- Home

- »

- Next Generation Technologies

- »

-

3D Imaging Market Size And Share, Industry Report, 2030GVR Report cover

![3D Imaging Market Size, Share & Trends Report]()

3D Imaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Software, Hardware, Services), By Deployment (On-premise, Cloud), By Organization (Large Enterprises, SMEs), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-950-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

3D Imaging Market Summary

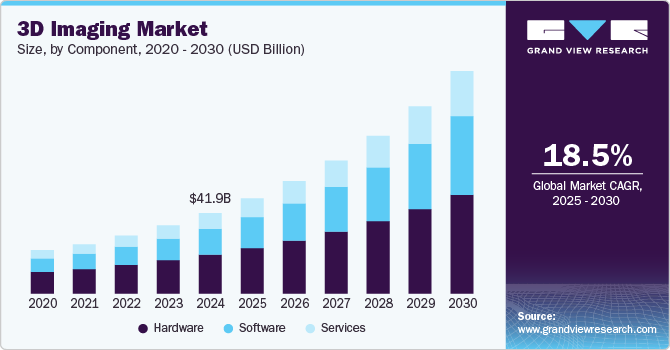

The global 3D imaging market size was estimated at USD 41.96 billion in 2024 and is projected to reach USD 115.98 billion by 2030, growing at a CAGR of 18.5% from 2025 to 2030. The market is experiencing significant growth, driven primarily by advancements in healthcare and entertainment.

Key Market Trends & Insights

- North America dominated the global 3D imaging market with the largest revenue share of 39% in 2024.

- The 3D imaging market in the U.S.led the North America market and is expected to grow at a CAGR of 17.1% from 2025 to 2030.

- By component, the hardware segment accounted for the largest revenue share of over 48.0% in 2024.

- By deployment, the on-premise segment held the dominant position in the market and accounted for the leading revenue share of 77% in 2024.

- By organization, the small and medium enterprises segment is expected to grow at a significant CAGR from 2025 to 2030.

- By end use, the media & entertainment segment is expected to grow at the fastest CAGR from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 41.96 Billion

- 2030 Projected Market Size: USD 115.98 Billion

- CAGR (2025-2030): 18.5%

- North America: Largest market in 2024

In healthcare, 3D imaging technology is being adopted for medical diagnostics, surgical planning, and more accurate treatment, particularly in fields such as dentistry, orthopedics, and oncology. Additionally, the entertainment industry, especially in areas such as gaming, film, and virtual reality (VR), is fueling demand as 3D imaging enables more immersive and realistic experiences.

Ongoing technological developments in the field of 3D imaging and the widespread adoption of and need for 3D imaging systems in different deployments are expected to drive the market in the coming future. Additionally, the increasing frequency of chronic diseases worldwide and growing awareness regarding the benefits of 3D imaging technology, such as a precise visual portrayal of internal organs that reduces tissue damage and the quality of data provided by various medical imaging methods, are among the factors driving the demand for 3D imaging solutions. The high cost of these sensors and a lack of knowledge about how to implement 3D imaging are expected to limit growth.

3D imaging is transforming product design and prototyping in manufacturing by enabling rapid, accurate, and cost-effective production processes. In construction, it is being utilized for building information modeling (BIM), where detailed 3D visualizations help in project planning and management. The rise of Industry 4.0, which emphasizes automation and smart manufacturing, is further propelling the adoption of 3D imaging across industries.

The rise of consumer applications in 3D imaging is another emerging trend. Devices like smartphones, drones, and even wearable technology are now equipped with 3D imaging capabilities, allowing consumers to capture and interact with 3D content in real-time. For example, smartphones with advanced cameras are being used to scan objects or spaces, enabling applications in areas like virtual home design, gaming, and augmented-reality shopping. As 3D imaging becomes more embedded in consumer devices, its potential for everyday use is expanding, opening new revenue streams for tech companies and service providers.

Component Insights

The hardware segment accounted for the largest revenue share of over 48.0% in 2024 and is expected to continue to dominate the market over the forecast period. This can be attributed to the increasing demand for 3D imaging devices such as X-ray devices, ultrasound systems, CT, and MRI in healthcare deployment. In addition, the growing gaming and entertainment industry has fueled the demand for 3D imaging technology as the viewers can witness the 3D experience with their own eyes because of these technologies. In terms of components, the market has been segmented into software, hardware, and components.

The software segment is expected to expand at a CAGR of 20.5% over the forecast period, owing to the use of 3D imaging software in the healthcare, automotive, and manufacturing industries. In addition, its growing popularity in other industries, such as media and entertainment, architecture and construction, and archaeological studies, is fueling the segment's growth.

Deployment Insights

The on-premise segment accounted for the largest revenue share of over 77.0% in 2024 and is expected to retain its position in the market over the forecast period. This can be attributed to a one-time upfront license purchase, an internal network that can be accessed anytime, and high security as data is stored locally.

The cloud segment is expected to expand at a significant CAGR over the forecast period. The use of cloud-based 3D imaging systems is growing owing to their advantages, such as easy and effective management, image data maintenance, flexibility, cost-effectiveness, agility, and scalability.

Organization Insights

The large enterprise segment accounted for the largest revenue share of over 57.0% in 2024 and is expected to continue to dominate the market over the forecast period. This can be attributed to the increasing use of 3D imaging hardware and solutions in large enterprises to manufacture improved products and give a better customer experience. Moreover, the dominance of this segment in the market is primarily accredited to the growing investments by large organizations.

The small and medium enterprises segment is expected to expand at a significant CAGR of over the forecast period. This can be attributed to the rising adoption of cloud-based 3D imaging solutions. Cloud platforms have made it easier for SMEs to store, share, and analyze 3D images without investing in expensive on-premise infrastructure. This accessibility allows businesses to collaborate on projects across locations, enhance data security, and scale their operations more efficiently.

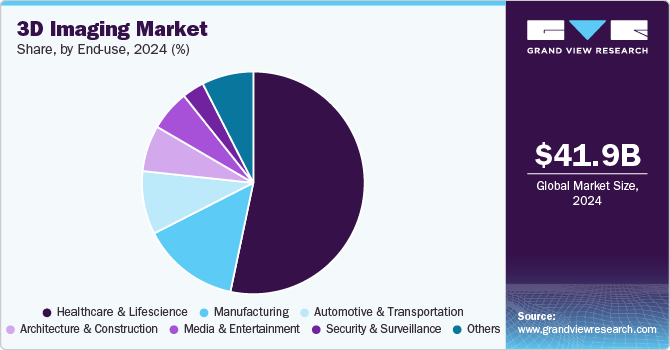

End-use Insights

The healthcare and life sciences segment accounted for the largest revenue share of over 53.0% in 2024 and is expected to continue to dominate the market over the forecast period. This can be attributed to the increasing adoption and growing need for 3D medical imaging technology in healthcare deployment to determine and diagnose the disease in the body. In terms of end-use, the market has been segmented into automotive and transportation, healthcare and life science, architecture and construction, manufacturing, media and entertainment, and security and surveillance.

Due to sedentary lifestyles, the increasing frequency of chronic diseases worldwide, and a considerable growth in the aging population, there's been an increase in the occurrence of lifestyle diseases and age-related illnesses. As a result, the 3D imaging devices demand has increased.

The media & entertainment segment is anticipated to register the fastest CAGR over the forecast period. The growth of this segment is fueled by advancements in digital technologies and the rising demand for immersive visual experiences. With the proliferation of 3D movies, video games, and virtual reality (VR) content, the entertainment industry has embraced 3D imaging as a means to captivate audiences and deliver more engaging storytelling experiences. The adoption of 3D technologies allows filmmakers and game developers to create more realistic and visually stunning content, which has driven increased investment in 3D imaging tools and software.

Regional Insights

North America 3D imaging market held a share of over 39.0% in 2024 and is expected to maintain its position over the forecast period. The market growth in the region is being driven by factors such as the presence of major market vendors and the high adoption of advanced technologies.

U.S. 3D Imaging Market Trends

The 3D imaging market in the U.S. is expected to grow significantly at a CAGR of 17.1% from 2025 to 2030, owing to the expanding use of 3D imaging in the entertainment and media industries. As immersive experiences like augmented reality (AR) and virtual reality (VR) gain traction, 3D imaging plays a critical role in creating lifelike environments and characters for movies, video games, and other media. The increased consumption of 3D content across platforms is also pushing technological advancements and demand for better imaging solutions.

Europe 3D Imaging Market Trends

The 3D imaging market in Europe is expected to grow with a significant CAGR from 2025 to 2030 due to the expanding healthcare deployment, where 3D imaging technologies are widely used for diagnostic and therapeutic purposes. In Europe, medical professionals are increasingly adopting advanced imaging techniques like MRI, CT scans, and 3D ultrasound for more accurate diagnosis, surgical planning, and personalized treatments.

Asia Pacific 3D Imaging Market Trends

The 3D imaging market in Asia Pacific is expected to grow significantly at a CAGR of 21.0% from 2025 to 2030. The growth of the regional market is mainly attributed to the growth in healthcare, automation, media and entertainment, and manufacturing deployment. With the potential growth in the deployments, there have been increasing investments from Asia Pacific nations such as Japan, India, and China. The growing technological awareness and adoption in the region are also expected to fuel market growth across the region over the forecast period.

Key 3D Imaging Company Insights

Key players operating in the 3D imaging market include GE HealthCare, Siemens Healthineers AG, Koninklijke Philips N.V., Alphatec Holdings, Inc., and FARO. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In July 2024, Alphatec Holdings, Inc. announced the commercial launch of EOS Insight, an advanced, cloud-based platform designed to support the entire spine surgery process. Powered by AI and the precision of EOSedge imaging, EOS Insight delivers essential data across various stages of spine care. The platform offers integrated, efficient tools such as AI-driven alignment calculations, 3D surgical planning simulations, patient-specific rods, intra-operative adjustments, and post-operative analytics to enhance patient outcomes and streamline surgical workflows.

-

In March 2024, Siemens Healthineers received FDA clearance for the CIARTIC Move, a mobile C-arm with automated capabilities. This system enhances and streamlines 2D fluoroscopic and 3D cone-beam CT imaging, providing surgeons and operating room teams in hospitals and outpatient centers with faster, standardized imaging workflows. Tailored for trauma, orthopedic, and spine surgeries, the CIARTIC Move is versatile enough for vascular, thoracic, cardiovascular, urology, general surgery, and interventional pulmonology, reducing imaging time and improving procedural consistency.

-

In July 2023, GE HealthCare formed a distribution partnership with DePuy Synthes, the orthopedics division of Johnson & Johnson, to expand the availability of OEC 3D Imaging System in the U.S. The collaboration aims to combine this advanced imaging technology with DePuy Synthes' extensive product line, making it more accessible to surgeons and patients. This initiative underscores GE HealthCare's dedication to enhancing medical imaging solutions, particularly for complex spinal procedures, improving patient care, and supporting clinicians in delivering high-quality treatment.

Key 3D Imaging Companies:

The following are the leading companies in the 3D imaging market. These companies collectively hold the largest market share and dictate industry trends.

- Ajile Light Industries

- Alphatec Holdings, Inc.

- eCential Robotics

- FARO

- GE HealthCare

- Intrasense

- Koninklijke Philips N.V.

- Olympus America

- Planmeca Oy

- Siemens Healthineers AG

- TOMTEC Imaging Systems GmbH.

3D Imaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 49.55 billion

Revenue forecast in 2030

USD 115.98 billion

Growth Rate

CAGR of 18.5% from 2025 to 2030

Actual data

2017 - 2023

Base year for estimation

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report component

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, organization, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico U.K.; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Ajile Light Industries; Alphatec Holdings; Inc.; eCential Robotics; FARO; GE HealthCare; Intrasense; Koninklijke Philips N.V.; Olympus America; Planmeca Oy; Siemens Healthineers AG; TOMTEC Imaging Systems GmbH.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 3D Imaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global 3D imaging market report based on component, deployment, organization, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Software

-

Hardware

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

On-premise

-

Cloud

-

-

Organization Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Enterprises

-

Small and Medium-sized Enterprises (SMEs)

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Automotive and Transportation

-

Manufacturing

-

Healthcare and Life Sciences

-

Architecture and Construction

-

Media and Entertainment

-

Security & Surveillance

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 3D imaging market size was estimated at USD 41.96 billion in 2024 and is expected to reach USD 49.55 billion in 2025.

b. The global 3D imaging market is expected to grow at a compound annual growth rate of 18.5% from 2025 to 2030 to reach USD 115.98 billion by 2030.

b. The hardware segment accounted for the largest revenue share of over 48.0% in 2024 and is expected to continue to dominate the market over the forecast period. This can be attributed to the increasing demand for 3D imaging devices such as X-ray devices, ultrasound systems, CT, and MRI in healthcare deployment.

b. Some key players operating in the 3D imaging market include Ajile Light Industries, Alphatec Holdings, Inc., eCential Robotics, FARO, GE HealthCare, Intrasense, Koninklijke Philips N.V., Olympus America, Planmeca Oy, Siemens Healthineers AG, TOMTEC Imaging Systems GmbH.

b. The 3D imaging market growth is driven primarily by advancements in healthcare and entertainment. In healthcare, 3D imaging technology is increasingly being adopted for medical diagnostics, surgical planning, and more accurate treatment, particularly in fields such as dentistry, orthopedics, and oncology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.