- Home

- »

- Sensors & Controls

- »

-

Fixed Commercial Gas Detection Market Size Report, 2033GVR Report cover

![Fixed Commercial Gas Detection Market Size, Share & Trends Report]()

Fixed Commercial Gas Detection Market (2025 - 2033) Size, Share & Trends Analysis Report By Product, By Gas Type, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-798-0

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fixed Commercial Gas Detection Market Summary

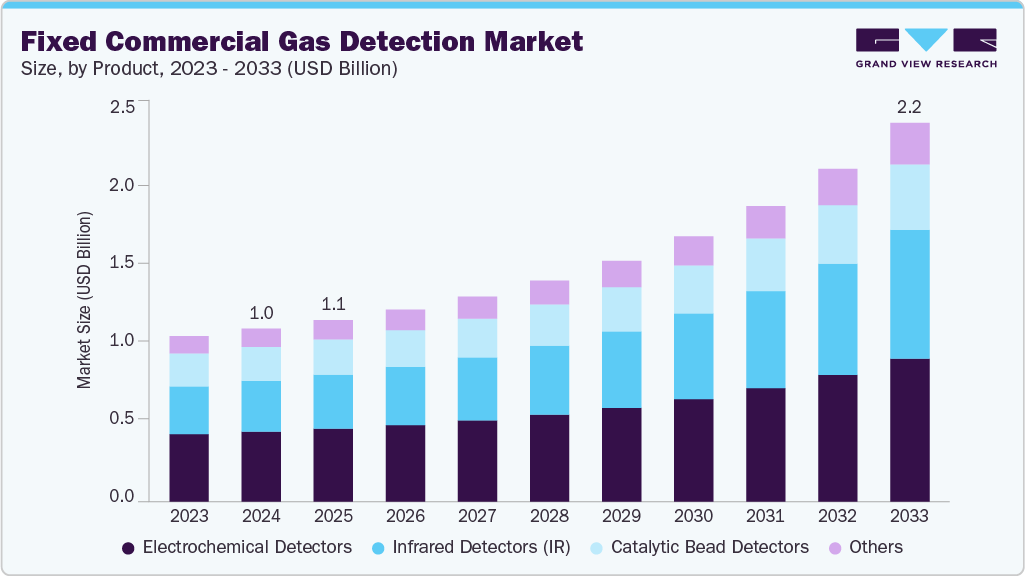

The global fixed commercial gas detection market size was estimated at USD 1.02 billion in 2024 and is projected to reach USD 2.24 billion by 2033, growing at a CAGR of 9.6% from 2025 to 2033. The increasing emphasis on workplace safety, environmental protection, and operational risk management across industrial and commercial sectors primarily drive the market growth.

Key Market Trends & Insights

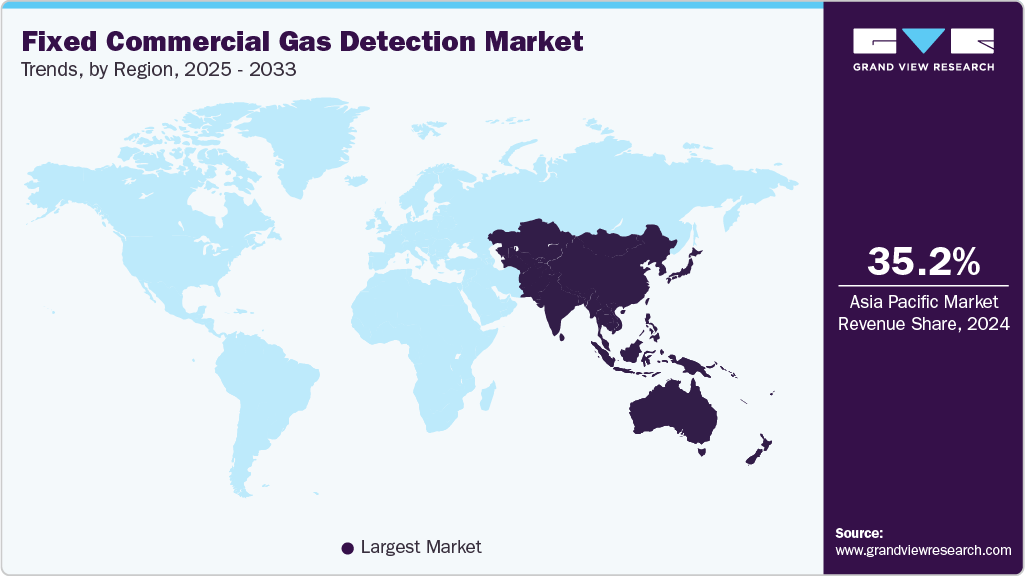

- Asia Pacific dominated the fixed commercial gas detection industry with a revenue share of 35.2% in 2024

- By type, the electrochemical detectors segment dominated the market with the largest revenue share of 40.5% in 2024.

- By gas type, the toxic/combustible gases segment dominated the market in 2024.

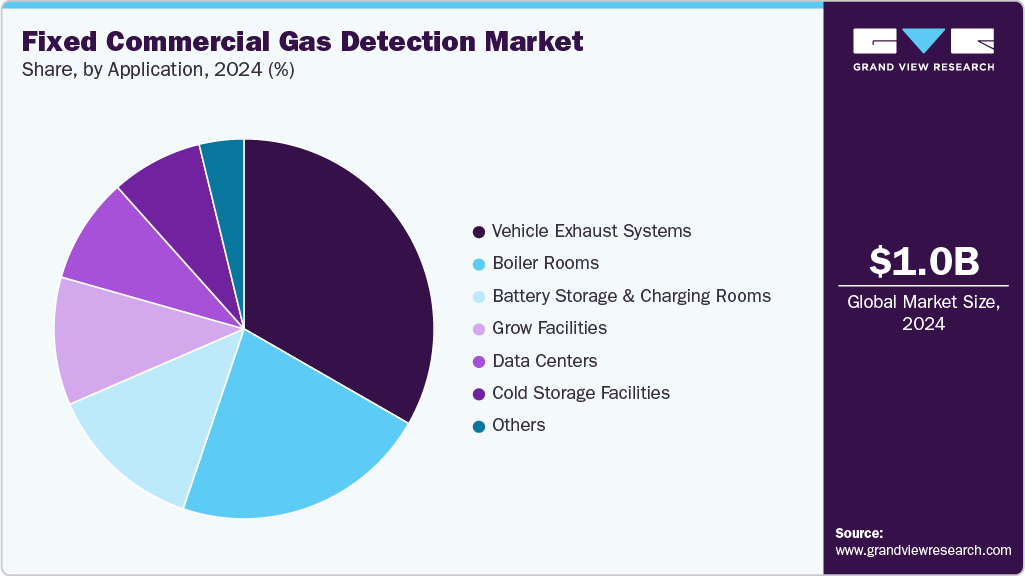

- By application, the vehicle exhaust systems segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.02 Billion

- 2033 Projected Market Size: USD 2.24 Billion

- CAGR (2025-2033): 9.6%

- Asia Pacific: Largest Market in 2024

Stringent safety regulations and occupational health standards are driving widespread adoption of fixed gas detection systems across industrial and commercial environments. Agencies such as OSHA, EPA, and NFPA in the U.S. have enforced strict compliance norms mandating continuous monitoring of toxic and combustible gases in facilities. This has led to increased installations in manufacturing plants, refineries, chemical storage sites, and commercial buildings. Businesses are prioritizing proactive safety measures to mitigate risks of gas leaks, fires, and explosions, fueling demand for reliable, permanently mounted detection systems that ensure round-the-clock monitoring and regulatory compliance.

Significant technological advancement has been witnessed in the development of fixed gas detection systems, driven by the integration of IoT, AI, and cloud-based monitoring technologies. Smart detection devices are increasingly being equipped with real-time data communication, predictive analytics, and remote maintenance capabilities. Sensor technologies such as infrared (IR), electrochemical, and ultrasonic detection have been refined to deliver enhanced accuracy and durability in harsh industrial environments. Furthermore, the convergence of gas detection systems with building management systems and industrial automation platforms has been facilitating centralized safety control, contributing to operational efficiency and reduced downtime.

Industrial facilities are increasingly adopting automation and advanced process control systems to enhance safety and efficiency, which directly supports the demand for fixed gas detectors. These devices play a critical role in monitoring hazardous gases in oil & gas, petrochemical, and power generation sectors, where automation reduces human intervention in high-risk environments. Modern fixed gas detection systems are now being designed to integrate seamlessly with SCADA and DCS platforms, enabling real-time data sharing and rapid incident response. The growth of automated industrial infrastructure is thus reinforcing the importance of fixed detection systems as an integral safety layer.

Despite strong demand growth, the fixed commercial gas detection industry has been restrained by several operational and economic challenges. High installation and maintenance costs associated with fixed detection systems have limited adoption in small and mid-sized enterprises. Calibration requirements and potential sensor drift in extreme environments have increased total cost of ownership and reduced user convenience. Furthermore, the lack of standardization across detection technologies and integration complexities with legacy systems have hindered seamless deployment. In emerging markets, limited technical expertise and budgetary constraints have continued to restrict the widespread implementation of advanced fixed gas detection solutions.

Product Insights

The electrochemical detectors segment dominated the fixed commercial gas detection market with the largest revenue share of 40.5% in 2024. Electrochemical detectors are increasingly adopted, due to their high sensitivity, compact size, and cost-effectiveness in detecting specific toxic gases. These detectors function by generating an electrical signal when a target gas undergoes a chemical reaction within the sensor cell. One of the main drivers behind this adoption is the growing enforcement of indoor air quality standards and workplace safety regulations across commercial spaces, including office buildings, hospitals, educational institutions, and laboratories.

The Infrared Detectors (IR) segment is expected to grow at the fastest CAGR over the forecast period. Infrared (IR) detectors are experiencing increasing adoption, particularly for applications involving the monitoring of combustible gases such as methane, propane, and butane, as well as carbon dioxide (CO₂). These detectors operate on the principle of infrared light absorption, where specific gas molecules absorb light at certain wavelengths. One of the major drivers behind the growth of IR detectors in commercial gas detection systems is their long operational lifespan and minimal maintenance requirements.

Gas Type Insights

The toxic/combustible gases segment dominated the fixed commercial gas detection market in 2024. The toxic gases fixed gas detection continues to experience strong growth momentum due to increasing awareness of occupational health hazards and stricter government regulations around indoor air quality. In commercial buildings such as offices, hospitals, laboratories, and parking garages, toxic gases like carbon monoxide (CO) and nitrogen dioxide (NO₂) can accumulate due to poor ventilation, fuel-burning appliances, or vehicular emissions. These gases, even at low concentrations, can have serious health implications, including respiratory issues, fatigue, and long-term organ damage. As a result, building managers are adopting electrochemical sensor-based fixed gas detectors to provide continuous, real-time monitoring and alarm functions.

The Volatile Organic Compounds (VOCs) segment is expected to grow at the fastest CAGR during the forecast period. The volatile organic compounds (VOCs) segment is witnessing rapid growth, driven by rising awareness of indoor air pollution and the health risks associated with prolonged VOC exposure. Global and regional regulatory pressures have also accelerated the adoption of VOC detection systems. Initiatives such as the European Union’s Energy Performance of Buildings Directive (EPBD) and the U.S. Environmental Protection Agency’s (EPA) Indoor Air Quality Tools for Schools Program encourage the monitoring of air pollutants, including VOCs, in commercial and institutional buildings.

Application Insights

The vehicle exhaust systems segment dominated the fixed commercial gas detection industry in 2024. Growth of the vehicle exhaust system segment has been driven by the rising need for air quality monitoring and emission control in enclosed or semi-enclosed environments such as parking garages, automotive workshops, tunnels, and transport depots. Fixed gas detection systems are increasingly being deployed to monitor toxic gases such as carbon monoxide, nitrogen dioxide, and hydrocarbons emitted by internal combustion engines. Urbanization and infrastructure development have accelerated the construction of large underground parking facilities, where adequate ventilation and gas monitoring are mandated by local safety codes and building regulations.

The battery storage & charging rooms segment is expected to witness the fastest CAGR over the forecast period. The increasing demand for fixed commercial gas detection systems in battery storage and charging rooms is being driven by heightened safety concerns surrounding energy storage technologies, particularly lithium-ion batteries. This trend is further reinforced by the global transition toward renewable energy and the growing deployment of grid-scale battery storage systems, where large battery arrays necessitate advanced monitoring and safety solutions. Additionally, sectors such as data centers, telecommunications, and EV charging infrastructure, where battery systems are becoming integral to operations are increasingly adopting fixed gas detection systems as a critical component of their overall safety and risk management frameworks.

Regional Insights

Asia Pacific dominated the fixed commercial gas detection market with a revenue share of 35.2% in 2024. The regional market growth is driven by rapid industrialization, expanding data center infrastructure, and stringent safety standards across key economies. Countries such as China, India, Japan, and South Korea are seeing increased demand for fixed gas detectors in applications ranging from battery storage rooms and data centers to chemical plants and grow facilities.

India’s fixed commercial gas detection market is expected to grow at the fastest CAGR during the forecast period. The India’s market growth is primarily driven by the expansion of data centers and heightened regulatory focus on workplace and environmental safety.

The fixed commercial gas detection market in China held a substantial revenue share in 2024. Factors including the rapid digital infrastructure growth, strong industrial activity, and government-led safety initiatives are driving the growth of the market. Moreover, China’s robust chemical, manufacturing, and battery industries create significant demand for gas detection systems in high-risk areas like boiler rooms, battery charging rooms, and cold storage facilities.

Europe Fixed Commercial Gas Detection Market Trends

Europe fixed commercial gas detection industry is expected to register a moderate CAGR from 2025 to 2033, driven by stringent safety regulations and a growing focus on environmental protection. Regulatory frameworks such as the European Union’s Occupational Safety and Health Administration (EU-OSHA) guidelines mandate the installation of gas detection systems in high-risk environments like chemical plants, refineries, and manufacturing facilities.

The UK fixed commercial gas detection market is expected to grow at the fastest CAGR from 2025 to 2033 due to a combination of regulatory requirements, industrial safety concerns, and environmental sustainability initiatives. Key regulations driving the market include the Health and Safety at Work Act 1974, which requires employers to ensure a safe working environment, and the Control of Substances Hazardous to Health (COSHH) Regulations, which mandate the monitoring of hazardous gases in industrial settings, particularly in chemical manufacturing and energy production sectors.

The fixed commercial gas detection market in Germany held a substantial market share in 2024. Germany’s strict safety regulations such as the Occupational Safety and Health Act (Arbeitsschutzgesetz - ArbSchG) and TRGS 900 (Technical Rules for Hazardous Substances), which require continuous monitoring of hazardous gases in high-risk industries such as manufacturing, chemicals, and energy production is driving the growth of the market in the country.

North America Fixed Commercial Gas Detection Market Trends

The North America fixed commercial gas detection industry is expected to grow at a notable CAGR of 8.8% during the forecast period. The market is driven by several factors, including the increasing demand for safety and environmental protection in commercial facilities, which require continuous gas monitoring to safeguard personnel and infrastructure.

U.S. Fixed Commercial Gas Detection Market Trends

In 2024, the U.S. fixed commercial gas detection industry held a dominant position in the region. The increasing demand for safety and environmental protection in industrial sectors such as data centers, manufacturing plants, and hazardous facilities necessitates continuous gas monitoring to safeguard both personnel and infrastructure, thereby driving the demand for fixed commercial gas detection solutions.

Key Fixed Commercial Gas Detection Company Insights

Some of the key companies in the fixed commercial gas detection industry include Honeywell International Inc.; MSA Safety Inc.; and Greystone Energy Systems Inc. New product launches have become a key competitive strategy to gain a competitive edge in the market.

-

Honeywell International Inc. is a global conglomerate operating in various sectors, including building technologies. Their gas detection solutions are part of their safety and productivity segment, offering advanced systems for monitoring hazardous gases in commercial environments. Honeywell's extensive experience and innovation in safety equipment make them a key player in the fixed commercial gas detection market.

-

MSA Safety Inc. is a foremost provider of safety solutions, specializing in the design and manufacture of products that safeguard both individuals and facility infrastructures. Their fixed gas and flame detection systems are engineered to detect hazardous gas levels in industrial and commercial settings, helping ensure the protection of personnel and assets.

Key Fixed Commercial Gas Detection Companies:

The following are the leading companies in the fixed commercial gas detection market. These companies collectively hold the largest market share and dictate industry trends.

- Macurco Inc.

- Honeywell International Inc.

- BELIMO AIRCONTROLS (USA), Inc.

- Greystone Energy Systems Inc.

- MSA Safety Incorporated

- INTEC Controls (BC Solutions, LLC)

- Critical Environment Technologies Canada Inc.

- TOXALERT International, Inc.

- American Gas Safety LLC

- Senva Inc.

- Quatrosense Environmental Limited (QEL)

Recent Developments

-

In February 2025, Greystone Energy Systems Inc. released an updated range of gas detection products for toxic, combustible, and refrigerant gases using infrared, catalytic bead, and electrochemical technologies. These detectors are designed to ensure accurate gas detection and regulatory compliance, supporting BACnet and Modbus communication protocols with CSA and UL certification.

Fixed Commercial Gas Detection Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.07 billion

Revenue forecast in 2033

USD 2.24 billion

Growth rate

CAGR of 9.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, gas type, application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Macurco Inc.; Honeywell International Inc.; BELIMO AIRCONTROLS (USA), Inc.; Greystone Energy Systems Inc.; MSA Safety Incorporated; INTEC Controls (BC Solutions, LLC); Critical Environment Technologies Canada Inc.; TOXALERT International, Inc.; American Gas Safety LLC; Senva Inc.; Quatrosense Environmental Limited (QEL)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fixed Commercial Gas Detection Market Report Segmentation

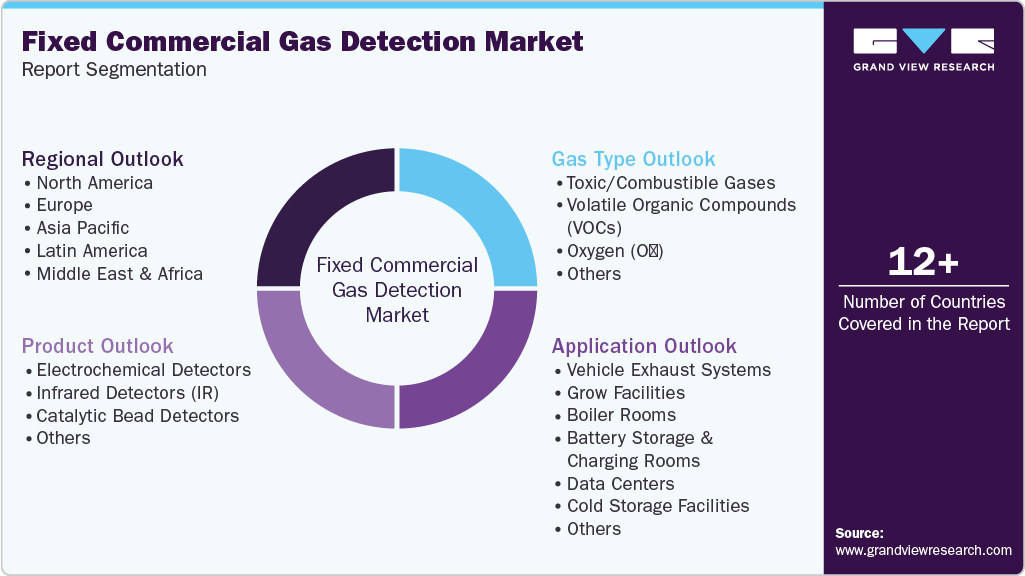

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global fixed commercial gas detection market report based on product, gas type, application, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Electrochemical Detectors

-

Infrared Detectors (IR)

-

Catalytic Bead Detectors

-

Others

-

-

Gas Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Toxic/Combustible Gases

-

Volatile Organic Compounds (VOCs)

-

Oxygen (O₂)

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Vehicle Exhaust Systems

-

Grow Facilities

-

Boiler Rooms

-

Battery Storage & Charging Rooms

-

Data Centers

-

Cold Storage Facilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fixed commercial gas detection market size was estimated at USD 1.02 billion in 2024 and is expected to reach USD 1.07 billion in 2025.

b. The global fixed commercial gas detection market is expected to grow at a compound annual growth rate of 9.6% from 2025 to 2033 to reach USD 2.24 billion by 2033.

b. The electrochemical detectors segment dominated the market in 2024 and accounted for the largest share of 40.5%. Electrochemical detectors are increasingly being adopted in the fixed commercial gas detection market due to their high sensitivity, compact size, and cost-effectiveness in detecting specific toxic gases.

b. Some key players operating in the fixed commercial gas detection market include Macurco Inc., Honeywell International Inc., BELIMO AIRCONTROLS (USA), Inc., Greystone Energy Systems Inc., MSA Safety Incorporated, INTEC Controls (BC Solutions, LLC), Critical Environment Technologies Canada Inc., TOXALERT International, Inc., American Gas Safety LLC, Senva Inc., and Quatrosense Environmental Limited (QEL).

b. The fixed commercial gas detection market has been primarily driven by the increasing emphasis on workplace safety, environmental protection, and operational risk management across industrial and commercial sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.