- Home

- »

- Consumer F&B

- »

-

Flavored Water Market Size & Share, Industry Report, 2030GVR Report cover

![Flavored Water Market Size, Share & Trends Report]()

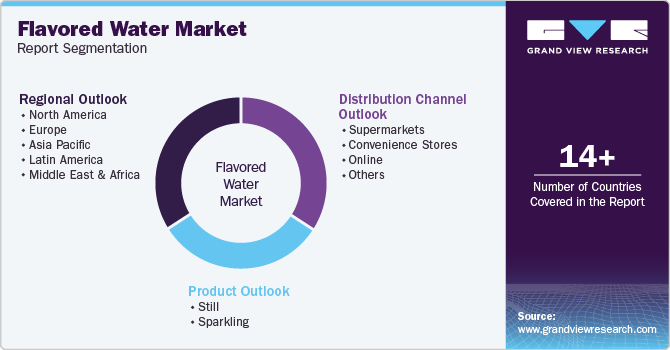

Flavored Water Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Sparkling, Still), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-260-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Flavored Water Market Summary

The global flavored water market size was estimated at USD 695.0 million in 2024 and is projected to reach USD 1,200.7 million by 2030, growing at a CAGR of 9.7% from 2025 to 2030. Consistently increasing demand for flavored, healthy, and functional drinks has been boosting the growth of the market across the globe.

Key Market Trends & Insights

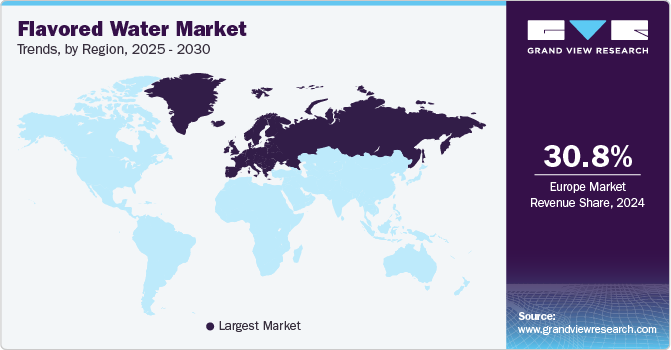

- Europe accounted for the largest revenue share of over 30.8% in 2024 and will expand further at a steady CAGR from 2025 to 2030

- Germany accounted for the largest share of the region.

- By product, the sparkling product segment accounted for the highest revenue share of more than 73.7% in 2024

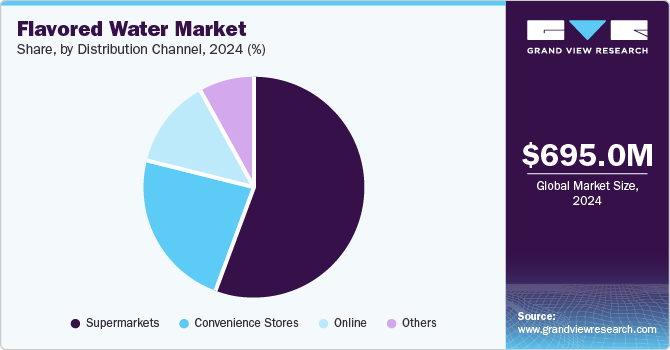

- By distribution channel, the supermarkets segment accounted for the largest revenue share, over 56.1%, in 2024

Market Size & Forecast

- 2024 Market Size: USD 695.0 Million

- 2030 Projected Market Size: USD 1,200.7 Million

- CAGR (2025-2030): 9.7%

- Europe: Largest market in 2024

Consumers are showing interest in exploring innovative beverages infused with fruits, herbs, other healthy ingredients. The demand is particularly strong among health-conscious individuals in the mid- to high-income segments, who are looking for flavorful hydration options that support their overall well-being. Consumers are increasingly looking for healthier alternatives to traditional sugary drinks such as juices and sodas. Flavored water infused with natural ingredients offers low low-calorie, refreshing alternative to traditional, bland water that helps consumers to stay hydrated and enjoy flavors. Global beverage brands including Nestlé, PepsiCo, and Coca-Cola have popularized the category by offering a variety of fruit-infused flavors with no added sugars or artificial ingredients. The appeal lies in the product’s ability to combine the refreshing fizz of soda with the health-conscious profile of water, making it especially attractive to the younger consumer group.

Consumers, especially millennials and Gen Z, in developed economies are spending more on flavored water. The trend of zero-calorie, zero-sugar, and low-carb soft drinks is rising across the globe, which is also boosting market growth. Citrus and berry flavors are gaining traction among consumers due to their refreshing tastes. Natural flavors are gaining traction due to their health benefits and refreshing tastes. As a result, producers have been launching beverages with multiple flavors that help improve physical and mental health.

The continuous introduction of new flavors, innovative packaging, and incorporation of functional ingredients have helped shape and boost the global market. Companies are adding vitamins and minerals to their drinks to attract modern consumers. With consumers' growing awareness of sustainability and the environment, industry players are increasingly offering flavored waters in sustainable packaging. Several brands offer their drinks in aluminum cans to appeal to environmentally conscious consumers. Furthermore, consumers are looking for drinks that are sourced and produced sustainably, which has created growth opportunities for the market players.

Product Insights

The sparkling product segment accounted for the highest revenue share of more than 73.7% in 2024 and is estimated to expand further at a steady CAGR from 2025 to 2030. The increase in demand for flavored bubbly and fizzy hydration products is projected to drive segment growth. The sparkling variants are increasingly preferred owing to their taste, fizz, and health benefits. Several brands, including Nestlé Pure Life, offer a range of zero-calorie and zero-sweetener-flavored products in different fruit flavors.

Key players are launching new products on the market in accordance with the changing demands from health-conscious consumers. For instance, on 19 March 2024, PepsiCo launched a brand-new product, Bubbly Burst. The new sparkling water is flavor-forward, lightly sweetened with bold fruit flavors, bright colors, zero added sugar, and minimal calories. Such launches are estimated to augment the segment growth over the forecast period.

Still flavored water market is expected to grow at a significant growth rate over the forecast period. It is evolving rapidly, driven by growing consumer interest in healthier and more customized hydration. The availability of a wide range of still water products enriched with minerals, antioxidants, vitamins, and caffeine is estimated to boost the growth of segment in the years to come. Furthermore, the perception that sparkling drinks cause low bone mineral density and tooth decay has encouraged many consumers to shift towards still alternatives.

The increasing availability of the still variants infused with various fruits, such as watermelon, blueberry, blackberry, lemon, mango, pomegranate, and mandarin orange, is boosting the consumption of the products. In March 2024, Essentia® Hydroboost launched flavored and functional water, offering a blend of B-complex vitamins and 400mg of electrolytes—30 times more than the leading premium still water available in lemon-lime, peach mango, and raspberry pomegranate flavors.

Distribution Channel Insights

The supermarkets segment accounted for the largest revenue share, over 56.1%, in 2024 and will grow further at a steady CAGR from 2025 to 2030. Many consumers prefer buying bottled water from supermarkets due to the shopping experience. Services, such as home delivery and click & collect, at several supermarkets have also been attracting consumers. Walmart, Carrefour, Woolworths, Magnit, and Edeka are among the leading supermarket chains across the globe.

The online distribution channel segment is expected to register the fastest CAGR over the forecast period. The provision of competitive pricing and hassle-free home delivery is driving the growth of this sales channel. Furthermore, the high penetration of the Internet across the globe is expected to boost product sales via online platforms over the coming years. The post-pandemic era has fundamentally changed the shopping patterns of consumers. Nowadays, more and more customers are willing to buy their essentials, including water and coffee, through online platforms. This has resulted in online portals becoming one of the most important distribution channels among manufacturers, distributors, retailers, and customers.

Regional Insights

North America accounted for a significant revenue share in 2024. Health-conscious consumers are constantly seeking alternatives to soft sugary drinks. Flavored water offers low-calorie and sugar-free options, aligning with their preferences. Many brands came with flavored waters which are keto-friendly, vegan, and free from allergens, which align perfectly with dietary preferences and restrictions popular among consumers. For instance, ‘Hint’ a popular flavored water brand in the United States offers vegan, kosher, and gluten-free products.

US Flavored Water Market Trends

Younger generations, especially Millennials and Gen-Zs, prioritize health and convenience. They also prefer innovative flavors and sustainable brands; this makes them a vital consumer segment for flavored water companies. Social media plays a greater role in influencing their decisions. Trends like ‘Watertok’ which showcases creative flavor water recipes gained popularity.

Europe Flavored Water Market Trends

Europe accounted for the largest revenue share of over 30.8% in 2024 and will expand further at a steady CAGR from 2025 to 2030 due to the rising product consumption as a healthy alternative to other carbonated drinks. Several popular brands, such as Bubbly, Volvic, Nestlé Pure Life, Perrier, Schweppes, and LaCroix, offer a wide range of products in the region. Thus, the increased accessibility of the product has been boosting product adoption in the region. Natural flavored and naturally carbonated waters with high levels of minerals make it more appealing to health-conscious consumers. The flavors added to the drinks are often obtained from natural fruit extracts. The product sales are strong in several countries, such as Germany, the U.K., Italy, Spain, and France, where the product is often served with meals in restaurants.

Germany accounted for the largest share of the region, driven by health-conscious consumers, innovative product offerings, and a shift towards sustainable practice. Innovation is a significant driver here. For instance, a Munich-based startup called ‘Air Up’ has developed innovative water bottles that utilize scent pods to create a perception of flavor, enabling consumers to experience flavored water without adding actual flavor or sugar.

Asia Pacific Flavored Water Market Trends

Asia Pacific is estimated to be the fastest-growing regional market from 2025 to 2030. Increasing consumer preference for the product, coupled with the expansion of quick-service and full-service restaurants, is likely to create a positive outlook for the market in the region. Rising consumer awareness about the benefits of following a healthy lifestyle has fueled the demand for healthy foods and beverages which, in turn, will support the regional market growth.

Furthermore, the surge in disposable income of consumers has changed their food and beverage consumption patterns globally. Consumers are highly inclined toward the consumption of healthy foods and beverages and limiting the intake of sugary drinks that have adverse health effects. Many restaurants and bars have been serving the product, resulting in an optimistic outlook for the growth of flavored water over the forecast period.

Key Flavored Water Company Insights

The key players have been implementing various expansion strategies, such as mergers & acquisitions and new product launches, to strengthen their market share. For example, in November 2024, Primo Water Corporation and BlueTrion Brands completed merger, forming Primo Brands Corporation, which will focus Primo’s sustainable practices with BlueTrion’s robust portfolio, including Poland Spring, Deer Park & Pure Life.

-

Spindrift Beverages CO. is a privately held company founded in Massachusetts, USA specializing in sparkling waters made with real fruits. The company distinguishes itself by using whole fruits, to flavor beverages, offering an authentic taste.

-

Talking Rain is a privately owned beverage company based in Washington . Its flagship product,' Sparkling Ice,' has a strong presence in the flavored water market. It’s zero-sugar sparkling water infused with natural fruit flavors and also contains vitamins and antioxidants, catering to health-conscious consumers. It offers flavors such as Black Cherry, Peach Nectarine, and kiwi Strawberry.

Key Flavored Water Companies:

The following are the leading companies in the flavored water market. These companies collectively hold the largest market share and dictate industry trends.

- Nestlé

- Talking Rain

- PepsiCo

- The Coca‑Cola Company

- Hint Inc.

- Spindrift Beverage Co.

- National Beverage Corp.

- Sanpellegrino S.p.A.

- KeurigDr Pepper, Inc.

- Saratoga Spring Water Company

Recent Developments

-

On 25 February 2025, LaCroix Sparkling Water by National Beverage Corp. introduced its new flavor ‘Sunshine’, blending citrus & tropical zest.

-

On 25 February 2025, Waterloo Sparkling Water launched two new flavors: Guava Berry and Ruby Red Tangerine. Both flavors will be available throughout the year and contain no calories, sugar, or sweetness.

-

On 19 February 2025, Culligan Quench announced its acquisition of Stonybrook Water, strengthening its presence in New England where Stonybrook has operated for over 40 years. This combination gives Stonybrook access to expand product line while maintaining comprehensive service and support.

-

In March 2024, Essentia launched ‘Hydroboost’ functional flavored water. It offers hydration with B-complex vitamins and 400mg of electrolytes. It comes in Lemon Lime, Peach Mango, and Raspberry Pomegranate flavors.

Flavored Water Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 756.8 million

Revenue forecast in 2030

USD 1,200.7 million

Growth Rate

CAGR of 9.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; Brazil; Argentina; South Africa; UAE.

Key companies profiled

Nestlé; Talking Rain; PepsiCo; The Coca‑Cola Company; Hint Inc.; Spindrift Beverage Co.; National Beverage Corp.; Sanpellegrino S.p.A.; Keurig Dr Pepper, Inc.; Saratoga Spring Water Company.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flavored Water Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global flavored water market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Still

-

Sparkling

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global flavored water market size was estimated at USD 13.50 billion in 2020 and is expected to reach USD 14.71 billion in 2021.

b. The global flavored water market is expected to grow at a compound annual growth rate of 10.3% from 2021 to 2028 to reach USD 29.56 billion by 2028.

b. North America dominated the flavored water market with a share of 37% in 2020. This is attributed to the rising consumption of healthy alternatives to carbonated drinks.

b. Some key players in the flavored water market include Nestlé, Talking Rain, PepsiCo, Inc., The Coca-Cola Company, Hint Inc., Spindrift, National Beverage Corp., SANPELLEGRINO S.P.A, Keurig Dr Pepper Inc., and Saratoga Spring Water Company.

b. Key factors that are driving the flavored water market growth include increasing consumer preference for healthy alternatives to sugary soft drinks. Moreover, the rising preference for flavorful, healthy, and functional drinks among consumers is also driving the growth of this market.

b. The supermarkets & hypermarkets segment accounted for the largest revenue share of over 55% in 2020 and will grow further at a steady CAGR from 2021 to 2028 in the flavored water market.

b. The sparkling product segment accounted for the highest revenue share of more than 72% in 2020 and is estimated to expand further at a steady CAGR from 2021 to 2028 in the flavored water market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.