- Home

- »

- Clothing, Footwear & Accessories

- »

-

Fishing Rods Market Size And Share, Industry Report, 2030GVR Report cover

![Fishing Rods Market Size, Share & Trends Report]()

Fishing Rods Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Spinning Rods, Fly Fishing Rods, Casting Rods), By Application, By Raw Material, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-556-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Fishing Rods Market Summary

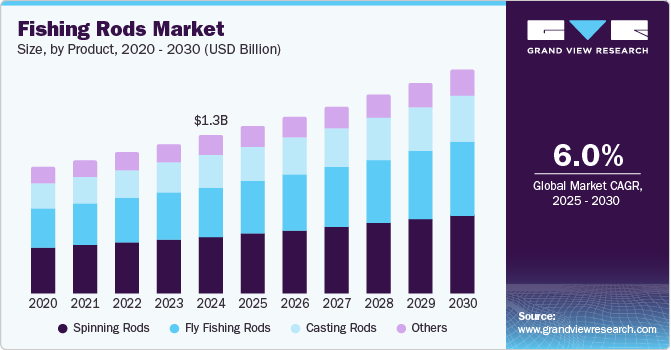

The global fishing rods market size was estimated at USD 1,254.2 million in 2024 and is projected to reach USD 1,771.9 million by 2030, growing at a CAGR of 6% from 2025 to 2030. Market growth worldwide is aided by a growing interest in fishing activities among both children and adults.

Key Market Trends & Insights

- In terms of region, Europe was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, spinning rods accounted for a revenue of USD 476.4 million in 2024.

- Casting Rods is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 1,254.2 Million

- 2030 Projected Market Size: USD 1,771.9 Million

- CAGR (2025-2030): 6.0%

- Europe: Largest market in 2024

Parents increasingly encourage their children to engage in recreational fishing due to its developmental benefits, such as enhanced focus and patience. This shift in participation dynamics indicates a notable demand for fishing rods, as families seek to introduce younger generations to this enriching pastime. With a greater emphasis on the holistic advantages of fishing, the market has witnessed an uptick in product sales as parents look for reliable equipment to facilitate enjoyable fishing experiences.

Advancements in materials technology have significantly improved fishing rod performance, attracting an expanding base of anglers. With innovations in carbon fiber and fiberglass, rods have become lighter, stronger, and more sensitive. These enhancements improve casting distance and accuracy, which are critical for fishing success. The continuous development in materials meets the demands of seasoned anglers and attracts new enthusiasts. As manufacturers prioritize the integration of advanced materials in their product lines, they are effectively tapping into the growing market of performance-driven consumers who seek quality and efficiency in their fishing gear.

The rise of e-commerce has further transformed the fishing rods market by expanding the accessibility of fishing equipment. Digital retail channels enable manufacturers to reach a wider audience and implement effective marketing strategies that resonate with consumers. Online platforms also facilitate comparison shopping and reviews, which are beneficial for informed decision-making. This trend underscores the importance of digital presence in reaching potential customers, particularly younger demographics adept at utilizing online resources for purchasing decisions.

Moreover, fishing tourism is emerging as a significant demographic driver within the fishing rods market. With an increasing number of anglers traveling for unique fishing experiences, there is a rising demand for specialized and travel-friendly fishing rods. This trend promotes local economies and engages younger generations in fishing tourism activities. According to the NOAA’s Fisheries’ Office 2023 Review, nearly 80% of recreational fishing trips in the U.S. included groups of two to five people in 2023, proving that the social aspect of fishing continues to reinforce its cultural significance. Furthermore, changes in Asian fishing communities emphasize the need for adaptive strategies in response to evolving demographics, ensuring sustainable practices that align with contemporary fishing demands.

Product Insights

Spinning rods dominated the market with a revenue share of 36.0% in 2024, driven by their user-friendly design and versatility. Suitable for various fishing techniques, these rods excel at casting lighter lures over long distances, particularly in challenging conditions. Their ability to minimize backlash further enhances performance, solidifying spinning rods’ popularity among anglers.

Casting rods are expected to grow at the fastest rate of 6.5% over the forecast period. They provide superior accuracy and distance for lure casting, making them essential for anglers who prioritize precision. Their design enhances line and lure control, particularly beneficial for bass and saltwater fishing. Recent advancements in materials and construction have further elevated performance, appealing to both recreational and competitive anglers.

Application Insights

Recreational fishing led the market with a revenue share of 45.8% in 2024. Fishing is increasingly recognized as a recreational activity that promotes relaxation, strengthens relationships, and fosters an appreciation for nature. Rising disposable incomes allow for investment in quality gear, while organized events and fishing tourism drive demand for specialized recreational fishing rods, enhancing the overall experience for enthusiasts.

Commercial fishing is expected to register the fastest CAGR of 6.7% over the forecast period, owing to the increasing necessity for efficient, specialized equipment for diverse fish species. Commercial fishermen require durable rods that can withstand challenging conditions and larger catches. Expanding global seafood consumption and regulatory changes promoting sustainable practices further drive the demand for advanced, high-performance rods tailored to specific fishing techniques.

Raw Material Insights

Carbon fiber held the largest market share of 50.7% in 2024, fueled by the exceptional strength-to-weight ratio of carbon fiber rods, which are lightweight yet durable. Their enhanced sensitivity allows anglers to detect subtle bites, while rigidity improves casting accuracy and power. Moreover, corrosion resistance and low maintenance appeal to serious anglers, reinforcing carbon fiber rods’ popularity in demanding fishing conditions.

Fiberglass is expected to register the fastest CAGR of 6.4% over the forecast period. Fiberglass rods are durable and withstand harsh conditions, attracting both novice and experienced anglers. Their natural flexibility enhances casting smoothness and responsiveness, especially for targeting larger fish. Moreover, their affordability compared to graphite options ensures fiberglass rods remain a favored choice among budget-conscious consumers in the fishing market.

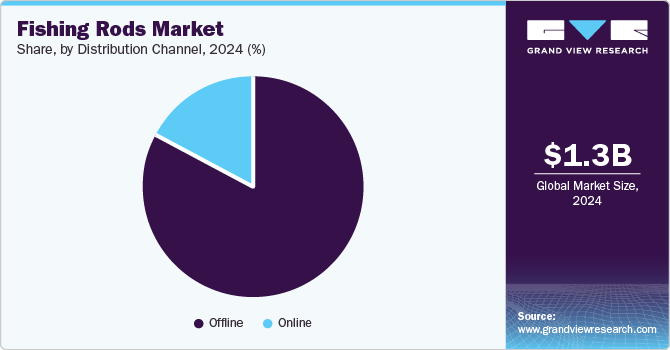

Distribution Channel Insights

Offline distribution channels dominated the market and accounted for a share of 82.9% in 2024. Anglers often prefer to physically evaluate rods prior to purchase to assess weight, balance, and overall feel, ensuring an ideal fit for their fishing style. Brick-and-mortar stores offer valuable customer support and expert advice, enhancing the buying experience and making offline channels preferred by many consumers in this market.

The online segment is projected to grow rapidly over the forecast period, stemming from the convenience and accessibility of e-commerce platforms. Anglers can explore a wide array of products from home, facilitating price and feature comparisons. Online shopping removes geographical limitations, allowing access to specialized fishing rods, while detailed product descriptions enable informed purchasing decisions, especially among younger consumers.

Regional Insights

North America fishing rods market is expected to register the fastest CAGR of 6.4% over the forecast period. The presence of extensive water bodies and diverse fish species expands opportunities for fishing enthusiasts. Increased disposable incomes enable consumers to invest in specialized, high-quality rods. The rising trend of fishing tournaments fosters community engagement and competition, while advancements in rod technology enhance performance, attracting both novice and experienced anglers.

U.S. Fishing Rods Market Trends

The fishing rods market in the U.S. dominated the North America fishing rods market in 2024. With a wealth of lakes, rivers, and coastal areas for fishing, there is a growing demand among Americans for high-quality gear. The emergence of organized fishing tournaments fosters community engagement, while advancements in rod design enhance performance, allowing consumers to invest in specialized rods aligned with various fishing styles.

Europe Fishing Rods Market Trends

Europe fishing rods market dominated the global market with a revenue share of 33.0% in 2024. The region is bolstered by numerous fishing events and competitions, fostering community engagement. Rising disposable incomes empower consumers to purchase high-quality fishing gear. Technological advancements in rod materials enhance performance and durability, while the trend toward sustainable fishing practices encourages the adoption of specialized equipment.

The fishing rods market in the UK dominated the Europe fishing rods market with the largest revenue share in 2024. The rise in organized fishing competitions promotes active participation among enthusiasts. Advancements in rod technology, including lightweight materials and enhanced sensitivity, attract both novice and experienced anglers. Increased awareness of sustainable fishing practices boosts demand for specialized rods while growing fishing clubs improve social engagement and accessibility within the sport.

Asia Pacific Fishing Rods Market Trends

Asia Pacific fishing rods market held a substantial market share in 2024, driven by the rising interest in recreational fishing among younger populations seeking outdoor activities. Urbanization, increased disposable incomes, and the growth of fishing tourism in countries such as Japan and Australia further enhance engagement. Technological advancements in rod design promote user satisfaction and accommodate diverse fishing techniques, while cultural traditions surrounding fishing elevate its status as a social activity.

The fishing rods market in China is expected to grow rapidly over the forecast period, fueled by rapid urbanization and a burgeoning middle-class with disposable income for leisure activities. Increased interest in fishing as a hobby boosts demand for quality rods, while government initiatives promote outdoor participation. Technological advancements and the rise of fishing tourism further enhance market growth.

Key Fishing Rods Company Insights

Some key companies operating in the market include AFTCO Mfg.; Cabela’s L.L.C.; Dongmi Fishing; Eagle Claw; Preston Innovations; among others. Key market players leverage innovation and diverse product portfolios, focusing on smart fishing rod development and global expansion through partnerships and acquisitions to access emerging markets.

-

AFTCO Mfg. specializes in high-performance fishing gear, including rods for saltwater and freshwater applications. The company emphasizes durability and functionality, utilizing advanced materials while promoting sustainable fishing practices and supporting conservation efforts within the fishing community.

-

RYOBI Limited manufactures high-quality fishing rods and tackle, offering a wide array of spinning and casting rods suitable for diverse fishing techniques. The company prioritizes innovation and technology, catering to both recreational and professional anglers seeking dependable, performance-oriented equipment.

Key Fishing Rods Companies:

The following are the leading companies in the fishing rods market. These companies collectively hold the largest market share and dictate industry trends.

- AFTCO Mfg.

- Cabela’s L.L.C.

- Dongmi Fishing

- Eagle Claw

- Preston Innovations

- RYOBI Limited

- POKEE FISHING TACKLE

- Shakespeare

- SHIMANO INC.

- St. Croix Rods

- Tica Fishing

- TIEMCO Ltd.

- Weihai Guangwei Group Co., Ltd.

Recent Developments

-

In November 2024, the MLF Fisheries Management Division collaborated with American Feeder, TPWD, and local volunteers to complete habitat restoration projects in Early, Texas, enhancing fishing opportunities and supporting local conservation efforts.

-

In August 2024, Preston Innovations launched a significant product range, featuring new Superium poles, winter clothing, rods, reels, Supera luggage, and landing nets, enhancing their competitive presence in the fishing industry.

-

In June 2024, St. Croix Rod announced the upcoming unveiling of the next-generation Mojo Musky TRIGON series at ICAST 2024, featuring ergonomic upgrades and expanded model options based on angler feedback.

-

In March 2024, Elite Fishing became TICA’s sole distributor in Hungary, expanding its portfolio beyond carp fishing to include coarse, spinning, and catfishing products since transitioning to wholesale in 2009.

Fishing Rods Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.33 billion

Revenue forecast in 2030

USD 1.77 billion

Growth rate

CAGR of 6.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, raw material, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

AFTCO Mfg.; Cabela’s L.L.C.; Dongmi Fishing; Eagle Claw; Preston Innovations; RYOBI Limited; POKEE FISHING TACKLE; Shakespeare; SHIMANO INC.; St. Croix Rods; Tica Fishing; TIEMCO Ltd.; Weihai Guangwei Group Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fishing Rods Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fishing rods market report based on product, application, raw material, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Spinning Rods

-

Fly Fishing Rods

-

Casting Rods

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Competitive Casting

-

Recreational Fishing

-

Commercial Fishing

-

Others

-

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Bamboo

-

Fiberglass

-

Carbon Fiber

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia & NZ

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.