- Home

- »

- Consumer F&B

- »

-

Flavored Yogurt Market Size & Share, Industry Report, 2030GVR Report cover

![Flavored Yogurt Market Size, Share & Trends Report]()

Flavored Yogurt Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Strawberry, Blueberry, Vanilla, Peach), By Distribution Channel (Supermarkets, Convenience Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-174-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flavored Yogurt Market Summary

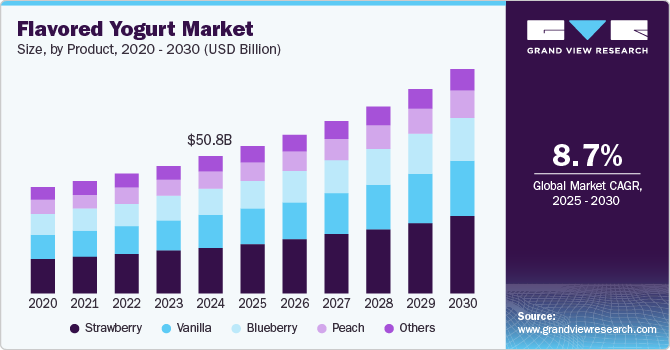

The global flavored yogurt market size was valued at USD 50.82 billion in 2024 and is projected to reach USD 77.12 billion by 2030, growing at a CAGR of 8.7% from 2025 to 2030. The market's growth is driven by rising health consciousness and increasing consumer demand for nutritious and probiotic-rich food products.

Key Market Trends & Insights

- The Europe region accounted for the highest share in the global flavored yogurt market in 2024.

- Asia Pacific is expected to emerge as the fastest-growing regional market, with a CAGR of 9.6% over the forecast period.

- By product, the strawberry segment was the largest revenue-generating product, accounting for a 34.0% share in 2024.

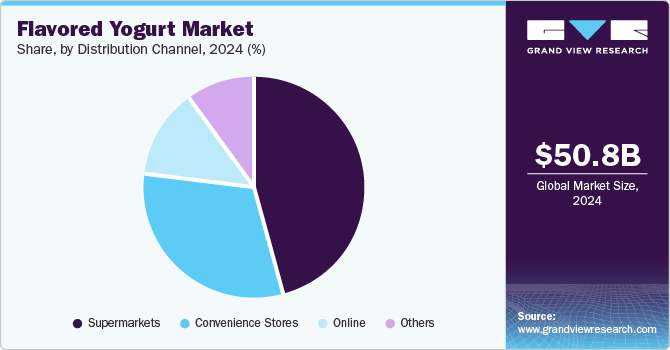

- By distribution channel, the supermarket segment dominated the market with the largest revenue share of 45.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 50.82 Billion

- 2030 Projected Market Size: USD 77.12 Billion

- CAGR (2025-2030): 8.7%

- Europe: Largest market in 2024

Flavored yogurt, known for its probiotic benefits and versatility, has become a popular choice for those looking to maintain a healthy diet while enjoying flavorful snacks.

In addition, the introduction of innovative product variations has played a crucial role in driving industry growth. Manufacturers are increasingly focusing on developing plant-based and dairy-free yogurt options to cater to the growing demand for vegan products. This shift appeals to health-conscious consumers and addresses dietary restrictions such as lactose intolerance. The flavored yogurt industry benefits from changing lifestyles, prioritizing convenience and ready-to-eat foods. The busy schedules of modern consumers have led to a preference for quick and easy meal solutions, making flavored yogurt an ideal choice for breakfast or snacks. As supermarkets and hypermarkets expand their offerings of flavored yogurt, including single-serve packaging options, they are meeting the demand for convenient products that fit into consumers' fast-paced lives.

Increased consumer awareness of health-related issues has led to a preference for yogurt enriched with essential vitamins, creamy textures, and sugar-free options, positively affecting digestive health. As a result, traditional plain yogurt is increasingly being replaced by flavored and fruit yogurts. The broad acceptance of packaged flavored yogurt products, which are often high in protein and low in sugar, is further fueling the industry expansion. The demand for naturally enriched fruit-flavored yogurts, particularly berry flavors like strawberry and blueberry, is notably high.

Furthermore, the growing popularity of flavored yogurt in restaurants and dairy shops is positioning it as an alternative to mayonnaise and ice cream. Online discounts offered by food e-retailers are also expected to boost demand for these products. Major players in the flavored yogurt industry, including Danone, Nestlé, and General Mills, are focusing on expanding their distribution channels to tap into developing regions. For instance, Nestlé's acquisition of a majority stake in the Indian dairy startup Mooz in early 2023 has strengthened its presence in India's growing flavored yogurt industry, which has witnessed a surge in demand for healthy and innovative dairy products.

Product Insights

The strawberry segment dominated the industry with the largest revenue share of 34.0% in 2024. Strawberry-flavored yogurt is often associated with nostalgia and comfort. Its natural sweetness and vibrant color contribute to its attractiveness, encouraging consumers to choose it over other flavors. For example, brands such as Chobani have effectively marketed its strawberry yogurt by emphasizing its use of real fruit and minimal added sugars, appealing to health-conscious consumers seeking tasty yet nutritious options.

The vanilla segment is expected to grow significantly over the forecast period due to its classic appeal and versatility in culinary applications. Vanilla is one of the most popular flavors worldwide, often associated with comfort and familiarity, making it a staple choice for consumers. Its neutral flavor profile allows it to be paired easily with various toppings, fruits, and cereals, enhancing its appeal as a flexible ingredient in both sweet and savory dishes.

Distribution Channel Insights

The supermarket segment dominated the industry with the largest revenue share of 45.8% in 2024. It provides consumers with a one-stop shopping experience, offering a wide variety of flavored yogurt brands and types in one location. This convenience particularly appeals to busy consumers who prefer to complete their grocery shopping efficiently. For instance, major supermarket chains such as Walmart and Kroger stock a diverse range of yogurt products, making it easy for customers to find their preferred flavors while also exploring new options.

The online segment is expected to grow at the fastest CAGR over the forecast period due to the increasing consumer preference for convenience and accessibility in shopping. E-commerce platforms offer various flavored yogurt options, often with detailed product descriptions and customer reviews, which help consumers make informed choices.

Regional Insights

The North American flavored yogurt market is expected to grow significantly over the forecast period, driven by increasing consumer awareness of health and wellness, which has led to a rising demand for nutritious, probiotic-rich foods. As more individuals prioritize their diets, they are seeking yogurt options that provide health benefits, such as high protein content and digestive support. In addition, product diversification is enhancing market appeal, with manufacturers introducing innovative flavors, organic choices, and plant-based alternatives. The market has seen a surge in unique flavor offerings, including tropical and Latin-inspired options to cater to a broader audience.

U.S. Flavored Yogurt Market Trends

The U.S. flavored yogurt market dominated North America in 2024. Consumers are seeking nutritious options, such as Greek yogurt, that offer probiotics and higher protein content. The multicultural population in the U.S. drives demand for a wide range of flavors, including exotic options, which are less common in other regions. Major brands, including Chobani, Yoplait, and Danone, held a considerable share, and are investing heavily in marketing and product development to maintain consumer interest.

Europe Flavored Yogurt Market Trends

Europe's flavored yogurt market dominated the global market with a revenue share of 30.7% in 2024, primarily due to Europeans having a long-standing tradition of consuming dairy products, which includes yogurt. Berry-flavored yogurts are becoming most popular among consumers due to the presence of naturally potent ingredients, which is anticipating the market for strawberry and blueberry flavors in the forecast period.

The France flavored yogurt market dominated Europe in 2024, owing to its rich culinary tradition and a strong emphasis on dairy products, particularly yogurt, which individuals of all ages often consume daily. French yogurt is typically made with whole milk and minimal ingredients, focusing on quality over quantity, which appeals to health-conscious consumers. In addition, the pot-setting method used in French yogurt production involves culturing yogurt directly in individual containers, resulting in a thicker and creamier texture that distinguishes it from other varieties

Asia Pacific Flavored Yogurt Market Trends

Asia Pacific flavored yogurt market is expected to grow at the fastest CAGR of 9.6% over the forecast period due to rising health consciousness among consumers, leading to increased demand for nutritious options that offer gut health benefits, such as probiotics. This trend is particularly strong in countries such as India and China, where consumers are becoming more aware of the advantages of incorporating yogurt into their diets.

Key Flavored Yogurt Company Insights

Some key players in the flavored yogurt market are General Mills Inc., DANONE, Nestlé S.A., Chobani, LLC., Fonterra Co-operative Group Limited, LACTALIS, FAGE International S.A, Arla Foods amba, China Mengniu Dairy Company Limited., YILI.COM INC., and others. These companies employ various strategies to maintain a competitive edge, such as introducing innovative product offerings with unique flavors and health benefits to cater to changing consumer preferences. They focus on using high-quality ingredients and improving nutritional value, which aligns with the growing demand for healthier and functional foods.

- Fonterra Co-operative Group Limited offers a variety of flavored yogurt products, including those enriched with probiotics and tailored for health-conscious consumers.

- Danone, Inc. offers a broad portfolio of dairy-based products, including popular brands such as Activia and Oikos. The company emphasizes innovation in creating unique flavors and functional benefits, such as probiotics for digestive health.

Key Flavored Yogurt Companies:

The following are the leading companies in the flavored yogurt market. These companies collectively hold the largest market share and dictate industry trends.- General Mills Inc.

- DANONE

- Nestlé S.A.

- Chobani, LLC.

- Fonterra Co-operative Group Limited

- LACTALIS

- FAGE International S.A

- Arla Foods amba

- China Mengniu Dairy Company Limited.

- YILI.COM INC.

Recent Developments

-

In October 2024, Chobani launched its new high-protein Greek yogurt line. The yogurt cup lineup contains options of 15 grams, 20 grams, and 30 grams of protein per drink. These yogurt cups are available in vanilla, strawberry, raspberry lemon, kiwi, mango, and cherry-berry flavors.

-

In April 2024, Danone launched its new REMIX collection, a diverse range of dairy snacks and yogurts designed to meet the snacking needs of busy consumers. This innovative line features products from three of Danone's well-known brands: Light + Fit, Oikos, and Too Good & Co. Oikos REMIX is available in three varieties, with 11g of protein in every 4.5 oz cup.

Flavored Yogurt Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 54.74 billion

Revenue forecast in 2030

USD 77.12 billion

Growth rate

CAGR of 8.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; South Africa

Key companies profiled

General Mills Inc.; DANONE; Nestlé S.A.; Chobani; LLC.; Fonterra Co-operative Group Limited; LACTALIS; FAGE International S.A; Arla Foods amba; China Mengniu Dairy Company Limited.; YILI.COM INC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flavored Yogurt Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global flavored yogurt market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Strawberry

-

Blueberry

-

Vanilla

-

Peach

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.