- Home

- »

- IT Services & Applications

- »

-

Flare Monitoring Market Size, Share & Growth Report, 2030GVR Report cover

![Flare Monitoring Market Size, Share & Trends Report]()

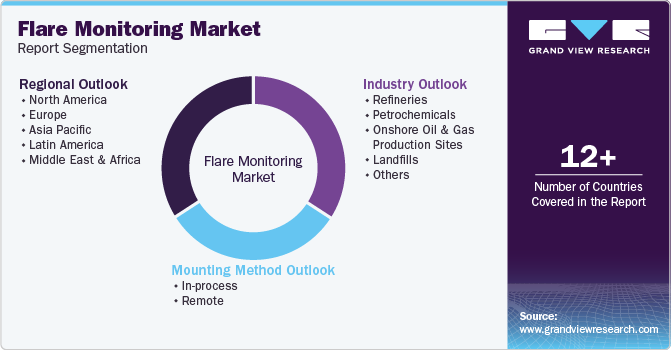

Flare Monitoring Market (2024 - 2030) Size, Share & Trends Analysis Report By Mounting Method (In-process, Remote), By Industry (Refineries, Petrochemicals, Onshore Oil & Gas Production Sites, Landfills), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-430-2

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flare Monitoring Market Summary

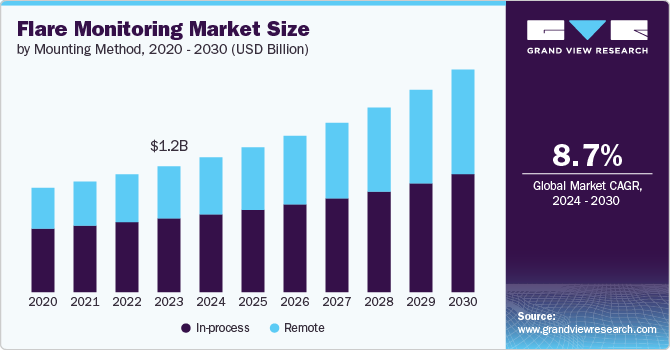

The global flare monitoring market size was estimated at USD 1.18 billion in 2023 and is anticipated to reach USD 2.08 billion by 2030, growing at a CAGR of 8.7% from 2024 to 2030. The growing demand for precise control over waste gas combustion parameters owing to stringent local and global environmental regulations is a major factor behind the growth of the market.

Key Market Trends & Insights

- The North America flare monitoring market dominated the global market in 2023 and accounted for 32.40% of the global revenue share.

- The U.S. flare monitoring market is expected to grow at a significant CAGR from 2024 to 2030.

- By mounting method, the in-process segment dominated the market in 2023 and accounted for a 58.55% share of global revenue.

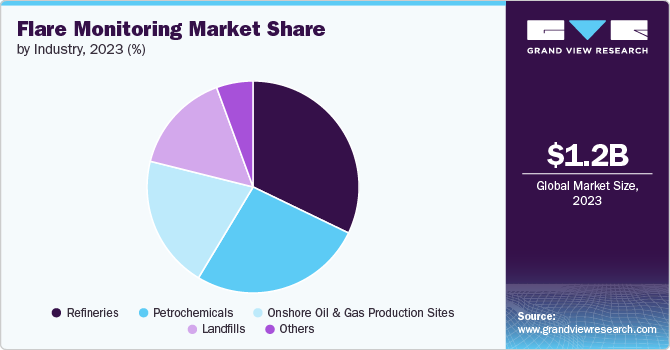

- By industry, the refineries segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.18 Billion

- 2030 Projected Market Size: USD 2.08 Billion

- CAGR (2024-2030): 8.7%

- North America: Largest market in 2023

The rapid growth of the oil and gas sector, the rising adoption of flare monitoring technologies in the chemical and petrochemical industries, and continuous advancements in wireless flare monitoring systems are further contributing to the growth of the market. In addition, integration of advanced analytics and artificial intelligence (AI) and increased adoption of remote monitoring technologies.Technological advancements have significantly improved the capabilities and efficiency of flare monitoring systems. The development of more accurate sensors, data analytics tools, thermal IR imagers, and remote monitoring capabilities has enabled operators to gain better insights into their flare operations and optimize performance. These technologies provide enhanced visibility into flare system performance without requiring physical presence, leading to better decision-making and more efficient operations. These innovations are making flare monitoring more reliable, cost-effective, and environmentally friendly, thereby driving its demand in various end use industries.

The flare monitoring market is witnessing a rise in regulatory requirements and compliance standards, driven by increasing environmental concerns and stricter regulations. Governments and regulatory bodies are implementing more rigorous rules regarding flare emissions, necessitating improved monitoring and reporting practices. For instance, In December 2023, the Environmental Protection Agency (EPA) announced major updates to its air emissions regulations through the introduction of the New Source Performance Standards (NSPS) OOOOb and EG OOOOc. These revisions specifically target emissions in the oil & gas industry and establish rigorous new requirements for both enclosed combustion devices and flares, with a strong focus on reducing methane emissions. This trend is encouraging companies to invest in advanced flare monitoring solutions that can provide accurate, real-time data and ensure compliance with evolving regulations.

Another significant trend is the integration of advanced analytics and AI in flare monitoring systems. AI and machine learning algorithms analyze large volumes of data generated by flare monitoring devices to identify patterns, predict potential failures, and optimize flare performance. By leveraging these technologies, companies can move from reactive to predictive maintenance, reducing downtime and operational disruptions. The use of AI also enhances the accuracy of flare emissions measurements and contributes to more effective regulatory reporting and environmental protection. Thus, several companies provide flame monitoring systems integrated with AI and ML technologies, which in turn drive the market’s growth. For instance, CleanFlare, the UK-based company, provides FlareX, an innovative optical-based multi-spectral continuous monitoring system that integrates advanced AI and Deep ML technologies with image processing.

High costs associated with the installation and maintenance of flare maintenance systems could hamper the growth of the market. Advanced technologies, such as Continuous Emission Monitoring Systems (CEMS) and infrared cameras, require a significant initial investment and ongoing maintenance expenses. Furthermore, these systems are often installed in challenging environments, such as elevated positions or hazardous locations, which increases both the complexity and the cost of deployment. In addition, data accuracy and reliability concerns could further hinder the growth of the market.

Mounting Method Insights

The in-process segment dominated the market in 2023 and accounted for a 58.55% share of global revenue. The segment is further divided into mass spectrometers, gas chromatographs, flowmeters, calorimeters, and others. The need for real-time, on-site data collection drives the adoption of in-process mounting methods, which provide immediate insights into flare performance and operational conditions. This mounting method allows for direct observation and measurement, which is crucial for accurate monitoring and quick response to any irregularities. Additionally, advancements in sensor technology and miniaturization have made it possible to integrate high-precision monitoring equipment directly into existing flare systems without significant modifications, thereby driving the segment’s growth.

The remote segment is projected to witness significant growth from 2024 to 2030. The segment is further bifurcated into Thermal (IR) Imagers, Multi-Spectrum Infrared (MSIR) Imagers, and others. The segment is growing rapidly due to the increasing focus on safety and operational efficiency. Remote mounting methods allow monitoring equipment to be installed at a safe distance from the flare system, reducing the risk to personnel and minimizing exposure to hazardous conditions. This approach benefits from advancements in wireless communication and data transmission technologies, which enable real-time data collection and analysis from remote locations. The trend towards digital transformation and the adoption of IoT technologies in various industrial settings is further boosting the segment’s growth.

Industry Insights

The refineries segment dominated the market in 2023. Refineries face stringent regulations and significant operational risks with their flare systems due to their involvement in processing and refining petroleum products. Effective flare monitoring is essential in refineries to ensure adherence to environmental regulations, optimize flare performance, and prevent harmful emissions. The requirement for continuous, precise monitoring to avoid operational disruptions and mitigate the risk of costly fines drives substantial investment in flare-monitoring technologies within this sector.

The onshore oil & gas production sites segment is projected to witness considerable growth from 2024 to 2030. The increasing complexity of operations in onshore oil and gas production sites and the need for stringent environmental oversight are major factors driving the segment growth. Onshore production sites, often located in remote or challenging environments, require effective monitoring solutions to ensure safety and compliance with environmental regulations. Advanced flare monitoring systems offer critical benefits, including real-time monitoring capabilities and enhanced data accuracy, which are essential for managing flare emissions and maintaining operational efficiency in these settings. In addition, the rising focus on reducing carbon emissions and improving resource management is driving the adoption of these technologies within this segment.

Regional Insights

The North America flare monitoring market dominated the global market in 2023 and accounted for 32.40% of the global revenue share. Stringent environmental regulations and a strong emphasis on technological advancement are driving the demand for flare monitoring systems in several end use industries across the region. The U.S. and Canada have established rigorous standards for flare emissions, driving the adoption of advanced monitoring systems to ensure compliance and enhance environmental protection. In addition, North America's substantial investments in energy infrastructure and the push towards improving operational efficiency and sustainability contribute to the increased demand for sophisticated flare monitoring technologies.

U.S. Flare Monitoring Market Trends

The U.S. flare monitoring market is expected to grow at a significant CAGR from 2024 to 2030. The Environmental Protection Agency (EPA) enforces stringent rules regarding flare systems, which drives U.S. companies to invest heavily in advanced monitoring technologies to ensure compliance and avoid penalties. In addition, the need for reducing greenhouse gas emissions and improving operational efficiency fuels the adoption of real-time flare monitoring systems. Furthermore, the presence of a large and diverse industrial base, including oil, gas, and refining operations, further drives the market growth.

Europe Flare Monitoring Market Trends

The Europe flare monitoring marketis expected to grow at a notable CAGR from 2024 to 2030. The European Union and various national governments have implemented comprehensive legislation to control flare emissions and reduce environmental impact, encouraging industries to adopt advanced monitoring solutions. In addition, the region's focus on innovation and technology adoption, along with the presence of major industrial players and research institutions, further accelerates the deployment of advanced flare monitoring systems to meet regulatory requirements and sustainability goals.

Asia Pacific Flare Monitoring Market Trends

The Asia Pacific flare monitoring market is expected to grow at the highest CAGR from 2024 to 2030. The market's growth can be attributed to growing industrial activities and increasing regulatory focus on environmental protection. Countries such as China, Japan, and India, with their significant oil, gas, and petrochemical industries, are investing heavily in advanced flare monitoring technologies to address growing environmental concerns and comply with emerging regulations. The region's rapid industrialization and economic growth drive the need for effective emissions management solutions, thereby driving the market's growth.

Key Flare Monitoring Company Insights

Key players operating in the flare monitoring market are focusing on various strategic initiatives, including new product development, agreements, and partnerships & collaborations to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In July 2024, JP3 Measurement, a provider of innovative analytical measurement solutions and a wholly owned subsidiary of Flotek Industries, announced that the Environmental Protection Agency (EPA) has approved its system for compliance with the latest flare regulations. This cutting-edge optical instrument, was developed for accurate measurement of Net Heating Values (NHV) in flare gases. This approval supports the oil and gas industry's efforts to achieve more efficient and cleaner operations.

-

In March 2024, Baker Hughes, an energy technology firm, announced a significant advancement in flare emissions monitoring through a collaboration with bp, an oil and gas company. By utilizing Baker Hughes’ flare.IQ emissions abatement technology, bp is now able to quantify emissions of methane from its flares—a new application in the upstream oil and gas sector. With no standard solution available for measuring methane emissions from flares, Baker Hughes and bp conducted one of the largest full-scale studies of flare combustion. This study involved testing various flares under challenging conditions and validating the precision of the flare.IQ technology.

Key Flare Monitoring Companies:

The following are the leading companies in the flare monitoring market. These companies collectively hold the largest market share and dictate industry trends.

- Ametek Inc.

- Emerson Electric Co.

- Fluenta AS

- Zeeco, Inc.

- Advanced Energy

- Thermo Fisher Scientific Inc.

- Teledyne FLIR LLC

- Fluenta

- Honeywell International Inc.

- John Zink Company, LLC

Flare Monitoring Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.26 billion

Revenue forecast in 2030

USD 2.08 billion

Growth rate

CAGR of 8.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Mounting method, industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Ametek Inc.; Emerson Electric Co.; Fluenta AS; Zeeco, Inc.; Advanced Energy; Thermo Fisher Scientific Inc.; Teledyne FLIR LLC; Fluenta; Honeywell International Inc.; John Zink Company, LLC

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flare Monitoring Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global flare monitoring market report based on mounting method, industry, and region:

-

Mounting Method Outlook (Revenue, USD Million, 2018 - 2030)

-

In-process

-

Mass Spectrometers

-

Gas Chromatographs

-

Flowmeters

-

Calorimeters

-

Others

-

-

Remote

-

Thermal (IR) Imagers

-

Multi-Spectrum Infrared (MSIR) Imagers

-

Others

-

-

-

Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Refineries

-

Petrochemicals

-

Onshore Oil & Gas Production Sites

-

Landfills

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global flare monitoring market size was estimated at USD 1.18 billion in 2023 and is expected to reach USD 1.26 billion in 2024.

b. The global flare monitoring market is expected to grow at a compound annual growth rate of 8.7% from 2024 to 2030 to reach USD 2.08 billion by 2030.

b. North America dominated the flare monitoring market with a share of 32.40% in 2023. Stringent environmental regulations and a strong emphasis on technological advancement are driving the demand for flare monitoring systems in several end-use industries across the region.

b. Some key players operating in the flare monitoring market include Ametek Inc., Emerson Electric Co., Fluenta AS, Zeeco, Inc., Advanced Energy, Thermo Fisher Scientific Inc., Teledyne FLIR LLC, Fluenta, Honeywell International Inc., and John Zink Company, LLC.

b. Key factors that are driving the market growth include the growing demand for precise control over waste gas combustion parameters owing to stringent local and global environmental regulations and the rising adoption of flare monitoring technologies in the chemical and petrochemical industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.