs can pose challenges for smaller enterprises and in cost-sensitive markets. Technical complexity and variation in local fire safety regulations may limit standardized adoption and complicate compliance. Moreover, the limited availability of certified service providers in some regions can hinder timely inspection, maintenance, and system reliability, especially for advanced and digitally enabled solutions.

Product Insights

Fire extinguishers led the market, accounting for a revenue share of 57.0% in 2024. Fire extinguishers remain indispensable for first-response firefighting across virtually all environments-commercial, industrial, and residential. The demand is fueled by their relatively low cost, mandatory inclusion under safety regulations, easy maintenance, and broad awareness programs driving compliance locally and globally. Increasing emphasis on eco-friendly extinguishing agents and digital tagging for auditability is shaping product evolution.

Sprinkler systems are a critical component in modern fire safety strategies due to their proven effectiveness in rapidly detecting and extinguishing fires, especially in commercial and industrial applications. Continued enforcement of stringent building codes and insurance mandates globally is driving widespread adoption of advanced sprinkler solutions with faster detection, improved water efficiency, and integration with digital monitoring systems.

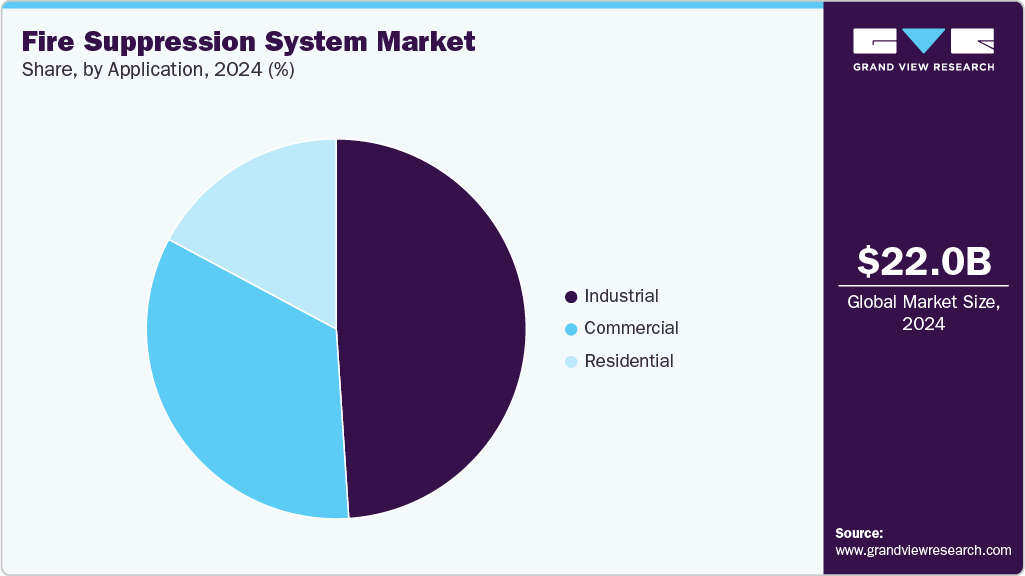

Application Insights

The industrial segment dominated the industry, accounting for 49.0% share in 2024. Industrial facilities, including manufacturing plants, energy producers, warehouses, and logistics hubs, face high fire hazards due to flammable materials and critical operational equipment. This segment’s expansion is driven by the need for robust, code-compliant fire suppression to ensure workplace safety, protect assets, and maintain regulatory certifications. The increasing scale of industrial operations worldwide and a focus on downtime minimization have resulted in rising investment in high-performance systems, such as gas-based and foam suppression, tailored for specialized industrial risks.

Growth in the residential segment is mainly attributed to stricter enforcement of fire safety codes for multi-family dwellings and new housing developments. Rising public awareness, government-led safety campaigns, and the spread of urban high-rises are supporting adoption. The segment is evolving with more user-friendly, space-efficient systems and a focus on affordable, easy-to-install sprinkler solutions for homes. Ongoing efforts in emerging markets to introduce or raise minimum fire safety requirements underpin long-term growth for residential fire suppression installations.

Regional Insights

North America fire suppression system market led the global industry in 2024, accounting for 36.3% of the total revenue share. Growth is driven by well-established fire safety regulations, a large base of commercial and industrial facilities, and ongoing investments in infrastructure modernization. Adoption of advanced, smart suppression systems is rising across new and retrofit projects. The presence of major international players and a robust service network supports widespread system availability and compliance. Upgrades prompted by insurance and code requirements continue to fuel long-term market momentum.

U.S. Fire Suppression System Market Trends

The fire suppression system market in the U.S. is expected to grow at a CAGR of 3.9% over the forecast period. Well-established, stringent fire safety codes, high adoption of advanced suppression technologies, and an extensive base of commercial, industrial, and institutional buildings drive demand. The ongoing modernization of older infrastructure, frequent upgrades prompted by insurance requirements, robust growth in data centers, logistics, and high-rise construction support steady market expansion.

Europe Fire Suppression System Market Trends

The fire suppression system market in Europe is supported by strict fire safety standards, comprehensive insurance mandates, and a mature enforcement landscape. Efforts to renovate and retrofit aging building stock-including historic and cultural sites-boost demand for both traditional and clean-agent solutions. Eco-friendly and digitally integrated systems are gaining traction as sustainability and performance become key priorities.

The UK fire suppression system market is projected to grow at a significant CAGR of 6.7% over the forecast period. Growth is propelled by rigorous fire safety standards, a mature regulatory framework, and widespread insurance-driven compliance in the commercial and institutional sectors. Trends include rapid adoption of clean-agent and environmentally friendly suppression systems in data centers, offices, and public buildings.

The fire suppression system market in France is projected to grow at a CAGR of 5.1% over the forecast period. France’s fire suppression system market represented a considerable portion of Europe’s regional revenue. The country’s strict fire codes and insurance mandates drive consistent adoption, especially in commercial, cultural, and residential buildings.

Asia Pacific Fire Suppression System Market Trends

The fire suppression system market in Asia Pacific is expected to grow at the fastest CAGR, underpinned by rapid urbanization and major commercial construction projects. Growth is especially prominent in countries like China and India, where stricter enforcement of fire codes and significant infrastructure investment are ongoing. Widespread development of high-density residential, commercial, and industrial zones accelerates system installation rates.

India fire suppression system market is projected to grow at a rapid CAGR of 8.7% over the forecast period. India’s fire suppression system market is in a phase of rapid expansion, capturing an increasing share of Asia Pacific revenue in 2024. The surge is led by urbanization, new high-rise and commercial developments, and greater enforcement of fire safety regulations.

The fire suppression system market in China is projected to grow at a fast-paced CAGR of 8.1% over the forecast period. Massive urbanization, large-scale real estate developments, ongoing industrialization, and government-backed infrastructure projects underpin high demand. National fire safety standards have become more stringent, accelerating adoption across residential, commercial, and industrial sectors.

Middle East & Africa Fire Suppression System Market Trends

The fire suppression system market in the Middle East & Africa region captured a notable market share due to large-scale construction, urban development, and ambitious nation-building initiatives, particularly in Gulf countries such as Saudi Arabia. Expansion of commercial, hospitality, and industrial zones is supporting robust adoption of advanced fire suppression systems. Ongoing government focus on safety standards, combined with widespread infrastructure projects, shapes a dynamic market landscape.

Saudi Arabia fire suppression system market is estimated to expand at a considerable CAGR of 6.6% over the forecast period. The Kingdom’s Vision 2030 and rapid expansion of urban, commercial, and industrial facilities have fueled sustained demand for high-quality fire suppression solutions. Large-scale projects in hospitality, transport, oil and gas, and industry require integrated suppression technologies meeting global standards. Increasing adoption of automated and smart fire safety systems is seen in new building complexes and government infrastructure.

Latin America Fire Suppression System Market Trends

The fire suppression system market in Latin America is supported by infrastructure upgrades and urban housing expansion in key economies such as Brazil. Market growth is spurred by tightening regulatory oversight and greater awareness of fire safety, particularly in the commercial sector. Rapid urbanization and increasing industrial investment are creating new opportunities for system deployment.

Brazil fire suppression system market is projected to grow at a significant CAGR of 6.9% over the forecast period. Market momentum in Brazil is primarily driven by infrastructure development, expansion of urban housing, and tightening fire safety regulations and enforcement.

Key Fire Suppression System Companies Insights

Key players operating in the fire suppression system market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Fire Suppression System Companies:

The following are the leading companies in the fire suppression system market. These companies collectively hold the largest market share and dictate industry trends.

- Fike Corporation

- Minimax USA LLC

- GENTEX Corporation

- Halma Plc

- HOCHIKI America Corporation

- Honeywell International Inc.

- Johnson Controls

- Robert Bosch GmbH

- Siemens AG

- Carrier

- NAFFCO

- Amerex Corporation

- ORR Protection

- Desautel

- Feuerschutz JOCKEL GmbH & Co. KG

Recent Developments

-

In October 2024, Siemens Smart Infrastructure announced its acquisition of Danfoss Fire Safety, a Denmark-based subsidiary specializing in sustainable fire suppression technologies, particularly high-pressure water mist systems. This acquisition aims to strengthen Siemens's fire safety portfolio by integrating environmentally friendly and rapidly growing fire suppression solutions, enabling Siemens to better serve industries with rising fire safety demands such as data centers, industrial processes, and tunnels.

-

In January 2023,Halma Plc acquired Thermocable (Flexible Elements) Ltd. to integrate Thermocable’s special detection technologies in its safety sector fire detection company, Apollo Fire Detectors Limited. The acquisition enabled Halma Plc to expand Apollo’s range of devices in the commercial and industrial fire detection markets.

Fire Suppression System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 23,044.6 million

Revenue forecast in 2033

USD 34,973.6 million

Growth rate

CAGR of 5.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, application, region.

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Fike Corporation; Minimax USA LLC; GENTEX Corporation; Halma Plc; HOCHIKI America Corporation; Honeywell International Inc.; Johnson Controls; Robert Bosch GmbH; Siemens AG; Carrier; NAFFCO; Amerex Corporation; ORR Protection; Desautel; Feuerschutz JOCKEL GmbH & Co. KG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Fire Suppression System Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global fire suppression system market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Fire Extinguishers

-

Gas

-

Water

-

Dry Chemical Powder

-

Others

-

Sprinklers

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial

-

Industrial

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fire suppression system market size was estimated at USD 22,038.9 million in 2024 and is expected to be USD 23,044.6 million in 2025.

b. The global fire suppression system market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.4% from 2025 to 2033 to reach USD 34,973.6 million by 2033.

b. The fire extinguishers segment led the market accounting for a global revenue share of 57.0% of the global fire suppression system market in 2024. Fire extinguishers remain indispensable for first-response firefighting across virtually all environments—commercial, industrial, and residential.

b. Fike Corporation, Minimax USA LLC, GENTEX Corporation, Halma Plc, HOCHIKI America Corporation, Honeywell International Inc., Johnson Controls, Robert Bosch GmbH, Siemens AG, Carrier, AFFCO, Amerex Corporation, ORR Protection, Desautel, and Feuerschutz JOCKEL GmbH & Co. KG

b. Stringent fire safety regulations, ongoing urbanization, and increased investments in commercial and industrial infrastructure are key drivers of the global fire suppression system market. Rising awareness of life-safety standards and rapid adoption of advanced, smart fire suppression technologies further support strong market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.