- Home

- »

- Medical Devices

- »

-

Fixed And Mobile C-arms Market Size, Industry Report, 2030GVR Report cover

![Fixed And Mobile C-arms Market Size, Share & Trends Report]()

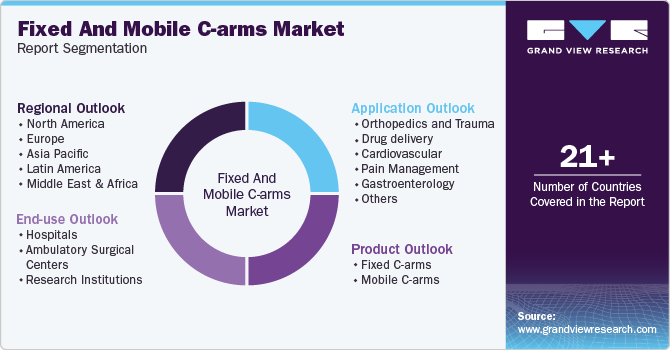

Fixed And Mobile C-arms Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Fixed C-arms, Mobile C-arms), By Application (Neurosurgery, Cardiovascular), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-804-6

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Fixed And Mobile C-arms Market Summary

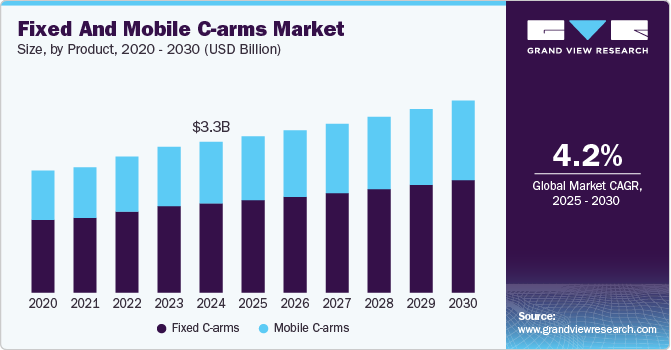

The global fixed and mobile c-arms market size was estimated at USD 3,322.5 million in 2024 and is projected to reach USD 4,233.3 million by 2030, growing at a CAGR of 4.2% from 2025 to 2030. Rising number of surgical procedures, growing demand for minimally invasive surgeries, technological advancements, the increasing prevalence of chronic disorders, and the expanding global geriatric population are key factors contributing to the industry growth.

Key Market Trends & Insights

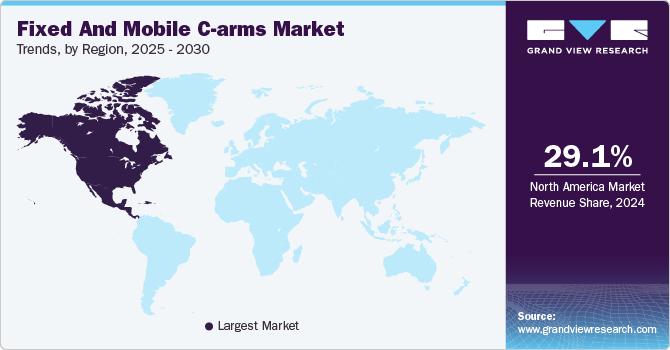

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, Japan is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, fixed c-arms accounted for a revenue of USD 2,037.1 million in 2024.

- Mobile C-arms is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 3,322.5 Million

- 2030 Projected Market Size: USD 4,233.3 Million

- CAGR (2025-2030): 4.2%

- North America: Largest market in 2024

For instance, the WHO states that by 2030, one in six people globally will be aged 60 years or older.

Using C-arm systems in intraoperative procedures has become increasingly essential because they provide high-resolution, real-time imaging that enhances surgical precision and patient outcomes. These systems are particularly valuable in complex procedures where accurate visualization of anatomical structures is essential. The growing adoption of minimally invasive surgeries, prioritizing smaller incisions, reduced recovery times, and lower risk of complications further drive growth in the fixed and mobile C-arms industry. These surgeries often require precise imaging guidance, so C-arm systems are important in operating rooms.

In addition, technological advancements, such as improved image quality, reduced radiation exposure, and enhanced system mobility, are significantly contributing to the widespread use of these systems, making them more efficient and accessible for various surgical applications. In March 2024, Siemens Healthineers introduced an advanced, automated, self-driving C-arm system designed for intraoperative imaging in surgery. The Cios Move features holonomic, omnidirectional wheels that enable precise maneuvering, even in confined spaces, and allow for easy and accurate positioning. The system can be moved to pre-set positions at the touch of a button using a remote control, significantly reducing the workload for technologists who previously had to adjust these positions manually.

The growing prevalence of chronic disorders is also contributing to the expansion of fixed and mobile C-arms industry, as these conditions frequently require advanced imaging for diagnosis, treatment planning, and surgical interventions. Chronic disorders such as cardiovascular diseases, cancer, diabetes, orthopedic conditions like osteoporosis or arthritis, and neurological disorders like Parkinson’s disease or strokes often necessitate surgical procedures where precise intraoperative imaging is required.

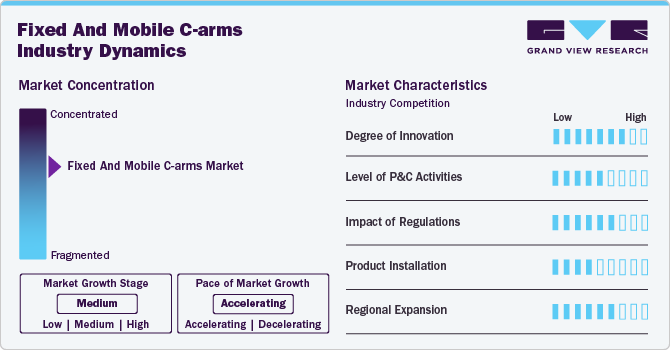

Market Concentration & Characteristics

The fixed and mobile C-arms industry is accelerating at a moderate pace, driven by technological advancements and the increasing adoption of these advanced devices by end users across healthcare settings. The rising prevalence of the geriatric population, who are more susceptible to a range of disorders such as cardiovascular diseases, orthopedic conditions, and degenerative illnesses, is further propelling industry demand. This demographic trend underscores the need for imaging solutions like C-arms to support effective diagnosis, treatment planning, and surgical interventions.

Companies strategically focus on partnerships and collaborations to enhance their position and broaden their competitive advantage. By teaming up with key stakeholders, including healthcare providers, technology innovators, and research institutions, they aim to drive innovation, expand their product offerings, and address emerging healthcare challenges. This collaborative approach allows them to stay ahead of industry trends, improve service delivery, and better meet the growing demand for advanced medical technologies. For instance, in November 2023, Cleveland Clinic and Canon Inc. announced plans to establish a strategic research partnership to develop advanced imaging and healthcare IT technologies. The collaboration aims to enhance diagnostic capabilities, improve patient care, and achieve better health outcomes by leveraging innovative medical imaging and information technology solutions.

The degree of innovation in the fixed and mobile C-arms industry is high, driven by advancements in imaging technology, miniaturization of components, and the increasing demand for more precise and efficient surgical tools. In January 2022, Philips announced the integration of cloud-based AI and 3D mapping technology into its Mobile C-arm System Series, Zenition, to enhance workflow efficiency and improve endovascular treatment outcomes.

Industry players engage in partnerships and collaborations to strengthen their industry positions and enhance innovation. For instance, in October 2023, Ziehm Imaging announced a partnership with Body Vision Medical in bronchoscopy. Body Vision Medical revealed the successful validation of its LungVision system with Ziehm Imaging's entire product line, including the Ziehm Solo FD and the Ziehm Vision RFD 2D and 3D mobile C-arms.

The impact of regulations on fixed and mobile C-arms is significant, as they must comply with strict safety and quality standards to ensure patient safety and effective performance. Regulatory bodies such as the FDA (U.S. Food and Drug Administration) and the European Medicines Agency (EMA) enforce guidelines on device approval, radiation safety, and operational protocols.

Manufacturers are expanding the reach of their products by growing the installation base of their new offerings. For instance, in September 2024, Tahoe Forest Health System in Truckee, California, became the first healthcare facility in the U.S. to install the Ciartic Move, a fully motorized mobile C-arm from Siemens Healthineers featuring self-driving capabilities.

The fixed and mobile C-arms industry's geographical reach is experiencing moderate to high growth, driven by increasing demand for advanced imaging solutions across various healthcare sectors. This expansion is fueled by rising healthcare infrastructure investments, growing awareness of advanced medical technologies, and the increasing prevalence of chronic diseases requiring precise surgical interventions.

Product Insights

The fixed C-arms segment dominated the market in 2024. Fixed C-arms are particularly adopted in large hospitals and surgical centers for complex procedures that require continuous and precise imaging. Their ability to provide detailed, real-time imaging for a range of medical applications, including orthopedics, cardiology, and neurology, contributes to market growth. Furthermore, technological advancements and integrating features like 3D imaging and AI further boost segment growth.

Mobile C-arms is expected to grow at the fastest CAGR of 4.5% over the forecast period. This growth can be attributed to the flexibility of mobile C-arms, which can be easily moved around the patient to achieve optimal angles for high-quality imaging, all while ensuring the patient's comfort. This mobility is a key advantage over fixed systems, particularly in dynamic and time-sensitive environments. Moreover, continuous technological advancements, such as integrating motorized axes, enhance the ease of movement and positioning, further driving the segment's growth. These innovations allow for more efficient workflow, reduce the need for manual adjustments, and improve imaging precision during procedures.

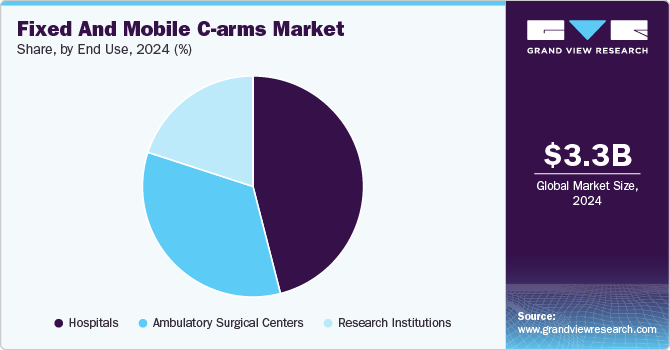

End Use Insights

Hospital dominated the market by capturing a share of 46.3% in 2024. This is due to the high demand for advanced imaging technologies in hospitals, where C-arms are extensively used for various orthopedic, cardiovascular, and trauma surgeries. Hospitals are major users of fixed and mobile C-arm systems, requiring accurate, real-time imaging to ensure precise surgical interventions and enhance patient outcomes. The presence of comprehensive healthcare services and the need for top-quality diagnostic and surgical equipment further boosts the hospital segment's dominant position in the C-arm market.

The ambulatory surgical centers segment is expected to grow fastest over the forecast period. This growth can be attributed to patients' increasing preference for ASCs due to their cost-effectiveness, convenience, and shorter recovery times compared to traditional hospitals. As patient demand for these centers continues to rise, many ASCs are adopting advanced technologies, including C-arms, to enhance their diagnostic and surgical capabilities. This shift towards state-of-the-art equipment is expected to further drive this segment.

Application Insights

The orthopedics and trauma segment dominated the fixed and mobile C-arms market and accounted for the largest revenue share of 26.9% in 2024. This is due to the extensive use of C-arm systems in orthopedic procedures, including fracture management, joint replacement surgeries, and spinal operations. C-arms provide real-time, high-quality imaging, critical for precise positioning and guidance during these surgeries. Moreover, the growing incidence of musculoskeletal disorders, trauma-related injuries, and an aging population are driving the demand for advanced imaging solutions in orthopedic and trauma care. According to the International Osteoporosis Foundation (IOF), hip fracture rates are projected to increase significantly by 2050, with rates in men expected to rise by 310% and rates in women by 240%, compared to the levels observed in 1990.

The cardiovascular segment is expected to grow at the fastest CAGR of over 4.7% during the forecast period. This is due to the rising prevalence of cardiovascular diseases, including coronary artery disease, heart failure, and arrhythmias, which are leading causes of morbidity and mortality globally. The increasing need for minimally invasive diagnostic and interventional procedures, such as angioplasty and stenting, further contributes to the demand for advanced imaging technologies like C-arms. These systems enable real-time, high-resolution imaging during cardiovascular procedures, improving precision and outcomes while minimizing patient risk. As the global burden of cardiovascular conditions continues to rise, the demand for effective imaging solutions is expected to grow, fueling the expansion of the fixed and mobile C-arms industry.

Regional Insights

North America fixed And mobile C-arms market held the largest share of 29.1% in 2024. Advancements in technology, such as improved imaging quality, enhanced mobility, and integration with advanced features like 3D mapping and AI, significantly contribute to market growth. Furthermore, the rising geriatric population, which is more prone to chronic disorders and requires surgical interventions, is further fuelling demand for C-arm systems in this region.

U.S. Fixed And Mobile C-arms Market Trends

The fixed and mobile C-arms marketin the U.S. dominated the market in the North American region. This is attributed to the presence of major manufacturers, which ensures the availability of advanced products and technologies. In addition, the increasing adoption of C-arms in the U.S. is driven by the growing demand for surgical procedures and the need for advanced imaging solutions to support complex surgeries across various medical specialties.

Europe Fixed And Mobile C-arms Market Trends

The fixed and mobile C-arms market in Europe held a significant market share in 2024, driven by the presence of key market players and their regional strategic initiatives, such as product introductions and technological innovations. For instance, in July 2022, Fujifilm Europe launched a new hybrid C-arm and portable X-ray device, further enhancing the range of advanced imaging solutions available. These initiatives and the increasing demand for high-quality imaging solutions in medical procedures contribute to market growth.

The UK fixed and mobile C-arms market is experiencing significant growth, driven by the country's increasing incidence of chronic disorders. As conditions such as cardiovascular diseases, musculoskeletal disorders, and neurological conditions become more prevalent, the demand for advanced imaging solutions like C-arms to support accurate diagnosis and treatment is rising. For instance, data published by the British Heart Foundation in September 2024 indicates that approximately 6.4 million people in England live with heart and circulatory diseases.

The fixed and mobile C-arms market in France is expected to grow over the forecast period, with technological advancements playing a significant role in driving the adoption of these devices. Innovations such as enhanced imaging quality, integration of 3D imaging, AI, and portability are making C-arms more efficient and accessible for a wider range of medical applications.

Germany fixed and mobile C-arms market is experiencing significant growth, driven by the increasing prevalence of chronic diseases, a strong healthcare infrastructure, and advancements in medical imaging technology. The rising incidence of conditions like cardiovascular diseases, orthopedic disorders, and neurological conditions is fuelling the demand for advanced imaging solutions to support accurate diagnosis and minimally invasive surgeries.

Asia Pacific Fixed And Mobile C-arms Market Trends

The fixed and mobile C-arms market in Asia Pacific is expected to witness the fastest growth of CAGR 5.3% over the forecast period. This growth is primarily driven by the expanding healthcare markets in countries like Japan, China, and India. The increasing burden of chronic diseases, such as cardiovascular conditions, orthopedic disorders, and cancer, is contributing to the rising demand for advanced imaging technologies in these regions. Furthermore, growing awareness among the population about the benefits of medical devices, along with improvements in healthcare infrastructure and access to advanced technologies, is fueling the adoption of fixed and mobile C-arms in the Asia Pacific.

China fixed and mobile C-arms market is expected to grow at a steady rate over the forecast period. This growth is primarily driven by the rising demand for advanced diagnostic tools and therapeutic devices, supported by the country’s aging population and increasing healthcare awareness. Moreover, ongoing investments in healthcare infrastructure and technology, along with government initiatives to enhance medical services, are likely to boost the adoption of C-arms in China.

The fixed and mobile C-arms market in Japan is significantly driven by growing initiatives. For instance, in July 2024, FUJIFILM Holdings Corporation is set to issue a JPY 200 billion social bond offering, the largest social bond offering in Japan's corporate bond market. The funds raised from this offering will be allocated to expanding the company's biopharmaceutical contract development and manufacturing (Bio CDMO) business, helping to meet unmet medical needs and enhance global access to medicines.

Latin America Fixed And Mobile C-arms Market Trends

The fixed and mobile C-arms market in Latin America is expected to growowing to the increasing adoption of medical systems in the region. As the population becomes more aware of healthcare options, the demand for advanced diagnostic and treatment technologies, including C-arms, is rising. This growing awareness about the benefits of early diagnosis and effective treatment, along with improvements in healthcare infrastructure, is driving the adoption of advanced medical systems in the region.

Middle East & Africa Fixed And Mobile C-arms Market Trends

The fixed and mobile C-arms market in the Middle East and Africa is experiencing notable growth, driven by various government initiatives to improve healthcare infrastructure and access to advanced medical technologies. Governments in the region are increasingly investing in healthcare development and supporting the adoption of innovative medical devices to enhance diagnostic and treatment capabilities. These efforts and the rising demand for accurate imaging in surgical procedures fuel the growth of the region's fixed and mobile C-arms market.

Key Fixed And Mobile C-arms Company Insights

The fixed and mobile C-arms industry players actively focus on strategies such as product innovation and technological advancements and expand their product portfolios to strengthen their market position. Many companies are investing in research and development to introduce advanced C-arm systems with improved image quality, enhanced mobility, and reduced radiation exposure. Furthermore, market players engage in partnerships, collaborations, and acquisitions to broaden their reach, access new markets, and meet the growing demand for advanced diagnostic and surgical solutions. These efforts are driving the overall growth of the fixed and mobile C-arms market.

Key Fixed And Mobile C-arms Companies:

The following are the leading companies in the fixed and mobile c-arms market. These companies collectively hold the largest market share and dictate industry trends.

- GE HealthCare

- Koninklijke Philips N.V.

- Siemens Healthineers AG

- Medtronic

- Shimadzu Corporation

- Hologic, Inc.

- Canon Medical Systems Corporation

- Fujifilm Holdings Corporation

- Ziehm Imaging GmbH

Recent Developments

-

In February 2024, Philips introduced the Philips Image Guided Therapy Mobile C-arm System 9000 - Zenition 90 Motorized, designed to assist surgeons in providing high-quality care to a larger number of patients.

-

In June 2023, GE HealthCare signed a distribution agreement with DePuy Synthes, the orthopedics division of Johnson & Johnson, to deliver GE HealthCare's OEC 3D Imaging System in combination with DePuy Synthes’ extensive product range, making it accessible to more surgeons and patients throughout the U.S.

-

In April 2022, Medtronic and GE Healthcare announced a collaboration to address the specific needs and demands of care in Ambulatory Surgery Centers (ASCs) and Office-Based Labs (OBLs). Customers can access a comprehensive range of products, financial solutions, and outstanding service through this partnership.

Fixed And Mobile C-arms Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.44 billion

Revenue forecast in 2030

USD 4.23 billion

Growth rate

CAGR of 4.2% from 2025 to 2030

Actual period

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GE HealthCare; Koninklijke Philips N.V.; Siemens Healthineers AG; Medtronic; Shimadzu Corporation; Hologic, Inc.; Canon Medical Systems Corporation; Fujifilm Holdings Corporation; Ziehm Imaging GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fixed And Mobile C-arms Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fixed and mobile C-arms market report based on product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed C-arms

-

Mobile C-arms

-

Full-size C-arms

-

Mini C-arms

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedics and Trauma

-

Drug delivery

-

Cardiovascular

-

Pain Management

-

Gastroenterology

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Research Institutions

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global fixed and mobile C-arms market size was estimated at USD 3.32 billion in 2024 and is expected to reach USD 3.44 billion in 2025.

b. The global fixed and mobile C-arms market is expected to grow at a compound annual growth rate of 4.2% from 2025 to 2030 to reach USD 4.23 billion by 2030.

b. North America dominated the fixed and mobile C-arms market with a share of 29.1% in 2023. The dominance of this region can be attributed to the well-established healthcare infrastructure, the high adoption rate of advanced technology, and the presence of a large target population.

b. Some key players operating in the fixed and mobile C-arms market include GE HealthCare; Koninklijke Philips N.V.;Siemens Healthineers AG; Medtronic; Shimadzu Corporation ; Hologic, Inc.; Canon Medical Systems Corporation; Fujifilm Holdings Corporation; Ziehm Imaging GmbH

b. Key factors that are driving the fixed and mobile C-arms market growth include the growing number of surgical procedures and technological advancements in the development of novel C-arms.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.